Global Thalidomide Market

Market Size in USD Billion

CAGR :

%

USD

1.71 Billion

USD

2.89 Billion

2025

2033

USD

1.71 Billion

USD

2.89 Billion

2025

2033

| 2026 –2033 | |

| USD 1.71 Billion | |

| USD 2.89 Billion | |

|

|

|

|

Thalidomide Market Size

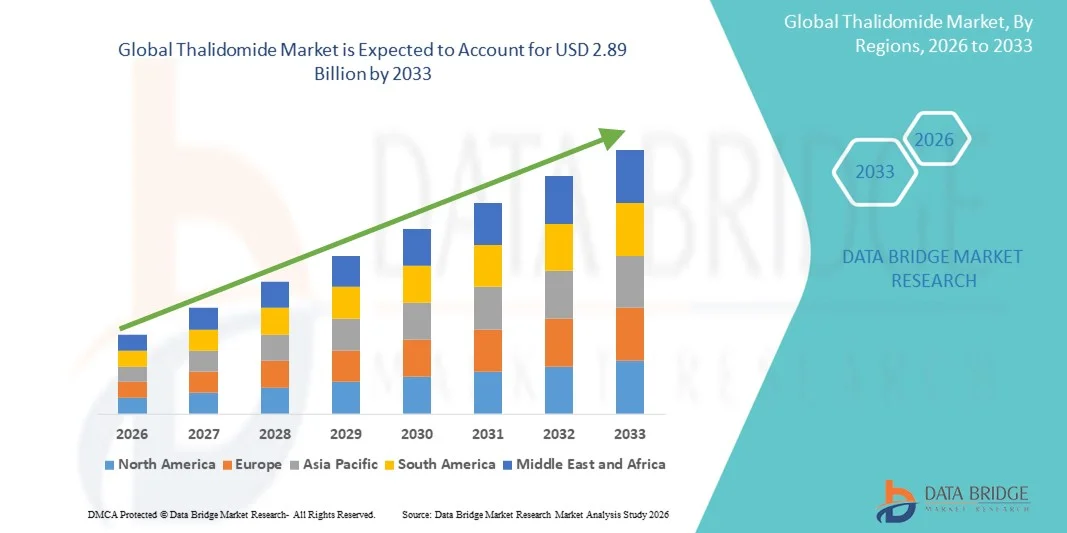

- The global Thalidomide market size was valued at USD 1.71 billion in 2025 and is expected to reach USD 2.89 billion by 2033, at a CAGR of 6.80% during the forecast period

- The market growth is largely fueled by the rising prevalence of multiple myeloma and leprosy-related complications, alongside increasing clinical adoption of immunomodulatory therapies across developed and emerging regions

- Furthermore, growing demand for effective, targeted treatment options with manageable safety profiles is positioning thalidomide as a critical therapeutic agent in oncology and immunology. These converging factors are accelerating the uptake of thalidomide-based therapies, thereby significantly boosting the industry's growth

Thalidomide Market Analysis

- Thalidomide, an immunomodulatory drug widely used for the treatment of multiple myeloma and erythema nodosum leprosum (ENL), remains a vital component of oncology and leprosy management due to its anti-inflammatory, antiangiogenic, and immune-regulating properties, driving consistent clinical demand across global healthcare systems

- The escalating demand for thalidomide is primarily fueled by the rising global burden of multiple myeloma, expanding therapeutic applications of immunomodulatory agents, and the continued need for effective treatments in regions where leprosy-related complications remain prevalent

- North America dominated the global thalidomide market with the largest revenue share of 38.7% in 2025, supported by advanced oncology treatment infrastructure, strong reimbursement frameworks, and the high incidence of multiple myeloma in the U.S., alongside active participation of leading pharmaceutical manufacturers specializing in hematologic therapies

- Asia-Pacific is expected to be the fastest-growing region during the forecast period due to increasing diagnosis rates of multiple myeloma, improving healthcare access, and rising government initiatives aimed at managing leprosy-associated conditions in countries such as India and China

- The multiple myeloma segment dominated the thalidomide market with a market share of 72.1% in 2025, driven by thalidomide’s established therapeutic role, proven clinical efficacy in combination treatments, and expanding physician preference for immunomodulatory drug regimens in first-line and maintenance therapy

