Global Straw Market

Market Size in USD Billion

CAGR :

%

USD

30.17 Billion

USD

45.60 Billion

2024

2032

USD

30.17 Billion

USD

45.60 Billion

2024

2032

| 2025 –2032 | |

| USD 30.17 Billion | |

| USD 45.60 Billion | |

|

|

|

|

Straw Market Size

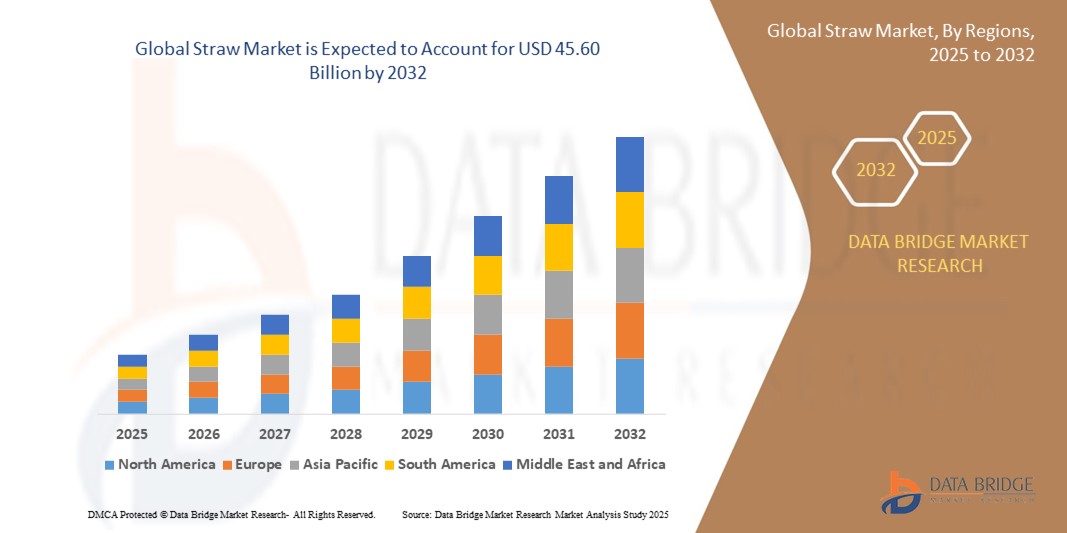

- The global straw market size was valued at USD 30.17 billion in 2024 and is expected to reach USD 45.60 billion by 2032, at a CAGR of 5.30% during the forecast period

- The market growth is primarily driven by increasing consumer awareness of sustainable and eco-friendly products, coupled with stringent regulations banning single-use plastics in various regions, boosting demand for biodegradable and reusable straws

- Rising preferences for sustainable alternatives in foodservice and household applications, along with innovations in materials such as bamboo, metal, and silicone, are accelerating the adoption of eco-conscious straw solutions, significantly contributing to market expansion

Straw Market Analysis

- Straws, essential for convenient beverage consumption, are witnessing a shift toward sustainable materials due to environmental concerns and regulatory pressures on single-use plastics

- The growing demand for eco-friendly straws is fueled by increasing consumer preference for sustainable products, heightened environmental awareness, and the convenience of reusable and biodegradable options

- Asia-Pacific dominated the straw market with the largest revenue share of 38.5% in 2024, driven by high consumption in foodservice industries, large population bases, and increasing adoption of sustainable products in countries such as China and India

- Europe is expected to be the fastest-growing region during the forecast period, propelled by stringent environmental regulations, rising consumer demand for eco-friendly products, and innovations in sustainable straw materials

- The paper straw segment dominated the largest market revenue share of 38.2% in 2024, driven by rising environmental awareness and stringent regulations banning single-use plastics, which have accelerated the adoption of biodegradable alternatives

Report Scope and Straw Market Segmentation

|

Attributes |

Straw Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Straw Market Trends

“Increasing Adoption of Sustainable and Biodegradable Materials”

