Global Spray Foam Insulation Market

Market Size in USD Billion

CAGR :

%

USD

2.09 Billion

USD

2.88 Billion

2025

2033

USD

2.09 Billion

USD

2.88 Billion

2025

2033

| 2026 –2033 | |

| USD 2.09 Billion | |

| USD 2.88 Billion | |

|

|

|

|

What is the Global Spray Foam Insulation Market Size and Growth Rate?

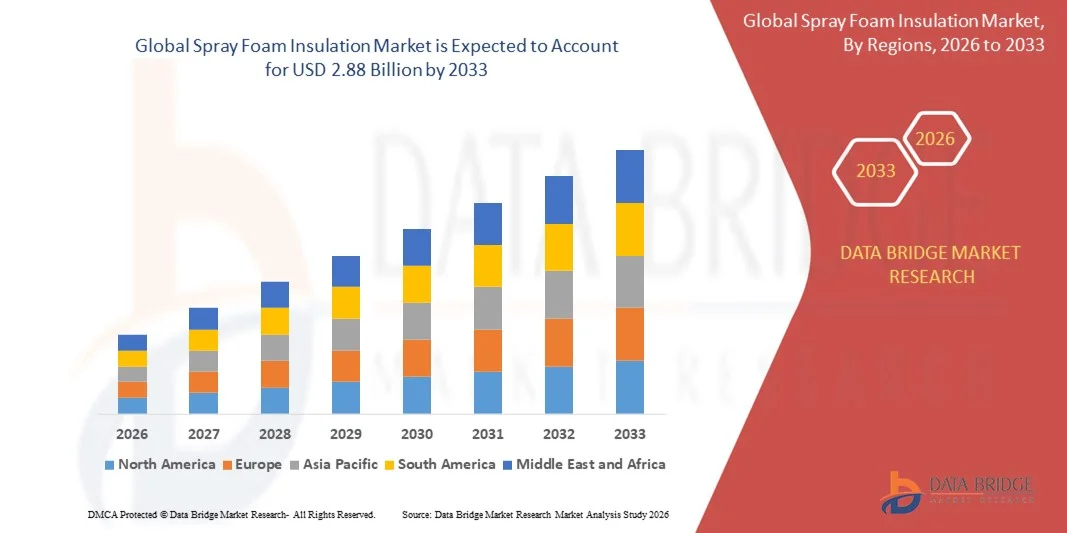

- The global spray foam insulation market size was valued at USD 2.09 billion in 2025 and is expected to reach USD 2.88 billion by 2033, at a CAGR of 4.10% during the forecast period

- Rising demand for polystyrene foams is the vital factor escalating the market growth, also rising research and development in the market, increasing greenhouse gas emissions, rising growth in end-use industry, rising demand for energy-efficient equipment that can be used in applications such as roofing, concrete rehabilitation, rising demand for green technologies that can be incorporated into commercial construction and office buildings to reduce energy consumption along with various advancements in metal foam by manufacturers operating in market are the major factors among others driving the spray foam insulation market

What are the Major Takeaways of Spray Foam Insulation Market?

- Increasing government initiatives regarding adoption of energy-efficient equipment and rising technological advancements and increasing modernization in the production techniques will further create new opportunities for the spray foam insulation market

- However, increasing presence of strict regulations regarding the usage of specific products and their applications and increasing fluctuation in crude oil prices are the major factors among others acting as restraints, while rising efficacy maintenance of feed acidifiers will further challenge the growth of spray foam insulation market

- North America dominated the spray foam insulation market with the largest revenue share of 42.5% in 2025, driven by strong construction and renovation activities, growing adoption of energy-efficient building codes, and the presence of key insulation manufacturers

- The Asia-Pacific region is projected to witness the fastest growth rate of 10.2% during 2026–2033, driven by rapid urbanization, rising construction and industrial activities, and increasing awareness of energy-efficient building materials

- The LDPE segment dominated the market with the largest revenue share of 44.8% in 2025, attributed to its superior flexibility, excellent sealability, and moisture barrier properties that make it ideal for food, pharmaceutical, and consumer packaging applications

Report Scope and Spray Foam Insulation Market Segmentation

|

Attributes |

Spray Foam Insulation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Spray Foam Insulation Market?

