Global Traction Battery Market

Market Size in USD Billion

CAGR :

%

USD

54.89 Billion

USD

153.31 Billion

2024

2032

USD

54.89 Billion

USD

153.31 Billion

2024

2032

| 2025 –2032 | |

| USD 54.89 Billion | |

| USD 153.31 Billion | |

|

|

|

|

Traction Battery Market Size

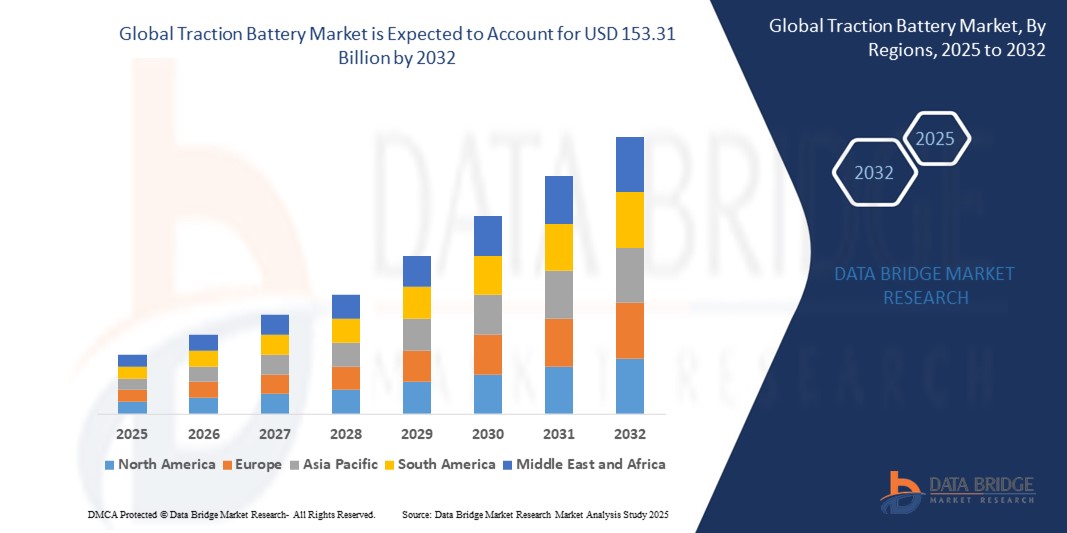

- The global traction battery market was valued at USD 54.89 billion in 2024 and is expected to reach USD 153.31 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 13.70% primarily driven by the increasing demand for electric vehicles and renewable energy storage solutions

- This growth is driven by factors such as the rising adoption of electric vehicles, advancements in battery technology, and government incentives promoting clean energy solutions

Traction Battery Market Analysis

- A traction battery is a high-capacity battery used to power electric vehicles (EVs) and other electric transportation systems, providing energy for movement and propulsion

- The traction battery market is witnessing growth due to the increasing demand for electric vehicles, with companies

- For instance, Tesla adopting advanced traction battery technologies to power their electric cars, while cities such as London are incorporating electric buses powered by such batteries for public transportation

- Innovations in battery technology, such as lithium-ion and solid-state batteries, are improving the efficiency and lifespan of traction batteries, enabling their wider use in electric vehicles and industrial machinery such as forklifts

- For instance, companies such as Toyota Material Handling are using lithium-ion batteries in their electric forklifts

- As industries focus on sustainability, traction batteries are becoming critical in material handling equipment, with companies

- For instance, Toyota Material Handling investing in electric forklifts powered by high-performance traction batteries, which are more efficient and eco-friendlier compared to traditional lead-acid batteries

- The rise of renewable energy solutions has further spurred traction battery adoption, with energy storage applications becoming popular in commercial and residential sectors, especially for solar power integration

- For instance, companies such as Sonnen and Tesla’s Powerwall are providing residential energy storage solutions using traction batteries

