Global Sports Betting Market

Market Size in USD Billion

CAGR :

%

USD

191.66 Billion

USD

385.80 Billion

2025

2033

USD

191.66 Billion

USD

385.80 Billion

2025

2033

| 2026 –2033 | |

| USD 191.66 Billion | |

| USD 385.80 Billion | |

|

|

|

|

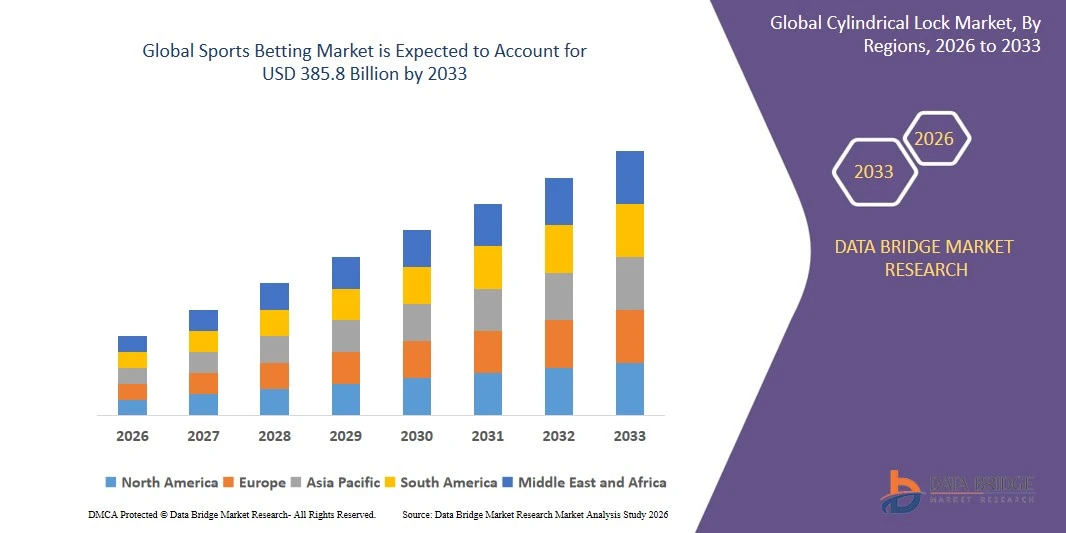

What is the Sports Betting Market Size and Growth Rate?

The global sports betting market was valued at USD 191.66 billion in 2025 and is expected to reach USD 385.8 billion by 2033. During the forecast period of 2026 to 2033 the market is likely to grow at a CAGR of 9.2%, primarily driven by the increasing legalization of betting activities and the expansion of digital platforms. This growth is driven by factors such as the rising popularity of sports leagues, increased internet and smartphone penetration, and technological advancements in real-time data analytics and betting software.

Market Size and Forecast:

- Market Size (2025): 191.66 USD Billion

- Projected Market Size (2033): 385.8 USD Billion

- CAGR (2026-2033): 9.2%

What are the Major Takeaways of Sports Betting Market?

- Sports betting involves predicting sports results and placing a wager on the outcome. It is a popular form of gambling, spanning across multiple sports including football, basketball, baseball, and esports

- The demand for sports betting has surged due to growing digital transformation, increased accessibility through mobile applications, and the legalization of sports betting in several countries

- The North America region stands out as one of the dominant regions in the sports betting market, fueled by regulatory changes, increasing participation in fantasy sports, and the integration of secure digital payment platforms

- For instance, in the U.S., the Supreme Court’s 2018 decision to overturn the federal ban on sports betting has led to a rapid expansion of the market across multiple states, with sportsbooks launching both online and in physical venues

- Globally, online sports betting holds the majority of the market share and continues to rise, driven by real-time betting options, live-streaming integration, and user-friendly interfaces that enhance the overall betting experience

Report Scope and Sports Betting Market Segmentation

|

Attributes |

Sports Betting Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sports Betting Market Trends

“Increased Integration of AI and Data Analytics”

