Global Ultrasound Elastography Systems Market

Market Size in USD Billion

CAGR :

%

USD

7.39 Billion

USD

13.56 Billion

2025

2033

USD

7.39 Billion

USD

13.56 Billion

2025

2033

| 2026 –2033 | |

| USD 7.39 Billion | |

| USD 13.56 Billion | |

|

|

|

|

Ultrasound Elastography Systems Market Size

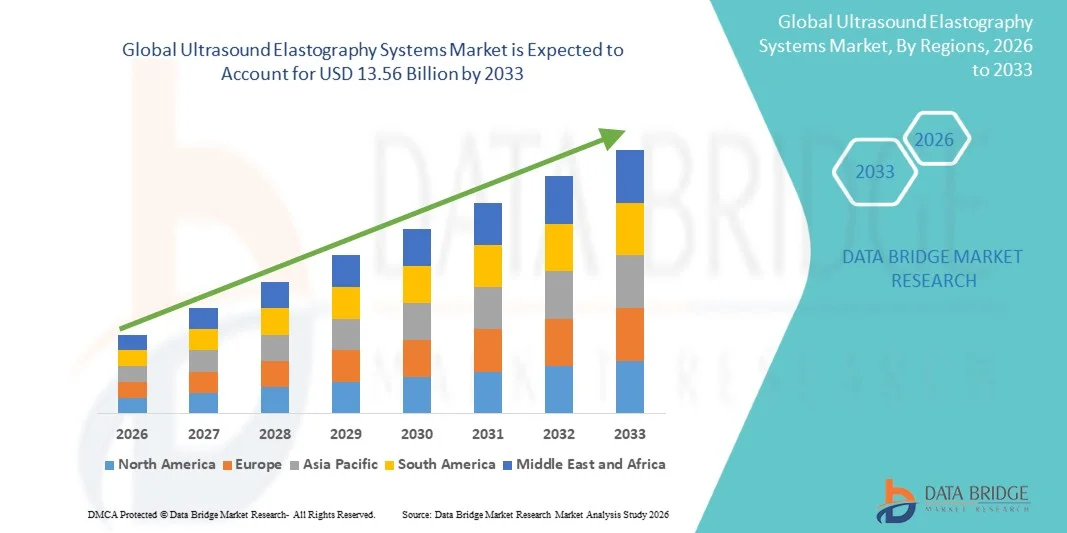

- The global ultrasound elastography systems market size was valued at USD 7.39 billion in 2025 and is expected to reach USD 13.56 billion by 2033, at a CAGR of 7.89% during the forecast period

- The market growth is largely fueled by the rising prevalence of chronic liver diseases, growing demand for non‑invasive diagnostic imaging, and continuous technological advancements in elastography‑enabled ultrasound systems that improve diagnostic accuracy and clinical workflow

- Furthermore, increasing clinical adoption for oncology, hepatology, musculoskeletal, and broader diagnostic applications along with integration of AI and automation to enhance imaging performance is driving higher demand for ultrasound elastography systems in hospitals and diagnostic centers worldwide

Ultrasound Elastography Systems Market Analysis

- Ultrasound elastography systems, providing non-invasive imaging to assess tissue stiffness, are increasingly vital in modern diagnostic workflows across hospitals, clinics, and diagnostic centers due to their enhanced diagnostic accuracy, real-time imaging capabilities, and integration with conventional ultrasound platforms

- The escalating demand for ultrasound elastography systems is primarily fueled by the rising prevalence of chronic liver diseases, increasing adoption of non-invasive diagnostic techniques, and growing preference for early detection and monitoring of cancers, musculoskeletal disorders, and vascular conditions

- North America dominated the ultrasound elastography systems market with the largest revenue share of 38.5% in 2025, characterized by early adoption of advanced imaging technologies, high healthcare expenditure, and a strong presence of key industry players, with the U.S. experiencing substantial growth in elastography installations, particularly in radiology and cardiology departments, driven by innovations from both established medical device companies and AI-enabled imaging startups

- Asia-Pacific is expected to be the fastest growing region in the ultrasound elastography systems market during the forecast period due to increasing healthcare infrastructure, rising awareness of non-invasive diagnostics, and expanding geriatric population

