Global Tumor Lysis Syndrome Market

Market Size in USD Billion

CAGR :

%

USD

2.30 Billion

USD

4.79 Billion

2024

2032

USD

2.30 Billion

USD

4.79 Billion

2024

2032

| 2025 –2032 | |

| USD 2.30 Billion | |

| USD 4.79 Billion | |

|

|

|

|

Tumor Lysis Syndrome Market Size

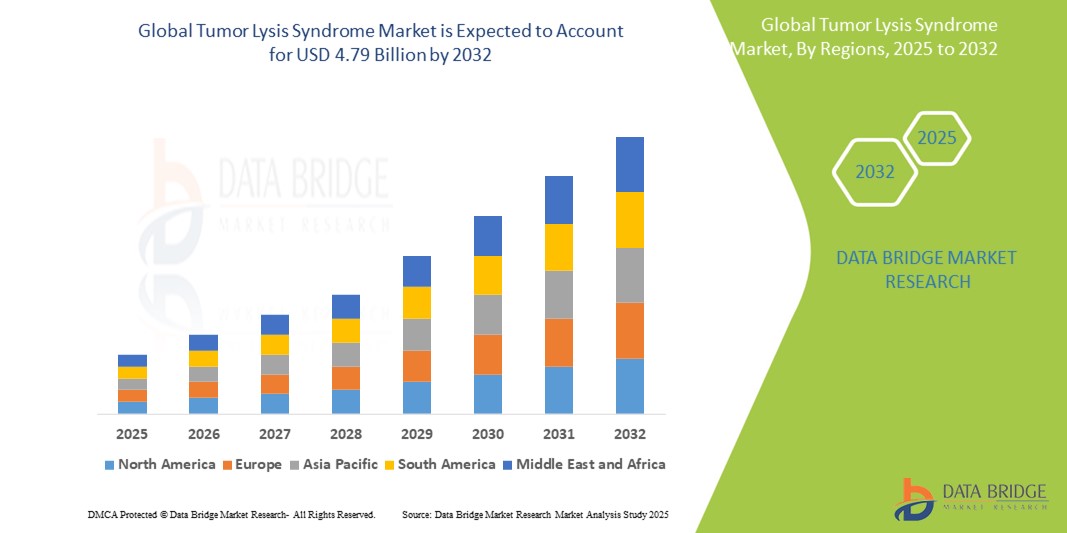

- The Global Tumor Lysis Syndrome Market size was valued at USD 2.30 billion in 2024 and is expected to reach USD 4.79 billion by 2032, at a CAGR of 9.6% during the forecast period

- The market growth is primarily driven by the rising incidence of hematologic malignancies and solid tumors treated with aggressive therapies such as chemotherapy, radiation, and biological treatments. These interventions increase the risk of TLS, thereby boosting demand for effective preventive and treatment strategies

- Moreover, increasing awareness among clinicians, the availability of advanced diagnostic tools like serum electrolyte tests and creatinine assays, and the growing use of uric acid-lowering drugs such as allopurinol and rasburicase are accelerating the market expansion. The development of targeted therapies and improved clinical guidelines for TLS management are further strengthening the market outlook

Tumor Lysis Syndrome Market Analysis

- Tumor Lysis Syndrome (TLS), a life-threatening oncological emergency resulting from rapid tumor cell breakdown, is gaining increased clinical attention due to its growing incidence among patients undergoing chemotherapy, radiation therapy, and targeted biological treatments—especially in hematologic malignancies such as leukemia and lymphoma.

- The escalating demand for effective TLS management is primarily driven by the rising global cancer burden, increasing use of aggressive cancer therapies, and the need for early diagnosis and prevention of complications like hyperuricemia and acute kidney injury.

- North America dominates the tumor lysis syndrome market with the largest revenue share of over 40.5% in 2025, attributed to high cancer prevalence, robust healthcare infrastructure, early adoption of advanced therapeutics (e.g., rasburicase), and strong clinical awareness. The U.S. leads in TLS treatment advancements due to widespread access to diagnostics and supportive care protocols.

- Asia-Pacific is expected to be the fastest-growing region in the tumor lysis syndrome market during the forecast period, driven by increasing oncology patient volumes, expanding healthcare access, and government initiatives to improve cancer care in countries such as China and India.

- Asia-Pacific is expected to be the fastest growing region in the Tumor Lysis Syndrome market during the forecast period due to increasing urbanization and rising disposable incomes

- Among drug types, the rasburicase segment is expected to dominate the market with a significant share of 45.2% in 2025, owing to its rapid and effective uric acid reduction capabilities in high-risk TLS cases, as well as favorable clinical guidelines supporting its use over traditional agents like allopurinol.

Report Scope and Tumor Lysis Syndrome Market Segmentation

|

Attributes |

Tumor Lysis Syndrome Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Tumor Lysis Syndrome Market Trends

“Rising Focus on Early Risk Stratification and Prophylactic Management”

- A significant and growing trend in the global Tumor Lysis Syndrome (TLS) market is the increasing emphasis on early identification of high-risk patients and the adoption of proactive prophylactic treatment. Healthcare providers are integrating TLS risk assessment protocols into standard oncology practice, particularly for hematologic malignancies like acute lymphoblastic leukemia (ALL) and non-Hodgkin lymphoma, where TLS incidence is higher.

