Global Soybean Oil Market

Market Size in USD Billion

CAGR :

%

USD

55.49 Billion

USD

78.32 Billion

2024

2032

USD

55.49 Billion

USD

78.32 Billion

2024

2032

| 2025 –2032 | |

| USD 55.49 Billion | |

| USD 78.32 Billion | |

|

|

|

|

Soybean Oil Market Size

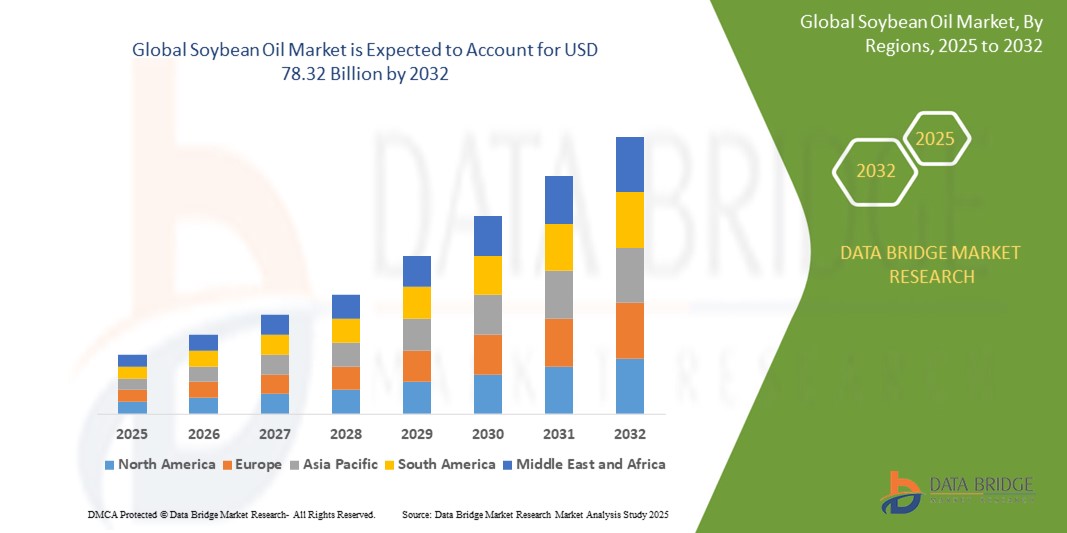

- The global soybean oil market size was valued at USD 55.49 billion in 2024 and is expected to reach USD 78.32 billion by 2032, at a CAGR of 4.4% during the forecast period

- The market growth is largely fueled by the increasing consumption of vegetable oils in food processing, household cooking, and industrial applications, with soybean oil emerging as a preferred choice due to its affordability, versatility, and favorable fatty acid profile

- Furthermore, growing awareness of health and wellness trends, rising demand for non-GMO and trans fat-free oils, and expanding use of soybean oil in biodiesel and personal care products are accelerating its adoption across sectors, thereby significantly boosting the industry's growth

Soybean Oil Market Analysis

- Soybean oil, extracted from soybeans, is a versatile cooking oil prized for its neutral flavor and high smoke point. It is widely used in food processing, frying, and salad dressings, and it's also a common ingredient in margarine and shortening. Nutritionally, it is rich in polyunsaturated fats and vitamin E, making it a popular choice for health-conscious consumers

- The market growth is primarily driven by increasing demand for plant-based and sustainable cooking oils, rapid expansion of the food processing sector, and a global shift toward healthier dietary habits that favor oils low in saturated fat

- Asia-Pacific dominated the soybean oil market with a share of 47.02% in 2024, due to high population density, rising disposable incomes, and a growing preference for affordable vegetable oils in daily cooking

- North America is expected to be the fastest growing region in the soybean oil market during the forecast period due to strong demand for vegetable oils in processed foods, plant-based products, and commercial kitchens

- Conventional soybean oil segment dominated the market with a market share of 86.2% in 2024, due to its long-standing use in both domestic and industrial applications. Its affordability, high availability, and refined taste make it the preferred choice for food processing companies, fast-food chains, and households alike. In developing countries, where price sensitivity remains high, conventional soybean oil continues to meet large-scale demand. Its consistent quality, neutral flavor, and stability under heat further position it as a versatile oil for frying, baking, and sautéin

Report Scope and Soybean Oil Market Segmentation

|

Attributes |

Soybean Oil Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Soybean Oil Market Trends

“Rising Demand for Edible Oils”

- A key and accelerating trend in the global soybean oil market is the growing demand for edible oils, driven by changing dietary habits, population growth, and rising urbanization. Soybean oil, known for its neutral flavor and affordability, is increasingly preferred in cooking, frying, and processed food manufacturing across households and industrial kitchens

