Global Surgical Tape Market

Market Size in USD Million

CAGR :

%

USD

9,959.04 Million

USD

16,358.76 Million

2022

2030

USD

9,959.04 Million

USD

16,358.76 Million

2022

2030

| 2023 –2030 | |

| USD 9,959.04 Million | |

| USD 16,358.76 Million | |

|

|

|

|

Surgical Tape Market Analysis and Size

The market for surgical tape is expected to grow during the forecast period. It is used to cover wounds and maintain the integrity and positioning of bandages. The materials used to create surgical tape include fabric, nylon, foam, paper, and tape with a transparent porous consistency. For those who are prone to latex allergies, there are also surgical tapes that are hypoallergenic and waterproof.

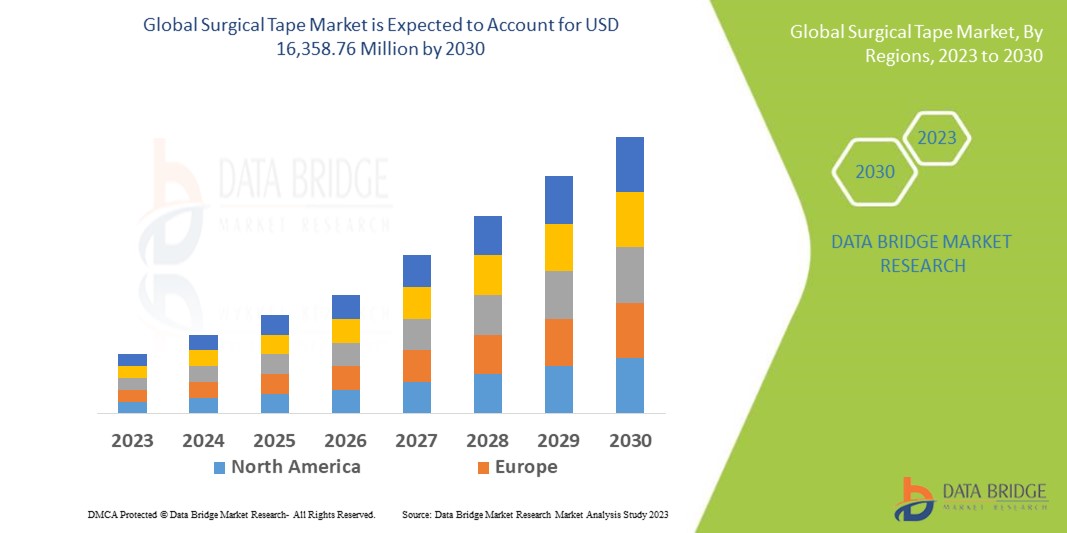

Data Bridge Market Research analyses that the global surgical tape market, which was USD 9,959.04 million in 2022, would rocket up to USD 16,358.76million by 2030, and is expected to undergo a CAGR of 6.40% during the forecast period. This indicates that the “Breathable Non-Woven Tape” dominates the product type segment of theSurgical Tape Market owing to the advancements in technology. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Surgical Tape Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product Type (Breathable Non-Woven Tape, Breathable PE Tape, Rayon Tape, Easy-Tear Non-Woven Cloth Tape, Zinc Oxide Adhesive Cloth Tape, Elastic Tapes, Silicone Tapes, Paper Tapes, and Silk Cloth Tapes), Sales Channel (Direct Sales and Distributor), Application (Splints, Wound Dressings, Secure IV Lines, Ostomy Seals, Surgeries and Surgical Wounds, Traumatic and Laceration Wound, and Burns and Ulcers), End-User (Hospitals, Clinics, Ambulatory Settings, and Home Care Settings) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Market Players Covered |

3M (U.S.), Johnson & Johnson Services, Inc. (U.S.), PAUL HARTMANN AG (Germany), Scapa Group Ltd. (France), Medtronic (Ireland), NITTO DENKO CORPORATION (Japan), NICHIBAN Co., Ltd. (Japan), B. Braun Melsungen AG (Germany), Mölnlycke Health Care AB (Sweden), Smith+Nephew (U.K.), Cardinal Health (U.S.), Henkel Adhesives Technologies India Private Limited (India) |

|

Market Opportunities |

|

Market Definition

In first aid and medicine, surgical tape or medical tape is a form of pressure-sensitive adhesive tape used to fasten a bandage or other dressing. These tapes often have a hypoallergenic adhesive that is made to stick strongly to skin, dressing materials, and underlying layers of tape, yet to detach without leaving any skin damage. Some elastic bandages with adhesive and breathable tapes, such as kinesiology tape, are made of cotton.

