Global Visual Effects Market

Market Size in USD Billion

CAGR :

%

USD

11.70 Billion

USD

21.13 Billion

2024

2032

USD

11.70 Billion

USD

21.13 Billion

2024

2032

| 2025 –2032 | |

| USD 11.70 Billion | |

| USD 21.13 Billion | |

|

|

|

|

Visual Effects Market Size

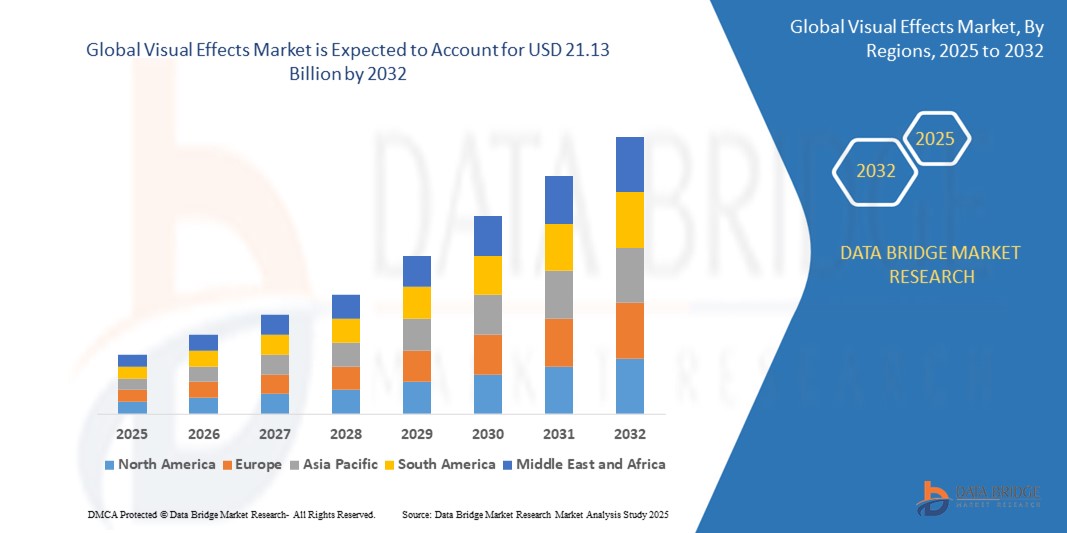

- The global visual effects market size was valued at USD 11.70 billion in 2024 and is expected to reach USD 21.13 billion by 2032, at a CAGR of 7.67% during the forecast period

- The market growth is largely fueled by the increasing demand for high-quality content across streaming platforms, films, and gaming, coupled with advancements in VFX technologies such as AI-driven animation, virtual production, and real-time rendering

- Furthermore, the surge in global film production, rapid expansion of OTT platforms such as

- Netflix, Disney+, and Amazon Prime, and rising investments in immersive storytelling techniques are driving the integration of VFX into mainstream entertainment and advertising. These converging factors are significantly accelerating the expansion of the visual effects industry worldwide

Visual Effects Market Analysis

- Visual effects (VFX) are essential in creating immersive, high-quality digital content across film, television, advertising, and gaming, helping producers meet audience expectations for realism and creativity

- The growth of the visual effects market is propelled by rapid advancements in computer graphics, AI-driven automation, and virtual production technologies, alongside rising demand for content with sophisticated effects in streaming platforms and video games

- North America holds the largest revenue share of approximately 38% in 2025, driven by a strong entertainment industry, the presence of leading Hollywood studios, and significant investments in cutting-edge VFX and Simulation FX technologies. The U.S. remains a hub for innovation in physics-based effects, particle systems, and real-time simulations

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, supported by increasing outsourcing of VFX work to countries such as India, China, and South Korea, expansion of local film industries, and adoption of cloud-based simulation and rendering solutions to reduce production costs

- The Simulation FX segment is expected to dominate the visual effects market with a market share of around 45% in 2025. This dominance is driven by its ability to create realistic natural phenomena such as fire, water, smoke, explosions, and destruction effects, which are increasingly demanded in blockbuster movies, TV shows, and interactive games for enhanced audience engagement

Report Scope and Visual Effects Market Segmentation

|

Attributes |

Visual Effects Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Visual Effects Market Trends

