Global Veterinary Imaging Market

Market Size in USD Billion

CAGR :

%

USD

2.00 Billion

USD

3.14 Billion

2024

2032

USD

2.00 Billion

USD

3.14 Billion

2024

2032

| 2025 –2032 | |

| USD 2.00 Billion | |

| USD 3.14 Billion | |

|

|

|

|

Veterinary Imaging Market Size

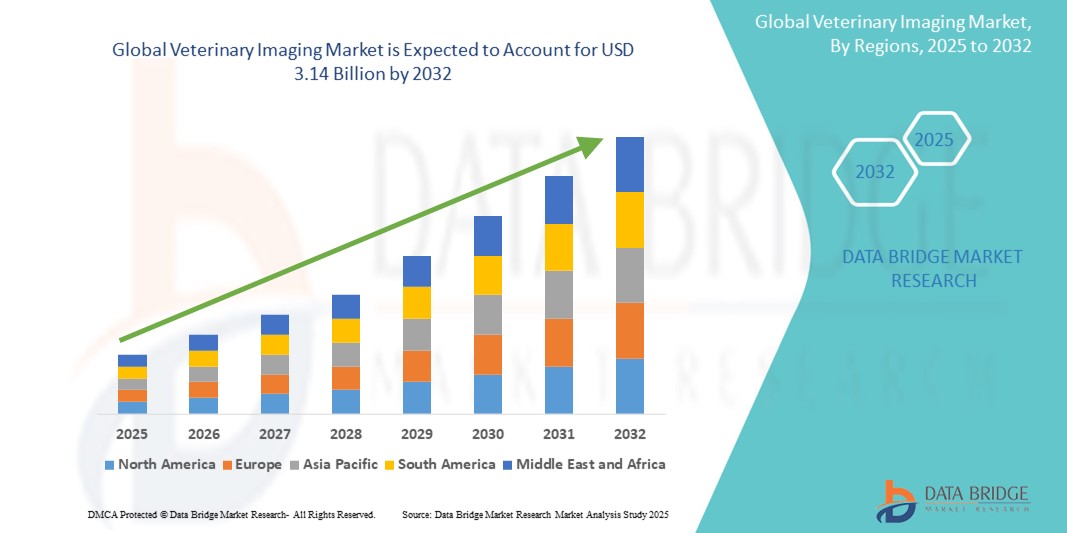

- The global veterinary imaging market size was valued at USD 2.00 billion in 2024 and is expected to reach USD 3.14 billion by 2032, at a CAGR of 5.75% during the forecast period

- This growth is driven by factors such as the increasing pet adoption, rising awareness of animal health, and advancements in imaging technologies such as digital radiography and ultrasound

Veterinary Imaging Market Analysis

- Veterinary imaging technologies, including X-ray, ultrasound, MRI, and CT scans, are essential diagnostic tools used to detect and monitor a variety of animal diseases and injuries, enabling precise treatment planning

- The market growth is significantly driven by rising pet ownership, increasing awareness of animal health, and technological advancements in imaging modalities

- North America is expected to dominate the veterinary imaging market with a market share of 41.5%, due to advanced veterinary healthcare infrastructure, high adoption of cutting-edge imaging technologies, and a strong presence of key market players

- Asia-Pacific is expected to be the fastest growing region in the veterinary imaging market with a market share of 17.5%, during the forecast period due to rapid improvements in veterinary healthcare infrastructure, rising awareness of animal health, and growing pet adoption rates

- Small companion animals segment is expected to dominate the market with a market share of 69.43% due to its increasing pet ownership, especially of dogs and cats, and the growing awareness among pet owners about preventive healthcare

Report Scope and Veterinary Imaging Market Segmentation

|

Attributes |

Veterinary Imaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Veterinary Imaging Market Trends

“Advancements in Digital Imaging & AI Integration for Veterinary Diagnostics”

- A key trend in veterinary imaging is the increasing adoption of advanced digital imaging technologies combined with artificial intelligence (AI) for enhanced diagnostic accuracy