- The global straw market is experiencing a significant shift towards the use of sustainable and biodegradable materials, such as paper, bamboo, and silicone, driven by growing environmental awareness and regulatory pressures

- These materials reduce the environmental impact of single-use plastics, aligning with consumer preferences for eco-friendly alternatives and supporting global sustainability goals

- Advanced manufacturing techniques are being employed to enhance the durability and functionality of biodegradable straws, such as coated paper straws and compostable PLA (polylactic acid) straws, making them viable substitutes for traditional plastic straws

- For instance, companies are developing innovative straw designs, such as plant-based edible straws and reusable bamboo straws, to cater to eco-conscious consumers and businesses in the foodservice industry

- This trend is increasing the appeal of sustainable straws for both individual consumers and commercial sectors, particularly in foodservice applications where environmental responsibility is a priority

- Data analytics is being leveraged to track consumer preferences and optimize production processes, ensuring that sustainable straws meet diverse needs across different straw lengths and end-use applications

Straw Market Dynamics

Driver

“Growing Foodservice Industry and Regulatory Bans on Single-Use Plastics”

- The rapid expansion of the global foodservice industry, including restaurants, cafes, and fast-food chains, is a key driver for the straw market, fueled by rising consumer demand for convenient beverage consumption

- Straws enhance user experience by enabling hygienic and easy sipping of beverages such as smoothies, sodas, and cocktails, particularly in foodservice settings

- Government regulations, especially in regions such as Asia-Pacific and Europe, banning single-use plastics are accelerating the adoption of alternative materials such as paper, bamboo, and metal straws

- The rise of e-commerce and online food delivery platforms, such as Zomato, has increased the demand for straws, particularly in the 9-15 cm length segment, which is ideal for standard beverage containers

- Manufacturers are increasingly offering customizable and branded straws to meet the needs of foodservice businesses, enhancing market growth across various sales channels, including retailers and e-retail

Restraint/Challenge

“High Production Costs and Regulatory Compliance”

- The high initial costs associated with producing sustainable straws, such as paper and bamboo, compared to traditional plastic straws, pose a significant barrier, particularly for small businesses and price-sensitive markets

- Developing durable and functional biodegradable straws, such as those resistant to sogginess, requires advanced technology and materials, increasing production expenses

- Compliance with varying environmental regulations across countries, particularly regarding material sourcing, biodegradability standards, and waste management, creates operational challenges for manufacturers and distributors

- Consumer concerns about the performance of alternative straws, such as paper straws becoming soggy in certain beverages, can limit adoption in some foodservice and household applications

- These factors may hinder market growth in regions with high cost sensitivity or where infrastructure for sustainable material production is underdeveloped, despite strong demand in Asia-Pacific, the dominating region, and Europe, the fastest-growing region

Straw market Scope

The market is segmented on the basis of product, straw length, sales channel, and end use.

- By Product

On the basis of product, the global straw market is segmented into plastic, bamboo, metal, paper, glass, silicone, and others. The paper straw segment dominated the largest market revenue share of 38.2% in 2024, driven by rising environmental awareness and stringent regulations banning single-use plastics, which have accelerated the adoption of biodegradable alternatives. Paper straws are widely used in foodservice and household sectors due to their eco-friendly nature and compatibility with various beverages.

The bamboo straw segment is expected to witness the fastest growth rate of 5.1% from 2025 to 2032, driven by its reusable and biodegradable properties, appealing to eco-conscious consumers and businesses in the foodservice industry. Bamboo straws, particularly those with a 7-10 mm diameter, are favored for their versatility and durability across beverages such as water, soft drinks, and smoothies.

- By Straw Length

On the basis of product, the global straw market is segmented into <9 cm, 9-15 cm, 16-20 cm, and >20 cm. The 9-15 cm segment dominated the market with a revenue share of 45.0% in 2024, as it is the most practical and universally used length for standard drink containers such as soft drink cans, juice boxes, and cups. This length offers a balance of convenience and usability, making it ideal for restaurants, cafes, and households.

