Global Topical Non Steroidal Anti Inflammatory Drugs Market

Market Size in USD Billion

CAGR :

%

USD

2.93 Billion

USD

4.39 Billion

2024

2032

USD

2.93 Billion

USD

4.39 Billion

2024

2032

| 2025 –2032 | |

| USD 2.93 Billion | |

| USD 4.39 Billion | |

|

|

|

|

Topical Non-Steroidal Anti-Inflammatory Drugs Market Size

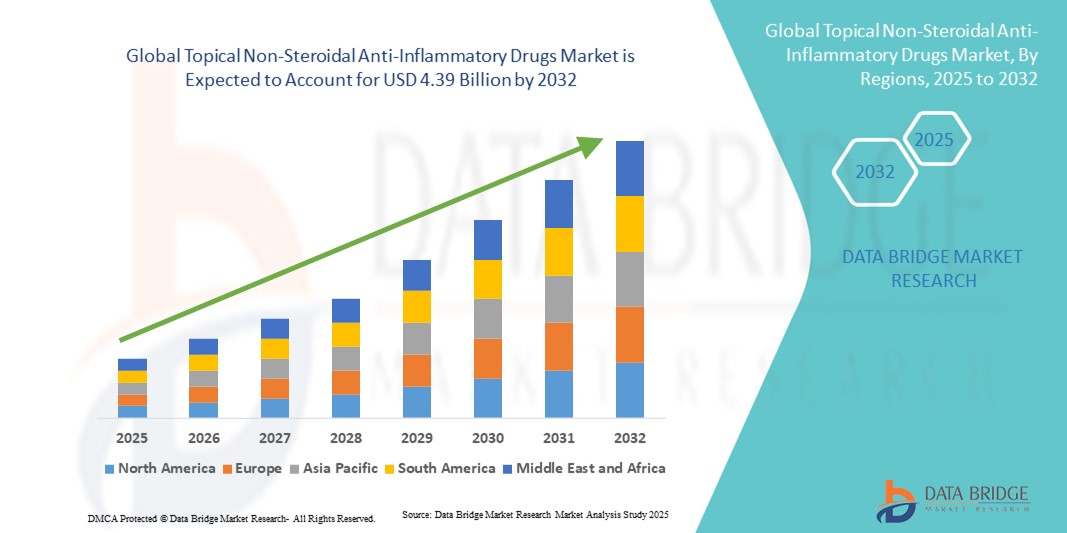

- The global topical non-steroidal anti-inflammatory drugs market size was valued at USD 2.93 billion in 2024 and is expected to reach USD 4.39 billion by 2032, at a CAGR of 5.20% during the forecast period

- The market growth is largely fueled by the growing prevalence of chronic and acute inflammatory skin conditions, such as psoriasis, dermatitis, and localized pain, which are driving the demand for effective topical NSAID treatments. Increasing awareness among patients and healthcare providers about the benefits of non-steroidal alternatives over corticosteroids is also contributing to market expansion

- Furthermore, rising consumer preference for safe, targeted, and easy-to-apply anti-inflammatory solutions is establishing topical NSAIDs as a preferred treatment option for both acute flare-ups and long-term management of inflammatory conditions. The introduction of advanced formulations, such as gels, creams, and patches, enhances drug delivery and patient compliance, thereby accelerating adoption

Topical Non-Steroidal Anti-Inflammatory Drugs Market Analysis

- Topical Non-Steroidal Anti-Inflammatory Drugs (NSAIDs), used for localized pain relief and inflammation management, are increasingly vital in both clinical and homecare settings due to their targeted action, reduced systemic side effects, and convenience compared to oral formulations

- The escalating demand for topical NSAIDs is primarily fueled by the rising prevalence of musculoskeletal disorders, sports injuries, osteoarthritis, and chronic pain conditions, along with growing patient awareness about non-invasive treatment options

- North America dominated the topical non-steroidal anti-inflammatory drugs market with the largest revenue share of 43.4% in 2024, supported by advanced healthcare infrastructure, high patient awareness, and the strong presence of key market players. The U.S., in particular, is witnessing substantial adoption due to increasing incidences of arthritis, sports-related injuries, and other musculoskeletal conditions. Easy access to dermatology and pain management specialists, coupled with established pharmaceutical distribution networks, further drives market growth in the region

- Asia-Pacific is expected to be the fastest-growing region in the topical non-steroidal anti-inflammatory drugs market during the forecast period, driven by increasing urbanization, rising disposable incomes, expanding healthcare access in countries like China, India, and Japan, and growing patient awareness about localized pain management solutions

- The generic segment dominated the topical non-steroidal anti-inflammatory drugs market with the largest market revenue share of 55.2% in 2024, primarily due to affordability, wide availability, and increasing insurance coverage for generic medications

Report Scope and Topical Non-Steroidal Anti-Inflammatory Drugs Market Segmentation

|

Attributes |

Topical Non-Steroidal Anti-Inflammatory Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Topical Non-Steroidal Anti-Inflammatory Drugs Market Trends

Rising Demand for Targeted Pain Relief and Inflammation Management

- A significant and accelerating trend in the global Topical NSAIDs market is the increasing preference for targeted, localized pain relief over systemic oral medications. Patients and healthcare providers are prioritizing treatments that deliver faster results directly to affected areas while minimizing side effects

- For instance, gels and creams are widely prescribed for joint pain, tendonitis, and sports-related injuries, providing rapid absorption and sustained relief. Similarly, topical NSAID patches are gaining traction for chronic pain management due to their convenience and long-acting formulations, offering patients more flexible treatment options

