Global Teeth Whitening Light Market

Market Size in USD Billion

CAGR :

%

USD

2.20 Billion

USD

3.16 Billion

2025

2033

USD

2.20 Billion

USD

3.16 Billion

2025

2033

| 2026 –2033 | |

| USD 2.20 Billion | |

| USD 3.16 Billion | |

|

|

|

|

Teeth Whitening Light Market Size

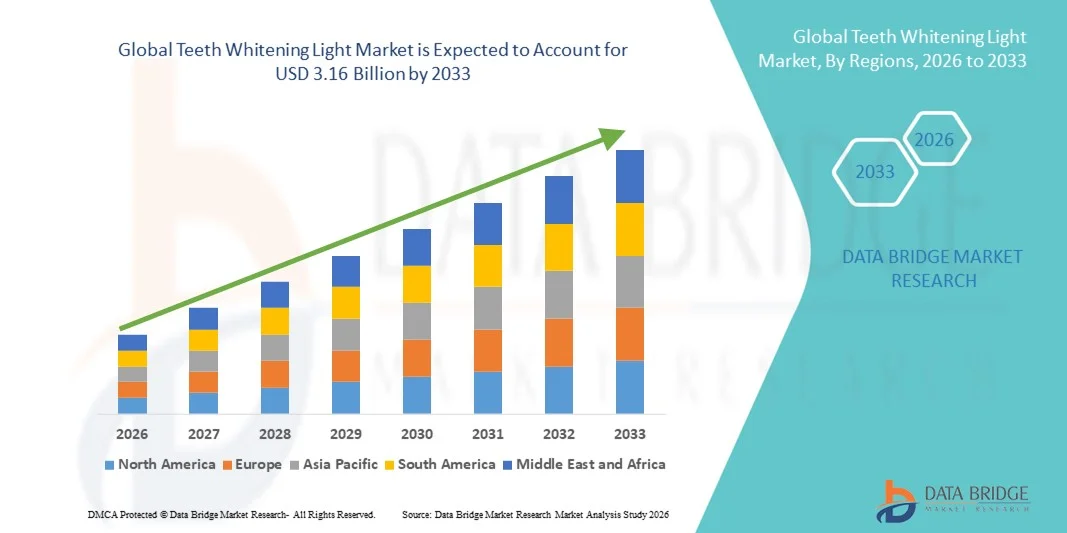

- The global teeth whitening light market size was valued at USD 2.20 billion in 2025 and is expected to reach USD 3.16 billion by 2033, at a CAGR of 4.65% during the forecast period

- The market growth is largely fueled by increasing awareness of oral aesthetics and the rising demand for cosmetic dental procedures in both professional and at-home settings

- Furthermore, technological advancements in LED and laser-based teeth whitening devices, coupled with the growing preference for faster, effective, and non-invasive solutions, are driving the adoption of Teeth Whitening Light solutions, thereby significantly boosting the industry's growth

Teeth Whitening Light Market Analysis

- Teeth whitening light devices, offering LED or laser-based solutions, are increasingly vital components of modern dental aesthetics and cosmetic care in both professional clinics and at-home settings due to their enhanced effectiveness, safety, and fast results

- The escalating demand for teeth whitening light solutions is primarily fueled by growing consumer awareness of oral aesthetics, rising preference for non-invasive cosmetic treatments, and technological advancements that improve comfort, efficiency, and ease of use

- North America dominated the Teeth Whitening Light market with the largest revenue share of 43% in 2025, characterized by high consumer awareness, well-established dental care infrastructure, and strong presence of key industry players. The U.S. is witnessing substantial adoption of professional whitening treatments and at-home LED/laser devices due to increasing dental care expenditure and rising focus on cosmetic dentistry

- Asia-Pacific is expected to be the fastest-growing region in the Teeth Whitening Light market during the forecast period, with a market share in 2025, driven by urbanization, rising disposable incomes, and increasing awareness of oral hygiene and cosmetic dental procedures in countries such as China, India, and Japan

- The LED Light segment dominated the largest market revenue share of 61.5% in 2025, attributed to its efficiency, safety, and consistent performance in both professional and home-use applications

