Global Systemic Lupus Erythematosus Sle And Lupus Nephritis Market

Market Size in USD Billion

CAGR :

%

USD

2.85 Billion

USD

4.44 Billion

2024

2032

USD

2.85 Billion

USD

4.44 Billion

2024

2032

| 2025 –2032 | |

| USD 2.85 Billion | |

| USD 4.44 Billion | |

|

|

|

|

Systemic Lupus Erythematosus (SLE) and Lupus Nephritis (LN) Market Size

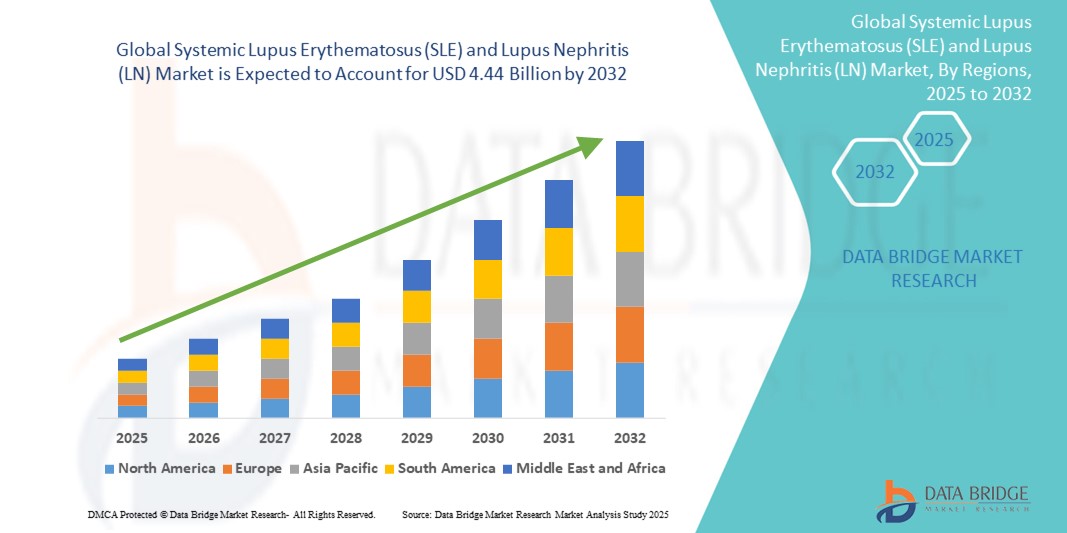

- The global systemic lupus erythematosus (SLE) and lupus nephritis (LN) market size was valued at USD 2.85 billion in 2024 and is expected to reach USD 4.44 billion by 2032, at a CAGR of5.70% during the forecast period

- The market growth is largely fueled by the rising prevalence of autoimmune disorders such as systemic lupus erythematosus (SLE) and its severe renal manifestation, lupus nephritis (LN), leading to an increased demand for advanced therapeutic and diagnostic tools across both developed and developing regions

- Furthermore, the growing demand for targeted, user-friendly, and long-term disease management solutions is establishing biologics and immunosuppressive therapies as the standard of care for SLE and LN. These converging factors are accelerating the uptake of systemic lupus erythematosus (SLE) and lupus nephritis (LN) solutions, thereby significantly boosting the industry's growth

Systemic Lupus Erythematosus (SLE) and Lupus Nephritis (LN) Market Analysis

- Systemic Lupus Erythematosus (SLE) and Lupus Nephritis (LN) are chronic autoimmune disorders that significantly impact patient quality of life and increase the risk of severe organ damage, particularly affecting the kidneys in LN cases. The rising prevalence of autoimmune diseases, improvements in diagnostic capabilities, and advancements in targeted biologics are major factors driving market growth

- The increasing demand for advanced therapies is primarily fueled by a growing number of SLE and LN diagnoses, heightened awareness among patients and healthcare professionals, and the launch of novel biologic treatments such as belimumab and voclosporin

- North America dominated the systemic lupus erythematosus (SLE) and lupus nephritis (LN) market with a revenue share of 37.6% in 2024, attributed to the region's advanced healthcare infrastructure, high disease awareness, strong reimbursement policies, and the presence of major pharmaceutical companies engaged in clinical trials and new product launches.

