Global Allograft Market

Market Size in USD Million

CAGR :

%

USD

670.75 Million

USD

1,083.46 Million

2022

2030

USD

670.75 Million

USD

1,083.46 Million

2022

2030

| 2023 –2030 | |

| USD 670.75 Million | |

| USD 1,083.46 Million | |

|

|

|

|

Allograft Market Regional Market Analysis and Size

The prevalence of osteoporosis, osteoarthritis, and other bone diseases among the general population is one of the major factors driving the growth of the allograft market. Increasing life expectancy and increasing incidence of lifestyle diseases, technological advancements, and growing consumer preference for minimally invasive procedures are boosting the development of the transplant market. The increase in the number of orthopedic surgeries and, among other things, the demand for surgical procedures such as shoulder surgery is driving the allograft market.

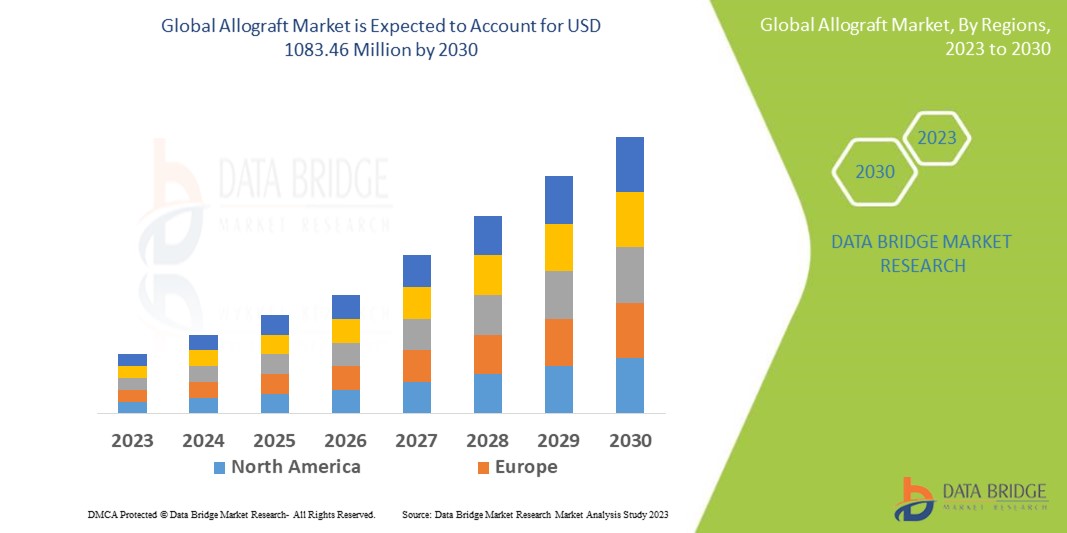

Data Bridge Market Research analyzes that the market, which was USD 670.75 million in 2022, would rocket up to USD 1083.46 million by 2030 and is expected to undergo a CAGR of 5.90% during the forecast period. The "Orthopaedic" dominates the application segment of the allograft market owing to the rise in orthopedic diseases worldwide. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Allograft Market Regional Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Type (DBM, Machined Allograft, Soft Tissue Allograft, and Others), Application (Dentistry, Orthopedic, Wound Care, Spinal, Trauma, and Others), End-Users (Hospitals, Specialized Clinics, Ambulatory Surgical Centers, and Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of the Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

ALLERGAN (Ireland), B. Braun Melsungen AG (Germany), CONMED Corporation (U.S.), XTANT MEDICAL (U.S.), LeMaitre Vascular, Inc. (U.S.), Alliqua (U.S.), BD (U.S.), Arthrex, Inc. (U.S.), Bone Bank Allografts (U.S.), Osiris (U.S.), Integra LifeSciences (U.S.), AlloSource (U.S.), Baxter (U.S.), DePuy Synthes (U.S.), Medtronic (Ireland), NuVasive, Inc. (U.S.), Orthofix Holdings, Inc. (U.S.), Smith & Nephew (U.K.), Stryker (U.S.), Wright Medical Group N.V. (U.S.) and Zimmer Biomet (U.S.) |

|

Market Opportunities |

|

Market Definition

Allografts refer to bone or tissue known to be transplanted from one person to another with a different genotype. These bones and tissues are derived from tissues or even living donors, whether related or not, cadaveric bones. The donor specimen does not have to be a twin of the recipient, although both must be of the same species.

