Global Tryptophan Market

Market Size in USD Million

CAGR :

%

USD

700.58 Million

USD

1,067.04 Million

2024

2032

USD

700.58 Million

USD

1,067.04 Million

2024

2032

| 2025 –2032 | |

| USD 700.58 Million | |

| USD 1,067.04 Million | |

|

|

|

|

Tryptophan Market Analysis

The tryptophan market has shown significant growth over recent years, driven by the increasing demand for dietary supplements, animal feed, and functional foods. Tryptophan, an essential amino acid, is highly valued for its role in promoting health and well-being, supporting functions such as serotonin production and sleep regulation. The market is expanding due to rising awareness among consumers about the benefits of amino acid supplementation for mental health, sleep, and general wellness. Advancements in production technology have also played a vital role in shaping the market. Innovative biotechnological methods, such as fermentation-based processes and synthetic biology, have enabled companies to produce high-quality, sustainable tryptophan more efficiently. These advancements have led to increased product availability and reduced costs, making tryptophan more accessible to both consumers and industries. Companies are also focusing on research and development to improve the bioavailability and efficacy of tryptophan products, contributing to new formulations in dietary supplements and animal feed. Regionally, North America and Asia Pacific lead the market, with North America benefiting from strong consumer demand for health supplements and Asia Pacific experiencing rapid growth due to its expanding healthcare and livestock sectors. As awareness of tryptophan's health benefits continues to rise, the market is poised for continued expansion.

Tryptophan Market Size

The global tryptophan market size was valued at USD 700.58 million in 2024 and is projected to reach USD 1067.04 million by 2032, with a CAGR of 5.40% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Tryptophan Market Trends

“Increasing Use of Tryptophan in Dietary Supplements”

The tryptophan market is witnessing substantial growth, driven by rising consumer awareness of its health benefits and advancements in production technologies. One prominent trend is the increasing use of tryptophan in dietary supplements, as consumers seek natural solutions for enhancing sleep quality and mood regulation. For instance, Plexus Worldwide’s Plexus Sleep gummies include L-tryptophan to support sleep cycles, demonstrating the growing integration of tryptophan into wellness products. Moreover, improvements in fermentation and synthetic biology have enabled more efficient, sustainable production, enhancing product availability and affordability. The demand is also expanding in the animal feed industry, where tryptophan is crucial for optimizing livestock growth and feed efficiency. Asia Pacific is experiencing rapid growth due to its booming nutraceutical sector and robust livestock industry. As awareness about mental health and sleep disorders continues to rise, the tryptophan market is projected to maintain an upward trajectory with innovative product formulations and increased consumer adoption.

Report Scope and Tryptophan Market Segmentation

|

Attributes |

Tryptophan Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

AMINO GmbH (Germany), Avantor, Inc. (U.S.), Parchem (U.S.), Swanson (U.S.), Ajinomoto Co., Inc. (Japan), Cargill, Incorporated (U.S.), CJ CHEILJEDANG CORP. (South Korea), Kyowa Kirin Co., Ltd. (Japan), Penta Manufacturer (U.S.), Daesang Co., Ltd. (South Korea), ADM (U.S.), Evonik Industries AG (Germany), Novus International, Inc. (U.S.), Glanbia PLC (Ireland), Adisseo (France), Sumitomo Chemical Co., Ltd. (Japan), The Good Scents Company (tgsc) (U.S.), and Merck KGaA (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Tryptophan Market Definition

Tryptophan is an essential amino acid that plays a vital role in the body’s protein synthesis and is a precursor to important molecules such as serotonin, a neurotransmitter that regulates mood, sleep, and appetite. It is found in various dietary sources, including turkey, chicken, eggs, dairy products, and certain seeds and nuts. As an essential amino acid, tryptophan cannot be produced by the human body and must be obtained through diet or supplements.