- For instance, the implementation of the Cairo-Bishop classification and other TLS risk stratification tools in clinical workflows has enabled oncologists to pre-emptively identify patients who may require prophylaxis with urate-lowering agents such as rasburicase or febuxostat, rather than waiting for overt TLS to manifest.

- Additionally, real-time monitoring through serum creatinine, uric acid, phosphate, and potassium levels is being supported by automated hospital systems, helping providers initiate timely intervention before complications such as acute kidney injury arise.

- Pharmaceutical companies are responding to this trend by investing in education campaigns, clinical decision support tools, and broader indications for their TLS-focused drugs. For instance, several drugmakers are supporting the inclusion of TLS prophylaxis in cancer care pathways across both developed and developing markets.

- This trend of preemptive care, improved diagnostic practices, and clinical vigilance is fundamentally changing the TLS treatment paradigm from reactive to preventive. As a result, market players focusing on early-intervention therapies and integrated monitoring solutions are likely to gain competitive advantages.

Tumor Lysis Syndrome Market Dynamics

Driver

“Rising Cancer Incidence and Growing Use of Aggressive Oncology Therapies”

- The rising global burden of cancer, particularly blood cancers such as leukemia and lymphoma, is a key driver of the Tumor Lysis Syndrome market. With oncology care increasingly involving high-efficacy therapies like intensive chemotherapy, monoclonal antibodies, and CAR-T cell therapy, the incidence of treatment-induced TLS is rising sharply.

- For instance, the growing adoption of CAR-T cell therapy in relapsed/refractory leukemia and lymphoma patients has significantly increased TLS risk due to the rapid destruction of malignant cells. To mitigate these risks, guidelines such as those by the American Society of Clinical Oncology (ASCO) recommend pre-treatment with urate-lowering agents in high-risk individuals.

- The growing availability and reimbursement of TLS treatments like rasburicase in developed markets and the inclusion of TLS risk management protocols in cancer care pathways globally are supporting widespread market growth.

- Additionally, hospital protocols now emphasize early hospitalization and fluid management for high-risk patients, reinforcing the need for TLS-specific therapeutics and diagnostics.

- As cancer care becomes more personalized and intensive, the demand for TLS prevention and management solutions is expected to grow significantly across hospitals, specialty clinics, and home care settings.

Restraint/Challenge

“High Drug Costs and Limited Access in Low-Resource Settings”

- One of the major challenges for the global TLS market is the high cost of key drugs such as rasburicase, which can limit their accessibility, especially in low- and middle-income countries. Despite its clinical efficacy, rasburicase remains out of reach for many healthcare systems due to limited availability, budget constraints, and lack of insurance coverage.

- In many developing regions, clinicians rely on less effective alternatives like allopurinol, which may delay treatment response and increase the risk of complications. Moreover, awareness regarding TLS and its management protocols remains low in several regions, leading to underdiagnosis and delayed intervention.

- Another challenge is the lack of standardized TLS screening and treatment protocols in many cancer treatment centers, especially outside major urban hospitals.

- To address these barriers, companies are exploring biosimilar development, tiered pricing strategies, and partnership models with governments and NGOs to expand access to life-saving therapies.

- However, unless cost-effective treatment options and improved clinical education efforts are implemented on a global scale, TLS outcomes will continue to show disparity between high-income and low-income regions, thereby restraining uniform market growth.

Tumor Lysis Syndrome Market Scope

The market is segmented on the basis of pathophysiology, causative therapy, diagnosis, drug type, route of administration, end user, and distribution channel.

- By Pathophysiology

On the basis of pathophysiology, the TLS market is segmented into hyperuricemia, acute kidney injury, and others. The hyperuricemia segment holds the largest market revenue share of approximately 47.3% in 2025, driven by the fact that elevated uric acid levels are among the earliest and most common manifestations of TLS. The clinical emphasis on managing hyperuricemia to prevent further complications like renal failure has led to widespread use of urate-lowering agents such as rasburicase and allopurinol, making this segment the most dominant in terms of demand and therapeutic focus.

The acute kidney injury (AKI) segment is projected to witness the fastest CAGR of 10.6% from 2025 to 2032, as AKI is a serious and life-threatening consequence of TLS. Increasing awareness, improved monitoring tools, and advancements in diagnostic markers for early renal dysfunction are fueling demand for prompt intervention and targeted therapies to manage kidney-related TLS outcomes, especially in critical care and high-risk oncology patients.

• By Causative Therapy

On the basis of causative therapy, the market is segmented into chemotherapy, radiation therapy, biological therapy, and others. The chemotherapy segment dominates the market in 2025, as it remains the most common trigger for TLS, particularly in hematologic malignancies. Intensive chemotherapy regimens are known to induce rapid tumor cell lysis, thus necessitating preventive and therapeutic interventions for TLS.