Report Scope and Teeth Whitening Light Market Segmentation

|

Attributes |

Teeth Whitening Light Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Teeth Whitening Light Market Trends

Enhanced Convenience Through Technological Advancements and User-Friendly Designs

- A significant and accelerating trend in the global teeth whitening light market is the integration of advanced LED technology with ergonomic and portable designs, enhancing user convenience and treatment efficiency

- For instance, several professional-grade teeth whitening lights now feature adjustable intensity settings and built-in timers, allowing patients to receive precise, comfortable, and safe whitening sessions. Similarly, compact at-home devices provide consistent light exposure for effective whitening, making treatments accessible outside dental clinics

- Innovations in wavelength optimization have enabled faster bleaching results with reduced sensitivity, appealing to both professionals and consumers. Some devices combine blue and near-infrared LEDs to accelerate whitening gels’ action while minimizing discomfort

- Portable, battery-powered devices with rechargeable capabilities are driving adoption for at-home use. They allow flexible treatment schedules, increased patient compliance, and convenient storage

- Integration with mobile applications for session tracking and reminders is another emerging trend, improving the user experience and adherence to recommended whitening protocols

- Companies such as Philips, Zoom, and Snow are developing enhanced devices with intuitive interfaces, ergonomic mouth trays, and adjustable light intensity to improve treatment outcomes

- Technological enhancements are also addressing pain points such as uneven whitening and gum sensitivity, which historically limited adoption

- Furthermore, combination products, such as teeth whitening gels with LED activators, are increasing consumer confidence in visible results

- The trend toward compact, lightweight, and user-friendly professional and home-use devices is transforming the market landscape

- Growing awareness about oral aesthetics and cosmetic dentistry fuels demand for effective, convenient, and safe whitening solutions

- Regulatory approvals and safety certifications in major markets ensure that advanced devices meet clinical standards, reinforcing trust among users

- Overall, the trend is reshaping consumer expectations, emphasizing safety, portability, and effective results across both professional and home-use segments

Teeth Whitening Light Market Dynamics

Driver

Rising Demand Due to Cosmetic Awareness and Oral Aesthetics

- The increasing focus on oral aesthetics and cosmetic dental care is a significant driver for the heightened demand for teeth whitening lights

- For instance, in April 2025, Philips introduced a new advanced LED whitening kit designed for both clinical and at-home applications, reflecting the growing consumer preference for convenient cosmetic dental solutions

- Consumers increasingly seek brighter, whiter teeth as part of self-care and appearance enhancement, driving market growth globally

- Professional dental clinics are adopting advanced whitening devices to offer shorter treatment times and more predictable results, boosting sales and revenue

- Rising disposable income and beauty-conscious populations in both developed and emerging markets further propel the market

- Integration of portable and easy-to-use devices for at-home use complements professional treatments, increasing overall adoption

- Marketing campaigns and influencer endorsements are raising awareness about teeth whitening solutions and encouraging trial and repeat purchases

- Convenience, safety, and visible results of advanced devices enhance user satisfaction and drive repeat usage

- The trend toward minimally invasive cosmetic procedures increases consumer interest in non-dental professional options

- Oral healthcare awareness initiatives by dental associations reinforce the benefits of safe and effective whitening methods

- Growing dental tourism in regions such as Asia-Pacific also contributes to adoption of professional whitening devices

- Availability of bundled products combining gels and lights encourages integrated treatment approaches and increases overall market penetration

Restraint/Challenge

Concerns Regarding Tooth Sensitivity and Device Costs

- The risk of tooth sensitivity and enamel damage due to improper use or overexposure poses a significant challenge to market growth

- For instance, reports from dental clinics indicate that some at-home LED whitening devices used excessively can lead to mild gum irritation or temporary tooth sensitivity

- Ensuring proper usage guidelines and safety instructions is critical to build consumer confidence and prevent adverse effects

- The relatively high initial cost of advanced teeth whitening light devices compared to traditional gel-only treatments can limit adoption, especially in price-sensitive regions

- While entry-level home kits are more affordable, professional-grade devices with optimized LED technology and ergonomic designs carry premium pricing

- Consumer hesitation regarding long-term effects on enamel and oral tissues may slow market penetration

