Global Swine Feed Enzymes Market

Market Size in USD Million

CAGR :

%

USD

229.10 Million

USD

359.68 Million

2024

2032

USD

229.10 Million

USD

359.68 Million

2024

2032

| 2025 –2032 | |

| USD 229.10 Million | |

| USD 359.68 Million | |

|

|

|

|

Swine Feed Enzymes Market Analysis

The swine feed enzymes market has experienced significant growth, driven by technological advancements and the increasing demand for efficient livestock feed. A major development in this sector is the use of enzyme supplementation, which improves nutrient availability and digestibility, leading to healthier swine and optimized feed utilization. Technologies such as precision fermentation are being utilized to produce high-quality, cost-effective enzymes for swine diets. These enzymes are engineered to break down complex carbohydrates, proteins, and fats in the feed, enhancing overall digestibility and improving weight gain.

The usage of multi-enzyme formulations is also on the rise, allowing for a more tailored approach to swine nutrition, improving feed conversion ratios. Enzyme-producing microbes and genetically modified organisms (GMOs) are being explored to boost enzyme production, reducing the dependency on synthetic alternatives and ensuring a more sustainable supply. In addition, digital platforms that monitor enzyme effectiveness in real-time are gaining traction, offering farmers more control over their feed strategies.

The global growth of the swine feed enzymes market is fueled by a rising demand for animal protein, coupled with sustainability efforts in livestock farming.

Swine Feed Enzymes Market Size

The global swine feed enzymes market size was valued at USD 229.10 million in 2024 and is projected to reach USD 359.68 million by 2032, with a CAGR of 5.8% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Swine Feed Enzymes Market Trends

“Enzyme Innovation for Improved Feed Efficiency”

A key trend driving growth in the swine feed enzymes market is the innovation of enzymes that enhance feed efficiency and gut health in pigs. These advanced enzymes improve the digestibility of nutrients, reducing feed waste and optimizing growth rates. For instance, enzymes such as phytase and xylanase are widely used to break down complex plant fibers and phosphorus in feed, improving nutrient absorption and minimizing environmental impact. Companies such as Novozymes and DSM are leading the development of these specialized enzymes. This trend is vital for the growing demand for sustainable farming practices, with producers seeking to reduce costs while improving productivity in swine farming.

Report Scope and Swine Feed Enzymes Market Segmentation

|

Attributes |

Swine Feed Enzymes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

BASF SE (Germany), NOVUS INTERNATIONAL (U.S.), Novozymes (Denmark), Alltech (U.S.), Evonik Industries AG (Germany), DuPont (U.S.), Impextraco NV (Belgium), Cargill, Incorporated (U.S.), Biomin (Austria), DSM (Netherlands), Akzo Nobel N.V. (Netherlands), Nutreco N.V. (Netherlands), Adisseo (France), ADDCON GmbH (Germany), Kemin Industries, Inc. (U.S.), Lucta (Spain), VEMO 99 Ltd (Bulgaria), Advanced Enzyme Technologies (India), JH Biotech, Inc. (U.S.), Nutrex (Belgium), ADM (U.S.), and Chr. Hansen Holdings A/S (Denmark) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Swine Feed Enzymes Market Definition

Swine feed enzymes are additives used in animal feed to enhance the digestion and absorption of nutrients in pigs. These enzymes help break down complex feed components such as fiber, starches, and proteins that pigs' digestive systems may not efficiently process on their own. Common enzymes used in swine feed include phytase, xylanase, and protease. By improving nutrient utilization, they enhance feed efficiency, growth rates, and overall health of pigs. In addition, the use of enzymes can reduce the environmental impact of swine farming by minimizing waste production, as more of the feed is converted into usable energy.

Swine Feed Enzymes Market Dynamics

Drivers

- Increase in Pork Consumption

The increase in global pork consumption, particularly in emerging markets such as China, India, and Southeast Asia, is a key driver for the swine feed enzymes market. As demand for pork rises, producers are under pressure to improve feed efficiency and productivity. Enzymes play a crucial role by enhancing digestion and nutrient absorption, leading to better feed conversion ratios (FCR) and healthier pigs. For instance, in China, the world's largest pork producer, the implementation of enzyme-based feed solutions helps optimize the use of raw materials, reducing costs while boosting animal performance. This trend is pushing the market growth of swine feed enzymes, as producers seek cost-effective and sustainable feed solutions.

