Global Electric Vehicles Adhesives Market

Market Size in USD Billion

CAGR :

%

USD

4.60 Billion

USD

11.55 Billion

2024

2032

USD

4.60 Billion

USD

11.55 Billion

2024

2032

| 2025 –2032 | |

| USD 4.60 Billion | |

| USD 11.55 Billion | |

|

|

|

|

Electric Vehicles Adhesives Market Size

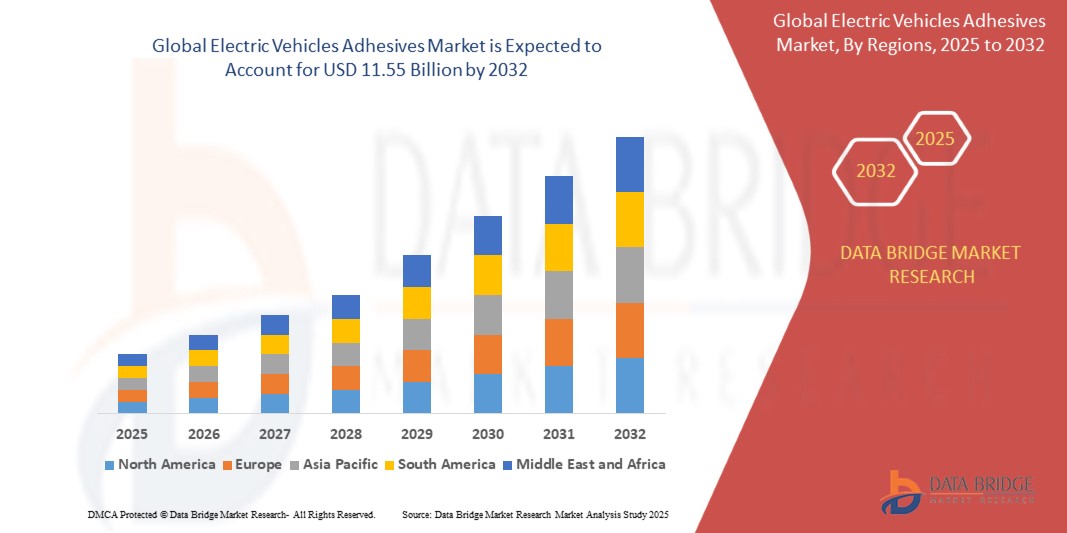

- The global electric vehicles adhesives market size was valued at USD 4.60 billion in 2024 and is expected to reach USD 11.55 billion by 2032, at a CAGR of 12.20% during the forecast period

- The market growth is largely fuelled by the rising production and sales of electric vehicles (EVs), increasing demand for lightweight and high-performance adhesive solutions, and strict regulatory policies promoting emission reduction and vehicle efficiency

Electric Vehicles Adhesives Market Analysis

- Growing focus on electric mobility has significantly influenced the demand for advanced adhesive technologies that enhance structural integrity, thermal management, and battery safety

- Adhesives are replacing traditional mechanical fasteners to reduce vehicle weight and support energy efficiency

- North America dominated the electric vehicles adhesives market with the largest revenue share of 38.6% in 2024, driven by rising EV adoption, a strong focus on lightweight vehicle construction, and advancements in battery technologies

- Asia-Pacific region is expected to witness the highest growth rate in the global electric vehicles adhesives market, driven by rising electric vehicle (EV) production, government incentives for EV adoption, and increasing investments in battery and automotive manufacturing infrastructure across countries such as China, Japan, and South Korea

- The liquid segment dominated the market with the largest market revenue share in 2024, attributed to its superior ability to conform to complex geometries and ensure strong structural bonds. Liquid adhesives are widely preferred in battery modules, body panels, and interior assembly due to their ease of application and high strength. Their excellent thermal conductivity and vibration-damping capabilities also make them suitable for enhancing EV safety and performance

Report Scope and Electric Vehicles Adhesives Market Segmentation

|

Attributes |

Electric Vehicles Adhesives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Electric Vehicles Adhesives Market Trends

“Growing Use of Thermal Interface Adhesives for Battery Performance and Safety”

- Thermal interface adhesives are becoming critical in electric vehicle (EV) battery systems to ensure optimal thermal conductivity and stable operating temperatures during high load conditions

- These adhesives replace traditional thermal pads and gap fillers by offering a more consistent interface between battery cells and cooling plates, enhancing durability and performance

- Their role is especially vital in high-energy-density battery packs used in long-range EVs, where managing excess heat is essential for preventing degradation and thermal runaway

- Automakers are also turning to these adhesives to reduce reliance on mechanical fasteners, which adds to vehicle weight and complicates design in tight spaces

- As EVs transition to 800V architectures and ultra-fast charging capabilities, the thermal load on battery components increases, driving the adoption of these high-performance adhesives

- For instance, Tesla’s Model Y integrates thermally conductive adhesives in its battery module design to facilitate efficient heat dissipation, reduce component stress, and optimize battery lifespan

Electric Vehicles Adhesives Market Dynamics

Driver

“Surge in EV Production Driving Adhesive Integration in Lightweight Components”

