Global Video Wall Industrial Display Market

Market Size in USD Billion

CAGR :

%

USD

3.53 Billion

USD

5.63 Billion

2024

2032

USD

3.53 Billion

USD

5.63 Billion

2024

2032

| 2025 –2032 | |

| USD 3.53 Billion | |

| USD 5.63 Billion | |

|

|

|

|

Video Wall Industrial Display Market Size

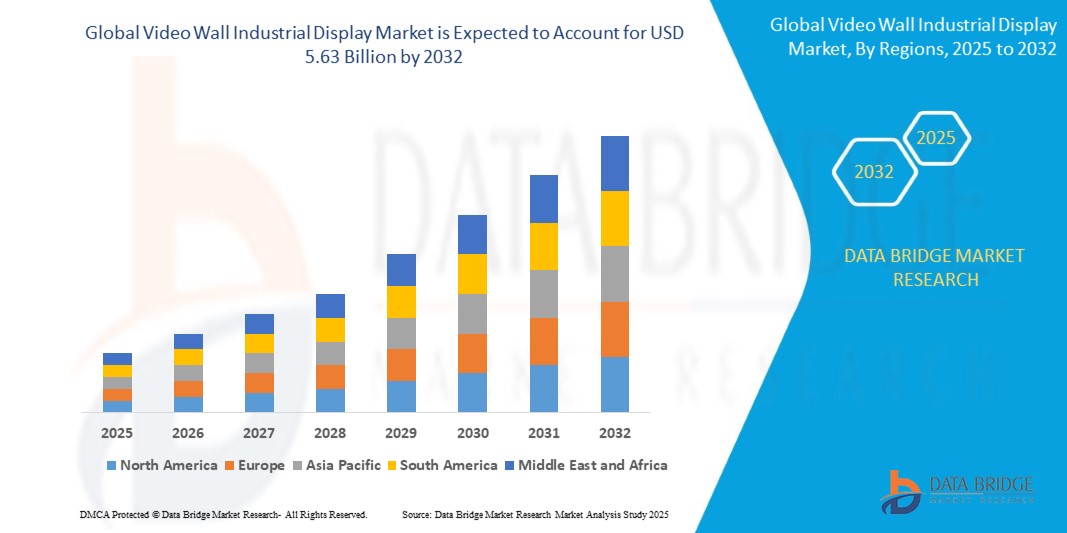

- The global video wall industrial display market size was valued at USD 3.53 billion in 2024 and is expected to reach USD 5.63 billion by 2032, at a CAGR of 6.00% during the forecast period

- This growth is driven by factors such as increasing demand for large-scale displays in various industries, advancements in display technologies, and growing investments in the entertainment and retail sectors

Video Wall Industrial Display Market Analysis

- Video wall industrial displays are vital components in various industries, offering large-scale, high-resolution visual solutions for control rooms, corporate environments, retail spaces, and public areas. They provide seamless integration of multiple screens, ensuring enhanced visualization for critical applications such as monitoring, security, and communication

- The demand for video wall industrial displays is primarily driven by the growing need for efficient and effective communication systems, advancements in display technologies, and increasing investments in sectors like entertainment, retail, and public safety

- North America is expected to lead the global video wall industrial display market due to its advanced technological infrastructure, high demand for digital signage, and the adoption of cutting-edge display solutions in sectors like retail and transportation

- Asia-Pacific is expected to be the fastest growing region in the video wall industrial display market during the forecast period due to rapid urbanization, rising infrastructure development, and increasing awareness of the benefits of large-scale display systems

- The HMI segment is expected to dominate the market with the largest market share of 6.3%, due to the increasing adoption of video walls in corporate offices, control centers, and public spaces for communication and monitoring purposes

Report Scope and Video Wall Industrial Display Market Segmentation

|

Attributes |

Video Wall Industrial Display Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Video Wall Industrial Display Market Trends

“Advancements in Video Wall Technology & Integration for Industrial Applications”

- One prominent trend in the evolution of video wall technology is the increasing integration of high-resolution displays, seamless connectivity, and smart features such as touch interaction and real-time content management

