Global V2x For Automotive Market

Market Size in USD Billion

CAGR :

%

USD

4.10 Billion

USD

81.90 Billion

2024

2032

USD

4.10 Billion

USD

81.90 Billion

2024

2032

| 2025 –2032 | |

| USD 4.10 Billion | |

| USD 81.90 Billion | |

|

|

|

|

V2X for Automotive Market Size

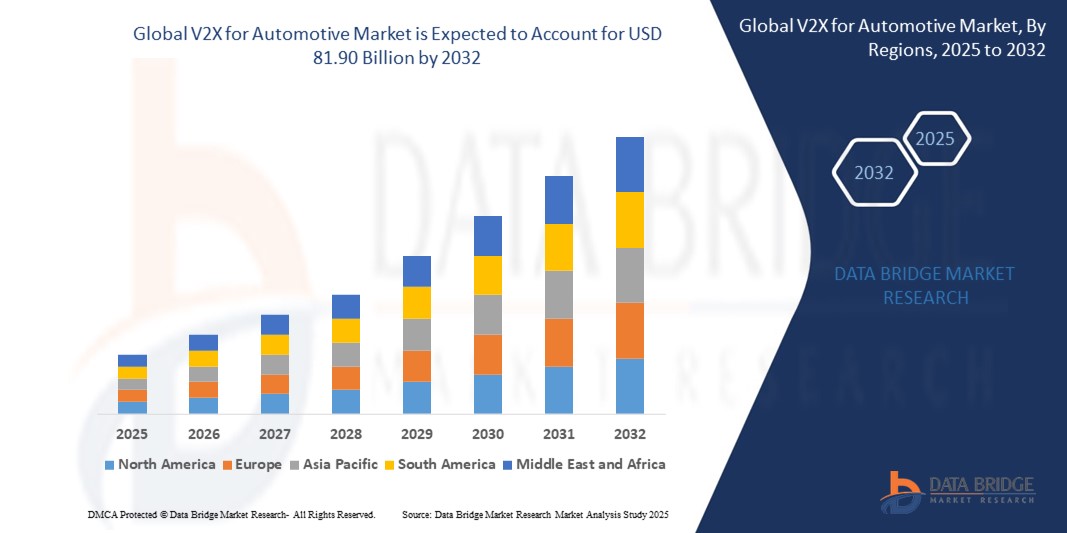

- The global V2X for Automotive market size was valued at USD 4.10 billion in 2024 and is expected to reach USD 81.90 billion by 2032, at a CAGR of 45.4% during the forecast period

- This growth is driven by the rapid adoption of connected vehicle technologies, increasing demand for enhanced road safety, and the global rollout of 5G networks supporting advanced V2X applications across automotive, smart city, and logistics sectors. The surge in autonomous vehicle development further accelerates market expansion.

- Advancements in V2X technologies, including the shift to C-V2X for superior connectivity, coupled with government mandates for vehicle safety and the integration of V2X in electric vehicles, are propelling market growth, particularly in regions with robust automotive infrastructure.

V2X for Automotive Market Analysis

- V2X components are critical systems enabling vehicle communication with other vehicles, infrastructure, pedestrians, and networks, facilitating real-time data exchange for safety, traffic efficiency, and autonomous driving. These components, including onboard units, roadside units, and software platforms, are integral to applications like ADAS, traffic management, and fleet optimization.

- The market is fueled by the global rise in vehicle production, with 85.4 million units in 2022, driving demand for V2X systems in new vehicles. The autonomous vehicle market, projected to reach 3 million units by 2030, further boosts demand for V2X in V2V and V2I applications.

- The adoption of advanced technologies like C-V2X enhances V2X performance, offering low-latency communication for automotive and smart city applications. The rise of electric vehicles, requiring V2G communication for energy management, is a significant growth driver.

- Asia-Pacific led the global V2X market with a commanding revenue share of 42.6% in 2024, driven by its robust automotive manufacturing ecosystem, high 5G adoption, and government support in China, Japan, and India. China dominates due to its massive C-V2X infrastructure investments.

- North America is anticipated to witness the fastest growth rate, with a projected CAGR of 46.2% from 2025 to 2032, propelled by regulatory support, advancements in autonomous vehicles, and significant R&D investments in the U.S. and Canada.

- Among communication types, the V2V segment held the largest market share of 42.01% in 2024, valued at USD 1.72 billion, attributed to its critical role in collision avoidance and safety applications for passenger cars and commercial vehicles, ensuring enhanced road safety.

Report Scope and V2X for Automotive Market Segmentation

|

Attributes |

V2X for Automotive Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

V2X for Automotive Market Trends

“Advancements in C-V2X, 5G Integration, and Autonomous Driving”

- A prominent trend in the global V2X market is the widespread adoption of C-V2X technologies, with over 60% of new deployments in 2023 and 2024 leveraging 5G for low-latency, high-bandwidth vehicle communication, enabling safer autonomous driving.

