Global Welding Products Market

Market Size in USD Billion

CAGR :

%

USD

15.47 Billion

USD

23.27 Billion

2024

2032

USD

15.47 Billion

USD

23.27 Billion

2024

2032

| 2025 –2032 | |

| USD 15.47 Billion | |

| USD 23.27 Billion | |

|

|

|

|

Welding Products Market Analysis

The welding products market has seen significant growth driven by technological advancements, increased industrial activities, and the expansion of infrastructure projects globally. Key trends include the integration of advanced automation, robotics, and smart technology that enhances precision, efficiency, and safety in welding operations. Innovations such as real-time vision systems, AI-driven quality control, and portable, battery-powered welding units have revolutionized the way welding is performed, making it more adaptable and efficient for various applications. In recent years, advancements in welding technology have focused on eco-friendly solutions and energy-efficient systems, reducing the carbon footprint of welding processes. New welding products are being designed for higher durability and performance, including those that work with advanced materials and composites. The industry has also witnessed the emergence of advanced materials such as high-strength steels and alloys, which demand specialized welding products and techniques. The demand for welding products is strong in sectors such as construction, automotive, shipbuilding, and manufacturing. Increased investments in renewable energy and electrification projects are further contributing to market growth. The trend towards digitalization and Industry 4.0 solutions is propelling the industry forward, with welding equipment becoming more connected and user-friendly.

Welding Products Market Size

The global welding products market size was valued at USD 15.47 billion in 2024 and is projected to reach USD 23.27 billion by 2032, with a CAGR of 5.23% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Welding Products Market Trends

“Increasing Integration of Automation and Robotics in Industrial Operations”

The welding products market is experiencing robust growth, driven by the trend of automation and robotics in industrial operations. The integration of automated welding systems enhances precision, speed, and consistency, which is crucial for high-demand applications in sectors such as automotive manufacturing and shipbuilding. For instance, Novarc Technologies’ NovEye Autonomy system uses real-time vision processing to fully automate the pipe welding process, improving productivity and weld quality. This innovation exemplifies how welding technology is evolving to incorporate AI-driven solutions and digital connectivity, aligning with Industry 4.0 advancements. Automated welding equipment, such as robotic welding arms equipped with sensors and smart software, is enhancing safety and reducing human error. These advancements are pushing the market towards solutions that support complex, high-volume tasks while ensuring consistent high-quality outputs. The shift to automated and intelligent systems is set to redefine the welding products market, meeting the increasing need for precision and efficiency in modern manufacturing.

Report Scope and Welding Products Market Segmentation

|

Attributes |

Welding Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Colfax Corporation (U.S.), voestalpine AG (Austria), Air Liquide (France), The Lincoln Electric Company (U.S.), Illinois Tool Works Inc. (U.S.), HYUNDAI WELDING CO., LTD. (South Korea), Obara Group Inc. (Japan), Sandvik AB; (publ) (Sweden), KISWEL LTD. (South Korea), Kemppi Oy. (Finland), Mitco Weld Products Pvt. Ltd. (India), Senor Metals Pvt. Ltd. (India), Coherent Corp (U.S.), DAIHEN Corporation. (Japan), Basiloid Diversified Products (U.S.), AMADA WELD TECH (Japan), ESAB. (Sweden), RME MIDDLE EAST FZCO (U.A.E.), and capilla GmbH (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Welding Products Market Definition

Welding products refer to a range of equipment, materials, and tools used in the process of welding, which is the method of joining materials, usually metals or thermoplastics, by causing coalescence. These products include welding machines (such as MIG, TIG, and arc welders), electrodes and welding wires that provide the filler material, shielding gases that protect the weld area from contamination, and protective gear such as helmets and gloves. Additional products include welding consumables such as flux-cored wires, cutting tools, welding torches, and robotic welding systems that automate the process for high-volume production. The market also encompasses accessories such as clamps, jigs, and welding positioners.

