Global Veterinary Tetracycline Market

Market Size in USD Billion

CAGR :

%

USD

1.38 Billion

USD

2.35 Billion

2024

2032

USD

1.38 Billion

USD

2.35 Billion

2024

2032

| 2025 –2032 | |

| USD 1.38 Billion | |

| USD 2.35 Billion | |

|

|

|

|

Veterinary Tetracycline Market Size

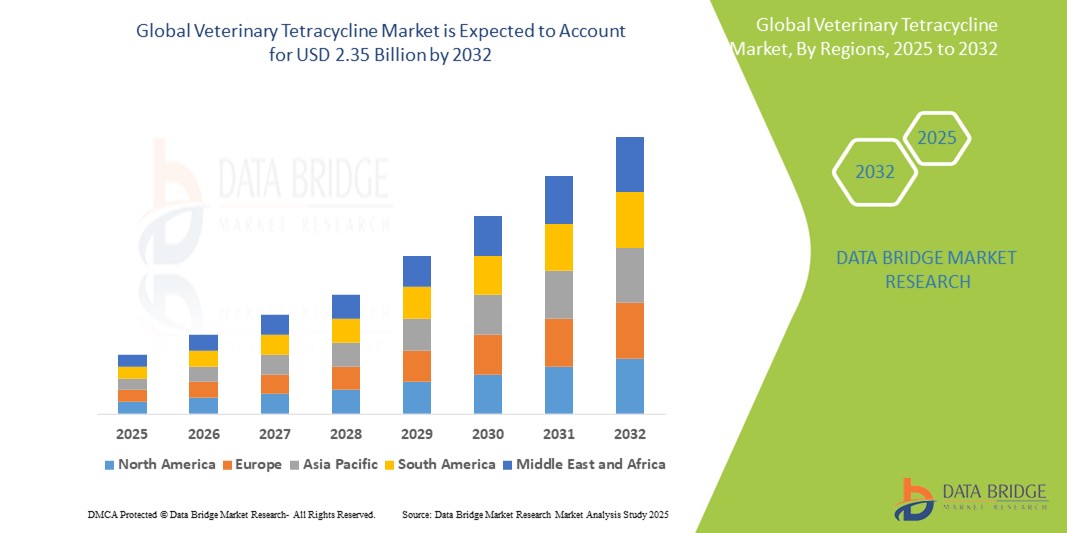

- The global veterinary tetracycline market size was valued at USD 1.38 billion in 2024 and is expected to reach USD 2.35 billion by 2032, at a CAGR of 6.80% during the forecast period

- The market growth is largely driven by the widespread use of tetracyclines in managing bacterial infections in both livestock and companion animals, owing to their broad-spectrum activity and affordability. Increased awareness of animal health, coupled with rising meat and dairy consumption worldwide, is further stimulating demand

- Furthermore, the rising incidence of zoonotic diseases, coupled with a surge in livestock production and the growing trend of pet ownership, is accelerating the demand for veterinary antibiotics. These factors are positioning tetracyclines as a preferred antibiotic class in veterinary medicine, thereby significantly contributing to the expansion of the global veterinary tetracycline market

Veterinary Tetracycline Market Analysis

- Veterinary tetracyclines, offering broad-spectrum antibacterial efficacy for treating infections in livestock and companion animals, are increasingly vital components of modern veterinary healthcare systems due to their cost-effectiveness, ease of administration, and widespread use in both therapeutic and prophylactic applications

- The escalating demand for veterinary tetracyclines is primarily fueled by the rising prevalence of infectious diseases among animals, growing awareness about animal health and food safety, and increased global demand for animal-derived products such as meat, milk, and eggs

- North America dominates the veterinary tetracycline market with the largest revenue share of 35.5% in 2024, characterized by advanced veterinary infrastructure, strong livestock production, and a high level of awareness among farmers and pet owners, with the U.S. experiencing substantial growth in antibiotic usage for animal health, particularly in large-scale commercial farms and companion animal clinics, driven by innovations from both established veterinary pharmaceutical companies and emerging animal health startups

