Global Vitamin D Testing Market

Market Size in USD Billion

CAGR :

%

USD

0.77 Billion

USD

1.17 Billion

2021

2029

USD

0.77 Billion

USD

1.17 Billion

2021

2029

| 2022 –2029 | |

| USD 0.77 Billion | |

| USD 1.17 Billion | |

|

|

|

|

Vitamin D Testing Market Analysis and Size

Vitamin D is an essential nutrient for strong bones and teeth. A vitamin D test detects abnormal levels of vitamin D in the blood, which can indicate bone disorders, nutrition issues, organ damage, or other medical conditions. Vitamin D primary function is to help regulate calcium, phosphorus, and magnesium levels in the blood. It has been shown to influence the growth and differentiation of many other tissues, as well as to aid in immune system regulation.

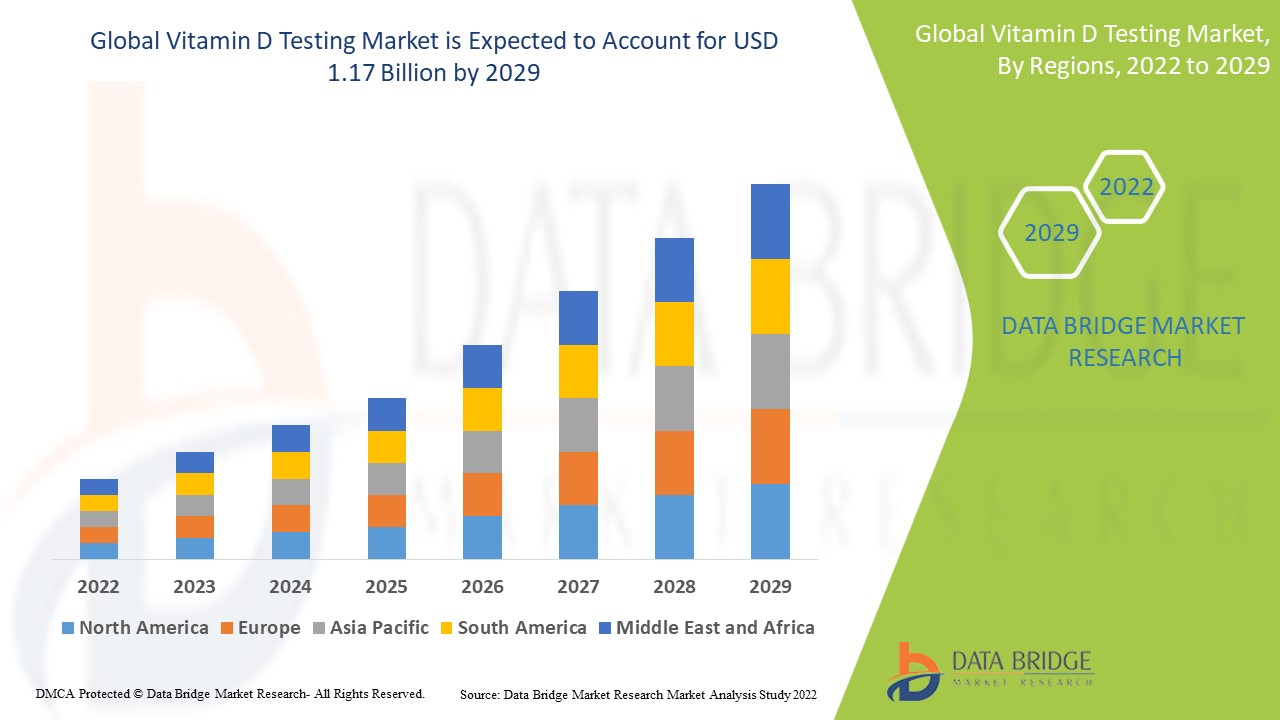

Data Bridge Market Research analyses that the vitamin D testing market which was USD 0.77 billion in 2021, and is expected to reach USD 1.17 billion by 2029, at a CAGR of 5.4% during the forecast period 2022 to 2029. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Vitamin D Testing Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product (25 -Hydroxy Vitamin D Testing, 1,25-Dihydroxy Vitamin D Testing, 24,25-Dihydroxy Vitamin D Testing), Application (Clinical Testing, Research Testing), Technique (Radioimmunoassay, ELISA, HPLC, LC-MS, Others), Patient (Adult, Paediatric), Indication (Osteoporosis, Rickets, Thyroid Disorders, Malabsorption, Vitamin D Deficiency, Others), End User (Hospitals, Diagnostic Laboratories, Home Care, Point-of-Care, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Market Players Covered |

