Global Wax Coated Cartons

Market Size in USD Billion

CAGR :

%

USD

3.02 Billion

USD

5.27 Billion

2024

2032

USD

3.02 Billion

USD

5.27 Billion

2024

2032

| 2025 –2032 | |

| USD 3.02 Billion | |

| USD 5.27 Billion | |

|

|

|

|

Wax-coated Cartons & Boxes Market Size

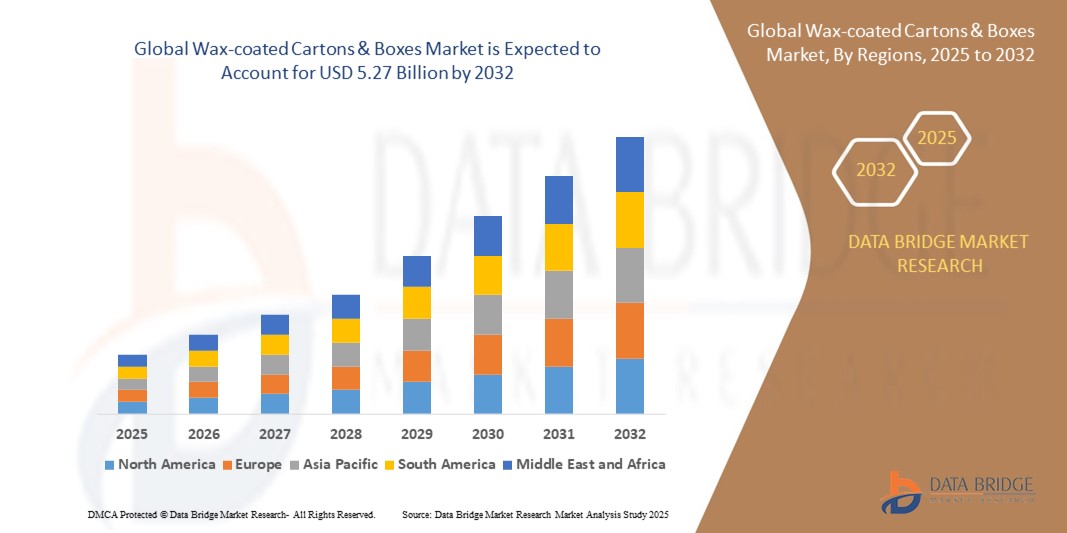

- The global wax-coated cartons & boxes market size was valued at USD 3.02 billion in 2024 and is expected to reach USD 5.27 billion by 2032, at a CAGR of 7.20% during the forecast period

- The market growth is largely fuelled by the increasing demand for moisture-resistant and durable packaging solutions across the food, agriculture, and industrial sectors

- The growing preference for sustainable and recyclable packaging alternatives is also driving innovation in wax-coated cartons & boxes, encouraging manufacturers to develop eco-friendly wax coatings and recyclable materials

Wax-coated Cartons & Boxes Market Analysis

- Wax-coated cartons and boxes are increasingly used in food and beverage packaging due to their ability to resist moisture and preserve product freshness

- The demand for durable and cost-effective packaging solutions is boosting the use of wax-coated materials across multiple industries

- Asia-Pacific dominates the wax-coated cartons and boxes market with the largest revenue share of 42.5% in 2024, driven by rapid industrialization, increasing agricultural exports, and the rising demand for sustainable packaging in food and beverage sectors

- North America region is expected to witness the highest growth rate in the global wax-coated cartons & boxes market, driven by increasing demand for sustainable packaging in foodservice and agricultural sectors, along with rising e-commerce activities requiring durable and eco-friendly shipping solutions

- The paraffin wax segment holds the largest market revenue share of 55.5% due to its effective moisture resistance, affordability, and widespread use in protecting perishable goods. Its properties make it ideal for maintaining product freshness during transport and storage

Report Scope and Wax-coated Cartons & Boxes Market Segmentation

|

Attributes |

Wax-coated Cartons & Boxes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wax-coated Cartons & Boxes Market Trends

“Rising Shift toward Sustainable Wax Alternatives in Packaging”

- Companies are increasingly adopting biodegradable wax coatings to replace traditional petroleum-based wax, aiming to reduce their environmental impact and meet sustainability targets

- The agriculture and foodservice sectors are shifting toward compostable wax-coated cartons to minimize landfill contribution and support green supply chain practices

- For instance, Green Bay Packaging introduced its Green Coat line, a recyclable alternative to conventional wax coatings, gaining popularity among environmentally conscious distributors

- Regulatory pressures and stricter environmental policies are encouraging manufacturers to develop recyclable and bio-based coating solutions that meet both performance and compliance standards

