Global Solid Tumor Testing Market

Market Size in USD Billion

CAGR :

%

USD

29.00 Billion

USD

45.88 Billion

2024

2032

USD

29.00 Billion

USD

45.88 Billion

2024

2032

| 2025 –2032 | |

| USD 29.00 Billion | |

| USD 45.88 Billion | |

|

|

|

|

Solid Tumor Testing Market Size

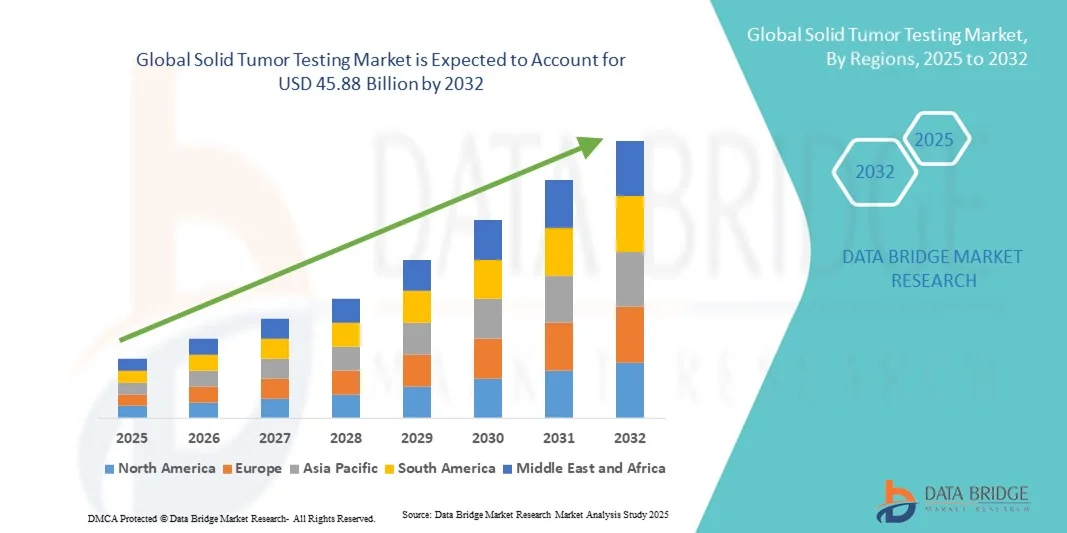

- The global solid tumor testing market size was valued at USD 29.00 billion in 2024 and is expected to reach USD 45.88 billion by 2032, at a CAGR of 5.90% during the forecast period

- This growth is driven by the increasing incidence of cancer, technological advancements in diagnostic tools, and heightened awareness about early detection, leading to a growing global investment in healthcare

- In addition, the increasing focus on personalized medicine is creating demand for tumor profiling and molecular diagnostics, allowing clinicians to tailor treatment strategies to individual patients. The shift toward minimally invasive and non-invasive testing methods, which reduce patient discomfort and improve compliance, is also significantly contributing to market expansion

Solid Tumor Testing Market Analysis

- Solid tumor testing, which includes both conventional and non-conventional diagnostic methods, is becoming a critical part of modern oncology by enabling early cancer detection, accurate diagnosis, and effective treatment planning across clinical and research settings

- The rising prevalence of cancers such as breast, lung, colorectal, prostate, and cervical cancers, coupled with increasing awareness about early diagnosis and the shift toward personalized medicine, is driving the growing demand for solid tumor testing globally

- North America dominated the solid tumor testing market with the largest revenue share of 38.7% in 2024, supported by advanced healthcare infrastructure, high adoption of cutting-edge diagnostics, and the presence of leading market players offering innovative conventional and non-conventional testing solutions

- Asia-Pacific is expected to be the fastest-growing region in the solid tumor testing market during the forecast period due to rising healthcare investments, growing cancer awareness, expanding screening programs, and increasing adoption of modern diagnostic technologies in emerging economies

- Conventional testing dominated the solid tumor testing market with a market share of 45.8% in 2024, driven by its widespread use in clinical diagnostics, established protocols, and reliability in detecting major cancer types for effective treatment planning

Report Scope and Solid Tumor Testing Market Segmentation

|

Attributes |

Solid Tumor Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Solid Tumor Testing Market Trends

Advancements in Non-Conventional Testing and Precision Oncology

- A significant and accelerating trend in the global solid tumor testing market is the increasing adoption of non-conventional testing methods such as liquid biopsies, molecular profiling, and next-generation sequencing, enhancing diagnostic precision and early cancer detection

- For instance, Guardant360 liquid biopsy tests provide comprehensive genomic profiling for multiple cancer types, allowing clinicians to monitor tumor progression and treatment response non-invasively