Global Surgical Tape Market Dynamics

Drivers

- Rising Adoption of Tapes

Surgical tape is a staple in the medical supply industry. It is used to cover wounds and maintain the integrity and positioning of bandages. The materials used to create surgical tape include fabric, nylon, foam, paper, and tape with a transparent porous consistency. Adhesion development is a serious post-operative complication that frequently necessitates further procedures for the treatment of affected individuals. In the case of abdominal surgery, post-operative adhesion formation causes significant abdominal discomfort, infertility in women following gynecological surgery and physical disability in patients following neurological surgery. The need for solutions such as adhesion barriers is growing in the market due to the negative consequences that post-surgery adhesion formation on patients. This will boost the market growth.

- Rising Demand for Surgical Tapes

Surgical tapes have a number of advantages, including the fact that they are waterproof, flexible, simple to tear, non-adherent to hair, and strongly attach to skin. Surgical tapes are mostly used in first-aid kits found in healthcare facilities, hospitals, and homes. Increasing population, an increase in accidents, and a growth in demand from the healthcare industry since surgical tapes are used more frequently in procedures are all factors in the demand for surgical tapes.

- Rise in the Number of Surgeries

Surgical tapes are used to secure infusion lines, wound dressings, and the treatment of wounds in circumstances where it is necessary to settle catheters and infusions in patients before or after surgery. Amputations and incisions, which are the main causes of wounds, occur during surgeries. The surgical segment is anticipated to dominate the surgical tape market. This will boost the market expansion.

Opportunities

- Increasing Healthcare Expenditure

Rising healthcare expenditure, particularly in developing regions, is contributing to the growth of the global surgical tape market. Increased investments in healthcare infrastructure and technological advancements are expanding access to these devices and procedures.

- Growing Number of Innovations

Surgical Innovations specializes in the design, development and manufacture of creative solutions for minimally invasive surgery. Adhesives are being used more and more in industrial manufacturing. The benefits of utilizing adhesives are obvious they are portable, hygienic, and secure.

- Restraints/Challenges

Rising Raw Material Costs

Many surgical tapes are made from specialized materials, and the costs of these materials can fluctuate. Rising raw material costs can put pressure on manufacturers to either raise prices or compromise on quality, both of which can affect the market.

Regulatory Hurdles

Surgical tapes are considered medical devices, and they are subject to strict regulations in various countries. Manufacturers must meet regulatory requirements, including safety and efficacy standards. Compliance with these regulations can be time-consuming and costly.

This global surgical tape market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the global surgical tape market, Contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In June 2022, 3M agreed to sell its rights to the Neoplast and Neobun brands and related assets in Thailand and certain other Southeast Asia countries, including the manufacturing assets of its Ladlumkaew, Thailand, facility to Selic Corp Public Company Limited (Selic). Neoplast and Neobun products portfolios include sports and medical tapes, bandages, and medicated products for the consumer and healthcare industry

- In April 2021, Tricol Biomedical and Tactical Medical Solutions partnered to launch the next generation of the OLAES Modular Bandage. By combining the proven battlefield effectiveness of HemCon ChitoGauze PRO with the time-tested OLAES Modular Bandage, the two companies have created a cutting-edge convenience kit - the OLAES Hemostatic Modular Bandage

Global Surgical Tape Market Scope

The global surgical tape market Market is segmented on the basis of product type, sales channel, application, and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Breathable Non-Woven Tape

- Breathable PE Tape

- Rayon Tape

- Easy-Tear Non-Woven Cloth Tape

- Zinc Oxide Adhesive Cloth Tape

- Elastic Tapes

- Silicone Tapes

- Paper Tapes

- Silk Cloth Tapes

Sales Channel

- Direct Sales

- Distributor

Application

- Splints

- Wound Dressings

- Secure IV Lines

- Ostomy Seals

- Surgeries and Surgical Wounds

- Traumatic and Laceration Wound

- Burns and Ulcers

End-User

- Hospitals

- Clinics

- Ambulatory Settings

- Home Care Settings

Global Surgical Tape Market Regional Analysis/Insights

The surgical tape market is analysed and market size insights and trends are provided by country, product type, sales channel, application and end user as referenced above.