- The use of topical NSAIDs is expanding across clinical and homecare settings, with hospital pharmacies, dermatology clinics, and retail pharmacies ensuring broad accessibility. Patients increasingly prefer non-invasive options that allow self-administration, supporting higher adherence to treatment regimens

- The availability of multiple formulations—such as gels, creams, patches, and sprays—enables personalized therapy for different pain conditions, body areas, and patient preferences. This versatility is driving adoption among diverse demographic groups, including elderly populations and active adults

- This trend toward convenient, effective, and safe localized therapies is fundamentally reshaping patient expectations in pain management. Consequently, companies such as Johnson & Johnson, Novartis, and Mylan are expanding their topical NSAID product lines, introducing innovative formulations that combine efficacy with user-friendly application methods

- The demand for topical NSAIDs is growing rapidly across both developed and emerging markets, as consumers increasingly prioritize effective, low-risk alternatives to oral pain medications and look for products that can be used comfortably at home or in outpatient care

Topical Non-Steroidal Anti-Inflammatory Drugs Market Dynamics

Driver

Growing Need Due to Rising Prevalence of Musculoskeletal Disorders and Chronic Pain Management

- The increasing prevalence of musculoskeletal disorders, arthritis, and chronic pain conditions, coupled with the growing awareness of effective pain management solutions, is a significant driver for the heightened demand for topical NSAIDs

- For instance, in April 2024, Onity, Inc. announced advancements in patient-centric formulations aimed at improving local drug delivery and absorption. Such strategies by key companies are expected to drive the topical NSAIDs market growth during the forecast period

- As patients and healthcare providers become more aware of non-invasive alternatives to oral pain medications, topical NSAIDs offer targeted relief with reduced systemic side effects, providing a compelling advantage over traditional oral therapies

- Furthermore, the growing adoption of self-care routines and home-based treatment options is making topical NSAIDs an integral component of pain management strategies, offering ease of use and improved patient compliance

- The convenience of localized application, rapid relief from inflammation, and the ability to manage chronic conditions at home are key factors propelling the adoption of topical NSAIDs in both clinical and over-the-counter settings. The trend towards self-medication and the increasing availability of user-friendly topical formulations further contribute to market growth

Restraint/Challenge

Concerns Regarding Skin Irritation and High Product Costs

- Concerns surrounding potential skin irritation, allergic reactions, or long-term topical use pose a significant challenge to broader market penetration. As topical NSAIDs are applied directly to the skin, some patients remain cautious about adverse effects or sensitivities

- For instance, reports of mild dermatitis or irritation associated with prolonged use have made some consumers hesitant to adopt topical NSAID solutions

- Addressing these concerns through hypoallergenic formulations, dermatologically tested products, and clear usage instructions is crucial for building consumer trust. Companies such as Abbott and Pfizer emphasize their safe formulations and quality standards in their marketing to reassure potential buyers

- In addition, the relatively high cost of some advanced topical NSAID products compared to generic or traditional alternatives can be a barrier to adoption for price-sensitive consumers, particularly in developing regions. While basic over-the-counter formulations have become more affordable, premium products with enhanced delivery systems or combined therapeutic benefits often carry a higher price tag

- While prices are gradually becoming more competitive, the perceived premium for advanced topical NSAIDs can still hinder widespread adoption, especially among those who do not see an immediate need for enhanced formulations

- Overcoming these challenges through improved formulation safety, consumer education on proper usage, and the development of more affordable topical NSAID options will be vital for sustained market growth

Topical Non-Steroidal Anti-Inflammatory Drugs Market Scope

The market is segmented on the basis of indication, drug type, age group, dosage form, end-users, and distribution channel.

- By Indication

On the basis of indication, the topical non-steroidal anti-inflammatory drugs market is segmented into anti-inflammatory, analgesic, swelling, stiffness, and skin infections. The anti-inflammatory segment dominated the largest market revenue share of 38.6% in 2024, driven by its widespread use in managing arthritis, musculoskeletal disorders, sports injuries, and post-operative inflammation. Patients and healthcare providers increasingly prefer topical anti-inflammatory formulations for their targeted action, which reduces systemic side effects commonly associated with oral NSAIDs. Hospitals, specialty clinics, and homecare users frequently recommend anti-inflammatory topical NSAIDs as first-line treatments. The demand is further bolstered by growing awareness of non-invasive pain management solutions and the increasing prevalence of chronic inflammatory conditions globally. Advancements in formulation technologies, such as enhanced absorption and prolonged action, further strengthen this segment’s market position. The segment also benefits from strong consumer trust and repeated usage due to its proven efficacy.

The analgesic segment is anticipated to witness the fastest CAGR of 8.7% from 2025 to 2032, fueled by rising chronic pain cases and the growing preference for over-the-counter analgesic topical NSAIDs. Consumers are increasingly seeking effective pain relief options that are easy to apply and have fewer systemic side effects compared to oral medications. The rise of sports injuries, occupational pain, and lifestyle-related muscle strains contributes to the growing adoption of topical analgesics. Increasing awareness campaigns by healthcare providers and manufacturers further promote their use. Innovation in delivery systems, such as gels, creams, and sprays, enhances convenience and patient compliance. In addition, analgesics are gaining traction in emerging markets due to affordable pricing, accessibility, and targeted relief. Online and retail pharmacy channels are expanding their offerings, making analgesic topical NSAIDs more accessible to end-users.