- Integration of precision oncology approaches enables actionable insights from tumor genetic profiles, guiding personalized treatment strategies and improving patient outcomes. Instance, Tempus uses AI-driven analytics to recommend targeted therapies based on individual tumor characteristics

- The adoption of high-throughput sequencing and multiplex testing platforms facilitates rapid, accurate, and cost-effective tumor profiling, enabling clinicians to make timely treatment decisions

- This trend toward more personalized, data-driven diagnostics is reshaping oncology practice, with companies such as Foundation Medicine developing advanced solutions that combine genomic insights with clinical interpretation

- The demand for advanced solid tumor testing solutions is rapidly growing across both clinical and research applications, as healthcare providers increasingly prioritize precision diagnostics and patient-centric treatment planning

Solid Tumor Testing Market Dynamics

Driver

Increasing Cancer Incidence and Rising Awareness for Early Detection

- The growing global prevalence of cancers such as breast, lung, colorectal, prostate, and cervical cancers, coupled with increasing awareness about early detection, is a primary driver for solid tumor testing adoption

- For instance, in March 2024, Roche Diagnostics announced the expansion of its comprehensive oncology testing portfolio, integrating high-sensitivity assays for early tumor detection and patient monitoring

- As patients and healthcare providers recognize the benefits of timely diagnosis, solid tumor testing offers accurate detection, molecular profiling, and monitoring of disease progression, improving treatment outcomes

- Furthermore, rising adoption of personalized medicine and targeted therapies is driving the need for detailed tumor profiling to select optimal treatment strategies for individual patients

- Healthcare infrastructure improvements, combined with research initiatives and funding in oncology diagnostics, are also fueling market growth by increasing accessibility to advanced solid tumor testing solutions

Restraint/Challenge

High Costs and Regulatory Compliance Hurdles

- The relatively high cost of advanced solid tumor testing solutions, especially non-conventional methods such as liquid biopsies and genomic profiling, poses a significant challenge to broader adoption

- For instance, comprehensive genomic profiling tests can cost several thousand dollars, limiting accessibility for patients in developing regions or with budget constraints

- Strict regulatory requirements and the need for extensive clinical validation before market approval can slow product launches and hinder timely adoption of innovative diagnostic technologies

- Variability in reimbursement policies and insurance coverage across regions further restricts market penetration, particularly in emerging markets with limited healthcare funding

- Overcoming these challenges through cost reduction strategies, streamlined regulatory approvals, and expanded reimbursement coverage will be crucial for sustaining growth in the global solid tumor testing market

Solid Tumor Testing Market Scope

The market is segmented on the basis of type, cancer type, and application.

- By Type

On the basis of type, the solid tumor testing market is segmented into conventional testing and non-conventional testing. The conventional testing segment dominated the market with the largest revenue share of 45.8% in 2024, driven by its long-standing use in clinical diagnostics and established protocols for cancer detection. Conventional testing methods, such as tissue biopsies and histopathological analyses, are widely trusted for their accuracy and reliability. Healthcare providers rely on these methods for detecting major cancers such as breast, lung, and colorectal cancers. The broad availability of conventional testing tools, combined with regulatory familiarity and insurance coverage, also supports its continued dominance. In addition, conventional testing provides foundational data that complements newer molecular and genomic approaches, reinforcing its relevance in clinical practice. The integration of conventional testing results with patient records and treatment planning ensures robust decision-making in oncology care.

The non-conventional testing segment is expected to witness the fastest growth at a CAGR of 20.1% from 2025 to 2032, fueled by rising demand for precision diagnostics and personalized medicine. Non-conventional methods, including liquid biopsies, next-generation sequencing (NGS), and molecular profiling, enable minimally invasive detection and real-time monitoring of tumors. These techniques offer faster results, higher sensitivity, and the ability to detect actionable genetic mutations, guiding targeted therapies. Rapid technological advancements, combined with increasing awareness among oncologists and patients, are accelerating adoption. Non-conventional testing is particularly gaining traction in research applications and advanced clinical setups where early detection and dynamic monitoring of tumor evolution are critical. The increasing integration of AI and bioinformatics in these methods further enhances their accuracy and predictive capabilities, supporting sustained growth.

- By Cancer Type

On the basis of cancer type, the solid tumor testing market is segmented into breast cancer, lung cancer, colorectal cancer, prostate cancer, and cervical cancer. The breast cancer segment dominated the market with the largest revenue share of 32.8% in 2024, driven by high prevalence rates globally and the strong emphasis on early detection programs. Breast cancer screening programs and widespread adoption of mammography and molecular diagnostic tools contribute to the segment’s leadership. The availability of targeted therapies for breast cancer, such as HER2 inhibitors, further increases demand for accurate testing and profiling. Continuous awareness campaigns, government-led screening initiatives, and patient advocacy efforts also support the dominance of this segment. Breast cancer testing is routinely integrated into clinical workflows, and the growing adoption of genomic assays enhances its clinical significance. Furthermore, the combination of conventional and non-conventional testing approaches allows for comprehensive monitoring of disease progression and treatment response.