- For instance, in developing nations such as India, Indonesia, and Brazil, increasing disposable income and a shift toward packaged and restaurant food have boosted soybean oil consumption significantly. Its versatility across various culinary applications and its ability to blend well with other ingredients make it a preferred choice for food manufacturers

- Consumers are also actively seeking healthier oil options, and soybean oil, being low in saturated fats and rich in polyunsaturated fats, aligns well with current health trends. This is particularly evident in urban regions where there is heightened awareness about cardiovascular health and cholesterol control

- In addition, food processors are increasingly incorporating soybean oil into ready-to-eat meals, margarine, and baked goods to cater to demand for trans-fat-free formulations. The oil’s functional properties, such as longer shelf life and high oxidative stability, are adding to its appeal in commercial food production

- This sustained demand for high-quality, affordable, and multipurpose edible oils is reshaping global consumption patterns, firmly positioning soybean oil as a staple in the global cooking oil segment

Soybean Oil Market Dynamics

Driver

“Rising Prevalence of Obesity”

- The growing global prevalence of obesity and related lifestyle disorders such as diabetes and hypertension is driving consumers toward healthier cooking oil choices. Soybean oil, with its favorable fatty acid profile, including essential omega-3s and vitamin E, is perceived as a health-conscious alternative to saturated animal fats and partially hydrogenated oils

- For instance, in countries such as the U.S., China, and Mexico—where obesity rates are particularly high—public health campaigns and nutritional guidelines are urging populations to reduce saturated fat intake. As a result, many consumers are switching to plant-based oils such as soybean oil, which supports cardiovascular wellness and offers a better lipid profile

- Restaurants and commercial kitchens are also replacing traditional fats with soybean oil in deep frying, salad dressing, and baking to meet consumer demand for healthier meals without compromising taste or texture

- This shift is particularly visible in quick service restaurant (QSR) chains that are revising their oil usage to comply with health labeling and nutritional transparency standards

- Moreover, rising demand for low-calorie and cholesterol-free food products is prompting food companies to formulate new product lines using soybean oil, further boosting its market presence across both residential and institutional segments

Restraint/Challenge

“High Price of the Soybean Oil”

- The relatively high and volatile price of soybean oil continues to pose a significant restraint to the market. Factors such as erratic weather conditions affecting soybean harvests, fluctuating input costs, global supply chain disruptions, and export policy changes from major producers such as the U.S., Brazil, and Argentina all contribute to pricing instability

- For instance, drought conditions in key producing regions or geopolitical trade disputes can reduce global soybean output, resulting in sharp price hikes for soybean oil. Such volatility makes it difficult for manufacturers and retailers to maintain pricing consistency, especially in cost-sensitive markets

- Small and medium-sized food businesses, particularly in developing economies, often face difficulty absorbing high input costs, leading them to shift toward cheaper alternatives such as palm oil, which is more stable in pricing despite environmental concerns

- In addition, the growing global emphasis on sustainable and organic sourcing can further push prices upward, making premium soybean oil products less accessible to a broader consumer base

- Addressing this challenge requires strategic investments in crop resilience, supply chain efficiency, and supportive government trade policies to stabilize supply and pricing over the long term

Soybean Oil Market Scope

The market is segmented on the basis of product type, application, ingredients, distribution channel, and end user.

• By Product Type

On the basis of product type, the soybean oil market is segmented into organic soybean oil and conventional soybean oil. The conventional soybean oil segment dominated the market with the largest revenue share of 86.2% in 2024, primarily due to its long-standing use in both domestic and industrial applications. Its affordability, high availability, and refined taste make it the preferred choice for food processing companies, fast-food chains, and households alike. In developing countries, where price sensitivity remains high, conventional soybean oil continues to meet large-scale demand. Its consistent quality, neutral flavor, and stability under heat further position it as a versatile oil for frying, baking, and sautéing.

The organic soybean oil segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the global shift toward clean-label and non-GMO products. Consumers are increasingly seeking foods free from synthetic pesticides, hormones, and fertilizers, elevating the value of organic certification. The rising awareness around sustainable farming, health-related concerns about chemical residues in food, and the premiumization of organic products in modern retail outlets contribute to this growth. Organic soybean oil also appeals to environmentally-conscious consumers due to its lower ecological footprint and support for regenerative agriculture.

• By Application

On the basis of application, the market is segmented into margarine, frozen foods, salad dressings, shortenings, baked food, cosmetics and personal care products, animal agriculture, and others. The margarine segment held the largest market share in 2024, driven by the rising global demand for plant-based alternatives to butter. Soybean oil is a core ingredient in margarine manufacturing due to its excellent emulsifying capacity, mild flavor, and ability to maintain product consistency at refrigerated and room temperatures. It offers an economical solution for manufacturers to meet growing consumer preferences for cholesterol-free and trans-fat–compliant spreads.