- These innovations enable faster image processing, automated anomaly detection, and improved interpretation of diagnostic images, aiding veterinarians in making precise treatment decisions

- For instance, AI-powered software can assist in identifying fractures, tumors, or organ abnormalities in X-rays and ultrasounds, improving diagnostic efficiency and reducing human error

- The integration of portable imaging devices and telemedicine is also gaining traction, allowing remote consultations and real-time diagnostics, particularly beneficial in large animal and rural veterinary practices

Veterinary Imaging Market Dynamics

Driver

“Increasing Prevalence of Animal Diseases and Rising Pet Ownership”

- The growing incidence of animal diseases such as orthopedic injuries, tumors, and internal organ conditions is significantly driving the demand for advanced veterinary imaging equipment

- Increasing pet ownership and rising awareness about early diagnosis and preventive healthcare for pets are fueling the need for precise diagnostic tools such as X-rays, ultrasound, MRI, and CT scans

- As more pet owners and veterinary professionals seek timely and accurate diagnosis, the demand for veterinary imaging systems continues to rise, improving treatment outcomes and animal welfare

For instance,

- In According to a 2022 report by the American Pet Products Association, pet ownership in the U.S. reached a historic high, with over 70% of households owning a pet, thereby increasing veterinary care demand

- Consequently, the rising prevalence of animal health conditions combined with expanding pet populations is driving substantial growth in the global veterinary imaging market

Opportunity

“Enhancing Veterinary Diagnostics with Artificial Intelligence Integration”

- AI-powered veterinary imaging systems can improve diagnostic precision by automating image analysis, detecting abnormalities early, and assisting veterinarians in treatment planning

- AI algorithms can analyze diagnostic images in real time, providing instant feedback on potential issues such as fractures, tumors, or organ diseases, thus enhancing decision-making during animal care

- In addition, AI-enabled imaging solutions facilitate longitudinal tracking of animal health, enabling veterinarians to monitor disease progression and response to treatment more accurately

For instance,

- In March 2024, a study published in the Journal of Veterinary Science highlighted how deep learning models effectively identified canine bone fractures from X-rays with accuracy comparable to expert radiologists, accelerating diagnosis and treatment initiation

- The integration of AI in veterinary imaging is expected to improve diagnostic outcomes, reduce time to treatment, and elevate overall animal healthcare standards, creating significant growth opportunities in the market

Restraint/Challenge

“High Equipment Costs Limiting Market Adoption”

- The expensive nature of advanced veterinary imaging equipment such as MRI, CT scanners, and high-resolution ultrasound systems presents a major challenge for widespread market penetration, particularly in small veterinary clinics and developing regions

- These sophisticated imaging devices often come with high acquisition and maintenance costs, which can be prohibitive for veterinary practices with limited financial resources

- As a result, many smaller clinics rely on basic or outdated imaging technologies, restricting their ability to provide comprehensive diagnostic services

For instance,

- In October 2024, a report by Veterinary Practice News highlighted that the high capital investment required for advanced imaging modalities remains a significant barrier, limiting access to cutting-edge diagnostics in rural and underserved areas

- This financial constraint leads to disparities in the quality of veterinary care and slows the overall growth of the veterinary imaging market, especially in emerging economies

Veterinary Imaging Market Scope

The market is segmented on the basis of product, modality, animal type, application, and end user

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Modality |

|

|

By Animal Type |

|

|

By Application

|

|

|

By End user |

|

In 2025, the small companion animals is projected to dominate the market with a largest share in animal type segment

The small companion animals segment is expected to dominate the veterinary imaging market with the largest share of 69.43% in 2025 due to its increasing pet ownership, especially of dogs and cats, and the growing awareness among pet owners about preventive healthcare. In addition, the rising prevalence of diseases and injuries in small companion animals drives the demand for advanced imaging diagnostics to ensure accurate and timely treatment. Veterinary clinics are also increasingly investing in imaging technologies to cater to this high-demand segment.