- Businesses are aligning packaging strategies with consumer demand for eco-friendly products, enhancing brand image and reducing long-term costs related to waste disposal and compliance

Wax-coated Cartons & Boxes Market Dynamics

Driver

“Rising Demand from Food Packaging and Agricultural Applications”

- Growing demand from the food packaging and agricultural sectors is a major driver of the wax-coated cartons and boxes market due to the need for durable, moisture-resistant packaging

- These boxes are essential for transporting perishable goods such as fruits, vegetables, seafood, and dairy, maintaining freshness during long-distance shipping

- In the foodservice industry, wax-coated containers are widely used for hot and cold meal deliveries, especially amid rising online food ordering and takeaway trends

- For instance, quick-service restaurants and catering providers rely on wax-coated cartons to ensure food quality and temperature during delivery

- The packaging's cost-efficiency, bulk manufacturing potential, and recyclability make it a practical choice for businesses seeking effective and sustainable solutions

Restraint/Challenge

“Recycling Limitations and Environmental Regulations”

- A major challenge in the wax-coated cartons and boxes market is the difficulty of recycling petroleum-based coatings, which prevents easy repulping at standard facilities

- Most wax-coated cartons are sent to landfills due to limited recyclability, raising sustainability issues and adding to environmental waste concerns

- Regulatory bodies in regions such as North America and Europe are imposing stricter rules on non-recyclable packaging, increasing costs for businesses reliant on wax-coated solutions

- For instance, certain municipalities have implemented landfill bans and packaging waste levies that pressure companies to find greener alternatives

- Eco-conscious consumers and advocacy groups are demanding sustainable packaging, but the high cost and variable performance of alternatives pose a barrier to immediate adoption

Wax-coated Cartons & Boxes Market Scope

The global wax-coated cartons and boxes market is segmented on the basis of wax type, product type, and end use.

- By Wax

On the basis of wax, the wax-coated cartons & boxes market is segmented into paraffin wax, microcrystalline wax, and others. The paraffin wax segment holds the largest market revenue share of 55.5% due to its effective moisture resistance, affordability, and widespread use in protecting perishable goods. Its properties make it ideal for maintaining product freshness during transport and storage.

The microcrystalline wax segment is expected to witness the fastest growth rate, thanks to its excellent flexibility and strong adhesion qualities. These features make it ideal for specialized packaging applications that demand enhanced durability and protection. Its ability to provide a robust moisture barrier and withstand rough handling contributes to its increasing use. Industries requiring reliable, high-performance packaging are increasingly adopting microcrystalline wax-coated cartons to meet these needs.

- By Product

On the basis of product, the wax-coated cartons & boxes market is segmented into regular slotted containers, die-cut boxes, folding cartons, tray-style boxes, and others. Regular slotted containers segment holds the largest market revenue share of 40.5%, due to their versatility and efficiency in packaging a wide range of goods, especially fresh produce and industrial items.

The die-cut boxes segment is expected to witness the fastest growth rate due to their high level of customizability and design flexibility. These boxes can be tailored to fit specific product shapes and branding requirements, making them especially popular in retail and e-commerce sectors. Their ability to provide both protection and an attractive presentation helps businesses enhance customer experience and product visibility. As online shopping and personalized packaging demands increase, die-cut boxes are becoming a preferred choice for many manufacturers and sellers.

- By End Use

On the basis of end use, the wax-coated cartons & boxes market is segmented into food and beverages, agricultural sector, industrial goods, pharmaceuticals, retail and e-commerce, and others. The food and beverage segment commands the largest revenue share of 38.5%, driven by the high demand for wax-coated cartons to maintain freshness and hygiene of perishable food products.

The agricultural segment is expected to see the fastest growth, driven by the increasing demand for secure and durable packaging to transport fruits, vegetables, and flowers. Wax-coated cartons help maintain freshness and reduce damage during long-distance distribution, making them essential for this industry. As the global demand for fresh produce rises, the need for reliable packaging solutions that preserve quality and extend shelf life is becoming more critical. This trend is encouraging wider adoption of wax-coated cartons in agricultural supply chains.