Tryptophan Market Dynamics

Drivers

- Rising Incidence of Sleep Disorders

The rising incidence of sleep disorders is a significant driver for the growth of the tryptophan market, as more people seek natural solutions to improve sleep quality. According to the American Sleep Association, approximately 50-70 million U.S. adults suffer from chronic sleep disorders, highlighting the demand for effective sleep aids. Tryptophan, known for its role in increasing serotonin and melatonin production, is commonly included in sleep supplements to promote relaxation and better sleep patterns. This growing need has led to an increased incorporation of tryptophan into products such as sleep gummies and capsules, such as Plexus Sleep, which include this amino acid to support sleep cycles. The surge in consumer interest for non-pharmaceutical solutions to sleep issues has driven manufacturers to innovate and expand their product lines, boosting the demand for tryptophan and contributing to the overall growth of the market.

- Increasing Health and Wellness Trends

Health and wellness trends have significantly contributed to the increasing popularity of natural and functional food ingredients, with tryptophan standing out as a key component for mood and mental health support. As consumers become more health-conscious and prioritize mental well-being, there has been a notable rise in the demand for supplements that promote relaxation and emotional balance. For instance, products such as Zesty Paws’ Hemp Elements Plus Calming Bites, which include tryptophan alongside other natural ingredients, cater to pet owners looking to support their pets’ stress relief and overall mental health. This shift in consumer preferences toward natural solutions and holistic approaches presents a significant market opportunity for tryptophan-based products. With consumers increasingly seeking alternatives to synthetic pharmaceuticals, the market for tryptophan as a supplement ingredient is poised for growth, driving product development and innovation in both human and animal wellness sectors.

Opportunities

- Increasing Advancements in Production Technologies

Advancements in production technologies, particularly in fermentation processes and synthetic biology, have significantly improved the efficiency and sustainability of tryptophan production. These innovations have enabled manufacturers to produce tryptophan at a lower cost and with a reduced environmental footprint, making it more accessible to both consumers and industries. For instance, companies such as Ajinomoto Co., Inc. have leveraged advanced fermentation techniques to scale up production while minimizing waste and energy consumption. The use of synthetic biology has also facilitated the creation of bio-engineered strains that can produce high-quality tryptophan more efficiently than traditional methods. These advancements present a substantial market opportunity as they help meet the growing demand for tryptophan and align with consumer preferences for sustainable and eco-friendly products. This trend opens the door for the expansion of tryptophan-based supplements and animal feed products, fostering growth across various sectors within the health and nutrition industry.

- Increasing Research and Product Development

Increasing research and product development focused on the health benefits of tryptophan have opened up significant opportunities in the nutraceutical and pharmaceutical sectors. Ongoing studies are highlighting its potential in supporting mood regulation, reducing anxiety, and promoting better sleep, leading to innovative formulations that meet diverse consumer needs. For instance, Plexus Sleep gummies, which include tryptophan along with melatonin and other natural ingredients, are designed to improve sleep quality, showcasing how research is translating into targeted consumer products. These advancements have prompted manufacturers to expand their portfolios, introducing new supplements and functional foods that incorporate tryptophan to enhance wellness. This growing focus on research-driven product development positions tryptophan as a promising market opportunity, as consumers increasingly seek evidence-based solutions for mental and physical health. The surge in demand for products that are scientifically backed and cater to specific health concerns supports market growth and innovation.

Restraints/Challenges

- Different Standards for Product Quality and Safety Across Regions

Regulatory issues present a significant challenge in the tryptophan market, as companies must comply with different standards for product quality and safety across regions, leading to higher production costs and complicating international trade. For instance, the European Union (EU) enforces stringent regulations on animal feed additives, including tryptophan, mandating detailed safety assessments and certifications to ensure that products meet their specific standards. In contrast, other regions, such as the U.S., may have different requirements that do not align with EU regulations, creating barriers for companies that wish to export globally. This discrepancy can result in increased compliance costs for manufacturers, as they need to adapt their products and processes to meet the highest standards among their target markets. Such regulatory complexity can also delay the time-to-market for products and limit opportunities for market expansion, posing a significant hurdle for companies operating internationally.