Global Allograft Market Dynamics

Drivers

- Increasing prevalence of chronic diseases and orthopaedic conditions

The increasing incidence of chronic diseases such as cardiovascular diseases, diabetes and orthopaedic diseases such as osteoarthritis increases the demand for allografts. Allografts are widely used in surgical procedures to replace damaged or diseased tissue, providing patients with a viable treatment option. As the world's population ages and chronic diseases continue to increase, the demand for allografts will increase significantly.

- Technological advancements in allograft processing and preservation

Improved allograft handling and storage techniques have greatly improved the safety and efficacy of allografts. Innovations such as cryopreservation, sterilization methods, and tissue banking practices have prolonged the preservation of allografts while maintaining their structural and functional integrity. These technological advances have increased the availability and availability of allografts, stimulating market growth.

- Growing preference for minimally invasive procedures

Patients and healthcare providers increasingly prefer minimally invasive procedures, which offer several advantages, including shorter recovery times, fewer post-operative complications, and better patient outcomes. Allografts are often used in minimally invasive surgeries such as arthroscopy and laparoscopy because they can be easily implanted through small incisions. The demand for allografts is expected to increase with the increased use of minimally invasive techniques.

- Increasing focus on sports medicine and sports-related injuries

Sports-related injuries such as torn ligaments, tendons, and cartilage damage are common among athletes and the general population. Allografts play a crucial role in sports medicine because they provide transplant options for reconstructive surgery and promote faster healing and tissue regeneration. The growing awareness of sports injuries and the importance of timely intervention and rehabilitation is increasing the demand for allografts in the field of sports medicine.

Opportunities

- Increasing adoption of precision medicine

Precision medicine, which involves tailoring treatment to individual patients based on their specific genetic, environmental, and lifestyle factors, represents a significant market opportunity. Allografts can play an important role in personalized medicine by providing transplant options that precisely match the patient's biological and immunological characteristics. As the field of precision medicine evolves, the demand for personalized allograft solutions is increasing, creating opportunities for companies to develop and offer customized transplant products and services.

- Growing focus on regenerative therapies

Regenerative therapies, which aim to restore or replace damaged tissues and organs, are receiving considerable attention in medicine. Allografts, especially those containing stem cells or other regenerative components, have enormous potential for regenerative medicine applications. There are opportunities for companies to invest in research and development to improve the regenerative properties of allografts, explore new delivery methods, and develop innovative combination therapies that combine allografts with other regenerative technologies.

Restraints

- Limited availability of donor tissues

The availability of donor tissues significantly limits the market for allografts. The supply of allografts is highly dependent on the availability of suitable donor tissues, which may be limited. Factors such as donor scarcity, eligibility criteria, and consent issues can limit the availability of allografts, leading to supply shortages and increased costs.

- Risk of disease transmission and graft rejection

Although strict screening and testing protocols exist to ensure the safety of allografts, there is still a tiny risk of donor-to-recipient transmission. Although this risk is minimal, it can be a concern for both patients and healthcare providers. In addition, transplant rejection, where the recipient's immune system attacks the transplanted tissue, remains a challenge that requires immunosuppressive medications and close patient monitoring.

Challenges

- Ethical and legal challenges

The use of allografts presents ethical and legal challenges related to tissue procurement, consent and allocation. Securing appropriate informed support from donors or their families, maintaining donor anonymity, and adhering to ethical guidelines can be difficult, especially in cross-border transactions. In addition, legal frameworks for tissue banking, import/export regulations, and intellectual property rights vary from country to country, presenting challenges for companies operating in the market.

