Global Wafer Confectionery Market

Market Size in USD Billion

CAGR :

%

USD

16.08 Billion

USD

25.83 Billion

2024

2032

USD

16.08 Billion

USD

25.83 Billion

2024

2032

| 2025 –2032 | |

| USD 16.08 Billion | |

| USD 25.83 Billion | |

|

|

|

|

Wafer Confectionery Market Size

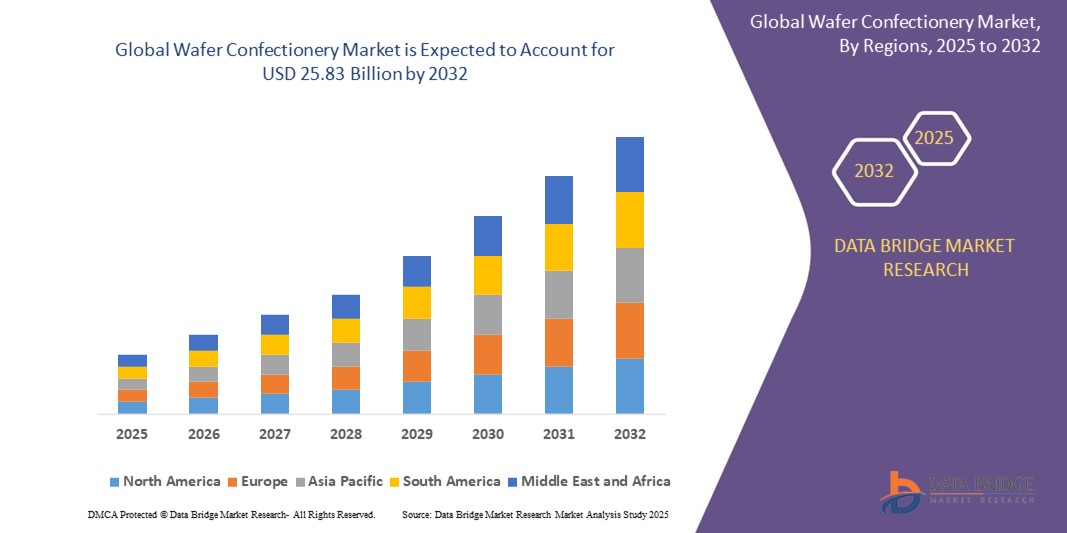

- The global wafer confectionery market size was valued at USD 16.08 billion in 2024 and is expected to reach USD 25.83 billion by 2032, at a CAGR of 6.10% during the forecast period

- The market growth is largely fuelled by the increasing demand for convenient, on-the-go snack options and the rising popularity of indulgent treats among younger consumers

- Rising disposable incomes, urbanization, and expanding retail channels such as supermarkets, hypermarkets, and online platforms are further boosting global sales of wafer-based confectionery

Wafer Confectionery Market Analysis

- Growing consumer preference for layered chocolate and cream-filled wafers, coupled with innovation in flavors and packaging, is intensifying market competition and brand engagement

- Leading manufacturers are focusing on product premiumization and healthier ingredient alternatives, such as organic and low-sugar variants, to appeal to health-conscious segments of the market

- Europe dominated the wafer confectionery market with the largest revenue share of 35.4% in 2024, driven by the region's long-standing confectionery traditions, high consumer demand for chocolate-coated snacks, and well-established retail networks

- Asia-Pacific region is expected to witness the highest growth rate in the global wafer confectionery market, driven by increasing penetration of global brands, the growth of organized retail, and a shift toward impulse snacking culture in countries such as China, Japan, and Indonesia

- The coated segment dominated the market with the largest market revenue share of 57.3% in 2024, driven by its broad appeal and variety of chocolate-covered options offered by major brands. Coated wafers are especially popular for their satisfying texture, combining crispiness with rich outer layers of chocolate or flavored coatings. This segment continues to expand due to consistent demand across age groups and strong performance in both impulse and giftable confectionery segments

Report Scope and Wafer Confectionery Market Segmentation

|

Attributes |

Wafer Confectionery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Demand for Premium and Artisanal Wafer Products • Expansion of Online Retail and Direct-To-Consumer Channels |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wafer Confectionery Market Trends