F. Hoffmann-La Roche Ltd (Switzerland), Abbott (U.S.), Siemens (Germany), Quest Diagnostics Incorporated. (U.S.), bioMérieux (France), DiaSorin S.p.A. (Italy), Tosoh Bioscience, Inc. (U.S.), QUALIGEN THERAPEUTICS, INC. (U.S.), Diazyme Laboratories, Inc. (Germany), Thermo Fisher Scientific Inc. (U.S.), Immunodiagnostic Systems (U.K.), RECIPE Chemicals + Instruments GmbH (Germany), Beckman Coulter, Inc. (U.S.), The Vitamin D Company (Canada), Danaher (U.S.) |

|

Market Opportunities |

|

Market Definition

Vitamin D is a steroid pro-hormone that is fat-soluble. The body uses vitamin D to improve and maintain normal bone health by increasing calcium, magnesium, and phosphate absorption. Around 1 billion people worldwide are vitamin D deficient, while 50% of the population is diet D deficient. Diet D deficiency causes widespread weakness, fatigue, muscle aches, muscle twitching, osteoporosis, osteomalacia, and depression. Irritability, lethargy, developmental delay, bone changes, or fractures are all important symptoms of vitamin D deficiency in children. The deficiency affects people of all ages, including infants, children, the elderly, pregnant women and others.

Global Vitamin D Testing Market Dynamics

Drivers

- Increasing incidence of Vitamin D deficiency

Vitamin D deficiency affects a large population and is frequently underestimated. This is primarily due to the fact that the symptoms are not very specific and can vary from person to person. The lack of understanding about the importance of vitamin D and its role in overall health, a large population is affected by this deficiency. Vitamin D testing is becoming increasingly popular for diagnosing and treating this condition. These are the certain factors which will propel the growth of the market.

- Growing popularity of preventive healthcare

There is a growing trend toward preventive healthcare, which has increased demand for diagnostic tests such as vitamin D testing. People are becoming more aware of the importance of early diagnosis and treatment for a variety of health conditions, which has resulted in an increase in demand for these tests.

Opportunities

- Rising deficiencies

Another important factor driving the growth of the global vitamin D testing market is a growing of deficiencies and how to treat them. Even though it is not a fatal illness, it can lead to other serious problems. As a result, major health organisations and healthcare authorities have begun campaigns and events to encourage vitamin D testing. As a result, the market is expected to grow in the near future.

Restraints/Challenges

- High Demand for 25-Hydroxy Vitamin D Test

The 25-hydroxy vitamin D segment dominated the market and held a significant market share in 2021. During the forecast period, the segment is expected to grow at a rapid pace. This segment is expected to maintain its dominance in terms of revenue and market share during the forecast period.

The segment's growth can be attributed to an increase in the number of tests performed globally, as well as the ease of identifying and estimating 25-hydroxy D vitamin levels in plasma serum due to its longer half-life, despite being present in smaller volumes. Furthermore, the segment is propelled by its ability to detect a variety of bone disorders caused by a lack of recommended vitamin D levels.

This vitamin D testing market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the vitamin D testing market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 impact on the Vitamin D testing market

COVID-19 had a favourable effect on the market. The Covid-19 pandemic made everyone in the population more cautious. The market for vitamin D testing has increased as a result of everyone starting to perform full body and blood check-ups. Along with lockdown and other issues caused by the COVID-19 Pandemic, people were careful about their health, which played a significant role in the pandemic's favourable market growth.