- By Drug Type

On the basis of drug type, the topical non-steroidal anti-inflammatory drugs market is segmented into branded and generics. The generic segment dominated the largest market revenue share of 55.2% in 2024, primarily due to affordability, wide availability, and increasing insurance coverage for generic medications. Generic topical NSAIDs provide cost-effective alternatives to branded products while maintaining comparable efficacy and safety. Hospitals, retail pharmacies, and homecare users increasingly prefer generic options for routine pain management. Regulatory approvals for generics and robust manufacturing capabilities of key market players also contribute to dominance. Furthermore, generics facilitate large-scale distribution and mass-market penetration, driving steady adoption. Consumer trust in established generic brands continues to strengthen the segment’s position. Partnerships between generic manufacturers and healthcare institutions further expand reach, reinforcing the segment’s market share.

The branded segment is expected to witness the fastest CAGR of 7.9% from 2025 to 2032, driven by innovations in formulations and advanced delivery systems that improve efficacy, patient compliance, and convenience. Branded products often include proprietary technologies, combination therapies, or enhanced skin penetration, making them attractive to physicians and end-users. Marketing campaigns, clinical endorsements, and physician recommendations contribute to higher adoption rates in both developed and emerging regions. Consumers increasingly value branded products for perceived quality, safety, and reliability. Premium features such as extended-release formulations and dual-action benefits are driving adoption. E-commerce platforms and retail channels are expanding their branded offerings, increasing accessibility. Rising disposable incomes and healthcare awareness among urban populations further support segment growth.

- By Age Group

On the basis of age group, the topical non-steroidal anti-inflammatory drugs market is segmented into pediatric, adult, and geriatric populations. The adult segment accounted for the largest market revenue share of 49.1% in 2024, due to high prevalence of musculoskeletal disorders, arthritis, and lifestyle-related injuries among this population. Adults are more likely to seek self-care solutions and OTC products, driving market adoption. The segment benefits from high awareness regarding non-invasive treatment options and preference for localized pain relief. Increased participation in sports and physical activities contributes to higher incidence of muscle and joint pain. Healthcare providers frequently recommend topical NSAIDs for adults to manage chronic and acute pain safely. Urbanization, rising disposable incomes, and exposure to health awareness campaigns further support this segment’s dominance.

The geriatric segment is anticipated to witness the fastest CAGR of 9.2% from 2025 to 2032, influenced by the aging global population and higher incidence of osteoarthritis and chronic pain conditions among older adults. Topical NSAIDs are preferred in this demographic due to their localized action, reduced gastrointestinal side effects, and convenience of use. Caregivers and healthcare providers increasingly recommend topical formulations for geriatric patients to improve compliance. Product innovations tailored to sensitive skin and ease of application accelerate market growth. Homecare adoption is rising among geriatric users who prefer self-administered pain relief options. Awareness campaigns targeting elderly pain management contribute to faster growth. Rising healthcare expenditure in developed and emerging markets also boosts the adoption of topical NSAIDs among older populations.

- By Dosage Form

On the basis of dosage form, the topical non-steroidal anti-inflammatory drugs market is segmented into creams, gel, ointment, spray, rubs, solution, and others. The gel segment dominated the largest market revenue share of 42.3% in 2024, favored for rapid absorption, non-greasy texture, and effective localized action. Gels are convenient for both chronic and acute pain relief, offering patient-friendly application. Their versatility in treating joint, muscle, and sports-related pain contributes to dominance. Increasing physician recommendations and consumer preference for fast-acting solutions further strengthen this segment. Advanced formulations with better skin penetration and sustained efficacy enhance adoption. Convenience, ease of use, and minimal residue contribute to sustained demand. The segment benefits from strong presence in both retail and online pharmacy channels.

The cream segment is projected to witness the fastest CAGR of 8.5% from 2025 to 2032, driven by innovations in moisturizing and skin-friendly ingredients. Consumers increasingly prefer creams for their cosmetic appeal, non-greasy application, and ability to combine pain relief with skin hydration. Rising awareness of self-care and home-based pain management drives adoption. Creams are widely used in both chronic and acute conditions, offering localized relief. Marketing campaigns emphasizing dual benefits of pain relief and skin care accelerate growth. The segment benefits from increasing retail and online availability. Physician recommendations for cream-based topical NSAIDs further support market penetration. Rising disposable incomes and preference for multipurpose products also contribute to faster growth.

- By End-Users

On the basis of end-users, the topical non-steroidal anti-inflammatory drugs market is segmented into hospitals, specialty clinics, homecare, and others. The homecare segment accounted for the largest market revenue share of 46.8% in 2024, driven by the growing trend of self-medication, increased awareness of home-based treatment options, and preference for over-the-counter topical NSAIDs. Consumers seek convenient, easy-to-apply solutions for pain and inflammation management without frequent hospital visits. Rising adoption of self-care routines, availability of user-friendly formulations, and guidance from online health resources strengthen the segment’s dominance. Homecare usage is further supported by retail and online pharmacy accessibility. Market players target homecare users through promotional campaigns emphasizing safety, ease of use, and effectiveness. The convenience of localized treatment drives repeat purchase and sustained adoption.

The hospitals segment is expected to witness the fastest CAGR of 7.8% from 2025 to 2032, due to increasing adoption of topical NSAIDs in post-operative care, orthopedic treatments, and inpatient pain management. Hospitals prefer topical NSAIDs for their targeted effect, safety profile, and ability to reduce systemic complications. Clinical recommendations, growing surgical procedures, and rising geriatric patient admissions contribute to segment growth. Hospitals increasingly integrate topical NSAIDs into pain management protocols. Rising awareness among healthcare professionals and enhanced hospital procurement strategies further accelerate adoption. Availability of advanced formulations suitable for hospital use supports faster growth. Increased partnerships between manufacturers and hospitals also enhance accessibility.