- Emergence of Alternatives and Substitutes

The emergence of alternatives and substitutes for tryptophan in animal feed formulations presents a notable challenge to the market, as these innovations can decrease the demand for traditional tryptophan products. For instance, research into plant-based protein sources, such as soybean and peas, and the development of microbial fermentation techniques have led to the production of more cost-effective and efficient feed additives that can mimic the nutritional benefits of tryptophan. In addition, synthetic amino acids and specialized blends designed to meet animal dietary needs at a lower cost are gaining traction among feed producers. Such developments can drive down the market share for conventional tryptophan, especially as feed producers seek to optimize their budgets and meet animal health requirements with less expensive alternatives. This shift can challenge traditional tryptophan producers, pushing them to invest in product innovation or face reduced profitability.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Tryptophan Market Scope

The market is segmented on the basis of grade, application, and type. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Grade

- Food Grade

- Feed Grade

Application

- Cosmetics and Personal Care

- Food and Beverage

- Pharmaceutical

- Animal Feed

- Dietary Supplements

Type

- Natural

- Synthetic

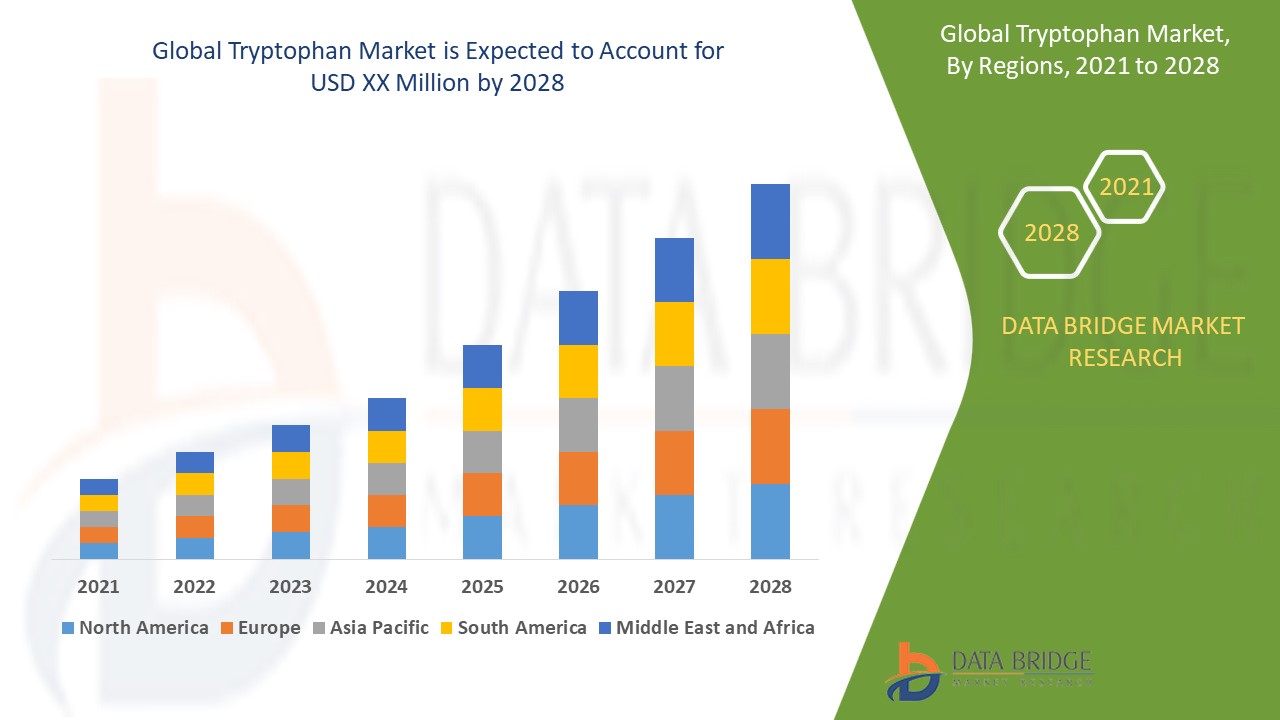

Tryptophan Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, grade, application, and type as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA)

North America dominates the global tryptophan market, driven by a growing number of health-conscious consumers who are increasingly aware of the benefits of dietary supplements and functional foods. This trend is complemented by a significant rise in the demand for animal feed ingredients, as the region has a robust livestock and poultry industry. In addition, advancements in research and development for bio-based tryptophan production contribute to the market's growth. The region's well-established healthcare infrastructure and strong regulatory framework further support the adoption and expansion of tryptophan-based products.

