Global Traumatic Brain Injury Diuretics Market

Market Size in USD Million

CAGR :

%

USD

170.41 Million

USD

262.01 Million

2024

2032

USD

170.41 Million

USD

262.01 Million

2024

2032

| 2025 –2032 | |

| USD 170.41 Million | |

| USD 262.01 Million | |

|

|

|

Traumatic Brain Injury Diuretics Market Size

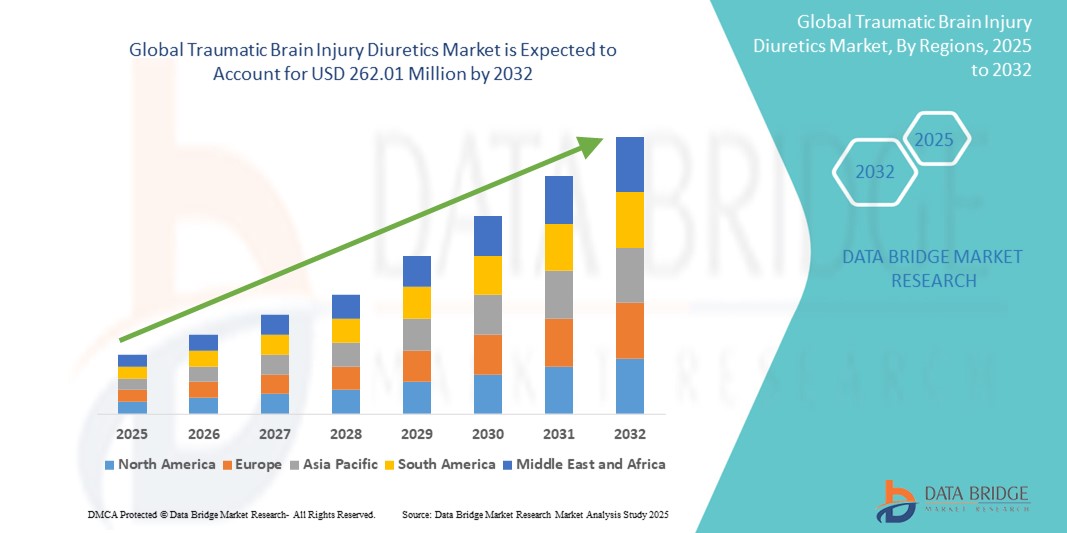

- The global traumatic brain injury diuretics market was valued at USD 170.41 million 2024 and is expected to reach USD 262.01 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.52%, primarily driven by the rising incidence of traumatic brain injuries and increasing demand for effective intracranial pressure management

- This growth is driven by factors such as the increasing prevalence of road accidents and sports-related head injuries, along with advancements in neurocritical care and diuretic drug formulations

Traumatic Brain Injury Diuretics Market Analysis

- Traumatic brain injury diuretics are essential pharmacological agents used to manage elevated intracranial pressure, a common and potentially life-threatening consequence of TBI. These drugs help in reducing cerebral edema and maintaining optimal brain perfusion during critical care

- The demand for traumatic brain injury diuretics is significantly driven by the rising incidence of road accidents, sports injuries, and falls, which are leading causes of traumatic brain injuries globally. Increased awareness and early intervention strategies have further propelled the need for effective diuretic therapies

- North America stands out as one of the dominant regions in the traumatic brain injury diuretics market, owing to its well-established emergency care infrastructure, advanced neurosurgical facilities, and a higher rate of reported TBI cases

- For instance, the U.S. alone, millions of TBI-related emergency department visits occur annually, leading to a strong demand for evidence-based pharmacological interventions such as diuretics to manage acute cases

- Globally, diuretics are considered among the first-line therapeutic options in the acute management of traumatic brain injury, playing a crucial role in reducing secondary brain injury and improving patient outcomes, especially in intensive care and trauma units

Report Scope and Traumatic Brain Injury Diuretics Market Segmentation

|

Attributes |

Traumatic Brain Injury Diuretics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Traumatic Brain Injury Diuretics Market Trends

“Advancements in Drug Formulations and Delivery Methods”

- One prominent trend in the global traumatic brain injury diuretics market is the advancement in drug formulations and delivery methods aimed at enhancing treatment effectiveness and patient safety

- Pharmaceutical companies are focusing on developing more stable, fast-acting diuretic formulations that ensure quicker reduction of intracranial pressure while minimizing systemic side effects

- For instance, newer hypertonic saline solutions with controlled osmolarity and modified-release formulations of mannitol are being introduced to provide more consistent therapeutic responses and reduce the risk of renal complications