- The integration of 5G networks, offering superior connectivity, is gaining traction, with over 35% of new V2X systems in 2024 utilizing 5G for applications like real-time traffic management and V2I communication.

- Miniaturization of V2X hardware, driven by advancements in semiconductor technologies, is expanding their use in compact vehicle systems, with 30% of new components designed for space-constrained automotive applications.

- The rise of software-defined V2X platforms is enhancing system flexibility, allowing dynamic updates for multiple applications, with adoption rates increasing by 20% in automotive and smart city sectors.

- Increasing focus on energy-efficient V2X designs, particularly for electric vehicles, is aligning with sustainability goals, with over 25% of new systems in 2024 featuring low-power consumption for V2G applications.

- The growth of online distribution channels is transforming market access, with online sales of V2X components growing by 15% annually, driven by e-commerce platforms for aftermarket solutions and developers.

V2X for Automotive Market Dynamics

Driver

“5G Expansion, Autonomous Vehicle Growth, and Safety Mandates”

- The global rollout of 5G networks, with over 2.5 billion subscriptions projected by 2028, is a primary driver, increasing demand for V2X systems like V2V and V2I in connected vehicles, ensuring high-speed communication.

- The proliferation of autonomous vehicles, with global sales expected to reach 3 million units by 2030, is driving demand for V2X in ADAS, V2X communication, and traffic management systems, enhancing safety and efficiency.

- The rise of electric vehicles, with global sales reaching 14 million units in 2023, is boosting demand for V2X in V2G communication, enabling efficient energy management and grid integration.

- Increasing investments in smart cities, with global spending reaching USD 189 billion in 2023, are driving demand for V2X in intelligent traffic systems, parking management, and pedestrian safety applications.

- Growing vehicle production, with over 85.4 million units in 2022, is fueling demand for V2X systems for seamless connectivity and safety in passenger cars and commercial vehicles.

- Government initiatives, such as China’s C-V2X mandates and the U.S. FCC’s spectrum allocation, are promoting V2X technology development, supporting market growth through regulatory and funding incentives.

Restraint/Challenge

“High Costs, Cybersecurity Risks, and Interoperability Issues”

- The high cost of advanced V2X systems, particularly those using C-V2X and 5G technologies, poses a challenge to adoption in cost-sensitive markets, limiting scalability for smaller manufacturers and regions.

- Cybersecurity risks, including hacking and data breaches, have impacted V2X adoption, leading to increased costs, with the V2X cybersecurity market growing at a CAGR of 19.1% to address threats.

- Technical complexities in designing and integrating V2X systems for autonomous vehicles require specialized expertise and advanced processes, increasing development costs and time-to-market.

- Stringent regulatory requirements, such as NHTSA standards in the U.S. and EU safety certifications, increase compliance costs and complexity for V2X manufacturers, particularly in automotive sectors.

- Interoperability issues between DSRC and C-V2X technologies pose a challenge to V2X adoption, particularly in regions with mixed infrastructure, requiring standardized protocols.

- The need for continuous innovation to meet evolving 5G and autonomous driving standards, coupled with rapid technological obsolescence, creates pressure on manufacturers to invest heavily in R&D, limiting profitability for smaller players.

V2X for Automotive Market Scope

The global RF components market is segmented on the basis of product type, component, application, technology, end-user, and sales channel.

- By Product Type

On the basis of product type, the market is segmented into hardware, software, and services. The hardware segment dominated the market with a commanding revenue share of 62.4% in 2024, valued at USD 2.56 billion, driven by its critical role in onboard and roadside units for V2X communication.

The software segment is anticipated to witness the fastest CAGR of 50.2% from 2025 to 2032, fueled by its use in IoT-enabled analytics and 5G platforms.

- By Communication Type

On the basis of communication type, the market is segmented into V2V, V2I, V2P, V2N, V2G, V2C, and V2D. The V2V segment held the largest market revenue share of 42.01% in 2024, valued at USD 1.72 billion, driven by its widespread use in collision avoidance and safety applications.

The V2I segment is expected to witness the fastest CAGR of 47.8% from 2025 to 2032, fueled by the rise of intelligent traffic systems.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into passenger cars, light commercial vehicles, heavy commercial vehicles, and others. The passenger cars segment accounted for the largest market revenue share of 68.5% in 2024, driven by high vehicle ownership and safety demands. The heavy commercial vehicles segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by logistics and fleet management needs.

- By Application

On the basis of application, the market is segmented into ADAS, intelligent traffic systems, emergency vehicle notifications, fleet management, parking management, and others. The ADAS segment accounted for the largest market revenue share of 38.2% in 2024, driven by its role in autonomous driving. The intelligent traffic systems segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by smart city initiatives.

- By Sales Channel

On the basis of sales channel, the market is segmented into direct sales, distributors, and online retail. The direct sales segment held the largest share of 65.6% in 2024, driven by B2B contracts with automakers and fleet operators. The online retail segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by e-commerce growth for aftermarket solutions.

