Global Trail Mix Snacks Market

Market Size in USD Billion

CAGR :

%

USD

5.44 Billion

USD

9.15 Billion

2024

2032

USD

5.44 Billion

USD

9.15 Billion

2024

2032

| 2025 –2032 | |

| USD 5.44 Billion | |

| USD 9.15 Billion | |

|

|

|

|

Trail Mix Snacks Market Size

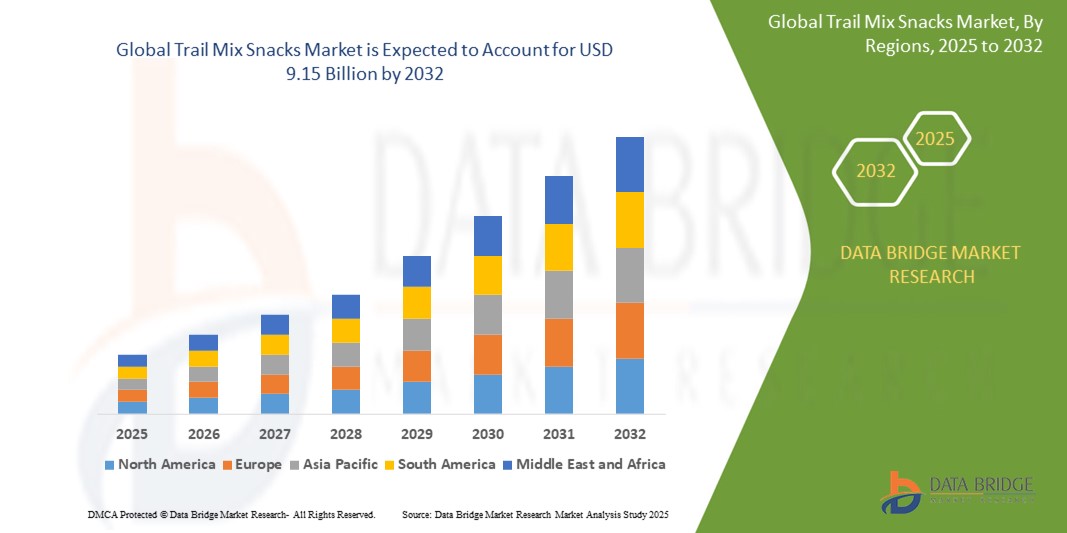

- The global trail mix snacks market size was valued at USD 5.44 billion in 2024 and is expected to reach USD 9.15 billion by 2032, at a CAGR of 6.71% during the forecast period

- The market growth is primarily driven by increasing consumer demand for healthy, convenient, and portable snack options, rising awareness of nutritional benefits, and growing popularity among fitness enthusiasts and outdoor adventurers

- Growing consumer preference for natural and organic ingredients, coupled with the rise in vegan and plant-based diets, is further propelling demand for trail mix snacks across retail and online channels

Trail Mix Snacks Market Analysis

- The trail mix snacks market is experiencing robust growth due to increasing consumer focus on health-conscious snacking, convenience, and diverse flavor profiles

- Demand is rising across various demographics, including millennials, fitness enthusiasts, and families, encouraging manufacturers to innovate with organic, non-GMO, and protein-rich trail mix formulations

- North America holds the largest revenue share of 35.2% in 2024, driven by a strong snacking culture, high disposable income, and widespread availability of trail mix products in retail and online channels

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, fueled by rapid urbanization, increasing health awareness, and rising demand for convenient snacks in countries such as China, India, and Japan

- The nuts and seeds segment held the largest market revenue share of 38.2% in 2024, driven by their high protein content, nutritional benefits, and ease of consumption. Consumers prefer nuts and seeds for their long-lasting energy and versatility, making them a popular choice for health-conscious individuals and on-the-go snacking

Report Scope and Trail Mix Snacks Market Segmentation

|

Attributes |

Trail Mix Snacks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Trail Mix Snacks Market Trends

“Rising Preference for Organic and Nut-Based Products”

- Organic trail mixes are gaining traction due to their perceived health benefits and absence of synthetic additives, appealing to health-conscious consumers

- Nut-based trail mixes, rich in protein and healthy fats, are preferred for their nutritional value and satiety, especially among active individuals and fitness enthusiasts

- In regions with growing health awareness, such as North America and Europe, organic trail mixes with superfoods such as chia seeds and goji berries are increasingly popular

- Premium and luxury snack brands are incorporating exotic nuts and dried fruits to cater to consumers seeking gourmet, high-quality options

- For instance, brands such as Nature Valley offer organic trail mix blends with customizable ingredients to meet diverse dietary preferences

- Retailers are increasingly promoting organic trail mix packages as value-added products in health food sections and subscription models

Trail Mix Snacks Market Dynamics

Driver

“Rising Demand for Convenient and Nutritious Snacking Options”

- Growing consumer awareness of health and wellness is boosting demand for trail mix snacks that offer a balanced mix of nutrients, including proteins, fibers, and healthy fats