- In parallel, research into alternative delivery methods, such as intravenous micro-infusions and targeted brain delivery systems, is gaining traction to maximize the therapeutic impact of diuretics in acute care settings

- This trend is reshaping the clinical approach to managing traumatic brain injuries, fostering innovation in drug development, and driving demand for advanced diuretic solutions in neurocritical care units worldwide

Traumatic Brain Injury Diuretics Market Dynamics

Driver

“Rising Incidence of Traumatic Brain Injuries and Emergency Care Needs”

- The increasing global incidence of traumatic brain injuries due to road traffic accidents, falls, sports-related injuries, and violence is significantly driving the demand for diuretics used in acute neurological care

- Traumatic brain injuries often result in elevated intracranial pressure, necessitating immediate and effective pharmacological intervention to prevent further brain damage and improve survival rates

- Diuretics such as mannitol and hypertonic saline are commonly used to reduce cerebral edema and stabilize patients during the critical early stages of injury management, making them essential components of emergency and intensive care protocols

- As global trauma cases rise and more countries expand their critical care capabilities, the need for reliable, fast-acting diuretic therapies becomes increasingly vital in both developed and developing healthcare systems

- The growing emphasis on rapid response and neurological stabilization in trauma units further reinforces the demand for these drugs, as healthcare professionals seek effective solutions to manage brain swelling and prevent long-term cognitive impairment

For instance,

- In March 2023, according to data published by the Centers for Disease Control and Prevention (CDC), an estimated 223,000 hospitalizations related to traumatic brain injury occurred in the U.S. in 2019, underscoring the ongoing demand for effective treatment modalities, including diuretics

- In June 2022, a study published in The Lancet Neurology highlighted that traumatic brain injuries account for over 30% of all injury-related deaths globally, with low- and middle-income countries experiencing the highest burden. This trend emphasizes the urgent need for accessible and efficient diuretic treatments to support brain injury management worldwide

- As a result of the increasing frequency of traumatic brain injuries and the critical need for intracranial pressure control, the demand for diuretics is expected to grow steadily, solidifying their role as a cornerstone of neurocritical care treatment

Opportunity

“Integration of Artificial Intelligence in Traumatic Brain Injury Management”

- The integration of artificial intelligence in the diagnosis and management of traumatic brain injury presents a significant opportunity to enhance the effectiveness of diuretic therapies and overall patient care

- AI-powered systems can analyze brain imaging data, such as CT and MRI scans, to rapidly detect signs of elevated intracranial pressure, hemorrhages, or cerebral edema—conditions where diuretics are often urgently required

- By providing real-time insights and predictive analytics, AI can assist clinicians in identifying patients at higher risk of complications, allowing for timely administration of diuretic treatments and improved decision-making in critical care settings

For instance,

- In February 2024, according to a study published by Frontiers in Neurology, AI algorithms demonstrated high accuracy in identifying early signs of brain swelling and hemorrhage in trauma patients, enabling faster intervention and more personalized treatment planning. The study emphasized the potential of AI to support neurosurgical teams in triaging patients for intensive care and guiding medication strategies, including the use of diuretics

- In August 2023, an article from the Journal of Neurotrauma highlighted the use of machine learning models in predicting intracranial pressure trends in patients with traumatic brain injury. These tools aid clinicians in anticipating when diuretic therapy will be necessary, optimizing dosage and timing to prevent secondary brain injury

- The adoption of artificial intelligence in traumatic brain injury treatment protocols, particularly in the monitoring and prediction of intracranial pressure, holds the potential to revolutionize patient outcomes by supporting proactive and precision-based use of diuretics

Restraint/Challenge

“Limited Accessibility and High Cost of Advanced Treatment Protocols”

- The high cost associated with advanced traumatic brain injury treatments, including specialized diuretic therapies and critical care infrastructure, poses a significant challenge to market expansion, particularly in low- and middle-income regions

- Although diuretics themselves are relatively affordable, their effective use often requires access to intensive care units, continuous intracranial pressure monitoring, and advanced imaging—all of which entail substantial healthcare expenditures

- Healthcare facilities in resource-limited settings may lack the infrastructure and trained personnel needed to administer and monitor diuretic therapy safely and effectively, leading to suboptimal outcomes or reliance on outdated treatment methods

For instance,

- In October 2023, a report published by the World Health Organization emphasized that over 50% of the global population lacks access to essential emergency and surgical care, particularly in regions with limited neurosurgical capabilities. This gap significantly affects the management of traumatic brain injuries, including the timely administration of diuretics