“Growing Consumer Preference For Healthier Wafer Options With Functional Ingredients”

- Health-conscious consumers are increasingly shifting toward wafers fortified with ingredients such as fiber, protein, and probiotics to align with their wellness goals. These functional ingredients not only promote better health but also make indulgence guilt-free. The demand for such nutritious alternatives is steadily pushing companies to reformulate traditional recipes

- The rise of plant-based lifestyles and dietary restrictions is propelling the popularity of gluten-free, dairy-free, and vegan wafer products. Brands are responding by launching innovative options that address both taste and health without compromising flavor. Consumers now expect confectionery to deliver added benefits beyond sweetness

- Clean label trends are reshaping the confectionery space, encouraging manufacturers to reduce artificial additives, colors, and preservatives. Transparent ingredient sourcing and natural formulations are driving trust and loyalty. Brands that highlight simplicity and authenticity in their wafers are winning over discerning customers

- For instance, Nestlé launched reduced-sugar, whole grain variants of its classic Kit Kat, catering to school-age children and health-aware parents. This move reflects the brand's alignment with global health campaigns such as “Nestlé for Healthier Kids”. The response to such innovations underscores growing acceptance of nutritious indulgence

- The shift toward healthier wafer products is creating a new growth trajectory where wellness, transparency, and innovation define consumer preferences. Brands must evolve to meet this demand or risk losing relevance in an increasingly conscious snacking market

Wafer Confectionery Market Dynamics

Driver

“Increasing Demand For Convenient And On-The-Go Snack Options”

- The fast-paced urban lifestyle has amplified the demand for portable, quick, and satisfying snack options, with wafers becoming a top choice. Their lightweight, non-messy nature makes them ideal for commuting, working, or traveling. Consumers seek compact indulgence that fits seamlessly into their schedules

- Single-serve packaging, resealable pouches, and multi-pack formats are helping brands meet snacking needs with better convenience. Smaller portions also appeal to portion-conscious buyers looking for controlled calorie intake. These innovations are expanding wafer consumption occasions beyond the traditional dessert moment

- The rise in e-commerce and vending machine availability further contributes to the on-the-go trend. Wafer products are being tailored for impulse purchases and easy stocking in lunchboxes, backpacks, or office drawers. Availability across multiple points of sale boosts visibility and accessibility

- For instance, Loacker’s individually packed wafer minis and Kit Kat’s travel-friendly snack bars are popular among office-goers and students. These convenient offerings combine taste with portability, meeting both functional and emotional snacking needs. Their success validates the importance of accessibility in driving wafer sales

- In conclusion, convenience remains a primary driver in the wafer confectionery market as consumers increasingly seek snacks that align with their busy lives. Brands that prioritize practical, appealing packaging and portable formats will continue to capture consumer loyalty and drive market expansion

Restraint/Challenge

“Rising Health Concerns and Growing Demand for Clean Label Products”

- The high sugar content and presence of artificial additives in traditional wafer products are leading to growing concerns among health-focused consumers. This awareness is causing a shift toward more natural and minimally processed snack alternatives. Negative perceptions are prompting reevaluation of mainstream wafer products

- Government regulations and public health campaigns targeting sugar reduction and processed food consumption are putting additional pressure on manufacturers. Reformulating products to meet healthier standards can increase production costs and affect taste profiles. This may impact market competitiveness and product acceptability

- Consumers are increasingly scrutinizing product labels for transparency, favoring brands that clearly communicate ingredient origins and nutritional facts. Wafer producers face challenges in balancing health-conscious innovation with traditional expectations of indulgence. This tension may restrict growth in certain market segments

- For instance, in countries such as Germany and the U.K., the shift toward low-sugar, organic, or additive-free confectionery is reshaping purchasing decisions. Brands not adapting to these expectations are witnessing decreased shelf presence and brand preference. Health-driven reformulations are becoming a necessity, not a choice

- Rising health awareness and regulatory scrutiny are redefining wafer product development. Manufacturers must innovate with cleaner, healthier options while preserving taste and affordability, or risk losing market share to emerging functional and better-for-you snacking alternatives

Wafer Confectionery Market Scope

The market is segmented on the basis of product type, type, and distribution channel.