- By Technology

On the basis of technology, the market is segmented into DSRC, C-V2X, Hybrid V2X, and others. The C-V2X segment held a significant share of 60.2% in 2024, driven by its 5G compatibility and reliability. This segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by its adoption in autonomous and connected vehicles.

- By End-User

On the basis of end-user, the market is segmented into individual consumers, fleet operators, government agencies, and others. The individual consumers segment dominated with a 55.3% revenue share in 2024, driven by high demand in passenger cars. The fleet operators segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by logistics and fleet management applications.

V2X for Automotive Market Regional Analysis

North America

North America is poised to grow at the fastest CAGR of approximately 46.2% from 2025 to 2032, driven by regulatory support, advancements in autonomous vehicles, and R&D investments. The U.S. accounted for 78.6% of the regional market in 2024, supported by FCC’s C-V2X spectrum allocation and strong demand for connected vehicle solutions.

U.S. V2X for Automotive Market Insight

The United States is expected to dominate the North American market, driven by its leadership in automotive innovation, autonomous vehicle development, and 5G infrastructure. The adoption of C-V2X in V2V and V2I applications, coupled with players like Qualcomm, supports market growth.

Europe V2X for Automotive Market Insight

Europe held a significant share in 2024, driven by its focus on safety regulations and smart city initiatives. Countries like Germany, the U.K., and France are key contributors, with growth fueled by the adoption of V2X in autonomous vehicles and intelligent traffic systems.

U.K. V2X for Automotive Market Insight

The United Kingdom is anticipated to grow steadily, driven by its strong automotive sector and investments in 5G and smart city technologies. Government initiatives like the U.K.’s Connected and Autonomous Vehicles program are boosting demand for V2X systems.

Germany V2X for Automotive Market Insight

Germany’s market is expected to grow at a considerable CAGR, fueled by its leadership in automotive manufacturing and smart mobility. The adoption of V2X in premium vehicles and smart highways, supported by players like Continental AG, drives market expansion.

Asia-Pacific V2X for Automotive Market Insight

Asia-Pacific dominated the global V2X market with a revenue share of 42.6% in 2024, driven by its robust automotive manufacturing ecosystem, high 5G adoption rates, and significant investments in smart city infrastructure. The passenger cars segment accounted for the largest vehicle type share of 65.4% in 2024, driven by high ownership. The heavy commercial vehicles segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by logistics growth.

Japan V2X for Automotive Market Insight

Japan’s market is expanding at a notable CAGR, fueled by its advanced automotive industry and focus on C-V2X and 5G applications. The presence of key players like DENSO and investments in autonomous vehicles drive market growth.

China V2X for Automotive Market Insight

China captured the largest revenue share of 48.2% within Asia-Pacific in 2024, driven by its leadership in C-V2X infrastructure, with over 500,000 5G-connected vehicles deployed by 2023, and a thriving electric vehicle market. Government initiatives like the Intelligent and Connected Vehicles Plan support V2X development through R&D funding and infrastructure incentives.

V2X for Automotive Market Share

- The V2X for Automotive industry is primarily led by well-established companies, including:

- Qualcomm Technologies, Inc. (U.S.)

- Continental AG (Germany)

- Robert Bosch GmbH (Germany)

- NXP Semiconductors N.V. (Netherlands)

- Autotalks Ltd. (Israel)

- Harman International (U.S.)

- Huawei Technologies Co., Ltd. (China)

- DENSO Corporation (Japan)

- Cohda Wireless (Australia)

- Infineon Technologies AG (Germany)

- Savari, Inc. (U.S.)

- Commsignia Ltd. (Hungary)

- Danlaw, Inc. (U.S.)

- Hitachi Solutions, Ltd. (Japan)

- Unex Technology Corp. (Taiwan)

- TDK Corporation (Japan)

Latest Developments in Global V2X for Automotive Market

- In March 2023, Qualcomm Technologies launched the Snapdragon Auto 5G Modem, a C-V2X solution with enhanced V2V capabilities, improving safety by 20% for autonomous vehicles, adopted by over 50 automakers globally.

- In January 2024, Continental AG introduced a new line of C-V2X onboard units for V2I communication, offering 25% improved latency, deployed in over 200 smart city projects in North America and Asia-Pacific.

- In April 2024, DENSO Corporation unveiled a compact V2X software platform for fleet management, reducing processing time by 30%, gaining traction in logistics markets in Japan and Europe.

- In February 2024, NXP Semiconductors launched an integrated V2X chipset for autonomous vehicles, enhancing signal reliability for V2P communication, with adoption by major automakers in Europe and the U.S.

- In June 2023, Huawei Technologies introduced a 5G-V2X module for smart traffic systems, supporting multi-band operations and reducing system complexity, adopted in over 100 smart city projects in China.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.