Global Stomatitis Market

Market Size in USD Billion

CAGR :

%

USD

1.68 Billion

USD

2.84 Billion

2025

2033

USD

1.68 Billion

USD

2.84 Billion

2025

2033

| 2026 –2033 | |

| USD 1.68 Billion | |

| USD 2.84 Billion | |

|

|

|

|

Stomatitis Market Size

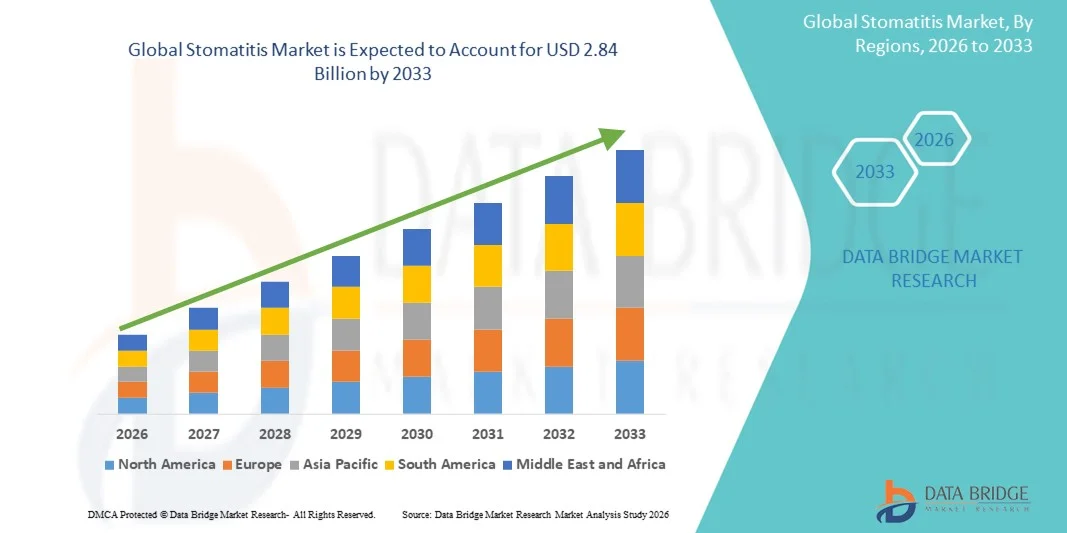

- The global stomatitis market size was valued at USD 1.68 billion in 2025 and is expected to reach USD 2.84 billion by 2033, at a CAGR of 6.80% during the forecast period

- The market growth is largely fueled by the increasing prevalence of oral disorders, growing awareness of oral hygiene, and advancements in pharmaceutical therapies targeting stomatitis, leading to improved patient outcomes in both pediatric and adult populations

- Furthermore, rising consumer demand for effective, fast-acting, and easy-to-administer treatments for oral mucosal conditions is positioning innovative stomatitis therapies as the preferred solution for patients and healthcare providers. These converging factors are accelerating the adoption of stomatitis treatments, thereby significantly boosting the industry's growth

Stomatitis Market Analysis

- Stomatitis, encompassing canker sores and cold sores, is a prevalent oral condition causing pain, inflammation, and discomfort, making effective diagnosis and treatment crucial for patient well-being across all age groups

- The increasing prevalence of oral mucosal disorders, rising awareness about oral hygiene, and advancements in treatment options such as antibiotics, corticosteroids, analgesics, and antiseptic mouthwashes are driving the market growth

- North America dominated the stomatitis market with the largest revenue share of 38.7% in 2025, supported by advanced healthcare infrastructure, high patient awareness, and the presence of key pharmaceutical companies, with the U.S. seeing significant adoption of novel therapies and OTC preventive products

- Asia-Pacific is expected to be the fastest growing region in the stomatitis market during the forecast period due to rising healthcare expenditure, increasing dental care awareness, and a growing population affected by oral mucosal conditions

- Antibiotics segment dominated the stomatitis market with a market share of 41.8% in 2025, driven by their effectiveness in treating bacterial infections associated with oral lesions and widespread availability through hospitals, clinics, and retail pharmacies