- Ultrasound segment dominated the market with a market share of 72.4% in 2025, driven by its cost-effectiveness, widespread clinical adoption, and seamless integration with conventional imaging workflows

Report Scope and Ultrasound Elastography Systems Market Segmentation

|

Attributes |

Ultrasound Elastography Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Ultrasound Elastography Systems Market Trends

“Integration with AI and Advanced Imaging Software”

- A significant and accelerating trend in the global ultrasound elastography systems market is the integration with artificial intelligence (AI) and advanced imaging software, enhancing image quality, automated measurements, and clinical decision support

- For instance, the Canon Aplio i-series elastography system utilizes AI-assisted workflow to automatically segment tissues and calculate stiffness values, reducing operator dependency and increasing diagnostic accuracy

- AI integration enables features such as predictive analytics for early disease detection and automated tissue characterization, improving workflow efficiency. For instance, some GE LOGIQ models analyze liver fibrosis progression over time and provide automated alerts for abnormal tissue stiffness

- Seamless integration with hospital PACS and EMR systems allows radiologists to centralize imaging review, monitor patient progress, and combine elastography data with conventional ultrasound and Doppler findings for more comprehensive diagnostics

- This trend towards AI-enabled, intuitive, and automated imaging systems is reshaping clinical expectations for diagnostic workflows. Consequently, companies such as Siemens Healthineers are developing AI-powered elastography solutions with automated tissue mapping and predictive analysis

- The demand for elastography systems with AI-assisted imaging and software integration is growing rapidly across radiology, hepatology, and musculoskeletal specialties as hospitals and diagnostic centers prioritize accuracy, speed, and workflow efficiency

- Increasing adoption of portable and point-of-care elastography devices is enabling use in outpatient clinics, emergency settings, and rural hospitals, expanding the market reach

Ultrasound Elastography Systems Market Dynamics

Driver

“Rising Prevalence of Liver Disease and Chronic Conditions”

- The increasing prevalence of chronic liver diseases, fibrosis, and other conditions requiring non-invasive diagnostics is a key driver for the adoption of ultrasound elastography systems

- For instance, in March 2025, Hitachi Medical Systems introduced an AI-enabled liver elastography solution aimed at improving early detection of NAFLD and hepatitis-related fibrosis in outpatient clinics

- As patients and physicians increasingly prioritize early and non-invasive disease detection, elastography systems offer precise tissue characterization, longitudinal monitoring, and reduced need for invasive biopsies

- Furthermore, the growing adoption of advanced diagnostic imaging in hospitals and specialty clinics is driving demand, particularly in regions with high incidence of liver and musculoskeletal diseases

- The ability to integrate elastography with conventional ultrasound platforms and provide multi-organ diagnostic insights is propelling adoption across radiology, cardiology, and orthopedic departments

- Improved clinical workflow efficiency, AI-assisted interpretation, and growing awareness of non-invasive monitoring methods are key factors supporting market growth in both developed and emerging regions

- Expansion of elastography applications into oncology and vascular diagnostics is creating new growth opportunities and increasing clinical adoption across multiple specialties

- For instance, Aixplorer Mach 30 is used to assess tumor stiffness and vascular abnormalities, enhancing diagnostic confidence and guiding treatment planning

Restraint/Challenge

“High Equipment Cost and Need for Skilled Operators”

- The relatively high cost of advanced ultrasound elastography systems compared to conventional ultrasound remains a significant barrier, limiting adoption in smaller clinics or budget-conscious healthcare facilities

- For instance, high-end systems from Philips or Siemens with AI-enabled elastography can cost multiple times more than standard ultrasound systems, deterring smaller outpatient centers

- The requirement for trained operators and sonographers to perform elastography accurately poses another challenge, as improper use can lead to inconsistent or unreliable results

- For instance, in emerging markets, lack of trained personnel and inadequate clinical training programs limit the penetration of elastography systems despite growing disease prevalence

- While costs are gradually decreasing and AI-assisted automation reduces operator dependency, the initial investment and training needs remain hurdles for widespread adoption

- Overcoming these challenges through affordable solutions, operator training programs, and AI-assisted workflow improvements is vital for the sustained growth of the ultrasound elastography systems market

- Limited awareness among healthcare providers and patients about the advantages of elastography over invasive procedures can slow adoption in certain regions

- For instance, in some rural areas, physicians continue to rely on biopsy or conventional imaging due to lack of knowledge about elastography capabilities, highlighting the need for educational initiatives

Ultrasound Elastography Systems Market Scope

The market is segmented on the basis of modality, application, and end use.

