Global Veterinary Infectious Disease Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

2.15 Billion

USD

4.38 Billion

2024

2032

USD

2.15 Billion

USD

4.38 Billion

2024

2032

| 2025 –2032 | |

| USD 2.15 Billion | |

| USD 4.38 Billion | |

|

|

|

|

Veterinary Infectious Disease Diagnostics Market Size

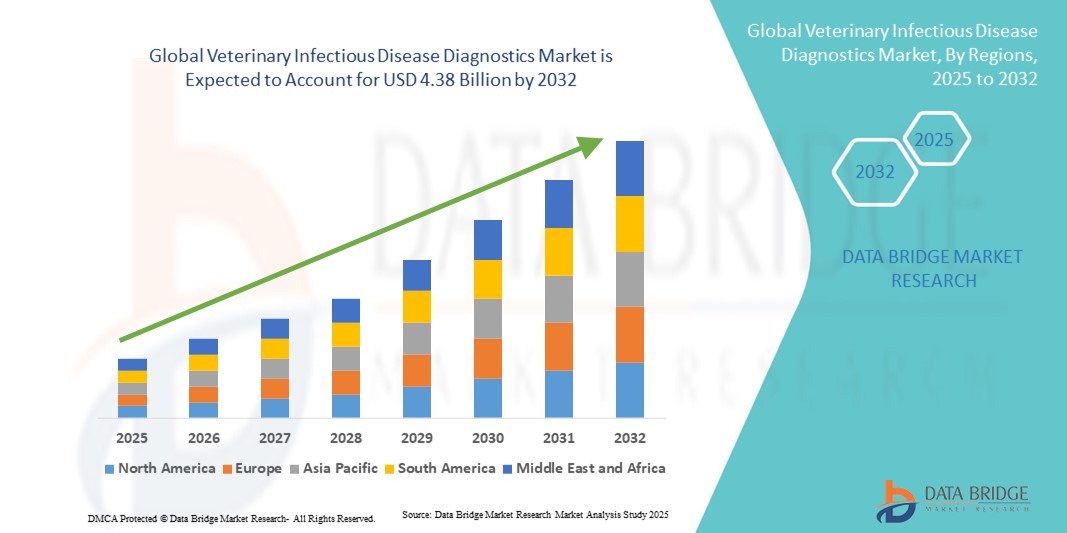

- The global veterinary infectious disease diagnostics market size was valued at USD 2.15 billion in 2024 and is expected to reach USD 4.38 billion by 2032, at a CAGR of 9.30% during the forecast period

- The market growth is largely fueled by the rising prevalence of infectious diseases in livestock and companion animals, coupled with advancements in molecular diagnostics, immunoassays, and point-of-care testing technologies

- Furthermore, increasing awareness among veterinarians and livestock owners about early disease detection, along with stringent regulatory frameworks for animal health, is driving the adoption of rapid and accurate diagnostic solutions. These factors are collectively propelling the market expansion, thereby significantly boosting the industry's growth

Veterinary Infectious Disease Diagnostics Market Analysis

- Veterinary infectious disease diagnostics, encompassing tests and tools for detecting bacterial, viral, and parasitic infections in livestock and companion animals, are increasingly essential for ensuring animal health, preventing outbreaks, and maintaining food safety across both commercial and small-scale farming operations due to their accuracy, rapid turnaround times, and integration with herd management systems

- The rising demand for veterinary infectious disease diagnostics is primarily driven by the increasing prevalence of animal diseases, growing awareness of early detection benefits among veterinarians and livestock owners, and advancements in molecular, serological, and point-of-care diagnostic technologies

- North America dominated the veterinary infectious disease diagnostics market with the largest revenue share of 39.2% in 2024, characterized by advanced veterinary infrastructure, high adoption of diagnostic technologies, and strong presence of key market players, with the U.S. witnessing significant adoption of multiplex and rapid diagnostic kits, driven by innovations from established animal health companies and startups focusing on AI-enabled disease prediction and remote monitoring solutions

