Global Surgical Tubing Market

Market Size in USD Billion

CAGR :

%

USD

2.28 Billion

USD

4.21 Billion

2024

2032

USD

2.28 Billion

USD

4.21 Billion

2024

2032

| 2025 –2032 | |

| USD 2.28 Billion | |

| USD 4.21 Billion | |

|

|

|

|

Surgical Tubing Market Size

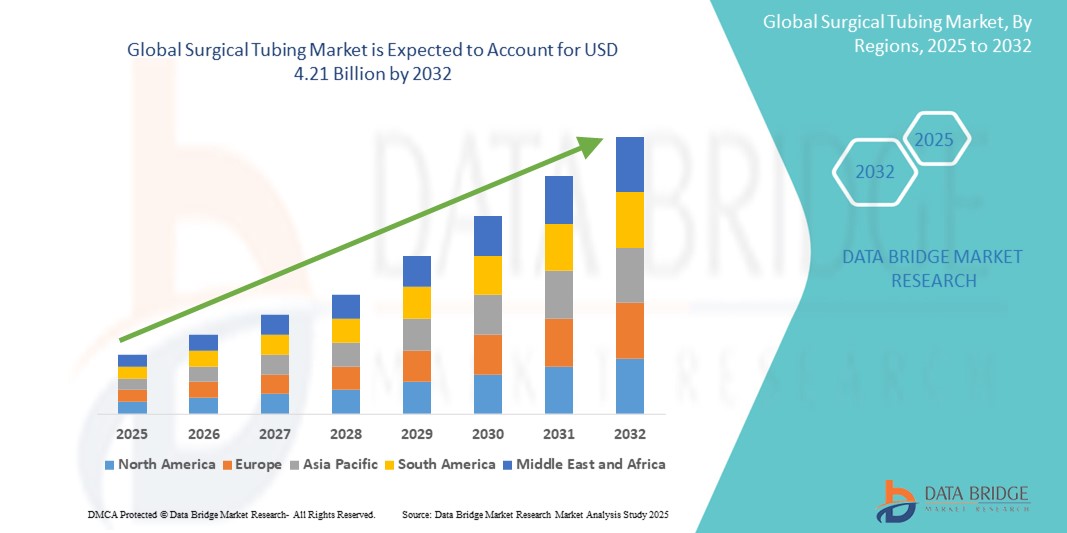

- The global surgical tubing market size was valued at USD 2.28 billion in 2024 and is expected to reach USD 4.21 billion by 2032, at a CAGR of 7.94% during the forecast period

- The market growth is primarily driven by the increasing volume of surgical procedures, rising demand for minimally invasive surgeries, and growing focus on patient safety and infection control

- In addition, advancements in biocompatible materials, alongside the expanding use of silicone and thermoplastics in tubing for fluid transfer and drainage in medical applications, are strengthening market adoption. These developments are reinforcing the vital role of surgical tubing in modern healthcare, accelerating overall industry growth

Surgical Tubing Market Analysis

- Surgical tubing, designed for fluid transfer, suction, and drainage in medical and surgical settings, is becoming indispensable in modern healthcare due to its flexibility, biocompatibility, and adaptability across a wide range of clinical procedures

- The growing demand for surgical tubing is mainly driven by the rise in surgical interventions, increasing prevalence of chronic diseases, and heightened emphasis on infection control and sterile processing in hospitals and ambulatory surgical centers

- North America dominated the surgical tubing market with the largest revenue share of 39.3% in 2024, supported by a well-established healthcare infrastructure, increased healthcare spending, and strong presence of key medical device manufacturers, with the U.S. leading in usage due to high procedural volumes and strict regulatory standards

- Asia-Pacific is projected to be the fastest-growing region in the surgical tubing market during the forecast period owing to improving healthcare access, rising medical tourism, and expanding investments in healthcare infrastructure

- Silicone segment led the surgical tubing market with a market share of 42% in 2024, attributed to its excellent biocompatibility, flexibility, and suitability for a broad range of surgical applications including catheters, drains, and shunts

Report Scope and Surgical Tubing Market Segmentation

|

Attributes |

Surgical Tubing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Surgical Tubing Market Trends

“Adoption of Advanced Biocompatible Materials and Customization Technologies”

