Global Tire Wrapping Machine Market

Market Size in USD Billion

CAGR :

%

USD

1.96 Billion

USD

2.94 Billion

2024

2032

USD

1.96 Billion

USD

2.94 Billion

2024

2032

| 2025 –2032 | |

| USD 1.96 Billion | |

| USD 2.94 Billion | |

|

|

|

|

Tire Wrapping Machine Market Size

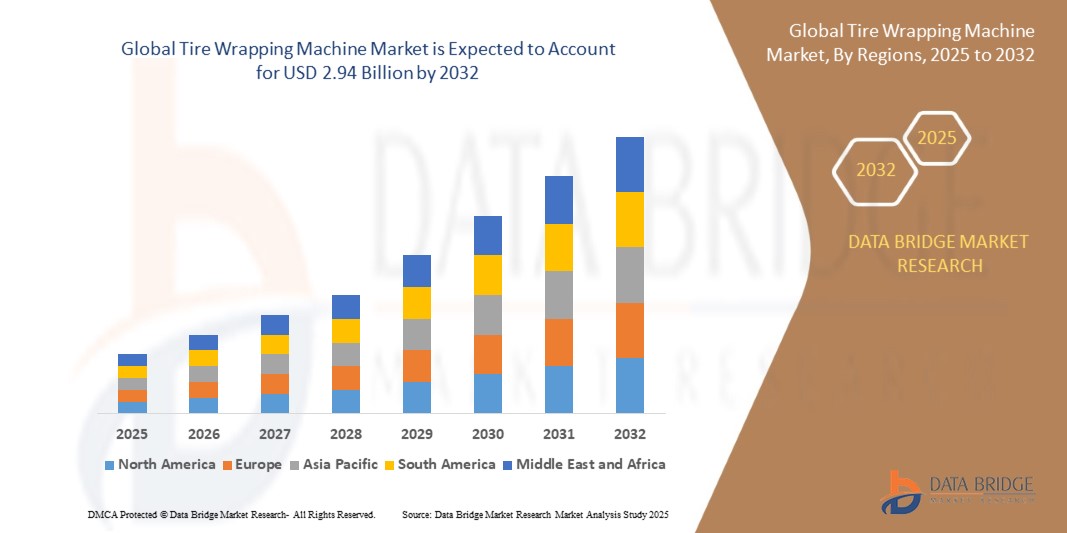

- The global tire wrapping machine market was valued at USD 1.96 billion in 2024 and is expected to reach USD 2.94 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.2%, primarily driven by the rising automation trends and increasing global tire production

- This growth is driven by factors such as the expansion of the automotive sector, growing demand for efficient packaging solutions to prevent tire damage, and the increasing adoption of automated machinery in manufacturing environments

Tire Wrapping Machine Market Analysis

- Tire wrapping machines are essential industrial equipment used to wrap tires for protection during storage and transportation. These machines ensure tires remain free from dust, moisture, and physical damage, maintaining their quality before they reach end-users or retail shelves

- The demand for tire wrapping machines is primarily driven by the growing automotive industry, increasing tire production, and the rising need for automated packaging solutions. The surge in electric vehicle (EV) manufacturing and the expansion of logistics and warehousing sectors also contribute to market growth

- The Asia Pacific region stands out as the dominant market for tire wrapping machines, fueled by the high concentration of tire manufacturing units, especially in countries like China, India, and Japan. The region benefits from cost-effective production capabilities and increasing investments in automation

- For instance leading tire manufacturers across China and India have ramped up production capacity and are adopting advanced wrapping solutions to improve efficiency and meet global export standards

- Globally, tire wrapping machines are considered critical equipment in tire manufacturing and packaging lines, second only to tire curing machines, ensuring the integrity, branding, and safe transport of tires from factories to distributors

Report Scope and Tire Wrapping Machine Market Segmentation

|

Attributes |

Tire Wrapping Machine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Tire Wrapping Machine Market Trends

“Integration of Automation and Smart Control Systems”

- One prominent trend in the global tire wrapping machine market is the increasing integration of automation and smart control systems to optimize operational efficiency and reduce manual intervention