The biological therapy segment is expected to grow at the fastest rate from 2025 to 2032. The increasing use of immunotherapy and targeted therapies like CAR-T cells has raised new clinical considerations for TLS risk management, as these therapies can induce swift tumor cell death in relapsed or refractory cases, prompting heightened need for proactive TLS control.

• By Diagnosis

The TLS market by diagnosis is segmented into blood urea nitrogen test, creatinine test, serum electrolytes test, and others. The serum electrolytes test segment is expected to hold the largest revenue share in 2025 due to its critical role in identifying hallmark metabolic imbalances like hyperkalemia, hyperphosphatemia, and hypocalcemia. These tests are vital in both TLS risk assessment and ongoing monitoring.

The creatinine test segment is anticipated to witness the fastest CAGR from 2025 to 2032, as elevated serum creatinine is an early indicator of renal dysfunction, a major TLS complication. Increased emphasis on early renal damage detection is driving its usage across oncology settings.

• By Drug Type

By drug type, the market is segmented into allopurinol, rasburicase, febuxostat, and others. The rasburicase segment is expected to dominate the market with the highest revenue share of approximately 45.2% in 2025, due to its superior efficacy in rapidly lowering uric acid levels and its strong recommendation in international TLS guidelines for high-risk patients.

The febuxostat segment is projected to grow at the fastest CAGR during the forecast period. As an alternative xanthine oxidase inhibitor for patients intolerant to allopurinol, febuxostat is gaining traction due to its improved safety profile and growing availability in emerging markets.

• By Route of Administration

The market is segmented by route of administration into oral, injectable, and others. The injectable segment holds the largest share in 2025, primarily due to the intravenous administration of rasburicase and other emergency treatments for high-risk TLS cases. Injectable therapies offer rapid systemic action, which is crucial in acute care settings.

The oral segment is expected to witness the fastest growth from 2025 to 2032, as drugs like allopurinol and febuxostat are widely used for outpatient TLS prophylaxis, particularly in low- to moderate-risk patients.

• By End User

Based on end user, the TLS market is segmented into hospitals, homecare, specialty clinics, and others. The hospital segment leads the market in 2025, driven by the high concentration of oncology treatment centers, inpatient TLS management protocols, and access to intensive care facilities for critical cases.

The homecare segment is projected to witness the fastest CAGR during the forecast period. This growth is fueled by the expansion of oncology home infusion services and the increasing adoption of oral prophylaxis therapies, enabling some elements of TLS management to transition to outpatient or home settings.

• By Distribution Channel

The market is segmented by distribution channel into hospital pharmacy, online pharmacy, retail pharmacy, and others. The hospital pharmacy segment dominates the market in 2025, supported by direct supply chains for injectable drugs and immediate availability in acute care environments.

The online pharmacy segment is anticipated to register the fastest CAGR from 2025 to 2032, with the rise of digital healthcare platforms, improved e-pharmacy regulations, and convenience of access to oral TLS medications playing a key role in expanding this channel.

Tumor Lysis Syndrome Market Regional Analysis

- North America dominates the tumor lysis syndrome market with the largest revenue share of 40.5% in 2025, driven by a high prevalence of hematologic malignancies, early adoption of advanced oncology therapies, and strong clinical awareness regarding TLS prevention and management.

- The region benefits from well-established healthcare infrastructure, widespread access to effective TLS therapeutics such as rasburicase and febuxostat, and the presence of leading pharmaceutical players actively involved in research and distribution of TLS-specific treatments.

- Additionally, favorable reimbursement policies, integration of TLS risk management into oncology care pathways, and increasing adoption of CAR-T and immunotherapy treatments—especially in the U.S.—are further fueling market growth. These factors collectively position North America as the most mature and lucrative regional market for TLS solutions across hospital, specialty clinic, and homecare settings.

U.S. Tumor Lysis Syndrome Market Insight

The U.S. tumor lysis syndrome market captured the largest revenue share of approximately 78% within North America in 2025, driven by a high prevalence of hematologic malignancies, advanced cancer care infrastructure, and widespread adoption of intensive therapies such as CAR-T, immunotherapy, and aggressive chemotherapy. The integration of TLS risk stratification and prophylaxis into clinical guidelines by bodies such as ASCO is further fueling market demand. In addition, the availability of advanced diagnostic tools and broad access to high-cost treatments like rasburicase support strong market penetration across hospitals, specialty oncology centers, and outpatient infusion facilities.

Europe Tumor Lysis Syndrome Market Insight

The European tumor lysis syndrome market is projected to expand at a solid CAGR during the forecast period, primarily driven by improved oncology care standards, increasing adoption of targeted cancer therapies, and rising awareness of TLS risk. The expansion of national cancer programs, along with reimbursement support for urate-lowering drugs, is fostering market growth across major European countries. Additionally, strong pharmaceutical R&D capabilities and access to trained healthcare professionals are reinforcing early diagnosis and TLS management protocols across inpatient and outpatient settings.

