Global Topical Keratolytics Market

Market Size in USD Billion

CAGR :

%

USD

1.58 Billion

USD

2.44 Billion

2023

2032

USD

1.58 Billion

USD

2.44 Billion

2023

2032

| 2024 –2032 | |

| USD 1.58 Billion | |

| USD 2.44 Billion | |

|

|

|

|

Topical Keratolytics Market Size

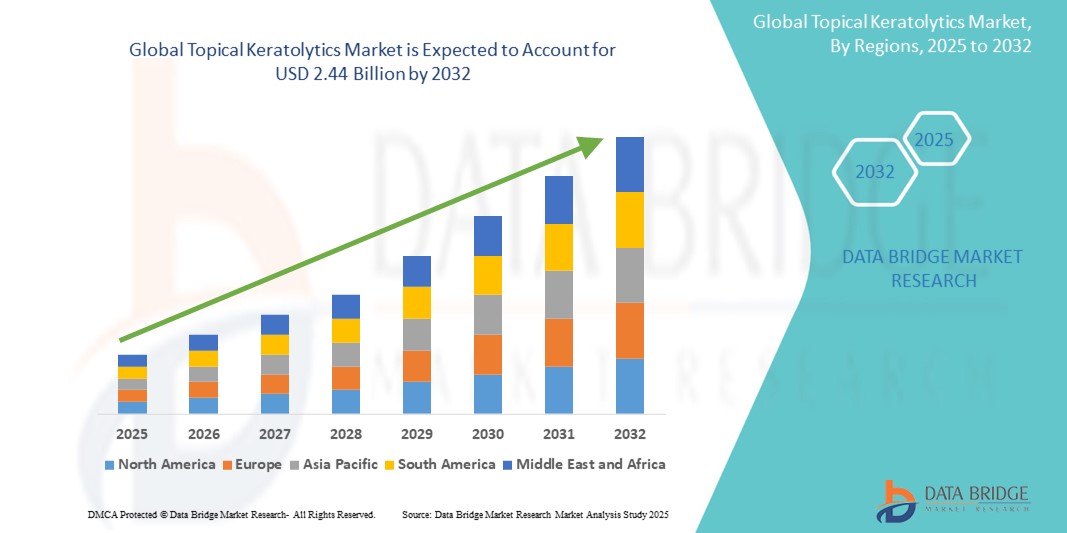

- The global topical keratolytics market size was valued at USD 1.58 billion in 2024 and is expected to reach USD 2.44 billion by 2032, at a CAGR of 5.58% during the forecast period

- The market growth is largely fueled by the increasing prevalence of dermatological conditions such as acne, psoriasis, and warts, driving the demand for effective and targeted Topical Keratolytics solutions in both prescription and over-the-counter segments

- Furthermore, rising consumer preference for non-invasive, easy-to-apply skincare treatments and advancements in dermatology formulations are positioning topical keratolytics as a preferred therapeutic approach for exfoliating and managing hyperkeratotic skin disorders. These converging factors are accelerating the adoption of Topical Keratolytics products, thereby significantly boosting the industry's growth

Topical Keratolytics Market Analysis

- Topical keratolytics, which aid in the removal of excess keratin from the skin’s surface, are increasingly recognized as essential dermatological treatments for conditions such as acne, psoriasis, warts, calluses, and ichthyosis. These solutions are gaining popularity in both prescription and OTC formats due to their effectiveness and ease of application

- The escalating demand for topical keratolytics is primarily fueled by the growing prevalence of chronic skin conditions, increasing focus on skincare, and a rising preference for non-invasive, at-home treatment options

- North America dominated the topical keratolytics market with the largest revenue share of 39.6% in 2024, driven by high awareness of dermatological health, strong purchasing power, and wide availability of both branded and generic formulations. The U.S. leads the region with robust consumer spending on dermatology products, including salicylic acid, urea, and lactic acid-based treatments

- Asia-Pacific is expected to be the fastest-growing region in the topical keratolytics market, with a projected CAGR of 7.9% from 2025 to 2032, driven by rising disposable incomes, increasing skincare awareness, and expanding access to dermatological products through e-commerce and retail pharmacies in countries such as India, China, and South Korea

- The salicylic acid segment dominated the topical keratolytics market with a market share of 42.1% in 2024, attributed to its broad application across acne, dandruff, warts, and psoriasis. Its exfoliating and comedolytic properties, along with widespread OTC availability, make it a first-line ingredient in keratolytic treatment formulations

Report Scope and Topical Keratolytics Market Segmentation

|

Attributes |

Topical Keratolytics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Topical Keratolytics Market Trends

“Growing Demand for Multifunctional Combination Formulations in Topical Keratolytics Market”

- A significant and accelerating trend in the global topical keratolytics market is the growing demand for combination formulations that integrate keratolytic agents with anti-inflammatory, antimicrobial, or moisturizing compounds. This multifunctional approach enhances treatment efficacy while minimizing irritation, making products more appealing for both therapeutic and cosmetic use

