Global Statin Market

Market Size in USD Billion

CAGR :

%

USD

16.85 Billion

USD

24.34 Billion

2024

2032

USD

16.85 Billion

USD

24.34 Billion

2024

2032

| 2025 –2032 | |

| USD 16.85 Billion | |

| USD 24.34 Billion | |

|

|

|

Statin Market Size

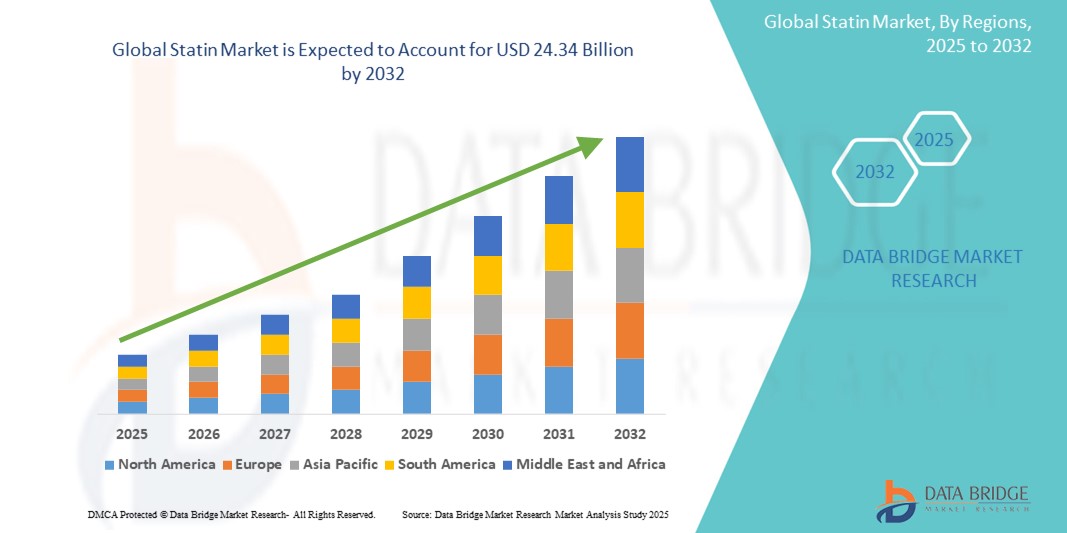

- The global statin market was valued at USD 16.85 billion in 2024 and is expected to reach USD 24.34 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.70%, primarily driven by the rising prevalence of cardiovascular

- This growth is driven by factors such as the aging population, and growing awareness of the importance of cholesterol management

Statin Market Analysis

- Statins are a class of medications widely used to lower cholesterol levels, particularly targeting low-density lipoprotein (LDL) cholesterol. These medications are crucial in preventing cardiovascular diseases (CVDs) such as heart attacks, strokes, and atherosclerosis, by managing cholesterol levels and improving overall heart health

- The demand for statins is predominantly driven by the increasing global prevalence of cardiovascular diseases, influenced by factors such as an aging population, unhealthy dietary patterns, physical inactivity, and rising incidences of diabetes and hypertension

- North America is the dominant region for the statin market, supported by its well-established healthcare infrastructure, high rates of statin prescriptions, and a growing focus on preventive healthcare. The region also benefits from substantial investments in research and development in the pharmaceutical industry

- For instance, in the U.S., statins are prescribed extensively due to the high rates of high cholesterol and cardiovascular diseases, with healthcare initiatives actively promoting their use to combat the growing burden of CVDs

- Statins rank as one of the most prescribed drugs globally due to their efficacy in lowering cholesterol, improving heart health, and reducing the risk of stroke and heart attacks, making them a fundamental component in the management of cardiovascular diseases worldwide

Report Scope and Statin Market Segmentation

|

Attributes |

Statin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Statin Market Trends

“Growing Shift Toward Combination Therapies and Personalized Medicine”

