Global Urinalysis Test Market

Market Size in USD Billion

CAGR :

%

USD

4.53 Billion

USD

9.03 Billion

2024

2032

USD

4.53 Billion

USD

9.03 Billion

2024

2032

| 2025 –2032 | |

| USD 4.53 Billion | |

| USD 9.03 Billion | |

|

|

|

|

Urinalysis Test Market Size

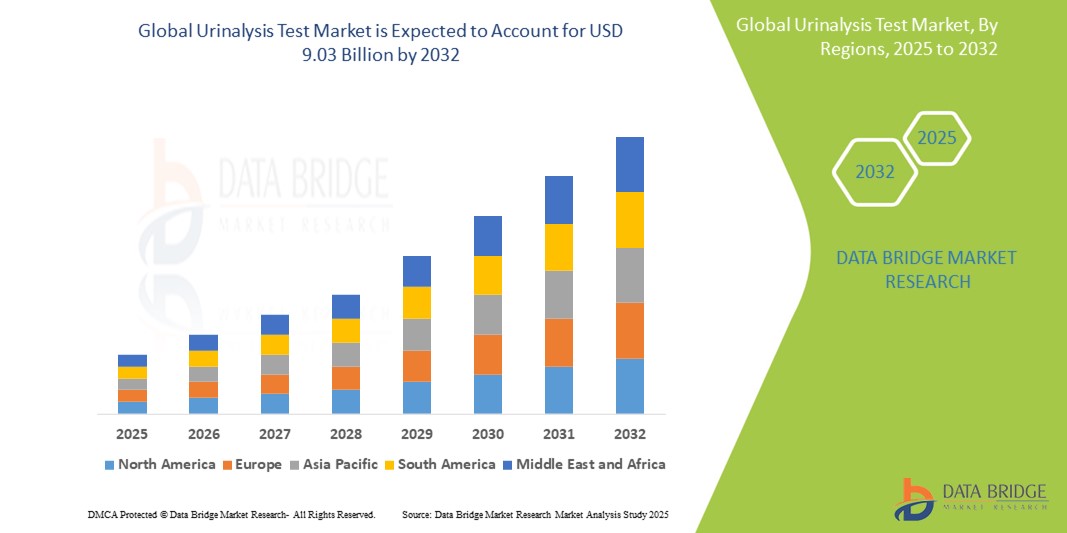

- The global urinalysis test market size was valued at USD 4.53 billion in 2024 and is expected to reach USD 9.03 billion by 2032, at a CAGR of 9.00% during the forecast period

- This growth is driven by factors such as the rising prevalence of urinary tract infections and kidney diseases, increasing adoption of point-of-care testing, and technological advancements in urinalysis devices

Urinalysis Test Market Analysis

- Urinalysis tests are essential diagnostic tools used to detect disorders such as urinary tract infections, kidney disease, and diabetes by analyzing urine samples. They play a crucial role in early disease detection and ongoing health monitoring

- The market growth is primarily driven by the increasing incidence of chronic kidney diseases and diabetes, along with the rising adoption of routine health screening and point-of-care testing

- North America is expected to dominate the urinalysis tests market with a market share of 38.4%, due to advanced healthcare infrastructure, high adoption of diagnostic technologies, and strong presence of leading medical device companies

- Asia-Pacific is expected to be the fastest growing region in the urinalysis test market with a market share of 23.4%, during the forecast period due to rapid healthcare infrastructure expansion, increasing awareness about kidney health, and rising chronic disease burdens

- Consumables segment is expected to dominate the market with a market share of 79.06% due to the high demand for disposable products such as test strips, reagents, and sample collection devices

Report Scope and Urinalysis Test Market Segmentation

|

Attributes |

Urinalysis Test Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Urinalysis Test Market Trends

“Technological Advancements in Automated and Point-of-Care Urinalysis Devices”

- One prominent trend in the urinalysis test market is the growing adoption of automated and point-of-care urinalysis devices that offer rapid, accurate, and user-friendly diagnostic capabilities

- These innovations streamline workflow in clinical settings by reducing manual errors, improving diagnostic efficiency, and enabling real-time testing in non-laboratory environments