- For instance, formulations combining salicylic acid with niacinamide or urea with lactic acid are increasingly favored in treating conditions such as acne, psoriasis, and dry skin, offering exfoliation alongside soothing and barrier-repairing benefits

- This trend supports the development of personalized skincare regimens and is being driven by consumer preferences for multitasking products that simplify routines while delivering visible results. Moreover, it aligns with the broader movement toward dermocosmetics, where clinical-grade efficacy meets cosmetic appeal

- The innovation in combination keratolytic formulations is also facilitating over-the-counter (OTC) expansion, as products with dual-action benefits are more marketable for self-care users seeking safe and effective treatments without prescriptions

- Consequently, companies such as CeraVe, Eucerin, and La Roche-Posay are investing in advanced keratolytic skincare lines that address both medical and aesthetic concerns in a single application

- The growing preference for integrated, dermatologically tested formulations is reshaping product development pipelines, with manufacturers prioritizing synergistic ingredient combinations that cater to informed, results-driven consumers

Topical Keratolytics Market Dynamics

Driver

“Growing Need Due to Rising Skin Disorders and Consumer Awareness”

- The increasing prevalence of dermatological conditions such as psoriasis, acne, ichthyosis, corns, and keratosis pilaris is a significant driver for the growing demand for topical keratolytics across the globe These conditions often require long-term skin management, and keratolytics such as salicylic acid, lactic acid, and urea are widely preferred due to their efficacy in softening and shedding the outer layer of the skin

- For instance, a 2024 report by the American Academy of Dermatology estimated that nearly 50 million Americans suffer from acne annually—further fueling the use of topical keratolytic formulations as part of treatment regimens

- Growing consumer awareness about the availability of over-the-counter (OTC) topical solutions for skin exfoliation, coupled with the rising popularity of at-home skincare routines, is contributing to increased market demand

- Furthermore, the expansion of e-commerce platforms, especially in developing regions, is making these products more accessible to a wider consumer base. The rise of clean-label and natural keratolytic products—those free from parabens, sulfates, and synthetic fragrances—is also gaining traction among health-conscious buyers

- The convenience of self-administered, non-invasive treatments and the trend toward preventive skincare are key factors propelling the adoption of topical keratolytics in both clinical and non-clinical settings. Growing investments by skincare brands to develop multi-functional formulations (such as, keratolytics with anti-inflammatory or moisturizing properties) further contribute to market expansion

Restraint/Challenge

“Concerns Regarding Skin Sensitivity and Regulatory Compliance”

- One of the primary challenges limiting broader adoption of topical keratolytics is the potential for skin irritation, dryness, or allergic reactions, particularly in individuals with sensitive skin or those using high-concentration formulations. Such adverse reactions can affect patient compliance and deter long-term use

- For instance, salicylic acid and urea-based products—though highly effective—can cause stinging, redness, or peeling if overused or not applied correctly, leading to hesitancy among first-time users

- In addition, varying international regulations regarding active ingredient concentrations, permissible claims, and labeling standards create complexity for manufacturers seeking global market entry. Stringent approval processes by authorities such as the U.S. FDA or European Medicines Agency can delay product launches and add to R&D costs

- Market fragmentation with a wide array of generic and branded options can also confuse consumers, impacting purchasing decisions and brand loyalty

- Overcoming these challenges through clearer labeling, educational outreach by dermatologists, and the development of gentle, dermatologically-tested formulations will be essential for sustained growth in the topical keratolytics market

Topical Keratolytics Market Scope

The market is segmented into five notable segments based on indication, dosage form, agents, end-users, and distribution channel.

• By Indication

On the basis of indication, the topical keratolytics market is segmented into psoriasis, dry skin, acne vulgaris, warts, dandruff, and others. Psoriasis held the largest market revenue share of 31.4% in 2024, owing to the chronic nature of the condition and the growing demand for long-term topical treatments that help manage scales and inflammation.

Acne Vulgaris is expected to witness the fastest CAGR of 20.6% from 2025 to 2032, driven by rising prevalence among adolescents and young adults, and increasing consumer awareness of skincare.

• By Dosage Form

On the basis of indication, the topical keratolytics market is segmented into shampoo, gel, solution, face wash, lotion, creams, and others. Creams dominated the market with a revenue share of 34.7% in 2024, due to their high skin absorption, ease of application, and broad use across multiple indications including psoriasis and dry skin.

Shampoos are anticipated to register the fastest CAGR of 18.9% during the forecast period, primarily due to their targeted effectiveness in dandruff and scalp psoriasis treatment.

• By Agents

On the basis of indication, the topical keratolytics market is segmented into urea, salicylic acid, lactic acid, alpha hydroxy acids, propylene glycol, and others. Salicylic Acid held the largest market share of 42.1% in 2024, driven by its widespread use in treating acne, psoriasis, and warts due to its exfoliating and anti-inflammatory properties.

Urea is projected to grow at the fastest CAGR of 19.7% from 2025 to 2032, owing to its potent moisturizing effects and rising adoption in dry skin and keratoderma treatments.