“Advanced AI-Driven Realism and Automation”

- A key and rapidly evolving trend in the global visual effects market is the increasing integration of artificial intelligence (AI) and machine learning (ML) technologies to enhance realism, automate complex tasks, and reduce production timelines in VFX workflows

- For instances, NVIDIA’s AI-powered tools such as Omniverse enable real-time collaboration and photorealistic rendering, significantly accelerating the creation of complex visual effects for films and games. Similarly, Adobe’s Sensei AI automates rotoscoping and masking, reducing manual effort and improving accuracy

- AI integration in VFX allows for intelligent simulations of natural phenomena such as fire, water, smoke, and crowd behaviors, enabling artists to generate more lifelike effects with less manual tweaking. For instance, Houdini’s AI-enhanced simulation engines optimize particle effects to create realistic destruction sequences faster and with greater detail

- The rise of voice-activated and gesture-based controls in virtual production environments is simplifying interaction with VFX tools, allowing creatives to manipulate scenes and effects more intuitively in real time, thus enhancing creative freedom and efficiency

- Integration of VFX pipelines with cloud-based platforms and AI-powered asset management systems enables studios to centralize control, streamline collaboration, and optimize rendering workloads across global teams, supporting more complex and large-scale projects.

- Leading companies such as Industrial Light & Magic (ILM) and Weta Digital are investing heavily in AI-driven VFX innovations, including procedural content generation and real-time visual effects previews powered by AI, to meet growing demand for faster turnaround times without sacrificing quality

- The demand for AI-enhanced VFX solutions is expanding rapidly across film, television, gaming, and advertising sectors, as producers seek more immersive, visually stunning content delivered under tighter schedules and budgets

Visual Effects Market Dynamics

Driver

“Growing Demand for Immersive Content across Media & Entertainment Platforms”

- he surging global appetite for high-quality, immersive content across film, television, OTT platforms, and gaming is a key driver for the visual effects market, as audiences increasingly expect hyper-realistic visuals and dynamic storytelling

- For instance, in November 2024, Netflix announced the expansion of its in-house VFX capabilities to support original content development, aiming to reduce dependency on external vendors and increase production speed for visually rich titles

- The rise of 4K, 8K, HDR, and VR/AR content formats is pushing production houses to adopt cutting-edge VFX to enhance the realism and visual appeal of their content. This demand spans genres, from superhero blockbusters and science fiction to historical epics and fantasy series

- Moreover, video game developers are increasingly investing in real-time VFX for next-gen gaming experiences. In January 2025, Epic Games showcased upgraded real-time visual effects capabilities in Unreal Engine 5.4, offering creators powerful tools for high-fidelity game development

- The integration of VFX in digital advertising, music videos, and immersive brand storytelling campaigns is also expanding its market applicability, with marketers leveraging visual effects to engage audiences more effectively in the digital-first era

- As consumer expectations continue to rise and competition among content platforms intensifies, VFX becomes a strategic investment to captivate viewers, drive engagement, and differentiate content

Restraint/Challenge

“High Production Costs and Complex Skill Requirements”

- Despite increasing demand, the high production costs associated with sophisticated visual effects represent a significant barrier to adoption, especially for small- and mid-budget studios. Advanced simulations, CGI, and motion capture require substantial investment in hardware, software, and skilled labor

- For instances, the VFX budget for major productions such as Avatar: The Way of Water reportedly exceeded $350 million, making such productions feasible only for top-tier studios. This creates an uneven playing field and limits opportunities for smaller players

- In addition, the complex skill sets required to create high-end VFX—ranging from 3D modeling and compositing to simulation and rendering—result in a heavy reliance on specialized artists, who are in short supply globally

- Talent shortages and rising labor costs, particularly in developed markets, can lead to project delays, quality compromises, and missed deadlines. For instance, several Hollywood productions in 2023 and 2024 experienced VFX-related delays due to overwhelmed post-production pipelines and artist burnout

- While cloud-based rendering and AI-assisted tools are helping reduce costs and streamline workflows, the upfront investment and learning curve for adopting such technologies remain a challenge

- Addressing these issues through scalable cloud solutions, AI-powered automation, global outsourcing, and expanded training programs will be crucial for sustaining the growth of the VFX market