The orthopaedics and traumatology is expected to account for the largest share during the forecast period in application market

In 2025, the orthopaedics and traumatology segment is expected to dominate the market with the largest market share of 37.75% due to its high incidence of musculoskeletal injuries and disorders in animals, especially pets and livestock. The growing demand for accurate diagnosis and effective treatment of fractures, joint disorders, and trauma cases drives the use of advanced imaging technologies in this segment. In addition, increasing veterinary surgical interventions and rehabilitation procedures further fuel the demand for orthopedic imaging solutions.

Veterinary Imaging Market Regional Analysis

“North America Holds the Largest Share in the Veterinary Imaging Market”

- North America dominates the veterinary imaging market with a market share of estimated 41.5%, driven, advanced veterinary healthcare infrastructure, high adoption of cutting-edge imaging technologies, and a strong presence of key market players

- U.S. holds a market share of 50.5%, due to increasing pet ownership, rising expenditure on pet healthcare, and growing demand for accurate diagnostics in companion and large animal care

- The Well-established veterinary insurance and reimbursement policies, along with significant investments in research and development by leading veterinary device manufacturers, further boost market growth.

- In addition, the increasing number of veterinary clinics and hospitals equipped with advanced imaging systems, coupled with a rise in complex surgical procedures, fuels market expansion in the region

“Asia-Pacific is Projected to Register the Highest CAGR in the Veterinary Imaging Market”

- Asia-Pacific is expected to witness the highest growth rate in the veterinary imaging market with a market share of 17.5%, driven by rapid improvements in veterinary healthcare infrastructure, rising awareness of animal health, and growing pet adoption rate

- Countries such as China, India, and Japan are emerging as key markets due to expanding veterinary services and increasing demand for advanced diagnostic imaging in both companion and livestock animals.

- Japan, with its sophisticated veterinary technology and skilled veterinary professionals, remains a crucial market, continuously adopting premium imaging equipment to improve diagnostic accuracy.

- India is projected to register the highest CAGR in the veterinary imaging market, fueled by growing investments in veterinary healthcare, increasing animal disease prevalence, and rising adoption of modern imaging modalities

Veterinary Imaging Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- IDEXX (U.S.)

- Esaote S.p.A. (Italy)

- VET.CT (U.K.)

- Antech Diagnostics, Inc. (U.S.)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- GE HealthCare. (U.S.)

- Siemens Healthineers AG (Germany)

- Agfa-Gevaert Group (Belgium)

- Carestream Health (U.S.)

- FUJIFILM Corporation (Japan)

- Shenzhen Mindray Animal Medical Technology Co., Ltd. (China)

- E.I. Medical Imaging (U.S.)

- IMV Imaging (U.K.)

- MXR Imaging Inc. (U.S.)

- Diagnostic Imaging Systems (U.S.)

- Vetel Diagnostics (U.S.)

- Scil Animal Care Company (Germany)

- Hallmarq Veterinary Imaging (U.K.)

- MinXray, Inc., (U.S.)

Latest Developments in Global Veterinary Imaging Market

- In January 2025, A study introduced a three-class annotation method that improves AI detection of early-stage osteosarcoma in canine radiographs, aiding in earlier and more accurate diagnosis of this rare bone cancer

- In January 2025, VET.CT expanded its teleradiology services, offering 24/7 access to board-certified veterinary radiologists, providing timely and accurate diagnostic reports for veterinary practices worldwide

- In January 2025, AI algorithms are being integrated into veterinary radiology to automate image interpretation, enhancing diagnostic accuracy and efficiency in veterinary practices

- In January 2024, The demand for portable veterinary ultrasound systems is increasing, driven by their affordability, portability, and suitability for both small and large animal care, particularly in field settings

- In January 2023, Esaote North America unveiled the Magnifico™ Vet open MRI system, offering an affordable and compact MRI solution tailored for veterinary use, enhancing diagnostic capabilities in veterinary clinics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.