Global Well Cementing Services Market

Market Size in USD Billion

CAGR :

%

USD

13.13 Billion

USD

23.42 Billion

2024

2032

USD

13.13 Billion

USD

23.42 Billion

2024

2032

| 2025 –2032 | |

| USD 13.13 Billion | |

| USD 23.42 Billion | |

|

|

|

|

What is the Global Well Cementing Services Market Size and Growth Rate?

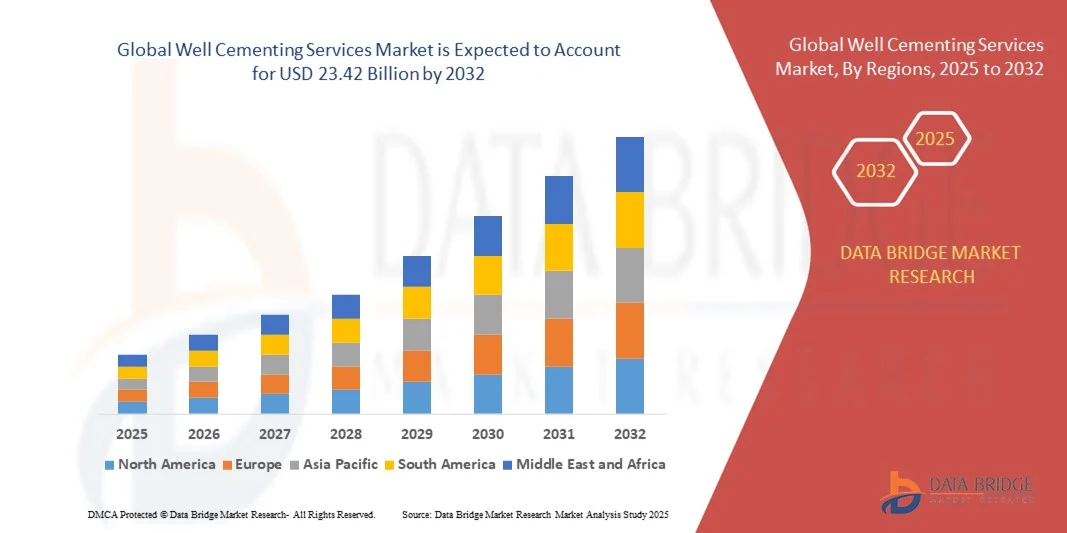

- The global well cementing services market size was valued at USD 13.13 billion in 2024 and is expected to reach USD 23.42 billion by 2032, at a CAGR of 7.50% during the forecast period

- The increase in energy demand across the globe and the rise in investment by the E&P companies on the onshore and offshore oil and gas reserves are the major factors driving the well cementing services market

- The rise in their application as they are known to protect the casing form corrosion, restrain irregular pore pressure, provide resistance to cement from chemical deterioration and increased possibilities of hitting the target and the increasing recovering activities of unconventional hydrocarbon sources including shale gas, coal bed methane and tight gas accelerate the well cementing services market growth

What are the Major Takeaways of Well Cementing Services Market?

- Increasing number of onshore and offshore drilling activities, growth of shale gas sector in developed nations and aged and matured wells positively affect the well cementing services market. Furthermore, technological advancements and new discoveries in the shale gas industry extend profitable opportunities to the well cementing services market players

- Local content requirement and limited access to reserves are factors expected to obstruct the well cementing services market growth. The rise in environmental concerns and scarcity of technical professionals are factors projected to challenge the well cementing services market

- North America dominated the well cementing services market with the largest revenue share of 46.87% in 2024, driven by the presence of mature oil and gas industries, high drilling activity, and strong adoption of advanced well cementing technologies

- The Asia-Pacific well cementing services market is poised to grow at the fastest CAGR of 10.8% from 2025 to 2032, driven by rising oil and gas exploration in countries such as China, India, and Indonesia. Increasing offshore drilling, exploration of deepwater reservoirs, and investments in energy infrastructure are fueling the adoption of well cementing services

- The Primary Cementing segment dominated the market with the largest revenue share of 45.3% in 2024, driven by its essential role in establishing wellbore integrity, zonal isolation, and long-term well performance

Report Scope and Well Cementing Services Market Segmentation

|

Attributes |

Well Cementing Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Well Cementing Services Market?