The countries covered in the global surgical tape market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina and Rest of South America.

North America is expected to dominate the global surgical tape market because of the strong base of healthcare facilities, widespread utilization of medications, surging occurrences of chronic neurological diseases and rising number of research activities in this region.

Asia-Pacific is expected to witness significant growth during the forecast period of 2023 to 2030 due to the increase in government initiatives to promote awareness, rise in medical tourism, growing research activities in the region, availability of massive untapped markets, large population pool, increasing health conscious people within the region, and the growing demand for quality healthcare in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed Base and New Technology Penetration

The global surgical tape market also provides you with a detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for the global surgical tape market, the impact of technology using lifeline curves and changes in healthcare regulatory scenarios and their impact on the global surgical tape market. The data is available for the historic period 2010-2020.

Competitive Landscape and Global Surgical Tape Market Market Share Analysis

The global surgical tape market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the global surgical tape market.

Some of the major players operating in the global surgical tape market are:

- 3M (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- PAUL HARTMANN AG (Germany)

- Scapa Group Ltd. (France)

- Medtronic (Ireland)

- NITTO DENKO CORPORATION (Japan)

- NICHIBAN Co., Ltd. (Japan)

- B. Braun Melsungen AG (Germany)

- Mölnlycke Health Care AB (Sweden)

- Smith+Nephew (U.K.)

- Cardinal Health (U.S.)

- Henkel Adhesives Technologies India Private Limited (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL SURGICAL TAPE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL SURGICAL TAPE MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL SURGICAL TAPE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S 5 FORCES MODEL