Report Scope and Stomatitis Market Segmentation

|

Attributes |

Stomatitis Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Stomatitis Market Trends

Rise of Targeted and Combination Therapies

- A significant and accelerating trend in the global stomatitis market is the development and adoption of targeted therapies and combination treatment regimens, offering faster symptom relief and improved healing of oral lesions

- For instance, recent formulations combining corticosteroids with analgesics or antiseptic mouthwashes provide multi-symptom management, reducing treatment duration and enhancing patient compliance

- Advanced drug delivery technologies, such as mucoadhesive gels and localized sprays, enable precise targeting of lesions, minimizing systemic side effects while improving efficacy

- Integration of these therapies with tele-dentistry platforms allows healthcare providers to remotely monitor patient progress and adjust treatment plans, creating a more personalized oral care experience

- Growing R&D in natural and plant-based therapeutics for stomatitis is gaining traction, providing alternatives with fewer side effects and catering to patient preference for safer, holistic treatments

- Digital platforms and mobile applications for tracking lesion occurrence, treatment adherence, and symptom relief are emerging, improving patient engagement and therapy outcomes

- This trend towards more precise, patient-centric, and multi-functional treatments is reshaping expectations for oral mucosal care, with companies such as GlaxoSmithKline and Pfizer developing innovative combination therapies

- The demand for effective, convenient, and fast-acting stomatitis treatments is growing rapidly across both outpatient and hospital settings, as patients increasingly prioritize relief, safety, and ease of use

Stomatitis Market Dynamics

Driver

Increasing Prevalence of Oral Disorders and Awareness of Oral Hygiene

- The rising prevalence of canker sores and cold sores, coupled with increasing awareness of oral hygiene and preventive care, is a significant driver for the growing demand for stomatitis treatments

- For instance, in March 2025, GlaxoSmithKline launched a new antiseptic mouthwash aimed at managing recurrent oral ulcers, reflecting the focus on preventive and therapeutic solutions in the market

- As patients seek faster and more effective relief from oral discomfort, stomatitis therapies such as corticosteroids, analgesics, and antibiotics provide targeted solutions, encouraging adoption

- Growing awareness campaigns by dental associations and healthcare providers are educating consumers on early diagnosis and treatment, further increasing demand

- Increasing accessibility of stomatitis treatments through online pharmacies and telemedicine services is enhancing reach, especially in remote or underserved regions

- Rising collaborations between pharmaceutical companies and dental clinics for clinical trials and new product launches are boosting market visibility and adoption

- The convenience of over-the-counter availability, tele-dentistry consultations, and easy-to-use topical formulations are key factors driving adoption across clinics, hospitals, and home-based care

- The trend towards patient-centric care and accessible treatment options continues to accelerate the uptake of stomatitis therapies globally

Restraint/Challenge

Side Effects and Regulatory Compliance Hurdles

- Concerns surrounding potential side effects of stomatitis treatments, such as irritation from corticosteroids or antibiotics, pose a challenge to broader market penetration

- For instance, reports of mouth irritation and allergic reactions have made some patients hesitant to use certain topical or systemic treatments for recurring lesions

- Ensuring safety through robust clinical testing, clear labeling, and adherence to regulatory guidelines is crucial for building consumer trust and supporting market growth

- In addition, the relatively high cost of patented combination therapies compared to generic options can limit access, particularly in developing regions or for price-sensitive patients

- Limited awareness about proper diagnosis and treatment protocols among patients in some regions can delay therapy initiation, impacting market growth

- Supply chain disruptions and raw material shortages for active pharmaceutical ingredients (APIs) can affect product availability and market expansion

- While generic and over-the-counter treatments are available, premium therapies with advanced formulations or faster efficacy often come with a higher price tag, restricting widespread adoption

- Overcoming these challenges through enhanced patient education, safe formulation practices, and affordable therapy options will be vital for sustained market growth

Stomatitis Market Scope

The market is segmented on the basis of type, treatment, diagnosis, dosage, route of administration, end-users, and distribution channel.