Asia -Pacific tryptophan market is expected to experience highest growth during the forecast period, driven by increasing demand for dietary supplements and functional foods among health-conscious consumers in the region. The rapid expansion of the livestock and poultry industries, coupled with a rising focus on high-quality animal feed, is also boosting the demand for tryptophan. In addition, economic growth and urbanization in countries such as China and India are encouraging investments in the pharmaceutical and nutraceutical sectors, further propelling market growth. Advancements in production technologies and increasing awareness of tryptophan's benefits are likely to fuel this upward trend.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Tryptophan Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Tryptophan Market Leaders Operating in the Market Are:

- AMINO GmbH (Germany)

- Avantor, Inc. (U.S.)

- Parchem (U.S.)

- Swanson (U.S.)

- Ajinomoto Co., Inc. (Japan)

- Cargill, Incorporated (U.S.)

- CJ CHEILJEDANG CORP. (South Korea)

- Kyowa Kirin Co., Ltd. (Japan)

- Penta Manufacturer (U.S.)

- Daesang Co., Ltd. (South Korea)

- ADM (U.S.)

- Evonik Industries AG (Germany)

- Novus International, Inc. (U.S.)

- Glanbia PLC (Ireland)

- Adisseo (France)

- Sumitomo Chemical Co., Ltd. (Japan)

- The Good Scents Company (tgsc) (U.S.)

- Merck KGaA (Germany)

Latest Developments in Tryptophan Market

- In June 2023, Plexus Worldwide introduced Plexus Sleep, a sugar-free gummy supplement designed to enhance restorative sleep and regulate a healthy sleep cycle. The formula includes 5 mg of melatonin, 1.7 grams of prebiotic fiber FOS (fructooligosaccharides), ashwagandha, GABA, lemon balm extract, and L-tryptophan

- In May 2023, Octarine Bio, a synthetic biology company, partnered with Ginkgo Bioworks to explore compounds in the tryptophan pathway. Their collaboration aims to engineer a strain for producing violacein, a natural bis-indole pigment known for its anti-microbial, anti-oxidant, and UV protective properties

- In September 2022, Zesty Paws expanded its product line with three new cat supplements, Hemp Elements Plus Calming Bites, Hemp Elements Plus Hairball Bites, and Aller-Immune Bites. Developed in collaboration with CBDistillery™, the calming bites feature broad-spectrum hemp extract, delivering 3 mg of CBD per two chews, alongside L-Theanine, L-Tryptophan, chamomile, ashwagandha, melatonin, and valerian root for stress relief

- In August 2022, Youtheory, a supplement brand renowned for its collagen products, launched a new range of liquid dietary supplements. Previously, collagen was criticized as a low-quality protein due to its lack of tryptophan, earning a score of 0 on the PDCAAS (Protein Digestibility-Corrected Amino Acid Score)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL TRYPTOPHAN MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 ARRIVING AT THE GLOBAL TRYPTOPHAN MARKET

2.3 VENDOR POSITIONING GRID

2.4 TECHNOLOGY LIFE LINE CURVE

2.5 MARKET GUIDE

2.6 COMPANY POSITIONING GRID

2.7 COMAPANY MARKET SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 DEMAND AND SUPPLY-SIDE VARIABLES

2.1 CONSUMPTION TREND OF END PRODUCTS

2.11 TOP TO BOTTOM ANALYSIS

2.12 STANDARDS OF MEASUREMENT

2.13 VENDOR SHARE ANALYSIS

2.14 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.15 DATA POINTS FROM KEY SECONDARY DATABASES

2.16 GLOBAL TRYPTOPHAN MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 IMPORT-EXPORT ANALYSIS

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF SUPPLIERS

5.4.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTE PRODUCTS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 RAW MATERIAL SOURCING ANALYSIS

5.6 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

5.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.8 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING ANALYSIS