- Lack of awareness about device efficacy and the need for proper supervision by dental professionals is a barrier in some markets

- Overcoming these challenges requires clear labeling, professional guidance, and educational campaigns for safe usage

- Companies such as Zoom and Philips emphasize safety features and clinical validation to reassure consumers

- Government regulations and safety certifications in key regions can mitigate concerns, but compliance may increase device costs

- Gradual price reductions and development of cost-effective, portable devices are helping expand accessibility

- Addressing both safety concerns and affordability will be vital for sustained market growth, ensuring consumer trust and adoption in both professional and home-use segments

Teeth Whitening Light Market Scope

The market is segmented on the basis of product type, light source, and end-user.

- By Product Type

On the basis of product type, the Teeth Whitening Light market is segmented into In-Office Dental Whitening Lamps and At-Home Dental Whitening Lamps. The In-Office Dental Whitening Lamps segment dominated the largest market revenue share of 52.4% in 2025, driven by the preference of dental professionals for high-intensity lamps that deliver rapid and effective whitening results. Dental clinics and hospitals favor in-office systems due to their superior wavelength precision, controlled light intensity, and reduced risk of overexposure, ensuring patient safety and consistent outcomes. The clinical setting allows professional supervision, enhancing patient trust and adoption rates. In addition, the integration of ergonomic designs, adjustable lamp arms, and intuitive interfaces has improved usability for dental practitioners. Ongoing technological advancements in LED intensity modulation and dual-wavelength operation also contribute to their market dominance. The segment benefits from rising cosmetic dentistry awareness and increasing patient demand for immediate, visible results. In-office systems are widely used for both general and aesthetic dental treatments, contributing to repeat business for dental clinics. Regulatory approvals and certifications in key regions further reinforce the adoption of in-office lamps. Marketing campaigns by leading brands such as Philips Zoom and Beyond enhance visibility among professionals, strengthening demand. Furthermore, combination treatments integrating bleaching gels with light activation optimize treatment efficiency. The expansion of dental tourism in Asia-Pacific and Latin America also drives revenue growth for in-office lamps. Overall, the reliability, professional oversight, and clinical efficacy position in-office dental whitening lamps as the dominant product type in 2025.

The At-Home Dental Whitening Lamps segment is anticipated to witness the fastest CAGR of 18.7% from 2026 to 2033, fueled by the growing consumer preference for convenient, safe, and effective at-home whitening solutions. Portable, battery-operated, and user-friendly devices allow individuals to maintain whitening results from professional sessions or achieve gradual cosmetic enhancement independently. Increasing awareness of oral aesthetics, rising disposable income, and preference for DIY cosmetic care in North America, Europe, and Asia-Pacific contribute to this growth. Technological innovations such as adjustable intensity, automatic timers, and ergonomic mouth trays enhance usability and reduce sensitivity risks. Growing e-commerce penetration has made at-home devices widely accessible, while influencer endorsements and digital marketing campaigns drive consumer adoption. Cost-effective solutions, compared to repeated professional treatments, further accelerate penetration. The combination of LED light sources with pre-formulated whitening gels ensures efficiency while maintaining enamel safety. Educational content on safe usage and product efficacy also boosts consumer confidence. Market players are expanding their product portfolios with compact, rechargeable, and aesthetically appealing devices. Rising interest in cosmetic self-care among millennials and Gen Z supports faster adoption. Overall, the at-home segment is rapidly growing due to convenience, accessibility, and evolving consumer lifestyle trends.

- By Light Source

On the basis of light source, the Teeth Whitening Light market is segmented into LED Light and Ultraviolet Light. The LED Light segment dominated the largest market revenue share of 61.5% in 2025, attributed to its efficiency, safety, and consistent performance in both professional and home-use applications. LEDs offer optimal wavelengths to activate whitening gels effectively without causing thermal damage or enamel degradation. Their energy efficiency, low heat generation, and long lifespan make them preferable over conventional ultraviolet lamps. Dental professionals value LED devices for patient safety, reduced treatment times, and predictable results. Compact designs, portability, and integration with ergonomic mouth trays enhance usability for both clinics and home users. In addition, advancements in multi-wavelength LED technology allow improved bleaching efficiency while minimizing sensitivity. Regulatory approvals, ease of maintenance, and favorable cost-benefit ratios further drive adoption. The LED segment benefits from growing cosmetic dentistry awareness, rising aesthetic consciousness among patients, and increased disposable income. Consumer trust in clinically validated LED systems reinforces market dominance. Marketing initiatives highlighting safety and professional effectiveness also promote adoption. Overall, LED light devices are positioned as the preferred choice for both professional and home whitening treatments.