- With continuous technological advancements and increasing investments, companies such as BYD and CATL are developing next-generation traction batteries that offer faster charging times and higher energy density to meet the needs of the electric vehicle and energy storage sectors, as seen in BYD's electric buses and CATL's battery cells used in various electric vehicle manufacturers

Report Scope and Traction Battery Market Segmentation

|

Attributes |

Traction Battery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Traction Battery Market Trends

“Growing Adoption of Lithium Iron Phosphate Batteries”

- Lithium iron phosphate batteries are gaining popularity for their safety and durability, offering superior thermal stability and longer cycle life compared to other lithium-ion chemistries, making them suitable for industrial applications

- For instance, Toyota Material Handling’s electric forklifts and automated guided vehicles used in Amazon’s distribution centers

- Tesla began using lithium iron phosphate batteries in its Model 3 Standard Range vehicles manufactured at the Shanghai Gigafactory, highlighting the brand’s shift toward cost-effective and safer battery options for mainstream electric vehicles

- BYD, one of the largest electric vehicle manufacturers globally, exclusively uses lithium iron phosphate batteries in its Blade Battery technology, which powers models

- For instance, the BYD Han and BYD Atto 3, ensuring better thermal management and extended battery life

- CATL, a major global battery producer, has significantly scaled up lithium iron phosphate battery production, including its partnership with VinFast to supply LFP batteries for electric scooters and cars, and has announced large investments for new manufacturing plants in Germany and Indonesia

- Sonnen, a German-based energy storage company owned by Shell, uses lithium iron phosphate batteries in its residential energy storage systems to deliver safe, long-lasting, and efficient backup power for solar homes, particularly in markets such as Germany and California where home solar adoption is high

Traction Battery Market Dynamics

Driver

“Increasing Electric Vehicle Adoption”

- The traction battery market is being driven by the rising adoption of electric vehicles across multiple sectors, with Tesla expanding its Model Y and Model 3 production at Gigafactory Shanghai and Berlin, both of which rely on traction batteries for efficient energy storage and extended driving range

- Automakers such as BYD have introduced a wide range of electric vehicles including the BYD Atto 3 and Tang EV, which are powered by their proprietary Blade Battery based on lithium iron phosphate chemistry, while Hyundai has committed to electrifying 100 percent of its vehicle lineup in key global markets

- Public transportation networks are increasingly electrifying fleets, such as the Transport for London (TfL) initiative deploying over 1,000 electric buses across the city, and Shenzhen becoming the first city globally to operate a fully electric bus fleet of over 16,000 vehicles, all powered by traction batteries

- Governments are rolling out aggressive policies and incentives to boost electric vehicle adoption

- For instance, the U.S. Inflation Reduction Act includes billions in tax credits for electric vehicles, while Germany provides purchase subsidies and reduced VAT for electric vehicles, directly increasing traction battery demand

- Leading battery manufacturers such as LG Energy Solution and CATL are investing in new production facilities, such as LG’s USD 3 billion battery plant in Arizona and CATL’s new lithium battery plant in Debrecen, Hungary, aimed at supplying traction batteries for electric vehicles manufactured in North America and Europe respectively

Opportunity

“Rising Demand for Energy Storage Solutions”

- Traction batteries are increasingly being integrated into stationary energy storage systems to support the intermittent nature of renewable energy sources such as solar and wind, with Tesla’s Megapack being deployed in projects such as the Moss Landing Energy Storage Facility in California, one of the largest in the world

- In residential applications, Tesla’s Powerwall and Sonnen’s Eco line use traction battery technology to store excess solar power, helping homeowners manage peak demand and power outages, especially in regions such as California and Germany where solar panel adoption is high

- Utility providers and commercial users are turning to traction battery-based storage to improve grid stability

- For instance, LG Energy Solution’s battery systems are being used in South Korea’s national grid to ensure energy reliability during high-demand periods

- In developing countries with unstable grid infrastructure, traction batteries are being used as backup power solutions, Indian startup Oorja Energy uses lithium-based battery storage for microgrid applications in rural areas where electricity access is inconsistent