- By Type

On the basis of type, the stomatitis market is segmented into canker sores and cold sores. The canker sores segment dominated the market with the largest market revenue share in 2025, driven by its high global prevalence and frequent recurrence among both adults and children. Patients commonly present canker sores due to triggers such as stress, nutritional deficiency, and oral trauma, increasing the need for rapid symptom-relief therapies. The segment benefits from wide availability of OTC and prescription products including corticosteroids, analgesics, and antiseptic formulations. Healthcare professionals often prioritize treatment for canker sores because of associated discomfort, difficulty eating, and reduced quality of life. Strong consumer awareness and continuous innovation in topical and mucoadhesive products further maintain segment leadership. These combined factors make canker sores the dominant segment within the type category.

The cold sores segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising cases of herpes simplex virus (HSV-1) infections worldwide. Increasing recurrence of viral outbreaks and higher transmission risk are motivating patients to seek faster, more effective antiviral therapies. Growing accessibility of OTC antiviral creams, patches, and oral formulations is supporting demand expansion. Cold sores also see strong growth through online pharmacy distribution, particularly among younger consumers who prefer convenient purchasing options. Clinicians increasingly recommend early therapeutic intervention for outbreak control, boosting product adoption. These dynamics position cold sores as the fastest growing type segment in the coming years.

- By Treatment

On the basis of treatment, the stomatitis market is segmented into antibiotics, corticosteroids, analgesics, antiseptic mouthwash, and others. The antibiotics segment dominated the stomatitis market with a market share of 41.8% in 2025, supported by its widespread use in treating bacterial-associated stomatitis and secondary infections that commonly worsen oral lesions. Rising incidence of recurrent oral infections and increasing prescriptions of broad-spectrum antibiotics for severe stomatitis cases further strengthen this segment’s leadership. Antibiotics are also frequently used as first-line therapy in clinical settings, especially where rapid infection control is required. In addition, the availability of multiple formulations including tablets, gels, and topical creams enhances clinical convenience and patient adherence. Growing awareness among clinicians about preventing bacterial exacerbation in chronic stomatitis significantly contributes to the segment’s sustained dominance across hospitals and clinics globally.

The corticosteroids segment is anticipated to witness the fastest growth from 2026 to 2033, driven by its effectiveness in reducing inflammation, pain, and swelling associated with recurrent canker sores and other immune-mediated stomatitis forms. Corticosteroids are increasingly preferred for moderate to severe cases due to their targeted anti-inflammatory action and rapid symptom relief. The expansion of topical corticosteroid formulations, such as gels, ointments, and mouth rinses, further accelerates adoption by offering localized treatment with limited systemic exposure. Rising prevalence of autoimmune-related stomatitis and increased physician preference for steroid-based therapy in recurrent episodes are key growth contributors. In addition, improved accessibility through over-the-counter (OTC) options and online pharmacies is enhancing patient access, supporting strong market expansion in the coming years.

- By Diagnosis

On the basis of diagnosis, the stomatitis market is segmented into blood tests, biopsy, patch tests, bacterial swabs, viral swabs, tissue scraping, and others. The tissue scraping segment dominated the market in 2025 due to its widespread use in identifying fungal, viral, and bacterial causes of stomatitis. Tissue scraping provides accurate microscopic evaluation of oral lesions, making it essential for differentiating complex or persistent cases. Healthcare professionals prefer this method for its cost-effectiveness, speed, and reliability in routine clinical settings. Its applicability in hospitals and dental clinics ensures high procedural volume. Growing need for precise diagnostic confirmation to guide targeted therapies further enhances its relevance. These capabilities maintain tissue scraping as the leading diagnostic method.

The viral swabs segment is anticipated to experience the fastest growth rate from 2026 to 2033, driven by increasing prevalence of HSV-related cold sores and the rising demand for laboratory-based viral detection. Viral swabs enable accurate identification of HSV-1, improving treatment accuracy and reducing misdiagnosis. Advancements in techniques such as PCR testing have increased confidence in viral confirmation, boosting adoption. Rising consumer awareness about viral transmission risks is also elevating demand for early testing. Enhanced laboratory infrastructure in developing regions is expanding access to swab-based testing. As a result, viral swabs are set to become the most rapidly growing diagnostic subsegment.