- By Distribution Channel

On the basis of distribution channel, the topical non-steroidal anti-inflammatory drugs market is segmented into hospital pharmacy, retail pharmacy, online pharmacy, and others. The retail pharmacy segment dominated the largest market revenue share of 44.5% in 2024, due to its accessibility, convenience, and immediate availability for consumers seeking topical NSAIDs. Retail pharmacies serve as primary points of purchase for over-the-counter products, promoting self-care. The widespread presence in urban and semi-urban areas contributes to dominance. Pharmacy staff recommendations enhance consumer trust and repeat purchase. Retail channels benefit from extensive marketing, promotions, and partnerships with manufacturers. Consumers prefer retail pharmacies for both branded and generic options, increasing overall sales. The segment supports multiple end-user categories, including homecare and clinics.

The online pharmacy segment is projected to witness the fastest CAGR of 9.0% from 2025 to 2032, driven by increasing adoption of e-commerce, digital health platforms, and convenient home delivery options. Consumers are increasingly comfortable purchasing healthcare products online, including topical NSAIDs, due to wider product selection and competitive pricing. Subscription-based delivery and promotional campaigns further accelerate adoption. Online pharmacies offer anonymity, convenience, and 24/7 accessibility, boosting user preference. Rapid digital penetration and smartphone usage in developing markets fuel market growth. The segment benefits from growing popularity of telemedicine consultations and online prescription fulfillment. Online pharmacy marketing strategies, including discounts and product bundles, further drive adoption.

Topical Non-Steroidal Anti-Inflammatory Drugs Market Regional Analysis

- North America dominated the topical non-steroidal anti-inflammatory drugs market with the largest revenue share of 43.4% in 2024, supported by advanced healthcare infrastructure, high patient awareness, and the strong presence of key market players

- The majority share within the region, driven by increasing incidences of arthritis, sports-related injuries, and other musculoskeletal conditions

- Easy access to dermatology and pain management specialists, along with well-established pharmaceutical distribution networks, further supports market growth. Rising adoption of both prescription and OTC topical non-steroidal anti-inflammatory drugs formulations in hospitals, specialty clinics, and homecare segments contributes to the region’s dominance

U.S. Topical NSAIDs Market Insight

The U.S. topical non-steroidal anti-inflammatory drugs market captured the largest revenue share in 2024 within North America, fueled by increasing prevalence of musculoskeletal disorders, arthritis, and sports-related injuries. Patients are increasingly seeking localized, non-steroidal treatment options such as gels, creams, ointments, and sprays to manage pain with fewer systemic side effects. Strong healthcare infrastructure, easy access to specialists, and established distribution channels in hospitals, clinics, and retail pharmacies drive market growth. Rising awareness about homecare pain management and self-administered therapies further supports adoption. The presence of major pharmaceutical companies and innovative topical formulations strengthens the U.S. market’s leadership position.

Europe Topical NSAIDs Market Insight

The Europe topical non-steroidal anti-inflammatory drugs market is projected to expand at a steady CAGR throughout the forecast period, driven by rising prevalence of musculoskeletal disorders, arthritis, and sports injuries. Key countries such as Germany and the U.K. contribute significantly due to strong healthcare infrastructure, patient awareness, and wide availability of topical NSAID formulations across hospitals, specialty clinics, and homecare segments. The region’s aging population and preference for non-steroidal localized pain management solutions further support growth.

U.K. Topical NSAIDs Market Insight

The U.K. topical non-steroidal anti-inflammatory drugs market is anticipated to grow at a notable CAGR, driven by increasing patient preference for non-steroidal topical therapies for arthritis, musculoskeletal injuries, and localized pain relief. Rising awareness about effective alternatives to oral NSAIDs, combined with a robust pharmaceutical distribution network, supports adoption in hospitals, clinics, and homecare. The growth of retail and online pharmacies further enhances accessibility of topical NSAID formulations.

Germany Topical NSAIDs Market Insight

The Germany topical non-steroidal anti-inflammatory drugs market is expected to witness significant growth during the forecast period, fueled by high healthcare standards, patient awareness of non-steroidal pain management therapies, and an increasing elderly population. Hospitals and specialty clinics are major end-users, while homecare adoption is growing due to convenience and accessibility. The presence of well-established pharmaceutical players and innovative topical formulations further reinforces market growth.

Asia-Pacific Topical NSAIDs Market Insight

The Asia-Pacific topical non-steroidal anti-inflammatory drugs market is expected to be the fastest-growing region in the topical non-steroidal anti-inflammatory drugs market during the forecast period, driven by increasing urbanization, rising disposable incomes, expanding healthcare access, and growing patient awareness in countries such as China, India, and Japan. The rising prevalence of musculoskeletal conditions, arthritis, and sports injuries, combined with greater availability of affordable topical NSAID formulations in hospitals, clinics, retail, and online pharmacies, is fueling rapid market expansion.

Japan Topical NSAIDs Market Insight

The Japan topical non-steroidal anti-inflammatory drugs market is gaining momentum due to a high-tech healthcare system, growing elderly population, and increasing patient awareness of localized pain management solutions. Hospitals, specialty clinics, and homecare segments contribute to adoption. The demand for easy-to-apply topical NSAID formulations such as gels, creams, and ointments is rising, particularly for arthritis and musculoskeletal conditions.

China Topical NSAIDs Market Insight

The China topical non-steroidal anti-inflammatory drugs market accounted for the largest revenue share within Asia-Pacific in 2024, driven by rapid urbanization, increasing disposable incomes, and expanding healthcare access. High prevalence of arthritis, sports injuries, and other inflammatory conditions supports strong demand for topical NSAIDs. Availability of affordable formulations, domestic pharmaceutical production, and increasing patient awareness about localized pain management solutions are key factors driving market growth.