- One prominent trend in the global sports betting market is the rising integration of artificial intelligence (AI) and data analytics to enhance user experience and optimize betting strategies

- These advanced technologies allow sportsbooks to offer personalized betting recommendations, real-time odds adjustments, and fraud detection, improving both user engagement and platform integrity

- For instance, AI-powered algorithms can analyze player performance data, team statistics, and historical trends to generate predictive models, which assist bettors in making more informed decisions

- Data analytics also allows platforms to monitor user behavior and provide customized marketing and promotional offers, increasing retention and engagement

- This trend is transforming the sports betting landscape, enabling smarter, faster, and more secure betting experiences, and driving demand for technologically advanced betting solutions in the market

Sports Betting Microscope Market Dynamics

Driver

“Legalization and Regulation of Sports Betting Across New Markets”

- The global sports betting market is experiencing robust growth due to the increasing legalization and regulation of sports betting in various countries and U.S. states

- Governments are recognizing the economic potential of regulated sports betting, including tax revenue generation, job creation, and increased consumer protection

- Legal frameworks also foster trust and transparency, encouraging more users to shift from unregulated, illegal platforms to authorized betting services

- This shift is especially significant in regions where sports have a massive following, such as North America, Europe, and parts of Asia-Pacific

For instance,

- In May 2023, Brazil passed legislation to legalize online sports betting, attracting global operators like Bet365 and Entain to expand into the region

- In January 2022, New York became one of the largest U.S. states to launch mobile sports betting, generating over USD 1.6 billion in handle within the first month

- As more countries and jurisdictions embrace regulatory reforms, the market is set to expand rapidly, opening up new revenue streams and attracting major industry players

Opportunity

“Growth of Mobile Sports Betting Platforms”

- The increasing adoption of smartphones and mobile apps has created a significant opportunity in the global sports betting market, making it more accessible and convenient for users to place bets on the go

- Mobile sports betting platforms allow users to place bets in real-time, track live events, and manage their accounts directly from their devices, driving market expansion

For instance,

- In August 2023, BetMGM launched a mobile sports betting app in new states across the U.S., enhancing its reach and accessibility for bettors

- In January 2024, FanDuel introduced a mobile app update that incorporated live streaming of major sports events, giving users an immersive and interactive betting experience

- The shift to mobile platforms is not only expanding the sports betting market but also attracting younger, tech-savvy bettors, further driving market growth

Restraint/Challenge

“Regulatory Uncertainty and Legal Restrictions in Key Markets”

- The sports betting market faces significant challenges due to regulatory uncertainty and legal restrictions across various countries and regions

- Differing national laws regarding online gambling, advertising restrictions, and inconsistent taxation policies create a fragmented regulatory landscape, hindering the seamless expansion of operators

- In some jurisdictions, sports betting remains illegal or is tightly regulated, making it difficult for global companies to enter or scale their operations

For instance,

- In October 2023, the Indian government announced stricter scrutiny and proposed a ban on offshore betting platforms operating without proper licenses, impacting the activities of several international operators in the region

- In May 2023, Germany introduced revised gambling regulations that imposed additional taxes and compliance burdens on online betting platforms, leading to reduced margins for operators and exit of smaller firms

- Such legal and regulatory challenges can limit market penetration, restrict advertising, and deter investor confidence, ultimately slowing down the overall growth of the global sports betting market

Sports Betting Market Scope

The market is segmented on the basis of type, platform, operator, sports, and age group.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Platform |

|

|

By Sports |

|

|

By Operator

|

|

|

By Age Group |

|

Sports Betting Market Regional Analysis

“North America is the Dominant Region in the Sports Betting Market”

- North America dominates the global sports betting market, driven by a large, sports-centric population, well-established online betting platforms, and progressive regulations in key markets like the U.S

- The U.S. holds a significant share due to the growing legalization of sports betting in multiple states, increasing consumer interest, and the presence of major sports leagues such as the NFL, NBA, and MLB

- The availability of well-established online platforms, digital payment systems, and partnerships with major sports organizations further strengthen the market