Report Scope and Thalidomide Market Segmentation

|

Attributes |

Thalidomide Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Thalidomide Market Trends

Expanding Role of Immunomodulatory Therapies in Oncology and Leprosy Management

- A significant and accelerating trend in the global thalidomide market is the expanding clinical utilization of immunomodulatory therapies in treating multiple myeloma and erythema nodosum leprosum, driven by rising diagnostic rates and increasing emphasis on targeted treatment regimens across global healthcare systems

- For instance, Celgene’s thalidomide-based regimens continue to be adopted in oncology centers due to their proven efficacy in combination therapies for multiple myeloma and supportive care protocols in hematologic malignancies

- AI-assisted clinical monitoring platforms are increasingly being used to optimize treatment outcomes, enabling oncologists to track patient responses, adjust dosing schedules, and identify early signs of adverse reactions, supporting safer long-term thalidomide therapy

- The integration of digital health tools into oncology workflows facilitates centralized patient monitoring, allowing clinicians to manage treatment adherence, toxicity profiles, and outcomes through unified platforms that support evidence-based decision-making

- This trend toward digitally supported, precise, and immunomodulatory-driven cancer care is reshaping clinical expectations for treatment personalization and patient management in multiple myeloma. Consequently, companies involved in hematology drug development are advancing research into next-generation IMiDs to complement thalidomide’s established therapeutic profile

- The demand for thalidomide-based therapies supported by improved clinical monitoring and targeted treatment pathways is growing rapidly across both developed and emerging markets, as healthcare providers prioritize effective and accessible oncology solutions

Thalidomide Market Dynamics

Driver

Growing Need Due to Rising Multiple Myeloma Prevalence and Immunomodulatory Treatment Adoption

- The increasing global prevalence of multiple myeloma, coupled with broader adoption of immunomodulatory drug therapies, is a significant driver supporting the rising demand for thalidomide

- For instance, in 2025, several oncology networks expanded access to thalidomide-inclusive combination regimens as part of multi-agent therapy, strengthening its relevance in frontline and maintenance treatment protocols

- As clinicians seek effective therapeutic options with manageable safety profiles, thalidomide offers proven benefits in reducing symptoms, delaying disease progression, and improving quality of life, positioning it as a cornerstone treatment in specific oncology pathways

- Furthermore, its ongoing use in managing erythema nodosum leprosum continues to support clinical demand in regions with persistent leprosy burdens, making thalidomide a critical medication in national disease management programs

- The convenience of oral dosing, relatively lower cost compared to newer IMiDs, and widespread availability in hospital pharmacies are key factors propelling adoption across both advanced and resource-limited healthcare settings. The trend toward evidence-backed combination therapies further contributes to market expansion

Restraint/Challenge

Skin Irritation Issues and Regulatory Compliance Hurdle

- Concerns surrounding severe side effects including teratogenic risks, neuropathy, and skin reactions pose significant challenges to wider market penetration and require stringent safety monitoring throughout treatment

- For instance, regulatory bodies have implemented strict risk evaluation and mitigation strategies (REMS) for thalidomide, making some clinicians hesitant due to administrative burden and potential treatment-associated complications

- Addressing these concerns through patient education, pregnancy prevention programs, and robust pharmacovigilance systems is crucial for maintaining safe therapeutic use, with manufacturers emphasizing controlled distribution pathways to ensure compliance

- In addition, the high regulatory scrutiny surrounding thalidomide’s prescribing and dispensing protocols can limit accessibility, particularly in regions with underdeveloped compliance infrastructures or limited monitoring resources

- While programs are improving globally, the perception of risk and intensive regulatory requirements can still hinder adoption, especially in markets prioritizing newer agents with fewer safety restrictions

- Overcoming these barriers through enhanced monitoring technologies, clinician training, and streamlined regulatory frameworks will be vital for sustained market growth

Thalidomide Market Scope

The market is segmented on the basis of type, application, demographic, dosage form, route of administration, end-users, and distribution channel.