- A key emerging trend in the global surgical tubing market is the increasing adoption of advanced biocompatible materials such as medical-grade silicone, thermoplastic elastomers (TPE), and polyvinyl chloride (PVC) to improve patient safety, tubing flexibility, and chemical resistance. This trend is enhancing surgical precision and reducing complications in procedures involving fluid and gas transfer

- For instance, Zeus Industrial Products and Saint-Gobain Life Sciences have developed highly customized tubing solutions that offer kink resistance and precision tolerances for minimally invasive procedures

- The integration of extrusion technologies allows for multilumen and reinforced tubing used in complex catheter-based interventions. Companies such as Teleflex are utilizing advanced extrusion techniques to design custom tubing with tailored diameters, hardness, and wall thickness to suit specific clinical needs

- In addition, sterilizable and anti-microbial tubing variants are gaining momentum, particularly in infection-sensitive environments such as intensive care units and operating rooms. These products help reduce infection risk and align with stringent hospital hygiene regulations

- The growing need for single-use medical devices is further driving demand for disposable surgical tubing, particularly in the wake of heightened hygiene awareness post-pandemic. This is promoting innovations in sustainable, recyclable material alternatives

- The trend toward patient-specific and application-specific tubing solutions is expected to redefine the market landscape, encouraging manufacturers to invest in R&D and collaborate closely with healthcare providers to design customized tubing sets for specialized procedures

Surgical Tubing Market Dynamics

Driver

“Rising Surgical Volume and Preference for Minimally Invasive Procedures”

- The global rise in surgical procedures, driven by aging populations, increasing incidence of chronic diseases, and expanding access to healthcare in developing economies, is a primary growth driver for the surgical tubing market

- For instance, WHO reports highlight a global increase in cardiovascular, orthopedic, and gastrointestinal surgeries, all of which require high-performance tubing for fluid management and drainage applications

- The rising preference for minimally invasive surgeries (MIS), such as laparoscopic and endoscopic procedures, necessitates tubing with enhanced flexibility, precision, and chemical resistance, supporting market expansion

- Furthermore, advancements in diagnostic and interventional techniques are creating demand for specialized tubing systems that can be used in catheters, suction devices, and surgical drains

- The increasing adoption of ambulatory surgical centers and outpatient procedures is also fueling demand for lightweight, disposable tubing systems that align with cost-efficiency and infection control standards

Restraint/Challenge

“Material Sensitivity, Sterility Concerns, and Regulatory Compliance”

- Despite the growing demand, the market faces constraints related to allergic reactions and skin sensitivities linked to certain tubing materials such as latex or PVC, which can pose risks to patients and restrict usage in sensitive populations

- Strict regulatory compliance requirements for medical-grade materials—imposed by bodies such as the FDA and European Medicines Agency—can delay product approvals and increase manufacturing costs

- In addition, ensuring sterility and compatibility of surgical tubing with various sterilization methods remains a technical challenge, particularly for complex, multi-layered designs.

- Manufacturers are also under pressure to maintain consistent quality and performance across diverse operating environments, which requires robust quality assurance systems.

- Balancing the need for advanced features and biocompatibility with affordability is essential to avoid pricing challenges in cost-sensitive healthcare markets, particularly in low- and middle-income countries

Surgical Tubing Market Scope

The market is segmented on the basis of material, structure, application, and end-user.

- By Material

On the basis of material, the surgical tubing market is segmented into silicone, polyvinyl chloride, thermoplastic elastomers, polyethylene, and others. The silicone segment dominated the market with the largest revenue share of 42% in 2024, owing to its superior biocompatibility, chemical inertness, flexibility, and tolerance to sterilization methods. Silicone tubing is widely used in a range of surgical applications including drains, catheters, and implants due to its ability to remain stable under varying temperatures and conditions. Its inert nature and softness make it ideal for sensitive medical procedures, driving its demand across surgical departments.

The thermoplastic elastomers segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by growing demand for latex-free, recyclable, and cost-effective alternatives. TPE tubing offers flexibility similar to silicone, along with improved processability, making it a preferred choice for disposable medical devices and surgical sets. Its eco-friendliness and lower production costs are further enhancing its adoption, particularly in high-volume surgical settings.

