Global Thermoplastic Polyurethane Paint Protection Film Market

Market Size in USD Million

CAGR :

%

USD

221.08 Million

USD

368.65 Million

2024

2032

USD

221.08 Million

USD

368.65 Million

2024

2032

| 2025 –2032 | |

| USD 221.08 Million | |

| USD 368.65 Million | |

|

|

|

|

What is the Global Thermoplastic Polyurethane Paint Protection Film Market Size and Growth Rate?

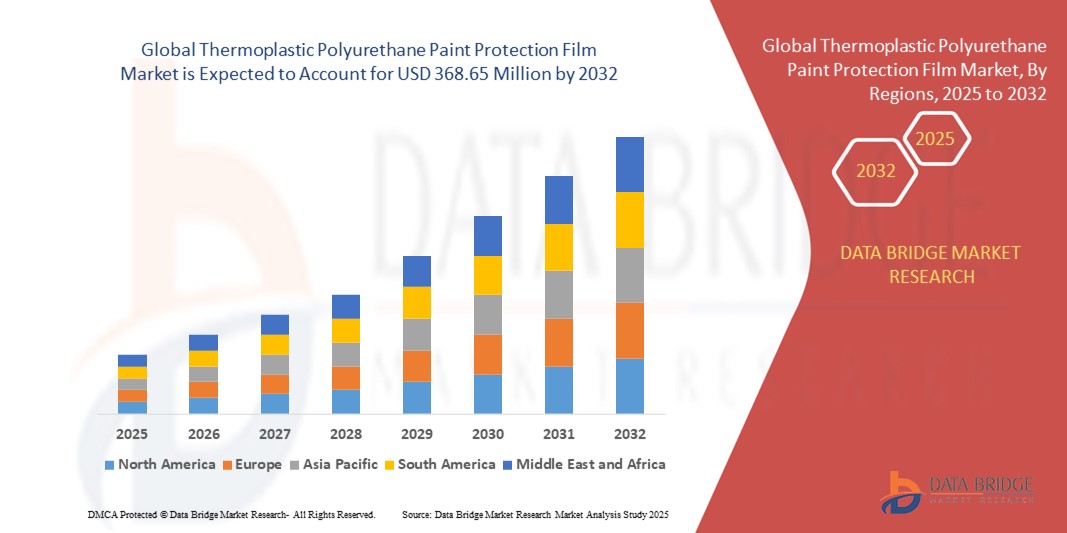

- The global thermoplastic polyurethane paint protection film market size was valued at USD 221.08 million in 2024 and is expected to reach USD 368.65 million by 2032, at a CAGR of 6.60% during the forecast period

- The global thermoplastic polyurethane paint protection film (TPU PPF) market is a segment within the broader automotive protective films industry. The automotive industry is a major consumer of TPU PPF, driven by the increasing production of vehicles globally

- The growing demand for automobiles, particularly high-end and luxury vehicles, is fueling the adoption of TPU PPF to protect vehicle surfaces from scratches, stone chips, and environmental damage

- With consumers becoming more conscious about preserving the appearance and value of their vehicles, the demand for paint protection films is on the rise. TPU PPF offers superior protection compared to traditional coatings, driving its adoption in both the automotive aftermarket and original equipment manufacturer (OEM) sectors

What are the Major Takeaways of Thermoplastic Polyurethane Paint Protection Film Market?

- The growing sales of automobiles, including passenger cars, commercial vehicles, and luxury vehicles, drive the demand for paint protection films globally. Consumers are increasingly investing in PPF to preserve the appearance and value of their vehicles

- The automotive industry is experiencing steady growth globally, driven by factors such as urbanization, rising disposable incomes, and improving economic conditions in emerging markets. For many consumers, purchasing a vehicle represents a significant investment. As such, they are motivated to protect their investment and maintain the resale value of their vehicles over time. Consumers recognize the long-term benefits of investing in paint PPF

- By applying PPF to their vehicles, they can prolong the life of the paintwork, reduce the need for costly repairs, and enhance the overall aesthetic appeal of their vehicles. This perceived value proposition encourages consumers to opt for PPF particularly when purchasing new or high-value vehicles

- North America dominated the thermoplastic polyurethane paint protection film (TPU PPF) market with the largest revenue share of 39.4% in 2024, driven by high automotive ownership rates, increasing demand for vehicle aesthetics, and strong consumer spending on premium protection solutions

- Asia-Pacific is projected to witness the fastest CAGR of 14.8% from 2025 to 2032, propelled by rising vehicle ownership, growing middle-class income, and booming consumer electronics markets

- The Automotive segment dominated the market with the largest revenue share of 41.2% in 2024. This growth is driven by increasing consumer preference for vehicle aesthetics, paint protection, and the rising penetration of luxury and sports vehicles globally

Report Scope and Thermoplastic Polyurethane Paint Protection Film Market Segmentation

|

Attributes |

Thermoplastic Polyurethane Paint Protection Film Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Thermoplastic Polyurethane Paint Protection Film Market?