- Modern tire wrapping machines are now equipped with programmable logic controllers (PLCs), touch-screen human-machine interfaces (HMIs), and sensor-based automation that allow precise control over wrapping parameters such as tension, speed, and film

- For instance, everal manufacturers are introducing fully automatic tire wrapping machines with auto-detection and adjustment features that can handle varying tire sizes without manual calibration, enhancing production throughput and consistency

- Smart control systems also enable real-time monitoring, remote diagnostics, and predictive maintenance through IoT connectivity, improving equipment uptime and reducing operational costs

- This trend is transforming tire packaging operations across manufacturing facilities, contributing to improved productivity, reduced material wastage, and higher adoption of advanced wrapping solutions worldwide

Tire Wrapping Machine Market Dynamics

Driver

“Rising Demand Due to Growth in Global Tire Production and Automotive Sale”

- The continuous rise in global tire production, driven by increasing automotive sales and fleet expansion, is significantly contributing to the growing demand for tire wrapping machines

- With the surge in vehicle ownership—particularly in developing economies—tire manufacturers are scaling up operations, leading to a higher volume of tires requiring efficient packaging and protection

- Tire wrapping machines ensure product integrity during transit and storage by safeguarding against environmental elements like moisture, dust, and physical damage, which is critical for maintaining tire performance and brand quality

- The push for automation and cost-efficiency in manufacturing facilities further accelerates the adoption of advanced tire wrapping solutions that reduce labor dependency and increase throughput

- Growing environmental and regulatory concerns are also prompting manufacturers to adopt eco-friendly wrapping materials, encouraging the use of machines that support sustainable packaging solutions

For instance,

- In November 2023, according to data from the European Tyre and Rubber Manufacturers’ Association (ETRMA), tire production in Europe increased by 5.8% year-over-year, with a strong push toward automated and efficient packaging methods across manufacturing units. This growth has created higher demand for tire wrapping machinery to handle larger volumes and ensure quality control

- As global tire production continues to rise in response to expanding automotive markets and logistical needs, tire wrapping machines play a crucial role in streamlining packaging operations and ensuring safe product handling

Opportunity

“Growth in Demand for Sustainable and Customizable Packaging Solutions”

- The rising global emphasis on sustainability and eco-friendly manufacturing is creating significant opportunities for tire wrapping machine manufacturers to innovate with sustainable packaging solutions

- Manufacturers are increasingly seeking machines compatible with biodegradable or recyclable wrapping films that align with environmental standards and reduce plastic waste

- In addition, there's growing demand for tire wrapping systems that allow customization in packaging—such as branded wraps, RFID tag integration, and variable wrap thickness—to cater to diverse logistic and branding needs

For instance,

- In October 2023, AllPack Solutions, a packaging automation company, launched a new line of tire wrapping machines designed to work with recyclable stretch films and offer branded wrapping capabilities. This development supports the shift toward sustainable, identity-focused packaging in the tire industry

- As governments and consumers increasingly push for environmentally conscious practices, tire manufacturers are responding by upgrading their packaging processes—creating a lucrative opportunity for advanced, eco-compatible, and flexible tire wrapping solutions

Restraint/Challenge

“High Initial Investment and Maintenance Costs Limiting Adoption”

- The high initial cost of tire wrapping machines, particularly fully automated and technologically advanced models, poses a major restraint for small- and medium-sized tire manufacturers and packaging service providers

- These machines often require substantial capital investment, including not only the equipment itself but also installation, operator training, and facility modifications

- Moreover, ongoing maintenance, part replacements, and the need for specialized technicians further add to the total cost of ownership, making it difficult for companies with limited budgets to adopt or upgrade their systems

For instance,

- In September 2023, according to a product report from Shanghai Jinglin Packaging Machinery Co., Ltd, the company cited that fully automatic tire wrapping machines with smart control and RFID tracking capabilities can cost upwards of USD 60,000–100,000, excluding customization and setup fees. This pricing structure makes it harder for small manufacturers in emerging markets to justify the investment

- As a result, many small-scale producers continue to rely on manual or semi-automated packaging methods, slowing down the overall adoption rate of advanced tire wrapping machines in certain regions