Visual Effects Market Scope

The market is segmented on the basis of component, type, and application

By Component

On the basis of component, the visual effects market is segmented into software, hardware, and services. The software segment dominates the largest market revenue share in 2025, driven by increasing reliance on advanced digital tools and platforms for rendering, simulation, and compositing. Industry professionals often prioritize robust software solutions due to their essential role in creating high-quality visual effects, seamless integration with production pipelines, and compatibility with various file formats and rendering engines. The demand for VFX software is further fueled by advancements in AI-assisted automation and real-time rendering capabilities

The services segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising trend of outsourcing post-production tasks to specialized VFX service providers. Studios and production houses increasingly rely on external vendors for simulation, animation, and compositing services, particularly in regions such as Asia-Pacific. This allows companies to access skilled labor, reduce costs, and accelerate time-to-market while maintaining high visual quality

• By Type

On the basis of type, the visual effects market is segmented into matte painting, simulation FX, compositing, motion capture, 3D scanning, character and creature animation, concept art, previs/pre-visualization, and others. The simulation FX segment dominates the largest market revenue share in 2025, driven by its critical role in generating realistic natural phenomena such as explosions, fire, water, and destruction. Studios often rely on simulation FX to create dynamic and immersive sequences that elevate storytelling and engage audiences across films, games, and streaming content

The character and creature animation segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for lifelike digital characters in movies, TV series, and video games. Advancements in rigging, motion capture, and AI-powered animation are enabling studios to produce more expressive, detailed, and emotive digital beings, significantly expanding the use of this VFX type in both cinematic and interactive media

• By Application

On the basis of application, the visual effects market is segmented into movies, advertisements, TV shows, and gaming. The movies segment accounted for the largest market revenue share in 2025, driven by the high budget allocation for VFX in blockbuster productions, rising viewer expectations for visual realism, and the extensive use of VFX across genres from action to fantasy. Movie studios increasingly depend on cutting-edge VFX to differentiate content, deliver immersive experiences, and attract global audiences

The gaming segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the surge in demand for visually rich, interactive environments and real-time effects in next-generation games. Game developers prioritize VFX to enhance gameplay realism, user immersion, and visual storytelling, especially with the rise of VR/AR gaming and advancements in graphics engines such as Unreal and Unity

Visual Effects Market Regional Analysis

- North America dominates the visual effects market with the largest revenue share of 38% in 2025, driven by the strong presence of leading VFX studios, high-budget film and television production, and the early adoption of advanced technologies such as real-time rendering and virtual production

- Studios in the region, especially in the U.S. and Canada, are recognized for producing blockbuster films and series that heavily rely on sophisticated VFX, fueling continuous investment in cutting-edge software, hardware, and talent

- The widespread use of VFX across the entertainment industry, including streaming content, gaming, and advertising, is further supported by the region’s advanced post-production infrastructure, skilled workforce, and a robust ecosystem of tech innovation, positioning North America as a global hub for visual effects development and delivery

U.S. Visual Effects Market Insight

The U.S. visual effects market captured the largest revenue share of 81% within North America in 2025, fueled by the dominance of Hollywood and the increasing reliance on digital content across streaming platforms, gaming, and advertising. The country is home to numerous world-leading VFX studios and benefits from strong investment in real-time rendering, virtual production, and AI-powered content creation. In addition, the rapid adoption of cloud-based rendering and virtual collaboration tools is enhancing productivity across post-production workflows. With rising consumer demand for visually immersive experiences, the U.S. market continues to drive innovation and set global standards in visual effects

Europe Visual Effects Market Insight

The European visual effects market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by government incentives for film production, increasing demand for digital content, and the region’s growing presence in international co-productions. Countries such as the U.K., Germany, and France are investing heavily in post-production infrastructure and talent development. European studios are increasingly integrating advanced VFX in television series, advertisements, and animated content. The growing appeal of high-quality streaming content and support from regional film funds are fostering expansion across both established and emerging VFX hubs

U.K. Visual Effects Market Insight

The U.K. visual effects market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by a strong creative industry ecosystem, tax relief schemes, and major studio investments. London is a recognized global VFX hub, housing prominent firms involved in high-end film and television production. The country’s vibrant film sector, combined with its push toward immersive media and real-time technology, is stimulating demand for cutting-edge visual effects. International collaborations and increasing content creation for platforms such as Netflix and Disney+ continue to fuel market growth in the U.K.