Welding Products Market Dynamics

Drivers

- Rising Construction Activities

Rising construction activities are a significant driver for the welding products market, as the demand for strong, reliable, and efficient metal joining solutions is essential for building infrastructure and commercial projects. According to the Global Construction Perspectives and Oxford Economics report, global construction output is expected to grow by 85% by 2030, driven by major investments in infrastructure, housing, and commercial projects. Advanced welding products, including automated systems and high-performance welding consumables, are being adopted to meet these demands and improve productivity. This surge in construction activities drives the market for welding equipment, as contractors seek solutions that deliver faster, more precise, and more durable welds. As construction projects continue to expand globally, the market for innovative welding technologies is poised to grow alongside it.

- Surging trend of Joining Dissimilar and Non-Metallic Materials

The surging trend of joining dissimilar and non-metallic materials is a key driver for the welding products market, as industries seek versatile solutions to meet the demands of modern manufacturing and construction. The use of composite materials and mixed-metal constructions is becoming more common, especially in the automotive and aerospace sectors, where lightweight, high-strength structures are essential for fuel efficiency and performance. For instance, the automotive industry increasingly combines aluminum and steel to create light vehicles with improved fuel economy, requiring specialized welding technologies such as laser welding and friction stir welding that can handle these material combinations effectively. This trend has expanded the market for innovative welding products that can join non-traditional materials such as plastics and composites with metals, pushing manufacturers to develop advanced solutions capable of adapting to these new requirements. As the demand for hybrid and composite materials grows, the market for welding technologies that can address these challenges is also set to expand.

Opportunities

- Increasing Focus of Manufacturers on Product Innovations

The increasing focus of manufacturers on product innovations presents a significant market opportunity for the welding products market, as companies strive to develop solutions that meet evolving industry needs. This emphasis on innovation has led to the creation of advanced welding technologies that improve efficiency, safety, and precision. For instance, Novarc Technologies’ NovEye Autonomy system, equipped with real-time vision processing, allows for fully automated pipe welding, enhancing productivity and weld quality. In addition, advancements in battery-powered welding systems, such as ESAB's Renegade Volt ES 200i, offer unprecedented portability and adaptability, meeting the demands of on-site and remote welding applications. Manufacturers are also investing in smart welding systems integrated with IoT capabilities, allowing for real-time data analysis, remote monitoring, and predictive maintenance. This focus on innovation is driving the development of products that cater to industries requiring high-performance, adaptable, and sustainable welding solutions, creating ample opportunities for growth in the market.

- Growth and Expansion of the Automobile Industry

The growth and expansion of the automobile industry presents a significant market opportunity for the welding products market, as the need for advanced welding solutions is essential for modern vehicle manufacturing. With the industry's shift towards producing lighter, more fuel-efficient, and safer vehicles, manufacturers are increasingly using high-strength steels and lightweight materials such as aluminum and composites. This trend demands specialized welding technologies that can handle dissimilar material joining and ensure robust welds. For instance, companies such as Lincoln Electric have developed state-of-the-art MIG and TIG welders that cater to the complex requirements of automotive assembly lines. In addition, the rise of electric vehicles (EVs) is pushing manufacturers to adopt advanced welding techniques for battery pack assembly and structural components. As automakers continue to innovate with new materials and production methods to meet consumer and regulatory demands, the demand for advanced, reliable, and efficient welding solutions is set to drive significant growth in the welding products market.

Restraints/Challenges

- Lack of Availability of Skilled Welders

The lack of availability of skilled welders poses a significant market challenge for the welding products market, as it affects the ability of industries to meet production demands and maintain quality standards. The welding industry has been facing a shortage of trained professionals, partly due to the aging workforce and the declining interest among younger generations in pursuing welding as a career. This shortage can lead to delays in project timelines, increased labor costs, and potential safety risks. For instance, the construction and shipbuilding industries, which rely heavily on skilled welders, are often impacted by this shortage, resulting in increased dependency on automation and robotic welding systems to bridge the skill gap. Companies are investing in training programs and educational initiatives to address this challenge, but the demand for skilled labor continues to outpace the supply. This scenario drives the need for innovative automated welding technologies that can help mitigate the impact of the skilled labor shortage, presenting a challenge that also fuels opportunities for advancements in smart, AI-driven, and automated welding solutions.

