Global Steel Safety Valve Market

Market Size in USD Billion

CAGR :

%

USD

6.93 Billion

USD

13.28 Billion

2024

2032

USD

6.93 Billion

USD

13.28 Billion

2024

2032

| 2025 –2032 | |

| USD 6.93 Billion | |

| USD 13.28 Billion | |

|

|

|

|

What is the Global Steel Safety Valve Market Size and Growth Rate?

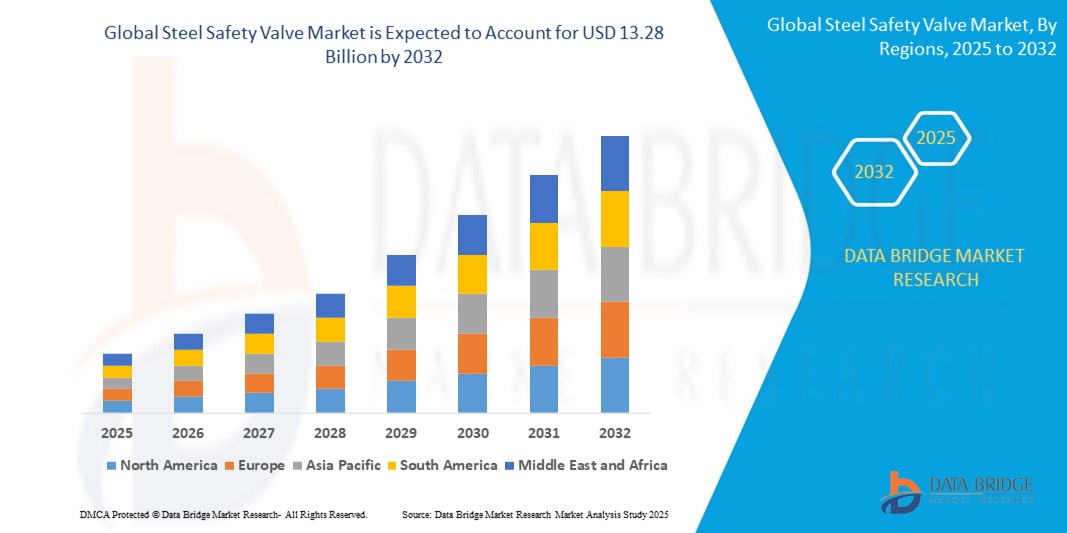

- The global steel safety valve market size was valued at USD 6.93 billion in 2024 and is expected to reach USD 13.28 billion by 2032, at a CAGR of 8.47% during the forecast period

- The global steel safety valve market is experiencing substantial growth driven by increasing industrialization and stringent safety regulations across various sectors. The market’s expansion is primarily fueled by the rising demand for reliable pressure management solutions in industries such as oil and gas, chemical processing, and manufacturing

- As these sectors continue to advance technologically, the need for robust and efficient safety valves that can handle high-pressure environments has become critical

- The market is characterized by a diverse range of applications, from protecting steam boilers to safeguarding pipelines, which drives the adoption of advanced steel safety valves designed for specific operational requirements

What are the Major Takeaways of Steel Safety Valve Market?

- The surge in industrial activities across sectors such as oil and gas, chemical processing, and manufacturing is significantly driving the demand for steel safety valves. As industries expand and develop, there is a growing need for effective management of high-pressure systems to ensure operational safety and efficiency

- Steel safety valves play a crucial role in this context by providing reliable protection against overpressure conditions, thus preventing potential equipment failures and accidents

- The evolution of industrial processes, with increased complexity and scale, has necessitated the use of advanced safety valves that can withstand demanding operational environments and contribute to the overall safety and reliability of industrial systems

- Asia Pacific dominated the steel safety valve market with the largest revenue share of 39.7% in 2024, driven by the rapid growth of industries such as oil & gas, energy, and chemicals, as well as increasing infrastructure development across emerging economies

- North America steel safety valve market is expected to grow at the fastest CAGR of 13.8% during the forecast period of 2025 to 2032, supported by established oil & gas operations, chemical industries, and stringent safety regulations

- The Spring-Loaded Pressure-Relief Valves segment dominated the steel safety valve market with the largest revenue share of 48.5% in 2024, driven by their simplicity, cost-effectiveness, and suitability for a wide range of pressure management applications across industries

Report Scope and Steel Safety Valve Market Segmentation

|

Attributes |

Steel Safety Valve Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Steel Safety Valve Market?

