Global Surface Radars Market

Market Size in USD Billion

CAGR :

%

USD

18.45 Billion

USD

27.67 Billion

2024

2032

USD

18.45 Billion

USD

27.67 Billion

2024

2032

| 2025 –2032 | |

| USD 18.45 Billion | |

| USD 27.67 Billion | |

|

|

|

Surface Radars Market Analysis

The global surface radars market is witnessing significant growth, driven by rising defense modernization programs, increasing geopolitical tensions, and advancements in radar technology. Governments and defense agencies worldwide are investing heavily in next-generation surface radar systems for enhanced surveillance, threat detection, and air defense capabilities. Technological innovations such as active electronically scanned array (AESA) radars, artificial intelligence (AI)-driven target tracking, and advanced signal processing are improving radar accuracy, range, and real-time data processing. In addition, the integration of surface radars with command-and-control systems is enhancing military situational awareness. The demand for multi-functional radars that can detect low-observable threats, including stealth aircraft and hypersonic missiles, is further propelling market growth. The commercial sector is also adopting surface radars for applications such as air traffic control, maritime monitoring, and weather forecasting. Leading players such as RTX, Lockheed Martin, and ASELSAN are focusing on R&D to develop cost-effective and energy-efficient radar solutions. Moreover, increased collaborations between governments and private defense contractors are accelerating product development. With rising security concerns and rapid technological advancements, the surface radars market is poised for substantial expansion in the coming years.

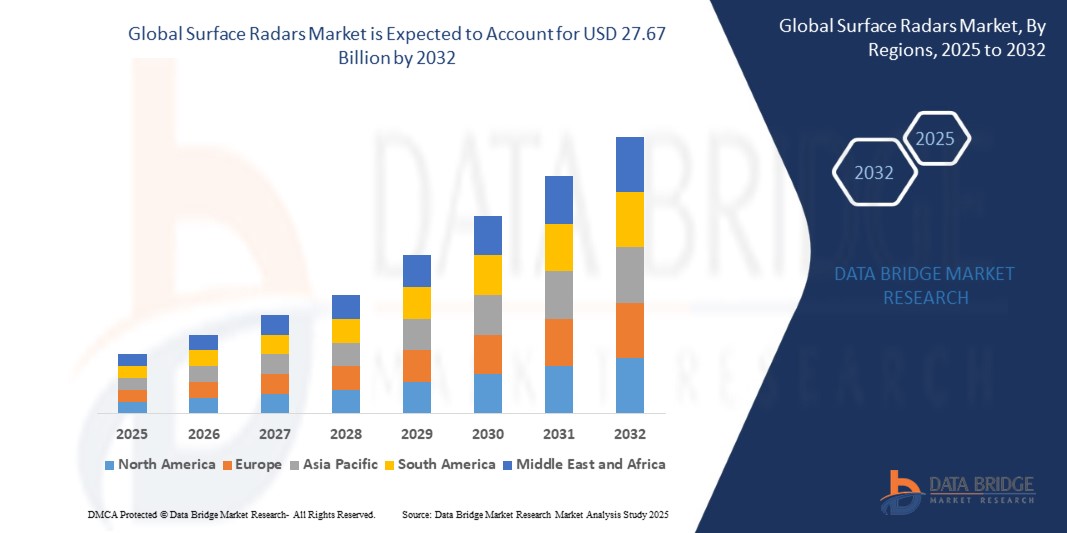

Surface Radars Market Size

The global surface radars market size was valued at USD 18.45 billion in 2024 and is projected to reach USD 27.67 billion by 2032, with a CAGR of 5.20% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Surface Radars Market Trends

“Growing Adoption of Multi-Function Radar Systems”

One key trend in the surface radars market is the growing adoption of multi-function radar systems that integrate air and missile defense capabilities into a single platform. Modern defense forces are increasingly deploying advanced surface radars capable of simultaneously tracking multiple threats, including drones, stealth aircraft, hypersonic missiles, and ballistic projectiles. For instance, RTX’s Lower Tier Air and Missile Defense Sensor (LTAMDS) is designed to provide 360-degree surveillance, enhancing battlefield awareness and response time. The increasing need for agile and cost-effective defense solutions is driving the shift from traditional, single-purpose radars to next-generation, software-defined radar systems that leverage AI-driven target recognition and real-time data processing. In addition, military modernization programs across the U.S., Europe, and Asia-Pacific are accelerating investments in surface radar upgrades to counter evolving threats. As adversaries develop sophisticated offensive capabilities, the demand for multi-role, networked radar systems is expected to drive significant growth in the global surface radars market.

