Global Telepharmacy Market

Market Size in USD Billion

CAGR :

%

USD

10.79 Billion

USD

17.46 Billion

2024

2032

USD

10.79 Billion

USD

17.46 Billion

2024

2032

| 2025 –2032 | |

| USD 10.79 Billion | |

| USD 17.46 Billion | |

|

|

|

|

Telepharmacy Market Size

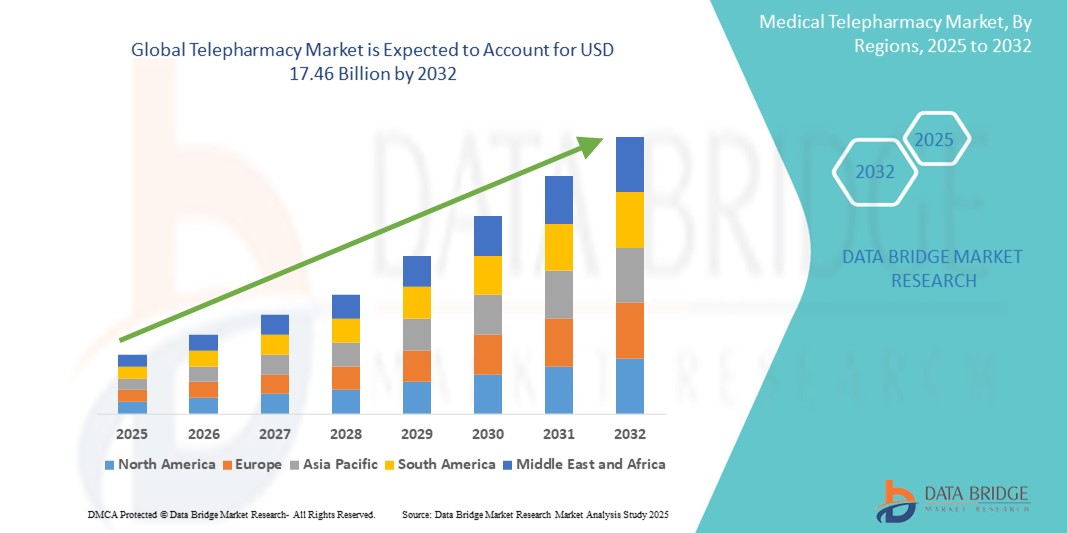

- The global telepharmacy market size was valued at USD 10.79 billion in 2024 and is expected to reach USD 17.46 billion by 2032, at a CAGR of 6.19% during the forecast period

- The market growth is largely fueled by the increasing adoption and technological advancements in digital healthcare and telemedicine platforms, leading to the rapid expansion of telepharmacy services across urban and remote regions

- Furthermore, rising demand for accessible, cost-effective, and pharmacist-led remote medication management solutions is positioning telepharmacy as a vital component of modern healthcare delivery. These converging factors are accelerating the uptake of Telepharmacy solutions, thereby significantly boosting the industry's growth

Telepharmacy Market Analysis

- Telepharmacy, offering remote pharmaceutical care through digital platforms, is becoming an increasingly vital component of modern healthcare systems in both urban and remote settings due to its enhanced accessibility, medication management capabilities, and seamless integration with telehealth ecosystems

- The escalating demand for telepharmacy services is primarily fueled by the growing need for timely pharmaceutical access in underserved areas, advancements in digital health technologies, and a rising preference for remote consultations and medication dispensing

- North America dominated the telepharmacy market with the largest revenue share of 40.8% in 2024, characterized by early telehealth adoption, favorable healthcare infrastructure, and a strong presence of key industry players. The U.S. experienced substantial growth in telepharmacy implementation, particularly across rural health clinics, hospitals, and small pharmacy networks—driven by innovations in real-time prescription management, AI-driven medication counseling, and secure digital platforms

- Asia-Pacific is expected to be the fastest-growing region in the telepharmacy market during the forecast period, supported by rapid urbanization, growing smartphone penetration, increasing healthcare digitization, and government initiatives to bridge rural healthcare gaps across countries such as India, China, and Indonesia