- Rising Cost of Labor

The rising cost of labor presents a significant market challenge for the welding products market, impacting profitability and operational efficiency for industries that rely heavily on skilled workers. As wages and benefits continue to increase, companies are under pressure to find ways to reduce labor costs while maintaining production quality. This challenge is particularly evident in sectors such as construction, shipbuilding, and automotive manufacturing, where welding is a core component of production. For instance, the automotive industry has been shifting towards more automated welding systems to decrease reliance on labor and reduce costs associated with hiring and training skilled welders. The high cost of labor increases operational expenses and limit a company’s ability to scale up production or invest in new projects. This scenario drives the need for cost-effective solutions, such as robotic welding systems and AI-driven automation, which can improve productivity and help companies manage labor costs more efficiently.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Welding Products Market Scope

The market is segmented on the basis of technology, product, application, and level of automation. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Technology

- Arc Welding

- Resistance Welding

- Oxy-Fuel Welding

- Laser Beam Welding

- Other

Product

- Stick Electrodes

- Solid Wires

- Flux-Cored Wires

- Saw Wires and Fluxes

- Others

Application

- Transportation and Automobiles

- Building and Construction

- Marine

- Others

Level of Automation

- Manual

- Semi-Automatic

- Automatic

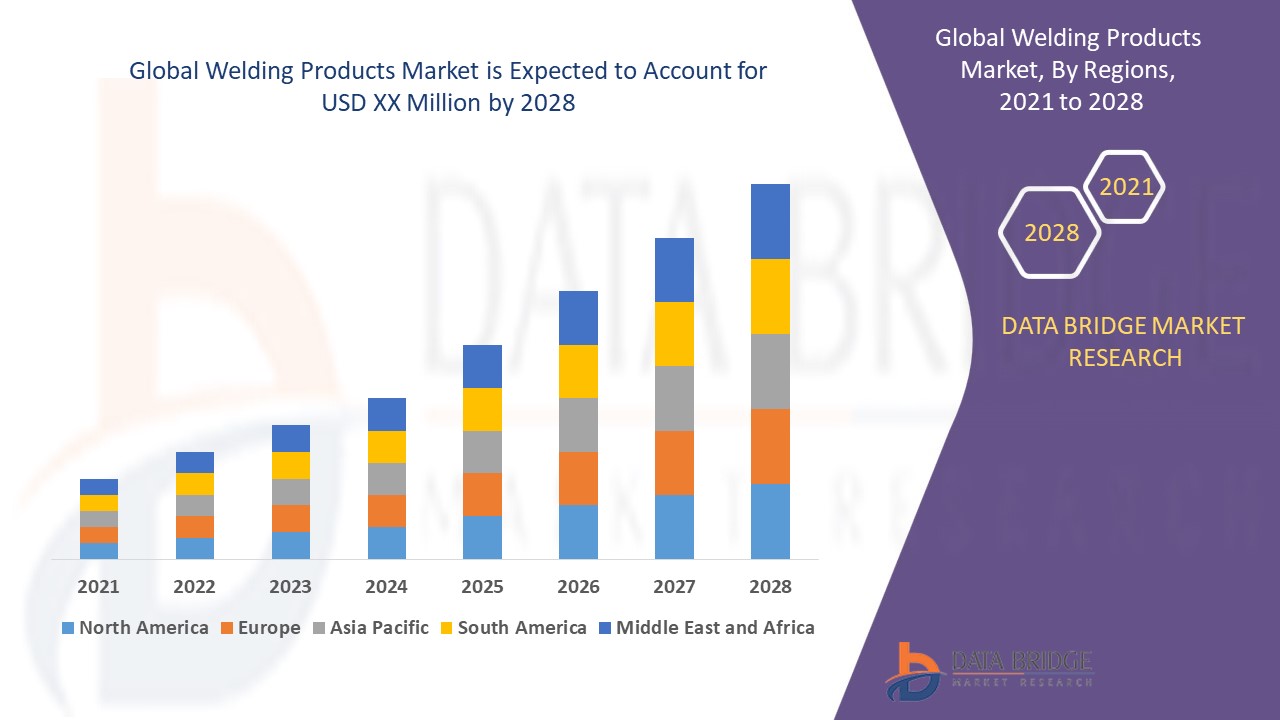

Welding Products Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, technology, product, application, and level of automation as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific dominates the global welding products market and is expected to maintain its dominant position throughout the forecast period. The growth of the construction and engineering sectors is a key driver behind the expansion of the welding products market in this region. The presence of numerous registered and unregistered market participants has also contributed to the market's growth rate. In addition, the emphasis on technological advancements, enhanced aftermarket services, and increased investments in research and development are crucial factors supporting market growth.