U.K. Tumor Lysis Syndrome Market Insight

The U.K. tumor lysis syndrome market is expected to grow at a notable CAGR over the forecast period, supported by a rising incidence of hematologic malignancies and the expansion of the NHS cancer treatment portfolio. Increasing use of biologics and targeted therapies in both adult and pediatric oncology is elevating the focus on TLS prevention and early intervention. Enhanced awareness campaigns, clinical education, and access to cost-effective oral urate-lowering drugs are helping bridge treatment gaps, while national initiatives continue to improve access to oncology services.

Germany Tumor Lysis Syndrome Market Insight

Germany’s tumor lysis syndrome market is forecasted to grow steadily, driven by its highly developed healthcare infrastructure, strong focus on oncology innovation, and adoption of TLS-specific treatment protocols in tertiary care hospitals. The widespread availability of high-precision diagnostics and a robust base of practicing hematologists/oncologists are further boosting demand. Germany’s emphasis on clinical guideline adherence, including routine screening for TLS risk and prophylactic therapy administration, is enabling effective market expansion across public and private institutions.

Asia-Pacific Tumor Lysis Syndrome Market Insight

The Asia-Pacific TLS market is expected to grow at the fastest CAGR of over 11% in 2025, driven by increasing cancer incidence, expanding healthcare access, and improved availability of oncology therapies in countries like China, India, and Japan. Government-led initiatives for cancer care improvement, rising investments in hospital infrastructure, and the inclusion of TLS management in oncology protocols are accelerating market development. In addition, the growing number of specialty cancer centers and the emergence of local drug manufacturers are making TLS treatment more accessible and affordable in the region.

Japan Tumor Lysis Syndrome Market Insight

The Japan TLS market is experiencing sustained growth, supported by the country’s aging population, high prevalence of hematologic cancers, and established precision medicine initiatives. Japan’s oncology care system increasingly emphasizes early detection and risk management of TLS, particularly in patients undergoing intensive therapies. The presence of domestic pharmaceutical giants and a strong clinical research environment ensures access to both branded and generic TLS drugs, while integration with national electronic health records supports better TLS monitoring and adherence.

China Tumor Lysis Syndrome Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2025, fueled by its rapidly growing cancer patient population, urbanization, and healthcare reforms aimed at improving oncology treatment access. The country is seeing increasing adoption of high-efficacy therapies such as chemotherapy and immunotherapy, which heightens the risk of TLS and thus the demand for effective preventive treatments. The availability of affordable generics, growing investment in hospital infrastructure, and the expansion of national health insurance coverage are key contributors to market growth. China also hosts a robust network of domestic pharmaceutical companies that are increasingly entering the TLS space.

Tumor Lysis Syndrome Market Share

The Tumor Lysis Syndrome industry is primarily led by well-established companies, including:

- Johnson & Johnson Private Limited (U.S.)

- Ironwood Pharmaceuticals, Inc. (U.S.)

- Sanofi (France)

- The Menarini Group (Italy)

- Merck KGaA (Germany)

- Takeda Pharmaceutical Company Limited (Japan)

- AstraZeneca (U.K.)

- Hikma Pharmaceuticals PLC (U.K.)

- Pfizer Inc. (U.S.)

- Lonza (Switzerland)

- Amgen Inc. (U.S.)

- Genentech, Inc. (U.S.) (subsidiary of Roche, Switzerland)

- Ionis Pharmaceuticals (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- AbbVie Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- Alexion Pharmaceuticals, Inc. (U.S.) (a subsidiary of AstraZeneca, U.K.)

- Mallinckrodt (Ireland)

- F. Hoffmann-La Roche Ltd (Switzerland)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL TUMOR LYSIS SYNDROME MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL TUMOR LYSIS SYNDROME MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL TUMOR LYSIS SYNDROME MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 MERGERS AND ACQUISITIONS

10.8 FUTURE OUTLOOK

11 EPIDEMIOLOGY

11.1 INCIDENCE OF ALL BY GENDER

11.2 TREATMENT RATE

11.3 MORTALITY RATE

11.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

11.5 PATIENT TREATMENT SUCCESS RATES

12 REGULATORY COMPLIANCE

12.1 REGULATORY AUTHORITIES

12.2 REGULATORY CLASSIFICATIONS

12.2.1 CLASS I

12.2.2 CLASS II

12.2.3 CLASS III

12.3 REGULATORY SUBMISSIONS

12.4 INTERNATIONAL HARMONIZATION

12.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

12.6 REGULATORY CHALLENGES AND STRATEGIES

13 PIPELINE ANALYSIS

13.1 CLINICAL TRIALS AND PHASE ANALYSIS

13.2 DRUG THERAPY PIPELINE

13.3 PHASE III CANDIDATES

13.4 PHASE II CANDIDATES

13.5 PHASE I CANDIDATES

13.6 OTHERS (PRE-CLINICAL AND RESEARCH)

TABLE 1 GLOBAL CLINICAL TRIAL MARKET FOR TUMOR LYSIS SYNDROME MARKET

Company Name Product Name

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 2 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE FOR TUMOR LYSIS SYNDROME MARKET

Phase Number of Projects

Preclinical/Research Projects XX

Clinical Development XX

Phase I XX

Phase II XX

Phase III XX

U.S. Filed/Approved but Not Yet Marketed XX

Total XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 3 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE FOR TUMOR LYSIS SYNDROME MARKET