- By Modality

On the basis of modality, the ultrasound elastography systems market is segmented into ultrasound and magnetic resonance (MR). The ultrasound segment dominated the market with the largest market revenue share of 72.4% in 2025, driven by its widespread adoption across hospitals and diagnostic centers due to cost-effectiveness, real-time imaging, and ease of integration with existing ultrasound platforms. Ultrasound elastography offers non-invasive assessment of tissue stiffness, making it highly suitable for liver, musculoskeletal, and vascular diagnostics. Its portability and lower operational cost compared to MR systems allow broader accessibility in outpatient clinics and rural hospitals. Moreover, continuous advancements in AI-assisted analysis and workflow automation enhance accuracy and efficiency, further strengthening its adoption. Hospitals and specialty clinics favor ultrasound elastography for routine monitoring and early detection of fibrosis, tumors, and musculoskeletal injuries, fueling strong revenue generation. In addition, the segment benefits from ongoing product launches with improved resolution and multi-organ imaging capabilities.

The magnetic resonance segment is anticipated to witness the fastest CAGR from 2026 to 2033, driven by its superior soft tissue contrast and detailed three-dimensional imaging, making it ideal for complex clinical cases and research applications. MR elastography is increasingly adopted in advanced hospitals and research institutions for liver fibrosis assessment, tumor characterization, and vascular studies. Its ability to quantify tissue stiffness across entire organs provides a non-invasive alternative to biopsies, attracting clinicians for precise diagnosis. Technological innovations in MR systems, including faster scan times and AI-assisted post-processing, are expanding the applicability of this modality. MR elastography’s growing recognition for oncology and cardiovascular applications is also contributing to its high growth potential. Furthermore, increasing investment in MR infrastructure in emerging economies is expected to boost adoption over the forecast period.

- By Application

On the basis of application, the market is segmented into radiology, cardiology, obstetrics, urology, vascular, orthopedic and musculoskeletal, and others. The radiology segment dominated the market with a 30% share in 2025, driven by its extensive clinical use for liver, breast, and abdominal imaging, where elastography provides critical diagnostic information. Radiologists rely on elastography to assess tissue stiffness non-invasively, reducing the need for biopsies and improving patient comfort. Integration with AI-assisted platforms enables automated tissue characterization and longitudinal monitoring, increasing workflow efficiency. Hospitals and imaging centers prioritize elastography for routine screening and disease progression tracking, contributing to strong market revenue. In addition, radiology departments benefit from the versatility of elastography across multiple organs and conditions, further cementing its dominance. Continuous training programs and increasing clinician awareness of elastography’s clinical benefits are also supporting adoption.

The cardiology segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by the growing use of elastography to evaluate myocardial stiffness and detect early cardiac fibrosis. Cardiologists are increasingly leveraging non-invasive elastography techniques for monitoring heart failure, cardiomyopathies, and vascular compliance, offering enhanced patient management. Technological advancements in cardiac imaging, including real-time strain analysis and AI-based assessment, are driving rapid adoption. The rising prevalence of cardiovascular diseases worldwide is encouraging hospitals to implement elastography in cardiology departments. Early detection and improved prognosis for cardiac conditions using elastography increase its clinical value. Furthermore, expanding research initiatives and clinical trials in cardiology are expected to accelerate the market growth for this segment.

- By End Use

On the basis of end use, the market is segmented into hospitals, ambulatory surgery centers (ASCs), and others. The hospitals segment dominated the market with a 65% share in 2025, driven by their high patient volumes, multi-specialty applications, and investments in advanced imaging technologies. Hospitals utilize elastography across radiology, hepatology, cardiology, and musculoskeletal departments, making it a preferred setting for system deployment. The capability to integrate elastography with existing ultrasound and MR infrastructure allows centralized patient management and comprehensive diagnostics. Hospitals also benefit from AI-assisted elastography software that improves workflow efficiency and diagnostic accuracy. Continuous product upgrades and training programs for radiologists and sonographers further support strong adoption. Moreover, hospitals are increasingly investing in elastography for preventive healthcare and chronic disease monitoring, contributing to sustained revenue growth.