Shift Towards High-Performance, Self-Healing and Eco-Friendly Films

- A leading trend in the thermoplastic polyurethane paint protection film (TPU PPF) market is the transition toward advanced self-healing films that offer durability, clarity, and environmental safety, aligning with automotive OEMs’ demand for high-performance and sustainable surface protection

- Modern TPU PPFs are increasingly being engineered with self-healing topcoats that can repair minor scratches through heat exposure, improving vehicle aesthetics and reducing maintenance costs. These coatings are typically solvent-free, reducing VOC emissions

- For instance, Eastman Chemical Company offers its SunTek Reaction series, a premium self-healing TPU film with hydroresist and anti-yellowing properties, targeting luxury vehicle segments across North America and Europe

- Manufacturers are also integrating biobased and recyclable TPU formulations, contributing to circular economy goals while maintaining performance benchmarks in impact resistance, flexibility, and UV stability

- This evolution towards self-healing and sustainable TPU films is expected to drive significant market expansion, particularly in luxury automotive, aviation, and electronics industries that prioritize surface protection and green materials

What are the Key Drivers of Thermoplastic Polyurethane Paint Protection Film Market?

- Growing consumer preference for vehicle aesthetics, combined with rising automotive paint protection awareness, is a major growth driver. PPF offers long-term protection from UV, stone chips, and chemical contaminants, enhancing resale value and surface life

- Automakers are increasingly adopting TPU PPF as a factory-installed option, especially in premium vehicle models. For instance, XPEL Inc. has partnered with several OEMs to deliver pre-cut protection kits customized for specific models

- Expansion of the automotive detailing industry, especially in emerging economies such as India and Southeast Asia, is creating strong aftermarket demand for TPU-based films due to their durability, clarity, and ease of installation

- Furthermore, environmental compliance pressures are steering manufacturers away from PVC-based films toward more eco-friendly TPU alternatives, supporting global sustainability goals

- TPU PPFs are also gaining traction beyond automobiles, with applications in electronics, consumer goods, and industrial surfaces, driven by the need for high-performance, transparent, and protective coatings

Which Factor is challenging the Growth of the Thermoplastic Polyurethane Paint Protection Film Market?

- The high production cost and installation complexity of TPU-based PPF remain key barriers to mass adoption, particularly in mid-range vehicles and price-sensitive markets

- Costs are driven by advanced materials, precision engineering, and the need for skilled labor to apply films without wrinkles or bubbles. For instance, Garware Hi-Tech Films Ltd. highlights the necessity of trained professionals and specialized tools to ensure defect-free application

- In addition, TPU films are prone to discoloration under prolonged UV exposure if not properly formulated, which can affect product life and customer satisfaction in tropical climates

- Another challenge is the limited awareness among consumers outside luxury car segments, who may not recognize the value proposition or consider PPF a priority in vehicle maintenance

- To address these hurdles, manufacturers are working on cost optimization, pre-cut installation kits, and UV-stable film formulations that enhance accessibility and long-term performance

- Ongoing investments in R&D and OEM integration strategies will be critical in overcoming these obstacles and unlocking scalable growth opportunities in the TPU paint protection film market

How is the Thermoplastic Polyurethane Paint Protection Film Market Segmented?

The market is segmented on the basis of end-use industry.

- By End-Use Industry

On the basis of end-use industry, the thermoplastic polyurethane paint protection film (TPU PPF) market is segmented into Automotive, Electronics, Construction, and Others. The Automotive segment dominated the market with the largest revenue share of 41.2% in 2024. This growth is driven by increasing consumer preference for vehicle aesthetics, paint protection, and the rising penetration of luxury and sports vehicles globally. Thermoplastic polyurethane films offer superior protection against scratches, stains, and harsh weather conditions, making them an ideal solution for automotive paint surface protection.

The Electronics segment is anticipated to witness the fastest CAGR during the forecast period (2025–2032), fueled by the demand for scratch-resistant and flexible films in smartphones, tablets, and wearables. The film's clarity, flexibility, and self-healing properties are making it popular for screen protection and casing applications.

Which Region Holds the Largest Share of the Thermoplastic Polyurethane Paint Protection Film Market?

- North America dominated the thermoplastic polyurethane paint protection film (TPU PPF) market with the largest revenue share of 39.4% in 2024, driven by high automotive ownership rates, increasing demand for vehicle aesthetics, and strong consumer spending on premium protection solutions

- The region’s well-established automotive aftermarket, growing preference for DIY installations, and widespread use of PPF in luxury vehicles are major growth enablers

- Presence of leading film manufacturers, rising adoption in electronics and aerospace, and robust distribution networks further support North America’s leadership position in the global TPU PPF market

U.S. Thermoplastic Polyurethane Paint Protection Film Market Insight

The U.S. held the largest share in North America in 2024, attributed to its thriving automotive customization culture, high penetration of electric vehicles, and strong aftermarket services. Growing consumer awareness about long-term paint protection and rising use of self-healing films in personal and commercial vehicles are key market drivers. OEM partnerships and innovation in matte and high-gloss finishes are also fueling demand.

