Global Stem Cell And Gene Therapy Biological Testing Market

Market Size in USD Billion

CAGR :

%

USD

2.99 Billion

USD

9.06 Billion

2025

2033

USD

2.99 Billion

USD

9.06 Billion

2025

2033

| 2026 –2033 | |

| USD 2.99 Billion | |

| USD 9.06 Billion | |

|

|

|

|

Stem Cell and Gene Therapy Biological Testing Market Size

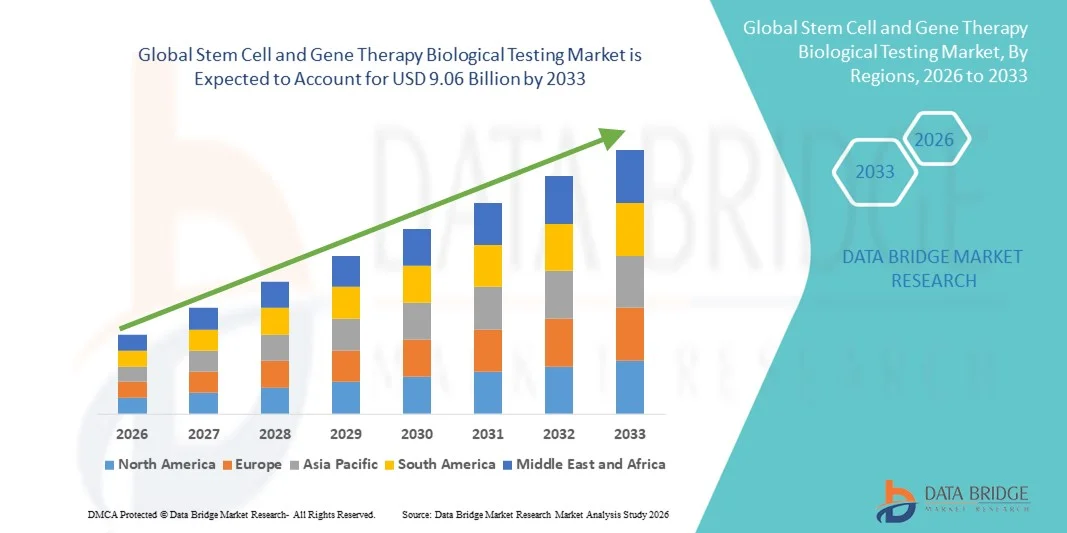

- The global stem cell and gene therapy biological testing market size was valued at USD 2.99 billion in 2025 and is expected to reach USD 9.06 billion by 2033, at a CAGR of 14.87% during the forecast period

- The market growth is largely fueled by the rapid expansion of stem cell and gene therapy research, increasing clinical trial activity, and continuous technological advancements in biological testing platforms. Rising investments from biopharmaceutical companies and academic research institutes are driving the adoption of advanced potency, safety, and identity testing solutions across both preclinical and clinical development stages

- Furthermore, growing regulatory scrutiny, rising demand for standardized quality control, and the need to ensure safety, efficacy, and consistency of complex cell- and gene-based therapies are establishing biological testing as a critical component of therapy development and commercialization. These converging factors are accelerating the uptake of stem cell and gene therapy biological testing solutions, thereby significantly boosting the overall growth of the industry

Stem Cell and Gene Therapy Biological Testing Market Analysis

- Stem cell and gene therapy biological testing solutions are critical components of advanced therapy development, ensuring product safety, potency, purity, and regulatory compliance across research, clinical, and commercial stages. The market is gaining strong traction due to the growing pipeline of cell- and gene-based therapies and increasing reliance on complex biological characterization techniques in both academic and biopharmaceutical settings

- The escalating demand for stem cell and gene therapy biological testing is primarily driven by rising clinical trial activity, expanding commercialization of approved therapies, and stringent regulatory requirements for quality assurance. In addition, growing adoption of advanced analytical methods—such as flow cytometry, molecular assays, and cell-based potency testing—is accelerating market growth, with quality and safety testing together accounting for over 60% of total testing demand in 2025

- North America dominated the stem cell and gene therapy biological testing market with the largest revenue share of approximately 42.6% in 2025, supported by a strong biopharmaceutical R&D ecosystem, high concentration of clinical trials, favorable regulatory frameworks, and the presence of leading testing service providers and technology developers. The U.S. accounted for the majority of regional revenue due to increased FDA approvals and accelerated biologics development

- Asia-Pacific is expected to be the fastest-growing region in the stem cell and gene therapy biological Testing market during the forecast period, registering a CAGR driven by rising government funding for regenerative medicine, expanding biotech manufacturing capacity, increasing clinical research outsourcing, and rapid growth of CROs in countries such as China, Japan, South Korea, and India