- By Type

On the basis of type, the global thalidomide market is segmented into 50 mg, 100 mg, 150 mg, and 200 mg. The 100 mg segment dominated the market in 2025, driven by its status as the commonly prescribed strength for multiple myeloma regimens and for managing erythema nodosum leprosum (ENL). Clinicians frequently favor the 100 mg dose because it balances efficacy and tolerability in adult oncology protocols, simplifying prescribing and inventory management in hospitals. Institutional formularies and treatment guidelines in many regions list 100 mg as the standard starting or maintenance dose, reinforcing its market share. For instance, combination therapy protocols often specify 100 mg as a component dose, increasing its uptake in combination drug supply chains. Patient adherence is higher with a single, standardized strength versus multiple fractionalized doses, supporting broad clinical adoption. Regulatory approvals and manufacturer focus on 100 mg presentations also ensure wide availability across markets, further cementing dominance.

The 50 mg segment is expected to be the fastest growing, propelled by dose-optimization strategies, geriatric dosing needs, and use in maintenance or low-dose regimens where lower toxicity is required. Lower strength tablets/capsules enable fine-tuning of therapy for patients experiencing adverse effects, making 50 mg preferable in titration schemes. Pediatric and frail patient populations benefit from smaller increment dosing, spurring demand for 50 mg presentations in specialized centers. For instance, clinicians managing tolerance issues in combination therapies often reduce to 50 mg rather than halting therapy, increasing real-world use. Manufacturers are responding with dedicated 50 mg formulations and blister packs tailored for titration, improving market penetration. Growing awareness of patient-centric dosing and personalized oncology regimens will continue to support the rapid growth of 50 mg products.

- By Application

On the basis of application, the market is segmented into multiple myeloma, erythema nodosum leprosum (ENL), graft vs. host disease (GvHD), renal cell carcinoma, glioblastoma multiforme, and others. The Multiple Myeloma segment dominated in 2025 with a market share of 72.1%, reflecting thalidomide’s entrenched role as an immunomodulatory agent in frontline and maintenance regimens and its inclusion in many combination therapies. Its antineoplastic and antiangiogenic properties have led to sustained use by hematologists as part of standard-of-care protocols, driving consistent demand from oncology centers. Reimbursement pathways in many developed markets favor established multiple myeloma regimens, supporting predictable procurement and inventory at hospitals. For instance, thalidomide-based combinations remain part of treatment algorithms where lenalidomide or pomalidomide access is limited, preserving market share. Longitudinal clinical evidence and guideline endorsements underpin physician confidence and sustained prescribing. The high prevalence and aging population in several key geographies also contribute to a robust patient base requiring chronic therapy.

The Graft vs. Host Disease (GvHD) application is expected to be the fastest growing, driven by expanding clinical research and off-label usage where immunomodulatory control of chronic GvHD shows promise. Growing interest in repurposing thalidomide for steroid-refractory GvHD and other immune-mediated complications has raised clinician awareness and trial activity. For instance, investigators and transplant centers exploring alternatives to prolonged high-dose steroids increasingly consider thalidomide for its immune-modulating effects, leading to incremental uptake. Improved supportive care and transplant survivorship increase the pool of patients with chronic GvHD who may benefit from adjunct therapies. Regulatory flexibility for off-label oncology use in some regions accelerates real-world adoption while ongoing studies aim to formalize indications. As evidence accumulates, formulary inclusion for GvHD will such asly expand, driving strong CAGR for this application.

- By Demographic

On the basis of demographic, the market is segmented into children and adults. The Adults segment dominated the market in 2025, reflecting the higher incidence of target conditions such as multiple myeloma and many solid tumors in adult and elderly populations. Adult oncology and dermatology clinics account for the bulk of prescriptions, and adult dosing regimens are well-established across treatment guidelines. For instance, the typical patient profile for thalidomide therapy—older adults with hematologic malignancies or ENL—results in larger adult patient volumes and predictable demand at hospital pharmacies. Market access, reimbursement, and clinical trial focus for adult indications further concentrate sales in this demographic. In addition, adult patients are more frequently managed in settings (hospitals, specialty centers) that procure larger volumes, supporting scale and supply stability.