Adoption of Advanced Digitalization and Automation in Well Cementing Operations

- A significant and accelerating trend in the global well cementing services market is the increasing adoption of advanced digitalization and automation technologies. This includes AI-driven cement slurry design, real-time monitoring of cement placement, and predictive analytics for optimizing well integrity and reducing operational risks

- For instance, Baker Hughes and Halliburton have integrated real-time sensors and cloud-based platforms into their cementing services, allowing operators to monitor cement placement and quality remotely, ensuring precise and efficient operations

- Automation in well cementing enables predictive modeling of slurry properties, real-time adjustments to pumping rates, and early detection of potential wellbore integrity issues. These capabilities reduce operational downtime and improve safety

- The seamless integration of IoT devices, cloud platforms, and AI-powered analytics allows operators to centralize control over cementing operations, providing actionable insights that enhance efficiency, minimize errors, and improve overall well performance

- This trend towards smarter, technology-driven well cementing solutions is redefining industry standards. Companies such as Schlumberger and Weatherford are developing digital-enabled cementing solutions with automated monitoring and predictive capabilities to enhance operational efficiency

- The demand for advanced, digitally integrated well cementing solutions is growing rapidly across onshore and offshore oil and gas operations as operators prioritize efficiency, risk reduction, and cost optimization

What are the Key Drivers of Well Cementing Services Market?

- The growing global demand for oil and gas, coupled with increasingly complex drilling operations, is a major driver for the adoption of advanced Well Cementing Services. Operators are seeking reliable cementing solutions to ensure wellbore integrity, prevent fluid migration, and optimize production

- For instance, in January 2024, Halliburton announced an AI-enabled cementing system capable of predicting slurry performance under varying downhole conditions, aimed at improving operational efficiency and reducing well risks. Such innovations are expected to accelerate market growth in the forecast period

- Increasing exploration and production in deepwater and unconventional reservoirs necessitate high-performance cementing solutions, driving demand for technologically advanced services

- Stringent regulatory standards and safety requirements globally are compelling operators to adopt robust cementing techniques that ensure long-term well integrity, particularly in environmentally sensitive regions

- In addition, the focus on reducing operational costs, optimizing drilling schedules, and minimizing non-productive time is prompting oilfield operators to adopt more efficient and automated cementing solutions, further driving market expansion

Which Factor is Challenging the Growth of the Well Cementing Services Market?

- The high capital cost of advanced well cementing equipment and technologies poses a significant challenge to market growth. Smaller operators and those in developing regions may find it difficult to invest in automated and AI-enabled solutions

- Moreover, the technical complexity of deploying digital and automated cementing systems requires skilled personnel, creating a barrier to adoption in regions with limited technical expertise

- Fluctuations in crude oil prices and periodic slowdowns in drilling activities can impact the demand for well cementing services, affecting overall market stability

- Environmental and regulatory compliance requirements, while necessary, may also increase operational costs and complicate service deployment

- Overcoming these challenges will require cost-efficient technology development, workforce training programs, and flexible service models tailored to different operational scales and geographic markets

How is the Well Cementing Services Market Segmented?

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

- By Service

On the basis of service, the well cementing services market is segmented into Primary Cementing, Remedial Cementing, and Other Cementing. The Primary Cementing segment dominated the market with the largest revenue share of 45.3% in 2024, driven by its essential role in establishing wellbore integrity, zonal isolation, and long-term well performance. Primary cementing is a mandatory operation in all drilling activities, ensuring proper bonding of the casing to the formation and preventing fluid migration. Its widespread adoption is further supported by its ability to reduce risks of well failure and enhance hydrocarbon recovery.

The Remedial Cementing segment is expected to witness the fastest growth rate of 22.1% from 2025 to 2032, fueled by the increasing need to address well integrity issues, repair casing leaks, and optimize existing wells. Operators are investing in advanced remedial cementing solutions, particularly in mature oil and gas fields, to extend the life of wells and reduce operational downtime.

- By Application

On the basis of application, the well cementing services market is segmented into Onshore Cementing and Offshore Cementing. The Onshore Cementing segment accounted for the largest market revenue share of 52% in 2024, driven by the extensive number of onshore drilling operations globally, particularly in regions such as North America, the Middle East, and Asia-Pacific. Onshore wells are more accessible, allowing operators to adopt advanced cementing technologies and optimize operations efficiently.

The Offshore Cementing segment is anticipated to witness the fastest CAGR of 23% from 2025 to 2032, fueled by increasing deepwater exploration and production activities. The growing complexity of offshore wells, including ultra-deepwater and harsh-environment reservoirs, necessitates specialized cementing services to ensure well integrity, zonal isolation, and safety compliance. Rising investments in offshore oilfields and technological advancements in offshore cementing operations are expected to drive strong market growth during the forecast period.

Which Region Holds the Largest Share of the Well Cementing Services Market?

- North America dominated the well cementing services market with the largest revenue share of 46.87% in 2024, driven by the presence of mature oil and gas industries, high drilling activity, and strong adoption of advanced well cementing technologies

- Operators in the region benefit from technological innovations, skilled workforce, and established infrastructure that enable efficient and reliable well cementing operations

- This widespread adoption is further supported by high investment in upstream oil and gas projects, strict regulatory standards, and a growing focus on well integrity and safety, positioning North America as a leader in the global Well Cementing Services market

U.S. Well Cementing Services Market Insight

The U.S. well cementing services market captured the largest revenue share of 81% in 2024 within North America, fueled by extensive onshore and offshore drilling activities. The country’s emphasis on enhancing well integrity, reducing operational downtime, and employing advanced cementing solutions is driving market growth. Increasing shale oil and gas exploration, coupled with adoption of high-performance cementing materials and services, further strengthens the U.S. market.