9 PRODUCTION CAPACITY OF KEY MANUFACTURERES

10 BRAND OUTLOOK

10.1 COMPARATIVE BRAND ANALYSIS

10.2 PRODUCT VS BRAND OVERVIEW

11 SUPPLY CHAIN ANALYSIS

11.1 OVERVIEW

11.2 LOGISTIC COST SCENARIO

11.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

12 CLIMATE CHANGE SCENARIO

12.1 ENVIRONMENTAL CONCERNS

12.2 INDUSTRY RESPONSE

12.3 GOVERNMENT’S ROLE

12.4 ANALYST RECOMMENDATIONS

13 GLOBAL TRYPTOPHAN MARKET, BY TYPE, 2018-2032 (USD MILLION) (KILO TONS)

13.1 OVERVIEW

13.2 L-TRYPTOPHAN

13.3 D-TRYPTOPHAN

13.4 5-HYDROXYTRYPTOPHAN (5-HTP)

14 GLOBAL TRYPTOPHAN MARKET, BY GRADE, 2018-2032 (USD MILLION)

14.1 OVERVIEW

14.2 FEED GRADE

14.3 FOOD GRADE

14.4 PHARMA GRADE

14.5 INDUSTRIAL GRADE

15 GLOBAL TRYPTOPHAN MARKET, BY FORM, 2018-2032 (USD MILLION)

15.1 OVERVIEW

15.2 DRY

15.2.1 CRYSTAL

15.2.2 POWDER

15.2.3 OTHERS

15.3 LIQUID

16 GLOBAL TRYPTOPHAN MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

16.1 OVERVIEW

16.2 NATURAL

16.3 SYNTHETIC

17 GLOBAL TRYPTOPHAN MARKET, BY PRODUCTION METHOD, 2018-2032 (USD MILLION)

17.1 OVERVIEW

17.2 CHEMICAL SYNTHESIS

17.3 ENZYME CONVERSION

17.4 MICROBIAL FERMENTATION

17.5 OTHERS

18 GLOBAL TRYPTOPHAN MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

18.1 OVERVIEW

18.2 FOOD AND BEVERAGES

18.2.1 FOOD AND BEVERAGES, BY TYPE

18.2.1.1. FOOD

18.2.1.2. DAIRY PRODUCTS

18.2.1.2.1. YOGHURT

18.2.1.2.2. CHEESE

18.2.1.2.3. ICE CREAM

18.2.1.2.4. BUTTER

18.2.1.2.5. OTHERS

18.2.1.3. BAKERY

18.2.1.3.1. COOKIES & BISCUITS

18.2.1.3.2. BREADS & ROLLS

18.2.1.3.3. CAKES & PASTRIES

18.2.1.3.4. DONUTS

18.2.1.3.5. MUFFINS

18.2.1.3.6. OTHERS

18.2.1.4. CONFECTIONERY

18.2.1.4.1. CHOCOLATES

18.2.1.4.2. GUMMIES

18.2.1.4.3. HARD CANDIES

18.2.1.4.4. SUGAR CONFECTIONERY

18.2.1.4.5. OTHERS

18.2.1.5. PROCESSED FOOD

18.2.1.5.1. PASTA

18.2.1.5.2. NOODLES

18.2.1.5.3. EXTRUDED SNACKS

18.2.1.5.4. SOUPS AND SAUCES

18.2.1.5.5. OTHERS

18.2.1.6. BREAKFAST CEREALS

18.2.1.7. INFANT FORMULA

18.2.1.7.1. GROWING UP MILK

18.2.1.7.2. STANDARD INFANT FORMULA

18.2.1.7.3. FOLLOW-ON FORMULA

18.2.1.7.4. SPECIALITY FORMULA

18.2.1.7.5. OTHERS

18.2.1.8. SPORTS NUTRITION

18.2.1.8.1. SPORTS NUTRITION BAR

18.2.1.8.2. SPORTS PROTEIN POWDER

18.2.1.8.3. OTHERS

18.2.1.9. DRESSINGS AND SEASONINGS

18.2.1.10. DAIRY ALTERNATIVE FOOD

18.2.1.11. MEAT & POULTRY PRODUCTS

18.2.1.12. OTHERS