- These innovations enhance the user experience by providing sharp, vibrant visuals and easy content control, making them ideal for applications in control rooms, retail spaces, and large public venues

- For instance, modern video walls now integrate advanced LED and OLED technologies, offering improved brightness, color accuracy, and energy efficiency, which are especially beneficial for use in environments with high ambient light or where clear visibility is critical

- These advancements are transforming industries by enabling more dynamic, efficient communication and monitoring systems, fueling the demand for next-generation video walls with enhanced performance and flexibility

Video Wall Industrial Display Market Dynamics

Driver

“Growing Demand Due to Increasing Use of Video Walls in Various Industries”

- The rising demand for video walls in industries such as retail, transportation, entertainment, and corporate sectors is significantly contributing to the increased adoption of industrial display solutions

- As businesses and organizations seek more effective ways to communicate, monitor, and engage with their audiences, the need for large-scale, high-quality visual solutions continues to grow

- The increasing focus on enhanced user experience, dynamic advertising, and real-time data visualization in control rooms and public spaces is driving the demand for video wall technology

- As a result of the growing demand for more impactful communication and seamless visual experiences, there is a significant increase in the use of video walls in commercial and industrial applications

Opportunity

“Advancements in Video Wall Technology with AI and Smart Integration”

- AI-powered video walls are enhancing content management, real-time analytics, and dynamic content delivery, enabling industries to improve communication, monitoring, and decision-making processes

- AI algorithms integrated into video walls can optimize content display, adjust brightness and contrast for different lighting conditions, and predict maintenance needs, ensuring seamless operation and reducing downtime

- Additionally, AI can help analyze viewer engagement and optimize content delivery based on audience behavior and preferences, making video walls even more effective in retail and advertising environments

- The integration of AI in video walls presents a significant opportunity for industries to improve operational efficiency, enhance user experience, and offer more personalized, data-driven content

Restraint/Challenge

“High Initial Costs and Maintenance Expenses Hindering Market Growth”

- The high cost of video wall systems, including the initial installation, hardware, and ongoing maintenance, poses a significant challenge, particularly for small and medium-sized businesses and organizations in developing regions

- Advanced video wall displays, such as those with OLED or LED technology, can be expensive, often reaching hundreds of thousands of dollars, which can limit adoption among businesses with constrained budgets

- This financial barrier can deter potential customers from investing in video wall systems, leading to a preference for lower-cost, less advanced alternatives that may not offer the same visual quality or performance

- As a result, these cost-related challenges can restrict market penetration, particularly in regions with lower economic capabilities, hindering the broader adoption and growth of video wall technologies

Video Wall Industrial Display Market Scope

The market is segmented on the basis of technology, panel size, applications, and verticals

|

Segmentation |

Sub-Segmentation |

|

By Technology |

|

|

By Panel Size |

|

|

By Applications |

|

|

By Verticals |

|

In 2025, the digital signage is projected to dominate the market with a largest share of 5.8% in application segment

The digital signage segment is expected to dominate the video wall industrial display market with the largest share of 5.8% in 2025 due to the increasing demand for dynamic content delivery in retail, transportation, and public spaces

The LCD is expected to account for the largest share of 4.8% during the forecast period in technology segment

In 2025, the LCD segment is expected to dominate the market with the largest market share of 4.8% due to their superior brightness, energy efficiency, and scalability, making them ideal for various industrial applications

Video Wall Industrial Display Market Regional Analysis

“North America Holds the Largest Share in the Industrial Display Market”

- North America dominates the video wall industrial display market, driven by the region’s advanced technological infrastructure, high adoption of cutting-edge display solutions, and the strong presence of key market players

- The U.S. holds a significant share due to the increasing demand for large-scale, high-resolution displays in sectors such as retail, corporate environments, and control rooms, as well as the growing use of digital signage and real-time monitoring systems

- The region’s well-established infrastructure for digital signage, along with the widespread use of video walls in transportation, entertainment, and security, further strengthens its market dominance

- Additionally, growing investments in the development of smart city projects and increasing demand for immersive customer experiences are driving market expansion across North America