The Children segment is expected to be the fastest growing from a percentage perspective, driven by expanding pediatric research, dose-formulation adaptations, and increasing attention to pediatric manifestations of ENL and selected off-label uses. Pediatric oncology and infectious disease centers are increasingly studying safe, lower-dose regimens and specialized formulations to make therapy feasible for younger patients. For instance, protocol-driven dose reductions and pediatric compassionate use programs are creating demand for child-appropriate strengths and packaging. Improved diagnostics and earlier identification of conditions in children in emerging markets also contribute to rising pediatric treatment numbers. Manufacturers developing smaller-dose presentations, pediatric labeling, or compounding guidance will accelerate uptake in this cohort.

- By Dosage Form

On the basis of dosage, the market is segmented into capsule, tablet, and others. The Capsule segment dominated the market in 2025, as thalidomide has traditionally been manufactured and supplied in capsule form which facilitates dose uniformity, stability, and ease of swallowing for adult patients. Capsules are widely accepted in hospital formularies and community pharmacies, and many legacy manufacturing lines are optimized for capsule production, keeping costs predictable. For instance, capsules allow clear strength differentiation (50 mg, 100 mg) and minimize dosing errors, supporting clinician preference. The well-understood pharmacokinetic profile of capsule formulations underpins their continued dominance in established treatment protocols. Supply chains, packaging, and prescribing habits centered on capsules further entrench their market position.

The Others segment (e.g., novel oral dispersible forms, liquid formulations, or compounded pediatric preparations) is anticipated to be the fastest growing as manufacturers and compounding pharmacies explore patient-centric formats to improve adherence and pediatric/geriatric usability. Demand for alternative forms rises where swallowing difficulty, dose titration, or pediatric dosing is a concern. For instance, oral dispersible or liquid options enable accurate dosing adjustments for children or patients with dysphagia and open new outpatient use cases. Continued R&D into bioequivalent alternative forms and regulatory approvals for novel oral presentations will accelerate this segment’s growth. Market entrants focusing on convenience and adherence solutions will help shift some share away from traditional capsules over time.

- By Route of Administration

On the basis of route, the market is segmented into oral and others. The Oral route dominated in 2025, as thalidomide’s pharmacology, safety monitoring processes, and established clinical protocols are built around oral administration, which is convenient for chronic outpatient therapy. Oral dosing aligns with home-based maintenance regimens, allowing patients to continue treatment outside inpatient settings and reducing hospital resource burden. For instance, the majority of multiple myeloma and ENL regimens prescribe daily oral dosing, reinforcing distribution through retail and hospital pharmacies. Oral administration also simplifies pharmacovigilance programs and risk management plans tied to teratogenicity controls. Manufacturing, packaging, and labeling systems are optimized for oral dosage forms, facilitating large-scale supply and inventory tracking.

The Others route (investigational or localized delivery approaches) is expected to be the fastest growing from a research and niche application standpoint, as investigators evaluate alternative administration methods to target local disease or modulate systemic exposure. For instance, topical or localized delivery approaches for dermatologic manifestations of ENL or formulations designed for investigational parenteral use in select oncologic protocols are under exploration. Although still niche, positive early-stage data or formulation breakthroughs could spur small but rapid uptake in specialized centers. Such innovations may also address tolerability or bioavailability challenges, creating new clinical niches over the forecast period.

- By End-Users

On the basis of end-users, the market is segmented into clinic, hospital, and others. The Hospital segment dominated in 2025, given that initiation, monitoring, and complex combination regimens for thalidomide are typically managed in hospital oncology and hematology departments with structured pharmacovigilance and pregnancy risk management programs. Hospitals maintain larger inventories, handle bulk procurement, and manage inpatient starts of therapy, which concentrates sales within hospital channels. For instance, adverse-event monitoring and multidisciplinary care for multiple myeloma patients are primarily hospital-based, reinforcing hospitals as the main end-user. Hospital formularies and tender processes also favor established suppliers and standardized strengths, solidifying hospital share. In addition, hospitals are pivotal for dispensing starter packs and counseling on teratogenicity precautions, functions less feasible in small clinics.