Germany Visual Effects Market Insight

The German visual effects market is expected to expand at a considerable CAGR during the forecast period, driven by growing demand for high-quality digital media, government support for creative industries, and a tech-savvy workforce. Germany’s focus on innovation and data privacy aligns with the development of VFX tools that balance creativity with security. As the country invests in animation and immersive content production, VFX integration into local film, television, and gaming projects is accelerating. Regional studios are also increasingly adopting AI and virtual production techniques to enhance efficiency and output

Asia-Pacific Visual Effects Market Insight

The Asia-Pacific visual effects market is poised to grow at the fastest CAGR of over 24% in 2025, driven by booming entertainment industries in China, India, South Korea, and Japan. Increasing investment in regional content, government support for digital infrastructure, and a surge in mobile and streaming consumption are encouraging studios to adopt sophisticated VFX solutions. The region’s growing talent pool and emergence as a cost-effective outsourcing destination make it highly attractive for global media giants. In addition, the expansion of gaming and animated content is accelerating the integration of VFX technologies across Asia-Pacific

Japan Visual Effects Market Insight

The Japan visual effects market is gaining momentum due to the country’s advanced digital infrastructure, rich animation heritage, and growing demand for immersive media. Japan's entertainment sector is expanding beyond anime into high-end VFX for films, television, and gaming, with increasing use of virtual reality and AI tools. The integration of VFX in smart city simulations, advertising, and metaverse applications is also driving innovation. Moreover, Japan’s emphasis on precision and design aesthetics aligns with the market’s demand for technically advanced and visually compelling VFX solutions

China Visual Effects Market Insight

The China visual effects market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the rapid expansion of domestic film production, massive growth in digital platforms, and increasing support for smart city and metaverse development. China’s entertainment industry, one of the world’s largest, is heavily investing in VFX to boost visual quality and global competitiveness. Local tech giants and content creators are pushing the boundaries with AI-driven VFX, real-time rendering, and immersive media formats. The strong presence of domestic VFX studios and favorable government policies are propelling continued growth across commercial, cinematic, and gaming applications

Visual Effects Market Share

The visual effects industry is primarily led by well-established companies, including:

- Blackmagic Design Pty. Ltd. (Australia)

- Foundry Visionmongers Ltd (U.K.)

- ZOIC STUDIOS (U.S.)

- Animal Logic (Australia)

- RE:Vision Effects, Inc. (U.S.)

- Worldwide Fx (Bulgaria)

- Video Copilot and Final Image Inc. (U.S.)

- Red Giant Software (U.S.)

- 3DAR LTDA. (U.S.)

- BORIS FX, INC. (U.S.)

- NaturalPoint Inc. (U.S.)

- DBA OptiTrack (U.S.)

- Adobe (U.S.)

- NVIDIA Corporation (U.S.)

- SCANLINE VFX (Germany)

- Tippett Studio (U.S.)

- Digital Idea Corp. (South Korea)

- Pixomondo LLC (U.S.)

- Digital Domain (U.S.)

- MPC Film (U.K.)

Latest Developments in Global Visual Effects Market

- In January 2025, Adobe Research and HKUST introduced TransPixar, an AI-driven visual effects system that revolutionizes transparency in smoke, reflections, and portals. By leveraging advanced alpha-channel generation, TransPixar seamlessly integrates transparent elements, overcoming traditional data and model limitations. This innovation transforms video production across films, games, and media, enabling real-time VFX enhancements with minimal manual effort

- In October 2024, Disney launched a major AI-driven initiative focused on post-production and visual effects, aiming to streamline costs amid ongoing industry layoffs. This move aligns with Hollywood’s increasing adoption of generative AI, enhancing content creation efficiency while reshaping traditional workflows. The initiative reportedly involves hundreds of Disney employees, signaling a significant shift in the company’s approach to film and television production

- In February 2024, Cinesite launched a visualisation division, expanding its previs, virtual production, techvis, and postvis services. Led by Richard Clarke and Eduardo Schmidek, the team integrates streamlined workflows and creative solutions, enhancing cost efficiency and flexibility for clients. This initiative aligns with Cinesite’s concept and pipeline departments, offering end-to-end visual effects solutions for filmmakers