5.3 STRATEGIC INITIATIVES

6 REGULATORY FRAMWORK

7 GLOBAL SURGICAL TAPE MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 BREATHABLE NON-WOVEN TAPE

7.2.1 MARKET VALUE (USD MN)

7.2.2 MARKET VOLUME (UNITS)

7.2.3 AVERAGE SELLING PRICE (USD)

7.3 BREATHABLE PE TAPE

7.3.1 MARKET VALUE (USD MN)

7.3.2 MARKET VOLUME (UNITS)

7.3.3 AVERAGE SELLING PRICE (USD)

7.4 RAYON TAPE

7.4.1 MARKET VALUE (USD MN)

7.4.2 MARKET VOLUME (UNITS)

7.4.3 AVERAGE SELLING PRICE (USD)

7.5 EASY-TEAR NON-WOVEN CLOTH TAPE

7.5.1 MARKET VALUE (USD MN)

7.5.2 MARKET VOLUME (UNITS)

7.5.3 AVERAGE SELLING PRICE (USD)

7.6 ZINC OXIDE ADHESIVE CLOTH TAPE

7.6.1 MARKET VALUE (USD MN)

7.6.2 MARKET VOLUME (UNITS)

7.6.3 AVERAGE SELLING PRICE (USD)

7.7 SILK CLOTH TAPES

7.7.1 MARKET VALUE (USD MN)

7.7.2 MARKET VOLUME (UNITS)

7.7.3 AVERAGE SELLING PRICE (USD)

7.8 ELASTIC TAPES

7.8.1 MARKET VALUE (USD MN)

7.8.2 MARKET VOLUME (UNITS)

7.8.3 AVERAGE SELLING PRICE (USD)

7.9 SILICONE TAPES

7.9.1 MARKET VALUE (USD MN)

7.9.2 MARKET VOLUME (UNITS)

7.9.3 AVERAGE SELLING PRICE (USD)

7.1 PAPER TAPES

7.10.1 MARKET VALUE (USD MN)

7.10.2 MARKET VOLUME (UNITS)

7.10.3 AVERAGE SELLING PRICE (USD)

7.11 FOAM TAPES

7.11.1 MARKET VALUE (USD MN)

7.11.2 MARKET VOLUME (UNITS)

7.11.3 AVERAGE SELLING PRICE (USD)

7.12 HYPOALLERGENIC TAPES

7.12.1 MARKET VALUE (USD MN)

7.12.2 MARKET VOLUME (UNITS)

7.12.3 AVERAGE SELLING PRICE (USD)

7.13 POROUS TAPES

7.13.1 MARKET VALUE (USD MN)

7.13.2 MARKET VOLUME (UNITS)

7.13.3 AVERAGE SELLING PRICE (USD)

7.14 OTHERS

8 GLOBAL SURGICAL TAPE MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 SPLINTS

8.3 DRESSINGS

8.3.1 INFUSION DRESSINGS

8.3.2 COMPRESSION DRESSINGS

8.3.3 WOUND CARE DRESSINGS

8.4 SECURE IV LINES

8.5 OSTOMY SEALS

8.6 SURGERIES AND SURGICAL WOUNDS

8.7 TRAUMATIC AND LACERATION WOUND

8.8 BURNS AND ULCERS

8.9 OTHERS

9 GLOBAL SURGICAL TAPE MARKET, BY PACKAGING

9.1 OVERVIEW

9.2 STANDARD ROLLS

9.3 SINGLE USE ROLLS

9.4 DRESS-IT PRE-CUT DRESSING COVER

9.5 DISPENSER PACK

9.6 OTHERS

10 GLOBAL SURGICAL TAPE MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITALS

10.3 CLINICS

10.4 AMBULATORY SETTINGS

10.5 HOME CARE SETTINGS

10.6 OTHERS

11 GLOBAL SURGICAL TAPE MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT SALES

11.3 HOSPITAL PHARMACIES

11.4 RETAIL PHARMACIES

11.5 ONLINE PHARMACIES

11.6 OTHERS

12 GLOBAL SURGICAL TAPE MARKET, SWOT AND DBMR ANALYSIS

13 GLOBAL SURGICAL TAPE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13.5 MERGERS & ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT & APPROVALS

13.7 EXPANSIONS

13.8 REGULATORY CHANGES

13.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 GLOBAL SURGICAL TAPE MARKET, BY REGION

GLOBAL DYSLEXIA TREATMENT MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

14.2 EUROPE

14.2.1 GERMANY

14.2.2 U.K.

14.2.3 ITALY

14.2.4 FRANCE

14.2.5 SPAIN

14.2.6 RUSSIA

14.2.7 SWITZERLAND

14.2.8 TURKEY

14.2.9 BELGIUM

14.2.10 NETHERLANDS

14.2.11 DENMARK

14.2.12 SWEDEN

14.2.13 POLAND

14.2.14 NORWAY

14.2.15 FINLAND

14.2.16 REST OF EUROPE

14.3 ASIA-PACIFIC

14.3.1 JAPAN

14.3.2 CHINA

14.3.3 SOUTH KOREA

14.3.4 INDIA

14.3.5 SINGAPORE

14.3.6 THAILAND

14.3.7 INDONESIA

14.3.8 MALAYSIA

14.3.9 PHILIPPINES

14.3.10 AUSTRALIA

14.3.11 NEW ZEALAND

14.3.12 VIETNAM

14.3.13 TAIWAN

14.3.14 REST OF ASIA-PACIFIC

14.4 SOUTH AMERICA

14.4.1 BRAZIL

14.4.2 ARGENTINA

14.4.3 REST OF SOUTH AMERICA

14.5 MIDDLE EAST AND AFRICA

14.5.1 SOUTH AFRICA

14.5.2 EGYPT

14.5.3 BAHRAIN

14.5.4 UNITED ARAB EMIRATES

14.5.5 KUWAIT

14.5.6 OMAN

14.5.7 QATAR

14.5.8 SAUDI ARABIA

14.5.9 REST OF MEA

15 GLOBAL SURGICAL TAPE MARKET, COMPANY PROFILE

15.1 3M

15.1.1 COMPANY OVERVIEW

15.1.2 GEOGRAPHIC PRESENCE

15.1.3 REVENUE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 BAXTER

15.2.1 COMPANY OVERVIEW

15.2.2 GEOGRAPHIC PRESENCE

15.2.3 REVENUE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 B. BRAUN MELSUNGEN AG

15.3.1 COMPANY OVERVIEW

15.3.2 GEOGRAPHIC PRESENCE

15.3.3 REVENUE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 COLOPLAST GROUP

15.4.1 COMPANY OVERVIEW

15.4.2 REVENUE ANALYSIS

15.4.3 GEOGRAPHIC PRESENCE

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 JOHNSON & JOHNSON SERVICES, INC