Therapeutic Area Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 4 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE FOR TUMOR LYSIS SYNDROME MARKET

Technology Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

FIGURE 1 TOP ENTITIES BASED ON R&D GLANCE FOR TUMOR LYSIS SYNDROME MARKET

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

14 REIMBURSEMENT FRAMEWORK

15 OPPUTUNITY MAP ANALYSIS

16 VALUE CHAIN ANALYSIS

17 HEALTHCARE ECONOMY

17.1 HEALTHCARE EXPENDITURE

17.2 CAPITAL EXPENDITURE

17.3 CAPEX TRENDS

17.4 CAPEX ALLOCATION

17.5 FUNDING SOURCES

17.6 INDUSTRY BENCHMARKS

17.7 GDP RATION IN OVERALL GDP

17.8 HEALTHCARE SYSTEM STRUCTURE

17.9 GOVERNMENT POLICIES

17.1 ECONOMIC DEVELOPMENT

18 GLOBAL TUMOR LYSIS SYNDROME MARKET, BY TREATMENT

18.1 OVERVIEW

18.2 MEDICATIONS

18.2.1 MARKET SIZE

18.2.1.1. MARKET VALUE (USD MN)

18.2.1.2. MARKET VOLUME (MILLION)

18.2.1.3. ASP (USD)

18.2.2 URICOSURIC AGENTS

18.2.2.1. ALLOPURINOL

18.2.2.1.1. BY BRAND

18.2.2.1.1.1 ZYLOPRIM

18.2.2.1.1.2 ALOPRIM

18.2.2.1.2. BY STRENGTH

18.2.2.1.2.1 100MG

18.2.2.1.2.2 300MG

18.2.2.1.2.3 500MG

18.2.2.2. RASBURICASE/ELITEK

18.2.2.2.1. 1.5MG

18.2.2.2.2. 7.5MG

18.2.3 ELECTROLYTES

18.2.3.1. DEXTROSE (D-GLUCOSE) PLUS INSULIN

18.2.3.1.1. BY TYPE

18.2.3.1.1.1 D50W

18.2.3.1.1.2 DGLUCOSE

18.2.3.1.1.3 GLUCOSE

18.2.3.1.2. BY CONCENTRATION

18.2.3.1.2.1 0.025

18.2.3.1.2.2 0.05

18.2.3.1.2.3 0.1

18.2.3.1.2.4 0.2

18.2.3.1.2.5 OTHERS

18.2.3.2. OTHERS

18.2.4 DIURETICS, LOOP

18.2.4.1. FUROSEMIDE

18.2.4.1.1. BY TYPE

18.2.4.1.1.1 LASIX

18.2.4.1.1.2 FUROSCIX

18.2.4.1.2. BY STRENGTH

18.2.4.1.2.1 20MG

18.2.4.1.2.2 40MG

18.2.4.1.2.3 80MG

18.2.4.1.2.4 OTHERS

18.2.4.2. OTHERS

18.2.5 ALKALINIZING AGENTS

18.2.5.1. ACETAZOLAMIDE/DIAMOX

18.2.5.1.1. 125MG

18.2.5.1.2. 250MG

18.2.5.1.3. 500MG

18.2.5.2. SODIUM BICARBONATE/NEUT

18.2.5.2.1. BY CONCENTRATION

18.2.5.2.1.1 0.04

18.2.5.2.1.2 0.042

18.2.5.2.1.3 0.075

18.2.5.2.1.4 0.084

18.2.5.2.2. BY STRENGTH

18.2.5.2.2.1 325MG

18.2.5.2.2.2 650MG

18.2.5.3. OTHERS

18.2.6 ELECTROLYTE SUPPLEMENTS, PARENTERAL

18.2.6.1. CALCIUM GLUCONATE

18.2.6.1.1. 50MG

18.2.6.1.2. 500MG

18.2.6.1.3. 650MG

18.2.6.2. CALCIUM CHLORIDE

18.2.6.3. OTHERS

18.2.7 ANTIDOTES, OTHER

18.2.7.1. SODIUM POLYSTYRENE SULFONATE

18.2.7.1.1. SPS

18.2.7.1.2. KAYEXALATE

18.2.7.1.3. KIONEX

18.2.7.1.4. KALEXATE

18.2.7.2. ALUMINUM HYDROXIDE

18.2.7.2.1. ALTERNAGEL

