Global Stretch And Shrink Film Market

Market Size in USD Billion

CAGR :

%

USD

20.12 Billion

USD

30.88 Billion

2024

2032

USD

20.12 Billion

USD

30.88 Billion

2024

2032

| 2025 –2032 | |

| USD 20.12 Billion | |

| USD 30.88 Billion | |

|

|

|

|

Stretch and Shrink Film Market Size

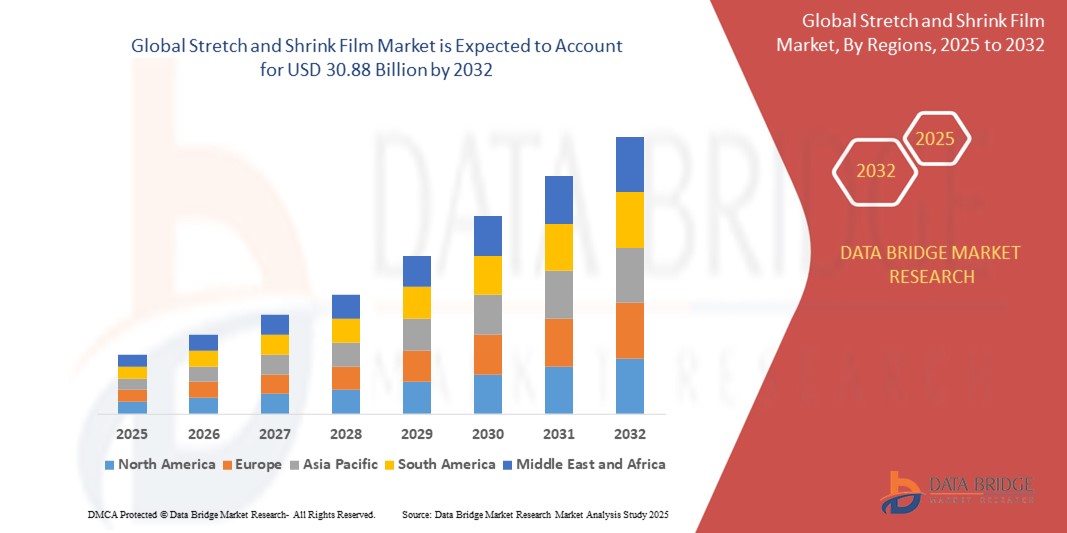

- The global stretch and shrink film market were valued at USD 20.12 billion in 2024 and is expected to reach USD 30.88 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.50% primarily driven by the increasing demand for packaging solutions across various industries, particularly in e-commerce, food and beverage, and consumer goods sectors

- This growth is driven by factors such as the rising need for secure, cost-effective, and sustainable packaging solutions, advancements in material technologies, and the growing trend of consumer convenience that enhances product safety and visibility

Stretch and Shrink Film Market Analysis

- The stretch and shrink film market are experiencing consistent growth due to its widespread application in packaging across industries such as food and beverages, pharmaceuticals, and consumer goods, where it is used for product protection and stability

- For instance, Coca-Cola uses shrink film to securely wrap its products for distribution

- These films provide superior protection against external elements such as dust, moisture, and physical damage, which is crucial for preserving the quality of goods during transportation and storage

- For instance, Amazon uses stretch films to wrap items for delivery, ensuring the safety of products during the shipping process

- Companies in the food and beverage sector are increasingly turning to stretch and shrink films for packaging to extend shelf life and maintain product integrity. Major brands such as Nestlé and PepsiCo have adopted shrink films to package snacks and beverages to retain freshness and enhance shelf appeal

- Recent innovations in film manufacturing technologies have enhanced the performance of stretch and shrink films, offering improved stretchability, clarity, and resistance, with instances such as bioplastics being incorporated into the films for more eco-friendly options. Companies such as Tetra Pak are leading the way in developing sustainable alternatives with their use of renewable materials in shrink films

- The market is seeing an uptick in demand for sustainable packaging solutions, with major retailers and manufacturers, such as Walmart and Unilever, committing to using more recyclable and biodegradable packaging materials, pushing for further advancements in stretch and shrink film products. Walmart, for instance, has set goals to achieve 100% recyclable packaging by 2025

Report Scope and Stretch and Shrink Film Market Segmentation

|

Attributes |

Stretch and Shrink Film Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Stretch and Shrink Film Market Trends

“Increasing Incorporation of Post-Consumer Recycled Materials into Film Formulations”

- The trend of incorporating post-consumer recycled materials into film formulations is gaining momentum as companies focus on sustainable packaging solutions, with a growing demand for reducing plastic waste and environmental impact

- For instance, Coca-Cola has committed to using 50% recycled content in its plastic packaging by 2030

- Leading packaging companies such as Amcor and Sealed Air have pioneered the use of recycled plastics in stretch and shrink films, providing high-performance products while promoting a circular economy

- For instance, Amcor has developed a line of recyclable stretch films made with post-consumer recycled materials

- Post-consumer recycled materials, such as recycled plastic bottles, are being repurposed to create new films, ensuring that packaging remains durable, flexible, and clear while reducing the need for virgin plastic