- Asia-Pacific is expected to be the fastest growing region in the veterinary tetracycline market during the forecast period due to increasing livestock farming activities, improving veterinary services, and rising disposable incomes

- Oral Solutions segment dominates the veterinary tetracycline market with a market share of 50.25% in 2024, driven by its ease of administration, high palatability, and suitability for mass medication through drinking water systems in livestock

Report Scope and Veterinary Tetracycline Market Segmentation

|

Attributes |

Veterinary Tetracycline Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Veterinary Tetracycline Market Trends

“Rising Demand for Antimicrobial Stewardship and Targeted Antibiotic Use”

- A significant and accelerating trend in the global veterinary tetracycline market is the increasing focus on antimicrobial stewardship, which emphasizes the responsible use of antibiotics in animals to combat resistance and ensure long-term efficacy. This trend is reshaping prescribing practices and driving demand for more targeted, regulated, and evidence-based antibiotic usage across veterinary settings

- For instance, governments and regulatory bodies in regions such as the EU and North America have implemented stricter guidelines restricting the over-the-counter sale of veterinary antibiotics, including tetracyclines, encouraging veterinary oversight and more judicious use. Such policies are creating a shift towards precision-based antibiotic treatments and improved diagnostic support in animal health

- Veterinary healthcare providers are increasingly adopting targeted therapies based on susceptibility testing and clinical need rather than routine or preventive use. This is leading to a more structured deployment of tetracyclines, especially in food-producing animals, to reduce residues in the food chain and slow resistance development

- The trend is also boosting demand for complementary technologies such as rapid diagnostics and monitoring systems, which help veterinarians determine the most effective antibiotic therapy. Pharmaceutical companies are responding by investing in improved tetracycline formulations and combination therapies that offer better spectrum control and lower resistance risk

- In addition, global animal health organizations are promoting awareness campaigns and education initiatives aimed at veterinarians and farmers regarding best practices in antibiotic usage. This is further fostering a culture of responsible drug use, where tetracyclines remain essential but are deployed more strategically

- The demand for regulated, targeted, and stewardship-compliant tetracycline use is growing rapidly across both developed and developing markets, as stakeholders increasingly prioritize sustainable animal health, food safety, and long-term antibiotic efficacy

Veterinary Tetracycline Market Dynamics

Driver

“Increasing Demand Due to Rising Incidence of Animal Infectious Diseases and Livestock Production”

- The growing prevalence of bacterial infections among livestock and companion animals, coupled with expanding global livestock farming activities, is a significant driver for the heightened demand for veterinary tetracyclines

- For instance, in 2024, key veterinary pharmaceutical companies enhanced their antibiotic portfolios with improved tetracycline formulations targeting prevalent infections in large-scale animal farming. Such strategies by major players are expected to drive the veterinary tetracycline market growth during the forecast period

- As farmers and veterinarians become more aware of the economic impact of infectious diseases, tetracyclines offer broad-spectrum antibacterial efficacy and cost-effectiveness, providing a preferred solution for animal health management

- Furthermore, increasing focus on animal welfare and stricter food safety regulations encourage the adoption of effective antibiotic treatments such as tetracyclines to ensure healthier livestock and safer animal-derived food products

- The versatility of tetracyclines in treating diverse bacterial infections across different animal species, alongside availability in multiple dosage forms (oral powders, oral solutions, injections), supports their widespread veterinary use

- The trend towards integrated animal health management and growing veterinary service accessibility in both developed and developing regions further fuels the market expansion

Restraint/Challenge

“Concerns Regarding Antibiotic Resistance and Regulatory Restrictions”

- Growing concerns surrounding antibiotic resistance due to the overuse and misuse of tetracyclines in veterinary medicine pose a significant challenge to the broader market growth. As tetracyclines are widely used, there is increasing scrutiny over their contribution to antimicrobial resistance, raising regulatory and consumer anxieties about long-term efficacy and food safety

- For instance, stringent regulations by governments and international bodies, such as the European Union’s restrictions on antibiotic use in food-producing animals, have limited the availability and application of tetracyclines in some markets