- By Product Type

On the basis of product type, the wafer confectionery market is segmented into coated and cream-filled. The coated segment dominated the market with the largest market revenue share of 57.3% in 2024, driven by its broad appeal and variety of chocolate-covered options offered by major brands. Coated wafers are especially popular for their satisfying texture, combining crispiness with rich outer layers of chocolate or flavored coatings. This segment continues to expand due to consistent demand across age groups and strong performance in both impulse and giftable confectionery segments.

The cream-filled segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising demand for indulgent snacking experiences and new product innovations featuring exotic and dual-flavor cream fillings. These products are increasingly marketed as premium treats with enhanced mouthfeel and unique taste combinations. The trend of incorporating health-conscious and natural cream alternatives is also gaining traction, further boosting segment growth.

- By Type

On the basis of type, the market is segmented into chocolate, ice cream, cookies, biscuit, and others. The chocolate segment held the largest market revenue share in 2024 due to its longstanding dominance in the confectionery sector and global consumer preference for chocolate-coated or chocolate-layered wafers. This type is often associated with major brands and seasonal offerings, making it a staple in retail and gifting segments. Moreover, the combination of chocolate and wafer continues to be a widely accepted indulgent treat.

The ice cream segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing popularity of frozen wafer-based desserts in both developed and emerging markets. The convenience of ready-to-eat, individually packed ice cream wafers appeals to consumers seeking quick, enjoyable snacks during warmer months. Rising innovation in flavors, formats, and dietary options such as lactose-free or vegan ice cream wafers is also contributing to this segment’s rapid growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hypermarkets and supermarkets, convenience stores, online stores, specialty food stores, and others. Hypermarkets and supermarkets held the largest revenue share in 2024 owing to their strong retail presence, promotional offers, and wide availability of wafer confectionery brands and variants. These retail outlets serve as key touchpoints for impulse purchases and seasonal promotions, reinforcing their dominance in the category.

The online stores segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by the surge in e-commerce activity and increasing consumer preference for convenient home delivery options. Online platforms offer consumers access to a broader range of wafer brands, including niche and premium offerings, which may not be available in physical retail spaces. The use of digital marketing, subscription models, and influencer partnerships is further expanding the reach and sales of wafer confectionery products through online channels.

Wafer Confectionery Market Regional Analysis

- Europe dominated the wafer confectionery market with the largest revenue share of 35.4% in 2024, driven by the region's long-standing confectionery traditions, high consumer demand for chocolate-coated snacks, and well-established retail networks

- Consumers across Europe are increasingly attracted to premium offerings, innovative product variations, and clean-label ingredients, contributing to continued market growth

- The presence of key players, strong brand loyalty, and growing preferences for sustainable and portion-controlled packaging formats further support Europe’s leadership in the global wafer confectionery industry

Germany Wafer Confectionery Market Insight

The Germany wafer confectionery market captured the largest revenue share in Europe in 2024, supported by high per capita chocolate consumption and a strong affinity for traditional as well as modern sweet snacks. German consumers value a mix of indulgence and health-conscious options, resulting in increased demand for organic and reduced-sugar wafer products. The country’s established retail infrastructure and frequent seasonal promotions help maintain steady sales and encourage impulse buying of wafer confectionery items.

U.K. Wafer Confectionery Market Insight

The U.K. wafer confectionery market is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing consumer demand for convenient snack products and indulgent treats. British consumers show a strong preference for chocolate-coated and cream-filled wafers, often consumed as part of afternoon snacks or on-the-go options. The rise in vegan and organic product lines, alongside premium packaging innovations, is also attracting health-aware and sustainability-focused shoppers across the country.

North America Wafer Confectionery Market Insight

The North America wafer confectionery market is expected to witness the fastest growth rate from 2025 to 2032, driven by growing consumer preference for convenient, on-the-go snacks and the rising popularity of chocolate-coated wafer bars. The region’s increasing interest in premium and artisanal confectionery, especially among millennials and Gen Z, is reshaping product development and marketing strategies. Health-conscious variants and functional ingredient infusions are also gaining traction in the U.S. and Canada, further expanding the consumer base.