Canada Well Cementing Services Market Insight

The Canada well cementing services market is expected to grow steadily, driven by investments in oil sands and unconventional wells. Emphasis on regulatory compliance and environmentally safe cementing solutions encourages operators to adopt modern cementing techniques. The market benefits from rising demand for enhanced well productivity and safety.

Europe Well Cementing Services Market Insight

The Europe well cementing services market is projected to expand at a moderate CAGR during the forecast period, driven by offshore and onshore drilling operations in the North Sea and other regions. Investments in aging oilfields and technological advancements in cementing solutions are key growth drivers. European operators increasingly focus on reducing operational risk and improving well longevity through specialized cementing services.

Germany Well Cementing Services Market Insight

The Germany well cementing services market is anticipated to grow steadily, supported by the country’s technological advancements in the oil and gas sector and growing demand for high-quality cementing solutions. Emphasis on sustainable and safe well operations fosters adoption of advanced services in both onshore and offshore applications.

Which Region is the Fastest Growing Region in the Well Cementing Services Market?

The Asia-Pacific well cementing services market is poised to grow at the fastest CAGR of 10.8% from 2025 to 2032, driven by rising oil and gas exploration in countries such as China, India, and Indonesia. Increasing offshore drilling, exploration of deepwater reservoirs, and investments in energy infrastructure are fueling the adoption of well cementing services.

China Well Cementing Services Market Insight

The China well cementing services market accounted for the largest revenue share in APAC in 2024, supported by rapid urbanization, technological adoption, and government initiatives promoting energy production efficiency. The market growth is fueled by offshore oilfields and onshore unconventional drilling.

Japan Well Cementing Services Market Insight

The Japan well cementing services market is witnessing strong growth due to increasing demand for deepwater oil exploration and high-performance cementing services. The country’s focus on advanced offshore drilling technologies and well safety standards is boosting market adoption.

India Well Cementing Services Market Insight

The India well cementing services market is anticipated to grow at a substantial rate, driven by rising onshore and offshore drilling operations, increasing investments in upstream oil and gas, and the adoption of modern cementing technologies to improve well efficiency and safety.

Which are the Top Companies in Well Cementing Services Market?

The well cementing services industry is primarily led by well-established companies, including:

- Baker Hughes Company (U.S.)

- Halliburton (U.S.)

- Schlumberger Limited (U.S.)

- Weatherford International (U.S.)

- Nabors Industries Ltd. (U.S.)

- Calfrac Well Services Ltd. (Canada)

- Condor Energy (U.S.)

- Sanjel Energy Services (Canada)

- Gulf Energy SAOC (Oman)

- China Oilfield Services Limited (China)

- Topco (Canada)

- Vallourec (France)

- Tenaris (Luxembourg)

- Viking Services (U.S.)

- Magnum Cementing Services Ltd. (Canada)

- Consolidated Oil Well Services (Canada)

- Nine Energy Service (U.S.)

- TMK Group (Russia)

What are the Recent Developments in Global Well Cementing Services Market?

- In October 2024, Uzma Bhd announced that its subsidiary, Uzma Engineering Ltd, secured a three-year contract from Philippine Geothermal Production Company Inc (PGPC) to provide drilling cementing services for geothermal wells in the Philippines, marking a significant expansion of its service footprint in the Asia-Pacific geothermal sector

- In August 2024, SLB, an oilfield services provider, introduced the EcoShield geopolymer cement-free system, which reduces CO2 emissions associated with well construction by approximately 85% compared to conventional cementing methods, showcasing the company’s commitment to sustainable and environmentally friendly operations

- In August 2024, GA Drilling announced a strategic partnership with Petrobras to advance next-generation deep geothermal drilling technologies, including tubing, casing, and cementing solutions, reinforcing innovation and collaboration in the energy sector

- In July 2023, RPC, Inc. announced the acquisition of Spinnaker Oilwell Services, LLC, a leading provider of oilfield cementing services operating in the Permian and Mid-Continent basins, with two facilities in El Reno, OK and Hobbs, NM, and 18 full-service cement spreads, expanding RPC’s operational capabilities and regional presence

- In November 2023, Expro secured a corporate frame agreement with Equinor ASA to deliver well-testing services on the Norwegian Continental Shelf, covering the Barents, Norwegian, and North Seas, with a four-year contract and options for up to six additional years, strengthening its long-term collaboration with Equinor

- In February 2020, Saipem secured multiple EPCI contracts across various countries valued at over USD 500 million, including a long-term agreement with Saudi Aramco in Saudi Arabia and a contract with Eni Angola S.p.A. for Cabaca and Agogo’s early phase 1 development, highlighting the company’s global scale and expertise in complex offshore projects

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Well Cementing Services Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Well Cementing Services Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Well Cementing Services Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.