Canada Thermoplastic Polyurethane Paint Protection Film Market Insight

The Canadian market is growing steadily, supported by rising new vehicle registrations and growing demand for high-performance surface protection in harsh weather conditions. TPU PPF’s durability and UV resistance are making it increasingly popular for both automotive and recreational applications. In addition, eco-conscious consumer behavior and government support for sustainable technologies are encouraging product uptake.

Mexico Thermoplastic Polyurethane Paint Protection Film Market Insight

Mexico is emerging as a promising market due to expanding automotive production and exports. The presence of major automotive OEMs and the growth of local detailing businesses are driving adoption of TPU PPF. Strategic trade ties with the U.S. and access to affordable skilled labor are attracting international brands to establish local manufacturing and distribution bases.

Which Region is the Fastest Growing in the Thermoplastic Polyurethane Paint Protection Film Market?

Asia-Pacific is projected to witness the fastest CAGR of 14.8% from 2025 to 2032, propelled by rising vehicle ownership, growing middle-class income, and booming consumer electronics markets. Rapid urbanization and increasing adoption of premium vehicle care services across China, India, Japan, and Southeast Asia are driving TPU PPF demand. Advancements in PPF manufacturing technologies and increasing online availability of automotive protective films are fueling widespread market expansion.

China Thermoplastic Polyurethane Paint Protection Film Market Insight

China held the largest share in Asia-Pacific in 2024, supported by a massive automotive base and consumer inclination toward luxury vehicle detailing. Strong e-commerce penetration, domestic film innovations, and increased spending on car aesthetics are fueling market growth. Favorable policies to support local manufacturing and technological upgrades also enhance China’s position.

Japan Thermoplastic Polyurethane Paint Protection Film Market Insight

Japan’s TPU PPF market is growing due to its focus on precision engineering and premium automotive care. The country’s advanced R&D infrastructure and strong consumer preference for high-quality, long-lasting materials are supporting adoption. Use in electronic displays and smart devices is also expanding due to the film's flexibility and clarity.

India Thermoplastic Polyurethane Paint Protection Film Market Insight

India is witnessing rapid growth in TPU PPF demand, driven by increased awareness of paint protection, urban lifestyle upgrades, and a surge in automobile sales. Government initiatives supporting local auto manufacturing, rising demand for imported luxury cars, and the emergence of detailing studios across Tier 1 and Tier 2 cities are expanding market presence.

Which are the Top Companies in Thermoplastic Polyurethane Paint Protection Film Market?

The thermoplastic polyurethane paint protection film industry is primarily led by well-established companies, including:

- 3M (U.S.)

- XPEL, Inc. (U.S.)

- SWM (Schweitzer-Mauduit International) (U.S.)

- Eastman Chemical Company (U.S.)

- AVERY DENNISON CORPORATION (U.S.)

- Saint-Gobain S.A. (France)

- RENOLIT SE (Germany)

- Ziebart International Corporation (U.S.)

- HEXIS S.A.S (France)

- Garware Hi - Tech Films Ltd. (India)

What are the Recent Developments in Global Thermoplastic Polyurethane Paint Protection Film Market?

- In May 2023, Covestro AG, headquartered in Germany, inaugurated a new production line in Taiwan focused on producing high-performance TPU for paint protection film applications. The company also launched Desmopan UP TPU, a new product series aimed at automotive and wind energy sectors. This development strengthens Covestro’s innovation leadership and global production capabilities in the TPU segment

- In October 2022, XPEL, Inc. completed the acquisition of the paint protection film division of Car Care Products Australia. This strategic move leverages the latter’s established distribution network to deepen XPEL’s footprint in the Australian market. The acquisition is expected to accelerate XPEL’s market expansion in the Asia-Pacific region

- In July 2022, SWM, Inc. and Neenah, Inc. announced the formation of Mativ Holdings, Inc., a merger aimed at enhancing global reach and distribution efficiency. Despite the merger, both firms continue operating through their respective platforms. This move is expected to create broader market access and drive synergy across their specialty materials businesses

- In February 2022, XPEL, Inc. launched ULTIMATE FUSION, a new-generation paint protection film that shields against light scratches, bug acids, bird droppings, and rock chips. The product was made available worldwide by Q2 2022. This launch reinforces XPEL’s commitment to high-performance protective solutions with global reach

- In November 2021, XPEL, Inc. acquired invisiFRAME, Ltd, a specialist in designing paint protection film patterns for bicycles. The acquisition enables XPEL to further diversify into non-automotive sectors. This strategic addition helps broaden XPEL’s consumer base and market offerings beyond the automotive segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Thermoplastic Polyurethane Paint Protection Film Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Thermoplastic Polyurethane Paint Protection Film Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Thermoplastic Polyurethane Paint Protection Film Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.