Global Tire Cord Market

Market Size in USD Billion

CAGR :

%

USD

7.76 Billion

USD

13.53 Billion

2021

2029

USD

7.76 Billion

USD

13.53 Billion

2021

2029

| 2022 –2029 | |

| USD 7.76 Billion | |

| USD 13.53 Billion | |

|

|

|

|

Market Analysis and Size

Tire cord is essential for providing strong support to rubber tires. Tire cord provides support and aids in the preservation of the tire's shape. It absorbs the overall weight of a vehicle and provides elongation and absorption performance. Tire cords are substantial structural components of a tire.

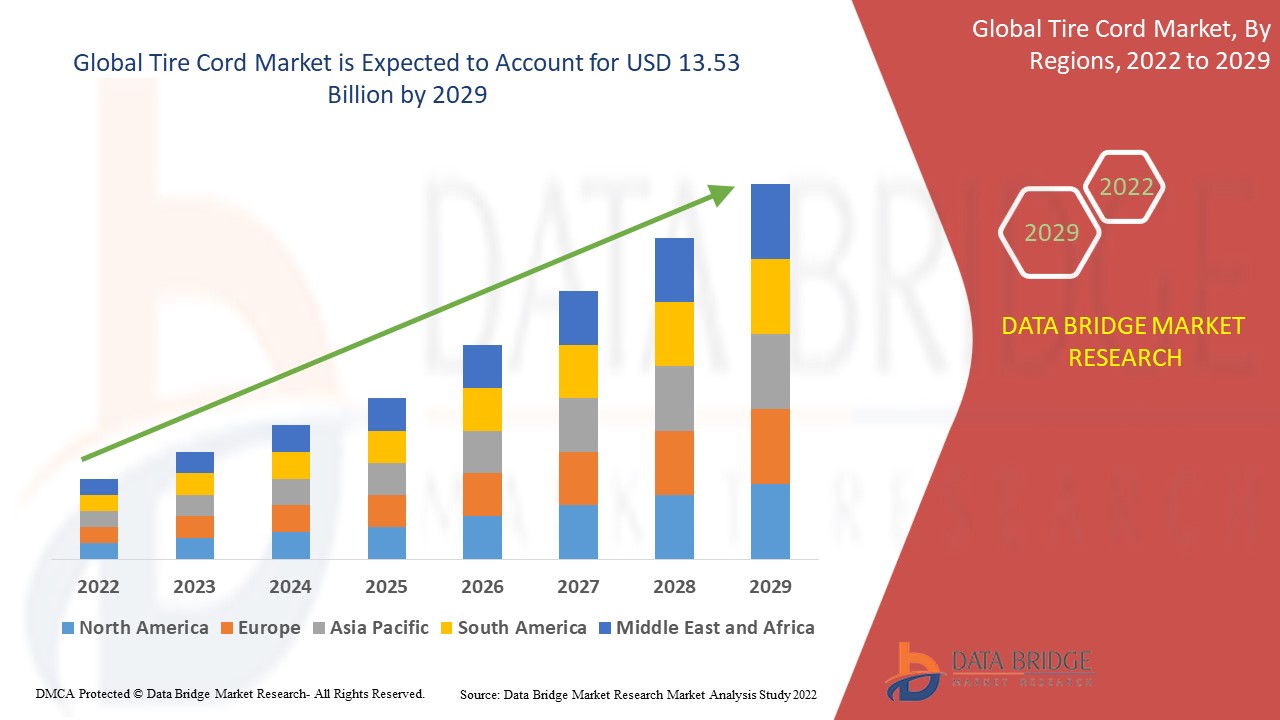

Data Bridge Market Research analyses that the tire cord market was valued at USD 7.76 billion in 2021 and is expected to reach the value of USD 13.53 billion by 2029, at a CAGR of 7.20% during the forecast period of 2022 to 2029.