- The cell therapy segment dominated the largest market revenue share of 55.4% in 2025, driven by the rising prevalence of chronic diseases, regenerative medicine applications, and increasing hospital adoption for cellular treatments

Report Scope and Stem Cell and Gene Therapy Biological Testing Market Segmentation

|

Attributes |

Stem Cell and Gene Therapy Biological Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Stem Cell and Gene Therapy Biological Testing Market Trends

Growing Adoption of Advanced Cell and Gene Therapy Testing Platforms

- A significant and accelerating trend in the global stem cell and gene therapy biological testing market is the increasing adoption of advanced testing platforms that enable high-precision analysis of cellular and genetic therapies. Laboratories and research institutions are seeking faster, safer, and more reliable methods to evaluate cell viability, gene editing efficiency, and therapeutic potency

- For instance, in 2024, Thermo Fisher Scientific launched the Invitrogen Attune NxT Flow Cytometer for gene therapy applications, offering high-throughput single-cell analysis to improve testing accuracy and reduce sample handling errors. Such innovations are enabling researchers to achieve more precise and reproducible results in stem cell and gene therapy studies

- The rising focus on quality assurance and regulatory compliance is driving the adoption of standardized testing protocols, particularly in clinical research and manufacturing environments

- Furthermore, the integration of multi-parameter testing platforms and next-generation sequencing (NGS) technologies is enhancing the ability to monitor gene editing outcomes, track off-target effects, and ensure patient safety in clinical applications

- This trend towards more sophisticated and reliable testing methodologies is reshaping the expectations of researchers, clinicians, and manufacturers, encouraging investment in next-generation biological testing solutions

Stem Cell and Gene Therapy Biological Testing Market Dynamics

Driver

Increasing Demand Due to Growth in Cell and Gene Therapy Research

- The growing global investment in cell and gene therapy research is a key driver for the stem cell and gene therapy biological testing market. Increasing clinical trials, personalized medicine initiatives, and advanced therapeutic development programs require precise testing at every stage of product development

- For instance, in March 2023, Lonza announced the expansion of its cell and gene therapy testing services to support GMP-compliant manufacturing and characterization of viral vectors for clinical trials, highlighting the rising demand for specialized testing services

- Moreover, the increasing prevalence of genetic disorders and chronic diseases is driving the need for personalized therapeutic approaches, which rely heavily on accurate and reliable testing for efficacy, safety, and patient-specific outcomes

- Collaborations between research institutions, biotech companies, and contract research organizations (CROs) are further expanding the market, as these partnerships enhance access to state-of-the-art testing technologies and expertise

- The overall trend towards precision medicine and regulatory emphasis on robust characterization of cell and gene therapy products is expected to sustain market growth across both research and clinical manufacturing segments

Restraint/Challenge

High Costs and Regulatory Complexity

- The high cost of advanced stem cell and gene therapy testing platforms and consumables remains a significant challenge, particularly for smaller laboratories and emerging-market healthcare institutions

- For instance, some academic research centers in Asia and Latin America have reported delays in adopting high-throughput flow cytometry or NGS platforms due to limited budgets and high equipment costs, despite recognizing their benefits for precise therapeutic assessment

- Regulatory complexity and stringent approval requirements for biological testing in clinical trials can also slow adoption, as testing procedures must comply with international guidelines such as GMP, GLP, and FDA/EMA regulations

- In addition, the technical expertise required to operate advanced testing instruments and interpret complex genomic or cellular data can pose challenges for widespread deployment in less specialized laboratories

- Overcoming these challenges through cost-effective testing solutions, training programs, scalable platforms, and harmonized regulatory frameworks will be essential for the sustained growth of the stem cell and gene therapy biological testing market globally

Stem Cell and Gene Therapy Biological Testing Market Scope

The market is segmented on the basis of product type and end-users.

- By Product Type

On the basis of product type, the Global Stem Cell and Gene Therapy Biological Testing market is segmented into Cell Therapy and Gene Therapy. The cell therapy segment dominated the largest market revenue share of 55.4% in 2025, driven by the rising prevalence of chronic diseases, regenerative medicine applications, and increasing hospital adoption for cellular treatments. Cell therapy tests are widely used for autologous and allogeneic stem cell procedures, requiring rigorous biological testing to ensure safety, viability, and potency. The segment benefits from technological advancements in cell characterization, flow cytometry, and molecular assays that improve the accuracy of therapeutic applications. Hospitals, wound care centers, and cancer care centers rely heavily on cell therapy testing for treatment planning and quality assurance. Increasing funding and government initiatives supporting regenerative medicine further strengthen market dominance. In addition, the segment’s established protocols and higher adoption in clinical trials contribute to sustained revenue. Expansion of cell therapy pipelines in oncology and rare diseases also drives consumption. Rising awareness among patients and healthcare professionals reinforces the need for validated biological testing. Furthermore, stringent regulatory requirements mandate comprehensive testing for cellular products, supporting consistent demand. The segment’s ability to integrate with advanced laboratory automation and diagnostics ensures scalability and reliability. Strong collaborations between hospitals, biotech firms, and research centers solidify its leading position globally.

