Global Tissue Fixation Market

Market Size in USD Billion

CAGR :

%

USD

3.29 Billion

USD

5.44 Billion

2025

2033

USD

3.29 Billion

USD

5.44 Billion

2025

2033

| 2026 –2033 | |

| USD 3.29 Billion | |

| USD 5.44 Billion | |

|

|

|

|

Tissue Fixation Market Size

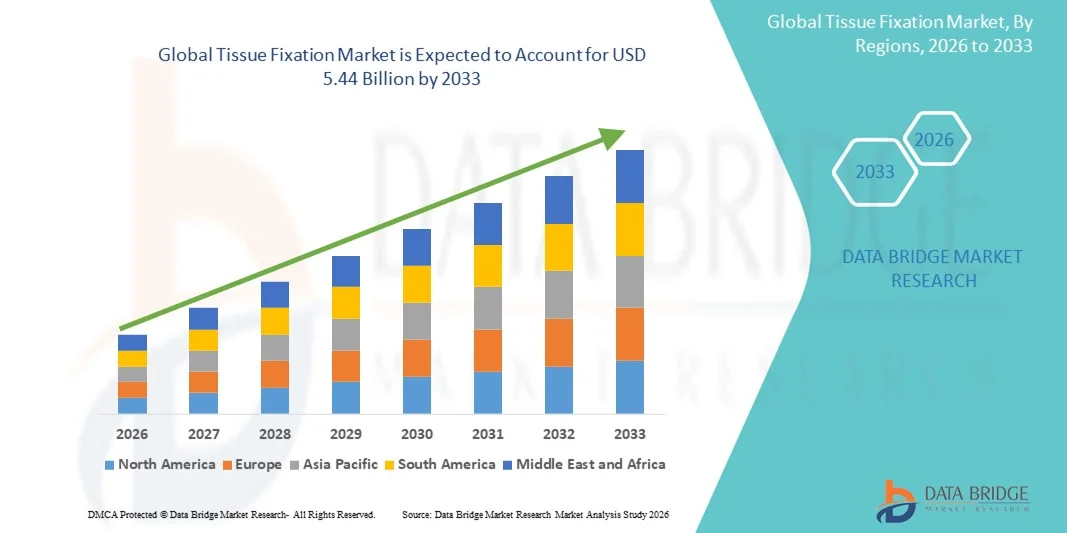

- The global tissue fixation market size was valued at USD 3.29 billion in 2025 and is expected to reach USD 5.44 billion by 2033, at a CAGR of 6.45% during the forecast period

- The market growth is largely fueled by the increasing prevalence of surgical procedures, rising incidence of orthopedic and soft tissue injuries, and continuous advancements in biomaterials and fixation technologies

- Furthermore, growing demand for minimally invasive surgeries, improved patient outcomes, and enhanced post-surgical recovery is establishing advanced tissue fixation devices as the preferred choice for surgeons and healthcare providers. These converging factors are accelerating the adoption of tissue fixation solutions, thereby significantly driving the industry’s growth

Tissue Fixation Market Analysis

- Tissue fixation devices, including sutures, anchors, and plates, are increasingly critical in modern surgical procedures, particularly in orthopedic, soft tissue, and reconstructive surgeries, due to their ability to provide stable fixation, promote faster healing, and improve surgical outcomes

- The escalating demand for tissue fixation solutions is primarily driven by the rising prevalence of musculoskeletal disorders, increasing volume of surgical interventions, and continuous innovations in biomaterials and minimally invasive fixation technologies

- North America dominated the tissue fixation market with the largest revenue share of 40.7% in 2025, characterized by a high volume of surgical procedures, advanced healthcare infrastructure, and strong presence of leading medical device manufacturers, with the U.S. witnessing significant adoption of innovative fixation devices such as bioabsorbable anchors and advanced suture systems

- Asia-Pacific is expected to be the fastest-growing region in the tissue fixation market during the forecast period due to increasing healthcare expenditure, rising number of orthopedic surgeries, and growing awareness about advanced surgical solutions

- Sutures and Suture Anchors segment dominated the tissue fixation market with a market share of 43.2% in 2025, driven by their proven effectiveness in tendon and ligament repairs and widespread use in both minimally invasive and open surgical procedures

Report Scope and Tissue Fixation Market Segmentation

|

Attributes |

Tissue Fixation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Tissue Fixation Market Trends