- This trend allows traction battery manufacturers to diversify beyond the electric vehicle sector and tap into the growing energy storage market, supported by global sustainability goals and energy transition initiatives such as the European Green Deal and India’s National Solar Mission

Restraint/Challenge

“High Initial Cost and Complex Integration”

- One of the key restraints in the traction battery market is the high initial cost of manufacturing advanced traction batteries, especially lithium-ion and solid-state batteries, which require expensive materials such as lithium, cobalt, and nickel, as seen with Tesla’s efforts to scale up battery production while managing costs

- For manufacturers and end-users, especially in developing regions, these high production and integration costs can be prohibitive, making it difficult for smaller enterprises or less developed economies to afford electric vehicles and traction battery systems

- The integration of traction batteries into electric vehicles or industrial systems also involves compatibility issues with hardware and software, requiring skilled labour for installation and long testing cycles to ensure safety and efficiency, as demonstrated by the extensive testing periods at companies such as Ford and BMW

- The availability of raw materials needed for battery production, such as lithium and cobalt, is limited, with supply chain vulnerabilities leading to price volatility and challenges for battery manufacturers

- For instance, concerns around cobalt supply from the Democratic Republic of Congo have raised questions about long-term stability in battery pricing

- Despite efforts to develop alternative chemistries and improve recycling programs, these solutions are not yet widespread enough to offset the cost barriers, meaning many markets still find it easier and cheaper to implement traditional fuel-based systems, slowing the adoption of electric vehicles and traction batteries across regions

Traction Battery Market Scope

The market is segmented on the basis of product type, capacity, and application type.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Capacity |

|

|

By Application Type |

|

Traction Battery Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Traction Battery Market”

- Asia-Pacific is the dominating region for the traction battery market due to its massive production capacity and high electric vehicle adoption

- China, Japan, and South Korea are the key players leading the region's market growth

- China is the largest producer of electric vehicles globally, significantly boosting its position in the traction battery market

- Companies such as CATL and BYD, based in China, are major global players in the battery production space

- Significant investments in renewable energy technologies and electric vehicle infrastructure in Asia-Pacific further strengthen the region's dominance

“North America is Projected to Register the Highest Growth Rate”

- North America is the fastest-growing region for the traction battery market due to the surge in electric vehicle adoption

- The U.S. is seeing significant investments from major automakers such as Tesla, Ford, and General Motors in electric vehicle production

- The region's rapid transition to electric vehicles and clean energy storage solutions is fuelling market growth

- Supportive government policies and infrastructure improvements are contributing to the acceleration of the traction battery market

- The increasing demand for sustainable transportation and energy storage solutions further drives the market's expansion in North America

Traction Battery Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Cymbet Corporation (U.S.)

- Seeo Inc. (U.S.)

- StmicroElectronics N.V. (Switzerland)

- Toyota Motor Corporation (Japan)

- Sakti3 Inc. (U.S.)

- Brightvolt, Inc. (U.S.)

- Excellatron (U.S.)

- Infinite Power Solution, Inc. (U.S.)

- Planar Energy Devices, Inc. (U.S.)

- QuantumEscape (U.S.)

- Altairnano (U.S.)

Latest Developments in Global Traction Battery Market

- In February 2023, Ford Motor Company announced plans to build a USD 3.5 billion lithium iron phosphate (LFP) battery plant in Marshall, Michigan, set to begin operations in 2026. This facility aims to produce 35 gigawatt-hours of LFP batteries annually, sufficient to power approximately 400,000 electric vehicles. By utilizing LFP technology, which is more affordable and uses abundant materials, Ford intends to offer lower-cost electric vehicle options, such as base models of the Mustang Mach-E and F-150 Lightning. This move aligns with the U.S. government's Inflation Reduction Act, which provides tax incentives for domestically produced batteries. The plant is expected to create 2,500 jobs, bolster the domestic supply chain, and support Ford's goal of producing 2 million electric vehicles globally by late 2026

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.