Wax-coated Cartons & Boxes Market Regional Analysis

- Asia-Pacific dominates the wax-coated cartons and boxes market with the largest revenue share of 42.5% in 2024, driven by rapid industrialization, increasing agricultural exports, and the rising demand for sustainable packaging in food and beverage sectors

- The region’s expanding e-commerce industry and growing awareness of product safety and preservation boost the adoption of wax-coated packaging solutions

- Increased government initiatives promoting sustainable packaging and investments in advanced manufacturing technologies further support market growth across Asia-Pacific

Japan Wax-coated Cartons & Boxes Market Insight

The Japan market is expected to witness the fastest growth rate, driven by a strong focus on food safety, quality preservation, and sustainability. Wax-coated cartons are widely used for packaging fresh produce, seafood, and pharmaceuticals, where maintaining freshness and durability is crucial. Increasing consumer demand for eco-friendly packaging and government policies promoting waste reduction further encourage adoption. Japan’s advanced manufacturing capabilities and innovation in biodegradable wax coatings also support market expansion in the country

China Wax-coated Cartons & Boxes Market Insight

The China holds a significant share in Asia-Pacific due to its vast agricultural production, booming e-commerce, and rising consumer awareness of food quality. The country’s growing export market and investments in packaging innovation drive demand for wax-coated cartons. Domestic manufacturers are also expanding production capacities, enabling wider availability of cost-effective, eco-friendly packaging solutions

North America Wax-coated Cartons & Boxes Market Insight

The North America market is expected to witness the fastest growth rate, fuelled by strong demand from the foodservice, agriculture, and retail sectors. Consumers prioritize packaging that preserves freshness and offers eco-friendly options. The growth of online grocery shopping and farm-to-table initiatives also contribute to increased demand for wax-coated cartons. Furthermore, technological advancements and stringent packaging regulations drive manufacturers to innovate with recyclable and compostable wax coatings, expanding market potential in the region

U.S. Wax-coated Cartons & Boxes Market Insight

The U.S. market is expected to witness the fastest growth rate, fuelled by the growing foodservice and agricultural sectors requiring reliable, moisture-resistant packaging solutions. Rising consumer preference for sustainable and recyclable packaging drives the shift toward eco-friendly wax-coated cartons. In addition, the surge in e-commerce grocery sales and fresh produce distribution necessitates durable packaging options. Regulatory emphasis on environmental sustainability and industry investments in innovative wax coatings further propel market growth in the U.S.

Europe Wax-coated Cartons & Boxes Market Insight

The Europe is expected to witness the fastest growth rate, supported by stringent environmental regulations and growing consumer preference for recyclable packaging. The region's emphasis on reducing plastic waste and adopting sustainable solutions encourages the use of wax-coated cartons in food and pharmaceutical applications. Countries across Europe are also investing in recycling infrastructure to better manage wax-coated packaging waste, boosting market acceptance

U.K. Wax-coated Cartons & Boxes Market Insight

The U.K. market is expected to witness the fastest growth rate due to increasing demand for sustainable packaging in retail and foodservice industries. The country’s commitment to reducing single-use plastics and promoting circular economy practices fosters adoption of wax-coated cartons. Growth in organic food sales and environmentally conscious consumer behaviour further drive market expansion

Germany Wax-coated Cartons & Boxes Market Insight

The Germany is a key market in Europe, driven by high environmental awareness and strict packaging laws. The demand for durable, moisture-resistant packaging in the agriculture and food sectors supports wax-coated carton growth. German manufacturers also emphasize innovation in biodegradable and recyclable wax coatings to align with sustainability goals and consumer expectations

Wax-coated Cartons & Boxes Market Share

The wax-coated cartons & boxes industry is primarily led by well-established companies, including:

-

- DS Smith (U.K.)

- Smurfit Kappa (Ireland)

- Georgia-Pacific LLC (U.S.)

- Prime Packaging (Australia)

- SCHC (U.S.)

- PB Packaging, Inc. (Australia)

- StarBox Inc. (U.S.)

- Packaging Products Corporation (U.S.)

- Stamar Packaging (U.S.)

- Carton Manufacturers Ltd. (New Zealand)

- Pack Edge Inc. (U.S.)

- CP Food Boxes (U.S.)

- Binh Minh PACKAGING (Vietnam)

Latest Developments in Global Wax-coated Cartons & Boxes Market

- In January 2025, International Paper finalized its USD 7.2 billion acquisition of DS Smith, forming a global leader in sustainable packaging solutions with a strong presence in North America and the EMEA regions. Headquartered in Tennessee, U.S., with a European base in London, the merger creates a combined entity with shared ownership, enhancing operational scale and innovation capabilities. This strategic move is expected to strengthen market leadership and accelerate the adoption of eco-friendly packaging across industries

- In August 2024, The Boxery announced a major expansion in its production of eco-friendly corrugated cardboard shipping boxes to address rising demand from the booming e-commerce sector. Offering over 1,000 box sizes made from more than 80% recycled materials, the company is advancing sustainable packaging trends while catering to diverse shipping needs. This expansion supports environmental goals and reinforces The Boxery’s position in the green packaging market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Wax Coated Cartons, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Wax Coated Cartons research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Wax Coated Cartons consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.