The Clinic segment (including specialty hematology/oncology and dermatology clinics) is expected to be the fastest growing end-user category as outpatient care expands and more treatments are shifted from inpatient to ambulatory settings. Clinics offering long-term follow-up and maintenance therapy are increasingly authorized to manage thalidomide prescriptions under robust risk-management frameworks. For instance, the growth of community oncology networks and hospital-affiliated clinics enables decentralized initiation and monitoring of stable patients, driving clinic demand. Improvements in telemedicine and home monitoring also support safe outpatient management, increasing clinic dispensing and prescribing volumes. As care models evolve to reduce hospital stays, clinic uptake will accelerate.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The Hospital Pharmacy channel dominated in 2025, reflecting the controlled distribution necessary for a drug with strict risk-management and teratogenicity mitigation requirements; hospitals are primary procurement points for inpatient initiation and monitored outpatient programs. Tight registry and certification programs often route initial dispensations through hospital pharmacies to ensure counseling and compliance with safety checklists. For instance, hospital pharmacies commonly coordinate enrollment into pregnancy prevention programs and dispense initial treatment cycles under supervision. Institutional purchasing agreements and tender systems also drive volume through hospital channels, maintaining their market leadership. The infrastructure for patient education and monitoring embedded in hospital pharmacies supports continued dominance.

The Online Pharmacy channel is expected to be the fastest growing, fueled by expanding e-commerce adoption, improved home delivery logistics, and telemedicine-linked prescribing for stable, monitored patients in certain markets. Increasing comfort with online prescription fulfillment, combined with verified certification requirements built into digital platforms, enables secure and convenient refills for long-term therapies. For instance, certified online pharmacies that integrate registry checks and mandatory counseling can facilitate safer remote dispensing while improving patient adherence. Marketplaces focusing on specialty medications are investing in compliance workflows, which reduces friction for remote patients. As regulatory frameworks adapt and digital health integration improves, online pharmacy growth will outpace traditional channels in percentage terms.

Thalidomide Market Regional Analysis

- North America dominated the global thalidomide market with the largest revenue share of 38.7% in 2025, supported by advanced oncology treatment infrastructure, strong reimbursement frameworks, and the high incidence of multiple myeloma in the U.S., alongside active participation of leading pharmaceutical manufacturers specializing in hematologic therapies

- Patients and providers in the region highly value the proven clinical efficacy, established treatment protocols, and continued integration of thalidomide into combination regimens for hematologic and inflammatory conditions

- This widespread adoption is further supported by favorable reimbursement systems, strong presence of leading pharmaceutical companies, and growing demand for effective oncology and leprosy-related treatments, establishing thalidomide as a critical therapeutic option across clinical settings

U.S. Thalidomide Market Insight

The U.S. thalidomide market captured the largest revenue share within North America in 2025, fueled by the rising prevalence of multiple myeloma and the expanding adoption of immunomodulatory therapies. Healthcare providers are increasingly prioritizing advanced and combination-based treatment regimens that include thalidomide for improved therapeutic outcomes. The growing reliance on specialty oncology care, combined with strong demand for effective ENL management within targeted populations, further propels the thalidomide industry. Moreover, the increasing integration of thalidomide into standardized clinical guidelines and expanded insurance coverage is significantly contributing to the market’s expansion.

Europe Thalidomide Market Insight

The Europe thalidomide market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by robust oncology infrastructure and the escalating need for effective therapies for multiple myeloma and leprosy-related complications. The rise in cancer diagnosis rates, coupled with the demand for advanced immunomodulatory drugs, is fostering the adoption of thalidomide. European healthcare systems also emphasize treatment accessibility and structured reimbursement pathways. The region is experiencing significant growth across hospital, clinical, and specialty pharmacy channels, with thalidomide being incorporated into both established care protocols and evolving therapeutic regimens.

U.K. Thalidomide Market Insight

The U.K. thalidomide market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing burden of hematologic cancers and the rising adoption of immunomodulatory drugs across oncology centers. In addition, growing clinical emphasis on improved patient outcomes is encouraging healthcare providers to incorporate thalidomide into personalized treatment strategies. The U.K.’s advanced healthcare infrastructure, alongside its strong specialty pharmaceutical distribution network, is expected to continue stimulating market growth.

Germany Thalidomide Market Insight

The Germany thalidomide market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing demand for advanced cancer therapies and the country’s emphasis on evidence-based treatment regimens. Germany’s well-developed healthcare system, combined with its focus on precision medicine and research-driven oncology care, promotes the adoption of thalidomide, particularly for multiple myeloma. The integration of thalidomide into combination therapies is also becoming increasingly prevalent, with a strong preference for safe, effective, and regulated pharmaceutical solutions aligning with local clinical standards.