Market Definition

Tire cord is a type of fabric made from high-quality fabric yarn. It has high tensile strength, abrasion resistance, and controlled deformations. Steel polyester, nylon, and rayon chords are the most common types of tire cord. Tire chords are made using a variety of processes such as yarn twisting, dipping, and weaving. During on-road performance, tire cord provides impact resistance from extreme pressure, weight, and force.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Material (Steel Cord, Polyester, Nylon, Rayon, Aramid, Others), Tire Type (Radial Tire, Biased Tire), Application (Aerospace, Passenger Cars, Light Commercial Vehicles, Heavy Duty Vehicles, Two Wheelers, Tractors, Others) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa |

|

Market Players Covered |

WABCO (Belgium), EnPro Industries (US), MICHELIN (France), The Goodyear Tire & Rubber Company (US), Dana Incorporated (US), SAF-HOLLAND (Luxembourg), IDEX Corporation (US), The Boler Company (US), PERIA TECHNOLOGIES, INC. (US), Bridgestone Corporation (Japan), Continental AG (Germany), Meritor, Inc. (US), CODA Development (US), Hendrickson USA, L.L.C. (US), Pirelli and C. S.p.A. (Italy), STEMCO Products Inc. (US), Hankook Tire (South Korea), Pressure Systems International, Inc. (US), DENSO CORPORATION (Japan), Haltec Corporation (US), Michelin North America Inc. (US), ti.systems GmbH (Germany), and PressureGuard (US) |

|

Opportunities |

|

Global Tire Cord Market Dynamics

Drivers

- Growing demand from the automotive sector

For safe and secure travel, the automotive industry is heavily reliant on tires and tire products. This is expected to drive tire cord demand during the forecast period. Tire cords improve vehicle performance and fuel consumption by absorbing a greater amount of weight and pressure for a longer period of time. Tire cord is an important part of vehicle performance because it improves fuel efficiency. The global demand for fuel-efficient vehicles is expected to boost the global tire cords market. The rising popularity of electric vehicles, luxury and premium vehicles, and self-driving cars in the automotive industry is expected to boost the tire cord market during the forecast period.

- The growing emphasis on reducing greenhouse gas emissions

Tire cord fabrics are primarily used in the tire manufacturing process as a reinforcing material to provide controlled deformation, high strength, and abrasion resistance properties to the end product. These fabrics are also used in the manufacture of rubber hose, air springs, expansion joints, and conveyor belts, among other things. Growing emphasis on reducing greenhouse gas emissions, as well as rising demand for economical fuel-efficient vehicles, are some of the factors expected to drive market growth over the forecast period.

Opportunity

The increasing penetration of electric vehicles is expected to boost demand. Traditional tires on electric vehicles (EV) wear out about 30% faster than conventional tires. As a result, aramid fibres are being used by manufacturers to create extremely lightweight and wear-resistant tires for the electric vehicle industry. The nylon tire cord fabric is dominating the U.S. market. Widespread product utilisation in the production of lightweight, wear-resistant tires for passenger cars, SUVs, trucks, and aircraft is expected to be the primary factor driving growth in the coming years.

Restraints

Fluctuating raw material prices, as well as increased competition among players, are expected to stymie the growth of the tire cord market during the forecast period. Over the forecast period, the preference for re-treading in the commercial vehicle segment is expected to have a negative impact on market growth.

This tire cord market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the Tire Cord market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Tire Cord Market

The global economy has been severely harmed by the coronavirus pandemic. The COVID-19 pandemic has had a negative impact on demand for all types of vehicles. As a result, the demand for tire cords has declined. However, demand for automobiles has gradually returned to normalcy following the lockdowns. This is expected to boost tire cord sales during the forecast period.

Recent Development

- Indorama Ventures Company Limited (IVL) purchased Kordarna Plus S.A. in October 2020. The acquisition will allow the companies to broaden their product portfolio and strengthen their market position.

- Indorama Ventures Company Limited (IVL) purchased the tire cord and single-end cord businesses of Glanzstoff Group (Netherlands) in June 2019. The acquisition will allow the company to strengthen its position in the auto segment's rayon, nylon 6.6, and polyester businesses.