18.2.2 BEVERAGES

18.2.2.1. YOGURT DRINKS

18.2.2.1.1. PLANT-BASED

18.2.2.1.1.1 SOY

18.2.2.1.1.2 ALMOND

18.2.2.1.1.3 CASHEW

18.2.2.1.1.4 RICE

18.2.2.1.1.5 COCONUT

18.2.2.1.1.6 OTHERS

18.2.2.1.2. DAIRY-BASED

18.2.2.1.3. COW

18.2.2.1.4. BUFFALO

18.2.2.1.5. GOAT

18.2.2.1.6. SHEEP

18.2.2.1.7. OTHERS

18.2.2.2. JUICES

18.2.2.3. SODA DRINKS

18.2.2.4. KOMBUCHA DRINKS

18.2.2.5. PROBIOTIC WATER

18.2.2.6. HEALTH DRINKS

18.2.2.6.1. IMMUNITY BOOSTERS

18.2.2.6.2. GUT SHOTS

18.2.2.6.3. ELECTROLYTE HYDRATION DRINKS

18.2.2.6.4. PROTEIN DRINKS

18.2.2.6.5. OTHERS

18.2.2.7. DAIRY BASED DRINKS

18.2.2.8. OTHERS

18.3 PHARMACEUTICALS

18.3.1 PHARMACEUTICALS, BY APPLICATION

18.3.1.1. GASTROINTESTINAL HEALTH

18.3.1.2. IMMUNE SYSTEM MODULATION

18.3.1.3. ALLERGY MANAGEMENT

18.3.1.4. METABOLIC DISORDERS

18.3.1.5. MENTAL HEALTH (PSYCHOBIOTICS)

18.3.1.6. CARDIOVASCULAR HEALTH

18.3.1.7. INTESTINAL DISORDERS

18.3.1.8. LACTOSE INTOLERANCE

18.3.1.9. INFLAMMATORY BOWEL DISORDERS

18.3.1.10. RESPIRATORY INFECTIONS

18.3.1.11. OBESITY

18.3.1.12. UROGENITAL INFECTIONS

18.3.1.12.1. TYPE-2 DIABETES

18.3.1.12.2. CANCER

18.3.1.13. ORAL AND DENTAL HEALTH

18.3.1.14. OTHERS

18.3.2 PHARMACEUTICALS, BY PRODUCT FORM

18.3.2.1. TABLETS

18.3.2.2. PROBIOTIC DRINKS

18.3.2.3. POWDERS

18.3.2.4. CAPSULES

18.3.2.5. OTHERS

18.4 COSMETICS

18.4.1 COSMETICS, BY CATEGORY

18.4.1.1. FACIAL CARE PRODUCTS

18.4.1.1.1. CREAMS & LOTIONS

18.4.1.1.2. SERUMS

18.4.1.1.3. SCRUBS & MASKS

18.4.1.1.4. OTHERS

18.4.1.2. HAIR CARE PRODUCTS

18.4.1.2.1. SHAMPOO

18.4.1.2.2. CONDITIONERS

18.4.1.2.3. OTHERS

18.4.1.3. MAKE-UP PRODUCTS

18.4.1.4. BODY CARE PRODUCTS

18.4.1.5. OTHERS

18.5 DIETARY SUPPLEMENTS

18.5.1 DIETARY SUPPLEMENTS, BY FUNCTION

18.5.1.1. IMMUNE HEALTH

18.5.1.2. GUT & DIGESTIVE HEALTH

18.5.1.3. WOMEN’S HEALTH

18.5.1.4. SPORTS FITNESS

18.5.1.5. ENERGY & WEIGHT MANAGEMENT

18.5.1.6. GENERAL HEALTH

18.5.1.7. BONE & JOINT HEALTH

18.5.1.8. GASTROINTESTINAL HEALTH

18.5.1.9. IMMUNITY

18.5.1.10. CARDIAC HEALTH

18.5.1.11. DIABETES

18.5.1.12. ANTI-CANCER

18.5.1.13. SKIN/HAIR/NAILS

18.5.1.14. BRAIN/MENTAL HEALTH

18.5.1.15. OTHERS

18.5.2 DIETARY SUPPLEMENTS, BY PRODUCT FORM

18.5.2.1. CHEWABLES & GUMMIES

18.5.2.2. SOFT GELS

18.5.2.3. CAPSULES

18.5.2.4. POWDERS

18.5.2.5. OTHERS

18.6 ANIMAL NUTRITION

18.6.1 ANIMAL NUTRITION, BY CATEGORY

