Global Wound Dressings Market

Market Size in USD Billion

CAGR :

%

USD

9.39 Billion

USD

16.94 Billion

2024

2032

USD

9.39 Billion

USD

16.94 Billion

2024

2032

| 2025 –2032 | |

| USD 9.39 Billion | |

| USD 16.94 Billion | |

|

|

|

|

Wound Dressings Market Size

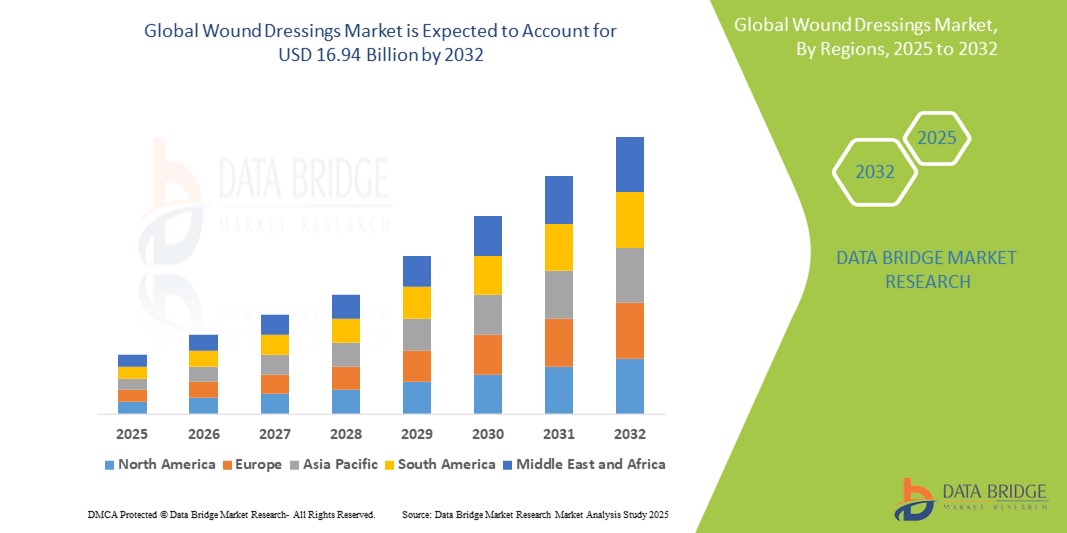

- The global wound dressings market size was valued at USD 9.39 billion in 2024 and is expected to reach USD 16.94 billion by 2032, at a CAGR of 7.65% during the forecast period

- This growth is driven by rising prevalence of diseases and increasing cases of chronic wounds

Wound Dressings Market Analysis

- The rising prevalence of chronic and acute wounds, such as diabetic foot ulcers, pressure ulcers, and surgical wounds, is significantly driving the demand for advanced wound dressings that promote faster healing and infection prevention

- Increasing surgical procedures and hospital admissions, especially in aging populations, are fueling the need for high-performance dressings that support effective wound care and reduce hospital stay

- North America is expected to dominate the global wound dressings market with the largest market share of 46.61%, driven by rising surgical procedures, increasing prevalence of chronic wounds, and the availability of advanced wound care products

- Asia-Pacific is projected to register the highest growth rate in the wound dressings market due to growing elderly population, rising healthcare expenditure, and a shift toward modern wound care practices

- The advanced wound dressings segment is expected to dominate the material segment with the largest market share of 53.45% in 2025, due to their superior efficacy in managing chronic and complex wounds, such as diabetic foot ulcers, pressure ulcers, and surgical wounds

Report Scope and Wound Dressings Market Segmentation

|

Attributes |

Wound Dressings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wound Dressings Market Trends

“Adoption of Antimicrobial-Integrated Wound Dressings”

- A significant trend in the wound dressings market is the increasing use of antimicrobial-integrated dressings to prevent infections and accelerate healing, particularly in chronic and surgical wounds. These dressings help reduce the need for systemic antibiotics, lowering antimicrobial resistance risks

- Healthcare professionals are favoring silver, iodine, and honey-based dressings for their broad-spectrum antimicrobial properties, especially in treating diabetic foot ulcers and pressure sores

- The adoption of such dressings is aligned with the global effort to curb hospital-acquired infections (HAIs) and improve wound care outcomes

- For instance, in 2024, Smith+Nephew introduced an advanced antimicrobial wound dressing with patented silver technology that demonstrated improved infection control in post-operative wound care

- The growing preference for antimicrobial wound dressings is expected to boost market demand across hospitals, homecare, and outpatient settings

Wound Dressings Market Dynamics

Driver

“Growing Burden of Diabetes and Chronic Wounds”

- The global increase in diabetes prevalence is driving higher demand for wound dressings, particularly advanced types that manage chronic wounds such as diabetic foot ulcers

- Chronic wounds require long-term and specialized care, and the availability of dressings that promote moisture balance, reduce infection, and enhance tissue regeneration is critical

- As healthcare systems emphasize preventive care and complication management, advanced wound dressings have become an essential component of diabetic treatment protocols

- For instance, in 2023, Coloplast A/S expanded its diabetic wound care product line to meet the increasing demand for efficient chronic wound treatment

- This rising burden of diabetes is expected to remain a key market driver, pushing innovation and accessibility of effective wound care products

Opportunity

“Expanding Access to Wound Care in Emerging Economies”

- Rapid healthcare development in countries such as India, China, and Brazil is creating strong growth opportunities for wound dressings, especially those that are affordable and easily distributed