Rising Focus on Energy Efficiency, Sustainability, and High-Performance Insulation Solutions

- The spray foam insulation market is experiencing a notable shift toward energy-efficient, eco-friendly, and high-performance insulation materials, driven by global regulations to reduce carbon emissions, improve energy conservation, and meet green building standards. Manufacturers are increasingly adopting bio-based, low-VOC, and recyclable foam formulations to align with sustainability initiatives and evolving construction norms

- For instance, BASF SE and Covestro AG have introduced eco-friendly spray foam products designed for residential, commercial, and industrial applications. These foams provide superior thermal insulation, moisture resistance, and structural support, while minimizing environmental impact

- Growing demand for rapid, easy-to-apply insulation solutions that offer superior thermal performance and long-term durability is propelling market adoption, particularly in commercial buildings, residential construction, and cold-storage facilities

- Leading manufacturers are incorporating advanced formulations and chemical innovations, such as closed-cell structures and hybrid polyurethanes, to enhance R-value, fire resistance, and air sealing capabilities. These innovations improve operational efficiency, energy savings, and occupant comfort

- Increasing focus on sustainable construction practices, green building certifications, and compliance with global energy efficiency frameworks such as LEED, BREEAM, and ENERGY STAR is accelerating the adoption of advanced spray foam insulation solutions

- As consumer awareness for energy efficiency and sustainable building materials rises, the integration of recyclable, low-emission, and high-performance insulation foams is expected to remain the defining trend shaping the Spray Foam Insulation market globally

What are the Key Drivers of Spray Foam Insulation Market?

- Increasing construction activities across residential, commercial, and industrial sectors are a primary driver for the Spray Foam Insulation market. Builders and contractors are seeking insulation solutions that improve energy efficiency, reduce operational costs, and meet stringent building codes

- For instance, Owens Corning and Saint-Gobain have reported growing adoption of spray foam insulation in North America and Europe, fueled by government incentives for energy-efficient buildings and rising consumer preference for sustainable construction materials

- Environmental awareness and energy conservation initiatives are driving manufacturers to develop bio-based, low-VOC, and recyclable foam solutions. Global companies are investing in next-generation polyurethane and polyisocyanurate foams to meet performance and sustainability standards

- Technological advancements in spray foam formulations, automated application equipment, and hybrid insulation systems have improved coverage, adhesion, and thermal resistance, making them suitable for diverse building types and climates

- Expansion of retrofit and renovation projects, coupled with growing adoption in cold storage, industrial facilities, and smart buildings, is further driving demand for durable, high-performance insulation solutions

- As building owners and developers increasingly focus on sustainability and cost savings, continuous innovation in spray foam chemistry, energy efficiency, and eco-friendly materials will propel the global market growth for Spray Foam Insulation

Which Factor is Challenging the Growth of the Spray Foam Insulation Market?

- High production and raw material costs associated with polyurethane and polyisocyanurate foams remain a major barrier to market expansion. Specialized chemical resins, flame retardants, and closed-cell formulations increase manufacturing complexity and overall costs

- For instance, smaller insulation contractors in Asia-Pacific and Europe face challenges in matching cost efficiency with larger multinational manufacturers, limiting market penetration in emerging regions

- Regulatory differences, environmental restrictions, and occupational safety requirements across countries restrict uniform adoption. Compliance with fire codes, VOC limits, and chemical handling standards adds complexity for global manufacturers

- Technical challenges such as maintaining optimal expansion, adhesion, and thermal performance under varying climatic conditions further hinder scalability. Improper application can reduce R-value and increase maintenance costs

- Volatility in raw material prices, particularly for petrochemical-based polyols and isocyanates, adds financial uncertainty and compresses profit margins for small and medium-sized firms

- Leading players are focusing on RandD investments, eco-friendly chemical innovations, and automated spray technologies to improve efficiency, reduce costs, and ensure compliance. Over time, standardized sustainable materials and energy-efficient formulations are expected to alleviate challenges and drive long-term market growth globally

How is the Spray Foam Insulation Market Segmented?

The market is segmented on the basis of product type, end-use, foam type, application, and infrastructure type.