- Asia-Pacific is expected to be the fastest-growing region in the veterinary infectious disease diagnostics market during the forecast period due to rising livestock populations, increasing veterinary expenditure, and growing awareness about zoonotic disease prevention

- Molecular diagnostics segment dominated the veterinary infectious disease diagnostics market with a market share of 42% in 2024, driven by its high sensitivity, specificity, and ability to detect multiple pathogens simultaneously

Report Scope and Veterinary Infectious Disease Diagnostics Market Segmentation

|

Attributes |

Veterinary Infectious Disease Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Veterinary Infectious Disease Diagnostics Market Trends

Adoption of Rapid and Point-of-Care Diagnostic Technologies

- A significant and accelerating trend in the global veterinary infectious disease diagnostics market is the increasing adoption of rapid, point-of-care (POC) diagnostic tools that enable faster detection of pathogens in livestock and companion animals. This trend is enhancing timely disease management and outbreak prevention

- For instance, the IDEXX SNAP test kits allow veterinarians to detect multiple pathogens on-site, providing results within minutes and enabling immediate treatment or isolation measures. Similarly, Zoetis VetScan analyzers offer compact POC solutions for routine animal health monitoring

- Advanced molecular diagnostics integrated into portable platforms enable veterinarians to identify infectious agents with high accuracy and sensitivity, supporting better decision-making and herd health management. Some GeneSeek PCR-based assays can detect multiple pathogens simultaneously, helping optimize disease control strategies

- The seamless integration of POC diagnostics with veterinary software and herd management platforms facilitates centralized monitoring of animal health, allowing veterinarians and farmers to track disease trends and vaccination effectiveness in real time

- This trend toward faster, more precise, and interconnected diagnostic solutions is reshaping expectations for animal health management. Consequently, companies such as Thermo Fisher and BioChek are developing compact POC molecular diagnostics with cloud connectivity and multiplex testing capabilities

- The demand for rapid, on-site diagnostic solutions is growing across veterinary clinics, commercial farms, and research institutions, as stakeholders increasingly prioritize early detection, disease prevention, and operational efficiency

Veterinary Infectious Disease Diagnostics Market Dynamics

Driver

Increasing Prevalence of Infectious Diseases and Awareness of Early Detection

- The rising incidence of infectious diseases in livestock and companion animals, combined with growing awareness among veterinarians and farmers regarding the importance of early detection, is a significant driver of market growth

- For instance, in March 2024, Zoetis launched an advanced PCR diagnostic panel for swine viral diseases, aiming to enhance early detection and outbreak prevention strategies. Such initiatives by key players are expected to accelerate adoption of veterinary diagnostics in the forecast period

- As veterinarians and livestock owners become more aware of the economic and health implications of delayed disease detection, veterinary diagnostics solutions provide rapid, reliable, and actionable results

- Furthermore, government programs and industry guidelines promoting routine disease monitoring are encouraging the adoption of advanced diagnostic tools across commercial and small-scale farms

- The convenience of on-site testing, multiplex detection capabilities, and integration with herd management systems are key factors driving the adoption of veterinary infectious disease diagnostics. The increasing availability of user-friendly, rapid diagnostic kits further supports market expansion

Restraint/Challenge

High Costs and Regulatory Compliance Barriers

- The relatively high cost of advanced diagnostic kits and molecular platforms, especially those offering multiplex detection or point-of-care functionality, poses a challenge for widespread adoption in cost-sensitive markets

- For instance, high-priced PCR and ELISA panels may limit access in small-scale farms or developing regions, where budget constraints affect investment in veterinary diagnostic tools.

- Regulatory compliance and certification requirements for veterinary diagnostics, varying across countries, add complexity and delay market entry for new diagnostic products. Companies must navigate stringent approval processes to ensure safety and accuracy

- Addressing these cost and compliance challenges through affordable product lines, simplified testing platforms, and harmonized regulatory pathways is crucial for expanding market penetration

- While the benefits of rapid and accurate diagnostics are clear, price sensitivity and regulatory hurdles can hinder adoption among smaller veterinary practices or budget-conscious livestock owners

- Overcoming these challenges through cost-effective solutions, streamlined approvals, and training programs for veterinarians will be vital for sustained growth in the veterinary infectious disease diagnostics market

Veterinary Infectious Disease Diagnostics Market Scope

The market is segmented on the basis of technology, animal type, end user, and infection type.

