Global Systemic Aspergillosis And Systemic Candidiasis Market

Market Size in USD Billion

CAGR :

%

USD

7.64 Billion

USD

10.45 Billion

2025

2033

USD

7.64 Billion

USD

10.45 Billion

2025

2033

| 2026 –2033 | |

| USD 7.64 Billion | |

| USD 10.45 Billion | |

|

|

|

|

Systemic Aspergillosis and Systemic Candidiasis Market Size

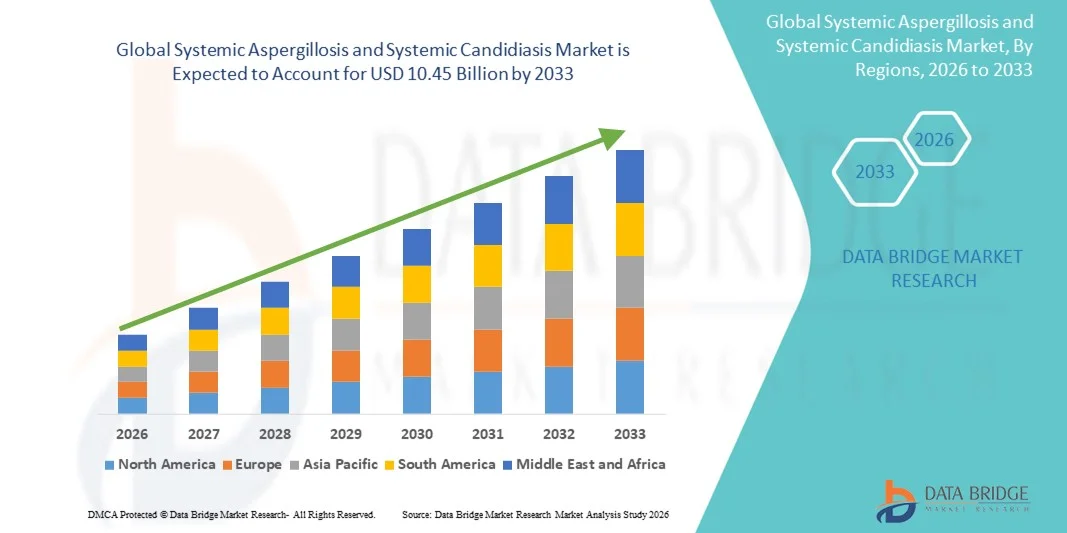

- The global systemic aspergillosis and systemic candidiasis market size was valued at USD 7.64 billion in 2025 and is expected to reach USD 10.45 billion by 2033, at a CAGR of 4.00% during the forecast period

- The market growth is largely fueled by the rising incidence of invasive fungal infections increasing immunocompromised patient population improved diagnostics and growing use of antifungal therapies globally

- Furthermore, increasing antifungal resistance surveillance, demographic shifts and growing awareness among healthcare providers and patients about systemic fungal infections are driving demand for effective and novel antifungal treatments making systemic aspergillosis and candidiasis treatment standard across hospitals and clinics worldwide

Systemic Aspergillosis and Systemic Candidiasis Market Analysis

- Systemic antifungal therapies for aspergillosis and candidiasis, targeting invasive fungal infections, are increasingly vital components of modern healthcare systems in both hospital and clinical settings due to their ability to reduce mortality, prevent complications, and improve outcomes in immunocompromised patients

- The escalating demand for systemic antifungal therapies is primarily fueled by the rising incidence of invasive fungal infections, improved diagnostic capabilities for early detection, and increasing adoption of effective antifungal drugs among healthcare providers globally

- North America dominated the systemic aspergillosis and systemic candidiasis market with the largest revenue share 42% in 2025, characterized by a well-established healthcare infrastructure, high disease awareness, and widespread adoption of advanced antifungal treatments, with the U.S. experiencing substantial growth in systemic antifungal therapy utilization, particularly among cancer, transplant, and HIV/AIDS patient populations

- Asia-Pacific is expected to be the fastest growing region in the systemic aspergillosis and systemic candidiasis market during the forecast period due to increasing healthcare expenditure, improving access to medical care, a growing immunocompromised population, and rising awareness of systemic fungal infections