The ambulatory surgery centers (ASCs) segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by the rising demand for minimally invasive and non-invasive diagnostic solutions in outpatient settings. ASCs increasingly adopt portable and compact ultrasound elastography systems to provide quick, accurate assessments for liver, musculoskeletal, and vascular conditions without requiring hospital admission. The convenience of bedside imaging, shorter procedure times, and reduced operational costs make elastography highly attractive for ASCs. Technological innovations in compact and AI-assisted elastography devices enhance usability for small clinics and outpatient centers. Growing patient preference for outpatient diagnostics and rising investments in outpatient healthcare infrastructure are expected to accelerate adoption. In addition, ASCs are expanding their diagnostic service offerings, which further supports the rapid growth of this segment.

Ultrasound Elastography Systems Market Regional Analysis

- North America dominated the ultrasound elastography systems market with the largest revenue share of 38.5% in 2025, characterized by early adoption of advanced imaging technologies, high healthcare expenditure, and a strong presence of key industry players

- Healthcare providers and hospitals in the region highly value the accuracy, real-time imaging capabilities, and AI-assisted workflow offered by elastography systems, which enable early disease detection and longitudinal patient monitoring

- This widespread adoption is further supported by high healthcare expenditure, a well-established medical infrastructure, and strong presence of leading elastography system manufacturers, establishing these systems as a preferred diagnostic tool across radiology, hepatology, cardiology, and musculoskeletal departments

U.S. Ultrasound Elastography Systems Market Insight

The U.S. ultrasound elastography systems market captured the largest revenue share of 82% in North America in 2025, fueled by the rapid adoption of advanced diagnostic imaging and growing prevalence of chronic liver diseases and musculoskeletal disorders. Healthcare providers increasingly prioritize non-invasive, accurate, and AI-assisted imaging solutions for early disease detection and longitudinal patient monitoring. The growing preference for outpatient and hospital-based elastography solutions, combined with integration into existing ultrasound and MR systems, further propels market growth. Moreover, the widespread availability of trained radiologists and sonographers, alongside continuous technological innovations from leading companies, is significantly contributing to market expansion.

Europe Ultrasound Elastography Systems Market Insight

The Europe ultrasound elastography systems market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising incidence of liver fibrosis, musculoskeletal disorders, and oncology applications. Increasing investments in healthcare infrastructure and stringent clinical guidelines for non-invasive diagnostics are fostering adoption across hospitals and specialty clinics. European healthcare providers are drawn to the accuracy, efficiency, and reduced procedural risk offered by elastography systems. The market is experiencing significant growth across radiology, cardiology, and vascular departments, with systems being incorporated into both new healthcare facilities and equipment upgrades.

U.K. Ultrasound Elastography Systems Market Insight

The U.K. ultrasound elastography systems market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing awareness of non-invasive imaging for liver disease and oncology applications. In addition, the rising prevalence of chronic conditions and demand for accurate, reproducible diagnostics are encouraging hospitals and clinics to adopt elastography solutions. The U.K.’s emphasis on advanced healthcare infrastructure and training programs for imaging specialists is expected to further stimulate market growth. Moreover, the integration of elastography with conventional ultrasound platforms and AI-assisted imaging software is gaining traction across diagnostic centers.

Germany Ultrasound Elastography Systems Market Insight

The Germany ultrasound elastography systems market is expected to expand at a considerable CAGR during the forecast period, fueled by high awareness of non-invasive diagnostics and growing investment in advanced imaging technologies. Germany’s strong healthcare infrastructure, emphasis on innovation, and adoption of AI-driven solutions promote elastography usage, particularly in hospitals and research institutions. Integration with routine diagnostic workflows and multi-organ imaging capabilities is becoming increasingly prevalent, with a strong preference for efficient, accurate, and minimally invasive diagnostic tools aligning with clinical expectations.