The gene therapy segment is expected to witness the fastest CAGR of 10.3% from 2026 to 2033, fueled by the increasing adoption of gene-editing technologies, targeted therapies, and personalized medicine. Gene therapy biological testing is critical for ensuring viral vector safety, transgene expression, and off-target effects. The rising number of clinical trials involving CRISPR, AAV, and lentiviral-based gene therapies drives demand for sophisticated testing. Emerging biotech companies are increasingly investing in gene therapy platforms, especially for rare genetic disorders, accelerating market growth. Government incentives, regulatory approvals, and growing funding for advanced therapies further support expansion. Technological innovations such as high-throughput sequencing and multiplex assays enhance test efficiency and reliability. Rising collaborations between research institutions and commercial labs increase access to gene therapy testing. In addition, increasing patient demand for novel therapies and personalized treatment options encourages rapid adoption. Expansion of contract research organizations (CROs) providing gene therapy testing services contributes to segment growth. Strong unmet medical needs in oncology, neurology, and rare diseases further fuel adoption. Enhanced focus on safety monitoring and quality assurance also supports market penetration. Collectively, these factors position gene therapy as the fastest-growing product type segment.

- By End-Users

On the basis of end-users, the Global Stem Cell and Gene Therapy Biological Testing market is segmented into Hospitals, Wound Care Centres, Cancer Care Centres, Ambulatory Surgical Centres, and Others. The hospitals segment dominated the market with a revenue share of 59.7% in 2025, driven by the high volume of cellular and gene therapy procedures performed across inpatient and outpatient settings. Hospitals are primary centers for regenerative medicine, requiring comprehensive biological testing to ensure patient safety and treatment efficacy. The segment benefits from the availability of skilled personnel, advanced laboratory infrastructure, and access to cutting-edge technologies. Increasing patient footfall for chronic and rare diseases further supports revenue dominance. Hospitals also maintain compliance with regulatory guidelines, requiring standardized testing protocols for stem cell and gene therapy products. Integration of testing into routine clinical workflows ensures consistent adoption. In addition, partnerships with biotech companies and clinical research organizations strengthen the hospital segment. High procedural volumes, combined with rising awareness of regenerative medicine benefits, reinforce dominance. Adoption of automation and advanced diagnostic platforms improves testing efficiency. Hospitals also serve as hubs for clinical trials, driving frequent use of testing services. The segment’s ability to scale across multiple therapy areas ensures long-term revenue leadership. Investments in infrastructure and training further solidify hospitals’ position as the leading end-user globally.

The cancer care centres segment is projected to register the fastest CAGR of 11.2% from 2026 to 2033, driven by increasing use of stem cell and gene therapies in oncology applications. Rising incidence of cancers and demand for personalized medicine have accelerated adoption of advanced biological testing in specialized centers. Cancer care centers increasingly perform autologous and allogeneic cellular therapies, necessitating rigorous testing for cell viability, genetic modifications, and treatment safety. Technological advancements, such as next-generation sequencing and multiplex biomarker assays, support rapid growth. Government initiatives and clinical trial expansions in oncology further boost adoption. Growing patient awareness and the shift toward precision medicine reinforce demand. Collaborations with research labs and biotech firms enable access to innovative testing solutions. In addition, the need for monitoring treatment efficacy and long-term outcomes drives frequent testing. Emerging markets with expanding cancer treatment infrastructure offer new growth opportunities. Integration of testing into immunotherapy and CAR-T therapy pipelines accelerates segment expansion. Overall, cancer care centers are the fastest-growing end-user segment during the forecast period.

Stem Cell and Gene Therapy Biological Testing Market Regional Analysis

- North America dominated the stem cell and gene therapy biological testing market, accounting for approximately 42.6% of the global revenue share in 2025

- The region’s leadership is supported by a strong biopharmaceutical R&D ecosystem, high concentration of clinical trials, favorable regulatory frameworks, and the presence of leading testing service providers and technology developers

- The market contributed the majority of regional revenue, driven by increased FDA approvals, accelerated biologics development, and robust demand for advanced stem cell and gene therapy testing services across hospitals, research institutes, and CROs

U.S. Stem Cell and Gene Therapy Biological Testing Market Insight

The U.S. stem cell and gene therapy biological testing market captured the largest share within North America in 2025, fueled by the country’s extensive clinical trial activity, well-established biotech infrastructure, and high adoption of advanced biologics testing platforms. Accelerated regulatory pathways for regenerative medicines and biologics, combined with a high concentration of contract research organizations (CROs) and technology providers, continue to drive the market.

