Global Track Geometry Measurement System Tgms Market

Market Size in USD Billion

CAGR :

%

USD

3.79 Billion

USD

6.06 Billion

2024

2032

USD

3.79 Billion

USD

6.06 Billion

2024

2032

| 2025 –2032 | |

| USD 3.79 Billion | |

| USD 6.06 Billion | |

|

|

|

|

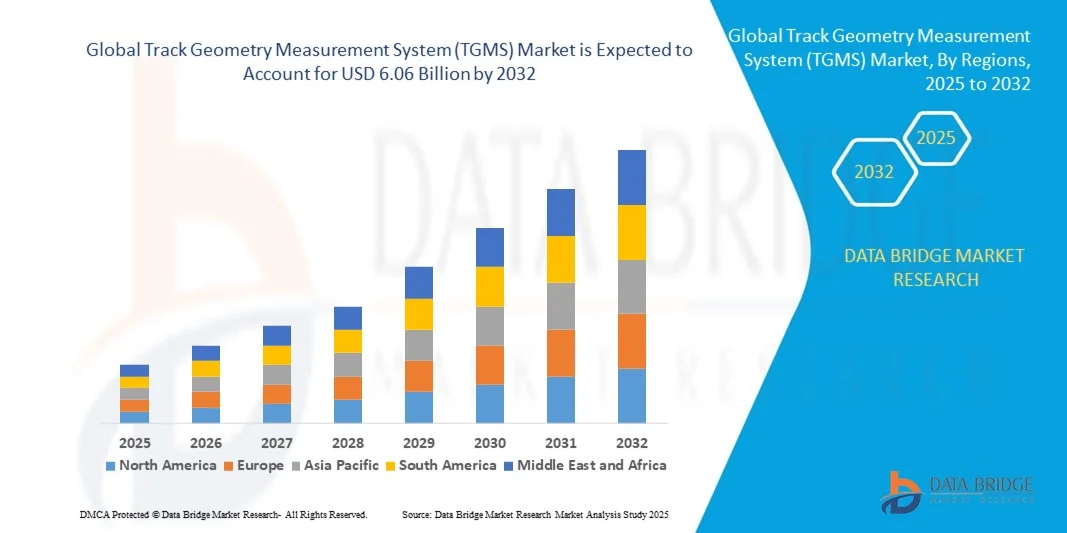

What is the Global Track Geometry Measurement System (TGMS) Market Size and Growth Rate?

- The global track geometry measurement system (TGMS) market size was valued at USD 3.79 billion in 2024 and is expected to reach USD 6.06 billion by 2032, at a CAGR of 8.9% during the forecast period

- The deployment of intelligent techniques in railways across the globe acts as one of the major factors driving the growth of track geometry measurement system (TGMS) market. The presence of various standards and regulations in railway industry and concerns regarding numerous mishaps and accidents involving trains prompting governments to digitize the mode of transport in order to ensure a safer journey accelerate the market growth

What are the Major Takeaways of Track Geometry Measurement System (TGMS) Market?

- The high popularity of no contact track geometry measurement system and use of track geometry measurement systems for track maintenance in railway sector further influence the market. In addition, growth in network of metro lines and high speed railway lines, rapid industrialization and growth in network of metro lines and high speed railway lines positively affect the track geometry measurement system (TGMS) market

- Asia-Pacific dominated the track geometry measurement system (TGMS) market with the largest revenue share of 36.7% in 2024, driven by rapid industrialization, government-backed infrastructure projects, and widespread adoption of smart railway systems

- The North America TGMS market is poised to grow at the fastest CAGR of 8.24% from 2025 to 2032, fueled by strong R&D investments in advanced optical technologies and increasing deployment of fiber-optic communication systems

- The Gauge segment dominated the market with a share of 35.4% in 2024, owing to its critical role in ensuring track safety, stability, and compliance with rail standards

Report Scope and Track Geometry Measurement System (TGMS) Market Segmentation

|

Attributes |

Track Geometry Measurement System (TGMS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Track Geometry Measurement System (TGMS) Market?