Report Scope and Surface Radars Market Segmentation

|

Attributes |

Surface Radars Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Lockheed Martin Corporation (U.S.), RTX (U.S.), BAE Systems (U.K.), Northrop Grumman (U.S.), IAI (Israel), Thales (France), Saab AB (Sweden), Elbit Systems Ltd. (Israel), ASELSAN A.Ş. (Turkey), Bharat Electronics Limited (BEL) (India), Leonardo S.p.A. (Italy), L3Harris Technologies, Inc. (U.S.), Indra (Spain), Teledyne FLIR LLC (U.S.), Hensoldt AG (Germany), Hanwha Systems Co. Ltd. (South Korea), Mercury Systems, Inc. (U.S.), Navtech Radar (U.K.), Reunert (South Africa), and TERMA (Denmark) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Surface Radars Market Definition

Surface radars are ground-based radar systems designed for detecting, tracking, and monitoring objects on land, sea, and in the air. These radars use radio waves to identify the speed, direction, and distance of targets, providing crucial situational awareness for military, defense, and civilian applications. Surface radars are widely used for air and missile defense, border security, maritime surveillance, and weather monitoring.

Surface Radars Market Dynamics

Drivers

- High Development and Deployment Costs

The development and deployment of surface radar systems require substantial financial investment, primarily due to the integration of advanced technologies, extensive research and development (R&D) efforts, and complex manufacturing processes. Military-grade radars, in particular, need high precision, durability, and reliability, leading to significant procurement and maintenance expenses. For instance, phased array radar systems, widely used in missile defense and surveillance, can cost millions of dollars per unit, making them unaffordable for many countries with limited defense budgets. This cost barrier restricts widespread adoption and forces governments and organizations to seek cost-effective alternatives. In addition, long development cycles and expensive system upgrades further add to the financial burden, limiting market expansion despite the rising need for advanced radar systems.

- Cybersecurity and Electronic Warfare Threats

The increasing reliance on digital infrastructure makes surface radar systems highly susceptible to cybersecurity threats and electronic warfare tactics, such as jamming, spoofing, and hacking. Malicious actors, including hostile military forces and cybercriminal organizations, can exploit radar vulnerabilities to manipulate or disable radar functionality, compromising national security and defense operations. For instance, electronic countermeasures (ECMs) are frequently deployed to interfere with radar signals, disrupting air defense systems and surveillance capabilities. In modern warfare, adversaries can use sophisticated cyberattacks to infiltrate radar networks, gaining unauthorized access to critical military intelligence. To counteract these threats, radar manufacturers and defense agencies are investing in advanced encryption, artificial intelligence-driven cybersecurity solutions, and electronic counter-countermeasures (ECCM) to enhance radar resilience. However, the ongoing cybersecurity risks remain a key challenge, driving continuous innovation in radar protection technologies.

Opportunities

- Increasing Advancements in Radar Technology

The continuous evolution of radar technology is driving the expansion of the surface radars market. Innovations such as active electronically scanned array (AESA) radars, artificial intelligence (AI), and digital signal processing (DSP) are significantly enhancing radar performance. AESA technology, in particular, provides superior target detection, tracking, and adaptability in complex environments, making it a crucial component in modern defense systems. For instance, Raytheon’s AN/TPY-2 radar, which incorporates AESA technology, offers high-resolution tracking and early threat detection for missile defense applications. Similarly, AI-powered radars are improving automation and predictive analytics, reducing response times in critical situations. These advancements create opportunities for radar manufacturers to develop next-generation systems for defense, air surveillance, and civilian applications. As countries invest in modernizing their military infrastructure and surveillance capabilities, the demand for advanced radar solutions is expected to grow, positioning cutting-edge radar technologies as a lucrative market segment.

- Growing Use in Air Traffic Control and Weather Monitoring

Surface radars play a critical role in air traffic management and weather forecasting, ensuring flight safety, disaster preparedness, and efficient aviation operations. Airports worldwide are integrating advanced radar systems to enhance collision avoidance, optimize airspace utilization, and improve real-time tracking of aircraft. For instance, the Federal Aviation Administration (FAA) in the U.S. deploys modern surface movement radars at major airports to enhance situational awareness and reduce runway incursions. Similarly, the demand for weather monitoring radars is increasing, as meteorological agencies seek accurate and early warning systems for extreme weather conditions. Doppler radar systems, such as those used by the U.K. Met Office, provide high-resolution climate predictions, enabling early warnings for hurricanes, storms, and heavy rainfall. As climate change drives an increased focus on disaster management and aviation safety becomes a priority, the market for surface radars in these sectors is set to expand, creating new growth opportunities for radar technology providers.

Restraints/Challenges

- High Development and Deployment Costs

The production and deployment of surface radar systems require significant financial investments due to advanced technology integration, research and development (R&D) expenses, and complex manufacturing processes. Military-grade radars, in particular, demand high precision and durability, leading to higher procurement and maintenance costs. For instance, the cost of phased array radar systems used in defense applications can be prohibitively expensive for many countries, limiting widespread adoption.