Europe Stem Cell and Gene Therapy Biological Testing Market Insight

The Europe stem cell and gene therapy biological testing market is projected to expand at a substantial CAGR during the forecast period, supported by government initiatives promoting regenerative medicine, increasing clinical trial activity, and growing demand for advanced biologics testing services. Strong regulatory standards, coupled with increasing R&D investment across Germany, the U.K., France, and other European countries, are encouraging adoption of cutting-edge testing technologies.

U.K. Stem Cell and Gene Therapy Biological Testing Market Insight

The U.K. stem cell and gene therapy biological testing market is expected to grow at a noteworthy CAGR during the forecast period due to increasing biopharmaceutical research, adoption of innovative testing platforms, and a strong focus on clinical trials for cell and gene therapies. The country’s well-developed healthcare infrastructure and supportive regulatory environment further stimulate market expansion.

Germany Stem Cell and Gene Therapy Biological Testing Market Insight

The Germany stem cell and gene therapy biological testing market is anticipated to witness considerable growth, driven by high investments in biotechnology, advanced laboratory infrastructure, and increasing demand for quality-controlled testing services for stem cell and gene therapy products. Germany’s emphasis on innovation, compliance, and regulatory adherence promotes the adoption of advanced testing solutions.

Asia-Pacific Stem Cell and Gene Therapy Biological Testing Market Insight

The Asia-Pacific region is expected to be the fastest-growing market, registering a CAGRduring the forecast period. Growth is driven by rising government funding for regenerative medicine, expanding biotech manufacturing capacity, increasing clinical research outsourcing, and rapid expansion of CROs in countries such as China, Japan, South Korea, and India.

Japan Stem Cell and Gene Therapy Biological Testing Market Insight

The Japan stem cell and gene therapy biological testing market is gaining momentum due to strong government support for regenerative medicine, advanced clinical trial infrastructure, and rising adoption of biologics testing platforms. The growing number of cell and gene therapy research programs further fuels market growth.

China Stem Cell and Gene Therapy Biological Testing Market Insight

China stem cell and gene therapy biological testing market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to significant government investment in regenerative medicine, rapid expansion of biotech manufacturing, and increasing clinical research outsourcing. The presence of numerous CROs and rising biologics development activities are key factors driving growth in the country.

Stem Cell and Gene Therapy Biological Testing Market Share

The Stem Cell and Gene Therapy Biological Testing industry is primarily led by well-established companies, including:

• Thermo Fisher Scientific (U.S.)

• Lonza Group (Switzerland)

• Miltenyi Biotec (Germany)

• Sartorius AG (Germany)

• Charles River Laboratories (U.S.)

• WuXi AppTec (China)

• GE Healthcare Life Sciences (U.S.)

• Takara Bio Inc. (Japan)

• Bio-Rad Laboratories (U.S.)

• STEMCELL Technologies (Canada)

• FUJIFILM Cellular Dynamics (U.S.)

• Celltrion (South Korea)

• Catalent, Inc. (U.S.)

• PerkinElmer, Inc. (U.S.)

• Merck KGaA (Germany)

• PromoCell GmbH (Germany)

• GenScript Biotech Corporation (China)

• Creative Biolabs (U.S.)

• Cytiva (U.S.)

Latest Developments in Global Stem Cell and Gene Therapy Biological Testing Market

- In January 2025, the NHS in England approved the gene‑editing therapy exagamglogene autotemcel (exa‑cel) for use on the National Health Service, marking one of the first CRISPR‑based treatments to be made routinely available. Exa‑cel is designed to correct the defective gene responsible for sickle cell disease in patients’ own stem cells, and clinical trials demonstrated a 96.6% functional cure rate, positioning it as a transformative example of precision gene therapy for a chronic genetic condition

- In March 2025, AstraZeneca announced its definitive agreement to acquire Belgian biotechnology company EsoBiotec for up to $1 billion, aiming to enhance its cell therapy and genetic modification capabilities. EsoBiotec’s innovative platform allows direct genetic modification of immune cells in vivo—potentially cutting processing time from weeks to minutes—which underscores the accelerating drive toward more efficient biological therapies and related testing needs

- In February 2025, a collaboration of researchers from UCLA, University College London, and Great Ormond Street Hospital reported major positive results from an experimental gene therapy for ADA‑SCID, a rare and life‑threatening immune disorder. The therapy restored immune function in 59 out of 62 treated children, representing a significant clinical breakthrough and setting the stage for future regulatory submissions and expanded testing protocols required for broader adoption

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.