The Ultraviolet (UV) Light segment is expected to witness the fastest CAGR of 16.3% from 2026 to 2033, driven by demand for faster whitening outcomes and enhanced bleaching efficiency. UV lamps, when used with compatible whitening gels, accelerate the chemical reaction, producing visible results in shorter sessions. Rising innovation in portable UV devices suitable for home use and improved safety mechanisms have increased consumer acceptance. The growing popularity of DIY cosmetic treatments and online sales platforms for UV-based lamps contribute to expansion. Product innovations that combine UV and LED light for dual activation enhance effectiveness while reducing overexposure risks. Regions with rising disposable income and high awareness of cosmetic dental treatments, such as Asia-Pacific and Latin America, are driving growth. Marketing campaigns highlighting faster whitening results and convenience have increased consumer interest. Continuous R&D for user safety, compact design, and compatibility with bleaching gels ensures wider adoption. Overall, the UV light segment is rapidly growing due to efficiency, visible results, and expanding at-home usage.

- By End-User

On the basis of end-user, the Teeth Whitening Light market is segmented into Hospitals, Dental Clinics, and Home Care Settings. The Dental Clinics segment dominated the largest market revenue share of 58.7% in 2025, driven by the preference for professional supervision, higher-intensity lamps, and clinical expertise for optimal whitening outcomes. Dental clinics leverage advanced lamp designs, ergonomic mouth trays, and precise wavelength controls to offer safe and efficient cosmetic treatments. Clinics benefit from repeat treatments, patient trust, and the integration of whitening services into broader cosmetic dentistry packages. Leading clinics adopt in-office lamps that are FDA approved and CE certified, ensuring regulatory compliance. High visibility, marketing, and professional endorsement further contribute to dominance. Patients seeking immediate, predictable, and long-lasting results prefer clinical procedures, reinforcing revenue share. The integration of whitening treatments with other dental procedures boosts market performance. Expansion of dental tourism in key regions also drives clinic-based adoption. Overall, professional dental settings remain the dominant end-user segment.

The Home Care Settings segment is expected to witness the fastest CAGR of 19.2% from 2026 to 2033, fueled by rising demand for at-home cosmetic solutions and portable whitening devices. Consumers increasingly prefer convenient, safe, and cost-effective home treatments, avoiding repeated clinic visits. Technological advancements in ergonomic, rechargeable, and LED-based lamps enhance user safety and treatment consistency. E-commerce availability and digital marketing campaigns are driving adoption across all age groups. Growing awareness of oral aesthetics, influence of social media, and DIY cosmetic trends further accelerate growth. Affordable, compact, and easy-to-use home lamps improve accessibility for price-sensitive and remote consumers. Integration of timers, adjustable intensity, and usage reminders enhances adherence and confidence in results. Expansion of tele-dentistry consultations supports safe home usage. Overall, home care settings are rapidly growing due to convenience, accessibility, and increasing consumer interest in self-managed oral aesthetics.

Teeth Whitening Light Market Regional Analysis

- North America dominated the teeth whitening light market with the largest revenue share of 43% in 2025

- Characterized by high consumer awareness, well-established dental care infrastructure, and a strong presence of key industry player

- The market is witnessing substantial adoption of professional whitening treatments and at-home LED/laser devices due to increasing dental care expenditure and a rising focus on cosmetic dentistry

U.S. Teeth Whitening Light Market Insight

The U.S. teeth whitening light market captured the largest revenue share in 2025 within North America, fueled by growing consumer preference for cosmetic dental procedures, widespread availability of advanced whitening devices, and strong investments in dental clinics offering professional whitening solutions. Moreover, rising awareness about oral hygiene and increasing disposable income are contributing to the adoption of at-home whitening lamps and professional treatments.