- In January 2024, Netflix integrated Animal Logic into its global animation studio structure, nearly two years after acquiring the Australian animation studio. As part of this transition, CEO Sharon Taylor stepped down, with Karen Toliver, Netflix Animation Film VP, assuming leadership. This move strengthens Netflix’s animation capabilities, streamlining production and expanding its creative reach

- In August 2022, Cinesite acquired a majority stake in FX3X, a visual effects studio with offices in Skopje and Belgrade. This acquisition significantly expands Cinesite’s global capacity, adding expertise in creative VFX supervision and production management. FX3X will continue serving clients across feature films, streaming content, and episodic television, strengthening Cinesite’s presence in Eastern Europe

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL VISUAL EFFECTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL VISUAL EFFECTS MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY MARKET SHARE ANALYSIS

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 STANDARDS OF MEASUREMENT

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL VISUAL EFFECTS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

6 GLOBAL VISUAL EFFECTS MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOFTWARE

6.3 SERVICES

6.3.1 PROFESSIONAL SERVICES

6.3.1.1. CONSULTING

6.3.1.2. SUPPORT & MAINTENANCE

6.3.1.3. IMPLEMENTATION & INTEGRATION

6.3.2 MANAGED SERVICES

7 GLOBAL VISUAL EFFECTS MARKET, BY OPERATING SYSTEM

7.1 OVERVIEW

7.2 WINDOWS

7.3 LINUX

7.4 MAC OS

7.5 OTHERS

8 GLOBAL VISUAL EFFECTS MARKET, BY DEPLOYMENT MODE

8.1 OVERVIEW

8.2 ON-PREMISES

8.3 CLOUD

9 GLOBAL VISUAL EFFECTS MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 SMALL & MEDIUM ORGANIZATION SIZE

9.2.1 BY DEPLOYMENT MODE

9.2.1.1. ON-PREMISES

9.2.1.2. CLOUD

9.3 LARGE ORGANIZATION SIZE

9.3.1 BY DEPLOYMENT MODE

9.3.1.1. ON-PREMISES

9.3.1.2. CLOUD

10 GLOBAL VISUAL EFFECTS MARKET, BY EFFECTS

10.1 OVERVIEW

10.2 BULLET TIME

10.3 DIGITAL COMPOSITING

10.4 STOP MOTION ANIMATION

10.5 MATTE PAINTING

10.6 PROSTHETIC MAKEUP

11 GLOBAL VISUAL EFFECTS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 MOVIES

11.2.1 BY OFFERING

11.2.1.1. SOFTWARE

11.2.1.2. SERVICES

11.3 ADVERTISING

11.3.1 BY OFFERING

11.3.1.1. SOFTWARE

11.3.1.2. SERVICES

11.4 TELEVISION

11.4.1 BY OFFERING

11.4.1.1. SOFTWARE

11.4.1.2. SERVICES

11.5 GAMING

11.5.1 BY OFFERING

11.5.1.1. SOFTWARE

11.5.1.2. SERVICES

11.6 OTHERS

12 GLOBAL VISUAL EFFECTS MARKET, BY GEOGRAPHY

12.1 GLOBAL VISUAL EFFECTS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.1.1 NORTH AMERICA

12.1.1.1. U.S.

12.1.1.2. CANADA

12.1.1.3. MEXICO

12.1.2 EUROPE

12.1.2.1. GERMANY

12.1.2.2. FRANCE

12.1.2.3. U.K.

12.1.2.4. ITALY

12.1.2.5. SPAIN

12.1.2.6. RUSSIA

12.1.2.7. TURKEY

12.1.2.8. BELGIUM

12.1.2.9. NETHERLANDS

12.1.2.10. NORWAY

12.1.2.11. FINLAND

12.1.2.12. SWITZERLAND

12.1.2.13. DENMARK

12.1.2.14. SWEDEN

12.1.2.15. POLAND

12.1.2.16. REST OF EUROPE

12.1.3 ASIA PACIFIC

12.1.3.1. JAPAN

12.1.3.2. CHINA

12.1.3.3. SOUTH KOREA

12.1.3.4. INDIA

12.1.3.5. AUSTRALIA

12.1.3.6. NEW ZEALAND

12.1.3.7. SINGAPORE

12.1.3.8. THAILAND

12.1.3.9. MALAYSIA

12.1.3.10. INDONESIA

12.1.3.11. PHILIPPINES

12.1.3.12. TAIWAN

12.1.3.13. VIETNAM

12.1.3.14. REST OF ASIA PACIFIC

12.1.4 SOUTH AMERICA