- Addressing these concerns through responsible use policies, improved veterinary oversight, and the promotion of antimicrobial stewardship programs is crucial for maintaining market stability. Companies and regulatory agencies are emphasizing stricter guidelines, prescription-only access, and awareness campaigns to educate farmers and veterinarians on appropriate tetracycline use. In addition, the rising cost of compliance with such regulations and the need for alternative therapies may limit market growth, especially in developing regions where regulatory enforcement is increasing

- While veterinary tetracyclines remain essential, the perceived risks of resistance development and regulatory hurdles may hinder their widespread use, particularly in large-scale animal farming operations

- Overcoming these challenges through innovation in antibiotic formulations, enhanced diagnostic support for targeted therapy, and global cooperation on stewardship will be vital for sustained growth in the veterinary tetracycline market

Veterinary Tetracycline Market Scope

The market is segmented on the basis of animal type, dosage form, and distribution channel

- By Animal Type

On the basis of animal type, the market is segmented into food-producing animals and companion animals. The food-producing animals segment dominated with 65% market share in 2024, supported by the growing global demand for meat and dairy products.

The companion animals segment is anticipated to record the fastest growth rate during forecast period, owing to rising pet ownership and increased spending on pet healthcare worldwide.

- By Dosage Form

On the basis of dosage form, the market is segmented into oral powders, oral solutions, injections, and others. The oral solutions segment dominated with a market share of 50.25% in 2024, attributed to its ease of administration and quick absorption.

The injectable segment is projected to grow the fastest during forecast period, fueled by rising use in acute and severe infections requiring immediate therapeutic action, especially in companion animals.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into veterinary hospitals, veterinary clinics, pharmacies & drug stores, and others. The veterinary hospitals dominated with a share of 60.5% in 2024 due to the increasing frequency of veterinary visits.

The online pharmacies and drug stores segment is expected to witness the fastest growth during forecast period, driven by increasing adoption of e-commerce and digital platforms for veterinary pharmaceuticals.

Veterinary Tetracycline Market Regional Analysis

- North America dominates the veterinary tetracycline market with the largest revenue share of 35.5% in 2024, driven by advanced veterinary infrastructure, strong livestock production, and a high level of awareness among farmers and pet owners

- Consumers and farmers in the region prioritize effective and affordable antibiotic treatments such as tetracyclines, supported by strong regulatory frameworks and extensive veterinary services

- This widespread adoption is further supported by high investment in animal health research, well-established supply chains, and the growing preference for quality assurance in food-producing animals, establishing veterinary tetracyclines as a preferred choice in both livestock and companion animal healthcare

U.S. Veterinary Tetracycline Market Insight

The U.S. veterinary tetracycline market captured the largest revenue share of 42% in 2024 within North America, driven by extensive use of tetracycline antibiotics in livestock and companion animal healthcare. The rising demand for disease prevention and growth promotion in food-producing animals, combined with advanced veterinary infrastructure and stringent regulatory frameworks, supports market growth. Increasing awareness about animal health management and adoption of responsible antibiotic use practices further propel the tetracycline market in the U.S.

Europe Veterinary Tetracycline Market Insight

The Europe veterinary tetracycline market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing focus on food safety, animal welfare regulations, and sustainable farming practices. Rising urbanization and growing demand for high-quality animal protein are fostering the use of veterinary antibiotics, including tetracyclines. The region is witnessing strong adoption across livestock and companion animal sectors, supported by advanced veterinary healthcare systems.

U.K. Veterinary Tetracycline Market Insight

The U.K. veterinary tetracycline market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing livestock production and rising awareness of effective animal disease management. Government initiatives promoting prudent antibiotic use and the growing companion animal population are encouraging veterinarians and farmers to adopt tetracycline solutions. The U.K.’s robust veterinary service infrastructure further stimulates market expansion.