- By Dosage

On the basis of dosage, the stomatitis market is segmented into cream, tablet, injection, and others. The cream segment dominated the market in 2025 due to its widespread use for localized treatment of cold sores and canker sores. Topical creams deliver immediate relief with minimal systemic exposure, making them widely preferred by patients. Their easy application and rapid symptom-reducing properties contribute to strong consumer acceptance. OTC availability of antiviral and analgesic creams further stimulates high product turnover. Continuous innovation in fast-acting, long-lasting, and non-irritating formulations supports adoption across demographics. The convenience and affordability of creams reinforce their leadership in the dosage category.

The tablet segment is projected to grow the fastest from 2026 to 2033, driven by increasing use of systemic therapies for severe, recurrent, or viral-related stomatitis. Tablets offer consistent dosing and enhanced therapeutic outcomes, especially for HSV-1 cases requiring antiviral medication. The growth of prescription-based management through telehealth is making tablets more accessible to wider patient groups. Improved awareness of systemic treatment benefits among clinicians and consumers further drives adoption. Expanding e-pharmacy penetration increases the availability of oral medications globally. These elements collectively place tablets as the fastest growing dosage segment.

- By Route of Administration

On the basis of route of administration, the market is segmented into oral, topical, intravenous, and others. The topical route dominated the market in 2025 due to its strong preference among clinicians and patients seeking localized symptom relief. Topical applications such as gels, ointments, and mouth rinses provide fast-acting therapeutic effects with minimal side effects. They are widely used for mild to moderate stomatitis and are highly suitable for children and elderly patients. OTC accessibility of topical formulations supports recurring use for frequent outbreaks. Pharmaceutical innovations in mucoadhesive and long-lasting agents further enhance treatment effectiveness. These advantages position topical administration as the leading delivery method.

The oral route is expected to witness the fastest growth from 2026 to 2033, driven by rising adoption of systemic antiviral and corticosteroid tablets for more severe or recurrent cases. Oral administration ensures improved systemic reach and long-lasting results, making it vital for treating HSV-related lesions. Increased physician preference for oral medications in chronic cases contributes significantly to growth. The convenience of simple dosing schedules enhances patient adherence. Expansion of online prescription services makes oral products more accessible to global consumers. These trends make the oral route the fastest expanding administration segment.

- By End-Users

On the basis of end-users, the market is segmented into clinic, hospital, and others. The hospital segment dominated the market in 2025 due to the high number of severe stomatitis cases requiring comprehensive evaluation and advanced diagnostic procedures. Hospitals offer access to specialized care, biopsy facilities, and laboratory testing essential for complex or recurrent lesions. Patients with underlying systemic conditions or suspected viral infections often require hospital-based treatment and monitoring. The presence of multidisciplinary specialists ensures accurate diagnosis and targeted therapy. Hospitals also manage a larger volume of immunocompromised patients who require intensive care for stomatitis. These factors secure hospitals as the leading end-user segment.

The clinic segment is anticipated to witness the fastest growth from 2026 to 2033, driven by rising patient preference for quick, accessible, and cost-effective care. Dental and ENT clinics are increasingly becoming first points of contact for individuals seeking immediate relief from oral ulcers and inflammation. Clinics offer shorter waiting times and personalized care, improving patient experience. Expansion of private dental practices globally has increased availability of professional stomatitis treatment. Many clinics also provide OTC and prescription medication options onsite, enhancing patient convenience. These advantages support the clinic segment’s rapid growth trajectory.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The retail pharmacy segment dominated the market in 2025, driven by high consumer preference for purchasing OTC creams, analgesics, and antiseptic mouthwashes directly from retail stores. Retail pharmacies offer immediate access to both prescription and non-prescription treatments, supporting high daily footfall. Pharmacist recommendations significantly influence product selection among patients. In developing regions, retail pharmacies serve as primary healthcare access points for oral issues. Broad product availability and strong consumer trust further reinforce their market position. These factors ensure retail pharmacies remain the dominant distribution channel.