- The software segment dominated in the telepharmacy market, with a revenue share of 61.3% in 2024, driven by the growing demand for virtual care platforms, e-prescribing systems, and compliance management tools. The increasing adoption of telehealth infrastructure and the need for secure, scalable digital pharmacy operations have further contributed to the dominance of this segment

Report Scope and Telepharmacy Market Segmentation

|

Attributes |

Telepharmacy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Telepharmacy Market Trends

“Enhanced Convenience Through Digital Healthcare Integration”

- A significant and accelerating trend in the global telepharmacy market is the deepening integration with digital health platforms and electronic health records (EHR), enabling seamless communication between pharmacists, healthcare providers, and patients. This interconnected approach significantly enhances the convenience and accessibility of pharmacy services in both clinical and remote settings

- For instance, modern telepharmacy systems allow real-time prescription verification, remote patient counseling, and medication management through secure digital interfaces. These platforms are being deployed across rural hospitals, long-term care facilities, and correctional institutions to ensure uninterrupted pharmaceutical care

- Cloud-based telepharmacy solutions offer features such as real-time inventory tracking, automated dispensing logs, and secure messaging between patients and pharmacists. Some systems also support multi-language capabilities and visual aids, helping improve medication adherence and patient understanding across diverse populations

- The seamless integration of telepharmacy with telehealth platforms allows centralized control over clinical workflows. Through a single dashboard, healthcare providers can manage medication dispensing, virtual consultations, and patient follow-ups, creating a streamlined and efficient care delivery model

- This trend toward more intuitive, accessible, and patient-centered pharmaceutical care is fundamentally reshaping expectations in healthcare delivery. Consequently, companies such as PipelineRx, AZOVA, and Aspen RxHealth are developing advanced telepharmacy platforms designed to improve medication access and reduce healthcare disparities

- The demand for telepharmacy services that offer secure, scalable, and compliant infrastructure is growing rapidly across hospitals, nursing homes, rural clinics, and military facilities, as healthcare systems increasingly prioritize convenience, cost-efficiency, and continuity of care

Telepharmacy Market Dynamics

Driver

“Growing Need Due to Rising Healthcare Access Demands and Digital Health Adoption”

- The increasing demand for timely and accessible pharmaceutical care, particularly in rural and underserved areas, coupled with the rapid adoption of digital health technologies, is a significant driver fueling the growth of the telepharmacy market

- For instance, in April 2024, PipelineRx announced an expansion of its remote pharmacy services to additional critical access hospitals in the Midwest, aiming to bridge the gap in pharmacist availability through 24/7 virtual coverage. Such initiatives by key players are expected to drive Telepharmacy industry growth over the forecast period

- As patients and healthcare providers seek alternatives to traditional pharmacy models, telepharmacy offers real-time medication management, remote consultations, and streamlined prescription fulfillment—providing a compelling solution for both acute and chronic care settings

- Furthermore, the growing integration of telehealth platforms with pharmacy services is making telepharmacy a central element of virtual care ecosystems, allowing for seamless coordination between physicians, pharmacists, and patients

- The convenience of remote access to pharmacists, medication counseling via video or chat, and automated dispensing in long-term care and correctional facilities are key factors accelerating telepharmacy adoption. The trend toward decentralized care and the increasing availability of scalable, user-friendly telepharmacy platforms further contribute to market expansion

Restraint/Challenge

“Concerns Regarding Data Security and High Implementation Costs”

- Concerns surrounding data privacy, HIPAA compliance, and cybersecurity vulnerabilities of digital health systems pose notable challenges to broader Telepharmacy market adoption. As telepharmacy platforms handle sensitive patient health information, they must adhere to stringent data protection standards, raising implementation complexities and costs

- For instance, high-profile data breaches in healthcare systems have led to greater scrutiny of virtual care models, making some providers hesitant to adopt new telepharmacy solutions without robust security assurances