- By Structure

On the basis of structure, the surgical tubing market is segmented into single-lumen tubing, multi-lumen tubing, braided tubing, and co-extruded tubing. The single-lumen tubing segment accounted for the largest market share in 2024 due to its broad utility in standard surgical and fluid transfer applications such as catheters and suction devices. Its simple design, ease of sterilization, and cost-effectiveness make it a widely preferred choice across healthcare facilities.

The multi-lumen tubing segment is projected to witness the fastest growth during the forecast period as minimally invasive procedures rise. This type allows for simultaneous delivery and removal of fluids or gases, making it ideal for complex surgical and diagnostic applications. Advancements in precision extrusion technologies are supporting the adoption of this structure in specialized surgeries.

- By Application

On the basis of application, the surgical tubing market is segmented into fluid management, drainage, anesthesia, peristaltic pumping, and others. The fluid management segment held the largest revenue share in 2024 due to the essential role of tubing in IV lines, infusion sets, and surgical suction systems. Increasing surgical procedures and critical care admissions are supporting segment growth.

The drainage segment is expected to witness the fastest CAGR during the forecast period, driven by the rise in post-operative wound drainage requirements and expanding use in abdominal, orthopedic, and cardiovascular surgeries. The need for sterile, kink-resistant, and patient-safe tubing products is fostering innovations in this category.

- By End User

On the basis of end user, the surgical tubing market is segmented into hospitals, ambulatory surgical centers (ASCs), clinics, and others. The hospital segment dominated the market with the largest revenue share in 2024, attributed to the high surgical volume, availability of advanced infrastructure, and increasing number of inpatient surgeries. Hospitals remain key consumers of surgical tubing, particularly in high-acuity and trauma procedures.

The ambulatory surgical centers (ASCs) segment is expected to exhibit the fastest CAGR from 2025 to 2032, driven by the shift toward outpatient surgical care. These facilities are increasingly utilizing sterile, single-use surgical tubing solutions to reduce infection risks, turnaround time, and costs—boosting demand across diverse procedural specialties.

Surgical Tubing Market Regional Analysis

- North America dominated the surgical tubing market with the largest revenue share of 39.3% in 2024, supported by a well-established healthcare infrastructure, increased healthcare spending, and strong presence of key medical device manufacturers, with the U.S. leading in usage due to high procedural volumes and strict regulatory standards

- The region benefits from strong demand for biocompatible and sterilizable tubing used in critical care, operating rooms, and diagnostics

- In addition, the presence of leading medical device manufacturers, stringent regulatory standards, and ongoing innovation in material sciences support the development and adoption of advanced surgical tubing solutions across hospitals and ambulatory surgical centers

U.S. Surgical Tubing Market Insight

The U.S. surgical tubing market captured the largest revenue share of 85.2% in North America in 2024, driven by high surgical volumes, advanced medical infrastructure, and strong demand for minimally invasive procedures. The increasing prevalence of chronic diseases, coupled with a well-established network of hospitals and ASCs, supports consistent consumption of surgical tubing. Moreover, the presence of leading manufacturers and regulatory emphasis on biocompatibility and sterility standards are fostering ongoing innovation and adoption in surgical tubing solutions.

Europe Surgical Tubing Market Insight

The Europe surgical tubing market is projected to grow steadily throughout the forecast period, supported by robust healthcare systems, aging populations, and rising surgical procedure rates. Stringent EU medical device regulations are encouraging the use of high-quality, certified materials, especially in tubing used for drainage, fluid delivery, and anesthetic applications. The region is also seeing increased investment in advanced extrusion technologies and custom medical tubing tailored for specialty surgical interventions.

U.K. Surgical Tubing Market Insight

The U.K. surgical tubing market is expected to grow at a stable CAGR during the forecast period, driven by the National Health Service’s (NHS) focus on improving surgical outcomes and infection control. Demand is increasing across general surgery, cardiology, and orthopedic departments. Local preferences for environmentally friendly and latex-free tubing are influencing procurement decisions, while the shift towards outpatient surgical care is boosting the use of disposable and sterilized tubing solutions.