- By Technology

On the basis of technology, the veterinary infectious disease diagnostics market is segmented into immunodiagnostics, molecular diagnostics, and other veterinary diagnostic technologies. The molecular diagnostics segment dominated the market with the largest revenue share of 42% in 2024, driven by its high sensitivity, specificity, and ability to detect multiple pathogens simultaneously. Veterinarians and livestock owners often prioritize molecular diagnostics for early and accurate disease detection, particularly for high-risk or outbreak-prone populations. The segment’s dominance is further supported by advancements in PCR, qPCR, and next-generation sequencing technologies, which allow rapid identification of viral, bacterial, and parasitic infections. Molecular diagnostics also integrate effectively with herd management systems, providing real-time data and supporting proactive animal health management. The growing focus on preventive healthcare and disease surveillance in veterinary practices reinforces the continued demand for molecular diagnostic solutions.

The immunodiagnostics segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the widespread use of ELISA, lateral flow assays, and other serological tests. Immunodiagnostic tools offer cost-effective, rapid, and easy-to-use solutions, making them suitable for small- and medium-sized farms and point-of-care applications. Increasing awareness of zoonotic diseases and regulatory requirements for disease monitoring is further driving adoption. Immunodiagnostics also benefit from ongoing innovations in multiplex testing, allowing simultaneous detection of multiple pathogens, thereby improving efficiency and reducing testing costs.

- By Animal Type

On the basis of animal type, the veterinary infectious disease diagnostics market is segmented into companion animals and food-producing animals. The food-producing animals segment dominated the market with the largest revenue share in 2024, driven by the economic significance of livestock and the need to prevent disease outbreaks that can cause substantial financial losses. Livestock farmers and commercial enterprises increasingly rely on diagnostic solutions to monitor herd health, ensure food safety, and comply with regulatory standards. The demand is further reinforced by government and industry-led initiatives promoting regular testing and vaccination programs for cattle, poultry, swine, and aquaculture species. Molecular and immunodiagnostic tests are widely adopted for these animals to ensure early detection of infectious diseases, minimize mortality, and maintain productivity.

The companion animals segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising pet population and increasing willingness of pet owners to invest in preventive healthcare. Growing awareness regarding zoonotic disease risks, improved veterinary services, and the adoption of rapid and point-of-care diagnostic tools are key factors supporting growth. Companion animal diagnostics also benefit from the integration of mobile apps and cloud-based platforms, enabling pet owners and veterinarians to track test results and health trends conveniently.

- By End User

On the basis of end user, the veterinary infectious disease diagnostics market is segmented into reference laboratories, veterinary laboratories and clinics, point-of-care/in-house testing, and research institutes and universities. The veterinary laboratories and clinics segment dominated the market with the largest revenue share in 2024, due to their widespread presence and ability to offer comprehensive diagnostic services. Veterinary clinics provide routine and specialized testing for companion animals and livestock, ensuring early detection and management of infectious diseases. The segment’s dominance is supported by investments in advanced equipment, skilled personnel, and integration of diagnostic workflows with herd and patient management software. Increasing awareness among pet owners and livestock farmers about the benefits of timely veterinary intervention is also driving adoption. Veterinary laboratories and clinics serve as primary hubs for implementing preventive healthcare measures, outbreak management, and reporting to regulatory authorities.

The point-of-care/in-house testing segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the need for rapid, on-site diagnostics that reduce turnaround times and facilitate immediate intervention. Point-of-care testing is especially valuable in remote or resource-limited regions, where access to centralized laboratories may be limited. Veterinary professionals and farmers increasingly prefer portable, user-friendly kits for routine monitoring, herd health checks, and outbreak management. Advancements in multiplex and portable diagnostic technologies are further accelerating adoption in this segment, improving disease detection and operational efficiency.