Topical Non-Steroidal Anti-Inflammatory Drugs Market Share

The topical non-steroidal anti-inflammatory drugs industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sanofi (France)

- Pfizer Inc. (U.S.)

- GSk plc (U.K.)

- Novartis AG (Switzerland)

- Zydus Cadila (India)

- Boehringer Ingelheim International GmbH (Germany)

- Apotex Inc. (Canada)

- AstraZeneca (U.K.)

- Horizon Therapeutics PLC (Ireland)

- Johnson & Johnson and its affiliates (U.S.)

- Bayer AG (Germany)

- Perrigo Company plc (Ireland)

- Tolmar Pharmaceuticals, Inc. (U.S.)

- Reckitt Benckiser Group PLC (U.K.)

- Sun Pharmaceutical Industries Ltd. (India)

- Assertio Therapeutics, Inc. (U.S.)

- DAIICHI SANKYO COMPANY, LIMITED (Japan)

Latest Developments in Global Topical Non-Steroidal Anti-Inflammatory Drugs Market

- In March 2024, Sanofi S.A., a leading global pharmaceutical company, launched a spray formulation of its existing topical NSAID cream in France. The new spray enhances ease of application, increases patient compliance, and allows for rapid localized pain relief. This launch is expected to expand Sanofi’s market penetration in Europe and strengthen its position in the over-the-counter topical analgesics segment

- In October 2024, Hisamitsu Pharmaceutical Co., Inc. commenced clinical development of HP-3150, a novel transdermal nonsteroidal pain treatment, in the United States. The development underscores the company’s strategy to expand its presence in the North American market and addresses growing demand for effective, targeted topical pain therapies

- In May 2024, Hisamitsu’s Salonpas brand was recognized as the world’s No. 1 over-the-counter topical analgesic patch brand for the eighth consecutive year. This recognition highlights the brand’s global leadership, sustained consumer trust, and its strong market presence across multiple regions, supporting continued revenue growth

- In July 2025, Reckitt Benckiser Group Plc introduced the Biofreeze Ultraflex Patch, a new topical pain relief solution featuring 4% lidocaine. The patch provides up to 8 hours of targeted pain relief with patented 4-way flexibility technology for superior adhesion. This launch reinforces Reckitt’s market leadership in the topical analgesics segment and meets increasing consumer demand for high-efficacy, user-friendly products

- In March 2024, Sun Pharmaceutical Industries Ltd. inaugurated a new R&D and manufacturing facility in Gujarat, India, with an initial production capacity of 12 million tubes per year of lidocaine-based topical gels. The facility aims to support domestic and international market expansion, enhance supply chain efficiency, and accelerate innovation in topical NSAID formulations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL TOPICAL NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL TOPICAL NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL TOPICAL NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES MODEL

4.3 COMPETITIVE INTELLIGENCE

5 INDUSTRY INSIGHTS

5.1 PATENT ANALYSIS

5.1.1 PATENT LANDSCAPE

5.1.2 USPTO NUMBER

5.1.3 PATENT EXPIRY

5.1.4 EPIO NUMBER

5.1.5 PATENT STRENGTH AND QUALITY

5.1.6 PATENT CLAIMS

5.1.7 PATENT CITATIONS

5.1.8 PATENT LITIGATION AND LICENSING

5.1.9 FILE OF PATENT

5.1.10 PATENT RECEIVED CONTRIES

5.1.11 TECHNOLOGY BACKGROUND

5.2 DRUG TREATMENT RATE BY MATURED MARKETS

5.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

5.4 PATIENT FLOW DIAGRAM

5.5 KEY PRICING STRATEGIES

5.6 KEY PATIENT ENROLLMENT STRATEGIES

5.7 INTERVIEWS WITH SPECIALIST

5.8 OTHER KOL SNAPSHOTS

6 EPIDEMIOLOGY

6.1 INCIDENCE OF ALL BY GENDER

6.2 TREATMENT RATE

6.3 MORTALITY RATE

6.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

6.5 PATIENT TREATMENT SUCCESS RATES

7 MERGERS AND ACQUISITION

7.1 LICENSING

7.2 COMMERCIALIZATION AGREEMENTS

8 REGULATORY FRAMEWORK

8.1 REGULATORY APPROVAL PROCESS

8.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

8.3 REGULATORY APPROVAL PATHWAYS

8.4 LICENSING AND REGISTRATION

8.5 POST-MARKETING SURVEILLANCE

8.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

9 PIPELINE ANALYSIS

9.1 CLINICAL TRIALS AND PHASE ANALYSIS

9.2 DRUG THERAPY PIPELINE

9.3 PHASE III CANDIDATES

9.4 PHASE II CANDIDATES

9.5 PHASE I CANDIDATES

9.6 OTHERS (PRE-CLINICAL AND RESEARCH)

TABLE 1 GLOBAL TOPICAL NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET

Company Name Therapeutic Area

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 2 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE TOPICAL NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET

Phase Number of Projects

Preclinical/Research Projects XX

Clinical Development XX

Phase I XX

Phase II XX

Phase III XX

U.S. Filed/Approved But Not Yest Marketed XX

Total XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 3 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE TOPICAL NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET

Therapeutic Area Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 4 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE TOPICAL NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET

Technology Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

FIGURE 1 TOP ENTITIES BASED ON R&D GLANCE FOR TOPICAL NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

10 MARKETED DRUG ANALYSIS

10.1 DRUG

10.1.1 BRAND NAME

10.1.2 GENERICS NAME

10.2 THERAPEUTIC INDIACTION

10.3 PHARACOLOGICAL CLASS OD THE DRUG

10.4 DRUG PRIMARY INDICATION

10.5 MARKET STATUS

10.6 MEDICATION TYPE

10.7 DRUG DOSAGES FORM

10.8 DOSAGES AVAILABILITY

10.9 PACKAGING TYPE

10.1 DRUG ROUTE OF ADMINISTRATION

10.11 DOSING FREQUENCY

10.12 DRUG INSIGHT

10.13 AN OVERVIEW OF THE DRUG DEVELOPMENT ACTIVITIES SUCH AS REGULATORY MILSTONE, SAFETY DATA AND EFFICACY DATA, MARKET EXCLUSIVITY DATA.