18.6.1.1. POULTRY

18.6.1.1.1. BROILERS

18.6.1.1.2. LAYERS

18.6.1.1.3. BREEDERS

18.6.1.1.4. CHICKS & POULTS

18.6.1.1.5. OTHERS

18.6.1.2. RUMINANTS

18.6.1.2.1. CALVES

18.6.1.2.2. DAIRY CATTLE

18.6.1.2.3. BEEF CATTLE

18.6.1.2.4. OTHERS

18.6.1.3. SWINE

18.6.1.3.1. STARTER

18.6.1.3.2. GROWER

18.6.1.3.3. SOW

18.6.1.3.4. OTHERS

18.6.1.4. PET

18.6.1.4.1. CAT

18.6.1.4.2. DOG

18.6.1.4.3. RABBIT

18.6.1.4.4. HORSE

18.6.1.4.5. MICE

18.6.1.4.6. OTHERS

18.6.1.5. AQUATIC ANIMAL

18.6.1.5.1. FISH

18.6.1.5.1.1 TILAPIA

18.6.1.5.1.2 SALMON

18.6.1.5.1.3 CARP

18.6.1.5.1.4 TROUT

18.6.1.5.1.5 OTHERS

18.6.1.5.2. CRUSTACEANS

18.6.1.5.2.1 SHRIMP

18.6.1.5.2.2 CRABS

18.6.1.5.2.3 KRILL

18.6.1.5.2.4 OTHERS

18.6.1.5.3. MOLLUSKS

18.6.1.5.3.1 OYSTERS

18.6.1.5.3.2 MUSSELS

18.6.1.5.3.3 OTHERS

18.6.1.5.4. OTHERS

18.6.1.6. OTHERS

18.6.2 ANIMAL NUTRITION, BY HEALTH FUNCTION

18.6.2.1. FEED INTAKE AND EFFICIENCY

18.6.2.2. YIELD

18.6.2.3. GUT HEALTH

18.6.2.4. NUTRITION

18.6.2.5. EGG PRODUCTION & QUALITY

18.6.2.6. IMMUNITY

18.6.2.7. OTHERS

18.7 OTHERS

19 GLOBAL TRYPTOPHAN MARKET, BY GEOGRAPHY, 2018-2032 (USD MILLION) (KILO TONS)

OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

19.1 NORTH AMERICA

19.1.1 U.S.

19.1.2 CANADA

19.1.3 MEXICO

19.2 EUROPE

19.2.1 GERMANY

19.2.2 U.K.

19.2.3 ITALY

19.2.4 FRANCE

19.2.5 SPAIN

19.2.6 SWITZERLAND

19.2.7 NETHERLANDS

19.2.8 BELGIUM

19.2.9 RUSSIA

19.2.10 DENMARK

19.2.11 SWEDEN

19.2.12 POLAND

19.2.13 TURKEY

19.2.14 REST OF EUROPE

19.3 ASIA-PACIFIC

19.3.1 JAPAN

19.3.2 CHINA

19.3.3 SOUTH KOREA

19.3.4 INDIA

19.3.5 AUSTRALIA

19.3.6 SINGAPORE

19.3.7 THAILAND

19.3.8 INDONESIA

19.3.9 MALAYSIA

19.3.10 PHILIPPINES

19.3.11 NEW ZEALAND

19.3.12 VIETNAM

19.3.13 REST OF ASIA-PACIFIC

19.4 SOUTH AMERICA

19.4.1 BRAZIL

19.4.2 ARGENTINA

19.4.3 REST OF SOUTH AMERICA

19.5 MIDDLE EAST AND AFRICA

19.5.1 SOUTH AFRICA

19.5.2 UAE

19.5.3 SAUDI ARABIA

19.5.4 KUWAIT

19.5.5 REST OF MIDDLE EAST AND AFRICA

20 GLOBAL TRYPTOPHAN MARKET, COMPANY LANDSCAPE

20.1 COMPANY SHARE ANALYSIS: GLOBAL

20.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

20.3 COMPANY SHARE ANALYSIS: EUROPE

20.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

20.5 MERGERS & ACQUISITIONS

20.6 NEW PRODUCT DEVELOPMENT & APPROVALS

20.7 EXPANSIONS & PARTNERSHIP

20.8 REGULATORY CHANGES