- Addressing these security concerns through end-to-end encryption, secure logins, and regular compliance audits is essential for building trust among healthcare organizations and patients. Companies such as AZOVA and Cerner Corporation emphasize their secure, HIPAA-compliant infrastructure in their service offerings to mitigate these concerns

- In addition, the relatively high upfront costs of deploying telepharmacy infrastructure—such as automation equipment, remote kiosks, and integrated software—can be a barrier for smaller pharmacies or healthcare facilities operating on limited budgets

- While cost-effective solutions are emerging, the perception of high investment requirements can hinder adoption, particularly in developing regions or low-resource settings

- Overcoming these challenges will require continued innovation in affordable delivery models, greater consumer and provider education, and enhanced cybersecurity frameworks to ensure safe, reliable, and equitable telepharmacy services

Telepharmacy Market Scope

The market is segmented on the basis of type, component, delivery mode, devices, and application.

• By Type

On the basis of type, the telepharmacy market is segmented into inpatient, remote dispensing, IV admixture, and remote counselling. The remote dispensing segment dominated the market with the largest revenue share of 42.7% in 2024, driven by the ability to deliver medications to underserved locations.

The remote counselling segment is projected to register the fastest CAGR of 23.4% from 2025 to 2032, fueled by growing demand for virtual pharmacist consultations for chronic disease management and medication adherence.

• By Component

On the basis of component, the telepharmacy market is segmented into hardware and software. The software segment accounted for the largest revenue share of 61.3% in 2024, owing to the growing demand for virtual platforms, e-prescribing systems, and compliance software.

The hardware segment is expected to grow at a CAGR of 18.9% from 2025 to 2032, supported by the rising use of telemedicine kiosks and automated dispensing machines.

• By Delivery Mode

On the basis of delivery mode, the telepharmacy market is segmented into on-premises, web-based, and cloud-based. The cloud-based segment held the largest revenue share of 47.6% in 2024, due to its scalability, cost-effectiveness, and ease of integration with EHRs and telehealth platforms.

The web-based segment is forecasted to witness the fastest CAGR of 21.2% from 2025 to 2032, driven by demand from smaller practices for accessible and browser-based solutions.

• By Devices

On the basis of devices, the telepharmacy market is segmented into computers, smartphones, tablets, and kiosk. The computers segment contributed to the largest market revenue share of 49.8% in 2024, with desktops/laptops being the preferred mode for pharmacist workflows.

The smartphones segment is expected to grow at the fastest CAGR of 24.1% from 2025 to 2032, owing to rising mobile health adoption, app-based access, and growing patient preference for mobile-enabled consultations.

• By Application

On the basis of application, the telepharmacy market is segmented into hospitals, small pharmacies, nursing homes, prisons, military base, and war ships. The hospitals segment accounted for the largest revenue share of 38.9% in 2024, as telepharmacy becomes increasingly integrated into inpatient care and overnight pharmacy services.

The prisons segment is anticipated to register the fastest CAGR of 22.8% from 2025 to 2032, as secure remote medication management becomes a priority in correctional facilities.

Telepharmacy Market Regional Analysis

- North America dominated the telepharmacy market with the largest revenue share of 40.8% in 2024, driven by increasing demand for digital healthcare solutions, rising adoption of telehealth services, and regulatory support for remote medication dispensing

- Consumers and healthcare providers in the region highly value the convenience, cost savings, and enhanced accessibility that telepharmacy services offer, especially for patients in rural or underserved areas

- This widespread adoption is further supported by a well-developed healthcare IT infrastructure, high digital literacy rates, and growing investments in virtual care platforms, establishing telepharmacy as a vital component of the modern healthcare delivery model

U.S. Telepharmacy Market Insight

The U.S. telepharmacy market captured the largest revenue share of 80% in 2024 within North America, fueled by the rapid uptake of telehealth platforms and increased need for 24/7 pharmacy services. Consumers are increasingly prioritizing convenience and access to medication counseling through remote consultations. The expanding use of e-prescriptions, secure video communication, and centralized medication management further propels the telepharmacy industry. Moreover, the integration of telepharmacy into home care, rural hospitals, and correctional facilities is significantly contributing to the market’s expansion.

