Global Terrestrial Laser Scanning Market

Market Size in USD Billion

CAGR :

%

USD

4.82 Billion

USD

9.10 Billion

2024

2032

USD

4.82 Billion

USD

9.10 Billion

2024

2032

| 2025 –2032 | |

| USD 4.82 Billion | |

| USD 9.10 Billion | |

|

|

|

|

What is the Global Terrestrial Laser Scanning Market Size and Growth Rate?

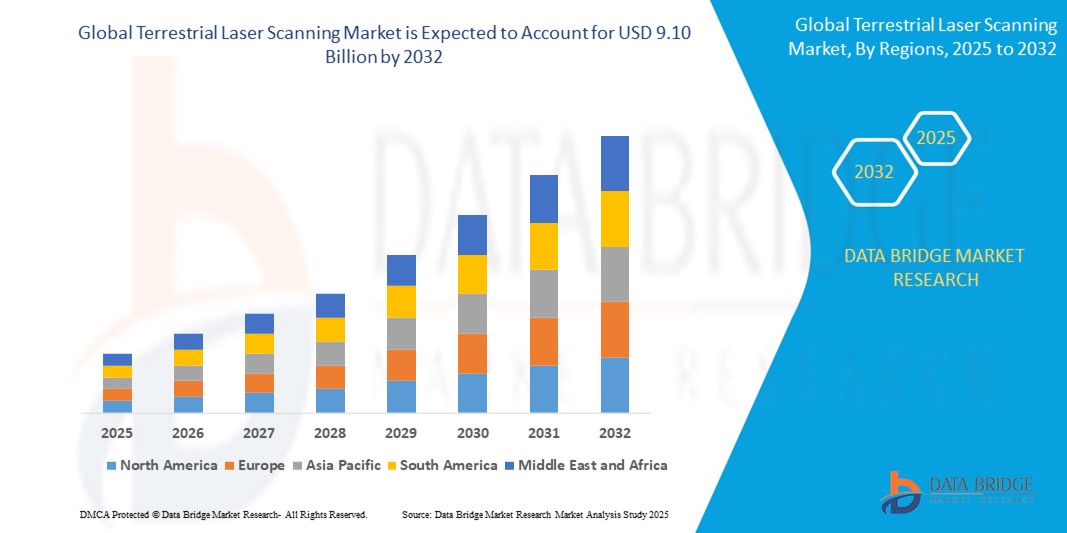

- The global terrestrial laser scanning market size was valued at USD 4.82 billion in 2024 and is expected to reach USD 9.10 billion by 2032, at a CAGR of 8.25% during the forecast period

- The terrestrial laser scanning market is experiencing significant growth, driven by advancements in technology and the increasing demand for precise 3D data collection across various sectors

- Recent methods include the integration of high-resolution imaging and advanced software that enhances data processing and analysis capabilities. For instance, the use of mobile laser scanning systems allows for quicker and more efficient data capture in complex environments, such as urban settings and construction sites

What are the Major Takeaways of Terrestrial Laser Scanning Market?

- The market is also expanding due to the rising applications in industries such as mining, forestry, and cultural heritage documentation. With organizations increasingly recognizing the value of accurate and detailed spatial data, the terrestrial laser scanning market is projected to grow at a robust pace, with forecasts suggesting a significant compound annual growth rate (CAGR) in the coming years. This growth reflects a broader trend towards digital transformation and data-driven decision-making across various industries

- North America dominated the terrestrial laser scanning market with the largest revenue share of 38.6% in 2024, fueled by extensive adoption in infrastructure modernization, industrial automation, and high-precision mapping projects. The region’s mature construction sector and strong emphasis on technological integration are driving widespread implementation across applications

- Asia-Pacific is projected to grow at the fastest CAGR of 13.5% from 2025 to 2032, driven by massive investments in smart cities, transportation infrastructure, and industrial digitization. Countries such as China, India, Japan, and South Korea are rapidly adopting laser scanning technologies for city planning, construction monitoring, and utility mapping as part of their urban transformation agendas

- The Phase-Shift Scanner segment dominated the market with the largest revenue share of 36.4% in 2024, owing to its ability to capture high-resolution data quickly and with exceptional accuracy, making it ideal for detailed architectural and infrastructure projects

Report Scope and Terrestrial Laser Scanning Market Segmentation

|

Attributes |

Terrestrial Laser Scanning Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Terrestrial Laser Scanning Market?

“AI Integration and Real-Time Data Processing for Enhanced Scanning Efficiency”

- A leading trend in the terrestrial laser scanning (TLS) market is the integration of artificial intelligence (AI) and real-time data analytics to improve scanning accuracy, automation, and speed in high-demand industries

- New-generation TLS systems now feature AI-powered automation to auto-register point clouds, filter noise, and detect anomalies in real time—reducing manual processing time

- Major players such as FARO Technologies and Trimble are implementing smart scanners that can learn from previous scans, adapt to environmental variables, and deliver consistent outputs

- Integration with cloud-based platforms and BIM systems allows seamless data transfer, collaborative modeling, and remote monitoring, making TLS central to digital twin and smart infrastructure projects

- These developments are especially vital in construction, mining, and transportation, where dynamic environments require responsive and intelligent scanning tools

- The shift towards AI-enabled TLS is redefining the industry by enhancing operational productivity, data precision, and multi-device synchronization across large-scale projects

What are the Key Drivers of Terrestrial Laser Scanning Market?