The lung cancer segment is expected to witness the fastest growth at a CAGR of 19.5% from 2025 to 2032, driven by increasing lung cancer incidence and the need for early detection to improve survival rates. Non-invasive tests such as liquid biopsies and NGS panels are rapidly being adopted to identify mutations such as EGFR, ALK, and ROS1, guiding targeted therapies. Rising awareness about lung cancer risk factors, including smoking and environmental pollutants, is encouraging regular testing and screening. Advanced hospitals and research centers are increasingly integrating molecular diagnostics into standard lung cancer care. The segment also benefits from ongoing research in immunotherapy and precision medicine, which relies on detailed tumor profiling. Government initiatives and public-private partnerships aimed at improving lung cancer diagnostics are further fueling market growth in this segment.

- By Application

On the basis of application, the solid tumor testing market is segmented into clinical and research applications. The clinical segment dominated the market with the largest revenue share of 51.2% in 2024, supported by widespread adoption of testing for diagnosis, prognosis, and treatment monitoring in hospitals and oncology centers. Clinicians rely on solid tumor testing to guide personalized treatment plans, select targeted therapies, and monitor disease progression. Conventional testing remains heavily used in clinical settings due to regulatory approval and integration with standard care protocols. The rising emphasis on early detection and patient-centric care continues to boost clinical adoption. In addition, clinical applications benefit from reimbursement coverage in many developed markets, ensuring broader accessibility. The combination of molecular and conventional tests in clinical practice provides comprehensive insights that improve patient outcomes and optimize treatment strategies.

The research segment is expected to witness the fastest CAGR of 21.3% from 2025 to 2032, fueled by the growing focus on drug development, clinical trials, and precision oncology research. Research institutions and biotech companies increasingly use non-conventional testing methods to study tumor genomics, identify biomarkers, and evaluate treatment efficacy. Advanced technologies, including NGS, multiplex assays, and liquid biopsies, provide researchers with high-throughput and sensitive diagnostic capabilities. Funding from government and private sources for cancer research continues to expand, driving adoption. The rise of translational research programs connecting lab findings to clinical applications further accelerates growth. This segment benefits from global collaborations and data-sharing initiatives aimed at developing next-generation therapies and improving early detection methods.

Solid Tumor Testing Market Regional Analysis

- North America dominated the solid tumor testing market with the largest revenue share of 38.7% in 2024, supported by advanced healthcare infrastructure, high adoption of cutting-edge diagnostics, and the presence of leading market players offering innovative conventional and non-conventional testing solutions

- Patients and healthcare providers in the region prioritize early detection, precision diagnostics, and personalized treatment planning, which are supported by widespread availability of molecular profiling, liquid biopsies, and genomic testing technologies

- This dominance is further reinforced by strong research and development initiatives, high healthcare expenditure, and regulatory support for advanced diagnostic solutions, establishing North America as a leader in solid tumor testing for both clinical and research applications

U.S. Solid Tumor Testing Market Insight

The U.S. solid tumor testing market captured the largest revenue share of 79% in 2024 within North America, fueled by advanced healthcare infrastructure, high adoption of precision diagnostics, and robust cancer screening programs. Patients and clinicians increasingly prioritize early detection, molecular profiling, and personalized treatment strategies. The growing integration of next-generation sequencing (NGS), liquid biopsies, and AI-driven analytics into clinical practice further propels the market. Moreover, strong government initiatives, research funding, and insurance coverage for diagnostic tests support widespread adoption. The U.S. also benefits from a concentration of key market players and ongoing innovations in both conventional and non-conventional testing methods.

Europe Solid Tumor Testing Market Insight

The Europe solid tumor testing market is projected to expand at a substantial CAGR throughout the forecast period, driven by rising cancer prevalence and stringent healthcare regulations emphasizing early diagnosis. Increasing urbanization and investments in advanced diagnostic infrastructure are fostering adoption of both conventional and non-conventional testing methods. European healthcare providers are focused on integrating molecular diagnostics with standard clinical workflows to improve treatment precision. The demand for personalized therapies and the growth of research collaborations are supporting market growth. In addition, reimbursement support and government-led cancer awareness initiatives encourage adoption across both clinical and research applications.