“Growing Focus on Smart Monitoring and Predictive Maintenance”

- A significant and accelerating trend in the global steel safety valve market is the integration of smart monitoring technologies and predictive maintenance solutions, aimed at enhancing operational safety and efficiency in industrial environments. This is particularly driven by the adoption of Industrial Internet of Things (IIoT) platforms across oil & gas, power, and manufacturing sectors

- For instance, leading players such as Emerson Electric Co. and Danfoss are introducing safety valves equipped with real-time monitoring sensors that provide continuous feedback on pressure, temperature, and flow, allowing operators to proactively address potential system failures

- Smart Steel Safety Valves enable predictive maintenance by detecting anomalies such as pressure fluctuations, corrosion, or wear, reducing the risk of equipment downtime and preventing costly failures. Predictive alerts, generated through AI-driven analytics, are transforming how industries manage safety-critical components

- The ability to integrate steel safety valves with centralized plant control systems enhances safety and process optimization, allowing operators to make informed decisions and comply with stringent safety standards. This integration ensures seamless connectivity with broader automation infrastructure

- As industries face increasing regulatory pressures and demand for operational efficiency, the trend towards intelligent, connected steel safety valves is reshaping market expectations. Companies such as ALFA LAVAL and LESER GmbH & Co.KG are actively investing in smart valve solutions to meet these evolving demands

- The growing requirement for predictive maintenance, operational transparency, and regulatory compliance across high-risk industries is expected to fuel sustained adoption of smart steel safety valves globally

What are the Key Drivers of the Steel Safety Valve Market?

- Rising safety regulations across industries such as oil & gas, chemical processing, and power generation are major drivers fueling demand for reliable and high-performance steel safety valves. These valves play a critical role in preventing overpressure situations that can lead to equipment failure, environmental hazards, and personnel safety risks

- For instance, in January 2024, The Weir Group PLC announced advancements in pressure relief valve technology tailored for high-pressure steam and gas systems, enhancing safety standards in industrial operations

- The global emphasis on industrial automation and process efficiency is driving the integration of steel safety valves with smart monitoring systems, offering real-time insights and automated control. This enables industries to comply with strict safety norms while reducing operational downtime

- In addition, the rapid expansion of energy and infrastructure projects, especially in emerging markets, is increasing the need for robust safety mechanisms, further propelling the Steel Safety Valve market. The use of corrosion-resistant materials, improved designs, and compatibility with harsh environments is also supporting industry growth

- Growing investments in chemical, petrochemical, and power generation sectors, coupled with the need for sustainable, reliable safety components, will continue to drive demand for advanced Steel Safety Valve solutions globally

Which Factor is challenging the Growth of the Steel Safety Valve Market?

- One of the key challenges facing the steel safety valve market is the high initial cost associated with advanced smart valve systems, particularly those incorporating real-time monitoring and IIoT capabilities. This can deter adoption among price-sensitive industries or smaller players

- For instance, the deployment of smart steel safety valves requires additional investment in sensor technology, data infrastructure, and trained personnel, which can be a significant financial barrier for small and mid-sized enterprises (SMEs)

- Furthermore, the complexity of integrating smart safety valves with existing plant automation and control systems can pose operational hurdles, particularly in legacy infrastructure where compatibility issues arise

- The need for continuous maintenance, calibration, and adherence to evolving regulatory standards can also strain resources for operators, especially in developing markets with limited technical expertis

- Addressing these challenges will require market players to focus on cost-efficient solutions, enhanced compatibility with existing systems, and providing comprehensive training and support. As technology evolves and costs decrease, wider adoption of smart Steel Safety Valves is expected

How is the Steel Safety Valve Market Segmented?

The market is segmented on the basis of product type, size, and industry.

• By Product Type

On the basis of product type, the steel safety valve market is segmented into Spring-Loaded Pressure-Relief Valves, Dead-Weight Pressure-Relief Valves, and Pilot-Operated Pressure-Relief Valves. The Spring-Loaded Pressure-Relief Valves segment dominated the Steel Safety Valve market with the largest revenue share of 48.5% in 2024, driven by their simplicity, cost-effectiveness, and suitability for a wide range of pressure management applications across industries. Their reliability and ability to function without external energy sources make them a preferred choice for both low and high-pressure systems in sectors such as oil & gas, power, and manufacturing.

The Pilot-Operated Pressure-Relief Valves segment is anticipated to witness the fastest growth rate of 22.4% from 2025 to 2032, fueled by increasing demand for precise pressure control in high-capacity and high-pressure industrial environments. Their superior sealing capabilities and adaptability to fluctuating pressure conditions make them ideal for critical operations, particularly in the oil & gas and energy sectors.

• By Size

On the basis of size, the steel safety valve market is segmented into Less Than 6 Inch, 7 Inch-25 Inch, 26 Inch-50 Inch, and 50 Inch and Above. The 7 Inch-25 Inch segment held the largest market revenue share of 41.9% in 2024, driven by their widespread use in mid-size pipelines, process plants, and distribution networks across various industries, including water treatment, chemicals, and power generation. Their optimal balance of flow capacity and installation flexibility contributes to high demand across both greenfield and retrofit projects.

The 50 Inch and Above segment is expected to witness the fastest CAGR from 2025 to 2032, owing to the rising deployment of large-scale infrastructure projects, including oil pipelines, desalination plants, and power facilities. These large-size safety valves offer high-pressure control and enhanced durability, catering to the needs of heavy industries and high-volume operations.