- For instance, modern automated urine analyzers equipped with AI and cloud connectivity allow remote monitoring and immediate data sharing, enhancing chronic disease management and routine health assessments

- These technological advancements are revolutionizing the diagnostic landscape, supporting early disease detection, improving patient care, and fueling market growth for advanced urinalysis solutions

Urinalysis Test Market Dynamics

Driver

“Rising Incidence of Chronic Diseases and Increased Demand for Early Diagnosis”

- The growing prevalence of chronic conditions such as diabetes, kidney disorders, and urinary tract infections is significantly driving the demand for urinalysis testing as a critical diagnostic and monitoring tool

- With lifestyle-related health issues on the rise and an aging population worldwide, early and routine diagnostic testing has become essential for effective disease management and prevention

- Urinalysis offers a non-invasive, cost-effective method for early detection of multiple health conditions, which is fueling its adoption across hospitals, diagnostic laboratories, and home healthcare settings

For instance,

- According to the International Diabetes Federation, approximately 537 million adults were living with diabetes in 2021, a number projected to rise to 643 million by 2030, increasing the need for regular urinalysis to monitor kidney function and glucose levels

- Consequently, the expanding burden of chronic diseases and heightened awareness about preventive diagnostics are propelling the growth of the global urinalysis test market

Opportunity

“Integration of Artificial Intelligence and Digital Health Technologies”

- The integration of AI and digital health technologies in urinalysis testing presents a significant opportunity to enhance diagnostic accuracy, efficiency, and accessibility, especially in remote and underserved regions

- AI algorithms can assist in interpreting complex urinalysis results, reducing diagnostic errors, enabling early detection of conditions such as kidney disease or urinary tract infections, and supporting clinical decision-making

- Moreover, AI-enabled urinalysis devices can be linked with electronic health records (EHRs), enabling real-time data sharing, trend monitoring, and personalized treatment strategies

For instance,

- In November 2023, a study published in Nature Digital Medicine highlighted the success of AI-driven urinalysis platforms in identifying early markers of diabetic nephropathy, significantly improving intervention timing and patient outcomes. These platforms use pattern recognition to flag abnormalities and alert healthcare providers instantly

- As the healthcare industry continues to embrace smart diagnostics and remote monitoring, the application of AI in urinalysis is poised to drive innovation, expand access, and improve the overall quality of patient care

Restraint/Challenge

“High Equipment Costs and Maintenance Expenses”

- The high initial cost of advanced urinalysis testing equipment, along with ongoing maintenance and reagent costs, can be a significant barrier to market penetration, particularly for smaller healthcare facilities or those in low-income regions

- Automated and high-throughput urinalysis systems, while offering greater diagnostic accuracy and efficiency, can be prohibitively expensive for many clinics, particularly in developing economies where budget constraints are prevalent

- Smaller diagnostic centers may struggle to invest in these technologies, relying instead on manual methods or older devices that may not provide the same level of accuracy or efficiency

For instance,

- In August 2024, a report from World Health Organization highlighted the challenges faced by many low-resource countries in acquiring advanced diagnostic equipment due to high costs, leading to delays in diagnosis and suboptimal care

- As a result, the high financial burden associated with state-of-the-art urinalysis devices can slow the adoption of advanced diagnostic technologies and create disparities in healthcare access and quality

Urinalysis Test Market Scope

The market is segmented on the basis of product, test type, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Test Type |

|

|

By Application |

|

|

By End User |

|

In 2025, the consumables is projected to dominate the market with a largest share in product segment

The consumables segment is expected to dominate the urinalysis test market with the largest share of 79.06% in 2025 due to the high demand for disposable products such as test strips, reagents, and sample collection devices. These consumables are essential for routine diagnostic testing and are required for every test, making them a consistent revenue driver. In addition, the increasing frequency of diagnostic screenings and the growing adoption of point-of-care testing are further fueling the demand for consumables

The biochemical urinalysis is expected to account for the largest share during the forecast period in test type market