- Improved Animal Welfare Standards

As consumer demand for ethically raised and healthy livestock increases, there is a growing focus on improving animal welfare in the swine industry. Producers are seeking ways to enhance the health and performance of animals while meeting these standards. Enzymes play a key role in improving gut function and nutrient absorption, which supports overall animal health. For instance, the use of phytase in swine feed helps break down phytic acid, increasing the availability of phosphorus and improving bone health. This enhances the growth and immunity of pigs, reducing the need for antibiotics and promoting welfare. As a result, the demand for feed enzymes continues to rise in line with these welfare trends.

Opportunities

- Growth in Industrial Swine Farming

The rapid expansion of large-scale swine farming in regions such as Asia and Latin America presents significant opportunities for the swine feed enzymes market. Industrial farms require efficient feed solutions to optimize productivity and reduce operational costs across large herds. Enzymes play a vital role in enhancing feed efficiency, improving nutrient absorption, and reducing waste. As these farms scale up, the demand for enzyme-based feed additives to improve growth rates and health outcomes will increase. This growth in industrial swine farming creates a lucrative opportunity for enzyme suppliers to offer tailored solutions, catering to the specific needs of large farming operations, thereby driving market expansion.

- Increasing Adoption of Precision Feeding

The increasing adoption of precision feeding presents a significant opportunity in the swine feed enzymes market. Precision feeding involves customizing diets to meet the specific nutritional needs of individual animals based on factors such as age, weight, and health. This approach optimizes feed efficiency, improving growth rates and reducing waste. Enzymes play a crucial role in enhancing the digestibility of complex feed ingredients, making them more effective in a precision feeding system. As more swine producers adopt precision feeding technologies, the demand for specialized enzyme solutions is expected to rise, driving market growth and offering tailored, efficient solutions to improve productivity and sustainability in swine farming.

Restraints/Challenges

- High Cost of Enzyme Production

The high cost of enzyme production is a significant restraint in the swine feed enzymes market. The production process involves complex biotechnological methods and advanced raw materials, which result in elevated production costs. These higher costs are passed on to the consumer, making swine feed enriched with enzymes more expensive. This price increase can be prohibitive for smaller or price-sensitive farmers, especially in developing markets where cost-effective feed solutions are a priority. Consequently, the adoption of feed enzymes may be slow in these regions, limiting the overall growth of the market. The financial burden of enzyme supplementation often deters farmers from making the investment, hindering market expansion.

- Limited Awareness and Adoption

Limited awareness and adoption of swine feed enzymes among small and medium-scale swine farmers significantly hinder the market's growth. Many of these farmers are not fully aware of the potential benefits of using enzymes in swine feed, such as improved nutrient digestibility and enhanced growth rates. Without proper knowledge, these farmers may continue to rely on traditional feed methods, which do not incorporate enzymes, limiting market penetration. In addition, the cost of enzyme-based feed additives may seem prohibitive for smaller operations, further deterring adoption. This lack of awareness, coupled with resistance to change, slows down the overall uptake of enzyme-based solutions in the swine feed market.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Swine Feed Enzymes Market Scope

The market is segmented on the basis of type, function, form and source. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Phytase