- Cost and reimbursement pressures

Allografts can be expensive due to costs associated with tissue collection, processing, testing, and storage. Reimbursement policies and healthcare budget constraints can create problems in obtaining adequate reimbursement for transplant procedures, especially in public health systems. Pricing pressures and the need to demonstrate cost-effectiveness and long-term clinical benefit can create challenges for companies that can affect market entry and profitability.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market, contact Data Bridge Market Research for an Analyst Brief, our team will help you make an informed market decision to achieve market growth.

Recent Development

- In August 2022, orthopedic surgeons at University National Hospital performed the first meniscal transplant and implanted donor cartilage into the patient's knee in Scotland

- In July 2022, AlloSource added a quadricep tendon to its AlloConnex line of tendons, ligaments, and fascia. AlloSource's AlloConnex quadricep tendon is used for cruciate ligament procedures and is available with or without the bone block for various surgical techniques

Allograft Market Regional Market Scope

The market is segmented on the basis of type, application and end-users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Demineralized bone (DBM)

- Machined allograft

- Soft tissue allograft

- Others

Application

- Dentistry

- Orthopedic

- Wound care

- Spinal

- Trauma

- Others

End User

- Hospitals

- Specialized clinics

- Ambulatory surgical centers

- Others

Global Allograft Market Regional Analysis/Insights

The market is analyzed and market size insights and trends are provided by country, type, application, and end-user as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the allograft market due to the growing awareness related to the commercially accessible innovative products, well-developed healthcare structure, increasing number of trauma-related injuries and cases of orthopedic disease and higher healthcare expenditure in the region.

Asia-Pacific is expected to witness the fastest growth during the forecast period of 2023 to 2030 because of the rising medical tourism and favourable government initiatives in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to significant or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The market also provides detailed market analysis for every country's growth in healthcare expenditure for capital equipment, installed base of different products for the market, impact of technology using lifeline curves, and changes in healthcare regulatory scenarios and their impact on the market. The data is available for the historic period 2010-2020.

Competitive Landscape and Market Share Analysis

The competitive market landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Some of the major players operating in the global allograftmarket are:

- ALLERGAN (Ireland)

- B. Braun Melsungen AG (Germany)

- CONMED Corporation (U.S.)

- XTANT MEDICAL (U.S.)

- LeMaitre Vascular, Inc. (U.S.)

- Alliqua (U.S.)

- BD (U.S.)

- Arthrex, Inc. (U.S.)

- Bone Bank Allografts (U.S.)

- Osiris (U.S.)

- Integra LifeSciences (U.S.)

- AlloSource (U.S.)

- Baxter (U.S.)

- DePuy Synthes (U.S.)

- Medtronic (Ireland)

- NuVasive, Inc. (U.S.)

- Orthofix Holdings, Inc. (U.S.)

- Smith & Nephew (U.K.)

- Stryker (U.S.)

- Wright Medical Group N.V. (U.S.)

- Zimmer Biomet (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ALLOGRAFT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ALLOGRAFT MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 SALES VOLUME DATA

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL ALLOGRAFT MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER'S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYSIS AND RECOMMENDATIONS

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNOLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.2.1 CLASS I