21 SWOT AND DBMR ANALYSIS, GLOBAL TRYPTOPHAN MARKET

22 GLOBAL TRYPTOPHAN MARKET, COMPANY PROFILES

22.1 MEIHUA GROUP

22.1.1 COMPANY OVERVIEW

22.1.2 PRODUCT PORTFOLIO

22.1.3 REVENUE ANALYSIS

22.1.4 RECENT DEVELOPMENTS

22.2 EVONIK INDUSTRIES AG

22.2.1 COMPANY OVERVIEW

22.2.2 PRODUCT PORTFOLIO

22.2.3 REVENUE ANALYSIS

22.2.4 RECENT DEVELOPMENTS

22.3 ADM

22.3.1 COMPANY OVERVIEW

22.3.2 PRODUCT PORTFOLIO

22.3.3 REVENUE ANALYSIS

22.3.4 RECENT DEVELOPMENTS

22.4 ADISSEO

22.4.1 COMPANY OVERVIEW

22.4.2 PRODUCT PORTFOLIO

22.4.3 REVENUE ANALYSIS

22.4.4 RECENT DEVELOPMENTS

22.5 BIO-TECHNE (NOVUS)

22.5.1 COMPANY OVERVIEW

22.5.2 PRODUCT PORTFOLIO

22.5.3 REVENUE ANALYSIS

22.5.4 RECENT DEVELOPMENTS

22.6 CJ CHEILJEDANG CORP

22.6.1 COMPANY OVERVIEW

22.6.2 PRODUCT PORTFOLIO

22.6.3 REVENUE ANALYSIS

22.6.4 RECENT DEVELOPMENTS

22.7 AJINOMOTO CO., INC.

22.7.1 COMPANY OVERVIEW

22.7.2 PRODUCT PORTFOLIO

22.7.3 REVENUE ANALYSIS

22.7.4 RECENT DEVELOPMENTS

22.8 DAESANG CORPORATION

22.8.1 COMPANY OVERVIEW

22.8.2 PRODUCT PORTFOLIO

22.8.3 REVENUE ANALYSIS

22.8.4 RECENT DEVELOPMENTS

22.9 GLANBIA PLC

22.9.1 COMPANY OVERVIEW

22.9.2 PRODUCT PORTFOLIO

22.9.3 REVENUE ANALYSIS

22.9.4 RECENT DEVELOPMENTS

22.1 KYOWA HAKKO BIO CO.,LTD.

22.10.1 COMPANY OVERVIEW

22.10.2 PRODUCT PORTFOLIO

22.10.3 REVENUE ANALYSIS

22.10.4 RECENT DEVELOPMENTS

22.11 AMINO GMBH

22.11.1 COMPANY OVERVIEW

22.11.2 PRODUCT PORTFOLIO

22.11.3 REVENUE ANALYSIS

22.11.4 RECENT DEVELOPMENTS

22.12 MERCK KGAA

22.12.1 COMPANY OVERVIEW

22.12.2 PRODUCT PORTFOLIO

22.12.3 REVENUE ANALYSIS

22.12.4 RECENT DEVELOPMENTS

22.13 VWR INTERNATIONAL, LLC

22.13.1 COMPANY OVERVIEW

22.13.2 PRODUCT PORTFOLIO

22.13.3 REVENUE ANALYSIS

22.13.4 RECENT DEVELOPMENTS

22.14 TOKYO CHEMICAL INDUSTRY CO., LTD.

22.14.1 COMPANY OVERVIEW

22.14.2 PRODUCT PORTFOLIO

22.14.3 REVENUE ANALYSIS

22.14.4 RECENT DEVELOPMENTS

22.15 WUHAN AMINO ACID BIO-CHEMICAL CO., LTD.

22.15.1 COMPANY OVERVIEW

22.15.2 PRODUCT PORTFOLIO

22.15.3 REVENUE ANALYSIS

22.15.4 RECENT DEVELOPMENTS

23 CONCLUSION

24 REFERENCE

25 QUESTIONNAIRE

26 RELATED REPORTS

27 ABOUT DATA BRIDGE MARKET RESEARCH

Global Tryptophan Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Tryptophan Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Tryptophan Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.