10.13.1 FORECAST MARKET OUTLOOK

10.13.2 CROSS COMPETITION

10.13.3 THERAPEUTIC PORTFOLIO

10.13.4 CURRENT DEVELOPMENT SCENARIO

11 MARKET ACCESS

11.1 10-YEAR MARKET FORECAST

11.2 CLINICAL TRIAL RECENT UPDATES

11.3 ANNUAL NEW FDA APPROVED DRUGS

11.4 DRUGS MANUFACTURER AND DEALS

11.5 MAJOR DRUG UPTAKE

11.6 CURRENT TREATMENT PRACTICES

11.7 IMPACT OF UPCOMING THERAPY

12 R & D ANALYSIS

12.1 COMPARATIVE ANALYSIS

12.2 DRUG DEVELOPMENTAL LANDSCAPE

12.3 IN-DEPTH INSIGHTS ON REGULATORY MILESTONES

12.4 THERAPEUTIC ASSESSMENT

12.5 ASSET-BASED COLLABORATIONS AND PARTNERSHIPS

13 MARKET OVERVIEW

13.1 DRIVERS

13.2 RESTRAINTS

13.3 OPPORTUNITIES

13.4 CHALLENGES

14 GLOBAL TOPICAL NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET, BY TYPE

14.1 OVERVIELW

14.2 NON-SELECTIVE NSAIDS

14.2.1 BY DRUG TYPE

14.2.1.1. ACETYLATED SALICYLATES (ASPIRIN)

14.2.1.1.1. NON-ACETYLATED SALICYLATES

14.2.1.1.1.1 DIFLUNISAL

14.2.1.1.1.2 SALSALATE

14.2.1.1.1.3 OTHERS

14.2.1.1.2. PROPIONIC ACIDS

14.2.1.1.2.1 NAPROXEN

14.2.1.1.2.2 IBUPROFEN

14.2.1.1.2.3 FLURBIPROFEN

14.2.1.1.2.4 KETOPROFEN

14.2.1.1.2.5 OTHERS

14.2.1.1.3. ACETIC ACIDS

14.2.1.1.3.1 DICLOFENAC

14.2.1.1.3.2 INDOMETHACIN

14.2.1.1.3.3 OTHERS

14.2.1.1.4. ENOLIC ACID

14.2.1.1.4.1 PIROXICAM

14.2.1.1.4.2 OTHERS

14.2.1.1.5. BUFEXAMIC ACID

14.2.1.1.6. CELEBREX

14.2.1.1.7. KETOROLAC TROMETHAMINE

14.2.1.1.8. ETODOLAC

14.2.1.1.9. OTHERS

14.2.2 INDICATION

14.2.2.1. ARTHRITIS

14.2.2.1.1. DRUG TYPE

14.2.2.1.1.1 ACETYLATED SALICYLATES(ASPRIN)

14.2.2.1.1.2 NON-ACETYLATED SALICYLATES

14.2.2.1.1.3 PROPIONIC ACIDS

14.2.2.1.1.4 ACETIC ACIDS

14.2.2.1.1.5 ENOLIC ACIDS

14.2.2.1.1.6 BUFEXAMIC ACID

14.2.2.1.1.7 OTHERS

14.3 COMBINATION PRODUCTS

14.3.1 INDICATION

14.3.1.1. OSTEOARTHRITIS

14.3.1.1.1.1 BY DRUG TYPE

14.3.1.1.1.1.1. ACETYLATED SALICYLATES(ASPRIN)

14.3.1.1.1.1.2. NON-ACETYLATED SALICYLATES

14.3.1.1.1.1.3. PROPIONIC ACIDS

14.3.1.1.1.1.4. ACETIC ACIDS

14.3.1.1.1.1.5. ENOLIC ACIDS

14.3.1.1.1.1.6. BUFEXAMIC ACID

14.3.1.1.1.1.7. CELEBREX

14.3.1.1.1.1.8. CELECOXIB CAPSULES

14.3.1.1.1.1.9. OTHERS

14.3.1.2. MIGRAINE

14.3.1.3. ECZEMA

14.3.1.4. OPHTHALMIC DISEASES (BROMSITE)

14.3.1.5. KERATOSIS

14.3.1.6. MUSCLE PAIN (NAPROXEN EC)

14.3.1.7. OTHERS

15 GLOBAL TOPICAL NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET, BY DRUG TYPE

15.1 OVERVIEW

15.2 GENERIC

15.3 BRANDED

15.3.1 VOLTAREN

15.3.2 FLECTOR

15.3.3 PENNSAID

15.3.4 SOLARAZE

15.3.5 ZICLOPRO

15.3.6 OTHERS

16 GLOBAL TOPICAL NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET, BY MODE OF PURCHASE

16.1 OVERVIEW

16.2 OVER THE COUNTER

16.3 PRESCRIPTION

17 GLOBAL TOPICAL NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET, BY AGE GROUP

17.1 OVERVIEW

17.2 PEDIATRIC

17.3 ADULT

17.4 ELDER

18 GLOBAL TOPICAL NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET, BY DOSES FORM

18.1 OVERVIEW

18.2 CREAMS

18.3 GEL

18.4 OINTMENT

18.5 SPRAY

18.6 RUBS

18.7 SOLUTION

18.8 OTHERS

19 GLOBAL TOPICAL NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET, BY END USER

19.1 OVERVIEW

19.2 HOSPITALS

19.3 CLINICS

19.4 HOME HEALTHCARE

19.5 SPECIALITY CENTER

19.6 AMBULTORY CENTERS

19.7 OTHERS

20 GLOBAL TOPICAL NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET, BY DISTRIBUTION CHANNEL