The online pharmacy segment is projected to experience the fastest growth from 2026 to 2033, driven by rising e-commerce adoption and the convenience of home delivery services. Online platforms offer a wider assortment of creams, tablets, and supportive therapies, often at competitive prices. Growing acceptance of telemedicine prescriptions has streamlined online purchase of stomatitis treatments. Younger consumers increasingly prefer digital channels due to ease of comparison and fast delivery. Expansion of e-pharmacy services across emerging markets further accelerates growth. These dynamics establish online pharmacies as the most rapidly growing distribution channel.

Stomatitis Market Regional Analysis

- North America dominated the stomatitis market with the largest revenue share of 38.7% in 2025, supported by advanced healthcare infrastructure, high patient awareness, and the presence of key pharmaceutical companies, with the U.S. seeing significant adoption of novel therapies and OTC preventive products

- Consumers in the region increasingly seek effective topical and systemic therapies due to rising cases of canker sores, cold sores, and treatment-associated stomatitis linked to chemotherapy and radiation procedures

- The presence of major pharmaceutical companies, robust R&D activity in oral inflammatory disease management, and increased patient access to hospital and retail pharmacies contribute significantly to regional expansion

U.S. Stomatitis Market Insight

The U.S. stomatitis market captured the largest revenue share of over 80% within North America in 2025, driven by the high prevalence of recurrent aphthous stomatitis, herpes labialis, and treatment-induced oral mucositis among cancer patients. The growing demand for effective topical and systemic therapies, including corticosteroids, antivirals, and analgesics, continues to strengthen market expansion. Increasing patient awareness, easy access to advanced diagnostic tools, and strong OTC product availability further contribute to growth. The widespread adoption of telehealth consultations and online pharmacy platforms enhances treatment accessibility. Moreover, continuous R&D activities and rapid FDA approvals for oral inflammatory therapies support the dominance of the U.S. stomatitis market.

Europe Stomatitis Market Insight

The Europe stomatitis market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising cases of cold sores, canker sores, and oral mucosal disorders linked to stress, viral infections, and nutritional deficiencies. Strong clinical guidelines, widespread access to healthcare services, and increasing use of advanced diagnosis tools fuel market growth. European consumers also show rising preference for topical corticosteroids, antiviral gels, and medicated mouthwashes for rapid relief. The region is witnessing increasing adoption of stomatitis treatments in hospitals, dental clinics, and oncology centers. Growing awareness of oral health and expanding retail pharmacy chains across major countries further support market expansion.

U.K. Stomatitis Market Insight

The U.K. stomatitis market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by heightened awareness of oral health and increasing incidences of viral and autoimmune-related stomatitis. A growing preference for prescription-based corticosteroid formulations and OTC antiviral treatments is fueling demand. Concerns about oral infections, along with greater patient engagement in preventive dental care, support the uptake of stomatitis therapies. The U.K.’s strong digital health infrastructure and thriving online pharmacy ecosystem also enhance accessibility to treatment. Furthermore, rising cases of chemotherapy-induced mucositis are contributing to increased demand across hospital and specialty clinics.

Germany Stomatitis Market Insight

The Germany stomatitis market is expected to expand at a considerable CAGR during the forecast period, fueled by high healthcare spending, increased clinical awareness, and rising demand for advanced oral anti-inflammatory and antiviral treatments. Germany’s well-developed healthcare infrastructure and strong emphasis on early diagnosis support significant market penetration of prescription and OTC therapies. The country shows growing adoption of corticosteroid gels, antiseptic mouthwashes, and biologic-based treatments in severe cases. Integration of digital prescription systems, along with Germany’s preference for clinically validated and safety-focused solutions, aligns strongly with the growing need for effective stomatitis management.

Asia-Pacific Stomatitis Market Insight

The Asia-Pacific stomatitis market is poised to grow at the fastest CAGR during the forecast period, driven by increasing urbanization, rising patient awareness, and expanding access to healthcare services in China, Japan, India, and Southeast Asia. High prevalence of nutritional deficiencies, viral infections, and stress-related oral ulcers contributes significantly to regional demand. Government-supported healthcare reforms and the rapid expansion of retail and online pharmacies are boosting market growth. As APAC becomes a major manufacturing hub for topical oral medications and antiviral therapies, affordability and accessibility continue to improve. In addition, rising adoption of Western treatment protocols is accelerating stomatitis management across urban populations.