The >20 cm segment is anticipated to experience the fastest growth rate from 2025 to 2032, driven by the increasing demand for specialty beverages such as milkshakes and smoothies, which require longer straws for taller glasses and deeper containers. The rise in foodservice outlets and consumer preference for customized beverage experiences further fuels this segment's growth.

- By Sales Channel

On the basis of product, the global straw market is segmented into manufacturers, distributors, retailers, and e-retail. The retailers segment held the largest market revenue share of 40.5% in 2024, driven by its role as the primary point of sale for both individual consumers and businesses. Supermarkets, convenience stores, and wholesale retailers offer a wide range of straws, including plastic, paper, and metal, catering to diverse customer needs with convenient access to small or bulk packs.

The e-retail segment is expected to witness the fastest growth rate of 5.4% from 2025 to 2032, fueled by the rapid expansion of e-commerce platforms and increasing consumer preference for online shopping. The convenience of purchasing eco-friendly straws, such as paper and bamboo, through e-retail channels, coupled with rising environmental awareness, drives this segment’s growth.

- By End Use

On the basis of product, the global straw market is segmented into foodservice, institutional, and households. The foodservice segment dominated the market with a revenue share of 55.0% in 2024, driven by the high demand for straws in restaurants, cafes, fast-food chains, and beverage stores. The increasing consumption of both alcoholic and non-alcoholic beverages, coupled with the shift toward sustainable straws such as paper and bamboo, supports this segment’s dominance.

The household segment is anticipated to experience robust growth from 2025 to 2032, driven by growing consumer awareness of environmental issues and the adoption of reusable and biodegradable straws such as bamboo, metal, and silicone. Households are increasingly opting for sustainable alternatives to reduce plastic waste, supported by campaigns and regulatory pressures promoting eco-friendly products.

Straw Market Regional Analysis

- Asia-Pacific dominated the straw market with the largest revenue share of 38.5% in 2024, driven by high consumption in foodservice industries, large population bases, and increasing adoption of sustainable products in countries such as China and India

- Consumers prioritize eco-friendly straws, such as bamboo, paper, and metal, for environmental sustainability, hygiene, and aesthetic appeal, particularly in regions with strong environmental regulations

- Growth is supported by innovations in biodegradable and reusable straw materials, alongside rising demand in foodservice, institutional, and household segments

Japan Straw Market Insight

Japan’s straw market is expected to witness significant growth, driven by consumer preference for high-quality, eco-friendly straws such as bamboo and paper, which align with sustainability goals. The presence of major foodservice chains and the integration of sustainable straws in institutional settings accelerate market penetration. Rising demand for reusable straws in households also contributes to growth.

China Straw Market Insight

China holds the largest share of the Asia-Pacific straw market, driven by rapid urbanization, increasing foodservice demand, and growing consumer awareness of environmental issues. The country’s expanding middle class and focus on sustainable products support the adoption of biodegradable straws, such as paper and bamboo. Strong domestic manufacturing and competitive pricing enhance market accessibility.

U.S. Straw Market Insight

The U.S. straw market is expected to witness significant growth, fueled by strong demand for sustainable straws in foodservice and household applications. Growing consumer awareness of plastic waste reduction and eco-friendly alternatives drives market expansion. Regulatory bans on single-use plastics and increasing adoption of reusable straws, such as metal and silicone, further boost the market.

Europe Straw Market Insight

The Europe straw market is expected to witness the fastest growth rate, driven by stringent regulations against single-use plastics and a strong push for sustainable alternatives. Consumers prioritize biodegradable straws, such as paper and bamboo, for environmental benefits and hygiene. Growth is notable in both foodservice and household sectors, with countries such as Germany and the U.K. leading due to heightened environmental awareness.

U.K. Straw Market Insight

The U.K. market for straws is expected to witness rapid growth, driven by demand for eco-friendly straws in foodservice and retail channels. Increased consumer focus on sustainability and bans on plastic straws encourage adoption of paper and bamboo straws. Evolving regulations and rising interest in reusable straws, such as metal and silicone, further support market growth.