- Asia-Pacific is expected to be the fastest-growing region in the systemic lupus erythematosus (SLE) and lupus nephritis (LN) market during the forecast period, driven by increasing healthcare access, rising autoimmune disease prevalence, expanding clinical research efforts, and growing public and private investments in rare and chronic disease treatment

- The injection segment dominated the systemic lupus erythematosus (SLE) and lupus nephritis (LN) market with a market share of 53.4% in 2024, owing to the high utilization of intravenous therapies for moderate to severe LN cases

Report Scope and Systemic Lupus Erythematosus (SLE) and Lupus Nephritis (LN) Market Segmentation

|

Attributes |

Systemic Lupus Erythematosus (SLE) and Lupus Nephritis (LN) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Systemic Lupus Erythematosus (SLE) and Lupus Nephritis (LN) Market Trends

“Evolving Landscape of Personalized and Targeted Therapies”

- A significant and accelerating trend in the global systemic lupus erythematosus (SLE) and lupus nephritis (LN) market is the rapid shift toward personalized medicine and targeted biologic therapies, aiming to address disease heterogeneity and improve long-term patient outcomes

- For instance, voclosporin (Lupkynis) and belimumab (Benlysta) have emerged as key therapeutic breakthroughs for managing lupus nephritis by targeting specific immune pathways and reducing renal flares. These drugs represent a paradigm shift from traditional immunosuppressants to more precise, disease-modifying treatments

- The approval of targeted biologics is enhancing clinician confidence in earlier intervention and better disease control. These therapies also offer improved safety profiles and reduced corticosteroid dependence, which is a major concern in long-term SLE management

- Advancements in biomarker discovery and companion diagnostics are enabling clinicians to stratify patients based on genetic and serologic profiles, thus optimizing therapeutic responses and minimizing adverse effects

- Pharmaceutical and biotech companies are heavily investing in clinical trials and R&D collaborations to expand the SLE and LN treatment pipeline. Multiple investigational drugs targeting interferon pathways, B-cell signaling, and JAK inhibitors are in late-phase development

- The demand for therapies that offer long-term organ protection and quality-of-life improvements is rising across global healthcare systems, as patients and providers increasingly seek tailored solutions backed by robust clinical evidence

Systemic Lupus Erythematosus (SLE) and Lupus Nephritis (LN) Market Dynamics

Driver

“Growing Need Due to Rising Autoimmune Disease Prevalence and Advancements in Targeted Therapies”

- The increasing global incidence of autoimmune disorders, particularly among women of reproductive age, coupled with rising awareness about early disease management, is a significant driver for the heightened demand for effective SLE and LN treatment options

- For instance, in April 2024, AstraZeneca announced the expansion of its anifrolumab trials into broader SLE populations, highlighting the ongoing investment in targeted biologic therapies. Such strategies by key companies are expected to drive the Systemic Lupus Erythematosus (SLE) and Lupus Nephritis (LN) industry growth in the forecast period

- As patients and healthcare providers become more aware of the risks associated with uncontrolled inflammation and organ damage, there is increased demand for therapies offering better long-term disease control and fewer adverse effects

- Furthermore, the growing popularity of precision medicine and the development of biologics and immunomodulators are making targeted SLE and LN therapies an integral component of advanced autoimmune disease care

- The availability of subcutaneous and self-administered formulations, improved clinical outcomes with newer drugs such as Benlysta and Rituximab, and the trend toward patient-centric treatment regimens are key factors propelling adoption. The shift toward outpatient care, coupled with increasing access to specialty pharmacies, further contributes to market growth

Restraint/Challenge

“Limited Awareness in Developing Regions and High Cost of Biologic Therapies”

- Limited disease awareness, especially in low-income and rural regions, continues to be a major barrier to early diagnosis and timely intervention for both SLE and LN. Many patients are diagnosed at advanced stages, reducing treatment effectiveness

- For instance, underdiagnosis rates remain high in regions lacking rheumatology specialists and access to advanced lab diagnostics, which delays therapy initiation and worsens prognosis

- Addressing these challenges through awareness campaigns, improved primary care training, and access to diagnostic panels (e.g., ANA, anti-dsDNA) is essential for timely disease detection

- In addition, the high cost of biologic therapies such as Benlysta and Rituximab can be prohibitive for many patients, particularly in middle- and low-income countries lacking insurance coverage or reimbursement frameworks

- While biosimilars and generic immunosuppressants are emerging, the affordability gap still restricts widespread access to optimal therapies. This limits long-term treatment adherence and disease control

- Overcoming these challenges through expanded healthcare coverage, inclusion of SLE/LN treatments in national formularies, and promotion of biosimilars will be crucial for ensuring sustained global market growth

Systemic Lupus Erythematosus (SLE) and Lupus Nephritis (LN) Market Scope

The market is segmented on the basis of treatment, dosage form, route of administration, end-users, and distribution channel.