11.2.2 CLASS II

11.2.3 CLASS III

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 INSTALLED BASE DATA

15 VALUE CHAIN ANALYSIS

16 HEALTHCARE ECONOMY

16.1 HEALTHCARE EXPENDITURE

16.2 CAPITAL EXPENDITURE

16.3 CAPEX TRENDS

16.4 CAPEX ALLOCATION

16.5 FUNDING SOURCES

16.6 INDUSTRY BENCHMARKS

16.7 GDP RATION IN OVERALL GDP

16.8 HEALTHCARE SYSTEM STRUCTURE

16.9 GOVERNMENT POLICIES

16.1 ECONOMIC DEVELOPMENT

17 GLOBAL ALLOGRAFT MARKET, BY TYPE

17.1 OVERVIEW

17.2 BONE ALLOGRAFT

17.2.1 BY TYPE

17.2.1.1. CORTICAL BONE ALLOGRAFTS

17.2.1.2. DEMINERALIZED BONE MATRIX

17.2.1.3. OSTEOCHONDRAL AND CORTICAL ALLOGRAFTS

17.2.1.4. MORSELIZED AND CANCELLOUS BONE ALLOGRAFTS

17.2.1.5. CANCELLOUS/CORTICOCANCELLOUS ALLOGRAFTS

17.2.2 BY FORM

17.2.2.1. CHIPS AND CUBES

17.2.2.2. BONE DOWELS

17.2.2.3. STRUTS

17.2.2.4. HEADS

17.2.2.5. WEDGES

17.2.2.6. SHAFTS

17.2.2.7. SPACERS

17.2.2.8. OTHERS

17.2.3 BY APPLICATION

17.2.3.1. DENTISTRY

17.2.3.2. ORTHOPAEDIC

17.2.3.3. SPINAL

17.2.3.4. TRAUMA

17.2.3.5. PLASTIC SURGERY

17.2.3.6. CARDIOLOGY

17.2.3.7. OTHERS

17.3 SOFT TISSUE ALLOGRAFT

17.3.1 BY TYPE

17.3.1.1. CARTILAGE ALLOGRAFT

17.3.1.1.1. COSTAL CARTILAGE

17.3.1.1.2. OSTEOCHONDRAL ALLOGRAFT PLUGS

17.3.1.1.3. OSTEOCHONDRAL ALLOGRAFT

17.3.1.2. TENDON ALLOGRAFT

17.3.1.2.1. NON-BONE TENDON ALLOGRAFT

17.3.1.2.2. BONE & BTB TENDON ALLOGRAFT

17.3.1.3. MENISCUS ALLOGRAFT

17.3.1.3.1. MEDIAL ALLOGRAFT

17.3.1.3.2. LATERAL ALLOGRAFT

17.3.1.4. DENTAL ALLOGRAFT

17.3.1.5. COLLAGEN ALLOGRAFT

17.3.1.6. AMNIOTIC ALLOGRAFT

17.3.2 BY APPLICATION

17.3.2.1. DENTISTRY

17.3.2.2. ORTHOPAEDIC

17.3.2.3. SPINAL

17.3.2.4. TRAUMA

17.3.2.5. PLASTIC SURGERY

17.3.2.6. CARDIOLOGY

17.3.2.7. OTHERS

17.4 MACHINED ALLOGRAFT

17.5 OTHERS

18 GLOBAL ALLOGRAFT MARKET, BY APPLICATION

18.1 OVERVIEW

18.2 DENTISTRY

18.2.1 BONE ALLOGRAFT

18.2.2 SOFT TISSUE ALLOGRAFT

18.2.3 MACHINED ALLOGRAFT

18.3 ORTHOPAEDIC

18.3.1 BONE ALLOGRAFT

18.3.2 SOFT TISSUE ALLOGRAFT

18.3.3 MACHINED ALLOGRAFT

18.4 SPINAL

18.4.1 BONE ALLOGRAFT

18.4.2 SOFT TISSUE ALLOGRAFT

18.4.3 MACHINED ALLOGRAFT

18.5 TRAUMA

18.5.1 BONE ALLOGRAFT

18.5.2 SOFT TISSUE ALLOGRAFT

18.5.3 MACHINED ALLOGRAFT

18.6 PLASTIC SURGERY

18.6.1 BONE ALLOGRAFT

18.6.2 SOFT TISSUE ALLOGRAFT

18.6.3 MACHINED ALLOGRAFT

