Global Technical Consumer Goods Tcg Market

Market Size in USD Billion

CAGR :

%

USD

1.58 Billion

USD

2.20 Billion

2024

2032

USD

1.58 Billion

USD

2.20 Billion

2024

2032

| 2025 –2032 | |

| USD 1.58 Billion | |

| USD 2.20 Billion | |

|

|

|

|

Technical Consumer Goods (TCG) Market Size

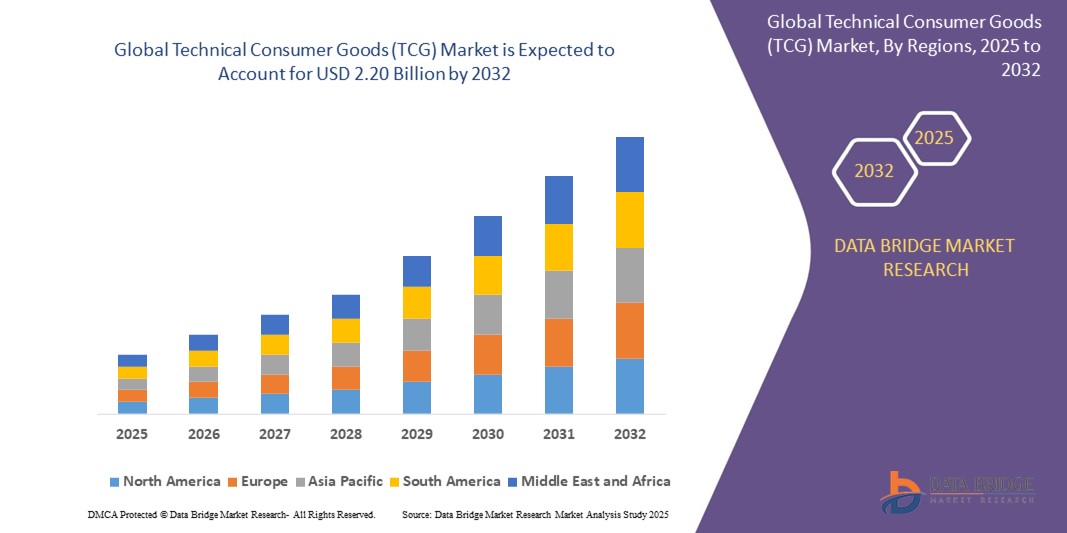

- The global Technical Consumer Goods (TCG) market size was valued at USD 1.58 billion in 2024 and is expected to reach USD 2.20 billion by 2032, at a CAGR of 4.20% during the forecast period

- The market growth is largely fuelled by the rising adoption of smart technologies, increasing disposable income, and consumer preference for upgraded home and personal electronics

- Continuous innovation in product design, energy efficiency, and connectivity features is encouraging consumers to replace traditional devices with smarter, multifunctional alternatives

Technical Consumer Goods (TCG) Market Analysis

- The growing digital transformation across households and workplaces has significantly elevated the demand for consumer electronics such as smartphones, televisions, laptops, and wearables

- Increased urbanization and tech-savvy younger populations, especially in emerging economies, are driving substantial sales in product categories including smart appliances, IT equipment, and digital imaging devices

- North America dominated the technical consumer goods (TCG) market with the largest revenue share in 2024, driven by strong demand for premium electronics and smart appliances, as well as increasing penetration of connected devices in households and enterprises

- Asia-Pacific region is expected to witness the highest growth rate in the global Technical Consumer Goods (TCG) market, driven by urbanization, a surge in consumer electronics manufacturing, favorable government policies, and expanding e-commerce platforms that facilitate easy access to a wide range of technical goods across emerging economies such as China, India, and Southeast Asia

- The consumer electronics segment dominated the market with the largest revenue share of 39.5% in 2024, driven by rising global demand for smartphones, smart televisions, and wearables. Technological advancements such as AI integration, ultra-HD displays, and multi-device connectivity continue to boost the appeal of modern consumer electronics. In addition, the shift toward remote work and hybrid learning environments has accelerated the adoption of personal electronic devices in both developed and emerging economies

Report Scope and Technical Consumer Goods (TCG) Market Segmentation

|

Attributes |

Technical Consumer Goods (TCG) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Demand for Smart Home Devices • Expansion of E-Commerce Retail Channels |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Technical Consumer Goods (TCG) Market Trends

“Shift Toward Energy-Efficient and Sustainable Appliances”

- Demand for energy star-rated products is rising globally across washing machines, refrigerators, and HVAC systems, as consumers seek to reduce long-term electricity costs and environmental impact

- Regulatory bodies are mandating minimum efficiency performance standards (MEPS) and eco-labeling, especially in regions such as the European Union and parts of Asia

- Tech innovation is driving the emergence of smart devices that monitor and optimize energy usage in real-time, enabling households to actively manage consumption

- Sustainable packaging and recyclable components are becoming key differentiators among premium TCG brands, with customers choosing eco-conscious companies over conventional ones