- By Infection Type

On the basis of infection type, the veterinary infectious disease diagnostics market is segmented into bacterial infections, viral infections, parasitic infections, and other infections. The viral infections segment dominated the market with the largest revenue share in 2024, driven by the high prevalence and economic impact of viral diseases in both livestock and companion animals. Diseases such as avian influenza, porcine reproductive and respiratory syndrome (PRRS), and canine parvovirus necessitate early and accurate diagnostic testing. Molecular and immunodiagnostic solutions are widely used to detect viral pathogens rapidly, enabling timely treatment, vaccination strategies, and outbreak control. The dominance of this segment is further supported by regulatory mandates for disease surveillance and biosecurity measures in commercial farming operations.

The bacterial infections segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising incidence of bacterial diseases such as salmonellosis, bovine mastitis, and leptospirosis. Growing awareness about antimicrobial resistance and the need for targeted treatment strategies are encouraging the adoption of advanced bacterial diagnostic solutions. Rapid immunoassays and molecular techniques allow veterinarians to quickly identify causative agents, implement appropriate interventions, and monitor treatment efficacy. Increasing government initiatives for livestock health management and food safety are also supporting the growth of diagnostics for bacterial infections.

Veterinary Infectious Disease Diagnostics Market Regional Analysis

- North America dominated the veterinary infectious disease diagnostics market with the largest revenue share of 39.2% in 2024, characterized by advanced veterinary infrastructure, high adoption of diagnostic technologies, and strong presence of key market players

- Veterinarians and livestock owners in the region highly value rapid, accurate, and reliable diagnostic solutions that enable early detection of infectious diseases in both companion animals and food-producing animals

- This widespread adoption is further supported by strong government regulations, research initiatives, and high investment in animal health, establishing veterinary diagnostics as a critical tool for disease management, outbreak prevention, and food safety in both commercial and small-scale farming operations

U.S. Veterinary Infectious Disease Diagnostics Market Insight

The U.S. veterinary infectious disease diagnostics market captured the largest revenue share of 82% in 2024 within North America, fueled by the advanced veterinary infrastructure and high adoption of diagnostic technologies. Livestock producers and companion animal owners are increasingly prioritizing early disease detection and preventive healthcare through rapid and accurate diagnostic solutions. The growing integration of molecular and immunodiagnostic tools, combined with demand for point-of-care testing, further propels the market. Moreover, government initiatives promoting animal health surveillance, outbreak management, and biosecurity measures are significantly contributing to market expansion.

Europe Veterinary Infectious Disease Diagnostics Market Insight

The Europe veterinary infectious disease diagnostics market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent animal health regulations and the rising need for effective disease monitoring in livestock and pets. Increasing urbanization, along with the demand for safe and traceable food production, is fostering the adoption of diagnostic solutions. European veterinarians and livestock owners are also drawn to the efficiency, speed, and reliability offered by modern diagnostic tests. The region is experiencing significant growth across commercial farms, veterinary clinics, and research institutes, with advanced diagnostics incorporated into both routine monitoring and outbreak response programs.

U.K. Veterinary Infectious Disease Diagnostics Market Insight

The U.K. veterinary infectious disease diagnostics market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by heightened awareness of animal health, zoonotic disease prevention, and demand for timely interventions. Concerns regarding livestock productivity, food safety, and companion animal welfare are encouraging the adoption of rapid and accurate diagnostic tests. The U.K.’s robust veterinary infrastructure, alongside its focus on research, education, and advanced technology adoption, is expected to continue stimulating market growth.

Germany Veterinary Infectious Disease Diagnostics Market Insight

The Germany veterinary infectious disease diagnostics market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of animal health management, early detection of infectious diseases, and regulatory compliance requirements. Germany’s well-developed livestock and veterinary sectors, combined with an emphasis on innovation and high-quality diagnostics, promote adoption across commercial farms and veterinary clinics. The integration of advanced diagnostic platforms with herd management systems is becoming increasingly prevalent, aligning with local demand for precision, accuracy, and preventive animal care.