Recent developments

- In November 2020, OmegaQuant will launch a Vitamin D Test with a sample collection kit, allowing normal levels to be tested at home. The safe, simple and convenient test requires just a finger stick and a couple drops of blood for analysis in the range of omega-3 blood tests. Vitamin D has played a major role in bone health for decades

- In March 2020, Thermo Fisher Scientific announced the availability of the Cascadion SM clinical analyzer for the Cascadion SM 25-Hydroxy Vitamin D assay in the United States, with the goal of expanding its brand presence

Global Vitamin D Testing Market Scope

The vitamin D testing market is segmented on the basis of product, application technique, patient, indication, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- 25 -Hydroxy Vitamin D Testing

- 1,25-Dihydroxy Vitamin D Testing

- 24,25-Dihydroxy Vitamin D Testing

Application

- Clinical Testing

- Research Testing

Technique

- Radioimmunoassay

- ELISA

- HPLC

- LC-MS

- Others

Patient

- Adult

- Paediatric

Indication

- Osteoporosis

- Rickets Thyroid Disorders

- Malabsorption

- Vitamin D Deficiency

- Others

End User

- Hospitals

- Diagnostic Laboratories

- Home Care

- Point-of-Care

- Others

Vitamin D Testing Market Regional Analysis/Insights

The vitamin D testing market is analysed and market size insights and trends are provided by country, product, application technique, patient, indication, and end user as referenced above.

The countries covered in the vitamin D testing market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the vitamin D testing market due to the introduction of new product and rising demand of technological advancement which makes the testing process easier and provide the result faster.

Asia-Pacific is expected to grow at the highest growth rate in the forecast period of 2022 to 2029 due to increase in the awareness by government and private agencies.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

Competitive Landscape and Vitamin D Testing Market Share Analysis

The vitamin D testing market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to vitamin D testing market.

Some of the major players operating in the vitamin D testing market are:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Abbott (U.S.)

- Siemens (Germany)

- Quest Diagnostics Incorporated. (U.S.)

- bioMérieux (France)

- DiaSorin S.p.A. (Italy)

- Tosoh Bioscience, Inc. (U.S.)

- QUALIGEN THERAPEUTICS, INC. (U.S.)

- Diazyme Laboratories, Inc. (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- Immunodiagnostic Systems (U.K.)

- RECIPE Chemicals + Instruments GmbH (Germany)

- Beckman Coulter, Inc. (U.S.)

- The Vitamin D Company (Canada)

- Danaher (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL VITAMIN D TESTING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL VITAMIN D TESTING MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY MODELING

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL VITAMIN D TESTING MARKET : RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