- Regulatory and compliance issues

Regulatory and compliance issues pose a significant challenge in the surface radar market, as companies must navigate complex international laws, export controls, and safety standards. Strict regulations, such as the U.S. International Traffic in Arms Regulations (ITAR) and the Wassenaar Arrangement, limit the export of advanced radar technology, restricting market expansion for manufacturers. Additionally, environmental concerns related to radar emissions and power consumption require compliance with regulations such as the European Union’s RoHS (Restriction of Hazardous Substances) directive. For instance, defense radar manufacturers must ensure their systems meet both military-grade safety requirements and civilian airspace regulations, complicating development and increasing costs. Such regulatory constraints not only delay product deployment but also create market entry barriers, affecting global competitiveness and growth potential.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Surface Radars Market Scope

The market is segmented on the basis of component, technology, frequency band, range, dimension, and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Antenna

- Control System

- Digital Signal Processor

- Receiver

- Software Systems

- Transmitter

Technology

- Continuous Wave

- Frequency Modulated Continuous Wave (FMCW)

- Pulsed

Frequency Band

- C Band

- Ka Band

- Ku Band

- L Band

- P Band

- S Band

- X Band

Range

- Long Range (> 200 Km)

- Medium Range (50 Km to 200 Km)

- Short Range (10 Km to 50 Km)

- Very Short Range (< 10 Km)

Dimension

- 2D

- 3D

- 4D

Application

- Aviation and Aerospace

- Defense and Military Applications

- Government Agencies and Law Enforcement

- Maritime Applications

- Meteorological and Environmental Monitoring

Surface Radars Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, component, technology, frequency band, range, dimension, and application as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America is dominating the global surface radar market due to its strong defense sector, advanced technological infrastructure, and significant investments in radar systems. The presence of major defense contractors and continuous research in radar technology further strengthen the region's market dominance. In addition, increasing demand for surveillance, border security, and air traffic control solutions is driving the adoption of advanced radar systems. The U.S., in particular, plays a crucial role in market growth, with government initiatives and military modernization programs fueling advancements in surface radar technology.

Asia-Pacific is experiencing the fastest growth in the global surface radar market due to rising defense budgets, increasing geopolitical tensions, and advancements in radar technology. Countries such as China, India, and Japan are heavily investing in modern radar systems for military surveillance, air defense, and maritime security. In addition, the expansion of air traffic management and coastal monitoring initiatives is driving demand for advanced radar solutions in the region. The growing focus on indigenous radar production and collaborations with international defense firms further accelerate market expansion in Asia-Pacific.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Surface Radars Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Surface Radars Market Leaders Operating in the Market Are:

- Lockheed Martin Corporation (U.S.)

- RTX (U.S.)

- BAE Systems (U.K.)

- Northrop Grumman (U.S.)

- IAI (Israel)

- Thales (France)

- Saab AB (Sweden)

- Elbit Systems Ltd. (Israel)

- ASELSAN A.Ş. (Turkey)

- Bharat Electronics Limited (BEL) (India)

- Leonardo S.p.A. (Italy)

- L3Harris Technologies, Inc. (U.S.)

- Indra (Spain)

- Teledyne FLIR LLC (U.S.)

- Hensoldt AG (Germany)

- Hanwha Systems Co. Ltd. (South Korea)

- Mercury Systems, Inc. (U.S.)

- Navtech Radar (U.K.)

- Reunert (South Africa)

- TERMA (Denmark)

Latest Developments in Surface Radars Market

- In January 2025, Elbit Systems Ltd. secured a USD 60 million contract to supply its multi-layered Counter Unmanned Aerial Systems (C-UAS) to a NATO European country. The contract, set to be executed over three years, includes the delivery of Elbit Systems' ReDrone modular Counter-UAS solution, which integrates the company’s advanced DAIR Radar

- In December 2024, ASELSAN and the Presidency of Defence Industries of Turkey signed an agreement for the supply of air defense radar systems. The agreements, valued at USD 170.9 million and USD 55.18 million (1.95 billion Turkish lira), outline deliveries scheduled between 2026 and 2031

- In November 2024, RTX successfully completed the first testing of its Lower Tier Air and Missile Defense Sensor (LTAMDS). During the most complex live-fire exercise to date, the system detected and neutralized a tactical ballistic missile, meeting all test objectives and progressing toward the deployment of a 360-degree, full-sector capability under the U.S. Army's rigorous test program

- In September 2024, the U.S. Air Force Three-Dimensional Expeditionary Long Range Radar (3DELRR) program team, in collaboration with Lockheed Martin, successfully completed risk reduction testing for the TPY-4 radar, enhancing the program's readiness for further development

- In September 2024, Raytheon, a business unit of RTX, delivered the first AN/TPY-2 radar to the Kingdom of Saudi Arabia. The AN/TPY-2 is an advanced missile defense radar capable of detecting, tracking, and discriminating ballistic missiles across multiple phases of flight

- In November 2023, Israel Aerospace Industries expanded its presence in India by opening a new HELA facility in Hyderabad. This initiative underscores the company's commitment to strengthening local capabilities and advancing self-reliance in radar technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.