- Trail mixes provide a convenient, portable snacking solution for busy lifestyles, appealing to urban consumers, hikers, and athletes seeking on-the-go nutrition

- These snacks help maintain energy levels and curb hunger, reducing the need for unhealthy alternatives, which aligns with the global shift toward healthier eating habits

- Manufacturers are responding by introducing innovative trail mix blends with plant-based, gluten-free, and low-sugar options to cater to diverse dietary needs

- For instance, Sahale Snacks, under The J.M. Smucker Company, launched bean and nut blends with plant-based protein for health-conscious consumers

- The rise of vegan and plant-based diets, particularly in North America and Asia-Pacific, is driving demand for meat-free trail mix options, enhancing market growth

Restraint/Challenge

“Regulatory Restrictions on Ingredient Labeling and Health Claims”

- Stringent regulations on ingredient transparency and health claims limit how trail mix products can be marketed, affecting consumer perception and brand strategies

- Different countries have varying standards for organic certification and nutritional labeling, complicating global supply chains and product standardization for manufacturers

- Excessive use of sugars or artificial additives in some trail mixes is scrutinized due to health concerns, potentially deterring health-conscious buyers

- For instance, in the European Union, strict guidelines on health claims require verifiable evidence, restricting marketing for certain trail mix products

- These regulations may discourage smaller manufacturers from entering the market and limit innovation in product formulations, potentially slowing market expansion

Trail Mix Snacks Market Scope

The market is segmented on the basis of product type, nature, and distribution channel.

- By Product Type

On the basis of product type, the trail mix snacks market is segmented into dried fruit, cereal and granola bars, nuts and seeds, meat, and trail mix. The nuts and seeds segment held the largest market revenue share of 38.2% in 2024, driven by their high protein content, nutritional benefits, and ease of consumption. Consumers prefer nuts and seeds for their long-lasting energy and versatility, making them a popular choice for health-conscious individuals and on-the-go snacking.

The dried fruit segment is anticipated to witness the fastest compound annual growth rate (CAGR) of 7.5% from 2025 to 2032, fueled by increasing demand for natural, organic, and clean-label products. Dried fruits are favored for their portability, long shelf life, and appeal to vegan and health-conscious consumers seeking nutrient-dense snacks.

- By Nature

On the basis of nature, the trail mix snacks market is segmented into organic and conventional trail mix snacks. The organic segment accounted for the largest market revenue share in 2024, driven by growing consumer preference for healthier, environmentally friendly products free from artificial additives. The rising popularity of veganism and demand for non-GMO ingredients further boost the organic segment’s growth.

The conventional segment is expected to witness the fastest CAGR from 2025 to 2032, as it remains a cost-effective option for price-sensitive consumers. Conventional trail mixes are widely available and cater to a broad audience, particularly in emerging markets where affordability is a key factor.

- By Distribution Channel

On the basis of distribution channel, the trail mix snacks market is segmented into hypermarkets/supermarkets, convenience stores, specialty stores, online retail stores, and other distribution channels. The hypermarkets/supermarkets segment dominated with the largest market revenue share of 44.2% in 2024, attributed to their extensive product range, accessibility, and frequent promotions. These retail outlets offer a wide variety of trail mix options, appealing to a diverse consumer base.

The online retail stores segment is projected to witness the fastest CAGR from 2025 to 2032, driven by the convenience of home delivery, a wider variety of products, and the increasing popularity of e-commerce platforms. Online retailers, such as Amazon and specialty health food sites, provide detailed product information and customer reviews, enhancing consumer trust and driving sales growth.

Trail Mix Snacks Market Regional Analysis

- North America holds the largest revenue share of 35.2% in 2024, driven by a strong snacking culture, high disposable income, and widespread availability of trail mix products in retail and online channels

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, fueled by rapid urbanization, increasing health awareness, and rising demand for convenient snacks in countries such as China, India, and Japan

U.S. Trail Mix Snacks Market Insight

The U.S. smart lock market captured the largest revenue share within North America in 2024, fueled by health-conscious consumers and busy lifestyles drive demand for nutritious, portable snacks. The growing popularity of outdoor activities, such as hiking and camping, boosts the consumption of trail mix as a convenient energy source. Retail channels, including supermarkets, convenience stores, and online platforms, are expanding access to premium and customized trail mix products, further supporting market growth..

Europe Trail Mix Snacks Market Insight

The European trail mix snacks market is projected to grow at a substantial CAGR during the forecast period, driven by increasing consumer focus on healthy eating and sustainable food choices. The demand for organic and eco-friendly snack options is rising, particularly in countries such as Germany, France, and the U.K. The market is also supported by the growing trend of snacking between meals and the popularity of trail mix in fitness and wellness communities. Retail innovation and the expansion of private-label brands contribute to market expansion.

U.K. Trail Mix Snacks Market

The U.K. trail mix snacks market is anticipated to expand at a noteworthy CAGR, fueled by rising health awareness and the growing popularity of plant-based diets. Consumers are increasingly seeking snacks that offer a balance of taste, nutrition, and convenience. The U.K.’s well-developed retail and e-commerce infrastructure, combined with the demand for premium and organic trail mix products, is expected to drive market growth. In addition, the trend of personalized trail mix blends is gaining traction among younger consumers.