Advancements in Minimally Invasive and Arthroscopic Fixation Devices

- A significant and accelerating trend in the global tissue fixation market is the development of minimally invasive and arthroscopic fixation devices, which improve surgical precision, reduce patient recovery time, and lower post-operative complications

- For instance, the Arthrex BioComposite SwiveLock anchor allows surgeons to perform soft tissue repairs through smaller incisions, reducing trauma and promoting faster recovery

- Advanced fixation devices increasingly integrate bioabsorbable and biocompatible materials, offering improved healing outcomes while eliminating the need for secondary removal procedures. For instance, Smith & Nephew’s bioabsorbable anchors provide stable fixation and gradually dissolve as tissue heals

- The adoption of smart surgical instruments with enhanced ergonomics and guided placement is enhancing procedural efficiency, allowing surgeons to achieve more predictable outcomes. For instance, DePuy Synthes offers instrumentation that ensures accurate implant positioning during orthopedic surgeries

- The growing use of imaging-assisted and navigation-guided fixation techniques is improving accuracy in implant placement and reducing intraoperative errors. For instance, Medtronic’s StealthStation navigation system assists surgeons in precise implant positioning

- Increasing research into patient-specific and 3D-printed fixation devices is enabling customized implants for complex orthopedic and reconstructive cases. For instance, 3D Systems has developed patient-specific bone plates tailored to individual anatomy

- This trend towards more precise, patient-friendly, and technologically advanced fixation devices is fundamentally transforming surgical expectations and standards. Consequently, companies such as Stryker are developing next-generation fixation systems with integrated guidance and minimally invasive delivery

- The demand for advanced tissue fixation solutions is growing rapidly across orthopedic, soft tissue, and reconstructive surgeries, as healthcare providers increasingly prioritize improved surgical outcomes and patient satisfaction

Tissue Fixation Market Dynamics

Driver

Increasing Surgical Procedures and Musculoskeletal Disorders

- The rising prevalence of musculoskeletal injuries, degenerative disorders, and sports-related injuries, coupled with increasing surgical interventions, is a significant driver for the heightened demand for tissue fixation devices

- For instance, in March 2025, Zimmer Biomet reported a surge in orthopedic surgeries in the U.S., driving demand for advanced fixation implants and bioabsorbable anchors

- As awareness of the benefits of minimally invasive procedures grows, surgeons and hospitals are increasingly adopting advanced fixation devices that offer improved stability, reduced recovery time, and lower complication rates

- Furthermore, increasing healthcare expenditure and accessibility to advanced surgical procedures are encouraging the adoption of innovative tissue fixation solutions in emerging markets

- The growing preference for patient-friendly surgical techniques and better post-operative outcomes is propelling the demand for fixation devices across orthopedic, soft tissue, and reconstructive surgery segments

- Increasing collaborations between device manufacturers and hospitals for clinical trials and training programs are helping surgeons adopt advanced fixation technologies more confidently. For instance, Arthrex conducts surgeon education programs to enhance adoption of new fixation systems

- Rising investments in research and development by key players to innovate bioabsorbable, smart, and multifunctional fixation devices are further accelerating market growth. For instance, Stryker’s R&D initiatives focus on next-generation fixation technologies

Restraint/Challenge

High Device Costs and Regulatory Compliance Hurdle

- The relatively high cost of advanced tissue fixation devices compared to traditional fixation methods poses a significant challenge to broader adoption, particularly in developing regions and smaller hospitals

- For instance, high-end bioabsorbable anchors and advanced suture systems are priced significantly higher than conventional stainless steel or titanium implants, limiting adoption in price-sensitive markets

- Stringent regulatory approvals and compliance requirements for medical devices can delay product launches and restrict market entry in certain regions, adding to operational complexity

- Furthermore, concerns over post-surgical complications, implant rejection, or improper device placement may cause hesitation among surgeons and patients when choosing advanced fixation solutions

- Overcoming these challenges through cost optimization, robust clinical validation, and streamlined regulatory pathways will be crucial for sustained growth and wider adoption of tissue fixation devices

- Limited reimbursement policies in certain countries for high-cost implants may restrain adoption of advanced fixation solutions in price-sensitive healthcare markets. For instance, some private insurance plans do not fully cover bioabsorbable anchors or advanced fixation plates

- Challenges in surgeon training and adoption of novel fixation technologies, especially in rural or resource-limited hospitals, may slow market penetration. For instance, smaller hospitals may lack access to specialized training for minimally invasive fixation procedure

Tissue Fixation Market Scope

The market is segmented on the basis of absorbability, product type, and end user.

