Global Voice Banking Market

Market Size in USD Billion

CAGR :

%

USD

6.20 Billion

USD

17.93 Billion

2024

2032

USD

6.20 Billion

USD

17.93 Billion

2024

2032

| 2025 –2032 | |

| USD 6.20 Billion | |

| USD 17.93 Billion | |

|

|

|

|

Voice Banking Market Analysis

The voice banking market is experiencing significant growth, driven by the increasing adoption of voice-activated technologies in the financial sector. As consumers increasingly prefer convenient, hands-free solutions, financial institutions are integrating voice assistants to enhance customer service and improve operational efficiency. Innovations in artificial intelligence (AI) and natural language processing (NLP) are facilitating these advancements, allowing voice assistants to understand and respond to complex banking queries. For instance, in 2024, Lunar, a Nordic challenger bank, introduced its GenAI Native Voice technology, powered by GPT-4, enabling customers to access 24/7 personalized banking support. This trend is further bolstered by the rising demand for contactless, user-friendly interfaces and the increased reliance on smartphones and smart speakers. The use of voice banking provides seamless access to services such as balance inquiries, fund transfers, and bill payments, reducing wait times and improving customer satisfaction. In addition, financial institutions are leveraging voice biometrics to enhance security. As voice technology continues to evolve, the market is expected to grow rapidly, especially in regions such as North America and Asia-Pacific, where there is a high level of technology adoption.

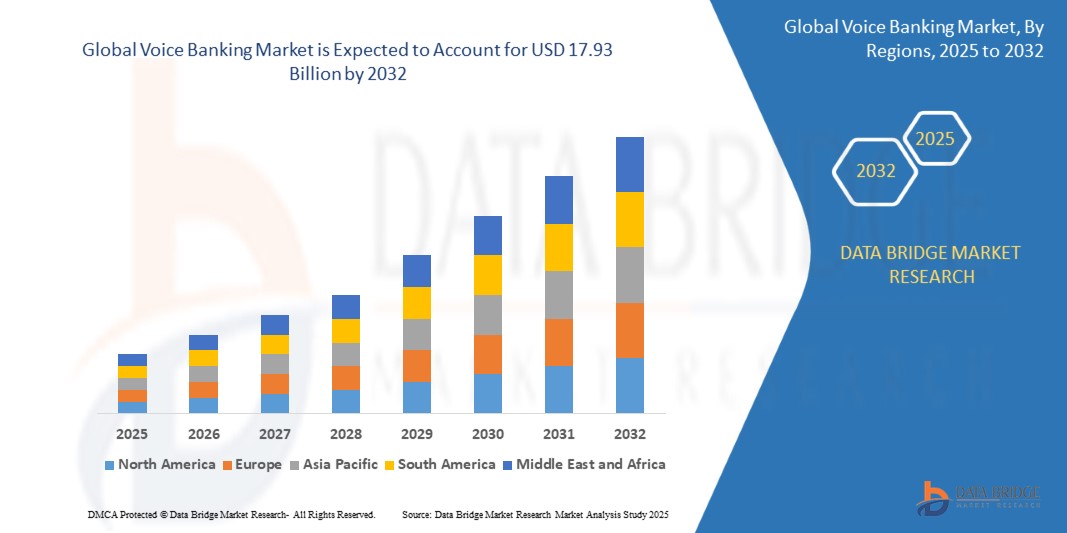

Voice Banking Market Size

The global voice banking market size was valued at USD 6.20 billion in 2024 and is projected to reach USD 17.93 billion by 2032, with a CAGR of 14.20% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Voice Banking Market Trends

“Growing Integration of Artificial Intelligence (AI) and Machine Learning (ML)”

The Voice Banking market is witnessing rapid growth, with a key trend being the integration of artificial intelligence (AI) and machine learning (ML) to enhance customer experience and operational efficiency. AI-driven voice assistants are revolutionizing how customers interact with their banks, offering personalized, 24/7 support for various services such as account inquiries, fund transfers, and loan management. For instance, U.S. Bank has integrated voice banking into its mobile platform, enabling users to access their accounts and perform transactions through voice commands. This trend is improving customer satisfaction by providing convenience and optimizing operational processes by reducing call center volumes. In addition, advancements in voice biometrics are enhancing security, ensuring that voice banking solutions are safe and reliable. The market’s growth is further fueled by the increasing demand for contactless and intuitive banking experiences, particularly in regions such as North America and Asia-Pacific, where voice-enabled technologies are gaining popularity.