Europe Teeth Whitening Light Market Insight

The Europe teeth whitening light market is projected to expand at a substantial rate throughout the forecast period, driven by increasing consumer interest in cosmetic dentistry and aesthetic dental treatments. Countries such as Germany, France, and the U.K. are witnessing significant growth in both in-office and at-home whitening solutions due to rising disposable incomes and growing awareness of oral care.

U.K. Teeth Whitening Light Market Insight

The U.K. teeth whitening light market is anticipated to grow steadily, driven by rising awareness of cosmetic dentistry and the growing availability of professional whitening treatments and at-home devices. Increasing spending on dental care and a focus on maintaining dental aesthetics are expected to support market expansion.

Germany Teeth Whitening Light Market Insight

The Germany teeth whitening light market is expected to grow consistently during the forecast period, fueled by a well-established dental care infrastructure, increasing adoption of cosmetic dental procedures, and high consumer preference for technologically advanced whitening lamps. Both professional clinics and home-use devices are witnessing steady demand.

Asia-Pacific Teeth Whitening Light Market Insight

The Asia-Pacific teeth whitening light market is poised to grow at the fastest rate, with a market share of 28% in 2025, driven by urbanization, rising disposable incomes, and increasing awareness of oral hygiene and cosmetic dental procedures in countries such as China, India, and Japan. Rapid expansion of dental clinics and growing consumer inclination toward aesthetic treatments are supporting the regional market growth.

Japan Teeth Whitening Light Market Insight

The Japan teeth whitening light market is witnessing increasing adoption of professional and at-home whitening devices due to high standards of dental care, rising disposable incomes, and growing awareness of cosmetic dental procedures. The aging population is also boosting demand for user-friendly teeth whitening solutions that can be used safely at home.

China Teeth Whitening Light Market Insight

The China teeth whitening light market accounted for the largest market revenue share within Asia-Pacific in 2025, supported by increasing consumer awareness of dental aesthetics, expanding middle-class population, growing number of dental clinics, and rising adoption of both in-office and at-home whitening devices. Government initiatives promoting oral health and cosmetic dentistry awareness are further accelerating market growth.

Teeth Whitening Light Market Share

The Teeth Whitening Light industry is primarily led by well-established companies, including:

- Philips (Netherlands)

- Dentsply Sirona (U.S.)

- Colgate-Palmolive (U.S.)

- GC Corporation (Japan)

- 3M (U.S.)

- Ivoclar Vivadent (Liechtenstein)

- Beyond Polus (U.S.)

- Beaming White (U.S.)

- Smile Sciences (U.S.)

- BriteSmile (U.S.)

Latest Developments in Global Teeth Whitening Light Market

- In February 2021, Crest introduced its “Whitening Emulsions with LED Accelerator Light Kit”—argued to be their biggest innovation in 20 years. The kit merges a leave‑on whitening formula with a LED accelerator light, promising “virtually no sensitivity” and faster whitening results

- In February 2023, Colgate Optic White launched two key innovations: the “ComfortFit LED Teeth Whitening Kit” and an “Express Whitening Pen”. The kit features a flexible LED tray that molds to the mouth, designed to remove up to 10 years of stains in just 3 days, while the pen targets rapid whitening in 1 day

- In November 2022, MySmile unveiled a new Bluetooth‑connected at‑home whitening kit which includes an LED light component and emphasises quick, non‑sensitive whitening sessions

- In September 2022, Spotlight Oral Care launched a home‑use LED teeth whitening system featuring dual‐wavelength red and blue light, designed to offer professional‑standard results in 30 minutes and to reduce gum sensitivity

- In August 2024, MOON Oral Beauty announced the “Platinum Pro Glow Teeth Whitening Device”, a triple LED (blue, red, yellow) device claimed to whiten up to 18 shades in one week while also supporting gum health and fresh breath—aimed at combining cosmetic whitening with broader oral‑health benefits

- In January 2025, Philips partnered with dental practice network Tend to roll out its “Zoom! WhiteSpeed” professional whitening system using blue LED light within the network, targeting results of up to 8 shades whiter in 45 minutes, highlighting growth in professional in‑office LED‑light whitening adoption

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.