- By Absorbability

On the basis of absorbability, the tissue fixation market is segmented into non-resorbable and bioresorbable. The Non-Resorbable segment dominated the market with the largest revenue share in 2025, driven by its long-standing use in orthopedic and soft tissue surgeries. Non-resorbable devices, such as titanium screws and stainless steel plates, provide permanent structural support, which is often preferred in high-load-bearing applications. Hospitals and surgical centers rely on these devices for their proven reliability, mechanical strength, and lower risk of implant failure. Surgeons also favor non-resorbable materials for complex fracture and tendon repair procedures due to their predictable performance. The compatibility of non-resorbable devices with existing surgical techniques further strengthens their market position. In addition, the widespread availability and clinical familiarity of these devices contribute to their dominance.

The Bioresorbable segment is anticipated to witness the fastest growth rate during the forecast period, fueled by increasing demand for implants that eliminate the need for secondary removal surgery. Bioresorbable devices gradually degrade in the body while supporting tissue healing, reducing long-term complications and improving patient comfort. Surgeons and patients increasingly prefer bioresorbable anchors, screws, and plates for minimally invasive procedures and pediatric applications. Advancements in polymer and composite materials have enhanced the strength and safety of bioresorbable devices. Growing awareness of post-surgical recovery benefits and improved aesthetic outcomes is driving adoption. Rising R&D investments by key players to expand bioresorbable product offerings are further accelerating market growth.

- By Product Type

On the basis of product type, the tissue fixation market is segmented into sutures and suture anchors, interference screws, plates and pins, buttons, arrows, IM nails, darts, and others. The Sutures and Suture Anchors segment dominated the market in 2025 with a market share of 43.2%, owing to its widespread use in tendon, ligament, and soft tissue repair procedures. Suture anchors provide secure fixation with minimally invasive techniques, reducing patient recovery time and post-operative complications. Surgeons prefer these devices for their versatility, ease of placement, and compatibility with arthroscopic procedures. Hospitals and surgical centers rely on sutures and anchors due to their proven clinical outcomes and cost-effectiveness. Technological advancements, such as bioabsorbable and knotless anchors, have further strengthened this segment’s market position. Strong surgeon familiarity and continuous product innovation contribute to sustained demand.

The Interference Screws segment is expected to witness the fastest growth during the forecast period, driven by increasing ACL and ligament reconstruction surgeries. Interference screws offer strong fixation in high-stress applications and are commonly used in arthroscopic ligament repairs. The growth is further supported by rising adoption of bioresorbable and composite screws, which enhance patient outcomes and eliminate secondary surgery. Technological innovations improving screw design and ease of insertion are attracting surgeons. Growing awareness among healthcare providers about improved recovery rates with interference screws is driving adoption. Expanding orthopedic and sports medicine procedures globally is contributing to the segment’s rapid growth.

- By End User

On the basis of end user, the tissue fixation market is segmented into hospitals, clinics, ambulatory surgical centers, and others. The Hospitals segment dominated the market in 2025, driven by the high volume of complex orthopedic, soft tissue, and reconstructive surgeries performed in hospital settings. Hospitals possess advanced infrastructure, trained surgical staff, and access to cutting-edge fixation devices, making them the largest consumers of tissue fixation solutions. Surgeons in hospitals prefer advanced devices due to their proven clinical outcomes and compatibility with a variety of procedures. Hospitals also act as hubs for clinical trials and early adoption of new fixation technologies. The ability to manage high patient throughput and complex cases ensures continued demand for these devices. Strong relationships between device manufacturers and hospital procurement teams further strengthen this segment’s dominance.

The Ambulatory Surgical Centers segment is expected to witness the fastest growth rate during the forecast period, fueled by the rising preference for outpatient and minimally invasive procedures. These centers offer cost-effective, convenient surgical options, driving adoption of compact and easy-to-use fixation devices. Increasing investments in outpatient surgical infrastructure and growing awareness about shorter recovery times are supporting growth. Surgeons are favoring advanced, user-friendly implants suitable for ambulatory settings. Patient demand for efficient procedures and reduced hospital stays is contributing to the segment’s expansion. Technological innovations enabling safer, faster outpatient surgeries are accelerating adoption in this segment.