12.1.4.1. BRAZIL

12.1.4.2. ARGENTINA

12.1.4.3. REST OF SOUTH AMERICA

12.1.5 MIDDLE EAST AND AFRICA

12.1.5.1. SOUTH AFRICA

12.1.5.2. EGYPT

12.1.5.3. SAUDI ARABIA

12.1.5.4. U.A.E

12.1.5.5. OMAN

12.1.5.6. BAHRAIN

12.1.5.7. ISRAEL

12.1.5.8. KUWAIT

12.1.5.9. QATAR

12.1.5.10. REST OF MIDDLE EAST AND AFRICA

12.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

13 GLOBAL VISUAL EFFECTS MARKET,COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13.5 MERGERS & ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

13.7 EXPANSIONS

13.8 REGULATORY CHANGES

13.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 GLOBAL VISUAL EFFECTS MARKET, SWOT & DBMR ANALYSIS

15 GLOBAL VISUAL EFFECTS MARKET, COMPANY PROFILE

15.1 ADOBE

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 GEOGRAPHIC PRESENCE

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 AUTODESK INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 GEOGRAPHIC PRESENCE

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 FOUNDRY

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 GEOGRAPHIC PRESENCE

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 THE QT COMPANY

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 GEOGRAPHIC PRESENCE

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 SIDEFX

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 GEOGRAPHIC PRESENCE

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 BLACKMAGIC DESIGN PTY. LTD.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 GEOGRAPHIC PRESENCE

15.6.4 PRODUCT PORTFOLIO

15.6.5 RECENT DEVELOPMENT

15.7 CHAOS SOFTWARE EOOD

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 GEOGRAPHIC PRESENCE

15.7.4 PRODUCT PORTFOLIO

15.7.5 RECENT DEVELOPMENT

15.8 COREL CORPORATION

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 GEOGRAPHIC PRESENCE

15.8.4 PRODUCT PORTFOLIO

15.8.5 RECENT DEVELOPMENT

15.9 BLENDER

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 GEOGRAPHIC PRESENCE

15.9.4 PRODUCT PORTFOLIO

15.9.5 RECENT DEVELOPMENT

15.1 SITNI SATI

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 GEOGRAPHIC PRESENCE

15.10.4 PRODUCT PORTFOLIO

15.10.5 RECENT DEVELOPMENT

15.11 ZBRUSH

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 GEOGRAPHIC PRESENCE

15.11.4 PRODUCT PORTFOLIO

15.11.5 RECENT DEVELOPMENT

15.12 MAXON COMPUTER GMBH

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 GEOGRAPHIC PRESENCE

15.12.4 PRODUCT PORTFOLIO

15.12.5 RECENT DEVELOPMENT

15.13 ARNOLD RENDERER

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 GEOGRAPHIC PRESENCE

15.13.4 PRODUCT PORTFOLIO

15.13.5 RECENT DEVELOPMENT

15.14 HITFILM

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 GEOGRAPHIC PRESENCE

15.14.4 PRODUCT PORTFOLIO

15.14.5 RECENT DEVELOPMENT

15.15 AVID TECHNOLOGY, INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 GEOGRAPHIC PRESENCE

15.15.4 PRODUCT PORTFOLIO

15.15.5 RECENT DEVELOPMENT

15.16 BORIS FX, INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 GEOGRAPHIC PRESENCE

15.16.4 PRODUCT PORTFOLIO

15.16.5 RECENT DEVELOPMENT

15.17 DNEG (A PART OF PRIME FOCUS LTD)

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 GEOGRAPHIC PRESENCE

15.17.4 PRODUCT PORTFOLIO

15.17.5 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

16 CONCLUSION

17 QUESTIONNAIRE

18 RELATED REPORTS

19 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.