- By Treatment

On the basis of treatment, the systemic lupus erythematosus (SLE) and lupus nephritis (LN) market is segmented into antimalarial therapy, steroids, cyclophosphamide, azathioprine, methotrexate, benlysta, rituximab, and others. The Benlysta segment dominated the market with a market revenue share of 28.6% in 2024, driven by its proven efficacy and favorable safety profile for SLE and lupus nephritis.

The Rituximab segment is anticipated to register the fastest CAGR of 7.9% from 2025 to 2032, supported by growing off-label usage and expanding research evidence for its effectiveness in refractory cases.

- By Dosage Form

On the basis of dosage form, the systemic lupus erythematosus (SLE) and lupus nephritis (LN) market is segmented into solution, injection, and others. The injection segment held the largest market share of 53.4% in 2024, owing to the high utilization of intravenous therapies for moderate to severe LN cases.

The solution segment is projected to witness the fastest CAGR of 6.3% during the forecast period, driven by increased demand for oral reconstitutable medications in outpatient settings.

- By Route of Administration

On the basis of route of administration, the systemic lupus erythematosus (SLE) and lupus nephritis (LN) market is segmented into subcutaneous, intravenous, and others. The Intravenous segment accounted for the largest revenue share of 46.7% in 2024, largely due to hospital-based use of biologics and immunosuppressive agents.

The Subcutaneous segment is expected to register the highest CAGR of 8.1% from 2025 to 2032, as at-home self-administration options become more accessible and widely adopted.

- By End-Users

On the basis of end-users, the systemic lupus erythematosus (SLE) and lupus nephritis (LN) market is segmented into clinics, hospitals, and others. The hospitals segment dominated with a market share of 61.2% in 2024, owing to the availability of advanced diagnostic equipment and multidisciplinary care.

The clinics segment is anticipated to grow at a CAGR of 6.8% from 2025 to 2032, fueled by rising outpatient treatment volumes and specialist-based long-term care.

- By Distribution Channel

On the basis of distribution channel, the systemic lupus erythematosus (SLE) and lupus nephritis (LN) market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The hospital pharmacy segment held the largest share of 48.9% in 2024, supported by direct procurement of specialty drugs for inpatient use.

The online pharmacy segment is projected to exhibit the fastest CAGR of 9.3% during the forecast period, driven by growing e-commerce adoption, home delivery demand, and chronic therapy convenience.

Systemic Lupus Erythematosus (SLE) and Lupus Nephritis (LN) Market Regional Analysis

- North America dominated the systemic lupus erythematosus (SLE) and lupus nephritis (LN) market with the largest revenue share of 37.6% in 2024, driven by a strong clinical research infrastructure

- Early diagnosis rates, and high adoption of biologic and immunosuppressive therapies

- Growth is supported by increasing awareness of autoimmune diseases, robust reimbursement policies, and access to specialized care across the U.S. and Canada

U.S. Systemic Lupus Erythematosus and Lupus Nephritis Market Insight

The U. S. systemic lupus erythematosus (SLE) and lupus nephritis (LN) market accounted for 71.0% of North America’s market share in 2024, owing to advanced diagnostics, a high prevalence of SLE (especially among women and ethnic minorities), and the availability of FDA-approved therapies such as Benlysta and anifrolumab. The market is expected to maintain its dominance due to increasing clinical trials, pharmaceutical innovation, and ongoing lupus awareness campaigns.

Europe Systemic Lupus Erythematosus and Lupus Nephritis Market Insight

The Europe systemic lupus erythematosus (SLE) and lupus nephritis (LN) market held a market share of 27.4% in 2024, driven by rising incidence rates, universal healthcare access, and national policies supporting autoimmune disease research. Countries such as Germany, the United Kingdom, and France are leading in the adoption of personalized treatment strategies and expanded biologic use.

U.K. Systemic Lupus Erythematosus and Lupus Nephritis Market Insight

The U.K. systemic lupus erythematosus (SLE) and lupus nephritis (LN) market accounted for 18.1% of the Europe market in 2024, supported by the NHS’s commitment to improving lupus care pathways and early screening protocols. The presence of research centers such as the LUPUS UK network and increased awareness among general practitioners is further fueling market expansion.

Germany Systemic Lupus Erythematosus and Lupus Nephritis Market Insight

The Germany systemic lupus erythematosus (SLE) and lupus nephritis (LN) market captured 23.5% of Europe’s market share in 2024, driven by high spending on healthcare R&D, early access to biologics, and efficient hospital infrastructure. Market growth is also supported by the rising prevalence of autoimmune and chronic kidney conditions associated with lupus nephritis.