Europe Telepharmacy Market Insight

The Europe telepharmacy market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the aging population, increasing prevalence of chronic diseases, and growing need for decentralized pharmacy services. The rise of digital health initiatives across EU nations, combined with supportive regulations for eHealth technologies, is fostering telepharmacy adoption in hospitals, long-term care settings, and community pharmacies. European consumers are also drawn to the efficiency and accessibility telepharmacy brings to medication management.

U.K. Telepharmacy Market Insight

The U.K. telepharmacy market is projected to expand at a substantial CAGR throughout the forecast period, driven by the National Health Service’s (NHS) digital transformation agenda and rising demand for virtual healthcare services. In addition, challenges in pharmacy staffing and increased healthcare demand post-pandemic are prompting providers to deploy telepharmacy solutions. The U.K.’s strong digital infrastructure and rising consumer preference for remote consultations continue to stimulate market growth.

Germany Telepharmacy Market Insight

The Germany telepharmacy market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of digital healthcare benefits and increasing government investments in smart health infrastructure. Germany’s robust healthcare system and emphasis on technological innovation promote the integration of telepharmacy in outpatient care and remote health management. The adoption is further supported by stringent data privacy compliance and an increasing need for cost-efficient pharmacy services.

Asia-Pacific Telepharmacy Market Insight

The Asia-Pacific telepharmacy market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032. This growth is driven by urbanization, a growing middle class, and strong digital transformation across emerging economies such as India, China, and Japan. Government initiatives to improve rural healthcare access, rising smartphone penetration, and rapid expansion of telemedicine platforms are contributing to the adoption of telepharmacy. In addition, APAC’s role as a growing hub for healthcare technology development supports widespread implementation.

Japan Telepharmacy Market Insight

The Japan telepharmacy market accounted for 6.7% of the Asia-Pacific market share in 2024, and is gaining momentum due to its aging population, high urban density, and strong government backing for digital health innovations. Japan’s tech-forward healthcare system is increasingly deploying telepharmacy to deliver efficient, remote pharmaceutical care across urban and rural settings. Integration with electronic medical records and automated dispensing systems is accelerating adoption in hospitals and homecare environments.

China Telepharmacy Market Insight

The China telepharmacy market accounted for the largest Asia-Pacific market revenue share of 44.3% in 2024, attributed to its fast-growing digital healthcare ecosystem, expanding middle class, and high smartphone penetration. Telepharmacy is increasingly used in urban hospitals, rural clinics, and retail chains to overcome geographic barriers and manage growing patient loads. Government-led smart healthcare initiatives and strong domestic health-tech innovation are key drivers fueling rapid market expansion.

Telepharmacy Market Share

The telepharmacy industry is primarily led by well-established companies, including:

- PipelineRx (U.S.)

- THE NORTH WEST COMPANY (Canada)

- MCKESSON VENTURES (U.S.)

- AMN Healthcare (U.S.)

- One Touch Video Chat (U.S.)

- CPS Solutions, LLC (U.S.)

- MedTel Services (U.S.)

- Cisco (U.S.)

- Cerner Corporation (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Aspen RxHealth (U.S.)

- Cardinal Health (U.S.)

- AlliantRx (U.S.)

- AZOVA (U.S.)

- Medtronic (Ireland)

Latest Developments in Global Telepharmacy Market

- In October 2024, GoodRx launched a new e‑commerce medication delivery solution in partnership with Opill, enabling direct-to-consumer prescription fulfillment through its telehealth platform—a strategic move enhancing convenience and access in the telepharmacy space

- In October 2024, American Well (Amwell) partnered with Hello Heart to integrate cardiovascular health risk management into its Amwell Converge clinical platform, expanding telepharmacy services to include chronic disease monitoring and remote therapeutic support

- In September 2024, the U.S. FDA extended its “Home as a Health Care Hub” initiative, fostering telepharmacy integration into home-based care delivery and reinforcing the role of pharmacists in remote patient management

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.