U.S. Wafer Confectionery Market Insight

The U.S. wafer confectionery market is expected to witness the fastest growth rate from 2025 to 2032, fuelled by aggressive product innovation, brand promotions, and the dominance of major multinational manufacturers. A strong distribution network across supermarkets, convenience stores, and e-commerce platforms makes wafer snacks easily accessible to consumers. In addition, frequent product launches with unique textures and flavor blends appeal to a wide demographic, supporting long-term market growth.

Asia-Pacific Wafer Confectionery Market Insight

The Asia-Pacific wafer confectionery market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising disposable incomes, changing dietary habits, and rapid urbanization in countries such as China, India, and Japan. Increased exposure to Western-style confectionery products, alongside the rising demand for quick energy snacks, is enhancing market potential across the region. Moreover, local manufacturers are increasingly investing in product quality and packaging innovation to appeal to younger consumers.

China Wafer Confectionery Market Insight

The China wafer confectionery market is expected to witness the fastest growth rate from 2025 to 2032, supported by expanding urban middle-class populations, the popularity of impulse snacks, and increasing product availability through online and offline retail channels. The demand for affordable yet indulgent confectionery options is fuelling sales of both international and domestic wafer brands. In addition, collaborations with influencers and digital marketing campaigns are helping brands strengthen consumer engagement and brand visibility across major urban centers.

Japan Wafer Confectionery Market Insight

The Japan wafer confectionery market is expected to witness the fastest growth rate from 2025 to 2032, fueled by consumer appreciation for seasonal flavors, unique textures, and visually appealing packaging. Wafers are commonly used in ice cream, desserts, and novelty snack items, reflecting Japan’s culture of creative confectionery. Limited edition releases, such as matcha or sakura-flavored wafer variants, and collaborations with anime or pop culture brands are key strategies driving excitement and repeat purchases among Japanese consumers.

Wafer Confectionery Market Share

The Wafer Confectionery industry is primarily led by well-established companies, including:

- Mars, Incorporated (U.S.)

- Nestlé (Switzerland)

- THE HERSHEY COMPANY (U.S.)

- Kellogg's Company (U.S.)

- pladis Global (U.K.)

- Shri Disnau Shakti Dham Foods Pvt. Ltd. (India)

- Bakewell Biscuits Pvt. Ltd. (India)

- Gopinath Foods (India)

- Antonelli (Italy)

- Lago Group S.p.A. (Italy)

- RAVI FOODS PRIVATE LIMITED (India)

- MAYANK FOOD PRODUCT (India)

- Mahendra Food Products (India)

- Ancora Foods (Italy)

- Prayagh Nutri Products P. Ltd. (India)

- Mondelez International (U.S.)

Latest Developments in Global Wafer Confectionery Market

- In July 2022, Loacker S.p.A. announced a product launch by entering the U.S. market through a partnership with Costco Stores. The brand introduced its Loacker Minis wafer biscuits in hazelnut, vanilla, and chocolate flavors, made with non-GMO ingredients including alpine milk and roasted Italian hazelnuts. This move supports Loacker's commitment to sustainability and premium quality, expanding its global footprint and catering to growing demand for authentic European confectionery in North America

- In May 2022, Lotte Corporation unveiled a special edition product in celebration of the Dragon Ball Super TV series, launching an anime-themed Bikkuri Man chocolate wafer in Japan. The offering includes collectible character stickers and comes in two packaging designs. This collaboration merges pop culture with snacks, targeting anime enthusiasts and boosting brand visibility among younger demographics

- In April 2022, Hostess Brands expanded its product line with the release of a new mint chocolate flavor under its Hostess Crispy Minis range. This flavor extension reflects the brand’s focus on continuous innovation by offering consumers a refreshing twist to its bite-sized wafer treats. The launch strengthens Hostess' competitive edge in the wafer segment and appeals to flavor-seeking snackers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.