Asia-Pacific Systemic Lupus Erythematosus and Lupus Nephritis Market Insight

The Asia-Pacific systemic lupus erythematosus (SLE) and lupus nephritis (LN) market is expected to grow at the fastest CAGR of 8.9% from 2025 to 2032, attributed to the increasing burden of lupus in countries such as China, India, and Japan. The region accounted for a market share of 22.5% in 2024, supported by growing diagnostic reach, improved healthcare access, and rising investments in biosimilar production. Government programs and international health collaborations are helping expand treatment options in both urban and rural areas.

Japan Systemic Lupus Erythematosus and Lupus Nephritis Market Insight

The Japan systemic lupus erythematosus (SLE) and lupus nephritis (LN) market held a market share of 17.6% in Asia-Pacific in 2024, driven by a strong national focus on rare and chronic diseases, along with a well-established biologics market. Increasing demand for patient-friendly options such as subcutaneous therapies and digital health monitoring tools is also contributing to market expansion.

China Systemic Lupus Erythematosus and Lupus Nephritis Market Insight

The China systemic lupus erythematosus (SLE) and lupus nephritis (LN) market accounted for the largest share of 42.3% in the Asia-Pacific market in 2024, owing to the country’s large population base, growing incidence of HBV-related autoimmune disorders, and expanding access to specialty care. National efforts under programs such as “Healthy China 2030” are improving early diagnosis and treatment coverage, driving the Systemic Lupus Erythematosus and Lupus Nephritis market forward.

Systemic Lupus Erythematosus (SLE) and Lupus Nephritis (LN) Market Share

The systemic lupus erythematosus (SLE) and lupus nephritis (LN) industry is primarily led by well-established companies, including:

- GSK plc (U.K.)

- Lilly (U.S.)

- Sanofi (France)

- Baxter (U.S.)

- Pfizer Inc. (U.S.)

- AstraZeneca (U.K.)

- Novartis AG (Switzerland)

- UCB S.A. (Belgium)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Aurinia Pharmaceuticals Inc. (Canada)

- ImmuPharma PLC (U.K.)

- Genentech, Inc. (U.S.)

- Amneal Pharmaceuticals LLC (U.S.)

- Sumitomo Corporation (Japan)

- Johnson & Johnson Services, Inc. (U.S.)

- Cipla (India)

- Abbott (U.S.)

- Bayer AG (Germany)

- Merck KGaA (Germany)

- Bristol-Myers Squibb Company (U.S.)

- Sandoz Group AG (Switzerland)

- Biogen (U.S.)

Latest Developments in Global Systemic Lupus Erythematosus (SLE) and Lupus Nephritis (LN) Market

- In May 2024, GSK plc announced that the U.S. Food and Drug Administration (FDA) approved a 200 mg subcutaneous formulation of Benlysta (belimumab), a monoclonal antibody that specifically inhibits B-lymphocyte stimulator (BLyS). This approval allows for treatment in patients aged five years and older with active systemic lupus erythematosus (SLE) who are already receiving standard therapy. The extension of Benlysta’s use to this new patient demographic is expected to significantly contribute to revenue growth for GSK. This milestone underscores the company’s commitment to advancing treatment options for individuals affected by SLE

- In September 2024, Otsuka Pharmaceutical Co., Ltd. announced that it had submitted a New Drug Application (NDA) in Japan for OPC-34712 (brexpiprazole) as a treatment for agitation associated with dementia of the Alzheimer's type. This application marks a significant step in expanding the company's central nervous system (CNS) portfolio, highlighting its continued efforts to address unmet medical needs in neuropsychiatric disorders

- In March 2025, Roche reported positive interim results from its Phase III SKYSCRAPER-08 study evaluating the efficacy of tiragolumab, its novel anti-TIGIT immunotherapy, in combination with atezolizumab for patients with unresectable, locally advanced, or metastatic esophageal squamous cell carcinoma (ESCC). These findings demonstrate Roche’s strategic commitment to pioneering next-generation immuno-oncology treatments targeting difficult-to-treat cancers

- In July 2024, Biogen and UCB announced positive topline results from their Phase 3 study evaluating zilucoplan, a complement C5 inhibitor, in patients with generalized myasthenia gravis (gMG). The trial met its primary endpoint, showing statistically significant improvements in disease severity. This milestone further strengthens Biogen’s position in the neurology space and underscores UCB’s focus on delivering transformative therapies for rare autoimmune conditions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.