• By End-Users

On the basis of indication, the topical keratolytics market is segmented into hospitals, specialty clinics, and others. Hospitals accounted for the highest revenue share of 38.6% in 2024, supported by the increasing prevalence of moderate-to-severe dermatological conditions requiring prescribed therapies.

Specialty Clinics are anticipated to experience the fastest CAGR of 17.2% during 2025–2032, owing to growing dermatology consultations, aesthetic treatments, and individualized skincare plans.

- By Distribution Channel

On the basis of indication, the topical keratolytics market is segmented into hospital pharmacy, retail pharmacy, and others. Retail Pharmacy held the dominant market share of 44.1% in 2024, driven by the high availability of OTC topical keratolytics and the preference for easily accessible skincare treatments.

Hospital Pharmacy is projected to witness the fastest CAGR of 18.4% from 2025 to 2032, owing to the increasing number of in-patient prescriptions and specialized treatments.

Topical Keratolytics Market Regional Analysis

- North America dominated the topical keratolytics market with the largest revenue share of 39.6% in 2024, driven by the high prevalence of skin conditions such as psoriasis, acne, and keratosis pilaris, along with strong consumer awareness of dermatological health

- The presence of major pharmaceutical companies and increasing adoption of over-the-counter (OTC) skincare treatments further support regional market growth

- Increased access to dermatologists, rising use of urea and salicylic acid-based creams, and the growing influence of skincare trends on social media are additional factors enhancing the uptake of topical keratolytic therapies in this region

U.S. Topical Keratolytics Market Insight

The U.S. topical keratolytics market captured the largest revenue share of 81.05% in 2024 within North America, owing to a surge in consumer expenditure on skin health, rising incidence of chronic skin disorders, and a robust OTC pharmaceutical retail network. The market is also propelled by innovations in dermatological formulations, including combination therapies with moisturizers, exfoliants, and anti-inflammatory agents.

Europe Topical Keratolytics Market Insight

The Europe topical keratolytics market is projected to expand at a substantial CAGR throughout the forecast period, fueled by increasing awareness about skin hygiene, a growing elderly population with chronic skin conditions, and the popularity of medicated cosmetic solutions. Countries such as Germany, the U.K., and France are witnessing a growing preference for non-invasive dermatological treatments.

U.K. Topical Keratolytics Market Insight

The U.K. topical keratolytics market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising demand for clinically proven OTC treatments, increasing self-medication trends, and a well-developed e-commerce infrastructure for health and wellness products.

Germany Topical Keratolytics Market Insight

The Germany topical keratolytics is expected to expand at a considerable CAGR during the forecast period, backed by a strong dermatological product development sector, high per capita healthcare expenditure, and a growing shift toward pharmaceutical-grade skincare. Germany's regulatory support for dermatological innovation also plays a crucial role in boosting local adoption.

Asia-Pacific Topical Keratolytics Market Insight

The Asia-Pacific topical keratolytics market is poised to grow at the fastest CAGR of 7.9% from 2025 to 2032, driven by rapid urbanization, a booming middle-class population, and increased focus on personal grooming and skincare. Countries such as India, China, and Japan are leading this growth, supported by rising dermatological awareness and expanding retail access to skincare treatments.

Japan Topical Keratolytics Market Insight

The Japan topical keratolytics market is gaining momentum due to its advanced cosmetic dermatology sector, aging population, and strong preference for scientifically backed skincare solutions. High product innovation, including hybrid cosmeceutical-keratolytic creams, is driving market expansion in both prescription and OTC segments.

China Topical Keratolytics Market Insight

The China topical keratolytics market accounted for the largest revenue share in the Asia-Pacific region in 2024, fueled by high consumer spending on skincare, an increasing burden of dermatological disorders, and aggressive market expansion by both domestic and international pharmaceutical brands. The rise of e-commerce and digital health platforms further accelerates consumer access to topical keratolytic treatments.

Topical Keratolytics Market Share

The topical keratolytics industry is primarily led by well-established companies, including:

- Bristol-Myers Squibb Company (U.S.)

- Galderma Laboratories, L.P. (Switzerland)

- Taro Pharmaceutical Industries Ltd. (Israel)

- Endo, Inc. (U.S.)

- AVITA Medical, Inc. (U.S.)

- BIOFRONTERA AG (Germany)

- Sciton (U.S.)

- Lumenis Be Ltd. (Israel)

- Alma Lasers (Israel)

- Cynosure Inc. (U.S.)

Latest Developments in Global Topical Keratolytics Market

- In December 2024, Australia introduced the first combined topical solution of 0.5% 5‑fluorouracil and 10% salicylic acid for actinic keratosis. This innovative formulation offers enhanced efficacy for field treatment of multiple lesions, marking a significant advance in keratolytic combination therapies

- In April 2025, Kingskin voluntarily recalled lots of its 17% salicylic acid topical solution (FDA Class II). The recall serves as a reminder of the importance of rigorous quality control and safety in the rapidly expanding keratolytics field

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.