15.5.1 COMPANY OVERVIEW

15.5.2 REVENUE ANALYSIS

15.5.3 GEOGRAPHIC PRESENCE

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 MEDTRONIC

15.6.1 COMPANY OVERVIEW

15.6.2 REVENUE ANALYSIS

15.6.3 GEOGRAPHIC PRESENCE

15.6.4 PRODUCT PORTFOLIO

15.6.5 RECENT DEVELOPMENTS

15.7 SMITH & NEPHEW

15.7.1 COMPANY OVERVIEW

15.7.2 GEOGRAPHIC PRESENCE

15.7.3 REVENUE ANALYSIS

15.7.4 PRODUCT PORTFOLIO

15.7.5 RECENT DEVELOPMENTS

15.8 MÖLNLYCKE HEALTH CARE AB

15.8.1 COMPANY OVERVIEW

15.8.2 REVENUE ANALYSIS

15.8.3 GEOGRAPHIC PRESENCE

15.8.4 PRODUCT PORTFOLIO

15.8.5 RECENT DEVELOPMENTS

15.9 MEDLINE INDUSTRIES, INC.

15.9.1 COMPANY OVERVIEW

15.9.2 REVENUE ANALYSIS

15.9.3 GEOGRAPHIC PRESENCE

15.9.4 PRODUCT PORTFOLIO

15.9.5 RECENT DEVELOPMENTS

15.1 SCAPA

15.10.1 COMPANY OVERVIEW

15.10.2 REVENUE ANALYSIS

15.10.3 GEOGRAPHIC PRESENCE

15.10.4 PRODUCT PORTFOLIO

15.10.5 RECENT DEVELOPMENTS

15.11 BDK INDUSTRIAL PRODUCTS LTD

15.11.1 COMPANY OVERVIEW

15.11.2 REVENUE ANALYSIS

15.11.3 GEOGRAPHIC PRESENCE

15.11.4 PRODUCT PORTFOLIO

15.11.5 RECENT DEVELOPMENTS

15.12 HUDSON MEDICAL INNOVATIONS

15.12.1 COMPANY OVERVIEW

15.12.2 REVENUE ANALYSIS

15.12.3 GEOGRAPHIC PRESENCE

15.12.4 PRODUCT PORTFOLIO

15.12.5 RECENT DEVELOPMENTS

15.13 INTEGRA LIFESCIENCES CORPORATION.

15.13.1 COMPANY OVERVIEW

15.13.2 REVENUE ANALYSIS

15.13.3 GEOGRAPHIC PRESENCE

15.13.4 PRODUCT PORTFOLIO

15.13.5 RECENT DEVELOPMENTS

15.14 HOLLISTER INCORPORATED

15.14.1 COMPANY OVERVIEW

15.14.2 REVENUE ANALYSIS

15.14.3 GEOGRAPHIC PRESENCE

15.14.4 PRODUCT PORTFOLIO

15.14.5 RECENT DEVELOPMENTS

15.15 MIMEDX

15.15.1 COMPANY OVERVIEW

15.15.2 REVENUE ANALYSIS

15.15.3 GEOGRAPHIC PRESENCE

15.15.4 PRODUCT PORTFOLIO

15.15.5 RECENT DEVELOPMENTS

15.16 ZIMMER BIOMET

15.16.1 COMPANY OVERVIEW

15.16.2 REVENUE ANALYSIS

15.16.3 GEOGRAPHIC PRESENCE

15.16.4 PRODUCT PORTFOLIO

15.16.5 RECENT DEVELOPMENTS

15.17 TRIAGE MEDITECH PVT. LTD.

15.17.1 COMPANY OVERVIEW

15.17.2 REVENUE ANALYSIS

15.17.3 GEOGRAPHIC PRESENCE

15.17.4 PRODUCT PORTFOLIO

15.17.5 RECENT DEVELOPMENTS

15.18 ESSITY AKTIEBOLAG