Germany Veterinary Tetracycline Market Insight

The Germany veterinary tetracycline market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing animal health expenditure and strong emphasis on research and innovation in veterinary pharmaceuticals. Germany’s focus on eco-friendly and sustainable farming practices, along with rising demand for technologically advanced veterinary products, supports the adoption of tetracyclines for disease control in both livestock and pet

Asia-Pacific Veterinary Tetracycline Market Insight

The Asia-Pacific veterinary tetracycline market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and increasing demand for animal protein in countries such as China, India, and Japan. The region’s expanding livestock population, government support for animal health, and growing veterinary healthcare infrastructure are significantly driving the adoption of tetracycline antibiotics.

Japan Veterinary Tetracycline Market Insight

The Japan Veterinary Tetracycline market is gaining momentum due to the country’s high-tech culture, rapid urbanization, and demand for convenience. The Japanese market places a significant emphasis on security, and the adoption of Veterinary Tetracyclines is driven by the increasing number of smart homes and connected buildings. The integration of Veterinary Tetracyclines with other IoT devices, such as home security cameras and lighting systems, is fueling growth. Moreover, Japan's aging population is such asly to spur demand for easier-to-use, secure access solutions in both residential and commercial sectors.

India Veterinary Tetracycline Market Insight

The India veterinary tetracycline market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country’s substantial livestock population, growing companion animal ownership, and improving veterinary healthcare services. Government programs focusing on animal health improvement and increasing adoption of modern veterinary practices are key factors propelling the demand for tetracycline antibiotics in India.

Veterinary Tetracycline Market Share

The Veterinary Tetracycline industry is primarily led by well-established companies, including:

- Zoetis Services LLC (U.S.)

- Elanco or its affiliates (U.S.)

- Merck & Co., Inc. (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Ceva (France)

- Virbac (France)

- Phibro Animal Health Corporation (U.S.)

- Vetoquinol (France)

- Dechra Pharmaceuticals Limited (U.K.)

- Huvepharma (Bulgaria)

- Ourofino Saúde Animal (Brazil)

- Norbrook Laboratories Ltd (U.K.)

- Neogen Corporation (U.S.)

- HESTER BIOSCIENCES LIMITED (India)

- Bimeda Holdings PLC (Ireland)

- Ashish Life Science Pvt. Ltd. (India)

- Alembic Pharmaceuticals Limited (India)

- Jiangxi Bolai Pharmacy Co., Ltd. (China)

- Shandong Lukang Pharmaceutical Co., Ltd. (China)

Latest Developments in Global Veterinary Tetracycline Market

- In March 2024, Zoetis Inc., a global leader in animal health, announced the launch of an enhanced veterinary tetracycline formulation designed to improve efficacy and reduce withdrawal periods in food-producing animals. This new product underscores Zoetis’s commitment to advancing antibiotic solutions that align with regulatory requirements and promote animal welfare. The launch aims to address increasing demand for effective disease management while supporting sustainable livestock production

- In February 2024, Elanco Animal Health Incorporated expanded its veterinary antibiotic portfolio with the introduction of a novel tetracycline-based treatment targeting respiratory infections in cattle and swine. This advancement reflects Elanco’s focus on addressing growing concerns around antibiotic resistance through innovative formulation strategies and responsible use guidelines

- In January 2024, Boehringer Ingelheim Animal Health announced a collaboration with agricultural research institutes in Europe to conduct extensive field trials evaluating the efficacy of tetracycline antibiotics in poultry. This initiative highlights the company’s commitment to scientific research and development aimed at optimizing veterinary treatments in line with evolving industry standards

- In December 2023, Phibro Animal Health Corporation reported a strategic partnership with feed manufacturers to integrate veterinary tetracycline products into animal nutrition programs. This collaboration seeks to enhance disease prevention strategies and improve overall animal health management in commercial farming operations globally

- In November 2023, Huvepharma AD launched a new veterinary tetracycline injectable formulation approved in multiple emerging markets, aiming to increase accessibility and affordability of effective antibiotics for livestock producers. This development reflects Huvepharma’s strategy to expand its global footprint in the veterinary pharmaceutical sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.