Tissue Fixation Market Regional Analysis

- North America dominated the tissue fixation market with the largest revenue share of 40.7% in 2025, characterized by a high volume of surgical procedures, advanced healthcare infrastructure, and strong presence of leading medical device manufacturers, with the U.S. witnessing significant adoption of innovative fixation devices such as bioabsorbable anchors and advanced suture systems

- Hospitals and surgical centers in the region prioritize advanced fixation devices such as bioabsorbable anchors, plates, and screws due to their proven reliability, mechanical strength, and improved patient outcomes

- This widespread adoption is further supported by high healthcare expenditure, technological advancements in surgical devices, and growing awareness among surgeons and patients about minimally invasive and arthroscopic procedures, establishing tissue fixation devices as a preferred solution across orthopedic and soft tissue surgeries

U.S. Tissue Fixation Market Insight

The U.S. tissue fixation market captured the largest revenue share in 2025 within North America, driven by a high volume of orthopedic, soft tissue, and reconstructive surgeries. Surgeons increasingly prefer advanced fixation devices such as bioabsorbable anchors, interference screws, and plates due to their proven clinical outcomes and reliability. The adoption of minimally invasive and arthroscopic procedures, combined with a technologically advanced healthcare infrastructure, further propels the market. In addition, rising awareness among patients and surgeons regarding faster recovery and reduced post-operative complications is increasing demand. Strong presence of leading medical device manufacturers and ongoing R&D initiatives are also supporting market growth. The integration of smart surgical instruments and navigation-assisted systems is further enhancing procedural precision and adoption.

Europe Tissue Fixation Market Insight

The Europe tissue fixation market is projected to expand at a substantial CAGR throughout the forecast period, driven by well-established healthcare systems, increasing prevalence of musculoskeletal disorders, and rising demand for advanced surgical solutions. Hospitals and surgical centers are adopting innovative fixation devices to improve patient outcomes in orthopedic and reconstructive procedures. Government initiatives supporting healthcare modernization and minimally invasive surgeries are fostering adoption. The market is witnessing growth across both private and public healthcare facilities, with bioresorbable anchors and advanced plates increasingly preferred. Surgeons’ awareness of improved clinical outcomes and reduced complication rates is fueling uptake. Continuous investments in R&D by key players are further driving technological advancements and market expansion.

U.K. Tissue Fixation Market Insight

The U.K. tissue fixation market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by increasing demand for minimally invasive surgeries and advanced orthopedic procedures. Surgeons and hospitals are emphasizing patient-centric approaches, including faster recovery and reduced implant-related complications. Growing prevalence of sports injuries and degenerative disorders is contributing to rising adoption of tissue fixation devices. Strong healthcare infrastructure and focus on innovative surgical solutions support market expansion. The U.K.’s adoption of bioresorbable and next-generation fixation devices enhances clinical efficiency. Rising investments in surgeon training and awareness programs are expected to sustain growth.

Germany Tissue Fixation Market Insight

The Germany tissue fixation market is expected to expand at a considerable CAGR during the forecast period, driven by high awareness of advanced surgical procedures and strong emphasis on patient safety. Hospitals prioritize technologically advanced fixation devices such as interference screws, bioresorbable anchors, and specialized plates. The country’s well-developed healthcare infrastructure and emphasis on innovation support adoption of minimally invasive and arthroscopic procedures. Surgeons’ preference for precision-guided implants enhances clinical outcomes and device utilization. Growing incidence of musculoskeletal disorders and sports-related injuries further fuels demand. Integration of advanced fixation technologies into routine surgical practice is strengthening market growth.

Asia-Pacific Tissue Fixation Market Insight

The Asia-Pacific tissue fixation market is poised to grow at the fastest CAGR during the forecast period, driven by rising healthcare expenditure, increasing number of orthopedic and reconstructive surgeries, and growing awareness about advanced fixation solutions. Countries such as China, India, and Japan are witnessing rapid adoption of minimally invasive and bioresorbable fixation devices. Government initiatives promoting digitalization in healthcare and development of modern surgical infrastructure are supporting market growth. Increasing patient awareness of faster recovery and reduced complications is driving demand. The region’s growing middle class and expanding healthcare access are boosting market adoption. Key players are investing in distribution networks and clinical training to expand penetration in both urban and semi-urban areas.