- By Product Type

On the basis of product type, the spray foam insulation market is segmented into Stand-Alone Systems and On-Grid Systems. The Stand-Alone System segment dominated the market with the largest revenue share of 47.2% in 2025, owing to its ability to operate independently of the grid, high reliability in remote locations, and suitability for residential and commercial buildings with limited grid connectivity. Its ease of installation and ability to integrate with renewable energy sources such as solar panels and wind turbines have further enhanced adoption.

The On-Grid System segment is expected to register the fastest CAGR from 2026 to 2033, driven by rising demand for cost-effective hybrid solutions, grid stability benefits, and government incentives promoting net-zero energy buildings.

- By Power Rating

On the basis of power rating, the market is categorized into Up to 10 kW, 11 kW–100 kW, and Above 100 kW. The Up to 10 kW segment dominated the market with a revenue share of 42.5% in 2025, primarily due to growing adoption in residential applications, small commercial facilities, and retrofitting projects where low-capacity systems are most suitable.

The Above 100 kW segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand in large industrial setups, utility-scale hybrid installations, and government-backed renewable energy projects across Asia-Pacific and Europe.

- By End Users

On the basis of end users, the spray foam insulation market is segmented into Residential, Commercial, and Industrial. The Residential segment dominated the market with the largest revenue share of 49.3% in 2025, due to rising adoption of energy-efficient homes, retrofit projects, and government incentives for sustainable building practices.

The Industrial segment is expected to register the fastest CAGR from 2026 to 2033, fueled by growing investments in large-scale manufacturing plants, warehouses, and cold storage facilities requiring high-performance insulation solutions to reduce energy costs and comply with environmental regulations.

Which Region Holds the Largest Share of the Spray Foam Insulation Market?

- North America dominated the spray foam insulation market with the largest revenue share of 42.5% in 2025, driven by strong construction and renovation activities, growing adoption of energy-efficient building codes, and the presence of key insulation manufacturers. The region’s focus on high-performance, sustainable, and fire-resistant insulation solutions is fostering widespread market adoption across residential, commercial, and industrial sectors

- The region benefits from stringent building regulations such as the U.S. International Energy Conservation Code (IECC) and Canadian National Building Code (NBC), which emphasize energy efficiency, thermal performance, and environmental compliance in insulation materials

- Continuous advancements in spray foam technology, particularly in closed-cell, open-cell, and hybrid formulations, are reinforcing North America’s leadership in the global Spray Foam Insulation landscape

U.S. Spray Foam Insulation Market Insight

The U.S. held the largest share in the North America spray foam insulation market in 2025, supported by rising residential and commercial construction projects, retrofitting initiatives, and government incentives for energy-efficient buildings. Leading companies such as Owens Corning and BASF SE are investing heavily in high-performance spray foam solutions to meet sustainability goals and compliance standards. The U.S. market also benefits from growing awareness of energy savings, driving demand for advanced insulation materials.

Canada Spray Foam Insulation Market Insight

Canada remains a key contributor within North America due to its thriving construction sector, stringent energy efficiency standards, and increasing focus on sustainable insulation practices. Demand is particularly strong in residential retrofits, commercial buildings, and industrial facilities, where spray foam offers superior thermal performance, air sealing, and moisture resistance. Canadian companies are prioritizing environmentally friendly formulations, supporting market growth.

Asia-Pacific Spray Foam Insulation Market Insight

The Asia-Pacific region is projected to witness the fastest growth rate of 10.2% during 2026–2033, driven by rapid urbanization, rising construction and industrial activities, and increasing awareness of energy-efficient building materials. Countries such as China, India, Japan, and South Korea are creating strong opportunities for spray foam insulation due to government incentives, growing commercial infrastructure, and residential expansion. Regional manufacturers are adopting innovative spray foam technologies to meet environmental regulations and reduce energy consumption in buildings.

China Spray Foam Insulation Market Insight

China is emerging as a central player in the Asia-Pacific Spray Foam Insulation market, fueled by rapid urbanization, large-scale infrastructure projects, and increasing demand for energy-efficient buildings. Manufacturers are investing in high-performance spray foam solutions with superior R-values, fire resistance, and low global warming potential (GWP). Government initiatives promoting green building certifications and energy-efficient retrofits are further supporting market growth.