- For instance, PepsiCo has introduced shrink films made with recycled polyethylene, maintaining both sustainability and product protection

- Major brands, including Coca-Cola and Nestlé, have started adopting recycled film packaging for products, demonstrating a commitment to sustainability and responding to consumer demands for greener packaging alternatives

- For instance, Nestlé has incorporated recycled stretch films in their packaging for bottled water, reducing the overall environmental footprint

- Regulatory pressures and consumer preferences are pushing more manufacturers to develop films with recycled content, aligning with global sustainability goals and meeting strict environmental standards set by governments and organizations such as the European Union

Stretch and Shrink Film Market Dynamics

Driver

“Growing Demand for Sustainable Packaging Solutions”

- The increasing demand for sustainable packaging solutions is a major driver of growth in the stretch and shrink film market, as both businesses and consumers prioritize reducing plastic waste and environmental impact

- For instance, Amazon has adopted recyclable stretch films for packaging to align with its sustainability goals

- Companies such as Coca-Cola are leading by instance, committing to use 50% recycled content in their packaging by 2030, highlighting the industry's shift toward more sustainable practices. Similarly, Coca-Cola's "World Without Waste" initiative is focused on recycling and reducing plastic waste

- Unilever, another major player, has pledged to make all its plastic packaging recyclable or reusable by 2025, demonstrating how sustainability is not only consumer-driven but also influenced by regulatory pressures such as the European Union's ban on single-use plastics. Unilever's commitment includes using recyclable shrink films for their food and beverage packaging

- The growing adoption of post-consumer recycled materials and biodegradable polymers in stretch and shrink films allows companies to lower their carbon footprint while maintaining high-performance packaging

- For instance, PepsiCo has integrated recyclable stretch films in the packaging of its snack products to reduce environmental impact

- As a result of this demand, manufacturers are investing in research and development to create new, eco-friendly packaging solutions, enhancing their brand value and attracting consumers who support sustainability-focused businesses such as Nestlé, which has begun using biodegradable shrink films for some of its products

Opportunity

“Technological Advancements in Film Production”

- The stretch and shrink film market are experiencing significant opportunities driven by technological advancements in film production, particularly innovations in polymer chemistry and film extrusion processes that enhance the efficiency and durability of films

- For instance, companies such as Amcor are utilizing advanced extrusion technologies to produce stronger, lighter films that improve packaging performance

- Advancements in multi-layer film technology have enabled manufacturers to produce films with improved strength, stretchability, and clarity. These films offer better protection for products during transportation and storage, making them ideal for industries such as food and beverages, pharmaceuticals, and consumer goods

- For instance, multi-layer films used in the packaging of perishable foods help extend shelf life by providing better moisture and oxygen barriers

- The demand for biodegradable films is also creating new opportunities in the market. Companies are exploring materials such as polylactic acid (PLA), a plant-based polymer, as an alternative to traditional petroleum-based plastics

- For instance, the use of PLA films in packaging by companies such as Danone reflects the industry's move toward sustainable and environmentally-friendly options

- These innovations are not just focused on sustainability but also on improving performance. As companies increasingly require packaging that is both eco-friendly and durable, the demand for high-performance films continues to grow

- For instance, pharmaceutical companies are adopting stretch films with enhanced barrier properties to protect sensitive products from environmental factors

- Technological advancements offer substantial growth potential for the market as businesses continue to invest in research and development to create films that balance performance and sustainability, helping them meet the evolving needs of environmentally-conscious consumers and industries such as Unilever, which has pledged to use biodegradable films in some of its product packaging

Restraint/Challenge

“Price Volatility of Raw Materials”

- One of the significant challenges in the stretch and shrink film market is the price volatility of raw materials, especially petroleum-based plastics. The primary materials used in film production, such as polyethylene and polypropylene, are derived from petroleum, and their prices fluctuate based on global oil prices, supply-demand imbalances, and geopolitical factors

- For instance, fluctuations in oil prices during geopolitical events or natural disasters can significantly increase raw material costs, impacting manufacturers

- During periods of oil price hikes or supply chain disruptions, the cost of raw materials for film production can rise sharply. This forces manufacturers to adjust their pricing, which can make stretch and shrink films less affordable for some customers, particularly small and medium-sized enterprises

- For instance, in 2020, disruptions in the global supply chain due to the COVID-19 pandemic caused a significant rise in raw material prices, affecting production costs for film manufacturers

- In addition, manufacturers transitioning to more sustainable materials, such as recycled content or biodegradable polymers, face higher production costs. These materials often require more complex processing, and the cost of incorporating these sustainable alternatives can be a barrier for companies working in cost-sensitive industries

- For instance, switching to biodegradable polymers such as polylactic acid (PLA) can increase the cost of film production initially, making it difficult for businesses to justify these materials on a large scale

- The volatility of raw material prices can also create supply chain disruptions, complicating the ability to secure consistent, cost-effective sources for film production. Manufacturers must manage these risks while attempting to keep costs competitive, which may involve sourcing from multiple suppliers or hedging against price increases