18.2.7.2.2. AMPHOJEL

18.2.7.2.3. NEPHROX

18.2.7.3. SEVELAMER HYDROCHLORIDE

18.2.7.3.1. BY TYPE

18.2.7.3.1.1 RENAGEL

18.2.7.3.1.2 RENVELA

18.2.7.3.2. BY STRENGTH

18.2.7.3.2.1 400MG

18.2.7.3.2.2 800MG

18.2.7.3.2.3 2400MG

18.2.7.4. FEBUXOSTAT

18.2.7.5. OTHERS

18.3 DIALYSIS

18.3.1 MARKET VALUE (USD MN)

18.3.2 MARKET VOLUME (MILLION)

18.3.3 ASP (USD)

18.4 OTHERS

19 GLOBAL TUMOR LYSIS SYNDROME MARKET, BY ROUTE OF ADMINISTRATION

19.1 OVERVIEW

19.2 ORAL

19.2.1 TABLET

19.2.2 CAPSULE

19.2.3 SOLUTION

19.2.4 OTHERS

19.3 PARENTERAL

19.3.1 INTRAVENEOUS

19.3.2 INTRAMUSCULAR

19.3.3 SUBCUTANEOUS

19.4 OTHERS

20 GLOBAL TUMOR LYSIS SYNDROME MARKET, BY DRUG TYPE

20.1 OVERVIEW

20.2 BRANDED

20.2.1 ZYLOPRIM

20.2.2 LOPURIN

20.2.3 ELITEK

20.2.4 OTHERS

20.3 GENERICS

21 GLOBAL TUMOR LYSIS SYNDROME MARKET, BY PRESCRIPTION MODE

21.1 OVERVIEW

21.2 OTC DRUG

21.3 PRESCRIPTION DRUG

22 GLOBAL TUMOR LYSIS SYNDROME MARKET, BY GENDER

22.1 OVERVIEW

22.2 MALE

22.2.1 PEDIATRIC

22.2.2 ADULT

22.2.3 GERIATRIC

22.3 FEMALE

22.3.1 PEDIATRIC

22.3.2 ADULT

22.3.3 GERIATRIC

23 GLOBAL TUMOR LYSIS SYNDROME MARKET, BY AGE GROUP

23.1 OVERVIEW

23.2 BELOW 30 YEARS

23.3 31-60 YEARS

23.4 ABOVE 60 YEARS

24 GLOBAL TUMOR LYSIS SYNDROME MARKET, BY INDICATION

24.1 OVERVIEW

24.2 NUMBNESS

24.3 SEIZURES

24.4 PARALYSIS

24.5 HEART PALPITATIONS

24.6 IRREGULAR HEARTBEATS

24.7 FLICKERING, BLURRED, OR DOUBLE VISION

24.8 UNCONTROLLABLE BODY MOVEMENTS

24.9 OTHERS

25 GLOBAL TUMOR LYSIS SYNDROME MARKET, BY END USER

25.1 OVERVIEW

25.2 HOSPITAL

25.2.1 PRIVATE

25.2.2 PUBLIC

25.3 SPECIALTY CLINICS

25.4 HOME HEALTHCARE

25.5 CANCER RESEARCH INSTITUTE

25.6 OTHERS

26 GLOBAL TUMOR LYSIS SYNDROME MARKET, BY DISTRIBUTION CHANNEL

26.1 OVERVIEW

26.2 DIRECT TENDER

26.3 RETAIL SALES

26.3.1 HOSPITAL PHARMACY

26.3.2 ONLINE PHARMACY

26.3.3 MEDICINE STORES

26.4 OTHERS

27 GLOBAL TUMOR LYSIS SYNDROME MARKET, COMPANY LANDSCAPE

27.1 COMPANY SHARE ANALYSIS: GLOBAL

27.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

27.3 COMPANY SHARE ANALYSIS: EUROPE

27.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

27.5 MERGERS & ACQUISITIONS

27.6 NEW PRODUCT DEVELOPMENT & APPROVALS

27.7 EXPANSIONS

27.8 REGULATORY CHANGES

27.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

28 GLOBAL TUMOR LYSIS SYNDROME MARKET, BY GEOGRAPHY

GLOBAL TUMOR LYSIS SYNDROME MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