- One prominent trend in the global statin market is the increasing adoption of combination therapies and personalized treatment plans for managing hyperlipidemia and reducing cardiovascular risk

- Healthcare providers are increasingly combining statins with other lipid-lowering agents such as ezetimibe or PCSK9 inhibitors to achieve more aggressive cholesterol reduction in high-risk patients

- For instance, recent clinical guidelines suggest fixed-dose combination pills (polypills) as a convenient and effective method to improve medication adherence and clinical outcomes, especially among elderly and comorbid patients

- The trend also aligns with the rise of precision medicine, where genetic testing and biomarker profiling help tailor statin therapy based on an individual’s metabolism, risk profile, and such likelihood of side effects

- This approach is revolutionizing how dyslipidemia is treated—offering better efficacy, reducing adverse effects, and boosting the global demand for innovative statin formulations in both primary and secondary prevention

Statin Market Dynamics

Driver

“Rising Prevalence of Cardiovascular Diseases (CVDs)”

- The growing incidence of cardiovascular diseases such as coronary artery disease, stroke, and atherosclerosis is a primary driver of the global statin market

- As lifestyle-related risk factors such as obesity, sedentary habits, poor diet, smoking, and diabetes become more widespread, the demand for cholesterol-lowering therapies such as statins continues to surge

- Statins effectively reduce low-density lipoprotein (LDL) cholesterol levels and are widely prescribed as both preventive and therapeutic agents for cardiovascular conditions

- Older adults, in particular, have a higher risk of CVDs, further boosting statin demand as the global population ages.

- The consistent inclusion of statins in clinical guidelines for managing high cholesterol and cardiovascular risk ensures continued market growth and adoption

For instance:

- In a 2023 report published by the World Heart Federation, cardiovascular disease remains the leading cause of death globally, accounting for over 20.5 million deaths annually, highlighting the continued and urgent need for lipid-lowering medications such as statins

- According to a 2022 study by the American Heart Association, nearly 94 million U.S. adults aged 20 or older have total cholesterol levels above 200 mg/dL, contributing to a growing patient pool requiring statin therapy

- The global statin market is primarily driven by the rising prevalence of cardiovascular diseases and associated risk factors, supported by clinical guidelines and an aging population

Opportunity

“Innovation in Fixed-Dose Combinations and OTC Statin Development”

- The development of fixed-dose combinations (FDCs) of statins with other cardiovascular drugs such as antihypertensives and antiplatelets represents a significant market opportunity

- FDCs simplify treatment regimens, increase adherence, and offer greater therapeutic efficiency, particularly in patients with multiple comorbidities

- Moreover, the push to develop over-the-counter (OTC) statin formulations, especially in Europe and North America, opens the market to broader consumer access and preventive use

- These innovations not only enhance accessibility and compliance but also reduce the long-term burden on healthcare systems by enabling early intervention

For instance:

- In December 2023, according to a press release by a leading pharmaceutical firm, a low-dose OTC statin was approved for pilot market access in the UK, with plans to expand into other European countries following positive safety trials

- In October 2024, a new triple-combination pill (statin + aspirin + ACE inhibitor) entered late-stage clinical trials, targeting high-risk cardiovascular patients in the U.S. and Latin America, offering promising potential for widespread adoption

- The development of fixed-dose combinations and OTC statin formulations presents a major growth opportunity by improving treatment adherence, expanding access, and supporting early cardiovascular disease prevention

Restraint/Challenge

“Concerns Over Statin Side Effects and Patient Non-Adherence”

- Despite their proven benefits, statins face limitations due to concerns about side effects such as muscle pain (myopathy), fatigue, and potential liver enzyme elevation

- These adverse effects contribute to poor patient compliance, especially in long-term therapy, which can reduce treatment effectiveness and increase cardiovascular risks

- Misinformation surrounding statin use, often amplified through media or non-scientific sources, also contributes to patients discontinuing therapy without medical advice