- For instance, Samsung reported a 40% year-on-year increase in sales of its EcoBubble washing machines in 2024, designed to reduce water and electricity consumption without compromising performance

Technical Consumer Goods (TCG) Market Dynamics

Driver

“Rising Disposable Incomes and Digital Lifestyle Adoption”

- Expanding middle class in countries such as India, Brazil, and Vietnam is driving demand for mid- to high-end electronics, including smart televisions, wearables, and kitchen appliances

- Online platforms and digital marketplaces have simplified the purchasing process and offer easy price comparisons, EMI options, and doorstep service, making TCG more accessible

- Consumers are upgrading existing gadgets to more integrated, smart-enabled alternatives that support app control, automation, and personalization for convenience

- Product bundling strategies—such as combining smart TVs with soundbars and game consoles—are enhancing value perception and boosting unit sales in electronics retail

- In India, Flipkart reported a 70% increase in smart TV sales in 2024 due to rising demand for home entertainment and improved affordability through financing options

Restraint/Challenge

“Supply Chain Disruptions and Semiconductor Shortages”

- Persistent semiconductor shortages have disrupted production timelines for laptops, smartphones, and smart appliances, leading to reduced inventory and delayed product launches

- Logistics and freight issues, including container shortages and port congestion, have extended lead times and created bottlenecks in seasonal and high-demand periods

- Manufacturers are incurring higher costs to secure critical components from secondary or alternate suppliers, which cuts into profit margins and inflates retail prices

- Consumer frustration due to backorders, rising prices, and limited product availability is pushing buyers to delay purchases or shift brands based on availability

- In 2023, Sony had to lower its PlayStation 5 production target due to ongoing chip shortages, underlining the global vulnerability of electronics manufacturing to component supply issues

Technical Consumer Goods (TCG) Market Scope

The market is segmented on the basis of product and end-user.

- By Product

On the basis of product, the technical consumer goods market is segmented into consumer electronics, home appliances, telecom, and IT and equipment. The consumer electronics segment dominated the market with the largest revenue share of 39.5% in 2024, driven by rising global demand for smartphones, smart televisions, and wearables. Technological advancements such as AI integration, ultra-HD displays, and multi-device connectivity continue to boost the appeal of modern consumer electronics. In addition, the shift toward remote work and hybrid learning environments has accelerated the adoption of personal electronic devices in both developed and emerging economies.

The IT and equipment segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by increasing investments in digital transformation across industries. Businesses are expanding their IT infrastructure to support cloud computing, data analytics, and cybersecurity, while individuals are upgrading computing devices for productivity and remote access. The growing demand for compact and powerful laptops, tablets, and peripherals is reinforcing the upward trend in this segment.

- By End-User

On the basis of end-user, the TCG market is segmented into business-oriented and personal. The personal segment accounted for the largest market revenue share in 2024, supported by the expanding global middle class, increasing digital literacy, and the popularity of smart gadgets for lifestyle enhancement. Consumers continue to prioritize convenience, connectivity, and energy efficiency when purchasing TCG products for home use.

The business-oriented segment is expected to witness the fastest growth rate from 2025 to 2032, driven by enterprise-level adoption of IT hardware, telecom devices, and automation solutions. Corporate digitization efforts, especially in sectors such as finance, education, and healthcare, are driving the replacement cycle for TCG products. The need for upgraded tech infrastructure and the proliferation of smart office environments are expected to bolster demand in this segment throughout the forecast period.

Technical Consumer Goods (TCG) Market Regional Analysis

• North America dominated the technical consumer goods (TCG) market with the largest revenue share in 2024, driven by strong demand for premium electronics and smart appliances, as well as increasing penetration of connected devices in households and enterprises

• Consumers in the region are investing heavily in products such as smart televisions, laptops, smartphones, and home automation systems, with a strong emphasis on convenience, entertainment, and productivity

• High purchasing power, rapid technological adoption, and a well-developed retail infrastructure further support the growth of TCG products across both business and personal segments

U.S. Technical Consumer Goods (TCG) Market Insight

The U.S. technical consumer goods market held the largest revenue share in 2024 within North America, led by robust consumer electronics demand, early adoption of innovation, and the presence of leading technology firms. The U.S. market is experiencing continued investment in smart home technology, high-performance computing, and 5G-enabled devices. Growth is also propelled by a rise in hybrid work models and remote education trends, fueling the sales of laptops, webcams, and broadband devices. Moreover, increasing interest in energy-efficient appliances and high-end kitchen electronics is shaping market dynamics across U.S. households.

Europe Technical Consumer Goods (TCG) Market Insight

The Europe TCG market is expected to witness the fastest growth rate from 2025 to 2032, supported by sustainability-driven innovation, government digital initiatives, and consumer demand for smart and eco-friendly devices. Rising disposable incomes and growing digital literacy in countries such as Germany, France, and the Netherlands are boosting product adoption. There is a notable shift towards high-efficiency appliances, modular kitchen gadgets, and compact computing solutions in urban regions. The region’s regulatory frameworks promoting energy-efficient goods are also influencing consumer purchasing decisions.