- Protease

- Carbohydrase

- Xylanase

- Amylase

- Cellulase

- Other

- Others

Function

- Performance Enhancement

- Feed Efficiency

Form

- Liquid

- Dry

Source

- Microorganism

- Plant

- Animal

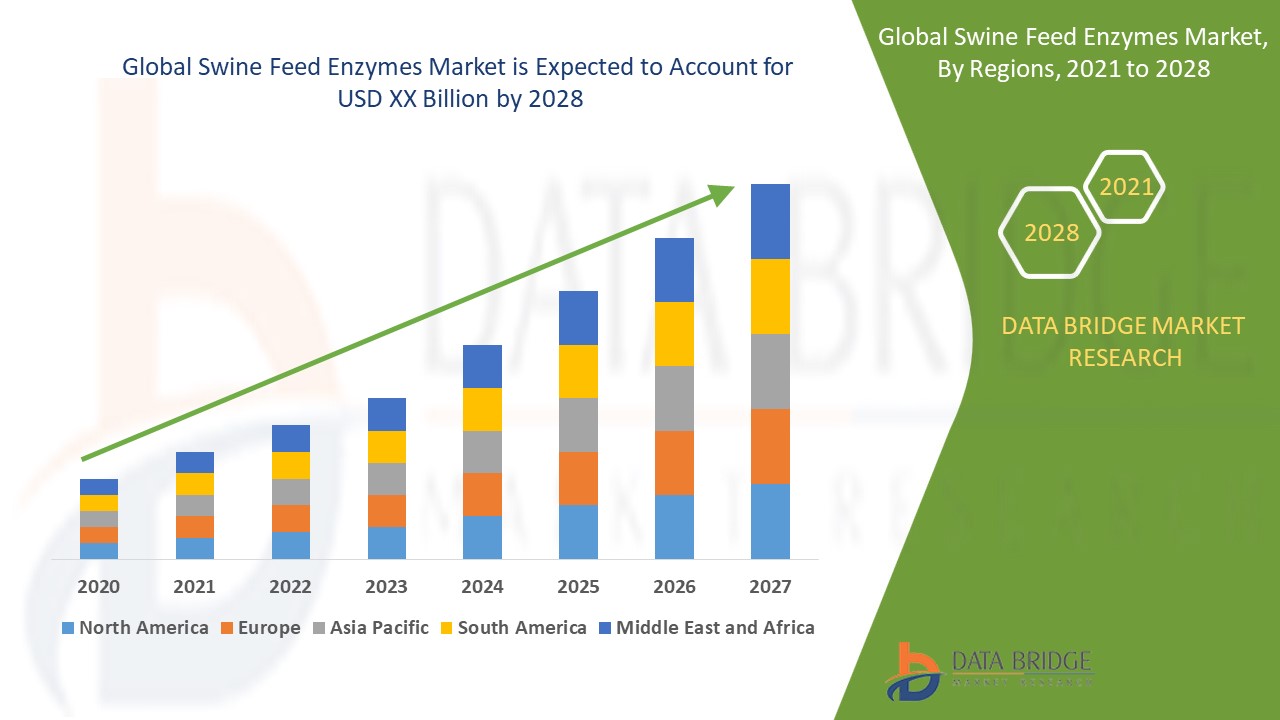

Swine Feed Enzymes Market Regional Analysis/Insights

The market is analysed and market size insights and trends are provided by country, type, function, form and source as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America is expected to dominate the swine feed enzymes market due to its large livestock population, particularly in the U.S. and Canada. The region's focus on optimizing feed efficiency and enhancing swine health is driving the demand for advanced feed additives. With significant investments in livestock production and the increasing adoption of enzyme-based solutions for improving growth rates and feed conversion ratios, North America is poised for substantial growth in the swine feed enzymes market.

Asia-Pacific is expected to show significant growth in the swine feed enzymes market due to the rapid increase in the number of feed mills, reflecting a boost in feed production, particularly in emerging countries such as India and Japan. The growing demand for efficient animal feed to enhance livestock productivity, coupled with increasing awareness of enzyme-based feed additives, is driving this market expansion in the region. This trend is anticipated to continue throughout the forecast period.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Swine Feed Enzymes Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Swine Feed Enzymes Market Leaders Operating in the Market Are:

- BASF SE (Germany)

- NOVUS INTERNATIONAL (U.S.)

- Novozymes (Denmark)

- Alltech (U.S.)

- Evonik Industries AG (Germany)

- DuPont (U.S.)

- Impextraco NV (Belgium)

- Cargill, Incorporated (U.S.)

- Biomin (Austria)

- DSM (Netherlands)

- Akzo Nobel N.V. (Netherlands)

- Nutreco N.V. (Netherlands)

- Adisseo (France)

- ADDCON GmbH (Germany)

- Kemin Industries, Inc. (U.S.)

- Lucta (Spain)

- VEMO 99 Ltd (Bulgaria)

- Advanced Enzyme Technologies (India)

- JH Biotech, Inc. (U.S.)

- Nutrex (Belgium)

- ADM (U.S.)

- Chr. Hansen Holdings A/S (Denmark)

Latest Developments in Swine Feed Enzymes Market

- In January 2023, BASF and Cargill expanded their collaboration to introduce innovative enzyme-based solutions in the U.S. market. Combining BASF’s expertise in enzyme research with Cargill’s market presence and application knowledge, they aim to create unique value for animal feed customers. Their joint effort focuses on advancing feed enzyme development, benefiting animal protein producers through enhanced solutions

- In November 2020, The DSM-Novozymes Feed Enzymes Alliance launched ProAct 360, a second-generation protease. This advanced technology improves feed efficiency, sustainability, and affordability for poultry producers. ProAct 360 enhances growth performance, offers better amino acid matrix values, and accelerates its action, providing sustained benefits in poultry feed formulation and contributing to the industry's long-term success

- In September 2020, DuPont released Axtra PHY GOLD, a novel phytase enzyme designed to reduce feed costs for producers while mitigating environmental impact. This enzyme solution addresses key production challenges by improving feed efficiency. Its innovative formulation enhances nutrient availability, leading to cost-effective solutions for poultry producers while promoting sustainable practices in animal feed management

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.