- Healthcare providers must invest additional time in patient education and risk communication to ensure consistent usage and therapeutic benefit

For instance:

- A 2022 study published in the British Medical Journal (BMJ) revealed that nearly 20% of patients prescribed statins discontinued treatment within the first year, primarily due to perceived side effects

- In March 2023, the U.S. FDA issued updated guidelines on statin labeling to emphasize the importance of continuous use and clearer communication of potential side effects to patients

- Despite their effectiveness, statins face challenges from side effects and misinformation, leading to poor patient adherence and requiring greater focus on education and risk communication by healthcare provider

Statin Market Scope

The market is segmented on the basis of type, drug class, therapeutic area application and end user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Drug Class |

|

|

By Therapeautic Area |

|

|

By Application

|

|

|

By End User |

|

Statin Market Regional Analysis

“North America is the Dominant Region in the Statin Market”

- North America dominates the statin market, primarily due to a high burden of cardiovascular diseases (CVDs), widespread cholesterol screening programs, and favourable healthcare reimbursement policies

- U.S. holds a substantial share, with an aging population, high obesity rates, and lifestyle-related risk factors driving consistent demand for statin therapy

- The strong presence of leading pharmaceutical companies and continuous investments in R&D for novel statin formulations and fixed-dose combinations further boost the market in this region

- In addition, the well-established healthcare infrastructure, growing awareness about preventive cardiac care, and adherence to clinical guidelines recommending statins contribute to market dominance

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to witness the highest growth in the statin market due to rising healthcare expenditure, increased urbanization, and a rapidly growing middle-class population with greater access to healthcare services

- Countries such as China, India, and Japan are experiencing a surge in lifestyle diseases such as diabetes and hypertension, significantly increasing the need for lipid-lowering therapies

- Japan’s advanced pharmaceutical sector and aging demographic create strong demand for statins, while India and China benefit from government-led initiatives to expand access to generic cardiovascular drugs

- The expansion of health insurance coverage, growing awareness about cardiovascular health, and rising availability of affordable statin generics are all fuelling rapid market growth across the region

Statin Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Pfizer Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- AstraZeneca (U.K.)

- Novartis AG (Switzerland)

- AbbVie Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Viatris Inc. (U.S.)

- Sun Pharmaceutical Industries Ltd. (India)

- Torrent Pharmaceuticals Ltd. (India)

- Dr. Reddy’s Laboratories Ltd. (India)

- GLENMARK PHARMACEUTICALS LTD. (India)

- Sanofi (France)

- Amgen Inc. (U.S.)

- Intas Pharmaceuticals Ltd. (India)

- Zydus Group (India)

- Lupin (India)

- Hetero (India)

- Apotex Inc. (Canada)

- GSK plc (U.K.)

Latest Developments in Global Statin Market

- In February 2024, Teva Pharmaceuticals received U.S. FDA approval for its once-daily fixed-dose combination statin pill, which combines atorvastatin and ezetimibe. This innovative formulation is designed to simplify treatment for patients with high cholesterol by combining two lipid-lowering agents in a single tablet, improving adherence and therapeutic outcomes

- In October 2024, Amgen highlighted positive long-term real-world data for Repatha (evolocumab), a PCSK9 inhibitor often used alongside statins, at the American Heart Association Scientific Sessions. The data demonstrated sustained LDL-C reduction and cardiovascular benefit when used in combination with statins, reinforcing the value of combination therapies in high-risk patients

- In November 2023, Pfizer announced a new phase III clinical trial for its next-generation statin candidate aimed at patients with statin intolerance. This trial focuses on evaluating efficacy and safety among individuals who have experienced adverse effects from traditional statins, aiming to expand treatment options and reduce cardiovascular risks for underserved populations

- In June 2021, Centrient Pharmaceuticals announced the commencement of production at its newly built statins manufacturing facility. With the completion of this second dedicated unit at its Toansa site in India, the company has effectively doubled its statins production capacity

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.