- In June 2022, a study in The Journal of Global Health highlighted the financial burden of neurocritical care in developing countries, noting that costs associated with ICU stays, diagnostic imaging, and continuous monitoring limit the feasibility of implementing advanced pharmacological protocols, including diuretic use

- Consequently, the high cost and infrastructure requirements surrounding the optimal use of diuretics in traumatic brain injury care can restrict access, widen the gap in treatment outcomes between regions, and ultimately slow the global growth of the diuretics market

Traumatic Brain Injury Diuretics Market Scope

The market is segmented on the basis of diuretics drug type, route-administration, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Diuretics Drug Type |

|

|

By Route- Administration |

|

|

By Distribution Channel

|

|

Traumatic Brain Injury Diuretics Market Regional Analysis

“North America is the Dominant Region in the Traumatic Brain Injury Diuretics Market”

- North America leads the global traumatic brain injury diuretics market, primarily driven by its advanced trauma care infrastructure, high incidence of head injuries, and the widespread use of evidence-based treatment protocols

- U.S. holds a substantial market share due to the growing number of emergency room visits related to traumatic brain injuries, the presence of established neurocritical care units, and early adoption of innovative pharmaceutical solutions

- The favorable healthcare reimbursement systems, coupled with strong investments in research and development by pharmaceutical companies, further support market dominance across the region

- In addition, increasing awareness about head injury management and the integration of digital health tools in emergency care settings continue to propel the demand for diuretics across North America

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is projected to witness the highest growth rate in the traumatic brain injury diuretics market, fueled by a rise in road accidents, industrial injuries, and growing investments in trauma care infrastructure

- Countries such as India, China, and Japan are emerging as key markets, driven by their large populations, increasing urbanization, and expanding access to emergency medical services

- Japan, with its technologically advanced healthcare system and increasing clinical research in neurotrauma, remains a crucial hub for the adoption of diuretic therapies in managing brain injuries

- In India and China, the growing burden of traumatic brain injuries due to traffic-related incidents and falls has led to government and private sector initiatives focused on improving emergency care facilities. This includes the introduction of advanced treatment protocols and greater availability of essential medications such as diuretics

- The region’s increasing healthcare expenditure, improving medical infrastructure, and growing collaborations with global pharmaceutical companies are key factors contributing to the rapid expansion of the market

Traumatic Brain Injury Diuretics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Fresenius Kabi AG (Germany)

- Baxter (U.S.)

- Viatris Inc. (U.S.)

- AbbVie Inc. (U.S.)

- Novartis AG (Switzerland)

- Boehringer Ingelheim International GmbH (Germany)

- Amgen Inc. (U.S.)

- Merck & Co., Inc., (U.S.)

- Lilly (U.S.)

- Sanofi (France)

- GSK plc. (U.K.)

- Stryker (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Endo, Inc. (U.S.)

- Hikma Pharmaceuticals PLC (U. K.)

- Grifols, S.A. (Spain)

Latest Developments in Global Traumatic Brain Injury Diuretics Market

- In February 2024, In-Med AI introduced NeuroShield CT, an AI-based neurotrauma screening and quantification tool. This technology assists neuro-critical teams in identifying and quantifying pathologies associated with TBI cases, ensuring accurate and expedited results by automating manual image processing. NeuroShield CT equips radiologists, neurologists, and neurosurgeons with precise data, enabling informed decisions regarding workflow prioritization and acute triage management

- In 2024, The University of California, San Francisco launched a clinical trial, evaluating the effectiveness of repurposed drugs—atorvastatin calcium, candesartan cilexetil, and minocycline hydrochloride—for mild to moderate TBI treatment. The study plans to enroll 672 patients over four years, with preliminary results indicating a 30% improvement in neuroinflammation reduction compared to traditional treatments

- In 2024, Stemedica Cell Technologies commenced clinical trials for a novel stem cell therapy targeting TBI recovery. Early trials revealed that patients receiving this therapy showed a 25% improvement in cognitive function and motor skills. The company projects a 60% increase in patient enrollment in the coming months due to growing demand for regenerative medicine solution

- In 2023, BrainScope Company Inc. introduced a new handheld device., that enhances the accuracy of TBI diagnosis by 40%. Emergency departments utilizing this device reported a 25% decrease in misdiagnosed TBI cases. The adoption rate for this technology increased by 50% across U.S. trauma centers within the first year of its launch

- In 2023, the U.S. Food and Drug Administration approved NeuroSTAT, a neuroprotective agent designed for the treatment of severe traumatic brain injury. Clinical trials demonstrated a 35% reduction in neuronal damage among patients receiving NeuroSTAT compared to a placebo group. This approval is expected to impact a significant portion of the annual 2.8 million TBI cases in the U.S.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.