- This price instability remains a key challenge for the stretch and shrink film market. To remain competitive and profitable, companies must find ways to manage raw material costs effectively, potentially through long-term supplier agreements or innovations that reduce dependence on volatile petroleum-based materials

Stretch and Shrink Film Market Scope

The market is segmented on the basis of type, material resin, and application

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Material Resin |

|

|

By Application |

|

Stretch and Shrink Film Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Stretch and Shrink Film Market”

- Asia Pacific region is the dominant market for stretch and shrink films, driven by large-scale manufacturing industries across key sectors such as food and beverages, pharmaceuticals, and consumer goods

- Countries such as China and India are leading the demand, with robust industrial growth and an expanding consumer base pushing the need for packaging solutions

- Significant investments in infrastructure, retail, and logistics in the region are further boosting the demand for packaging materials such as stretch and shrink films

- China’s vast population and high manufacturing output make it a central player in positioning Asia Pacific as the leading region for stretch and shrink film usage

- The increase in disposable income and a growing preference for packaged goods in emerging markets solidify Asia Pacific’s dominant position in the stretch and shrink film market

“North America is Projected to Register the Highest Growth Rate”

- North America is the fastest-growing region in the stretch and shrink film market, driven by several factors that increase the demand for packaging solutions

- The thriving food and beverage industry plays a key role, as stretch and shrink films are widely used for product packaging and preservation, ensuring quality throughout the supply chain

- The growing e-commerce sector further fuels the demand for packaging materials that offer secure, efficient, and protective shipping solutions to prevent product damage during transit

- Technological advancements in film production continue to support market growth by enhancing film durability, strength, and introducing more eco-friendly alternatives

- A combination of industrial growth, changing consumer preferences, and innovation positions North America as the fastest-growing region in the stretch and shrink film market

Stretch and Shrink Film Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Sealed Air (U.S.)

- KUREHA CORPORATION (Japan)

- Winpak Ltd. (Canada)

- Flexopack (Greece)

- Bonset America Corporation (U.S.)

- COVERIS (Austria)

- PREMIUMPACK GmbH (Germany)

- Sigma Plastics Group (U.S.)

- Schur Flexibles Holding GesmbH (Austria)

- Buergofol GmbH (Germany)

- Allfo (Germany)

- Atlantis-Pak (Russia)

- XtraPlast (U.S.)

- Transcontinental Inc. (Canada)

- BP Plastics Holding Bhd (Malaysia)

- Crawford Packaging (Canada)

- SYFAN USA (U.S.)

- Idemitsu Kosan Co., Ltd. (Japan)

- Vijay Packaging System (India)

- NPF.com (U.S.)

- Inteplast Group (U.S.)

- Akar Shrink Packs (India)

- Alpha Plastomers (India)

- MANOJ PLASTICS (India)

- Vishakha Polyfab Pvt Ltd (India)

- Gupta Package Industries (India)

- International Plastics Inc. (U.S.)

- Shri Balaji Packers (India)

- Global Polyfilms (India)

- RKW Group (Germany)

- Rishba Poly Product (India)

- 3D Plast (India)

- Eminent Solution (India)

- AEP Industries Inc. (U.S.)

- Anchor Packaging Inc. (U.S.)

Latest Developments in Global Stretch and Shrink Film Market

- In February 2024, Innovia Films (U.K.) introduced a white floatable polyolefin (WAPO) shrink film designed for light-sensitive products. This low-density, opaque film maintains its floatability even after printing, making it ideal for applications in industries such as dairy, food supplements, nutritional products, and cosmetics. Manufactured at Innovia' European site in Płock, Poland, the film enhances light-blocking properties in shrink sleeves applied to containers. By enabling the use of transparent PET bottles with floatable sleeves that detach during recycling, this innovation supports the recycling of food-grade packaging, aligning with the EU's Packaging and Packaging Waste Directive requiring recyclability by 2030. The film also contains up to 20% post-industrial recycled content, contributing to a closed-loop production process and promoting sustainability in packaging

- In February 2024, Intertape Polymer Group (IPG) launched ExlfilmPlus PCR, a polyolefin shrink film containing 35% recycled content. The film includes 10% certified post-consumer recycled content and 25% post-industrial recycled content, aligning with sustainability goals. It has been prequalified for store drop-off recycling by How2Recycle. This development offers an eco-friendly packaging solution while maintaining high performance, contributing to the market's shift towards recyclable and sustainable materials

- In May 2023, Innovia Films (U.K.) launched a thinner version of its RayoFloat polyolefin shrink film, called APO45. This new film is designed to improve PET recycling rates by enhancing the detection of PET bottles during the recycling process. Its reduced thickness allows for better identification by Near-Infrared (NIR) sorting systems, making PET separation more efficient. APO45 supports the circular economy by promoting more effective recycling and offering a sustainable alternative for packaging. This innovation helps packaging producers align with recycling guidelines and reduce carbon emissions in the supply chain

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Stretch And Shrink Film Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Stretch And Shrink Film Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Stretch And Shrink Film Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.