India Spray Foam Insulation Market Insight

India is witnessing rapid growth in the Spray Foam Insulation market, supported by expanding residential and commercial construction, rising industrial activity, and government initiatives promoting energy efficiency. Local manufacturers are focusing on cost-effective, durable, and thermally efficient spray foam solutions suitable for extreme climatic conditions. The growing adoption of energy-efficient building practices and rising awareness of sustainable construction materials are driving continuous market growth.

Europe Spray Foam Insulation Market Insight

The Europe spray foam insulation market is growing steadily, driven by strict energy efficiency regulations and increasing adoption of sustainable building materials under EU directives. Countries such as Germany, France, and the U.K. are leading in implementing advanced spray foam solutions for residential and commercial applications. The region’s focus on circular economy practices, low-carbon construction materials, and advanced building codes is promoting long-term market stability and growth.

Germany Spray Foam Insulation Market Insight

Germany leads the European Spray Foam Insulation market owing to its strong construction sector, stringent environmental regulations, and growing demand for high-performance insulation. Manufacturers are investing in spray foam formulations with low GWP, high R-values, and improved moisture resistance to comply with EU energy efficiency standards. Germany’s emphasis on sustainable building practices makes it a key innovation hub in the European market.

U.K. Spray Foam Insulation Market Insight

The U.K. market is expanding steadily, fueled by high consumer demand for energy-efficient homes and commercial buildings. Investments in eco-friendly and fire-resistant spray foam insulation solutions are supporting growth, while government initiatives such as the Future Homes Standard continue to drive adoption of advanced insulation technologies. Rising retrofitting projects in existing buildings are further strengthening market penetration.

Which are the Top Companies in Spray Foam Insulation Market?

The spray foam Insulation industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Covestro AG (Germany)

- Lapolla Industries, Inc. (U.S.)

- Huntsman International LLC. (U.S.)

- Dow (U.S.)

- SAFCO Foam Insulation (U.S.)

- Cajun Foam Insulation (U.S.)

- EnergyGuard Foam Insulators, LP (U.S.)

- Saint‑Gobain (France)

- Insulation Northwest (U.S.)

- PUFF INC (U.S.)

- Pittsburgh Foam Insulation (U.S.)

- Owens Corning (U.S.)

- Recticel (Belgium)

- Armacell (Germany)

- NCFI Polyurethanes (U.S.)

- CERTAINTEED (U.S.)

- Rhino Linings Corporation (U.S.)

- Bayer AG (Germany)

What are the Recent Developments in Global Spray Foam Insulation Market?

- In September 2024, Armacell announced plans to open a new aerogel insulation plant in India and to launch its next-generation aerogel product line, ArmaGel XG, marking a significant expansion in the company’s high-performance insulation offerings and reinforcing its commitment to advanced thermal solutions

- In December 2023, Saint-Gobain announced its intention to divest a majority stake in its UK foam insulation business, Celotex, as part of its strategic disposal plan, with Soprema, a private French firm specializing in waterproofing and insulation, acquiring a 75% ownership stake while Saint-Gobain retains a 25% minority share, reflecting a strategic realignment to optimize its business portfolio and leverage specialized industry expertise

- In November 2023, DAP, a leader in the home improvement and construction products industry, introduced the first-of-its-kind 1-component broadcast spray foam, Wall and Cavity Foam with Wide Spray Applicator, revolutionizing spray foam application and enhancing ease-of-use and coverage for residential and commercial projects

- In April 2023, Huntsman Building Solutions’ high-performance spray foam insulation was incorporated into Manchester’s OGS container scheme, demonstrating the material’s effectiveness and adoption in large-scale infrastructure projects and sustainable building initiatives

- In May 2022, BASF collaborated with Kinglong United Automotive (Suzhou) Co., Ltd., to deploy its 100% water-blown polyurethane open-cell spray foam in the latest bus model, meeting stringent VOC standards and improving interior air quality for public transportation, highlighting the role of eco-friendly insulation solutions in mobility applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Spray Foam Insulation Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Spray Foam Insulation Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Spray Foam Insulation Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.