28.1 NORTH AMERICA

28.1.1 U.S.

28.1.2 CANADA

28.1.3 MEXICO

28.2 EUROPE

28.2.1 GERMANY

28.2.2 U.K.

28.2.3 ITALY

28.2.4 FRANCE

28.2.5 SPAIN

28.2.6 RUSSIA

28.2.7 SWITZERLAND

28.2.8 TURKEY

28.2.9 BELGIUM

28.2.10 NETHERLANDS

28.2.11 DENMARK

28.2.12 SWEDEN

28.2.13 POLAND

28.2.14 NORWAY

28.2.15 FINLAND

28.2.16 REST OF EUROPE

28.3 ASIA-PACIFIC

28.3.1 JAPAN

28.3.2 CHINA

28.3.3 SOUTH KOREA

28.3.4 INDIA

28.3.5 SINGAPORE

28.3.6 THAILAND

28.3.7 INDONESIA

28.3.8 MALAYSIA

28.3.9 PHILIPPINES

28.3.10 AUSTRALIA

28.3.11 NEW ZEALAND

28.3.12 VIETNAM

28.3.13 TAIWAN

28.3.14 REST OF ASIA-PACIFIC

28.4 SOUTH AMERICA

28.4.1 BRAZIL

28.4.2 ARGENTINA

28.4.3 REST OF SOUTH AMERICA

28.5 MIDDLE EAST AND AFRICA

28.5.1 SOUTH AFRICA

28.5.2 EGYPT

28.5.3 BAHRAIN

28.5.4 UNITED ARAB EMIRATES

28.5.5 KUWAIT

28.5.6 OMAN

28.5.7 QATAR

28.5.8 SAUDI ARABIA

28.5.9 REST OF MIDDLE EAST AND AFRICA

28.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

29 GLOBAL TUMOR LYSIS SYNDROME MARKET, SWOT AND DBMR ANALYSIS

30 GLOBAL TUMOR LYSIS SYNDROME MARKET, COMPANY PROFILE

30.1 NORTHSTAR RX LLC.

30.1.1 COMPANY OVERVIEW

30.1.2 REVENUE ANALYSIS

30.1.3 GEOGRAPHIC PRESENCE

30.1.4 PRODUCT PORTFOLIO

30.1.5 RECENT DEVELOPMENTS

30.2 SUN PHARMACEUTICAL INDUSTRIES LTD.

30.2.1 COMPANY OVERVIEW

30.2.2 REVENUE ANALYSIS

30.2.3 GEOGRAPHIC PRESENCE

30.2.4 PRODUCT PORTFOLIO

30.2.5 RECENT DEVELOPMENTS

30.3 HARMAN FINOCHEM LTD

30.3.1 COMPANY OVERVIEW

30.3.2 REVENUE ANALYSIS

30.3.3 GEOGRAPHIC PRESENCE

30.3.4 PRODUCT PORTFOLIO

30.3.5 RECENT DEVELOPMENTS

30.4 VIATRIS INC.

30.4.1 COMPANY OVERVIEW

30.4.2 REVENUE ANALYSIS

30.4.3 GEOGRAPHIC PRESENCE

30.4.4 PRODUCT PORTFOLIO

30.4.5 RECENT DEVELOPMENTS

30.5 INDOCO REMEDIES LIMITED

30.5.1 COMPANY OVERVIEW

30.5.2 REVENUE ANALYSIS

30.5.3 GEOGRAPHIC PRESENCE

30.5.4 PRODUCT PORTFOLIO

30.5.5 RECENT DEVELOPMENTS

30.6 IPCA LABORATORIES LTD.

30.6.1 COMPANY OVERVIEW

30.6.2 REVENUE ANALYSIS

30.6.3 GEOGRAPHIC PRESENCE

30.6.4 PRODUCT PORTFOLIO

30.6.5 RECENT DEVELOPMENTS

30.7 PAR FORMULATIONS PRIVATE LIMITED

30.7.1 COMPANY OVERVIEW

30.7.2 REVENUE ANALYSIS

30.7.3 GEOGRAPHIC PRESENCE

30.7.4 PRODUCT PORTFOLIO

30.7.5 RECENT DEVELOPMENTS

30.8 CELON LABS

30.8.1 COMPANY OVERVIEW

30.8.2 REVENUE ANALYSIS

30.8.3 GEOGRAPHIC PRESENCE

30.8.4 PRODUCT PORTFOLIO

30.8.5 RECENT DEVELOPMENTS

30.9 LUPIN

30.9.1 COMPANY OVERVIEW

30.9.2 REVENUE ANALYSIS

30.9.3 GEOGRAPHIC PRESENCE

30.9.4 PRODUCT PORTFOLIO

30.9.5 RECENT DEVELOPMENTS

30.1 ACCORD HEALTHCARE (INTAS PHARMACEUTICALS)

30.10.1 COMPANY OVERVIEW

30.10.2 REVENUE ANALYSIS

30.10.3 GEOGRAPHIC PRESENCE

30.10.4 PRODUCT PORTFOLIO

30.10.5 RECENT DEVELOPMENTS

30.11 CHARTWELLPHARMA

30.11.1 COMPANY OVERVIEW

30.11.2 REVENUE ANALYSIS

30.11.3 GEOGRAPHIC PRESENCE

30.11.4 PRODUCT PORTFOLIO

30.11.5 RECENT DEVELOPMENTS

30.12 PATHEON MFG. SERVICES LLC

30.12.1 COMPANY OVERVIEW

30.12.2 REVENUE ANALYSIS

30.12.3 GEOGRAPHIC PRESENCE

30.12.4 PRODUCT PORTFOLIO

30.12.5 RECENT DEVELOPMENTS

30.13 SANOFI S.R.L.

30.13.1 COMPANY OVERVIEW

30.13.2 REVENUE ANALYSIS

30.13.3 GEOGRAPHIC PRESENCE

30.13.4 PRODUCT PORTFOLIO

30.13.5 RECENT DEVELOPMENTS