- Systemic Oral Azoles segment dominated the systemic aspergillosis and systemic candidiasis market with a market share of 43.8% in 2025, driven by their broad-spectrum activity, established efficacy against both aspergillosis and candidiasis, and wide acceptance among healthcare providers

Report Scope and Systemic Aspergillosis and Systemic Candidiasis Market Segmentation

|

Attributes |

Systemic Aspergillosis and Systemic Candidiasis Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Systemic Aspergillosis and Systemic Candidiasis Market Trends

Enhanced Treatment Through Rapid Diagnostics and AI‑Assisted Therapy

- A significant and accelerating trend in the global systemic antifungal market is the integration of rapid diagnostic tools and AI-assisted treatment planning, which are enhancing treatment precision and patient outcomes

- For instance, T2 Biosystems’ T2Candida Panel provides rapid bloodstream infection detection within hours, allowing clinicians to initiate targeted therapy sooner than conventional cultures. Similarly, bioMérieux’s automated systems combine diagnostics with clinical decision support to optimize antifungal therapy

- AI integration in treatment planning enables predictive modeling of patient risk, drug-drug interactions, and personalized dosing recommendations. For instance, some systems utilize AI to suggest optimal antifungal selection based on patient immune status, previous infections, and local resistance patterns

- The seamless integration of diagnostics with hospital information systems allows clinicians to centralize patient monitoring, laboratory results, and antifungal therapy management, facilitating faster, evidence-based decisions for better outcomes

- This trend towards more intelligent, data-driven, and integrated treatment systems is fundamentally reshaping expectations for systemic fungal infection management. Consequently, companies such as Pfizer and Gilead are developing AI-enabled antifungal solutions with predictive risk modeling and optimized dosing algorithms

- The demand for rapid, accurate, and AI-assisted systemic antifungal therapies is growing rapidly across both hospital and outpatient sectors, as clinicians increasingly prioritize patient safety, treatment efficacy, and workflow efficiency

- Furthermore, the integration of telemedicine platforms with antifungal management solutions is emerging, enabling remote patient monitoring and real-time therapy adjustments

- In addition, increasing collaboration between diagnostics companies and pharmaceutical developers is leading to companion diagnostic–driven antifungal therapies, enhancing precision treatment strategies and patient outcomes

Systemic Aspergillosis and Systemic Candidiasis Market Dynamics

Driver

Rising Incidence of Invasive Fungal Infections and Immunocompromised Population

- The increasing prevalence of systemic aspergillosis and candidiasis, especially among immunocompromised patients, is a significant driver for the heightened demand for effective antifungal therapies

- For instance, in 2025, Gilead Sciences reported an increase in echinocandin prescriptions for hospital-acquired fungal infections, indicating rising adoption of advanced antifungal treatments

- As the number of organ transplants, chemotherapy patients, and HIV/AIDS cases grows, antifungal therapies offer life-saving benefits and reduce hospital complications, providing a compelling reason for their adoption

- Furthermore, improvements in diagnostic capabilities, such as PCR and MALDI-TOF, are enabling earlier detection and intervention, making systemic antifungal therapy an essential part of patient care protocols

- The demand for broad-spectrum and targeted antifungal drugs, along with increased healthcare spending on infection management, is driving adoption across hospitals and specialty clinics

- Rising awareness campaigns and clinical guidelines emphasizing early antifungal intervention are encouraging hospitals to adopt advanced antifungal therapies as standard practice

- Innovations in drug delivery systems, including long-acting injectables and optimized oral formulations, are enhancing treatment adherence, creating further market growth opportunities

Restraint/Challenge

Antifungal Resistance and High Treatment Costs

- The emergence of antifungal resistance, particularly among Candida and Aspergillus strains, poses a significant challenge to effective treatment and broader market penetration

- For instance, reports of azole-resistant Aspergillus fumigatus in Europe have raised concerns among clinicians regarding treatment efficacy and the need for alternative therapies

- Addressing these resistance issues requires novel drug development, combination therapies, and antimicrobial stewardship programs, which can be costly and time-consuming. In addition, the high price of advanced antifungal treatments, such as liposomal amphotericin B or echinocandins, can limit adoption in price-sensitive regions