6 INDUSTRY INSIGHTS

7 REGULATORY FRAMEWORK

8 GLOBAL VITAMIN D TESTING MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 25 -HYDROXY VITAMIN D TESTING

8.2.1 25-OH VITAMIN D2

8.2.1.1. MARKET VALUE (USD MN)

8.2.1.2. MARKET VOLUME (UNITS)

8.2.1.3. AVERAGE SELLING PRICE (USD)

8.2.2 25-OH VITAMIN D3

8.2.2.1. MARKET VALUE (USD MN)

8.2.2.2. MARKET VOLUME (UNITS)

8.2.2.3. AVERAGE SELLING PRICE (USD)

8.3 1,25-DIHYDROXY VITAMIN D TESTING

8.3.1 MARKET VALUE (USD MN)

8.3.2 MARKET VOLUME (UNITS)

8.3.3 AVERAGE SELLING PRICE (USD)

8.4 24,25-DIHYDROXY VITAMIN D TESTING

8.4.1 MARKET VALUE (USD MN)

8.4.2 MARKET VOLUME (UNITS)

8.4.3 AVERAGE SELLING PRICE (USD)

9 GLOBAL VITAMIN D TESTING MARKET, BY COMPONENT

9.1 OVERVIEW

9.2 PRODUCT

9.2.1 DEVICES

9.2.1.1. IMMUNOASSAYS PLATFROM

9.2.1.1.1. BY BRANDS

9.2.1.1.1.1 ARCHITECT

9.2.1.1.1.1.1. MARKET VALUE (USD MN)

9.2.1.1.1.1.2. MARKET VOLUME (UNITS)

9.2.1.1.1.1.3. AVERAGE SELLING PRICE (USD)

9.2.1.1.1.2 LIAISON

9.2.1.1.1.2.1. MARKET VALUE (USD MN)

9.2.1.1.1.2.2. MARKET VOLUME (UNITS)

9.2.1.1.1.2.3. AVERAGE SELLING PRICE (USD)

9.2.1.1.1.3 IDS– ISYS

9.2.1.1.1.3.1. MARKET VALUE (USD MN)

9.2.1.1.1.3.2. MARKET VOLUME (UNITS)

9.2.1.1.1.3.3. AVERAGE SELLING PRICE (USD)

9.2.1.1.1.4 COBAS

9.2.1.1.1.4.1. MARKET VALUE (USD MN)

9.2.1.1.1.4.2. MARKET VOLUME (UNITS)

9.2.1.1.1.4.3. AVERAGE SELLING PRICE (USD)

9.2.1.1.1.5 ADVIA CENTAUR

9.2.1.1.1.5.1. MARKET VALUE (USD MN)

9.2.1.1.1.5.2. MARKET VOLUME (UNITS)

9.2.1.1.1.5.3. AVERAGE SELLING PRICE (USD)

9.2.1.1.1.6 ELECSYS

9.2.1.1.1.6.1. MARKET VALUE (USD MN)

9.2.1.1.1.6.2. MARKET VOLUME (UNITS)

9.2.1.1.1.6.3. AVERAGE SELLING PRICE (USD)

9.2.1.1.2. BY MODAILTY

9.2.1.1.2.1 FULL AUTOMATED

9.2.1.1.2.2 SEMI-AUTOMATED

9.2.1.2. HPLC DEVICES

9.2.1.2.1. MARKET VALUE (USD MN)

9.2.1.2.2. MARKET VOLUME (UNITS)

9.2.1.2.3. AVERAGE SELLING PRICE (USD)

9.2.1.3. OTHERS

9.2.2 KITS AND ASSAYS

9.2.2.1. MARKET VALUE (USD MN)

9.2.2.2. MARKET VOLUME (UNITS)

9.2.2.3. AVERAGE SELLING PRICE (USD)

9.2.3 OTHERS CONSUMABLES

9.2.3.1. MARKET VALUE (USD MN)

9.2.3.2. MARKET VOLUME (UNITS)

9.2.3.3. AVERAGE SELLING PRICE (USD)

9.3 SERVICES

10 GLOBAL VITAMIN D TESTING MARKET, BY TECHNIQUE

10.1 OVERVIEW

10.2 RADIOIMMUNOASSAY

10.3 CHEMILUMINESCENT IMMUNOASSAY (CLIA)

10.4 ELECTROCHEMILUMINESCENCE IMMUNOASSAY (ECLIA)

10.5 CHEMILUMINESCENTMICROPARTICLE IMMUNOASSAY (CMIA)

10.6 LATERAL FLOW IMMUNOASSAY

10.7 ENZYME-LINKED IMMUNOSORBENT ASSAY (ELISA)

10.8 HIGH-PERFORMANCE LIQUID CHROMATOGRAPHY(HPLC)

10.9 LIQUID CHRO-MATOGRAPHY-TANDEM MASS SPECTROMETRY (LC-MS/MS)

11 GLOBAL VITAMIN D TESTING MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 CLINICAL TESTING

11.2.1 PRODUCT

11.2.1.1. DEVICES

11.2.1.2. KITS AND ASSAYS