30.14 TAJ PHARMA GROUP

30.14.1 COMPANY OVERVIEW

30.14.2 REVENUE ANALYSIS

30.14.3 GEOGRAPHIC PRESENCE

30.14.4 PRODUCT PORTFOLIO

30.14.5 RECENT DEVELOPMENTS

30.15 AETOS PHARMA PRIVATE LIMITED

30.15.1 COMPANY OVERVIEW

30.15.2 REVENUE ANALYSIS

30.15.3 GEOGRAPHIC PRESENCE

30.15.4 PRODUCT PORTFOLIO

30.15.5 RECENT DEVELOPMENTS

30.16 ACTIZAPHARMA.COM

30.16.1 COMPANY OVERVIEW

30.16.2 REVENUE ANALYSIS

30.16.3 GEOGRAPHIC PRESENCE

30.16.4 PRODUCT PORTFOLIO

30.16.5 RECENT DEVELOPMENTS

30.17 G J PHARMACEUTICALS LLP

30.17.1 COMPANY OVERVIEW

30.17.2 REVENUE ANALYSIS

30.17.3 GEOGRAPHIC PRESENCE

30.17.4 PRODUCT PORTFOLIO

30.17.5 RECENT DEVELOPMENTS

30.18 UNICHEM PHARMACEUTICALS USA INC

30.18.1 COMPANY OVERVIEW

30.18.2 REVENUE ANALYSIS

30.18.3 GEOGRAPHIC PRESENCE

30.18.4 PRODUCT PORTFOLIO

30.18.5 RECENT DEVELOPMENTS

30.19 ZYDUS PHARMACEUTICALS, INC.

30.19.1 COMPANY OVERVIEW

30.19.2 REVENUE ANALYSIS

30.19.3 GEOGRAPHIC PRESENCE

30.19.4 PRODUCT PORTFOLIO

30.19.5 RECENT DEVELOPMENTS

30.2 DR. REDDY’S LABORATORIES, INC.

30.20.1 COMPANY OVERVIEW

30.20.2 REVENUE ANALYSIS

30.20.3 GEOGRAPHIC PRESENCE

30.20.4 PRODUCT PORTFOLIO

30.20.5 RECENT DEVELOPMENTS

30.21 WATSONS

30.21.1 TAKEDA COMPANY OVERVIEW

30.21.2 REVENUE ANALYSIS

30.21.3 GEOGRAPHIC PRESENCE

30.21.4 PRODUCT PORTFOLIO

30.21.5 RECENT DEVELOPMENTS

30.22 PHARMACEUTICAL COMPANY LIMITED

30.22.1 COMPANY OVERVIEW

30.22.2 REVENUE ANALYSIS

30.22.3 GEOGRAPHIC PRESENCE

30.22.4 PRODUCT PORTFOLIO

30.22.5 RECENT DEVELOPMENTS

30.23 AVET PHARMACEUTICALS INC

30.23.1 COMPANY OVERVIEW

30.23.2 REVENUE ANALYSIS

30.23.3 GEOGRAPHIC PRESENCE

30.23.4 PRODUCT PORTFOLIO

30.23.5 RECENT DEVELOPMENTS

30.24 ADVACARE PHARMA

30.24.1 COMPANY OVERVIEW

30.24.2 REVENUE ANALYSIS

30.24.3 GEOGRAPHIC PRESENCE

30.24.4 PRODUCT PORTFOLIO

30.24.5 RECENT DEVELOPMENTS

30.25 CAMBER PHARMACEUTICALS, INC.

30.25.1 COMPANY OVERVIEW

30.25.2 REVENUE ANALYSIS

30.25.3 GEOGRAPHIC PRESENCE

30.25.4 PRODUCT PORTFOLIO

30.25.5 RECENT DEVELOPMENTS

30.26 ALEMBIC PHARMACEUTICALS LIMITED

30.26.1 COMPANY OVERVIEW

30.26.2 REVENUE ANALYSIS

30.26.3 GEOGRAPHIC PRESENCE

30.26.4 PRODUCT PORTFOLIO

30.26.5 RECENT DEVELOPMENTS

30.27 MACLEODS PHARMA UK LIMITED

30.27.1 COMPANY OVERVIEW

30.27.2 REVENUE ANALYSIS

30.27.3 GEOGRAPHIC PRESENCE

30.27.4 PRODUCT PORTFOLIO

30.27.5 RECENT DEVELOPMENTS

30.28 LANNETT

30.28.1 COMPANY OVERVIEW

30.28.2 REVENUE ANALYSIS

30.28.3 GEOGRAPHIC PRESENCE

30.28.4 PRODUCT PORTFOLIO

30.28.5 RECENT DEVELOPMENTS

30.29 AUROBINDO PHARMA LIMITED

30.29.1 COMPANY OVERVIEW

30.29.2 REVENUE ANALYSIS

30.29.3 GEOGRAPHIC PRESENCE

30.29.4 PRODUCT PORTFOLIO

30.29.5 RECENT DEVELOPMENTS

30.3 NOVADOZ PHARMACEUTICALS

30.30.1 COMPANY OVERVIEW

30.30.2 REVENUE ANALYSIS

30.30.3 GEOGRAPHIC PRESENCE

30.30.4 PRODUCT PORTFOLIO

30.30.5 RECENT DEVELOPMENTS

30.31 WEST-WARD COLUMBUS INC.

30.31.1 COMPANY OVERVIEW

30.31.2 REVENUE ANALYSIS

30.31.3 GEOGRAPHIC PRESENCE

30.31.4 PRODUCT PORTFOLIO

30.31.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

31 RELATED REPORTS

32 CONCLUSION

33 QUESTIONNAIRE

34 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.