Integration of AI, IoT, and Advanced Sensing Technologies

- A significant trend in the global track geometry measurement system market is the adoption of artificial intelligence (AI), Internet of Things (IoT), and advanced sensor fusion to improve rail track inspection accuracy, predictive maintenance, and operational efficiency. AI-driven analytics are being deployed to detect micro-defects, optimize inspection cycles, and reduce downtime

- For instance, in March 2025, Siemens Mobility launched an upgraded digital rail inspection platform that integrates AI-based anomaly detection and cloud analytics, enabling faster decision-making for infrastructure managers

- AI-powered TGMS solutions are particularly impactful in high-speed rail and metro systems, where real-time monitoring ensures safety compliance and reduces operational risks

- In addition, the convergence of track geometry measurement system with LiDAR, drones, and unmanned inspection vehicles is reshaping industry expectations by offering high-resolution mapping, 24/7 monitoring, and reduced manual intervention

- This trend is positioning track geometry measurement system as a cornerstone technology in smart railway infrastructure, enhancing safety, automation, and cost efficiency across global rail networks

What are the Key Drivers of Track Geometry Measurement System (TGMS) Market?

- The rising demand for railway safety and reliability is a major driver, as track geometry measurement system plays a vital role in detecting alignment issues, gauge irregularities, and track wear before failures occur

- In January 2025, Plasser & Theurer introduced its new AI-enabled track recording vehicle, designed to support predictive maintenance strategies in European rail networks

- Growing investments in high-speed rail projects across Asia-Pacific and Europe are fueling adoption of track geometry measurement system for accurate, high-frequency inspections

- The shift toward automated and contactless measurement systems is boosting efficiency, minimizing labor dependency, and reducing inspection-related disruptions

- Expansion of urban transit networks and freight corridors worldwide is further accelerating track geometry measurement system deployment, as operators seek scalable, digital inspection technologies to meet rising passenger and cargo demand

Which Factor is Challenging the Growth of the Track Geometry Measurement System (TGMS) Market?

- One of the major challenges is the high capital cost of advanced track geometry measurement system solutions, which makes adoption difficult for smaller rail operators and in emerging economies. Despite long-term cost savings, upfront investment remains a barrier

- In February 2025, Harsco Rail highlighted cost-related adoption hurdles in its North American maintenance contracts, where smaller operators continue to rely on traditional inspection methods

- Technical complexity and the need for skilled operators also pose challenges, as advanced track geometry measurement system platforms demand training and integration with digital asset management system

- In addition, competition from manual inspection practices and low-cost alternatives creates resistance in markets where budget constraints dominate infrastructure decisions

- Overcoming these barriers through modular solutions, rental-based models, and government-backed standardization will be critical to unlocking wider adoption and ensuring long-term market growth

How is the Track Geometry Measurement System (TGMS) Market Segmented?

The market is segmented on the basis of measurement type, component, offering type, operation type, and railway type.

- By Measurement Type

On the basis of measurement type, the track geometry measurement system market is segmented into Gauge, Twist, Cant & Cant Deficiency, Vertical Profile, Curvature, Alignment, Dynamic Cross-Level, Dipped Joints, and Others. The Gauge segment dominated the market with a share of 35.4% in 2024, owing to its critical role in ensuring track safety, stability, and compliance with rail standards. Gauge measurements are essential for all railway types, and modern TGMS solutions provide real-time data, improving operational efficiency and reducing accidents.

The Dynamic Cross-Level segment is expected to record the fastest CAGR of 19.8% between 2025 and 2032, driven by increasing adoption in high-speed and mass transit railways where dynamic loading impacts track alignment. Growing focus on automated inspection systems and predictive maintenance is further accelerating demand for precise dynamic cross-level measurement technologies.

- By Component

On the basis of component, the track geometry measurement system market is segmented into Software, Lighting Equipment, Navigation Equipment, Communication Equipment, Computer, Camera, Data Storage, Power Supply Equipment, and Sensor. The Sensor segment dominated the market with a share of 38.7% in 2024, as sensors are core to capturing accurate track geometry data and feeding it into software analytics platforms. Advanced sensor technologies, including LiDAR, MEMS accelerometers, and laser-based systems, are increasingly integrated into track geometry measurement system vehicles for real-time inspections.

The Software segment is projected to grow at the fastest CAGR of 21.2% from 2025 to 2032, fueled by AI-enabled analytics, cloud integration, and predictive maintenance solutions. Rail operators are leveraging software to process large datasets, detect anomalies, and optimize maintenance schedules, which is driving robust growth for software components.