11.2.1.3. OTHER CONSUMABLES

11.2.2 SERVICES

11.3 RESEARCH TESTING

11.3.1 PRODUCT

11.3.1.1. DEVICES

11.3.1.2. KITS AND ASSAYS

11.3.1.3. OTHER CONSUMABLES

11.3.2 SERVICES

12 GLOBAL VITAMIN D TESTING MARKET, BY PATIENT

12.1 OVERVIEW

12.2 ADULT

12.3 PAEDIATRIC

13 GLOBAL VITAMIN D TESTING MARKET, BY INDICATION

13.1 OVERVIEW

13.2 OSTEOPOROSIS

13.3 RICKETS

13.4 THYROID DISORDERS

13.5 MALABSORPTION

13.6 VITAMIN D DEFICIENCY

13.7 OSTEOMALACIA

13.8 CYSTIC FIBROSIS

13.9 COELIAC’S DISEASE

13.1 CROHN'S DISEASE

13.11 OTHERS

14 GLOBAL VITAMIN D TESTING MARKET, BY TESTING TYPE

14.1 OVERVIEW

14.2 LABORATORY TESTING

14.3 POINT OF CARE TESTING

15 GLOBAL VITAMIN D TESTING MARKET, BY END USER

15.1 OVERVIEW

15.2 HOSPITALS

15.2.1 PUBLIC

15.2.2 PRIVATE

15.3 TESTING LABORATORIES

15.3.1 GOVERNMENT TESTING LABORATORIES

15.3.2 COMMERCIAL TESTING LABORATORIES

15.4 DIAGNOSTIC LABORATORIES

15.5 HOME CARE

15.6 OTHERS

16 GLOBAL VITAMIN D TESTING MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 DIRECT TENDER

16.3 RETAIL SALES

16.4 ONLINE SALES

16.5 OTHERS

17 GLOBAL VITAMIN D TESTING MARKET, BY REGION

GLOBAL VITAMIN D TESTING MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

17.2 EUROPE

17.2.1 GERMANY

17.2.2 U.K.

17.2.3 ITALY

17.2.4 FRANCE

17.2.5 SPAIN

17.2.6 RUSSIA

17.2.7 SWITZERLAND

17.2.8 TURKEY

17.2.9 BELGIUM

17.2.10 NETHERLANDS

17.2.11 DENMARK

17.2.12 SWEDEN

17.2.13 POLAND

17.2.14 NORWAY

17.2.15 FINLAND

17.2.16 REST OF EUROPE

17.3 ASIA-PACIFIC

17.3.1 JAPAN

17.3.2 CHINA

17.3.3 SOUTH KOREA

17.3.4 INDIA

17.3.5 SINGAPORE

17.3.6 THAILAND

17.3.7 INDONESIA

17.3.8 MALAYSIA

17.3.9 PHILIPPINES

17.3.10 AUSTRALIA

17.3.11 NEW ZEALAND

17.3.12 VIETNAM

17.3.13 TAIWAN

17.3.14 REST OF ASIA-PACIFIC

17.4 SOUTH AMERICA

17.4.1 BRAZIL

17.4.2 ARGENTINA

17.4.3 PERU

17.4.4 REST OF SOUTH AMERICA

17.5 MIDDLE EAST AND AFRICA

17.5.1 SOUTH AFRICA

17.5.2 EGYPT

17.5.3 BAHRAIN

17.5.4 UNITED ARAB EMIRATES

17.5.5 KUWAIT

17.5.6 OMAN

17.5.7 QATAR

17.5.8 SAUDI ARABIA

17.5.9 REST OF MEA

17.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

18 GLOBAL VITAMIN D TESTING MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18.2 COMPANY SHARE ANALYSIS: EUROPE

18.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

18.4 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

18.5 COMPANY SHARE ANALYSIS: SOUTH AMERICA

18.6 MERGERS & ACQUISITIONS

18.7 NEW PRODUCT DEVELOPMENT & APPROVALS

18.8 EXPANSIONS

18.9 REGULATORY CHANGES

18.1 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

19 GLOBAL VITAMIN D TESTING MARKET, SWOT AND DBMR ANALYSIS

20 GLOBAL VITAMIN D TESTING MARKET, COMPANY PROFILE

20.1 F. HOFFMANN-LA ROCHE LTD

20.1.1 COMPANY OVERVIEW

20.1.2 REVENUE ANALYSIS

20.1.3 GEOGRAPHIC PRESENCE