Report Scope and Voice Banking Market Segmentation

|

Attributes |

Voice Banking Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of Sonouth America as part of South America |

|

Key Market Players |

U.S. Bank (U.S.), Axis Bank (India), HSBC Group (U.K.), NatWest Group (U.K.), BankBuddy (India), Central 1 Credit Union (Canada), ICICI Bank (India), Acapela Group (Belgium), Emirates NBD Bank (U.A.E.), Softbrik (India), Kasisto (U.S.), Airkit.ai (U.S.), ebankIT (Portugal), City Union Bank (India), Apple Inc. (U.S.), FICO (U.S.), IBM (U.S.), PayPal (U.S.), Verint Systems Inc. (U.S.), Microsoft (U.S.), Bank of America Corporation (U.S.), Amazon Inc. (U.S.), Wells Fargo (U.S.), Nuance (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Voice Banking Market Definition

Voice banking refers to the use of voice recognition technology, artificial intelligence (AI), and natural language processing (NLP) to enable customers to interact with their banks or financial institutions using voice commands. This technology allows users to perform various banking tasks, such as checking account balances, transferring funds, making payments, and inquiring about recent transactions, all through spoken instructions.

Voice Banking Market Dynamics

Drivers

- Growing Consumer Preference for Convenience

The growing consumer preference for convenience is a significant driver of the voice banking market. With busy lifestyles and a need for quicker access to services, consumers are shifting towards more efficient banking solutions. Voice banking, which offers a seamless and hands-free alternative to traditional banking channels, has gained popularity due to its ability to simplify tasks such as checking account balances, transferring funds, and paying bills through voice commands. For instance, U.S. Bank has integrated voice banking features into its mobile app, allowing customers to use voice commands to manage their finances. This level of convenience eliminates the need to navigate complex menus or visit physical branches, making banking more accessible and user-friendly. As consumers continue to value time-saving and easy-to-use solutions, voice banking is expected to witness rapid adoption, further driving the growth of the market.

- Increasing Adoption of Smart Devices

The increasing adoption of smart devices is a key driver for the growth of the voice banking market. As the use of smart speakers, smartphones, and virtual assistants becomes more widespread, consumers are increasingly relying on these devices for everyday tasks, including managing their bank accounts. Voice assistants such as Amazon Alexa, Google Assistant, and Apple Siri have integrated banking features that allow users to check balances, transfer funds, and make payments through simple voice commands. For instance, customers of Bank of America can link their accounts to Alexa and ask for balance updates or recent transactions. This convenience of accessing banking services hands-free, paired with the growing prevalence of smart devices in homes and on mobile phones, is encouraging more users to adopt voice banking. The rise in smart device adoption, combined with its ease of use, continues to drive the market, making voice banking more accessible and appealing to consumers.

Opportunities

- Increasing Advancements in AI and NLP

Advancements in artificial intelligence (AI) and natural language processing (NLP) are creating a significant market opportunity for voice banking, as they improve voice recognition systems, making them more accurate and reliable. These technologies enable more natural and intuitive interactions between customers and banking platforms, enhancing the overall user experience. AI and NLP allow voice banking systems to understand and process complex requests, even with varying accents or speech patterns. For instance, HSBC has leveraged AI and NLP technologies in its voice-activated banking services, providing customers with a seamless, personalized experience while accessing banking services via voice commands. With continued advancements in these technologies, voice banking systems are becoming more effective at handling a broader range of customer queries, offering tailored recommendations, and improving service efficiency. This innovation improves customer satisfaction and increases the adoption of voice banking, positioning it as a preferred choice for users seeking convenient and efficient banking solutions.

- Increasing Integration of Voice Biometrics

The increasing integration of voice biometrics into voice banking systems is a significant market opportunity, as it enhances security by providing a more secure method of user authentication. With concerns over fraud and data security growing, banks and consumers are prioritizing safe and seamless transaction methods. Voice biometrics uses unique voice patterns to verify the identity of users, making it harder for unauthorized individuals to access sensitive banking information. For instance, U.S. Bank has implemented voice recognition technology in its mobile banking app, allowing customers to securely access their accounts and authorize transactions using only their voice. This added layer of security boosts consumer confidence and encourages the adoption of voice banking services. As more banks and financial institutions integrate voice biometrics into their platforms, the market for voice banking is expected to grow, meeting the rising demand for secure, efficient, and convenient banking experiences.

Restraints/Challenges

- Lack of Skilled Professionals

The lack of skilled professionals is a significant challenge in the Voice Banking market, as the demand for qualified designers, researchers, and strategists continues to exceed supply. This talent shortage can result in project delays, lower-quality services, and increased competition for top-tier professionals, especially for smaller firms with limited resources. For instance, a mid-sized UX agency may struggle to find and retain experienced designers who can handle complex user research or interface design for large clients, which may affect project timelines and overall client satisfaction. This challenge is particularly pronounced in emerging markets or regions with limited access to specialized UX education and training. As a result, businesses may either have to outsource work to larger agencies or accept suboptimal service quality, which undermines the potential benefits of a well-designed user experience. This shortage highlights the need for investment in professional development and talent recruitment strategies to meet the growing demand for Voice Bankings.