18.7 CARDIOLOGY

18.8 OTHER APPLICATIONS

19 GLOBAL ALLOGRAFT MARKET, BY DEMOGRAPHY

19.1 OVERVIEW

19.2 PEDIATRIC

19.3 ADULT

19.4 GERIARTIC

20 GLOBAL ALLOGRAFT MARKET, BY PRICE RANGE

20.1 OVERVIEW

20.2 PREMIUM

20.3 LOW COST

21 GLOBAL ALLOGRAFT MARKET, BY TECHNOLOGY

21.1 OVERVIEW

21.2 MINIMALLY PROCESSED

21.3 HIGHLY PROCESSED

22 GLOBAL ALLOGRAFT MARKET, BY END USER

22.1 OVERVIEW

22.2 HOSPITALS

22.2.1 BY TYPE

22.2.1.1. PUBLIC

22.2.1.2. PRIVATE

22.2.2 BY TIER

22.2.2.1. TIER 1

22.2.2.2. TIER 2

22.2.2.3. TIER 3

22.3 TRAUMA CENTERS

22.4 CLINICS

22.5 AMBULATORY SURGICAL CENTERS

22.6 ACADEMIC AND RESEARCH INSTITUTES

22.7 OTHER

23 GLOBAL ALLOGRAFT MARKET, BY DISTRIBUTION CHANNEL

23.1 OVERVIEW

23.2 DIRECT TENDER

23.3 RETAIL SALES

23.4 OTHERS

24 GLOBAL ALLOGRAFT MARKET, COMPANY LANDSCAPE

24.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

24.2 COMPANY SHARE ANALYSIS: EUROPE

24.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

24.4 MERGERS & ACQUISITIONS

24.5 NEW PRODUCT DEVELOPMENT & APPROVALS

24.6 EXPANSIONS

24.7 REGULATORY CHANGES

24.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

25 GLOBAL ALLOGRAFT MARKET, SWOT AND DBMR ANALYSIS

26 GLOBAL ALLOGRAFT MARKET, BY REGION

GLOBAL ALLOGRAFT MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

26.1 NORTH AMERICA

26.1.1 U.S.

26.1.2 CANADA

26.1.3 MEXICO

26.2 EUROPE

26.2.1 GERMANY

26.2.2 FRANCE

26.2.3 U.K.

26.2.4 HUNGARY

26.2.5 LITHUANIA

26.2.6 AUSTRIA

26.2.7 IRELAND

26.2.8 NORWAY

26.2.9 POLAND

26.2.10 ITALY

26.2.11 SPAIN

26.2.12 RUSSIA

26.2.13 TURKEY

26.2.14 NETHERLANDS

26.2.15 SWITZERLAND

26.2.16 REST OF EUROPE

26.3 ASIA-PACIFIC

26.3.1 JAPAN

26.3.2 CHINA

26.3.3 SOUTH KOREA

26.3.4 INDIA

26.3.5 AUSTRALIA

26.3.6 SINGAPORE

26.3.7 THAILAND

26.3.8 MALAYSIA

26.3.9 INDONESIA

26.3.10 PHILIPPINES

26.3.11 VIETNAM

26.3.12 REST OF ASIA-PACIFIC

26.4 SOUTH AMERICA

26.4.1 BRAZIL

26.4.2 ARGENTINA

26.4.3 PERU

26.4.4 COLOMBIA

26.4.5 VENEZUELA

26.4.6 REST OF SOUTH AMERICA

26.5 MIDDLE EAST AND AFRICA

26.5.1 SOUTH AFRICA

26.5.2 SAUDI ARABIA

26.5.3 UAE

26.5.4 EGYPT

26.5.5 KUWAIT

26.5.6 ISRAEL

26.5.7 REST OF MIDDLE EAST AND AFRICA

26.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

27 GLOBAL ALLOGRAFT MARKET, COMPANY PROFILE