In 2025, the biochemical urinalysis segment is expected to dominate the market with the largest market share of 39.5% due to its ability to detect a wide range of metabolic disorders, including kidney diseases, diabetes, and urinary tract infections. Biochemical tests, such as those measuring protein, glucose, and pH levels, offer high diagnostic accuracy and are essential for monitoring chronic conditions. The growing demand for early diagnosis and the increasing prevalence of chronic diseases further drive the adoption of biochemical urinalysis

Urinalysis Test Market Regional Analysis

“North America Holds the Largest Share in the Urinalysis Test Market”

- North America dominates the urinalysis test market with a market share of estimated 38.4%, driven, by advanced healthcare infrastructure, high adoption of diagnostic technologies, and strong presence of leading medical device companies

- U.S. holds a market share of 82.5%, due to widespread use of urinalysis in routine health screenings, high prevalence of chronic conditions such as diabetes and kidney diseases, and continuous innovations in testing devices and reagents

- The availability of well-established reimbursement policies and increasing government focus on preventive healthcare further strengthen the market

- In addition, the rising demand for home diagnostics, coupled with increasing awareness about the importance of early disease detection, is fueling market growth across the region

“Asia-Pacific is Projected to Register the Highest CAGR in the Urinalysis Test Market”

- Asia-Pacific is expected to witness the highest growth rate in the urinalysis test market with a market share of 23.4%, driven by rapid healthcare infrastructure expansion, increasing awareness about kidney health, and rising chronic disease burdens

- Countries such as China, India, and Japan are emerging as key markets due to the growing aging population, which is more susceptible to kidney-related diseases and diabetes

- Japan, with its advanced healthcare system and rising demand for precise diagnostics, remains a crucial market for urinalysis testing. The country's continuous innovation in diagnostic technologies further boosts market expansion

- India is projected to register the highest CAGR of 10.3%, driven by improving healthcare accessibility, rising prevalence of kidney disease, and an increasing focus on preventive diagnostics, particularly in rural and semi-urban areas

Urinalysis Test Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Abbott (U.S.)

- Medtronic (U.S.)

- Siemens Healthineers AG (Germany)

- General Electric Company (U.S.)

- BD (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- 77 Elektronika Kft (Hungary)

- Bio-Rad Laboratories, Inc. (U.S.)

- Sysmex Corporation (Japan)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Cardinal Health (U.S.)

- Beckman Coulter Inc. (U.S.)

- ACON Laboratories, Inc. (U.S.)

- ARKRAY, Inc. (Japan)

- Penn Medicine Lancaster General Health (U.S.)

- BioMaxima SA (Poland)

- QuidelOrtho Corporation (U.S.)

- Metropolis India (India)

- LalPathLabs (India)

- Trinity Biotech Ireland (Ireland)

Latest Developments in Global Urinalysis Test Market

- In April 2023, Cardinal Health announced the opening of two new distribution centers in Central Ohio. These facilities support Cardinal Health's Medical segment and At-home Solutions businesses, optimizing its global supply chain to meet growing demand and strengthen market leadership

- In February 2023, Siemens Healthineers partnered with Unilabs in a multi-year agreement to modernize Unilabs' healthcare infrastructure. This collaboration aims to enhance operational efficiency and customer service across Unilabs' extensive testing network, leveraging Siemens Healthineers' innovative diagnostic solutions

- In September 2022, Sysmex Corporation introduced the UF-1500 Fully Automated Urine Particle Analyzer, enhancing diagnostic capabilities in urine sediment testing. This innovation underscores Sysmex's commitment to advancing automated diagnostic solutions for accurate and efficient urine analysis

- In May 2022, Quidel Corporation expanded its diagnostic portfolio with the acquisition of Ortho Clinical Diagnostics. This strategic move bolsters Quidel's expertise in cellular-based virology assays and molecular diagnostic systems, reinforcing its leadership in the global diagnostics market

- In July 2023, Siemens Healthineers inaugurated the Erlangen Innovation Center in Germany, focusing on open innovation initiatives. The center fosters collaborations with clinical, academic partners, and startups to drive advancements in healthcare technologies and solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.