- In addition, the increasing adoption of mobile sports betting apps, technological advancements in live betting and streaming, and a high rate of consumer engagement are fueling market expansion across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the global sports betting market, driven by the increasing legalization of sports betting, rapid digitalization, and growing sports fanbase across the region

- Countries such as China, India, and Australia are emerging as key markets, with India, in particular, showing significant growth due to the rising popularity of cricket betting and the potential for further regulatory changes to legalize and expand sports betting

- Australia, with its well-established betting markets, continues to lead in both land-based and online sports betting activities, benefiting from its strong sports culture and advanced technological infrastructure

- China and India, with their large populations and growing middle class, are seeing increased government and private sector investments in both land-based and online sports betting platforms. This, combined with improving digital payment systems and internet access, is propelling market growth across the region

Sports Betting Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BETSSON AB (Sweden)

- Fortuna Entertainment Group (Czech Republic)

- Las Vegas Sands Corp (U.S.)

- bet365 (U.K.)

- Flutter Entertainment plc (Ireland)

- 888 Holdings Plc (U.K.)

- Entain (U.K.)

- Kindred Group plc (Sweden)

- MGM Resorts International (U.S.)

- Wynn Resorts Holdings (U.S.)

- NOVIBET (Greece)

- Galaxy Entertainment Group Limited (Hong Kong)

- Sun International (South Africa)

- RTSmunity a.s. (Slovakia)

- Sky Infotech. (India)

- Peermont Global Proprietary Limited (South Africa)

- SJM Holdings Limited (Macau)

- Sportradar AG (Switzerland)

- FanUp Inc. (U.S.)

- Rivalry Ltd. (Canada)

- EveryMatrix (Malta)

- Kairos Group (U.K.)

- BETAMERICA (U.S.)

- Scientific Game (U.S.)

- ComeOn Group (Malta)

Latest Developments in Global Sports Betting Market

- In December 2023, Betsson, a leading name in the sports betting industry, announced a strategic partnership with Racing Club de Avellaneda for the 2023/2024 season. Starting May 19, Betsson's logo would feature prominently on the upper back of the men's and women's First Division football teams' shirts during local and international matches. This collaboration aims to boost Betsson's brand visibility and engagement within the sports sector, capitalizing on football's immense global popularity to attract new customers and expand its market presence

- In September 2023, Betsson obtained a license to offer online sports betting in France's regulated market through a partnership with a local entity. The official launch took place in the fourth quarter of 2023 under the Betsson brand, marking a significant expansion into the French online betting sector. This strategic move highlights Betsson's commitment to geographic diversification and its ambition to deliver exceptional gaming experiences tailored to local markets. By combining global expertise with local insights, Betsson aims to strengthen its presence in one of Europe's largest gaming markets

- In September 2022, Bet365 introduced its e-sports betting service in Colorado, operating under Century Casinos' state master license. This strategic launch capitalized on the rising popularity of electronic sports betting in the region. By leveraging its partnership with Century Casinos, Bet365 effectively accessed the Colorado market, offering a seamless and engaging betting experience. The collaboration underscored Bet365's commitment to expanding its footprint in the U.S. and meeting the growing demand for innovative betting solutions

- In September 2022, Entain Plc, alongside Bally's Corporation, BetMGM, DraftKings, FanDuel, and MGM Resorts International, launched a joint initiative to promote responsible gaming. This collaboration introduced a 12-point pledge, emphasizing the importance of responsible gambling practices across their platforms. The initiative aims to enhance their global brand image by fostering a culture of accountability and consumer protection. By prioritizing responsible gaming, the companies seek to address problem gambling, ensure informed choices for users, and advocate for socially responsible advertising

- In May 2022, William Hill expanded its flagship brand into Latvia, unveiling strategies to drive substantial revenue growth in the region. The company aimed to leverage existing media partnerships to create customized content aligned with its Brotherhood brand strategy. This approach focused on enhancing market presence and fostering deeper engagement within Latvia's betting and online casino industry. By combining innovative branding with strategic collaborations, William Hill sought to solidify its position as a leading player in the Latvian market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.