20.1 OVERVIEW

20.2 DIRECT TENDER

20.3 HOSPITAL PHARMACY

20.4 RETAIL PHARMACY SALES

20.4.1 OFFLINE SALES

20.4.1.1. HOSPITAL PHARMACY

20.4.1.2. RETAIL PHARMACY

20.4.1.3. OTHERS

20.4.2 ONLINE SALES

20.4.2.1. E-STORES

20.4.2.2. COMPANY WEBSITE

20.4.2.3. OTHERS

20.5 OTHERS

21 GLOBAL TOPICAL NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET, COMPANY LANDSCAPE

21.1 COMPANY SHARE ANALYSIS: GLOBAL

21.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

21.3 COMPANY SHARE ANALYSIS: EUROPE

21.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

21.5 MERGERS & ACQUISITIONS

21.6 NEW PRODUCT DEVELOPMENT & APPROVALS

21.7 EXPANSIONS

21.8 REGULATORY CHANGES

21.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

22 GLOBAL TOPICAL NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET, BY GEOGRAPHY

22.1 GLOBAL TOPICAL NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

22.1.1 NORTH AMERICA

22.1.1.1. U.S.

22.1.1.1.1. U.S. TOPICAL NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET, BY TYPE

22.1.1.1.2. U.S. TOPICAL NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET, BY DRUG TYPE

22.1.1.1.3. U.S. TOPICAL NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET, BY MODE OF PURCHASE

22.1.1.1.4. U.S. TOPICAL NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET, BY AGE GROUP

22.1.1.1.5. U.S. TOPICAL NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET, BY DOSES FORM

22.1.1.1.6. U.S. TOPICAL NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET, BY END USER

22.1.1.1.7. U.S. TOPICAL NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET, BY DISTRIBUTION CHANNEL

22.1.2 CANADA

22.1.3 MEXICO

22.2 EUROPE

22.2.1 GERMANY

22.2.2 FRANCE

22.2.3 U.K.

22.2.4 ITALY

22.2.5 SPAIN

22.2.6 RUSSIA

22.2.7 TURKEY

22.2.8 NETHERLANDS

22.2.9 SWITZERLAND

22.2.10 AUSTRIA

22.2.11 IRELAND

22.2.12 NORWAY

22.2.13 POLAND

22.2.14 REST OF EUROPE

22.3 ASIA-PACIFIC

22.3.1 JAPAN

22.3.2 CHINA

22.3.3 TAIWAN

22.3.4 SOUTH KOREA

22.3.5 INDIA

22.3.6 AUSTRALIA

22.3.7 SINGAPORE

22.3.8 THAILAND

22.3.9 MALAYSIA

22.3.10 INDONESIA

22.3.11 PHILIPPINES

22.3.12 VIETNAM

22.3.13 REST OF ASIA-PACIFIC

22.4 SOUTH AMERICA

22.4.1 BRAZIL

22.4.2 ARGENTINA

22.4.3 CHILE

22.4.4 PERU

22.4.5 REST OF SOUTH AMERICA

22.5 MIDDLE EAST AND AFRICA

22.5.1 SOUTH AFRICA

22.5.2 SAUDI ARABIA

22.5.3 UAE

22.5.4 EGYPT

22.5.5 KUWAIT

22.5.6 ISRAEL

22.5.7 REST OF MIDDLE EAST AND AFRICA

22.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

23 GLOBAL TOPICAL NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET, SWOT AND DBMR ANALYSIS

24 GLOBAL TOPICAL NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET, COMPANY PROFILE

24.1 F. HOFFMANN-LA ROCHE LTD.

24.1.1 COMPANY OVERVIEW

24.1.2 REVENUE ANALYSIS

24.1.3 GEOGRAPHIC PRESENCE

24.1.4 PRODUCT PORTFOLIO

24.1.5 RECENT DEVELOPMENTS

24.2 IBSA PHARMA INC

24.2.1 COMPANY OVERVIEW

24.2.2 REVENUE ANALYSIS

24.2.3 GEOGRAPHIC PRESENCE

24.2.4 PRODUCT PORTFOLIO

24.2.5 RECENT DEVELOPMENTS

24.3 UNIPRIX

24.3.1 COMPANY OVERVIEW

24.3.2 REVENUE ANALYSIS

24.3.3 GEOGRAPHIC PRESENCE

24.3.4 PRODUCT PORTFOLIO

24.3.5 RECENT DEVELOPMENTS

24.4 AMGEN INC

24.4.1 COMPANY OVERVIEW

24.4.2 REVENUE ANALYSIS

24.4.3 GEOGRAPHIC PRESENCE

24.4.4 PRODUCT PORTFOLIO