- Growing adoption of BIM (Building Information Modeling) and digital twin technologies in construction, infrastructure, and urban planning is significantly boosting demand for high-resolution TLS systems

- In May 2024, Leica Geosystems launched a new TLS unit with automated self-calibration, reducing on-site setup time and enhancing scan quality under varying weather conditions

- TLS devices are crucial for applications that require non-contact, full-field 3D measurement, especially in areas such as forensics, archaeology, and tunnel surveying

- The need for accurate topographical data for highway expansion, smart cities, and rail development is accelerating TLS adoption among public sector agencies and contractors

- Growth in industrial automation and robotics is creating new use cases for TLS in component inspection, robotic path mapping, and warehouse automation

- Advancements in scanner portability, battery life, and user-friendly software are expanding the technology’s reach beyond traditional surveyors to architects, engineers, and facility managers

Which Factor is challenging the Growth of the Terrestrial Laser Scanning Market?

- A key challenge is the high upfront cost of terrestrial laser scanners and related software, which can restrict adoption among small and mid-sized firms

- Devices such as the RIEGL VZ-400i and Leica RTC360 offer powerful features but require significant investment in hardware, training, and post-processing tools

- Another barrier is data processing complexity, as large-scale point clouds require substantial computing resources and trained personnel for analysis and modeling

- Environmental factors such as rain, fog, or reflective surfaces can affect scan quality, requiring repeat scans or supplemental equipment to ensure accuracy

- Compliance with data handling regulations and securing cloud-based project data are growing concerns, especially for infrastructure and defense applications

- To enable wider adoption, vendors must focus on cost-effective models, improved training platforms, and enhanced interoperability with existing software ecosystems

How is the Terrestrial Laser Scanning Market Segmented?

The market is segmented on the basis of type, solution, laser type, products, principles, mappings, application, and end use.

• By Type

On the basis of type, the terrestrial laser scanning market is segmented into Phase-Shift Scanner, Pulse-Based Scanner, Mobile Scanner, and Optical Triangulation. The Phase-Shift Scanner segment dominated the market with the largest revenue share of 36.4% in 2024, owing to its ability to capture high-resolution data quickly and with exceptional accuracy, making it ideal for detailed architectural and infrastructure projects.

The Mobile Scanner segment is projected to witness the fastest CAGR from 2025 to 2032, driven by its portability, ease of deployment, and suitability for complex and dynamic environments such as urban mapping and construction sites.

• By Solution

On the basis of solution, the market is segmented into terrestrial laser scanning system and Terrestrial Laser Scanning Services. The Terrestrial Laser Scanning System segment accounted for the largest market share of 69.1% in 2024, driven by strong demand for integrated, hardware-focused solutions in construction, mining, and manufacturing industries.

The Terrestrial Laser Scanning Services segment is expected to grow at the fastest CAGR during the forecast period, supported by the rising demand for scanning-as-a-service, consulting, and data processing in projects requiring short-term or outsourced solutions.

• By Laser Type

On the basis of laser type, the market is segmented into Diode, Fiber, and Solid-State. The Fiber Laser segment held the largest market revenue share of 47.2% in 2024, credited to its efficiency, precision, and suitability for scanning metallic and industrial surfaces under diverse conditions.

The Diode Laser segment is expected to register the fastest CAGR from 2025 to 2032, owing to its compactness, cost-effectiveness, and increasing use in lightweight, handheld terrestrial laser scanning systems.

• By Products

On the basis of products, the market is categorized into Dynamic Terrestrial Laser Scanning and Stationary/Static Terrestrial Laser Scanning. The Stationary/Static Terrestrial Laser Scanning segment dominated with a revenue share of 58.5% in 2024, as it offers stable, high-precision scans in large-scale projects such as building documentation and archaeological mapping.

The Dynamic Terrestrial Laser Scanning segment is poised to grow at the highest CAGR during the forecast period, thanks to its application in mobile mapping, autonomous vehicles, and rapidly evolving geospatial data collection.

• By Principles

On the basis of principles the terrestrial laser scanning market is segmented into Galvanometer Scanner, Polygonal Scanner, Shaft Scanner, and Others. The Galvanometer Scanner segment held the largest revenue share of 33.8% in 2024, favored for its high-speed scanning capability and precision in applications such as industrial inspections and topographic surveys.

The Polygonal Scanner segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by its wide scanning angles and adaptability in high-throughput environments.

• By Mappings

On the basis of mapping types, the market is segmented into Camera Scanner, Hybrid Scanner, Panorama Scanner, and Others. The Panorama Scanner segment led the market in 2024 with a revenue share of 35.2%, thanks to its 360-degree scanning capabilities, crucial for large-area imaging and digital twin modeling.