U.K. Technical Consumer Goods (TCG) Market Insight

The U.K. TCG market is expected to witness the fastest growth rate from 2025 to 2032, propelled by increasing consumer preference for intelligent and connected products, as well as a thriving e-commerce sector. The demand for compact and multifunctional devices is growing rapidly due to limited living spaces in urban areas. Remote working trends and heightened focus on entertainment systems are also shaping the market, with a surge in demand for smart speakers, gaming consoles, and HD televisions. The presence of tech-savvy consumers and a strong digital retail ecosystem are key enablers.

Germany Technical Consumer Goods (TCG) Market Insight

The Germany TCG market is expected to witness the fastest growth rate from 2025 to 2032, owing to the country’s strong emphasis on engineering, innovation, and eco-efficiency. Consumer demand is shifting towards durable and smart home appliances, wearable tech, and integrated AI-based systems. Germany’s highly structured retail landscape, coupled with government incentives for sustainable consumer choices, is encouraging the uptake of energy-saving home electronics. The business-oriented segment is also witnessing increased investment in IT infrastructure and security systems, particularly in the industrial and healthcare sectors.

Asia-Pacific Technical Consumer Goods (TCG) Market Insight

The Asia-Pacific TCG market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, rising income levels, and expanding tech-savvy consumer base in countries such as China, India, and South Korea. Massive smartphone penetration, increasing access to broadband, and a booming e-commerce industry are collectively propelling market growth. Furthermore, government policies promoting digital infrastructure and local manufacturing are supporting large-scale adoption of technical consumer goods, especially in emerging economies.

Japan Technical Consumer Goods (TCG) Market Insight

The Japan TCG market is expected to witness the fastest growth rate from 2025 to 2032, due to the country’s technological advancement, consumer inclination toward smart living, and innovation-driven market ecosystem. Japanese consumers are early adopters of robotic appliances, high-definition display technology, and energy-efficient solutions. The country’s aging population is also driving demand for easy-to-use devices and healthcare-oriented electronics. Growth is reinforced by strong domestic manufacturing, sophisticated retail channels, and integration of artificial intelligence in consumer and business applications.

China Technical Consumer Goods (TCG) Market Insight

China is expected to dominate the Asia-Pacific technical consumer goods market, accounting for the largest revenue share in 2024. This is attributed to its large consumer base, accelerated urban development, and robust domestic production capabilities. High demand for smartphones, home appliances, and personal computing devices continues to grow, particularly among younger and middle-class consumers. In addition, China's leadership in 5G deployment, smart city initiatives, and e-commerce platforms significantly boosts the availability and affordability of TCG products across both urban and rural regions.

Technical Consumer Goods (TCG) Market Share

The Technical Consumer Goods (TCG) industry is primarily led by well-established companies, including:

- Apple Inc. (U.S.)

- Samsung Electronics Co. Ltd. (South Korea)

- Sony Corporation (Japan)

- LG Electronics Inc. (South Korea)

- Panasonic Corporation (Japan)

- Huawei Technologies Co. Ltd. (China)

- Xiaomi Corporation (China)

- Microsoft (U.S.)

- Lenovo (China)

- Dell Inc. (U.S.)

- HP Development Company, L.P. (U.S.)

- Canon India Pvt Ltd. (Japan)

- Nikon Corporation (Japan)

- GoPro Inc. (U.S.)

- Fitbit Inc. (U.S.)

- Garmin Ltd. (Switzerland)

- Sonos Inc. (U.S.)

- Bose Corporation (U.S.)

- Philips Electronics N.V. (Netherlands)

- TCL Technology Group Corporation (China)

- Sharp Corporation (Japan)

- Haier Group (China)

- Whirlpool Corporation (U.S.)

- Miele & Cie. KG (Germany)

- Electrolux AB (Sweden)

Latest Developments in Global Technical Consumer Goods (TCG) Market

- In March 2023, Google announced the expansion of its Google Play Games for PC service into the European and Japanese markets. This development includes the rollout of new tools and additional game titles aimed at enhancing the gaming experience for developers and players alike. The initiative is expected to boost user engagement, support regional gaming ecosystems, and strengthen Google’s presence in the global PC gaming sector

- In February 2023, Clikon introduced its Retro series of microwave ovens, featuring a modern blend of style and performance. This product launch focuses on improving the speed and efficiency of reheating processes while maintaining aesthetic appeal. The move enhances Clikon’s competitive edge in the kitchen appliance market and caters to growing consumer demand for both functionality and design

- In October 2022, LG launched its LG Charcoal Microwave+ series in India, incorporating charcoal-based heating technology. This innovation aims to deliver healthier cooking by retaining natural flavors and nutrients. The launch is expected to meet the rising demand for smart and health-focused kitchen appliances, further strengthening LG’s footprint in the Indian home appliance segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.