- While generic antifungal options exist, severe cases often require premium therapies, increasing the overall treatment cost burden for healthcare providers and patients

- Overcoming these challenges through development of new antifungal classes, improving drug accessibility, and implementing resistance monitoring programs will be vital for sustained market growth

- Variations in healthcare infrastructure and regulatory hurdles across regions can delay adoption of advanced antifungal therapies, particularly in emerging economies

- Moreover, limited awareness among some clinicians and patients about emerging fungal strains and proper treatment protocols can restrict early intervention, hampering market expansion

Systemic Aspergillosis and Systemic Candidiasis Market Scope

The market is segmented on the basis of type, applications, end-users, and distribution channel.

- By Type

On the basis of type, the systemic aspergillosis and systemic candidiasis market is segmented into Voriconazole, systemic oral azoles, topical antifungal agents, liposomal amphotericin B, and others. The systemic oral azoles segment dominated the market with the largest market revenue share of 43.8% in 2025, driven by their broad-spectrum efficacy against both Candida and Aspergillus species. Systemic oral azoles are widely prescribed due to ease of administration, established clinical guidelines, and proven safety profiles. Hospitals and clinics often prioritize oral azoles for initial therapy in non-critical cases, allowing effective outpatient treatment and reducing hospitalization costs. Their compatibility with combination therapies and growing adoption in prophylactic treatment among immunocompromised patients further strengthen their market dominance. In addition, the wide availability of generics makes systemic oral azoles a cost-effective choice for healthcare providers.

The liposomal amphotericin B segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by its efficacy in severe and resistant fungal infections, particularly in immunocompromised populations. Liposomal formulations reduce toxicity compared to conventional amphotericin B, increasing clinician confidence and patient compliance. Its adoption is rising in tertiary care centers and transplant hospitals, where aggressive treatment regimens are often required. Moreover, ongoing clinical trials and approvals for new indications are expected to expand its usage further. The ability of liposomal amphotericin B to target difficult-to-treat fungal infections and its improved safety profile make it a preferred choice in emerging markets as healthcare infrastructure develops.

- By Applications

On the basis of applications, the market is segmented into genitourinary tract candidiasis, allergic bronchopulmonary aspergillosis (ABPA), gastrointestinal candidiasis, chronic pulmonary aspergillosis (CPA), and others. The genitourinary tract candidiasis segment dominated the market in 2025, owing to the high prevalence of Candida infections in urinary and reproductive tracts. Clinicians often prioritize treatment in this application due to its widespread occurrence in both hospitalized and outpatient populations. The segment benefits from well-established treatment guidelines recommending systemic or oral antifungal therapy, enhancing consistent adoption. Moreover, frequent screening and early detection programs drive demand for effective antifungal treatment, strengthening market dominance. The availability of both generic and branded formulations ensures broad accessibility for patients.

The chronic pulmonary aspergillosis (CPA) segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing incidence of pulmonary infections, especially in patients with chronic lung conditions such as tuberculosis or COPD. Advanced diagnostic tools and growing awareness among pulmonologists are enabling early detection and treatment, fueling segment growth. In addition, rising adoption of combination antifungal therapy and prolonged treatment regimens for CPA patients contribute to higher revenue growth. Expanding healthcare infrastructure in emerging economies and increased access to specialized care further support the rapid expansion of this application segment.

- By End-Users

On the basis of end-users, the market is segmented into clinics, hospitals, and others. The hospital segment dominated the market in 2025, driven by the high concentration of immunocompromised patients and complex fungal infections requiring advanced antifungal therapies. Hospitals provide critical care, intensive monitoring, and access to a broad spectrum of systemic antifungal drugs, supporting dominance. Frequent hospitalizations for transplant patients, oncology cases, and severe infections ensure sustained demand for both first-line and specialty antifungal treatments. Moreover, hospitals often lead in adopting new therapies and protocols, further strengthening their market share. Availability of infectious disease specialists and advanced diagnostic facilities also contributes to hospital segment dominance.