The cosmetics and personal care products segment is projected to experience the fastest growth through 2032, owing to the increasing use of plant-based oils in skincare, body care, and haircare formulations. Soybean oil is naturally rich in vitamin E, linoleic acid, and antioxidants, making it suitable for hydration, anti-aging, and skin barrier support. With consumers prioritizing clean beauty, cruelty-free formulations, and natural actives, cosmetic brands are rapidly incorporating soybean oil as a base or carrier oil. The growth of the beauty and wellness industry, especially in Asia-Pacific and Latin America, further accelerates adoption in this category.

• By Ingredients

On the basis of ingredients, the soybean oil market is categorized into omega-3 fats, vitamin E, low saturated fats, and polyunsaturated fats. The polyunsaturated fats segment led the market in 2024, due to their proven cardiovascular benefits and strong backing from nutritional guidelines by major health organizations. Polyunsaturated fatty acids, including omega-6 and omega-3, are known to help reduce LDL cholesterol and lower heart disease risk. Soybean oil, with a favorable fatty acid profile, is frequently promoted as a heart-healthy cooking oil. This positioning drives its adoption among health-conscious consumers and supports marketing efforts targeting low-fat and low-cholesterol food formulations.

The omega-3 fats segment is projected to grow at the highest rate from 2025 to 2032, driven by their increasing application in functional foods and preventive health products. Consumers are becoming more proactive about cognitive health, inflammation control, and eye health—areas where omega-3s play a critical role. Soybean oil, being one of the few plant-based oils with naturally occurring alpha-linolenic acid (ALA), a precursor to omega-3s, offers a cost-effective and scalable alternative to marine-based sources such as fish oil.

• By Distribution Channel

On the basis of distribution channel, the market is divided into supermarket/hypermarket, convenience stores, wholesaler/distributor, and neighbourhood stores. The supermarket/hypermarket segment dominated the market in 2024, owing to their dominance in urban and suburban shopping patterns. These retail formats offer a wide variety of brands and packaging formats under one roof, making it convenient for consumers to compare and select soybean oil based on price, quality, or organic certification. Strong merchandising, promotional discounts, and product visibility help drive volume sales in this channel. The segment also benefits from the growing presence of private-label oils offered by retail giants.

The wholesaler/distributor segment is expected to witness the fastest growth rate through 2032, supported by growing demand from bulk buyers such as restaurants, institutional kitchens, and food manufacturers. These buyers prefer long-term supply agreements and value pricing efficiency over brand identity. As commercial food operations scale in emerging economies and the foodservice sector continues to expand, the role of distributors in managing bulk logistics, storage, and product freshness becomes increasingly vital.

• By End User

On the basis of end user, the market is segmented into commercial and household. The commercial segment accounted for the largest market share in 2024, driven by high-volume use of soybean oil across bakeries, quick-service restaurants (QSRs), food processing units, and catering services. Its versatility, stable frying performance, and consistent supply chain logistics make it a staple for industrial kitchens. The rising trend of packaged snacks, ready-to-eat meals, and large-scale institutional food service further supports demand from this segment.

The household segment is anticipated to grow at the fastest CAGR during the forecast period, reflecting the impact of rising health awareness and lifestyle changes, especially post-pandemic. Consumers are increasingly scrutinizing cooking oils for their health profiles, leading to the replacement of saturated fats with polyunsaturated options such as soybean oil. The segment also benefits from growing availability in small pack formats, online retail penetration, and rising home-cooking trends supported by food influencers and recipe platforms.

Soybean Oil Market Regional Analysis

- Asia-Pacific dominated the soybean oil market with the largest revenue share of 47.02% in 2024, driven by high population density, rising disposable incomes, and a growing preference for affordable vegetable oils in daily cooking

- The region’s expanding food processing industry, increasing demand for fried and packaged foods, and rising health awareness regarding unsaturated fats are key contributors to market growth

- Major soybean-producing countries such as China and India, coupled with rising imports and investments in oil refining infrastructure, are boosting the adoption of soybean oil across both urban and rural sectors

Japan Soybean Oil Market Insight

The Japan market is growing steadily due to increasing demand for light, healthy cooking oils among its aging population. Soybean oil is valued for its low saturated fat content and high stability, aligning with the country's dietary preferences. Japanese food manufacturers are incorporating soybean oil into processed foods and ready-to-eat meals, while ongoing innovation in cold-pressed and fortified variants supports premium market expansion.

China Soybean Oil Market Insight

China held the largest share in the Asia-Pacific soybean oil market in 2024, supported by strong domestic production and large-scale consumption across household and commercial applications. The demand is further driven by high soymeal output, government initiatives to improve edible oil self-sufficiency, and rising health-consciousness among urban consumers. Growth in quick-service restaurants and processed foods continues to fuel volume demand.