“Asia-Pacific is Projected to Register the Highest CAGR in the Video Wall Industrial Display Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the video wall industrial display market, driven by rapid urbanization, expanding infrastructure development, and rising adoption of advanced display technologies

- Countries such as China, India, and Japan are emerging as key markets due to their growing retail and entertainment sectors, along with increasing demand for digital signage and dynamic advertising solutions

- China and India, with their large populations and expanding commercial sectors, are experiencing a rise in demand for high-quality video walls in public spaces, shopping malls, airports, and transit hubs

- Japan, known for its cutting-edge technology and high adoption of digital signage, continues to lead in the integration of advanced video wall systems in retail, public spaces, and commercial environments, contributing to the growth of the regional market

Video Wall Industrial Display Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Samsung Electronics (South Korea)

- LG Electronics (South Korea)

- NEC Corporation (Japan)

- Barco (Belgium)

- Christie Digital Systems (U.S.)

- Sharp Corporation (Japan)

- Daktronics (U.S.)

- Leyard Optoelectronic (China)

- Planar Systems (U.S.)

- Elo Touch Solutions (U.S.)

- BenQ (Taiwan)

- InFocus Corporation (U.S.)

- Xtreme Media (India)

- Hitachi Ltd. (Japan)

- Unilumin Group (China)

- ViewSonic Corporation (U.S.)

- Panasonic Corporation (Japan)

- AOTO Electronics (China)

- Vewd Software (Norway)

- Mitsubishi Electric (Japan)

Latest Developments in Global Video Wall Industrial Display Market

- In September 2022, Samsung introduced the Wall All-In-One, available in 110-inch and 146-inch models, specifically designed for corporate office spaces. This innovative display system features a pre-adjusted seam and a 'Pre-Assembled Frame Kit,' ensuring simplified and efficient installation. This launch is significant in the context of the global Video Wall Industrial Display Market, as it reflects the growing demand for high-quality, easy-to-install solutions in commercial environments

- In February 2022, LG Electronics and VA Corporation established a joint research center aimed at developing an LED wall specifically optimized for in-camera visual effects. This cutting-edge technology enables filmmakers to create diverse scenes and locations within a single studio, offering a more cost-effective solution for film production. This collaboration holds significant relevance to the global Video Wall Industrial Display Market, as it highlights the expanding use of advanced video wall technology in the entertainment and media sectors

- In October 2023, LG Electronics revealed a major investment in Alphonso, aiming to integrate the technologies and innovations of both industry leaders into LG’s smart TV lineup. This collaboration is expected to advance the capabilities of LG’s smart TVs, enhancing their performance and functionality. The strategic partnership is highly relevant to the global Video Wall Industrial Display Market, as it reflects the increasing convergence of advanced display technologies and smart software solutions

- In June 2023, Samsung Electronics introduced The Wall for Virtual Production at InfoComm 2023, a state-of-the-art display designed to meet the high demands of virtual content creation. The Wall for Virtual offers pixel pitch options of P1.68 and P2.1, with dedicated studio frame rates (23.976, 29.97, and 59.94Hz) and genlocking capabilities, enabling synchronization with a camera’s video signal. The display also features an impressive refresh rate of up to 12,288Hz, maximum brightness of 1,500 nits, a fixed contrast ratio of 35,000:1 (for P2.1), and wide viewing angles of up to 170 degrees. This innovation is highly relevant to the global Video Wall Industrial Display Market, as it demonstrates the growing application of high-performance display technology in professional settings, particularly in film production and virtual studios

- In October 2022, Samsung Electronics introduced its cutting-edge Micro LED technology at Integrated Systems Europe (ISE) 2022 in Barcelona, showcasing three models of this advanced display solution. Micro LED technology represents a significant leap in display innovation, offering exceptional picture quality and flexibility. This breakthrough is highly relevant to the global Video Wall Industrial Display Market, as Micro LED technology is set to revolutionize the way video walls are used in commercial environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Video Wall Industrial Display Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Video Wall Industrial Display Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Video Wall Industrial Display Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.