24.4.5 RECENT DEVELOPMENTS

24.5 PFIZER INC.

24.5.1 COMPANY OVERVIEW

24.5.2 REVENUE ANALYSIS

24.5.3 GEOGRAPHIC PRESENCE

24.5.4 PRODUCT PORTFOLIO

24.5.5 RECENT DEVELOPMENTS

24.6 LUPIN

24.6.1 COMPANY OVERVIEW

24.6.2 REVENUE ANALYSIS

24.6.3 GEOGRAPHIC PRESENCE

24.6.4 PRODUCT PORTFOLIO

24.6.5 RECENT DEVELOPMENTS

24.7 MAYNE PHARMA GROUP LIMITED

24.7.1 COMPANY OVERVIEW

24.7.2 REVENUE ANALYSIS

24.7.3 GEOGRAPHIC PRESENCE

24.7.4 PRODUCT PORTFOLIO

24.7.5 RECENT DEVELOPMENTS

24.8 NOVARTIS

24.8.1 COMPANY OVERVIEW

24.8.2 REVENUE ANALYSIS

24.8.3 GEOGRAPHIC PRESENCE

24.8.4 PRODUCT PORTFOLIO

24.8.5 RECENT DEVELOPMENTS

24.9 TEVA PHARMACEUTICAL INDUSTRIES LTD.

24.9.1 COMPANY OVERVIEW

24.9.2 REVENUE ANALYSIS

24.9.3 GEOGRAPHIC PRESENCE

24.9.4 PRODUCT PORTFOLIO

24.9.5 RECENT DEVELOPMENTS

24.1 SUN PHARMACEUTICAL INDUSTRIES LTD.

24.10.1 COMPANY OVERVIEW

24.10.2 REVENUE ANALYSIS

24.10.3 GEOGRAPHIC PRESENCE

24.10.4 PRODUCT PORTFOLIO

24.10.5 RECENT DEVELOPMENTS

24.11 CIPLA INC.

24.11.1 COMPANY OVERVIEW

24.11.2 REVENUE ANALYSIS

24.11.3 GEOGRAPHIC PRESENCE

24.11.4 PRODUCT PORTFOLIO

24.11.5 RECENT DEVELOPMENTS

24.12 GLENMARK PHARMACEUTICALS U.S. INC., USA

24.12.1 COMPANY OVERVIEW

24.12.2 REVENUE ANALYSIS

24.12.3 GEOGRAPHIC PRESENCE

24.12.4 PRODUCT PORTFOLIO

24.12.5 RECENT DEVELOPMENTS

24.13 JOHNSON & JOHNSON CONSUMER INC.

24.13.1 COMPANY OVERVIEW

24.13.2 REVENUE ANALYSIS

24.13.3 GEOGRAPHIC PRESENCE

24.13.4 PRODUCT PORTFOLIO

24.13.5 RECENT DEVELOPMENTS

24.14 APOTEX INC.

24.14.1 COMPANY OVERVIEW

24.14.2 REVENUE ANALYSIS

24.14.3 GEOGRAPHIC PRESENCE

24.14.4 PRODUCT PORTFOLIO

24.14.5 RECENT DEVELOPMENTS

24.15 RECKITT BENCKISER GROUP PLC

24.15.1 COMPANY OVERVIEW

24.15.2 REVENUE ANALYSIS

24.15.3 GEOGRAPHIC PRESENCE

24.15.4 PRODUCT PORTFOLIO

24.15.5 RECENT DEVELOPMENTS

24.16 BAYER AG

24.16.1 COMPANY OVERVIEW

24.16.2 REVENUE ANALYSIS

24.16.3 GEOGRAPHIC PRESENCE

24.16.4 PRODUCT PORTFOLIO

24.16.5 RECENT DEVELOPMENTS

24.17 TORRENT PHARMACEUTICALS LTD.

24.17.1 COMPANY OVERVIEW

24.17.2 REVENUE ANALYSIS

24.17.3 GEOGRAPHIC PRESENCE

24.17.4 PRODUCT PORTFOLIO

24.17.5 RECENT DEVELOPMENTS

24.18 ADVACARE PHARMA

24.18.1 COMPANY OVERVIEW

24.18.2 REVENUE ANALYSIS

24.18.3 GEOGRAPHIC PRESENCE

24.18.4 PRODUCT PORTFOLIO

24.18.5 RECENT DEVELOPMENTS

24.19 INTAS PHARMACEUTICALS LTD.

24.19.1 COMPANY OVERVIEW

24.19.2 REVENUE ANALYSIS

24.19.3 GEOGRAPHIC PRESENCE

24.19.4 PRODUCT PORTFOLIO

24.19.5 RECENT DEVELOPMENTS

24.2 AMNEAL PHARMACEUTICALS

24.20.1 COMPANY OVERVIEW

24.20.2 REVENUE ANALYSIS

24.20.3 GEOGRAPHIC PRESENCE

24.20.4 PRODUCT PORTFOLIO

24.20.5 RECENT DEVELOPMENTS

24.21 DAIICHI SANKYO COMPANY, LIMITED

24.21.1 COMPANY OVERVIEW

24.21.2 REVENUE ANALYSIS

24.21.3 GEOGRAPHIC PRESENCE

24.21.4 PRODUCT PORTFOLIO

24.21.5 RECENT DEVELOPMENTS

24.22 GEBRO PHARMA GMBH

24.22.1 COMPANY OVERVIEW

24.22.2 REVENUE ANALYSIS

24.22.3 GEOGRAPHIC PRESENCE

24.22.4 PRODUCT PORTFOLIO

24.22.5 RECENT DEVELOPMENTS

24.23 INCEPTA PHARMACEUTICALS LTD.

24.23.1 COMPANY OVERVIEW

24.23.2 REVENUE ANALYSIS

24.23.3 GEOGRAPHIC PRESENCE

24.23.4 PRODUCT PORTFOLIO

24.23.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

25 RELATED REPORTS

26 CONCLUSION

27 QUESTIONNAIRE

28 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.