Europe Soybean Oil Market Insight

The Europe soybean oil market is projected to grow at a steady CAGR during the forecast period, driven by increasing demand for plant-based and sustainable cooking oils in food manufacturing and household use. Rising adoption of non-GMO and organic soybean oil, along with favorable food labeling regulations, is pushing manufacturers to reformulate products using cleaner oil alternatives. Countries across Western and Northern Europe are witnessing a shift from saturated fats toward polyunsaturated options, further enhancing soybean oil’s market penetration

U.K. Soybean Oil Market Insight

The U.K. market is expanding due to rising consumer interest in healthier edible oils and the growing vegan and vegetarian food trend. Soybean oil is gaining traction as a key ingredient in meat alternatives, salad dressings, and low-fat spreads. Supermarkets are increasingly stocking organic and cold-pressed variants, while foodservice operators seek cost-effective, high-performance oils amid inflationary pressures.

Germany Soybean Oil Market Insight

Germany’s soybean oil market is experiencing moderate growth, supported by its strong food processing industry and demand for sustainable, plant-based ingredients. The market is also benefiting from increased use of soybean oil in bakery and snack products. Consumer preference for non-GMO and minimally processed oils is steering demand toward refined and cold-pressed soybean oil sourced from traceable supply chains.

North America Soybean Oil Market Insight

North America is expected to grow at the fastest CAGR from 2025 to 2032, fueled by strong demand for vegetable oils in processed foods, plant-based products, and commercial kitchens. The shift toward trans fat-free and heart-healthy oils is accelerating soybean oil usage in packaged foods, snacks, and fast food chains. Technological advancements in oil refining, strong supply from domestic soybean producers, and supportive FDA regulations regarding GRAS (Generally Recognized As Safe) status for soybean oil are enhancing market penetration

U.S. Soybean Oil Market Insight

The U.S. soybean oil market captured the largest revenue share in 2024 within North America, driven by extensive domestic production and high consumption in both food and industrial sectors. Soybean oil is widely used by restaurants, snack manufacturers, and large-scale bakeries due to its affordability, neutral flavor, and frying stability. Additionally, increasing interest in biodiesel and bio-based products supports demand beyond culinary use.

Soybean Oil Market Share

The soybean oil industry is primarily led by well-established companies, including:

- DSM (Netherlands)

- ADM (U.S.)

- DuPont (U.S.)

- Cargill Incorporated. (U.S.)

- CHS Inc. (U.S.)

- Kerry Group plc (Ireland)

- Wilmar International Ltd (Singapore)

- Devansoy Inc. (U.S.)

- Blue Diamond Growers (U.S.)

- Dean Foods (U.S.)

- Eden Foods Inc. (U.S.)

- House Foods America Corporation. (U.S.)

- The Hain Celestial Group (U.S.)

- Pulmuone Foods USA (U.S.)

- Vitasoy International Holdings Limited. (Hong Kong)

- Tofurky (U.S.)

Latest Developments in Global Soybean Oil Market

- In July 2024, Louis Dreyfus Company (LDC), a leading global merchant and processor of agricultural goods, announced the relaunch of Vibhor, its consumer-facing edible oil brand in India. This strategic move reflects LDC’s intent to expand its downstream footprint in the value chain and is expected to intensify competition in the Indian soybean oil market. The relaunch strengthens brand visibility and consumer engagement, supporting the market’s ongoing shift toward branded and packaged edible oils amid rising health and quality consciousness

- In July 2024, ADM announced its commitment to supplying European customers with fully traceable and segregated soybean meal and oil, aligning with the upcoming EU deforestation regulations set to take effect on December 30, 2024. This initiative, involving over 5,300 U.S. farmers, leverages advanced technologies to enhance transparency and traceability across global supply chains, positioning ADM as a key player in sustainable sourcing within the soybean oil market

- In July 2024, Benson Hill, Inc. reported notable advancements in its innovation pipeline, aimed at enhancing product value across multiple segments of the soybean market. The company’s developments target improvements in applications such as animal feed, soybean oil, and biofuels, supporting market demand for higher-performing, sustainable, and multifunctional soybean-derived solutions

- In 2022, Emami Healthy & Tasty introduced its Ultra Lite Soyabean Oil to cater to the needs of health-conscious consumers. The product positioned itself as a low-absorption, heart-friendly option, which resonated well with urban households. Emami’s targeted marketing campaigns and wide retail network significantly boosted product reach, contributing to the premiumization trend in the Indian soybean oil segment and reinforcing the shift toward value-added offerings in the edible oil space

- In August 2021, ADM and Marathon Petroleum Corp announced a joint venture aimed at meeting the increasing demand for soybean oil used in the production of renewable diesel oil. The partnership seeks to capitalize on the growing popularity of renewable fuels and leverage the benefits of soybean oil as a key feedstock for sustainable energy solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Soybean Oil Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Soybean Oil Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Soybean Oil Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.