Germany Trail Mix Snacks Market

The German trail mix snacks market is expected to grow at a considerable CAGR, driven by the country’s emphasis on sustainability, health, and wellness. Consumers are gravitating toward natural and organic trail mixes, with a preference for transparent ingredient sourcing. Germany’s robust food and beverage industry, coupled with the increasing popularity of vegan and functional snacks, supports the adoption of trail mix in both retail and online channels. The integration of superfoods and low-calorie options aligns with local consumer preferences.

Asia-Pacific Trail Mix Snacks Market

The Asia-Pacific trail mix snacks market is poised to grow at the fastest CAGR in 2025, exceeding 20%, driven by rising disposable incomes, urbanization, and growing awareness of healthy snacking in countries such as China, India, and Japan. The region’s expanding middle class and increasing adoption of Western snacking habits are key growth drivers. Government initiatives promoting healthy lifestyles and the rise of e-commerce platforms are making trail mix snacks more accessible, while local manufacturers are introducing region-specific flavors to cater to diverse palates.

Japan Trail Mix Snacks Market

The Japan trail mix snacks market is gaining momentum due to the country’s health-conscious culture and demand for convenient, nutrient-dense snacks. The integration of traditional Japanese ingredients, such as dried seaweed and rice-based components, into trail mix products is driving innovation. Japan’s aging population and focus on functional foods are also contributing to market growth, with trail mix being marketed as a healthy snack for both young professionals and older consumers. The rise of premium and organic offerings further supports market expansion.

China Trail Mix Snacks Market

The China trail mix snacks market accounted for the largest revenue share in the Asia-Pacific region in 2025, driven by rapid urbanization, a growing middle class, and increasing consumer preference for healthy and convenient snacks. The popularity of trail mix in urban areas, coupled with the expansion of e-commerce and retail channels, is boosting market growth. Domestic manufacturers are introducing affordable and innovative trail mix products tailored to local tastes, while the trend of snacking as a lifestyle choice continues to gain traction.

Trail Mix Snacks Market Share

The trail mix snacks industry is primarily led by well-established companies, including:

- PepsiCo, Inc. (U.S.)

- General Mills Inc. (U.S.)

- Frito-Lay North America, Inc. (U.S.)

- Sahale Snacks (U.S.)

- Tropical Foods (U.S.)

- Kellanova (U.S.)

- Truly Good Foods (U.S.)

- Setton Pistachio of Terra Bella, Inc. (U.S.)

- JOHN B. SANFILIPPO & SON, INC. (U.S.)

- Jerry's Nut House (U.S.)

- Munki Food (U.S.)

- Kar's Nuts (U.S.)

- The Kraft Heinz Company (U.S.)

- Tyson Foods, Inc. (U.S.)

- Mondelēz International (U.S.)

Latest Developments in Global Trail Mix Snacks Market

- In January 2023, ProV Foods, a brand under Mumbai-based Proventus Agrocom, launched ProV Minis, a line of small snack packs featuring flavored dried fruits, nuts, and seeds. The range includes Nut & Seed Mix, Almonds Piri Piri, and Creamy Cashew Cheese, catering to the growing demand for healthy, on-the-go snacking in developing markets such as India. Priced at INR 30 per pack, ProV Minis offer a convenient and nutritious alternative to traditional snacks

- In April 2022, CapVest Partners LLP acquired Second Nature Brands, a Michigan-based premium snack company, from Palladium Equity Partners, LLC. This acquisition strengthens CapVest’s presence in the healthy snack market, leveraging Second Nature’s trail mix brands, including Kar’s Nuts, Second Nature Snacks, and Sanders Chocolates. The deal aligns with CapVest’s strategy to expand its global footprint and capitalize on the rising demand for nutritious, on-the-go snacks

- In July 2021, The J.M. Smucker Company launched two new snack mixes under its Sahale Snacks brand, featuring White Cheddar Black Pepper and Creole Bean & Nut Blends. These mixes emphasize plant-based protein, catering to health-conscious consumers looking for nutritious, on-the-go snacks. The White Cheddar Black Pepper mix blends roasted chickpeas, fava beans, cashews, and pepitas with white cheddar cheese and black pepper, while the Creole mix combines roasted chickpeas, fava beans, pecans, peanuts, and bell peppers with bold Creole spices

- In May 2021, Mars Inc. partnered with Instacart to enhance the availability of its trail mix and snack products through efficient online delivery. This collaboration aligns with the growing consumer preference for e-commerce grocery shopping, expanding Mars’ reach in North America. The partnership enables same-day delivery of over 40 Mars brands, including M&M'S®, SNICKERS®, and SEEDS OF CHANGE®, through Instacart’s retail network. By leveraging Instacart’s digital platform, Mars strengthens its presence in the snack segment, catering to on-demand shopping trends

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Trail Mix Snacks Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Trail Mix Snacks Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Trail Mix Snacks Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.