Tire Wrapping Machine Market Scope

The market is segmented on the basis machine type, mode of operation, application, product type technology, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Machine Type |

|

|

By Mode Of Operation |

|

|

By Application |

|

|

By Product Type |

|

|

By Technology |

|

|

By End User

|

|

Tire Wrapping Machine Market Regional Analysis

“Asia Pacific is the Dominant Region in the Tire Wrapping Machine Market”

- Asia Pacific dominates the tire wrapping machine market, fueled by its strong base of tire manufacturing, expanding automotive industry, and increasing adoption of industrial automation across production lines

- Countries such as China, India, Japan, and South Korea hold significant shares due to high tire production volumes, export-oriented manufacturing practices, and the presence of both global and regional tire brands

- Rising investments in smart manufacturing, availability of low-cost labor, and government initiatives supporting industrial automation and manufacturing upgrades are contributing to the region’s leadership in this market

- In addition, the region benefits from rapid infrastructure development and urbanization, leading to increased demand for vehicles and, consequently, for tire manufacturing and packaging equipment

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the tire wrapping machine market, driven by rapid industrialization, expanding automotive production, and rising investments in automated packaging solutions

- Countries such as China, India, and Indonesia are emerging as key markets due to robust tire manufacturing capacities, growing vehicle demand, and government initiatives promoting manufacturing modernization

- India, with its fast-growing automotive sector and increasing number of tire plants, is becoming a major hub for automated wrapping system adoption to improve operational efficiency and meet export standards

- China continues to dominate in terms of production scale and technology integration, with tire manufacturers increasingly adopting smart wrapping machinery to support high-volume exports and quality assurance

Tire Wrapping Machine Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Brenton, LLC (U.S.)

- Aetna Group S.p.A. (Italy)

- Loesch Pack (Germany)

- TOSA S.p.A. (Italy)

- Nido Machineries (India)

- Haloila OY (Finland)

- Fuji Packaging GmbH (Germany)

- SPG Packaging System GmbH (Germany)

- Mettler Toledo (U.S.)

- Pieri SRL (Italy)

- Messersi Packaging SRL (Italy)

- Adpak Machinery Systems Ltd. (U.K.)

- Signode Industrial Group (U.S.)

- Zuellig Industrial (Singapore)

- Sampack India Pvt. Ltd. (India)

Latest Developments in Global Tire Wrapping Machine Market

- In August 2023, China National Tire & Rubber Co., Ltd. unveiled plans to expand its plant in Shandong province. This strategic initiative incorporates fully automated wrapping and packaging lines, aimed at enhancing export readiness and operational efficiency. The expansion reflects the company's commitment to leveraging advanced technology to meet global market demands and streamline production processes. By integrating automation, the company seeks to boost productivity and strengthen its position in the international tire industry

- In March 2023, Indian tire manufacturer MRF Ltd. revealed plans to enhance its packaging lines across various facilities. This initiative includes the integration of automated tire wrapping machines, aimed at addressing the growing demand from both domestic and international markets. The investment underscores MRF's commitment to leveraging advanced technology to improve operational efficiency and meet evolving customer needs. By upgrading its packaging infrastructure, the company seeks to strengthen its position in the competitive tire industry

- In June 2022, China's Linglong Tire expanded its production base in Serbia, incorporating advanced tire wrapping systems to align with European export requirements. This strategic move highlights the company's dedication to meeting global supply chain standards and enhancing operational efficiency. The expansion reflects Linglong Tire's commitment to leveraging cutting-edge technology to cater to international market demands. By integrating these systems, the company aims to strengthen its position in the competitive tire industry and support sustainable growth in the European region

- In December 2022, Apollo Tyres announced the expansion of its Tamil Nadu plant in India, introducing advanced packaging capabilities, including state-of-the-art tire wrapping machines. This strategic move aims to address the growing demand from both domestic and international markets. By leveraging cutting-edge technology, Apollo Tyres seeks to enhance operational efficiency and strengthen its position in the competitive tire industry. The expansion reflects the company's commitment to innovation and meeting evolving customer needs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Tire Wrapping Machine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Tire Wrapping Machine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Tire Wrapping Machine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.