The clinic segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising outpatient management of fungal infections and the expansion of primary care networks. Clinics offer convenient access to oral antifungal therapies and routine monitoring, reducing the burden on hospitals. The growth of telemedicine and remote patient follow-up in clinics allows broader adoption of antifungal therapies in non-critical cases. Increasing awareness among general practitioners and expanding preventive screening programs further drive the segment’s rapid growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The hospital pharmacy segment dominated the market in 2025, as it is the primary source for advanced antifungal treatments such as echinocandins and liposomal amphotericin B. Hospitals ensure controlled drug dispensing, proper dosing, and direct clinician supervision, which is critical for high-risk patients. The segment also benefits from bulk procurement, insurance coverage, and integrated supply chains, supporting dominance. Adoption of hospital pharmacy channels ensures adherence to treatment protocols and reduces the risk of drug misuse, particularly for potent antifungal medications. Hospitals’ role in educating patients and monitoring therapy further reinforces their market share.

The online pharmacy segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing e-commerce adoption, convenience, and rising demand for outpatient antifungal treatments. Patients in remote regions increasingly rely on online pharmacies for access to systemic oral azoles and topical agents. The growth of digital health platforms, integration with telemedicine services, and home delivery options are contributing to rapid expansion. Online pharmacies also provide competitive pricing and subscription models for chronic therapy, enhancing accessibility and supporting the segment’s fast growth.

Systemic Aspergillosis and Systemic Candidiasis Market Regional Analysis

- North America dominated the systemic aspergillosis and systemic candidiasis market with the largest revenue share 42% in 2025, characterized by a well-established healthcare infrastructure, high disease awareness, and widespread adoption of advanced antifungal treatments

- Patients and healthcare providers in the region highly value the effectiveness, safety, and broad-spectrum coverage offered by systemic antifungal drugs, along with the availability of rapid diagnostic tools that enable early detection and targeted treatment

- This widespread adoption is further supported by well-established clinical guidelines, high healthcare expenditure, access to specialist care, and increased awareness of fungal infections, establishing systemic antifungal therapies as the preferred solution for both hospital and outpatient settings

U.S. Systemic Aspergillosis and Systemic Candidiasis Market Insight

The U.S. market captured the largest revenue share of 82% in North America in 2025, fueled by a high prevalence of invasive fungal infections and the well-established healthcare infrastructure. Clinicians increasingly prioritize early diagnosis and timely antifungal therapy for immunocompromised patients, enhancing treatment adoption. The growing availability of rapid diagnostic tools and advanced systemic antifungal drugs further propels the market. Moreover, rising awareness among healthcare professionals regarding resistance patterns and best treatment practices is significantly contributing to the market’s expansion. Strong insurance coverage, specialized care facilities, and ongoing clinical trials are supporting both hospital and outpatient segments.

Europe Systemic Aspergillosis and Systemic Candidiasis Market Insight

The Europe market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent healthcare regulations and growing incidence of systemic fungal infections. Increasing urbanization and enhanced access to healthcare facilities are fostering the adoption of antifungal therapies. European clinicians value the effectiveness, safety, and broad-spectrum coverage of systemic antifungal drugs. The market is experiencing significant growth across hospitals, specialty clinics, and outpatient care, with antifungal therapies being incorporated into standard treatment protocols for high-risk patients. Ongoing awareness campaigns and government-supported infection management programs are further supporting market growth.

U.K. Systemic Aspergillosis and Systemic Candidiasis Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising prevalence of immunocompromised populations and increased awareness of invasive fungal infections. Concerns regarding antifungal resistance and severe infection outcomes are encouraging both hospitals and clinics to adopt advanced systemic therapies. The U.K.’s robust healthcare system, combined with high clinical awareness and widespread access to diagnostic tools, is expected to continue to stimulate market growth. In addition, adoption of outpatient antifungal therapy programs and evidence-based treatment guidelines supports ongoing expansion.

Germany Systemic Aspergillosis and Systemic Candidiasis Market Insight

The Germany market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of systemic fungal infections and demand for advanced antifungal solutions. Germany’s well-developed healthcare infrastructure, combined with emphasis on clinical research and early intervention protocols, promotes adoption of systemic antifungal therapies. Hospitals and specialty clinics are increasingly integrating rapid diagnostics and novel therapies into patient care. Ongoing initiatives to monitor resistance patterns and optimize treatment outcomes further support the market.