Asia-Pacific Veterinary Infectious Disease Diagnostics Market Insight

The Asia-Pacific veterinary infectious disease diagnostics market is poised to grow at the fastest CAGR of 23% during the forecast period of 2025 to 2032, driven by increasing livestock populations, rising awareness of animal health, and technological advancements in countries such as China, India, and Japan. The region’s growing inclination toward preventive healthcare, supported by government initiatives and animal disease surveillance programs, is driving the adoption of diagnostic solutions. Furthermore, as APAC emerges as a manufacturing hub for veterinary diagnostic kits and platforms, affordability and accessibility are improving, expanding adoption among commercial farms, veterinary clinics, and point-of-care testing centers.

Japan Veterinary Infectious Disease Diagnostics Market Insight

The Japan veterinary infectious disease diagnostics market is gaining momentum due to the country’s advanced veterinary infrastructure, high pet population, and increasing demand for preventive healthcare. Japanese livestock producers and pet owners place a significant emphasis on rapid and reliable diagnostics to manage disease outbreaks effectively. The adoption of point-of-care testing and molecular diagnostic platforms, integrated with veterinary management systems, is fueling growth. Moreover, Japan’s aging population and high focus on animal welfare are such asly to spur demand for convenient, accurate, and easy-to-use diagnostic solutions in both companion animal and livestock sectors.

India Veterinary Infectious Disease Diagnostics Market Insight

The India veterinary infectious disease diagnostics market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country’s large livestock population, rising pet ownership, and expanding veterinary services. India represents one of the largest markets for preventive animal healthcare, and veterinary diagnostic solutions are becoming increasingly popular across farms, clinics, and research institutes. Government initiatives promoting animal disease control, combined with the availability of cost-effective diagnostic kits and domestic manufacturers, are key factors propelling the market in India.

Veterinary Infectious Disease Diagnostics Market Share

The Veterinary Infectious Disease Diagnostics industry is primarily led by well-established companies, including:

- Zoetis Services LLC (U.S.)

- IDEXX (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Virbac (France)

- Neogen Corporation (U.S.)

- Randox Laboratories Ltd. (U.K.)

- BIOMÉRIEUX (France)

- Bionote Inc. (South Korea)

- Heska Corporation (U.S.)

- IDVet (France)

- Biovet Inc. (Canada)

- VCA Animal Hospitals (U.S.)

- Laboratoire Labogen (France)

- Biovet India (India)

- Biocheck (Belgium)

- Eurofins Scientific (France)

- Agrolabo S.p.A. (Italy)

- AniCon Labor GmbH (Germany)

- Danaher (U.S.)

- Abaxis (U.S.)

What are the Recent Developments in Global Veterinary Infectious Disease Diagnostics Market?

- In June 2025, researchers at Assam Agricultural University developed a rapid antigen detection kit for African Swine Fever (ASF), enabling swift diagnosis using a single drop of blood. This innovation facilitates timely interventions in pig farming, crucial for controlling ASF outbreaks

- In May 2025, Bionote USA collaborated with PSIvet to introduce the Vcheck line of in-clinic diagnostic analyzers and biomarker tests. This partnership aims to provide affordable and efficient diagnostic solutions for veterinary practices, enhancing point-of-care testing capabilities

- In April 2025, the University of Missouri Veterinary Medical Diagnostic Laboratory expanded its facilities to accommodate the increasing demand for diagnostic testing. The upgraded infrastructure supports the processing of over 200,000 tests annually, bolstering efforts in animal disease surveillance and public health protection

- In December 2024, Zoetis introduced the Vetscan OptiCell, a new point-of-care hematology analyzer, at the Veterinary Meeting & Expo (VMX) in Orlando. This device leverages artificial intelligence to provide rapid and accurate blood cell analysis, enhancing diagnostic capabilities in veterinary practices. The launch underscores Zoetis's commitment to advancing veterinary diagnostics through innovative technology

- In December 2024, IDEXX Laboratories announced enhancements to its Vetscan Imagyst platform, integrating advanced artificial intelligence to improve diagnostic accuracy and efficiency. These upgrades aim to support veterinarians in delivering faster and more precise diagnoses, particularly in companion animal care

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.