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENTS

20.2 ABBOTT

20.2.1 COMPANY OVERVIEW

20.2.2 REVENUE ANALYSIS

20.2.3 GEOGRAPHIC PRESENCE

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPMENTS

20.3 SIEMENS HEALTHCARE PRIVATE LIMITED

20.3.1 COMPANY OVERVIEW

20.3.2 REVENUE ANALYSIS

20.3.3 GEOGRAPHIC PRESENCE

20.3.4 PRODUCT PORTFOLIO

20.3.5 RECENT DEVELOPMENTS

20.4 QUEST DIAGNOSTICS INCORPORATED.

20.4.1 COMPANY OVERVIEW

20.4.2 REVENUE ANALYSIS

20.4.3 GEOGRAPHIC PRESENCE

20.4.4 PRODUCT PORTFOLIO

20.4.5 RECENT DEVELOPMENTS

20.5 BIOMÉRIEUX

20.5.1 COMPANY OVERVIEW

20.5.2 REVENUE ANALYSIS

20.5.3 GEOGRAPHIC PRESENCE

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPMENTS

20.6 DIASORIN S.P.A.

20.6.1 COMPANY OVERVIEW

20.6.2 REVENUE ANALYSIS

20.6.3 GEOGRAPHIC PRESENCE

20.6.4 PRODUCT PORTFOLIO

20.6.5 RECENT DEVELOPMENTS

20.7 TOSOH BIOSCIENCE, INC.

20.7.1 COMPANY OVERVIEW

20.7.2 REVENUE ANALYSIS

20.7.3 GEOGRAPHIC PRESENCE

20.7.4 PRODUCT PORTFOLIO

20.7.5 RECENT DEVELOPMENTS

20.8 QUALIGEN THERAPEUTICS, INC.

20.8.1 COMPANY OVERVIEW

20.8.2 REVENUE ANALYSIS

20.8.3 GEOGRAPHIC PRESENCE

20.8.4 PRODUCT PORTFOLIO

20.8.5 RECENT DEVELOPMENTS

20.9 DIAZYME LABORATORIES, INC.

20.9.1 COMPANY OVERVIEW

20.9.2 REVENUE ANALYSIS

20.9.3 GEOGRAPHIC PRESENCE

20.9.4 PRODUCT PORTFOLIO

20.9.5 RECENT DEVELOPMENTS

20.1 THERMO FISHER SCIENTIFIC INC.

20.10.1 COMPANY OVERVIEW

20.10.2 REVENUE ANALYSIS

20.10.3 GEOGRAPHIC PRESENCE

20.10.4 PRODUCT PORTFOLIO

20.10.5 RECENT DEVELOPMENTS

20.11 IMMUNODIAGNOSTIC SYSTEMS

20.11.1 COMPANY OVERVIEW

20.11.2 REVENUE ANALYSIS

20.11.3 GEOGRAPHIC PRESENCE

20.11.4 PRODUCT PORTFOLIO

20.11.5 RECENT DEVELOPMENTS

20.12 RECIPE CHEMICALS + INSTRUMENTS GMBH

20.12.1 COMPANY OVERVIEW

20.12.2 REVENUE ANALYSIS

20.12.3 GEOGRAPHIC PRESENCE

20.12.4 PRODUCT PORTFOLIO

20.12.5 RECENT DEVELOPMENTS

20.13 BECKMAN COULTER, INC.

20.13.1 COMPANY OVERVIEW

20.13.2 REVENUE ANALYSIS

20.13.3 GEOGRAPHIC PRESENCE

20.13.4 PRODUCT PORTFOLIO

20.13.5 RECENT DEVELOPMENTS

20.14 BIO-RAD LABORATORIES, INC

20.14.1 COMPANY OVERVIEW

20.14.2 REVENUE ANALYSIS

20.14.3 GEOGRAPHIC PRESENCE

20.14.4 PRODUCT PORTFOLIO

20.14.5 RECENT DEVELOPMENTS

20.15 SCIEX (DH TECH. DEV. PTE. LTD)

20.15.1 COMPANY OVERVIEW

20.15.2 REVENUE ANALYSIS

20.15.3 GEOGRAPHIC PRESENCE

20.15.4 PRODUCT PORTFOLIO

20.15.5 RECENT DEVELOPMENTS

20.16 QUIDEL CORPORATION

20.16.1 COMPANY OVERVIEW

20.16.2 REVENUE ANALYSIS

20.16.3 GEOGRAPHIC PRESENCE

20.16.4 PRODUCT PORTFOLIO

20.16.5 RECENT DEVELOPMENTS

20.17 DIASYS DIAGNOSTIC SYSTEMS GMBH

20.17.1 COMPANY OVERVIEW

20.17.2 REVENUE ANALYSIS

20.17.3 GEOGRAPHIC PRESENCE

20.17.4 PRODUCT PORTFOLIO

20.17.5 RECENT DEVELOPMENTS

20.18 OMEGAQUANT.