Asia-Pacific Systemic Aspergillosis and Systemic Candidiasis Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during the forecast period, driven by increasing prevalence of invasive fungal infections, rising healthcare expenditure, and improving access to specialized care in countries such as China, Japan, and India. The region’s growing focus on healthcare infrastructure development, combined with government initiatives supporting infection control and digital healthcare solutions, is driving adoption. Expanding access to systemic antifungal therapies, rising awareness among clinicians, and availability of advanced diagnostics are further propelling market growth. In addition, the rise of outpatient care centers and telemedicine platforms supports faster therapy deployment across the region.

Japan Systemic Aspergillosis and Systemic Candidiasis Market Insight

The Japan market is gaining momentum due to the country’s advanced healthcare system, rising incidence of fungal infections, and emphasis on early intervention. Hospitals and clinics increasingly adopt rapid diagnostic tools and advanced systemic antifungal therapies. Integration of clinical decision support systems with diagnostics allows precise therapy selection and monitoring. The aging population and rising number of immunocompromised patients are expected to drive demand for effective, safe, and patient-friendly treatment options. Furthermore, national guidelines emphasizing proactive infection management are contributing to growth in both hospital and outpatient settings.

India Systemic Aspergillosis and Systemic Candidiasis Market Insight

The India market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to increasing prevalence of invasive fungal infections, expanding healthcare infrastructure, and rising awareness among clinicians. Hospitals and specialty clinics are adopting advanced systemic antifungal therapies to manage high-risk patients effectively. Government initiatives to improve infection control and expand diagnostic capabilities are supporting market expansion. In addition, rising healthcare expenditure, urbanization, and growing access to outpatient care facilities, along with availability of affordable antifungal drugs, are key factors propelling market growth in India.

Systemic Aspergillosis and Systemic Candidiasis Market Share

The Systemic Aspergillosis and Systemic Candidiasis industry is primarily led by well-established companies, including:

- Pfizer Inc., (U.S.)

- Merck & Co., Inc., (U.S.)

- Gilead Sciences, Inc., (U.S.)

- Astellas Pharma (Japan)

- Novartis AG (Switzerland)

- Bayer AG (Germany)

- GSK plc (U.K.)

- Sanofi (France)

- Abbott (U.S.)

- SCYNEXIS, Inc., (U.S.)

- Basilea Pharmaceutica Ltd., (Switzerland)

- F2G Ltd., (U.K.)

- Glenmark Pharmaceuticals Ltd., (India)

- Teva Pharmaceutical Industries Ltd., (Israel)

- Fresenius Kabi (Germany)

- Cipla Ltd. (India)

- Sun Pharmaceutical Industries Ltd., (India)

- Eli Lilly and Company (U.S.)

What are the Recent Developments in Global Systemic Aspergillosis and Systemic Candidiasis Market?

- In June 2025, a clinical‑stage biopharmaceutical company F2G Ltd. published data from a Phase 2b study showing that its novel oral antifungal olorofim produced positive therapeutic responses in patients with serious invasive fungal diseases — underlining its potential for treatment-resistant infections

- In April 2025, the World Health Organization published its first-ever global reports on tests and treatments for invasive fungal infections, highlighting serious gaps in diagnostics, limited antifungal drug availability, and calling for increased R&D, especially in low‑ and middle‑income countries

- In December 2023, the European Union granted marketing authorization for REZZAYO (rezafungin), based on strong results from the pivotal Phase III ReSTORE trial offering once‑weekly dosing and a new option for adult invasive candidiasis

- In March 2023, the U.S. Food and Drug Administration (FDA) approved REZZAYO (rezafungin for injection) for the treatment of candidemia and invasive candidiasis in adults with limited or no alternative treatment options marking the first new echinocandin approval in over a decade

- In June 2021, the FDA approved BREXAFEMME (ibrexafungerp), the first drug in a new, non-azole class of antifungal therapy, specifically for vulvovaginal candidiasis representing a major step forward in broadening antifungal treatment options

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.