- Budget Constraints for Small and Medium-Sized Enterprises (SMEs)

Budget constraints are a major challenge in the Voice Banking market, particularly for small and medium-sized enterprises (SMEs) that often lack the financial resources to invest in high-quality Voice Bankings. As a result, these businesses may opt for lower-cost solutions, which can lead to subpar user experiences that fail to meet user expectations or business goals. For instance, a small e-commerce company might choose an inexpensive Voice Banking provider, which could result in a website that is difficult to navigate, leading to higher bounce rates and lower customer satisfaction. This can ultimately hurt the business’s competitiveness in the market. SMEs may also rely on less experienced providers or in-house teams with limited expertise, compromising the overall quality of their digital products. This reliance on budget-friendly but lower-quality solutions hampers the overall growth of the Voice Banking market and lowers the industry’s standards, making it harder for businesses to realize the full potential of effective UX design.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Voice Banking Market Scope

The market is segmented on the basis of component, deployment, technology, and applications. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Solution

- Services

Deployment

- On-premise

- Cloud

Technology

- Artificial Intelligence

- Machine Learning

- Natural Language Processing (NLP)

- Others

Applications

- Banking

- NBFCs

- Credit Unions

- Financial Institutions

- Others

Voice Banking Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, component, deployment, technology, and applications. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America dominates the voice banking market, driven by the region's advanced technological infrastructure and early adoption of innovative banking solutions. The presence of key market players, coupled with strong investments in artificial intelligence and voice recognition technologies, has fueled the widespread integration of voice banking services. In addition, high consumer demand for personalized and seamless banking experiences has accelerated the adoption of voice-based solutions by financial institutions. This trend is further supported by the region's robust regulatory frameworks that promote secure and efficient digital banking practices.

Asia-Pacific is emerging as the fastest-growing region in the voice banking market, driven by rapid advancements in digital banking infrastructure and increasing smartphone penetration across the region. The widespread adoption of artificial intelligence and voice recognition technologies, particularly in countries such as India, China, and Japan, is fueling growth. Financial institutions in the region are actively embracing voice banking to cater to the tech-savvy population and enhance customer engagement. In addition, supportive government initiatives promoting digital transformation and financial inclusion are accelerating the expansion of voice banking services in Asia-Pacific.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Voice Banking Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Voice Banking Market Leaders Operating in the Market Are:

- U.S. Bank (U.S.)

- Axis Bank (India)

- HSBC Group (U.K.)

- NatWest Group (U.K.)

- BankBuddy (India)

- Central 1 Credit Union (Canada)

- ICICI Bank (India)

- Acapela Group (Belgium)

- Emirates NBD Bank (U.A.E.)

- Softbrik (India)

- Kasisto (U.S.)

- Airkit.ai (U.S.)

- ebankIT (Portugal)

- City Union Bank (India)

- Apple Inc. (U.S.)

- FICO (U.S.)

- IBM (U.S.)

- PayPal (U.S.)

- Verint Systems Inc. (U.S.)

- Microsoft (U.S.)

- Bank of America Corporation (U.S.)

- Amazon Inc. (U.S.)

- Wells Fargo (U.S.)

- Nuance (U.S.)

Latest Developments in Voice Banking Market

- In October 2024, Lunar, a Nordic challenger bank, introduced its next-generation AI Voice Assistant powered by the GPT-4o model, becoming the first European bank to implement GenAI Native Voice technology. This assistant provides instant, personalized, 24/7 support, catering to diverse demographics and handling both simple and complex banking queries without queue time

- In July 2023, Glia launched an AI-powered virtual assistant designed to revolutionize online and phone banking interactions, enabling customers to communicate banking inquiries in their own words seamlessly

- In April 2023, City Union Bank Limited added a voice biometric authentication feature to its mobile banking app, enhancing security and providing customers with multiple authentication options

- In March 2023, LinkLive, a CCaaS provider, partnered with Kasisto to integrate Kasisto’s KAI platform into LinkLive. This collaboration aims to deliver personalized experiences at financial institutions across the U.S., benefiting regional banks and credit unions

- In February 2023, Union Bank of India introduced its Voice Banking solution, “युवा” (UVA), during the Uttar Pradesh Global Investors Summit-2023. UVA, accessible via Alexa, allows customers to inquire about their balance and transaction history 24/7 using voice commands

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.