Asia-Pacific Thalidomide Market Insight

The Asia-Pacific thalidomide market is poised to grow at the fastest CAGR during the forecast period, driven by increasing diagnosis of multiple myeloma, rising healthcare expenditure, and expanding access to specialty treatments in countries such as China, Japan, and India. The region’s growing emphasis on early cancer detection and improved management of leprosy-related complications is accelerating thalidomide adoption. As APAC emerges as a significant manufacturing and distribution hub for oncology and immunology drugs, the affordability and availability of thalidomide are expanding to a wider patient population.

Japan Thalidomide Market Insight

The Japan thalidomide market is gaining momentum due to the country’s strong focus on advanced oncology care, rapid adoption of immunomodulatory therapies, and demand for high-efficacy treatment options. The Japanese market places a significant emphasis on precision medicine, and the use of thalidomide is driven by its proven effectiveness in multiple myeloma regimens. The integration of thalidomide into hospital-based cancer programs is fueling growth. Moreover, Japan’s aging population is such asly to spur demand for effective hematologic cancer treatments across both public and private healthcare sectors.

India Thalidomide Market Insight

The India thalidomide market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country’s high prevalence of ENL, growing cancer burden, and improving access to essential medicines. India stands as one of the largest markets for immunomodulatory therapies, and thalidomide is becoming increasingly central in both oncology and leprosy management programs. The push toward accessible cancer care, expanding hospital infrastructure, and availability of cost-effective generic formulations, alongside strong domestic pharmaceutical manufacturing, are key factors propelling the market in India.

Thalidomide Market Share

The Thalidomide industry is primarily led by well-established companies, including:

- Grünenthal GmbH (Germany)

- Bristol-Myers Squibb Company (U.S.)

- Natco Pharma Ltd (India)

- Dr. Reddy's Laboratories Ltd (India)

- Hetero Labs Ltd (India)

- Glenmark Pharmaceuticals Ltd (India)

- Cipla (India)

- Shilpa Medicare Ltd (India)

- Laurus Labs Ltd (India)

- Sun Pharmaceutical Industries Ltd (India)

- Emcure Pharmaceuticals Ltd (India)

- Intas Pharmaceuticals Ltd (India)

- Zydus (India)

- Alembic Pharmaceuticals Ltd (India)

- Torrent Pharmaceuticals Ltd (India)

- Viatris Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd (Israel)

- Changzhou Pharmaceutical Factory (China)

- Sami-Sabinsa Group (India)

What are the Recent Developments in Global Thalidomide Market?

- In July 2024, the Irish government issued a formal apology to survivors of the thalidomide tragedy, acknowledging decades of suffering and systemic oversight. Alongside the apology, Ireland announced expanded support schemes including long-term healthcare access, social assistance, and rehabilitative services for affected individuals and families

- In November 2023, the Australian government issued a historic national apology to thalidomide survivors, formally recognizing the long-standing physical, emotional, and social impacts caused by the drug more than six decades ago. The apology was accompanied by renewed commitments to expand financial, healthcare, and community support programs

- In November 2023, new clinical findings presented in Blood highlighted that low-dose thalidomide demonstrated comparable therapeutic efficacy to standard doses in reducing transfusion requirements for patients with hematologic disorders. The study emphasized improved patient tolerability and reduced adverse events, offering physicians a potentially safer dosing strategy

- In August 2023, a long-term follow-up analysis published in Scientific Reports (Nature) confirmed that thalidomide significantly improved hemoglobin levels and decreased transfusion dependence in patients with transfusion-dependent β-thalassemia (TDT). The study showed sustained clinical benefits and acceptable safety, further supporting the drug’s therapeutic viability in certain global regions where TDT remains highly prevalent.

- In March 2023, the U.S. FDA approved an official update to the Thalomid (thalidomide) REMS program following the transfer of application ownership from Celgene Corporation to Bristol Myers Squibb. The update included administrative revisions and continuity measures ensuring that strict safety protocols for prescribing, dispensing, and monitoring thalidomide especially regarding teratogenic risk remain fully intact

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.