15.18.1 COMPANY OVERVIEW

15.18.2 REVENUE ANALYSIS

15.18.3 GEOGRAPHIC PRESENCE

15.18.4 PRODUCT PORTFOLIO

15.18.5 RECENT DEVELOPMENTS

15.19 CONVATEC INC.

15.19.1 COMPANY OVERVIEW

15.19.2 REVENUE ANALYSIS

15.19.3 GEOGRAPHIC PRESENCE

15.19.4 PRODUCT PORTFOLIO

15.19.5 RECENT DEVELOPMENTS

15.2 L&R GROUP

15.20.1 COMPANY OVERVIEW

15.20.2 REVENUE ANALYSIS

15.20.3 GEOGRAPHIC PRESENCE

15.20.4 PRODUCT PORTFOLIO

15.20.5 RECENT DEVELOPMENTS

15.21 PAUL HARTMANN LIMITED

15.21.1 COMPANY OVERVIEW

15.21.2 REVENUE ANALYSIS

15.21.3 GEOGRAPHIC PRESENCE

15.21.4 PRODUCT PORTFOLIO

15.21.5 RECENT DEVELOPMENTS

15.22 HENSO MEDICAL (HANGZHOU) CO.,LTD.

15.22.1 COMPANY OVERVIEW

15.22.2 REVENUE ANALYSIS

15.22.3 GEOGRAPHIC PRESENCE

15.22.4 PRODUCT PORTFOLIO

15.22.5 RECENT DEVELOPMENTS

15.23 CARDINAL HEALTH

15.23.1 COMPANY OVERVIEW

15.23.2 REVENUE ANALYSIS

15.23.3 GEOGRAPHIC PRESENCE

15.23.4 PRODUCT PORTFOLIO

15.23.5 RECENT DEVELOPMENTS

15.24 ATOZBIO

15.24.1 COMPANY OVERVIEW

15.24.2 REVENUE ANALYSIS

15.24.3 GEOGRAPHIC PRESENCE

15.24.4 PRODUCT PORTFOLIO

15.24.5 RECENT DEVELOPMENTS

15.25 RECURA PTEL LTD.

15.25.1 COMPANY OVERVIEW

15.25.2 REVENUE ANALYSIS

15.25.3 GEOGRAPHIC PRESENCE

15.25.4 PRODUCT PORTFOLIO

15.25.5 RECENT DEVELOPMENTS

15.26 WUHAN HUAWEI TECHNOLOGY CO., LTD.

15.26.1 COMPANY OVERVIEW

15.26.2 REVENUE ANALYSIS

15.26.3 GEOGRAPHIC PRESENCE

15.26.4 PRODUCT PORTFOLIO

15.26.5 RECENT DEVELOPMENTS

15.27 URGO

15.27.1 COMPANY OVERVIEW

15.27.2 REVENUE ANALYSIS

15.27.3 GEOGRAPHIC PRESENCE

15.27.4 PRODUCT PORTFOLIO

15.27.5 RECENT DEVELOPMENTS

15.28 FIBROHEAL

15.28.1 COMPANY OVERVIEW

15.28.2 REVENUE ANALYSIS

15.28.3 GEOGRAPHIC PRESENCE

15.28.4 PRODUCT PORTFOLIO

15.28.5 RECENT DEVELOPMENTS

15.29 AHLSTROM-MUNKSJÖ

15.29.1 COMPANY OVERVIEW

15.29.2 REVENUE ANALYSIS

15.29.3 GEOGRAPHIC PRESENCE

15.29.4 PRODUCT PORTFOLIO

15.29.5 RECENT DEVELOPMENTS

15.3 ADVANCIS MEDICAL

15.30.1 COMPANY OVERVIEW

15.30.2 REVENUE ANALYSIS

15.30.3 GEOGRAPHIC PRESENCE

15.30.4 PRODUCT PORTFOLIO

15.30.5 RECENT DEVELOPMENTS

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.