Germany Straw Market Insight

Germany is expected to witness significant growth in the straw market, attributed to its strong environmental policies and consumer preference for sustainable products. German consumers favor biodegradable and reusable straws, such as paper and metal, for their eco-friendliness and durability. The integration of these straws in foodservice and institutional settings, alongside robust e-retail channels, drives market expansion.

Straw Market Share

The straw industry is primarily led by well-established companies, including:

- Hoffmaster Group, Inc. (U.S.)

- Transcend Packaging (U.K.)

- Footprint (U.S.)

- Huhtamaki Oyj (Finland)

- Canada Brown Eco Products Ltd (Canada)

- Alpha Charta d.o.o.(U.S.)

- Soton Daily Necessities Co., Ltd. (China)

- Tetra Pak Group (Switzerland)

- ALECOSTRAWS (Taiwan)

- Vegware (U.K.)

- Shakarganj Foods (Pakistan)

- Pactiv Evergreen Inc. (U.S.)

- Hellostraw (U.S.)

- STRAWLAND (U.S.)

- Gumi Bamboo (South Korea)

- BioPak (Australia)

- Wilbistraw (France)

- Sharp Serviettes (New Zealand)

What are the Recent Developments in Global Straw Market?

- In October 2022, Smurfit Kappa’s Townsend Hook paper mill in the UK unveiled a groundbreaking innovation in its paper drying process, significantly reducing CO₂ emissions and energy consumption. Using a “digital twin” simulation model, the new system achieved a 6% reduction in steam energy use and a 5% drop in total CO₂ emissions—addressing one of the most energy-intensive stages of paper manufacturing. While not directly linked to paper straws, this advancement supports the sustainable production of paper-based products by making the raw material more environmentally friendly, reinforcing Smurfit Kappa’s commitment to net-zero goals

- In September 2022, Karrie Laughton, owner of Lux Lounge in Rochester, New York, launched Roc Paper Straws—a manufacturing venture focused on producing durable, eco-friendly, and customizable paper straws. Co-founded with her mother, Kathryn Laughton, the company was created to address the lack of high-quality, U.S.-made paper straws that meet both environmental and branding needs. Roc Paper Straws offers compostable, marine-safe products in various colors and custom-printed designs, reflecting a growing trend toward personalization and sustainability in foodservice packaging. The launch highlights innovation in the paper straw market and the rise of small-scale domestic manufacturing

- In August 2022, Matrix Pack SA, a Greece-based leader in sustainable packaging, acquired The Paper Straw Co., the UK’s first paper straw manufacturer, to expand its product portfolio and strengthen its presence in the UK and Irish markets. The acquisition enhances Matrix Pack’s European production footprint and supports its mission to combat plastic pollution through fiber-based single-use alternatives such as biodegradable straws and lids. This strategic move reflects ongoing consolidation in the eco-friendly packaging industry and positions Matrix Pack to better serve growing demand for sustainable solutions across Europe

- In July 2022, LAMI PACKAGING (KUNSHAN) CO., LTD., a Chinese packaging company, launched its U-shaped paper straws in India, targeting beverage companies impacted by the nationwide ban on single-use plastics. Designed as an eco-friendly alternative, these straws are made from recyclable paper and food-grade adhesives, offering durability and sustainability. The launch reflects a growing trend in emerging markets toward adopting biodegradable packaging solutions. By expanding into India, LAMI PACKAGING aims to support the region’s shift toward environmentally responsible consumption and capitalize on rising demand for sustainable foodservice products

- In May 2022, SIG India launched a wide range of recyclable paper straws in various dimensions, shapes, and formats to meet the rising demand for sustainable packaging solutions. Available in straight I-shapes, U-shapes, and an innovative telescopic design, these straws are made from FSC-certified paper and are compatible with SIG’s aseptic carton packs. The launch targets India’s growing foodservice sector, including restaurants and beverage brands, which are increasingly adopting eco-friendly practices in response to the nationwide single-use plastic ban. This initiative reinforces SIG’s commitment to reducing environmental impact through functional, biodegradable alternatives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Straw Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Straw Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Straw Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.