The Hybrid Scanner segment is forecasted to grow at the highest CAGR, as it combines features of multiple scanning technologies, enhancing versatility and accuracy for multi-domain projects.

• By Application

On the basis of application, the terrestrial laser scanning market is segmented into Building Information Modeling (BIM), Surveying, Research and Engineering, and Others. The Building Information Modeling (BIM) segment dominated with the largest revenue share of 39.6% in 2024, driven by increasing adoption in smart construction, renovation, and infrastructure monitoring.

The Research and Engineering segment is projected to register the fastest growth, owing to expanding usage in academic, archaeological, and industrial R&D projects.

• By End Use

On the basis of end use, the market is categorized into Industrial, Nuclear Sites, Power and Energy, Residential, Oil and Gas, Naval Industry, and Chemicals. The Industrial segment captured the largest market share of 28.9% in 2024, as laser scanning is widely used in quality control, facility planning, and machine calibration.

The Nuclear Sites segment is expected to grow at the highest CAGR from 2025 to 2032, supported by the need for safe, remote, and highly precise scanning in hazardous and restricted-access areas.

Which Region Holds the Largest Share of the Terrestrial Laser Scanning Market?

- North America dominated the terrestrial laser scanning market with the largest revenue share of 38.6% in 2024, fueled by extensive adoption in infrastructure modernization, industrial automation, and high-precision mapping projects. The region’s mature construction sector and strong emphasis on technological integration are driving widespread implementation across applications

- The U.S. and Canada are leading markets, supported by government investments in smart transportation systems, utilities inspection, and BIM-based construction practices

- Regulatory mandates for safety, asset documentation, and digital archiving are further promoting the deployment of terrestrial laser scanners across federal and commercial project

U.S. Terrestrial Laser Scanning Market Insight

The U.S. leads the North American market, driven by rising demand in sectors such as civil engineering, power generation, and defense. TLS is heavily used for bridge inspection, site analysis, and facility modeling. Adoption is further enhanced by integration with drones, AI analytics, and cloud-based data platforms, boosting scalability and ROI.

Canada Terrestrial Laser Scanning Market Insight

Canada’s market is growing steadily due to its emphasis on sustainable urban development and remote infrastructure monitoring. Applications in oil and gas pipelines, mining, and historic preservation are key contributors. Government-backed innovation funding and 3D scanning mandates in environmental and heritage projects are strengthening national TLS adoption.

Which Region is the Fastest-Growing in the Terrestrial Laser Scanning Market?

Asia-Pacific is projected to grow at the fastest CAGR of 13.5% from 2025 to 2032, driven by massive investments in smart cities, transportation infrastructure, and industrial digitization. Countries such as China, India, Japan, and South Korea are rapidly adopting laser scanning technologies for city planning, construction monitoring, and utility mapping as part of their urban transformation agendas. The rising presence of local vendors, increasing awareness of automation benefits, and government infrastructure initiatives are accelerating TLS deployment across both public and private sectors.

China Terrestrial Laser Scanning Market Insight

China leads the Asia-Pacific region, supported by its digital infrastructure development goals under initiatives such as “New Infrastructure” and “Smart City China.” TLS is widely adopted in megaprojects involving highways, metro systems, and digital twin creation. Domestic scanner producers offer cost-effective solutions, boosting regional accessibility.

Japan Terrestrial Laser Scanning Market Insight

Japan’s focus on seismic safety and high-precision engineering fuels TLS use in transportation, utilities, and construction. Adoption is strong in railway modeling, tunnel inspections, and structural health monitoring. Integration with robotics and autonomous surveying systems further supports Japan’s technologically advanced applications.

India Terrestrial Laser Scanning Market Insight

India is emerging as a growth hotspot due to expanding smart city initiatives, real estate development, and industrial corridor planning. TLS is gaining traction in highway mapping, urban redevelopment, and asset documentation. Government campaigns such as “Digital India” and “Make in India” are pushing TLS adoption across sectors and regions.

Which are the Top Companies in Terrestrial Laser Scanning Market?

The terrestrial laser scanning industry is primarily led by well-established companies, including:

- Leica Geosystems AG (Switzerland)

- Trimble Inc. (U.S.)

- Teledyne Technologies Incorporated (U.S.)

- FARO Technologies, Inc. (U.S.)

- RIEGL Laser Measurement Systems GmbH (Austria)

- CREAFORM (Canada)

- Maptek Pty Limited (Australia)

- Zeiss India (India)

- Zoller + Fröhlich GmbH (Germany)

- Merrett Survey Limited (U.K.)

What are the Recent Developments in Global Terrestrial Laser Scanning Market?

- In November 2022, 3D Systems formed a strategic partnership with Wematter, a US-based terrestrial laser scanner maker, to expand its Selective Laser Sintering (SLS) portfolio. Through this alliance, 3D Systems secured exclusive global distribution rights for Wematter’s Gravity solution. This partnership enables 3D Systems to provide a high-reliability, cost-effective storage solution for end-use component manufacturing, enhancing Wematter's market reach while strengthening 3D Systems' SLS offerings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Terrestrial Laser Scanning Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Terrestrial Laser Scanning Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Terrestrial Laser Scanning Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.