Japan Stomatitis Market Insight

The Japan stomatitis market is gaining momentum due to a significant focus on preventive oral healthcare, technological advancement in diagnostics, and a rising elderly population prone to oral mucosal conditions. Japanese consumers prioritize clinically proven and fast-acting treatments such as antiviral creams, corticosteroid gels, and medicated mouth rinses. High levels of stress-related stomatitis and growing cases of therapy-induced oral mucositis further drive demand. The integration of stomatitis care into smart healthcare systems, along with widespread availability of pharmacies and hospital networks, supports robust market growth. Moreover, Japan’s strong adoption of innovative oral care products is accelerating market expansion.

India Stomatitis Market Insight

The India stomatitis market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s rapid urbanization, rising disposable incomes, and high prevalence of viral infections, nutritional deficiencies, and lifestyle-related stress leading to stomatitis. Increasing preference for affordable topical and oral treatments, including antivirals and antiseptic mouthwashes, is driving market demand. India’s fast-growing pharmaceutical industry and strong domestic manufacturing capabilities ensure wide product availability at competitive prices. The expansion of hospital and retail pharmacy networks, coupled with a rising shift toward online medication purchases, is boosting treatment accessibility. The growing burden of chemotherapy-induced mucositis is further accelerating demand across secondary and tertiary care hospitals.

Stomatitis Market Share

The Stomatitis industry is primarily led by well-established companies, including:

- GSK plc (U.K.)

- Pfizer Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Sanofi (France)

- Novartis AG (Switzerland)

- Takeda Pharmaceutical Company Limited (Japan)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sun Pharmaceutical Industries Ltd. (India)

- Cipla (India)

- Dr. Reddy’s Laboratories (India)

- Procter & Gamble Company (U.S.)

- Reckitt Benckiser Group plc (U.K.)

- Perrigo Company plc (Ireland)

- AstraZeneca (U.K.)

- Amgen Inc. (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Bayer AG (Germany)

- Eli Lilly and Company (U.S.)

- AbbVie Inc. (U.S.)

What are the Recent Developments in Global Stomatitis Market?

- In December 2024, a multicenter observational study found that oral roflumilast, a PDE-4 inhibitor, significantly improved outcomes in patients suffering from recurrent aphthous stomatitis (RAS). The therapy reduced ulcer frequency, shortened healing time, and improved pain scores, while maintaining a favorable safety profile

- In May 2024, a comprehensive systematic review and meta-analysis provided updated clinical insights into the use of thalidomide for recurrent aphthous stomatitis, reinforcing its efficacy in reducing ulcer recurrence and severity. Although thalidomide remains restricted due to teratogenic risks, the review highlighted its potential role in severe, refractory stomatitis cases under controlled environments

- In August 2023, the U.S. FDA issued a Complete Response Letter rejecting the NDA for avasopasem manganese, requesting additional data before granting approval for radiotherapy-induced severe oral mucositis. This decision temporarily halted the drug’s commercialization despite promising clinical results. The rejection underscores the regulatory emphasis on long-term safety and consistent efficacy for mucositis therapies, highlighting a major challenge for drug developers in this space

- In April 2023, Episil® (SP-03), a bio-adhesive lipid-based gel for managing oral mucositis and cancer-treatment-induced stomatitis, was officially incorporated into the Japanese Ministry of Health, Labor and Welfare’s clinical manual for “Stomatitis caused by cancer treatment drugs.” This recognition strengthens its clinical credibility and expands its adoption across hospitals and oncology centers in Japan

- In February 2023, a Phase III study confirmed that avasopasem manganese (GC4419), a selective superoxide dismutase mimetic, significantly reduced both the incidence and duration of severe oral mucositis (SOM) in head and neck cancer patients receiving chemoradiotherapy. The study demonstrated a strong safety profile and meaningful clinical benefit, indicating avasopasem’s potential to become a first-in-class therapeutic for mucositis management

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.