North America is projected to experience highest growth from 2025 to 2032 due to the increasing demand for welding products, particularly within the transportation industry. The expansion of this sector, driven by the need for vehicle manufacturing and infrastructure development, has spurred a higher requirement for reliable welding solutions. This trend is further supported by advancements in welding technology and the push for more durable, high-quality construction. In addition, the emphasis on modernizing transportation systems and enhancing vehicle safety and efficiency contributes to the growing need for welding products in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Welding Products Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Welding Products Market Leaders Operating in the Market Are:

- Colfax Corporation (U.S.)

- voestalpine AG (Austria)

- Air Liquide (France)

- The Lincoln Electric Company (U.S.)

- Illinois Tool Works Inc. (U.S.)

- HYUNDAI WELDING CO., LTD. (South Korea)

- Obara Group Inc. (Japan)

- Sandvik AB; (publ) (Sweden)

- KISWEL LTD. (South Korea)

- Kemppi Oy. (Finland)

- Mitco Weld Products Pvt. Ltd. (India)

- Senor Metals Pvt. Ltd. (India)

- Coherent Corp (U.S.)

- DAIHEN Corporation. (Japan)

- Basiloid Diversified Products (U.S.)

- AMADA WELD TECH (Japan)

- ESAB. (Sweden)

- RME MIDDLE EAST FZCO (U.A.E.)

- capilla GmbH (Germany)

Latest Developments in Welding Products Market

- In October 2024, Rinco Ultrasonics introduced the Ultrasonic Servo Driven Splicer (USDS), a cutting-edge ultrasonic metal welding system designed for high-performance wire splicing. The USDS enhances electrical conductivity compared to soldered joints, making it ideal for automotive applications. The 3000-watt system is already in commercial use, with plans underway for higher-power versions

- In July 2024, Novarc Technologies Inc. launched the second generation of its NovEye Autonomy system, a real-time vision processing solution for fully automating pipe welding. The system leverages data-driven improvements to maximize productivity and ensure high-quality welds, setting a new standard in automated welding technology

- In September 2023, Miller Electric Mfg. LLC unveiled the Millermatic 142 MIG Welder, a lightweight, 140-amp class machine designed for both DIY enthusiasts and professionals. Engineered for high-quality performance on smaller welding tasks, the Millermatic® 142 reinforces Miller’s commitment to exceptional welding solutions

- In September 2023, ESAB introduced the Renegade Volt ES 200i, a battery-powered welding system developed in partnership with Stanley Black & Decker. This innovative system features four DeWalt Flexvolt 12 Ah batteries, delivering 150A stick output solely on battery power. It can also connect to 120V-230V power sources, achieving a 200A output on 230V, representing a major advance in portable welding technology

- In March 2023, Kemppi launched the Master M 205 and Master M 323 portable welding machines for MIG/MAG welding. Designed for industrial applications in shipyards and repair shops, these machines are equally suitable for hobbyists, offering versatility and reliability in a compact design

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.