20.18.1 COMPANY OVERVIEW

20.18.2 REVENUE ANALYSIS

20.18.3 GEOGRAPHIC PRESENCE

20.18.4 PRODUCT PORTFOLIO

20.18.5 RECENT DEVELOPMENTS

20.19 ALPCO

20.19.1 COMPANY OVERVIEW

20.19.2 REVENUE ANALYSIS

20.19.3 GEOGRAPHIC PRESENCE

20.19.4 PRODUCT PORTFOLIO

20.19.5 RECENT DEVELOPMENTS

20.2 INNOVATION BIOTECH (BEIJING) CO.,LTD

20.20.1 COMPANY OVERVIEW

20.20.2 REVENUE ANALYSIS

20.20.3 GEOGRAPHIC PRESENCE

20.20.4 PRODUCT PORTFOLIO

20.20.5 RECENT DEVELOPMENTS

20.21 BIOHIT OYJ

20.21.1 COMPANY OVERVIEW

20.21.2 REVENUE ANALYSIS

20.21.3 GEOGRAPHIC PRESENCE

20.21.4 PRODUCT PORTFOLIO

20.21.5 RECENT DEVELOPMENTS

20.22 BODITECH MED INC

20.22.1 COMPANY OVERVIEW

20.22.2 REVENUE ANALYSIS

20.22.3 GEOGRAPHIC PRESENCE

20.22.4 PRODUCT PORTFOLIO

20.22.5 RECENT DEVELOPMENTS

20.23 EUROIMMUN MEDIZINISCHE L

20.23.1 COMPANY OVERVIEW

20.23.2 REVENUE ANALYSIS

20.23.3 GEOGRAPHIC PRESENCE

20.23.4 PRODUCT PORTFOLIO

20.23.5 RECENT DEVELOPMENTS

20.24 FUJIREBIO

20.24.1 COMPANY OVERVIEW

20.24.2 REVENUE ANALYSIS

20.24.3 GEOGRAPHIC PRESENCE

20.24.4 PRODUCT PORTFOLIO

20.24.5 RECENT DEVELOPMENTS

20.25 GETEIN BIOTECH, INC.

20.25.1 COMPANY OVERVIEW

20.25.2 REVENUE ANALYSIS

20.25.3 GEOGRAPHIC PRESENCE

20.25.4 PRODUCT PORTFOLIO

20.25.5 RECENT DEVELOPMENTS

20.26 DIAZYME LABORATORIES, INC.

20.26.1 COMPANY OVERVIEW

20.26.2 REVENUE ANALYSIS

20.26.3 GEOGRAPHIC PRESENCE

20.26.4 PRODUCT PORTFOLIO

20.26.5 RECENT DEVELOPMENTS

20.27 J. MITRA & CO. PVT. LTD.

20.27.1 COMPANY OVERVIEW

20.27.2 REVENUE ANALYSIS

20.27.3 GEOGRAPHIC PRESENCE

20.27.4 PRODUCT PORTFOLIO

20.27.5 RECENT DEVELOPMENTS

20.28 OPTIBIO CO., LTD

20.28.1 COMPANY OVERVIEW

20.28.2 REVENUE ANALYSIS

20.28.3 GEOGRAPHIC PRESENCE

20.28.4 PRODUCT PORTFOLIO

20.28.5 RECENT DEVELOPMENTS

20.29 BIOGENIX INC. PVT. LTD

20.29.1 COMPANY OVERVIEW

20.29.2 REVENUE ANALYSIS

20.29.3 GEOGRAPHIC PRESENCE

20.29.4 PRODUCT PORTFOLIO

20.29.5 RECENT DEVELOPMENTS

20.3 EVERLYWELL, INC

20.30.1 COMPANY OVERVIEW

20.30.2 REVENUE ANALYSIS

20.30.3 GEOGRAPHIC PRESENCE

20.30.4 PRODUCT PORTFOLIO

20.30.5 RECENT DEVELOPMENTS

20.31 BIOPANDA REAGENTS LTD

20.31.1 COMPANY OVERVIEW

20.31.2 REVENUE ANALYSIS

20.31.3 GEOGRAPHIC PRESENCE

20.31.4 PRODUCT PORTFOLIO

20.31.5 RECENT DEVELOPMENTS

20.32 CTK BIOTECH, INC

20.32.1 COMPANY OVERVIEW

20.32.2 REVENUE ANALYSIS

20.32.3 GEOGRAPHIC PRESENCE

20.32.4 PRODUCT PORTFOLIO

20.32.5 RECENT DEVELOPMENTS

20.33 ELABSCIENCE BIOTECHNOLOGY INC.

20.33.1 COMPANY OVERVIEW

20.33.2 REVENUE ANALYSIS

20.33.3 GEOGRAPHIC PRESENCE

20.33.4 PRODUCT PORTFOLIO

20.33.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

21 RELATED REPORTS

22 CONCLUSION

23 QUESTIONNAIRE

24 ABOUT DATA BRIDGE MARKET RESEARCHa

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.