U.K. Solid Tumor Testing Market Insight

The U.K. solid tumor testing market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising emphasis on early cancer detection and personalized medicine. Concerns about cancer prevalence and patient outcomes are encouraging healthcare providers to adopt advanced molecular and genomic testing solutions. The U.K.’s well-developed healthcare system, robust research infrastructure, and active participation in clinical trials continue to stimulate market growth. Moreover, increasing public awareness campaigns and access to diagnostic technologies in both hospitals and specialized clinics are enhancing adoption. Insurance coverage and government support for cancer diagnostics further reinforce the market expansion.

Germany Solid Tumor Testing Market Insight

The Germany solid tumor testing market is expected to expand at a considerable CAGR during the forecast period, fueled by strong healthcare infrastructure, high technological awareness, and demand for precise cancer diagnostics. German clinicians increasingly rely on both conventional and non-conventional testing methods to guide targeted therapies and treatment monitoring. Integration of molecular profiling and genomic analysis into routine clinical practice is gaining traction. Government support for early detection programs and investments in cancer research strengthen adoption. Moreover, patient demand for accurate, minimally invasive testing solutions and the presence of key diagnostic companies promote sustained growth.

Asia-Pacific Solid Tumor Testing Market Insight

The Asia-Pacific solid tumor testing market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising cancer incidence, expanding healthcare infrastructure, and increasing awareness about early detection. Countries such as China, Japan, and India are witnessing rapid adoption of advanced diagnostic technologies, including liquid biopsies and NGS. Government-led cancer screening initiatives, growing research activities, and the rise of private healthcare providers are accelerating market penetration. In addition, improving affordability of testing solutions and collaborations with global diagnostic companies are expanding accessibility across the region.

Japan Solid Tumor Testing Market Insight

The Japan solid tumor testing market is gaining momentum due to the country’s focus on precision oncology, advanced healthcare systems, and high patient awareness. The adoption of non-conventional testing methods, such as liquid biopsies and molecular profiling, is rising in clinical and research applications. Integration with AI-based analytics supports early detection and personalized treatment strategies. The aging population is driving demand for minimally invasive and highly accurate diagnostic solutions. Moreover, strong government support for cancer research and private-public collaborations encourages ongoing adoption of advanced tumor testing technologies.

India Solid Tumor Testing Market Insight

The India solid tumor testing market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to increasing cancer prevalence, growing middle-class population, and rising healthcare awareness. Rapid urbanization, expanding diagnostic infrastructure, and government initiatives for early cancer detection are driving adoption. Affordable testing solutions and partnerships with international diagnostic companies are enhancing accessibility. India is also witnessing growth in both conventional and non-conventional testing for breast, lung, colorectal, and other cancers. Rising research activities, private healthcare investments, and increasing patient awareness further propel market expansion across clinical and research applications.

Solid Tumor Testing Market Share

The solid tumor testing industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Caris Life Sciences (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- FOUNDATION MEDICINE, INC. (U.S.)

- Guardant Health (U.S.)

- Hologic, Inc. (U.S.)

- Illumina, Inc. (U.S.)

- MedGenome Labs Limited (India)

- Myriad Genetics, Inc. (U.S.)

- Invivoscribe Inc. (U.S.)

- Invitae Corporation (U.S.)

- Labcorp (U.S.)

- NeoGenomics Laboratories, Inc. (U.S.)

- OmniSeq, Inc. (U.S.)

- QIAGEN (Germany)

- Quest Diagnostics Incorporated (U.S.)

- SOPHiA GENETICS (Switzerland)

- Tempus Labs, Inc. (U.S.)

- Variantyx, Inc. (U.S.)

What are the Recent Developments in Global Solid Tumor Testing Market?

- In September 2025, IIT Madras launched a Cancer Genome and Tissue Bank aimed at transforming cancer treatment in India. This initiative focuses on collecting and analyzing genetic and tissue data from Indian cancer patients to facilitate the development of personalized therapies tailored to the genetic diversity of the population

- In July 2025, researchers developed a new blood test capable of detecting early-stage solid tumors with high accuracy. This advancement represents a significant step forward in cancer diagnostics, enabling earlier detection and potentially more effective treatment options

- In May 2025, Labcorp announced the expansion of its oncology portfolio, introducing new test offerings for solid tumor and hematologic malignancies. This expansion is designed to improve patient care and accelerate clinical trials, reflecting Labcorp's commitment to advancing cancer diagnostics

- In August 2024, the U.S. FDA granted approval to Illumina's comprehensive cancer biomarker test, which analyzes over 500 genes to profile a patient's solid tumor. This test aids in identifying immuno-oncology biomarkers and clinically actionable targets, thereby facilitating targeted therapy options and clinical trial enrollment

- In June 2024, Lyell Immunopharma initiated a Phase 1 clinical trial for its CAR T-cell therapy targeting advanced solid tumors. The trial, involving patients with relapsed or refractory metastatic diseases, aims to assess the efficacy and safety of the therapy, marking a significant step in the development of treatments for solid tumors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.