27.1 ZIMMER BIOMET

27.1.1 COMPANY OVERVIEW

27.1.2 REVENUE ANALYSIS

27.1.3 GEOGRAPHIC PRESENCE

27.1.4 PRODUCT PORTFOLIO

27.1.5 RECENT DEVELOPMENTS

27.2 ABBVIE.

27.2.1 COMPANY OVERVIEW

27.2.2 REVENUE ANALYSIS

27.2.3 GEOGRAPHIC PRESENCE

27.2.4 PRODUCT PORTFOLIO

27.2.5 RECENT DEVELOPMENTS

27.3 CONMED CORPORATION

27.3.1 COMPANY OVERVIEW

27.3.2 REVENUE ANALYSIS

27.3.3 GEOGRAPHIC PRESENCE

27.3.4 PRODUCT PORTFOLIO

27.3.5 RECENT DEVELOPMENTS

27.4 XTANT MEDICAL

27.4.1 COMPANY OVERVIEW

27.4.2 REVENUE ANALYSIS

27.4.3 GEOGRAPHIC PRESENCE

27.4.4 PRODUCT PORTFOLIO

27.4.5 RECENT DEVELOPMENTS

27.5 LEMAITRE VASCULAR, INC.

27.5.1 COMPANY OVERVIEW

27.5.2 REVENUE ANALYSIS

27.5.3 GEOGRAPHIC PRESENCE

27.5.4 PRODUCT PORTFOLIO

27.5.5 RECENT DEVELOPMENTS

27.6 CELULARITY INC.

27.6.1 COMPANY OVERVIEW

27.6.2 REVENUE ANALYSIS

27.6.3 GEOGRAPHIC PRESENCE

27.6.4 PRODUCT PORTFOLIO

27.6.5 RECENT DEVELOPMENTS

27.7 LEADER BIOMEDICAL

27.7.1 COMPANY OVERVIEW

27.7.2 REVENUE ANALYSIS

27.7.3 GEOGRAPHIC PRESENCE

27.7.4 PRODUCT PORTFOLIO

27.7.5 RECENT DEVELOPMENTS

27.8 ARTHREX, INC.

27.8.1 COMPANY OVERVIEW

27.8.2 REVENUE ANALYSIS

27.8.3 GEOGRAPHIC PRESENCE

27.8.4 PRODUCT PORTFOLIO

27.8.5 RECENT DEVELOPMENTS

27.9 BONE BANK ALLOGRAFTS

27.9.1 COMPANY OVERVIEW

27.9.2 REVENUE ANALYSIS

27.9.3 GEOGRAPHIC PRESENCE

27.9.4 PRODUCT PORTFOLIO

27.9.5 RECENT DEVELOPMENTS

27.1 INTEGRA LIFESCIENCES

27.10.1 COMPANY OVERVIEW

27.10.2 REVENUE ANALYSIS

27.10.3 GEOGRAPHIC PRESENCE

27.10.4 PRODUCT PORTFOLIO

27.10.5 RECENT DEVELOPMENTS

27.11 TISSUE REGENIX

27.11.1 COMPANY OVERVIEW

27.11.2 REVENUE ANALYSIS

27.11.3 GEOGRAPHIC PRESENCE

27.11.4 PRODUCT PORTFOLIO

27.11.5 RECENT DEVELOPMENTS

27.12 DEPUY SYNTHES

27.12.1 COMPANY OVERVIEW

27.12.2 REVENUE ANALYSIS

27.12.3 GEOGRAPHIC PRESENCE

27.12.4 PRODUCT PORTFOLIO

27.12.5 RECENT DEVELOPMENTS

27.13 ORTHOFIX HOLDINGS, INC.

27.13.1 COMPANY OVERVIEW

27.13.2 REVENUE ANALYSIS

27.13.3 GEOGRAPHIC PRESENCE

27.13.4 PRODUCT PORTFOLIO

27.13.5 RECENT DEVELOPMENTS

27.14 SMITH & NEPHEW

27.14.1 COMPANY OVERVIEW

27.14.2 REVENUE ANALYSIS

27.14.3 GEOGRAPHIC PRESENCE

27.14.4 PRODUCT PORTFOLIO

27.14.5 RECENT DEVELOPMENTS

27.15 STRYKER

27.15.1 COMPANY OVERVIEW

27.15.2 REVENUE ANALYSIS