• By Industry

On the basis of industry, the steel safety valve market is segmented into Oil and Gas, Energy and Power, Chemicals, Water and Wastewater, Building and Construction, Pharmaceuticals, Agriculture, Metal and Mining, Paper and Pulp, Food and Beverages, and Others. The Oil and Gas segment dominated the market with the largest revenue share of 38.6% in 2024, attributed to the critical need for overpressure protection in upstream, midstream, and downstream operations. Steel safety valves are essential for ensuring system integrity and preventing hazardous incidents in pipelines, drilling platforms, and processing facilities.

The Water and Wastewater segment is projected to witness the fastest growth from 2025 to 2032, driven by the growing emphasis on water infrastructure development, regulatory compliance, and the need for reliable pressure control systems in municipal and industrial water treatment plants. Investments in sustainable water management projects globally further support this segment's growth.

Which Region Holds the Largest Share of the Steel Safety Valve Market?

- Asia-Pacific dominated the steel safety valve market with the largest revenue share of 39.7% in 2024, driven by the rapid growth of industries such as oil & gas, energy, and chemicals, as well as increasing infrastructure development across emerging economies

- The region benefits from significant investments in power generation, petrochemicals, and water treatment sectors, where steel safety valves play a critical role in ensuring system safety and pressure management

- Moreover, the growing presence of global manufacturers, rising industrial automation, and stricter safety regulations are contributing to the widespread adoption of steel safety valves across both new and existing facilities

China Steel Safety Valve Market Insight

The China steel safety valve market accounted for the largest revenue share within Asia Pacific in 2024, supported by the country’s booming industrial sector, expansive energy infrastructure projects, and increasing focus on safety compliance. China's leadership in oil refining, power generation, and chemical processing industries fuels strong demand for Steel Safety Valves. In addition, initiatives such as "Made in China 2025" and the development of smart manufacturing facilities further enhance the market outlook by promoting advanced valve technologies.

India Steel Safety Valve Market Insight

The India steel safety valve market is anticipated to grow at a remarkable CAGR during the forecast period, driven by ongoing investments in oil & gas exploration, renewable energy projects, and water management infrastructure. The government's emphasis on industrial development, along with the growing demand for reliable safety components in refineries, power plants, and wastewater treatment, supports market growth. Domestic manufacturing expansion and increasing awareness of industrial safety standards also boost Steel Safety Valve adoption across key sectors.

Which Region is the Fastest Growing Region in the Steel Safety Valve Market?

North America steel safety valve market is expected to grow at the fastest CAGR of 13.8% during the forecast period of 2025 to 2032, supported by established oil & gas operations, chemical industries, and stringent safety regulations. The U.S., being a global leader in refining capacity and energy production, contributes significantly to regional demand. Upgrades to aging infrastructure, along with investments in LNG terminals and industrial automation, drive the need for advanced Steel Safety Valves across critical facilities.

U.S. Steel Safety Valve Market Insight

The U.S. steel safety valve market captured the largest revenue share within North America in 2024, fueled by high safety standards, technological advancements, and ongoing energy projects. Demand for Steel Safety Valves remains strong in oil & gas pipelines, chemical plants, and power generation, supported by the replacement of outdated systems and expansion of modern, high-efficiency facilities.

Which are the Top Companies in Steel Safety Valve Market?

The steel safety valve industry is primarily led by well-established companies, including:

- Emerson Electric Co. (U.S.)

- SLB (Schlumberger) (U.S.)

- General Electric Company (U.S.)

- Curtiss-Wright Corporation (U.S.)

- ALFA LAVAL (Sweden)

- IMI plc (U.K.)

- LESER GmbH & Co.KG (Germany)

- The Weir Group PLC (Scotland)

- Forbes Marshall (India)

- Danfoss (Denmark)

- Bosch Rexroth AG (Germany)

- Spirax Sarco Limited (U.K.)

What are the Recent Developments in Global Steel Safety Valve Market?

- In October 2024, Danfoss, a global leader in engineering technologies, unveiled its latest EVR and NRV safety valves, fully certified to meet UL 60335-2-40 and UL 60335-2-89 standards. This advancement addresses growing safety regulations by offering a solution that isolates flammable refrigerant charges in the event of leaks, thereby enhancing system safety and reliability across critical applications

- In April 2024, Xylem launched the Jabsco PureFlo 21, a next-generation single-use pump featuring an integrated safety valve, designed specifically for the pharmaceutical and biotechnology industries. The product aims to minimize fluid contamination risks while ensuring maximum operator safety, reinforcing Xylem’s commitment to innovation in hygienic pumping solutions

- In August 2022, Alfa Laval successfully completed the acquisition of Desmet, a globally recognized engineering solutions provider specializing in biofuel and edible oil technologies. This strategic move strengthens Alfa Laval’s portfolio and expands its capabilities in renewable energy and food processing markets

- In February 2022, GEA introduced the Varivent MX valve series, engineered to improve operational safety and hygiene standards within the food, beverage, dairy, and pharmaceutical industries. This launch underlines GEA’s focus on delivering reliable valve technologies that align with the strict sanitary requirements of critical process environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Steel Safety Valve Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Steel Safety Valve Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Steel Safety Valve Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.