- The surge in global EV production has intensified the need for advanced bonding solutions that reduce vehicle weight and improve structural integrity

- Adhesives are increasingly being used as alternatives to mechanical joints and welds, especially in battery enclosures, body-in-white, and structural frames

- Lightweight bonding directly contributes to extended driving range, improved fuel economy, and enhanced passenger safety, all of which are key selling points in the EV market

- In addition, adhesives provide uniform stress distribution, corrosion resistance, and enable design flexibility for joining dissimilar substrates such as magnesium, composites, and plastics

- OEMs benefit from reduced assembly time and fewer fastener points, streamlining production lines and supporting modular EV architecture designs

- For instance, BYD has adopted high-strength structural adhesives across its battery systems and chassis components to reduce overall vehicle mass and maximize energy efficiency, enabling better vehicle performance at lower cost

Restraint/Challenge

“Stringent Regulatory Approvals and Long Validation Cycles”

- One of the primary challenges in the EV adhesives market is the need for extensive testing and certification to meet stringent automotive safety and regulatory standards

- Adhesives used in critical EV components, particularly battery modules, must demonstrate resistance to flame, chemical exposure, vibration, and prolonged thermal cycling

- Regulatory delays often prolong time-to-market for new adhesive formulations, restricting innovation, especially for startups and mid-tier players with limited R&D budgets

- Compliance protocols vary across regions, with automakers requiring independent validation from global safety organizations such as UL, ISO, and SAE, adding layers of complexity

- The high cost and technical expertise needed for qualification procedures can deter market entry for smaller players and delay product scaling

- For instance, the thermal adhesive deployed in General Motors' Ultium battery system underwent over two years of validation testing to meet stringent UL 94V-0 flame resistance and thermal performance requirements, significantly slowing down implementation despite its potential

Electric Vehicles Adhesives Market Scope

The market is segmented on the basis of form, resin, application, vehicle type, and substrate.

• By Form

On the basis of form, the electric vehicles adhesives market is segmented into liquid, film and tape, and others. The liquid segment dominated the market with the largest market revenue share in 2024, attributed to its superior ability to conform to complex geometries and ensure strong structural bonds. Liquid adhesives are widely preferred in battery modules, body panels, and interior assembly due to their ease of application and high strength. Their excellent thermal conductivity and vibration-damping capabilities also make them suitable for enhancing EV safety and performance.

The film and tape segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the demand for clean, efficient, and automated bonding processes. Film adhesives offer consistent thickness, minimal waste, and faster curing times, making them ideal for mass production in automotive manufacturing lines. They are particularly gaining traction in applications such as battery cell-to-pack bonding and EV electronics assembly.

• By Resin

On the basis of resin, the electric vehicles adhesives market is segmented into polyurethane, epoxy, silicone, acrylic, and others. The polyurethane segment accounted for the largest market share in 2024 owing to its excellent flexibility, bonding strength, and durability. These adhesives are commonly used in bonding glass, composite, and metal surfaces across EV body parts and interiors.

The silicone segment is expected to witness the fastest growth rate from 2025 to 2032, due to its superior thermal stability and resistance to harsh environmental conditions. Silicone-based adhesives are increasingly favored in battery packs and power electronics, offering reliable performance under wide temperature ranges, which is essential in electric mobility systems.

• By Application

On the basis of application, the electric vehicles adhesives market is segmented into powertrain system, exterior, and interior. The powertrain system segment held the largest revenue share in 2024, as adhesives are critical in assembling and thermally managing EV batteries and electric motors. Their role in ensuring strong bonds and managing thermal expansion is essential for the durability and efficiency of EV powertrains.

The exterior segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the adoption of lightweight body materials and the shift toward seamless, aerodynamic designs. Adhesives in exteriors replace traditional mechanical fasteners, improving aesthetics while reducing noise and vibration.

• By Vehicle Type

On the basis of vehicle type, the market is segmented into electric car, electric bus, electric truck, and electric bike. The electric car segment led the market in 2024 with the largest revenue share due to the rising global sales of passenger EVs and increasing investments by automakers in electric mobility.

The electric truck segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by the rise in e-commerce logistics, stringent emission norms, and increasing need for high-performance adhesive solutions in large battery packs and heavy-duty structures.

• By Substrate

On the basis of substrate, the market is segmented into polymer, composite, and metals. The metal segment accounted for the largest market revenue share in 2024 due to its extensive use in EV chassis, battery enclosures, and powertrain components. Adhesives provide corrosion resistance, stress distribution, and durability when bonding metal surfaces.

The composite segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the automotive industry’s push toward lightweight materials. Adhesives enable strong, flexible bonds in composite parts, supporting the development of lighter and more energy-efficient EVs.