Germany Surgical Tubing Market Insight

The Germany surgical tubing market is expected to expand at a considerable CAGR during the forecast period, benefiting from the country’s strong focus on medical technology and innovation. High standards for hygiene and quality, coupled with demand for specialized tubing in cardiovascular and urological procedures, are fueling growth. Manufacturers in Germany are increasingly investing in research to develop antimicrobial and custom-structured tubing to meet precise surgical requirements and sustainability standards.

Asia-Pacific Surgical Tubing Market Insight

The Asia-Pacific surgical tubing market is poised to grow at the fastest CAGR during the forecast period from 2025 to 2032, driven by rising healthcare expenditure, rapid infrastructure development, and increased surgical interventions across developing economies. Countries such as China, India, and Japan are contributing to high demand due to population growth, rising chronic disease burden, and expanding access to advanced medical care. The region’s growing manufacturing base is also helping make surgical tubing more cost-effective and widely available.

Japan Surgical Tubing Market Insight

The Japan surgical tubing market is gaining traction owing to the country’s advanced healthcare system, aging population, and high frequency of minimally invasive and robotic surgeries. Japan’s preference for premium, high-performance materials is promoting the adoption of silicone and multi-lumen tubing. The emphasis on compact, sterilized tubing systems in urban hospitals and surgical centers supports ongoing market expansion.

India Surgical Tubing Market Insight

The India surgical tubing market accounted for the largest revenue share in Asia-Pacific in 2024, supported by rapid urbanization, increasing public and private investment in healthcare, and a high surgical burden. Government initiatives to modernize hospitals and expand access to affordable surgical care are boosting demand for single-use tubing products. Domestic manufacturers are playing a crucial role by offering cost-effective, standardized tubing for various surgical specialties.

Surgical Tubing Market Share

The surgical tubing industry is primarily led by well-established companies, including:

- Zeus Company LLC (U.S.)

- Saint-Gobain Group (France)

- Teleflex Incorporated (U.S.)

- RAUMEDIC AG (Germany)

- Tekni-Plex, Inc. (U.S.)

- W. L. Gore & Associates, Inc. (U.S.)

- Kent Elastomer Products (U.S.)

- THE RUBBER COMPANY (U.K.)

- Freudenberg (Germany)

- Grayline LLC (U.S.)

- MicroLumen Inc. (U.S.)

- Polyzen (U.S.)

- AP Technologies Group Pte Ltd. (Singapore)

- A.P. Extrusion Incorporated (U.S.)

- B. Braun SE (Germany)

- Cook (U.S.)

- Medtronic (U.S.)

- LVD Biotech (Belgium)

What are the Recent Developments in Global Surgical Tubing Market?

- In April 2023, Zeus Industrial Products, Inc. announced the expansion of its medical extrusion capabilities with the launch of a new cleanroom facility in South Carolina. This facility is dedicated to producing high-precision surgical tubing for minimally invasive and catheter-based procedures. The move underscores Zeus's commitment to meeting the rising global demand for advanced medical tubing and ensuring stringent cleanliness and quality standards for surgical applications

- In March 2023, Saint-Gobain Life Sciences introduced a new range of biocompatible TPE-based surgical tubing designed for fluid management in complex procedures. The tubing offers enhanced flexibility, chemical resistance, and sterilization compatibility. This innovation reflects the company’s strategic focus on sustainable, high-performance materials tailored for next-generation surgical environments

- In February 2023, Teleflex Incorporated announced a partnership with a leading Asian healthcare provider to supply custom multi-lumen tubing sets for use in cardiovascular surgeries. This collaboration aims to strengthen Teleflex’s presence in the Asia-Pacific region while delivering patient-specific tubing solutions that support precision medicine and improve surgical outcomes

- In January 2023, Qosina Corp., a global supplier of OEM components, expanded its catalog with over 100 new surgical tubing configurations, including kink-resistant and braided options for high-pressure applications. This expansion is intended to address the evolving needs of surgical device manufacturers, offering greater customization and material diversity for critical care and surgical interventions

- In January 2023, Raumedic AG launched its next-generation silicone surgical tubing line optimized for robot-assisted and laparoscopic surgeries. The tubing features ultra-smooth internal surfaces for optimal flow dynamics and enhanced patient safety. The innovation supports Raumedic’s strategic focus on advanced surgical technologies and precision-engineered medical solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.