27.15.3 GEOGRAPHIC PRESENCE

27.15.4 PRODUCT PORTFOLIO

27.15.5 RECENT DEVELOPMENTS

27.16 ENOVIS

27.16.1 COMPANY OVERVIEW

27.16.2 REVENUE ANALYSIS

27.16.3 GEOGRAPHIC PRESENCE

27.16.4 PRODUCT PORTFOLIO

27.16.5 RECENT DEVELOPMENTS

27.17 RTI SURGICAL

27.17.1 COMPANY OVERVIEW

27.17.2 REVENUE ANALYSIS

27.17.3 GEOGRAPHIC PRESENCE

27.17.4 PRODUCT PORTFOLIO

27.17.5 RECENT DEVELOPMENTS

27.18 AZIYO BIOLOGICS

27.18.1 COMPANY OVERVIEW

27.18.2 REVENUE ANALYSIS

27.18.3 GEOGRAPHIC PRESENCE

27.18.4 PRODUCT PORTFOLIO

27.18.5 RECENT DEVELOPMENTS

27.19 CAMLOG BIOTECHNOLOGIES GMBH

27.19.1 COMPANY OVERVIEW

27.19.2 REVENUE ANALYSIS

27.19.3 GEOGRAPHIC PRESENCE

27.19.4 PRODUCT PORTFOLIO

27.19.5 RECENT DEVELOPMENTS

27.2 ORGANOGENESIS INC.

27.20.1 COMPANY OVERVIEW

27.20.2 REVENUE ANALYSIS

27.20.3 GEOGRAPHIC PRESENCE

27.20.4 PRODUCT PORTFOLIO

27.20.5 RECENT DEVELOPMENTS

27.21 SPINAL ELEMENTS, INC.

27.21.1 COMPANY OVERVIEW

27.21.2 REVENUE ANALYSIS

27.21.3 GEOGRAPHIC PRESENCE

27.21.4 PRODUCT PORTFOLIO

27.21.5 RECENT DEVELOPMENTS

27.22 GLOBUS MEDICAL INC.

27.22.1 COMPANY OVERVIEW

27.22.2 REVENUE ANALYSIS

27.22.3 GEOGRAPHIC PRESENCE

27.22.4 PRODUCT PORTFOLIO

27.22.5 RECENT DEVELOPMENTS

27.23 NVISION BIOMEDICAL TECHNOLOGIES, INC.

27.23.1 COMPANY OVERVIEW

27.23.2 REVENUE ANALYSIS

27.23.3 GEOGRAPHIC PRESENCE

27.23.4 PRODUCT PORTFOLIO

27.23.5 RECENT DEVELOPMENTS

27.24 VIVEX BIOLOGICS, INC.

27.24.1 COMPANY OVERVIEW

27.24.2 REVENUE ANALYSIS

27.24.3 GEOGRAPHIC PRESENCE

27.24.4 PRODUCT PORTFOLIO

27.24.5 RECENT DEVELOPMENTS

27.25 BIOVENTUS

27.25.1 COMPANY OVERVIEW

27.25.2 REVENUE ANALYSIS

27.25.3 GEOGRAPHIC PRESENCE

27.25.4 PRODUCT PORTFOLIO

27.25.5 RECENT DEVELOPMENTS

27.26 B. BRAUN SE

27.26.1 COMPANY OVERVIEW

27.26.2 REVENUE ANALYSIS

27.26.3 GEOGRAPHIC PRESENCE

27.26.4 PRODUCT PORTFOLIO

27.26.5 RECENT DEVELOPMENTS

27.27 ALLIQUA BIOMEDICAL, INC.

27.27.1 COMPANY OVERVIEW

27.27.2 REVENUE ANALYSIS

27.27.3 GEOGRAPHIC PRESENCE

27.27.4 PRODUCT PORTFOLIO

27.27.5 RECENT DEVELOPMENTS

27.28 BAXTER

27.28.1 COMPANY OVERVIEW

27.28.2 REVENUE ANALYSIS

27.28.3 GEOGRAPHIC PRESENCE

27.28.4 PRODUCT PORTFOLIO

27.28.5 RECENT DEVELOPMENTS

28 RELATED REPORTS

29 CONCLUSION

30 QUESTIONNAIRE

31 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.