Electric Vehicles Adhesives Market Regional Analysis

- North America dominated the electric vehicles adhesives market with the largest revenue share of 38.6% in 2024, driven by rising EV adoption, a strong focus on lightweight vehicle construction, and advancements in battery technologies

- The region is characterized by a well-established EV infrastructure, increasing investments in sustainable transportation, and government initiatives offering tax incentives for electric vehicles

- Major automakers in the U.S. and Canada are actively integrating high-performance adhesives to replace traditional welding and mechanical fasteners, optimizing EV range and structural integrity

U.S. Electric Vehicles Adhesives Market Insight

The U.S. electric vehicles adhesives market captured over 80% of the North American share in 2024, supported by the expansion of EV production capacities and a robust automotive R&D ecosystem. Manufacturers such as Tesla and General Motors are widely incorporating adhesives for weight reduction and thermal management in battery packs. Government funding for EV innovation and a growing shift toward electrification across fleets and commercial transport continue to drive demand for advanced bonding solutions.

Europe Electric Vehicles Adhesives Market Insight

The Europe electric vehicles adhesives market is projected to grow at a significant CAGR during the forecast period, fueled by stringent emission regulations and ambitious carbon neutrality goals. Countries such as Germany, France, and the Netherlands are experiencing increased EV registrations, prompting OEMs to explore adhesive solutions for noise reduction, crash performance, and battery safety. Lightweight bonding in EV assembly is becoming more common in the region’s highly competitive and environmentally conscious market.

U.K. Electric Vehicles Adhesives Market Insight

The U.K. electric vehicles adhesives market is expected to grow steadily, driven by government-backed EV adoption schemes and expanding battery manufacturing capabilities. The nation’s aggressive carbon emissions targets and the ban on internal combustion engine vehicle sales by 2035 have encouraged automakers to adopt high-efficiency adhesives to support mass EV production. Local start-ups and global OEMs alike are leveraging adhesives for structural performance and corrosion resistance in varied vehicle classes.

Germany Electric Vehicles Adhesives Market Insight

The Germany’s electric vehicles adhesives market is thriving, backed by its position as a global automotive innovation hub. The presence of leading EV manufacturers, coupled with investment in battery Gigafactories and lightweight construction materials, is accelerating adhesive integration. Advanced adhesives are being utilized for module encapsulation, crash protection, and improved sealing in next-gen EV models, supporting the country’s commitment to low-carbon transportation solutions.

Asia-Pacific Electric Vehicles Adhesives Market Insight

The Asia-Pacific region is set to grow at the fastest CAGR of 13.7% from 2025 to 2032, owing to rapid urbanization, government incentives, and expanding EV production in China, Japan, and South Korea. The region benefits from cost-effective manufacturing and supply chains, alongside a tech-savvy consumer base. Adhesives are being adopted extensively for high-volume EV manufacturing, ensuring battery efficiency, safety, and light-weighting.

Japan Electric Vehicles Adhesives Market Insight

The Japan's electric vehicles adhesives market is progressing steadily due to the country’s focus on hybrid and full-electric vehicle development. Domestic automakers are integrating adhesives into battery casing, thermal interface, and crash-durable structures to meet performance and safety standards. The country’s aging population and urban density also increase the demand for efficient and compact electric vehicles using lightweight bonding solutions.

China Electric Vehicles Adhesives Market Insight

The China held the largest revenue share in Asia-Pacific in 2024, driven by its dominant position in global EV production and battery manufacturing. Strong government mandates for electric mobility, coupled with a growing EV consumer base, have led to widespread adoption of structural and thermal adhesives. Local EV giants such as BYD and NIO are utilizing innovative adhesive technologies to enhance vehicle durability, passenger safety, and battery performance.

Electric Vehicles Adhesives Market Share

The Electric Vehicles Adhesives industry is primarily led by well-established companies, including:

- DuPont (U.S.)

- SOLVAY (Belgium)

- Dow (U.S.)

- Henkel AG and Co. KgaA (Germany)

- 3M (U.S.)

- Bostik (France)

- Sika AG (Switzerland)

- H.B. Fuller (U.S.)

- BASF SE (Germany)

- DAP Global Inc.(U.S.)

- Owens Corning (U.S.)

- The Chemours Company (U.S.)

- Paroc Group (Finland)

- Kingspan Group (Ireland)

- DAIKIN (Japan)

- GAF (U.S.)

- Saint-Gobain S.A. (France)

- Franklin International (U.S.)

- Illinois Tool Works Inc. (U.S.)

- AVERY DENNISON CORPORATION (U.S.)

- ThreeBond Holdings Co., Ltd. (Japan)

- Dymax (U.S.)

- Ashland (U.S.)

- Shell plc (U.K.)

Latest Developments in Global Electric Vehicles Adhesives Market

- In January 2022, H.B. Fuller Company announced that it completed the acquisition of Apollo, the largest independent manufacturer of liquid adhesives,coatings and primers for the roofing, industrial and construction markets in U.K.

- In September 2022, Henkel AG & Co.KGaA has completed the acquisition of Nanoramic Laboratories Thermal Management Management Materials business.Henkel used this acquisition to strengthen its Adhesive Technologies business unit’s position in the growing markets for Thermal Interface Materials (TIM) by expanding its capabilities in high-performance segments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Electric Vehicles Adhesives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Electric Vehicles Adhesives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Electric Vehicles Adhesives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.