- By Offering Type

On the basis of offering type, the track geometry measurement system market is segmented into Hardware, Software, and Services. The Hardware segment dominated the market with a share of 52.6% in 2024, as high-precision measurement vehicles, sensors, and laser systems remain central to track geometry measurement system operations. These solutions are widely used in railways globally for routine inspections and compliance checks.

The Services segment is expected to register the fastest CAGR of 18.5% during 2025–2032, driven by increasing demand for maintenance contracts, calibration services, and software updates. Rail operators are increasingly outsourcing track geometry measurement system support services to reduce downtime, optimize lifecycle costs, and ensure regulatory compliance, which is propelling aftermarket and service-based growth.

- By Operation Type

On the basis of operation type, the track geometry measurement system market is segmented into No Contact and Contact. The No Contact segment dominated the market with a share of 61.3% in 2024, owing to its safety, speed, and ability to inspect tracks without disrupting rail traffic. Non-contact track geometry measurement system solutions leverage lasers, cameras, and LiDAR sensors to collect precise track geometry data.

The Contact segment is projected to witness the fastest CAGR of 17.9% from 2025 to 2032, as certain heavy-haul railways and maintenance operations still require contact-based systems for high-accuracy measurements under specific conditions. Advancements in hybrid systems combining contact and non-contact technologies are expected to further drive market adoption.

- By Railway Type

On the basis of railway type, the track geometry measurement system market is segmented into High-Speed Railways, Mass Transit Railways, Heavy Haul Railways, and Light Railways. The High-Speed Railways segment dominated the market with a share of 43.5% in 2024, driven by the critical need for precise, continuous monitoring to ensure safety at high operational speeds. High-speed lines require advanced TGMS solutions to detect micro-defects and alignment irregularities in real time.

The Mass Transit Railways segment is expected to record the fastest CAGR of 20.4% between 2025 and 2032, fueled by rapid urbanization, metro network expansions, and growing investments in public transportation infrastructure. Automated inspections and AI-driven analytics are increasingly adopted in urban transit systems to minimize service disruptions and enhance passenger safety.

Which Region Holds the Largest Share of the Track Geometry Measurement System (TGMS) Market?

- Asia-Pacific dominated the track geometry measurement system (TGMS) market with the largest revenue share of 36.7% in 2024, driven by rapid industrialization, government-backed infrastructure projects, and widespread adoption of smart railway systems. The region benefits from a growing base of domestic TGMS manufacturers, cost-effective production, and increasing investments in urban transit and high-speed rail networks

- Countries such as China, Japan, and India are at the forefront of deploying advanced photonics, AI-based analytics, and IoT-enabled inspection systems to enhance track safety and operational efficiency

- Strong government initiatives in smart city projects, railway modernization, and manufacturing automation further cement Asia-Pacific’s position as the leading regional market for TGMS solution

China Track Geometry Measurement System (TGMS) Market Insight

The China track geometry measurement system market accounted for the largest revenue share in Asia-Pacific in 2024, driven by extensive telecommunication infrastructure upgrades, rapid 5G deployment, and the push for smart manufacturing facilities. Domestic production of cost-effective lasers and photonics components, coupled with government-backed digitalization initiatives, supports robust adoption across research, industrial, and defense applications. The country’s focus on technological self-reliance and partnerships with global track geometry measurement system providers further strengthens market expansion.

Japan Track Geometry Measurement System (TGMS) Market Insight

The Japan track geometry measurement system market is experiencing steady growth, supported by advanced technology adoption in robotics, semiconductors, and healthcare sectors. Integration of track geometry measurement system with IoT devices and high-speed fiber networks enhances market demand, particularly in industrial automation and medical diagnostics. Japan’s aging population further increases the need for precise, minimally invasive diagnostic systems, driving wider track geometry measurement system adoption across hospitals and research institutions.

North America Track Geometry Measurement System (TGMS) Market Insight

The North America track geometry measurement system market is poised to grow at the fastest CAGR of 8.24% from 2025 to 2032, fueled by strong R&D investments in advanced optical technologies and increasing deployment of fiber-optic communication systems. The U.S., in particular, accounts for the largest share within North America, with key players such as Coherent, Lumentum, and Keysight Technologies expanding their product portfolios. Rapid adoption in medical imaging, spectroscopy, aerospace, and defense applications, along with rising 5G deployment, is driving market acceleration.