- Government programs aimed at improving rural healthcare infrastructure and public health awareness are boosting the demand for basic and advanced wound care solutions

- Local manufacturing and public-private partnerships are supporting the distribution of essential wound care products, including dressings, to underserved regions

- For instance, in 2024, Healthium Medtech partnered with regional health agencies to supply its Theruptor Novo range of dressings to tier-2 and rural hospitals across India

- The expansion of wound care services in emerging markets presents a significant opportunity for both local and global manufacturers

Restraint/Challenge

“Limited Reimbursement Policies for Advanced Wound Care Products”

- Despite their clinical benefits, advanced wound dressings often face reimbursement limitations, especially in outpatient and home healthcare settings

- Inadequate insurance coverage can discourage healthcare providers from prescribing high-cost wound care products, thereby limiting patient access to optimal treatment

- This challenge is more pronounced in developing countries, where reimbursement systems are underdeveloped or nonexistent

- For instance, in 2023, Advanced Medical Solutions Group plc reported reduced adoption of its advanced dressings in certain markets due to lack of coverage under national health insurance programs

- Addressing reimbursement gaps will be vital to expanding the usage of high-quality wound care solutions and ensuring equitable access for all patient populations

Wound Dressings Market Scope

The market is segmented on the basis of product, type, wound type and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Type |

|

|

By Wound Type |

|

|

By End User |

|

In 2025, the advanced wound dressings is projected to dominate the market with a largest share in product segment

The advanced wound dressings segment is expected to dominate the wound dressings market with the largest market share of 53.45% in 2025, due to their superior efficacy in managing chronic and complex wounds, such as diabetic foot ulcers, pressure ulcers, and surgical wounds.

The acute wounds is expected to account for the largest share during the forecast period in application segment

In 2025, the acute wounds segment is expected to dominate the market with the largest market share of 47.65% due to the high volume of surgical procedures, increased patient admissions for chronic and acute wounds, and the availability of advanced wound care facilities and skilled healthcare professionals.

Wound Dressings Market Regional Analysis

“North America Holds the Largest Share in the Wound Dressings Market”

- North America is expected to dominate the global wound dressings market with the largest market share of 46.61%, driven by rising surgical procedures, increasing prevalence of chronic wounds, and the availability of advanced wound care products

- The U.S. leads the region due to high healthcare expenditure, well-established healthcare infrastructure, and strong presence of leading wound care companies such as 3M and Smith & Nephew

- Technological innovations in dressing materials, growing adoption of home-based wound care, and favorable reimbursement policies are anticipated to maintain North America’s leadership through the forecast period

“Asia-Pacific is Projected to Register the Highest CAGR in the Wound Dressings Market”

- Asia-Pacific is expected to experience the highest compound annual growth rate (CAGR) in the wound dressings market, driven by improving healthcare infrastructure, a growing aging population, and rising incidence of diabetes-related wounds

- Key contributors include China, India, and Japan, where supportive government policies and increasing investments in local healthcare manufacturing are enhancing accessibility to modern wound care solutions

- An expanding middle-class population, increasing awareness of advanced wound management, and a surge in outpatient and home care settings are fueling rapid market growth in the region

Wound Dressings Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- 3M (U.S.)

- Smith+Nephew (U.K.)

- Integra LifeSciences Holdings Corporation (U.S.)

- Mölnlycke AB (Sweden)

- ConvaTec Group plc (U.K.)

- Coloplast A/S (Denmark)

- Medline Industries, Inc. (U.S.)

- Advanced Medical Solutions Group plc (U.K.)

- Hollister Incorporated (U.S.)

- B. Braun AG (Germany)

- DeRoyal Industries, Inc. (U.S.)

- PAUL HARTMANN (Germany)

- Cardinal Health (U.S.)

- Lohmann & Rauscher International GmbH & Co. KG (Germany)

- DermaRite Industries, LLC (U.S.)

- URGO MEDICAL (France)

- Shield Line (U.S.)

- Winner Medical Co., Ltd. (China)

- Zhejiang Top-Medical Medical Dressing Co., Ltd. (China)

- North Coast Medical Inc (U.S.)

- Safe n’ Simple (U.S.)

- Bravida Medical (U.S.)

- Focus Health Group (U.S.)

Latest Developments in Global Wound Dressings Market

- In January 2024, Coloplast A/S launched Biatain Silicone Fit, a silicone-based dressing developed for pressure injury prevention and wound management, as part of its strategic expansion in the U.S. market. This launch enhances Coloplast’s portfolio in advanced wound care and strengthens its position in the American healthcare sector

- In January 2024, Medline Industries, LP introduced its first transparent wound dressing aimed at pressure injury prevention, reflecting the company's commitment to expanding its product range. This innovation marks a step forward in Medline’s focus on comprehensive and preventive wound care solutions

- In June 2023, JeNaCell unveiled epicite balancing, a wound dressing tailored for the treatment of chronic wounds with low to medium exudate levels, including diabetic foot ulcers and venous leg ulcers, in the German market. This product enhances JeNaCell’s position in the chronic wound management segment in Europe

- In January 2023, Convatec Group PLC launched Convafoam, a versatile advanced foam dressing in the U.S., designed to support wound care at any healing stage. This product simplifies wound management and addresses both healthcare provider and patient needs effectively

- In October 2022, Healthium Medtech rolled out its Theruptor Novo wound dressing range for managing chronic sores such as leg ulcers and diabetic foot ulcers. This introduction signifies Healthium’s strategic intent to strengthen its presence in the chronic wound care market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.