- Indorama Ventures Company Limited (IVL) expanded its tire cord manufacturing line at its Performance Fibers facility in Kaiping, Guangdong Province, China, in January 2021. The company's presence in the high-value-added automotive safety market will be strengthened as a result of the expansion.

Global Tire Cord Market Scope

The tire cord market is segmented on the basis of material, tire type and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Material

- Steel Cord

- Polyester

- Nylon

- Rayon

- Aramid

- Others

Tire Type

- Radial tire

- Biased tire

Application

- Aerospace

- Passenger Cars

- Light Commercial Vehicles

- Heavy Duty Vehicles

- Two Wheelers

- Tractors

- Others

- 3 wheelers

- Mining machinery

Tire Cord Market Regional Analysis/Insights

The tire cord market is analysed and market size insights and trends are provided by country, material, tire type and application as referenced above.

The countries covered in the tire cord market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa.

Asia-Pacific consumes the most tire cords, followed by North America and Europe. Increased demand for automobiles in China, Japan, and South Korea is expected to boost demand for tire cords in Asia Pacific during the forecast period. Increased demand for electric vehicles and SUVs in the automotive industry in Asia Pacific developing economies such as China, India, and Indonesia is expected to provide lucrative opportunities for tire and tire cord manufacturers in the region. Because of the presence of well-established automotive suppliers and manufacturers in these regions, the market in North America and Europe is expected to expand at a moderate pace in the near future.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Tire Cord Market Share Analysis

The tire cord market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to tire cord market.

Some of the major players operating in the tire cord market are:

- WABCO (Belgium)

- EnPro Industries (US)

- MICHELIN. (France)

- The Goodyear Tire & Rubber Company (US)

- Dana Incorporated (US)

- SAF-HOLLAND (Luxembourg)

- IDEX Corporation (US)

- The Boler Company (US)

- PERIA TECHNOLOGIES, INC. (US)

- Bridgestone Corporation (Japan)

- Continental AG (Germany)

- Meritor, Inc. (US)

- CODA Development (US)

- Hendrickson USA, L.L.C. (US)

- Pirelli and C. S.p.A. (Italy)

- STEMCO Products Inc. (US)

- Hankook Tire (South Korea)

- Pressure Systems International, Inc. (US)

- DENSO CORPORATION (Japan)

- Haltec Corporation (US)

- Michelin North America Inc. (US)

- ti.systems GmbH (Germany)

- PressureGuard (US)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBALTIRE CORD MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBALTIRE CORD MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 GLOBALTIRE CORD MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PRODUCTION CONSUMPTION ANALYSIS

5.2 IMPORT EXPORT SCENARIO

5.3 RAW MATERIAL PRODUCTION COVERAGE

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 LIST OF KEY BUYERS, BY REGION