Asia-Pacific Ultrasound Elastography Systems Market Insight

The Asia-Pacific ultrasound elastography systems market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by rising prevalence of liver diseases, increasing healthcare expenditure, and growing adoption of non-invasive diagnostics in countries such as China, Japan, and India. The region’s focus on digital healthcare initiatives and modernization of hospitals is fueling elastography adoption. Moreover, as APAC emerges as a hub for manufacturing and distributing medical imaging devices, affordability and accessibility of elastography systems are expanding to a wider healthcare base.

Japan Ultrasound Elastography Systems Market Insight

The Japan ultrasound elastography systems market is gaining momentum due to the country’s advanced healthcare infrastructure, high prevalence of liver diseases, and growing demand for accurate, non-invasive diagnostics. Hospitals and diagnostic centers increasingly integrate elastography with conventional ultrasound and AI-assisted systems to improve clinical workflow. In addition, Japan’s aging population is likely to drive demand for easy-to-use, reliable, and precise imaging solutions in both outpatient and hospital settings.

India Ultrasound Elastography Systems Market Insight

The India ultrasound elastography systems market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising incidence of liver and musculoskeletal disorders, rapid expansion of healthcare infrastructure, and high adoption of advanced medical imaging technologies. India is witnessing increased use of elastography in hospitals, diagnostic centers, and specialty clinics. Government initiatives promoting non-invasive diagnostics, alongside the availability of cost-effective devices and growing domestic manufacturing, are key factors propelling the market. The expanding middle class and rising awareness of preventive healthcare are further accelerating adoption.

Ultrasound Elastography Systems Market Share

The Ultrasound Elastography Systems industry is primarily led by well-established companies, including:

- Siemens Healthineers AG (Germany)

- GE HealthCare (U.S.)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Samsung Medison Co., Ltd. (South Korea)

- Koninklijke Philips N.V. (Netherlands)

- Hitachi, Ltd. (Japan)

- Mindray Bio Medical Electronics Co., Ltd. (China)

- Esaote SpA (Italy)

- Echosens (France)

- SonoScape Medical Corp. (China)

- Chison Medical Technologies Co., Ltd. (China)

- Alpinion Medical Systems (South Korea)

- Analogic Corporation (U.S.)

- Resoundant, Inc. (U.S.)

- ZONARE Medical Systems (U.S.)

- Fujifilm Sonosite, Inc. (U.S.)

- Konica Minolta, Inc. (Japan)

- Verasonics, Inc. (U.S.)

- Edan Instruments, Inc. (China)

- Hologic, Inc. (U.S.)

What are the Recent Developments in Global Ultrasound Elastography Systems Market?

- In June 2025, Siemens Healthineers showcased significant ultrasound and elastography research at the American Institute of Ultrasound in Medicine (AIUM) 2025, emphasizing advancements in non‑invasive diagnostic capabilities for liver disease, musculoskeletal conditions, and breast cancer underscoring ongoing innovation and clinical collaboration

- In April 2025, Royal Philips unveiled its AI‑enabled Elevate Platform upgrade for the EPIQ Elite and Affiniti ultrasound imaging platforms at UltraFest 2025, enhancing diagnostic workflow efficiency and incorporating automated elastography features (Auto ElastQ) to streamline liver stiffness measurements and improve non‑invasive tissue assessment workflows

- In September 2024, Sonic Incytes Medical Corp. announced that the U.S. Food and Drug Administration (FDA) granted 510(k) clearance for its Velacur® Determined Fat Fraction (VDFF) measurement tool. This innovation enhances the Velacur® ultrasound system by quantitatively estimating liver fat with strong correlation to MRI‑PDFF, enabling clinicians to perform accurate hepatic steatosis evaluations at the point of care expanding utility in chronic liver disease diagnostics

- In June 2023, Mindray announced its strategic entry into the transient elastography segment with the Hepatus 6 Diagnostic Ultrasound System, combining transient elastography and diagnostic ultrasound in one device aimed at non‑invasive liver disease detection, quantification of fibrosis/steatosis, and addressing the global burden of chronic liver disease

- In September 2021, the industry recognized shear‑wave ultrasound elastography as a versatile diagnostic tool across multiple organs this acknowledgment was reported by AuntMinnie, a respected radiology news outlet, highlighting shear‑wave elastography’s expanding clinical use in breast, prostate, thyroid, pancreas, and musculoskeletal imaging, reflecting broader adoption and interest in non‑invasive elastography technologies within diagnostic imaging workflows

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.