Japan Tissue Fixation Market Insight

The Japan tissue fixation market is gaining momentum due to a technologically advanced healthcare system, rising number of orthopedic procedures, and preference for minimally invasive surgeries. Surgeons increasingly adopt bioresorbable anchors, interference screws, and advanced plates to improve patient outcomes. Integration of navigation-assisted surgical instruments and precision-guided implants is enhancing procedural efficiency. Growing aging population and higher incidence of musculoskeletal disorders are boosting market demand. Hospitals emphasize post-operative recovery and reduced complications, increasing uptake of advanced fixation devices. The focus on patient-centric care and clinical efficacy is driving continued growth.

India Tissue Fixation Market Insight

The India tissue fixation market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid urbanization, expanding healthcare infrastructure, and growing adoption of advanced surgical procedures. Hospitals and orthopedic centers are increasingly adopting bioresorbable anchors, plates, and interference screws. Rising awareness about minimally invasive surgeries, faster recovery, and improved patient outcomes is fueling market adoption. Government initiatives supporting orthopedic care and digital health infrastructure are accelerating growth. The availability of cost-effective fixation devices from domestic and international manufacturers further boosts demand. Increasing number of surgeries in private and multispecialty hospitals continues to expand the market.

Tissue Fixation Market Share

The Tissue Fixation industry is primarily led by well-established companies, including:

- Arthrex, Inc. (U.S.)

- CONMED Corporation (U.S.)

- Abbott (U.S.)

- B. Braun SE (Germany)

- Smith & Nephew (U.K.)

- Stryker (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Zimmer Biomet (U.S.)

- Medtronic (Ireland)

- Boston Scientific Corporation (U.S.)

- Integra LifeSciences Corporation (U.S.)

- LifeNet Health (U.S.)

- Tissue Regenix Group PLC (U.K.)

- CryoLife, Inc. (U.S.)

- Acell, Inc. (U.S.)

- Enovis Corporation (U.S.)

- Parcus Medical, LLC (U.S.)

- MedShape, Inc. (U.S.)

- Biocomposites Ltd. (U.K.)

- In2Bones Global, Inc. (U.S.)

What are the Recent Developments in Global Tissue Fixation Market?

- In June 2025, OSSIO launched its Small OSSIOfiber 2.5mm Suture Anchors, expanding its bio‑integrative, metal‑free fixation portfolio aimed at improving a wide range of soft tissue and ligament repair surgeries, including lateral ankle stability (Brostrom repair). These anchors are engineered with a novel mineral‑fiber matrix that integrates into bone, offering 55% greater pull‑out strength than leading bio‑composite anchors and potentially enhancing patient outcomes while reducing risks associated with metal implants

- In March 2025, Medline announced it would unveil a Synthetic Ligament Augmentation Implant at the ACFAS 2025 conference, reflecting industry momentum toward advanced soft tissue reinforcement technologies. This planned launch highlights Medline’s efforts to address growing clinical demand for effective ligament support solutions in foot and ankle surgeries an area where durable fixation and improved soft tissue repair are critical

- In June 2024, OSSIO expanded its fixation portfolio with OSSIOfiber small compression staples, cleared by the FDA in November 2023, designed to enhance fixation in procedures such as Akin bunion repair. These bio‑integrative staples are remarkably easy to insert and offer compression strength comparable to metal staples without leaving permanent hardware, reducing long‑term irritation and eliminating the need for secondary removal surgeries

- In February 2024, Anika Therapeutics showcased its Integrity Implant System and ProPass Suture Passer for tissue fixation at the 2024 American Academy of Orthopaedic Surgeons (AAOS) Annual Meeting, emphasizing enhancements in suture anchor technology and soft tissue management. The ProPass Suture Passer and bioresorbable components are designed to streamline surgical workflows and improve fixation reliability, particularly in sports medicine and soft tissue repair procedures

- In February 2021, In2Bones Global launched its Hercules Suture Anchor System and AlloAid® Wedges for lower extremity surgeries, introducing two PEEK‑based suture anchor families Fully‑Threaded and Knotless with ultra‑high molecular weight polyethylene (UHMWPE) sutures for enhanced soft tissue fixation strength and durability. The AlloAid wedges are designed for precision placement in flatfoot reconstructive surgeries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.