Europe Track Geometry Measurement System (TGMS) Market Insight

The Europe track geometry measurement system market is projected to expand at a substantial CAGR, driven by strict regulatory requirements for energy efficiency and precision in optical technologies. Countries like Germany and the U.K. are investing in industrial automation, photonics research, and high-speed broadband networks. Adoption of track geometry measurement system in automotive testing, scientific research, and healthcare applications is strong, supported by government incentives for quantum technology and photonics innovation.

Germany Track Geometry Measurement System (TGMS) Market Insight

The Germany track geometry measurement system market is expected to grow significantly, propelled by the country’s leadership in industrial automation, automotive R&D, and precision engineering. Strong government and private investments in photonics research, along with increasing use in manufacturing, smart factories, and medical diagnostics, highlight Germany’s critical role in the regional market. Emphasis on sustainable and eco-friendly technologies further supports track geometry measurement system adoption.

U.K. Track Geometry Measurement System (TGMS) Market Insight

The U.K. track geometry measurement system market is anticipated to expand steadily, driven by telecommunication network upgrades, life sciences research, and defense applications. Rising investments in high-speed broadband infrastructure and secure communication channels are boosting demand for TGMS. In addition, increasing awareness of energy-efficient and precision measurement solutions is contributing to the U.K.’s role in Europe’s overall market growth.

Which are the Top Companies in Track Geometry Measurement System (TGMS) Market?

The track geometry measurement system (TGMS) industry is primarily led by well-established companies, including:

- MER MEC S.p.A. (Italy)

- Balfour Beatty (U.K.)

- Plasser & Theurer (Austria)

- Siemens (Germany)

- R.Bance & Co Ltd. (U.K.)

- Bentley Systems, Incorporated (U.S.)

- Goldschmidt Thermit GmbH (Germany)

- Egis (France)

- DMA (Italy)

- KŽV, spol. s r.o. (Czech Republic)

- Vista Instrumentation LLC (U.S.)

- Harsco Corporation (U.S.)

- Trimble Inc. (U.S.)

- Amberg Technologies (Switzerland)

- Rail Vision Europe Ltd. (Israel)

- Holland LP (U.S.)

- ENSCO, Inc. (U.S.)

- Fugro (Netherlands)

What are the Recent Developments in Global Track Geometry Measurement System (TGMS) Market?

- In December 2025, The United States Department of Energy's Office of Nuclear Energy (NE) awarded Ensco, Inc. a contract to design and test a prototype 8-axle cask railcar, also called the Fortis railcar, for transporting spent nuclear fuel and high-level radioactive waste, highlighting Ensco’s role in advancing safe nuclear material transportation and innovation

- In January 2025, Network Rail approved Fugro's RILA train-borne track measurement equipment for platform gauging, facilitating current and upcoming route-wide surveys while reducing the reliance on risky manual inspections, demonstrating the shift toward safer, more efficient track monitoring methods

- In December 2024, ENSCO Rail delivered its second heavy-duty hi-rail truck to CPKC, equipped with an advanced Track Geometry Measurement System (TGMS) that provides high-precision track geometry data and features an innovative sliding weight design for improved mobility during loaded track testing, reinforcing ENSCO’s commitment to railway safety and operational excellence

- In November 2024, ENSCO Rail successfully installed its Autonomous Track Geometry Measurement System (ATGMS) for VALE EFVM, one of Brazil’s largest mining railroads, enabling real-time, autonomous track monitoring that enhances safety and efficiency while supporting data-driven maintenance through the Automated Maintenance Advisor and Vehicle/Track Interaction system, showcasing ENSCO’s leadership in automated rail solutions

- In November 2024, VALE EFVM equipped Locomotive 1256 with ENSCO Rail’s ATGMS, allowing real-time, autonomous track monitoring that optimizes rail maintenance, minimizes disruptions, and improves infrastructure management for mining operations, underscoring the growing adoption of smart rail technology in industrial applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Track Geometry Measurement System Tgms Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Track Geometry Measurement System Tgms Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Track Geometry Measurement System Tgms Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.