5.5.1 NORTH AMERICA

5.5.2 EUROPE

5.5.3 ASIA PACIFIC

5.5.4 SOUTH AMERICA

5.5.5 MIDDLE EAST & AFRICA

5.6 PORTER’S FIVE FORCES

5.7 VENDOR SELECTION CRITERIA

5.8 PESTEL ANALYSIS

5.9 REGULATION COVERAGE

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 CLIMATE CHANGE SCENARIO

7.1 ENVIRONMENTAL CONCERNS

7.2 INDUSTRY RESPONSE

7.3 GOVERNMENT’S ROLE

7.4 ANALYST RECOMMENDATIONS

8 GLOBAL TIRE CORD MARKET, BY RAW MATERIAL, 2020-2029, (USD MILLION) (KILO TONS)

8.1 OVERVIEW

8.2 NYLON

8.3 POLYESTER

8.4 RAYON

8.5 OTHERS

9 GLOBAL TIRE CORD MARKET, BY PRODUCT, 2020-2029, (USD MILLION) (KILO TONS)

9.1 OVERVIEW

9.2 RADIAL

9.3 BIAS

10 GLOBAL TIRE CORD MARKET, BY VEHICLE, 2020-2029, (USD MILLION) (KILO TONS)

10.1 OVERVIEW

10.2 PASSENGER CARS

10.2.1 HATCHBACK

10.2.2 SEDAN

10.2.3 SUV

10.2.4 MUV

10.3 COMMERCIAL VEHICLES

10.3.1 LIGHT COMMERCIAL VEHICLES

10.3.2 MEDIUM- AND HEAVY-DUTY COMMERCIAL VEHICLES

10.4 OTHERS

11 GLOBAL TIRE CORD MARKET, BY APPLICATION, 2020-2029, (USD MILLION) (KILO TONS)

11.1 OVERVIEW

11.2 OEM

11.3 REPLACEMENT

12 GLOBAL TIRE CORD MARKET, BY GEOGRAPHY, 2020-2029, (USD MILLION) (KILO TONS)

12.1 GLOBAL TIRE CORD MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.2 NORTH AMERICA

12.2.1 U.S.

12.2.2 CANADA

12.2.3 MEXICO

12.3 EUROPE

12.3.1 GERMANY

12.3.2 U.K.

12.3.3 ITALY

12.3.4 FRANCE

12.3.5 SPAIN

12.3.6 RUSSIA

12.3.7 SWITZERLAND

12.3.8 TURKEY

12.3.9 BELGIUM

12.3.10 NETHERLANDS

12.3.11 LUXEMBURG

12.3.12 REST OF EUROPE

12.4 ASIA-PACIFIC

12.4.1 JAPAN

12.4.2 CHINA

12.4.3 SOUTH KOREA

12.4.4 INDIA

12.4.5 SINGAPORE

12.4.6 THAILAND

12.4.7 INDONESIA

12.4.8 MALAYSIA

12.4.9 PHILIPPINES

12.4.10 AUSTRALIA & NEW ZEALAND

12.4.11 REST OF ASIA-PACIFIC

12.5 SOUTH AMERICA

12.5.1 BRAZIL

12.5.2 ARGENTINA

12.5.3 REST OF SOUTH AMERICA

12.6 MIDDLE EAST AND AFRICA

12.6.1 SOUTH AFRICA

12.6.2 EGYPT

12.6.3 SAUDI ARABIA

12.6.4 UNITED ARAB EMIRATES

12.6.5 ISRAEL

12.6.6 REST OF MIDDLE EAST AND AFRICA

13 GLOBAL TIRE CORD MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13.5 MERGERS AND ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

13.7 EXPANSIONS

13.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

15 GLOBAL TIRE CORD MARKET - COMPANY PROFILES

15.1 BENNINGER AG

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT UPDATES

15.2 CENTURY ENKA LIMITED

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT UPDATES

15.3 KOLON INDUSTRIES INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT UPDATES

15.4 TORAY HYBRID CORD, INC,

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT UPDATES

15.5 TEIJIN ARAMID B.V.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT UPDATES

15.6 KORDÁRNA PLUS A.S.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT UPDATES

15.7 JUNMA TYRE CORD COMPANY LIMITED

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATES

15.8 MILLIKEN & COMPANY

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT UPDATES

15.9 SHENMA INDUSTRIAL CO., LTD.

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT UPDATES

15.1 FIRESTONE FIBERS & TEXTILES

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT UPDATES

15.11 CORDENKA GMBH & CO KG

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT UPDATES

15.12 MADURA INDUSTRIAL TEXTILES LTD.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT UPDATES

15.13 SRF LTD.

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT UPDATES

15.14 HYOSUNG CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT UPDATES

15.15 CORDENKA GMBH & CO KG

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT UPDATES

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

16 RELATED REPORTS

17 QUESTIONNAIRE

18 CONCLUSION

19 ABOUT DATA BRIDGE MARKET RESEARCH

Global Tire Cord Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Tire Cord Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Tire Cord Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.